Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This year yes

Last year Greek shipping made my year:)

Actually no! I own just two stocks under $10. My focus is high quality DRIPS.

There are levels of crap - this is the lowest.

Practically 99.9 % of all Penny Stocks are crap ;) But is that not the same stocks you dabble in ?

I think a better answer is disillusioned buyers.

Sure you do. It's in your name:)

Why is this still trading after a judge ruled shareholders get zero?

Answer is capitalism

How is tthis trading at .02s last i seen this was in .00s

But yet everybody adores him, he was smart enough to know they will not bury him with his worldly possessions. lol

I guess that's why they are getting sued as well, the consolidated.LOL

Is that the reason they filed for BK, the consolidated.LOL

Apparently you still don't understand what consolidated financials means. Nevermind. Carry on. Lol.

"Unfortunately, you had to learn that the hard way". Not sure what you think i had to learn the hard way.

Try the financial definition that is standardized by the SEC. Consolidated doesn't mean the assets are owned by the company reporting them. Unfortunately, you had to learn that the hard way.

I have two definitions below which one do you like most.

-Make (something) physically stronger or more solid.

-Combine (a number of things) into a single more effective or coherent whole.

Also other words like combine,unite,merge,integrate,amalgamate,fuse,synthesize or unify can mean the same.

Their last filing is CONSOLIDATED. Do you know what consolidated means?

It's on their last fillings, so i am not really thinking, it's what they said they did.

So if what they said was false ,what else are they not telling the truth.

Have no idea what you're saying.

Do we have capitalism now?

It trades because there's a process a stock has to go through in order to be delisted. It's not an overnight process. I suggest researching the basics.

Why do you think they raised $24b?

Why then, does SUNEQ still trade?

Just kill it and get it over with.....there is a point of this to still allow buys and sells.

Whatever happened to 24bil they had raised 2 months before they filed BK, it seemed to have miraculously vanished out of thin air.

So when the judge has determined SunEdison is bankrupt and has no more money, you still think a lawsuit will fix that problem? Lol. Miraculously, there'll be money? Wow.

Very good questions indeed.

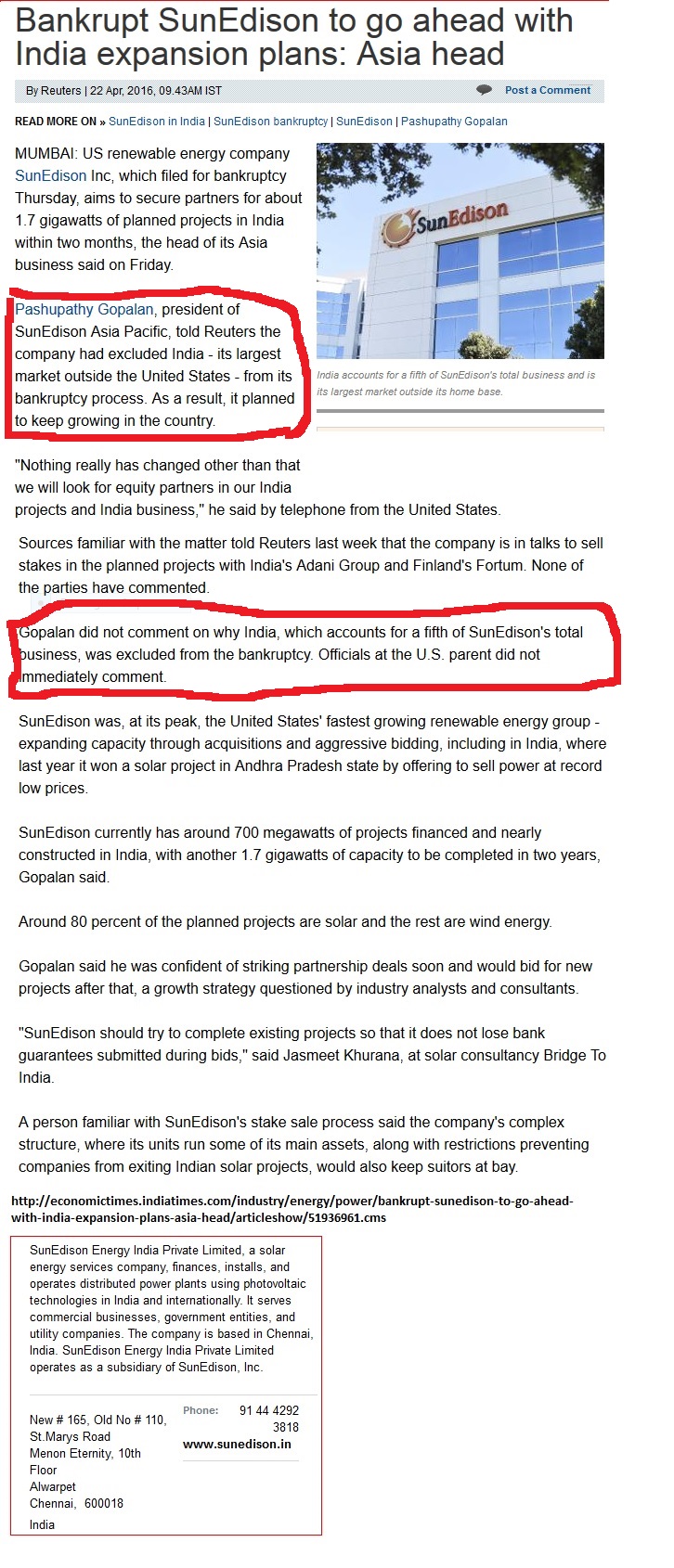

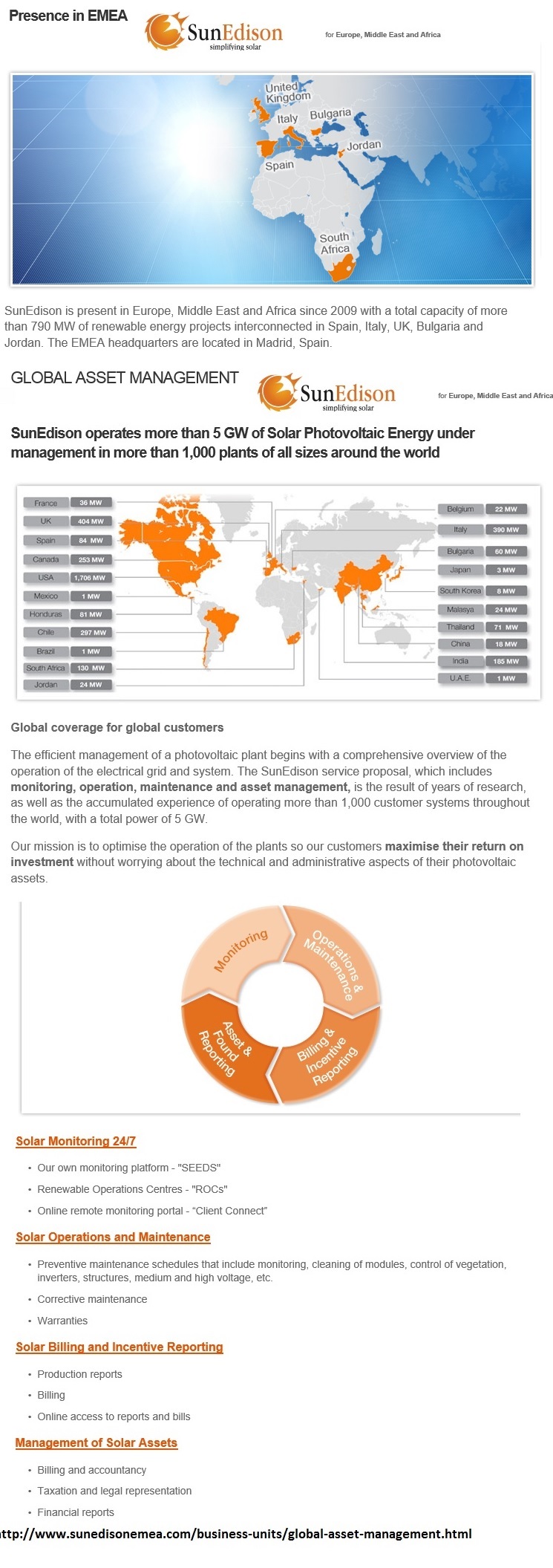

Why? Because the the KKR lawsuit and its implications and other lawsuits. If GS violated SEC rules, that goes beyond the clients KKR's immediate claims. If kickbacks of any kind occurred during the "fire sale" that will have implications. If the new SUNE is proven to have hidden or lied about assets worldwide, that will have implications.

It's not just about the shares, it's about years of litigation against SUNE, the new SUNE, its officers, some of the other banks involved. etc.

Why even bother asking? suneq commons will get canceled. Everything suneq is moot!

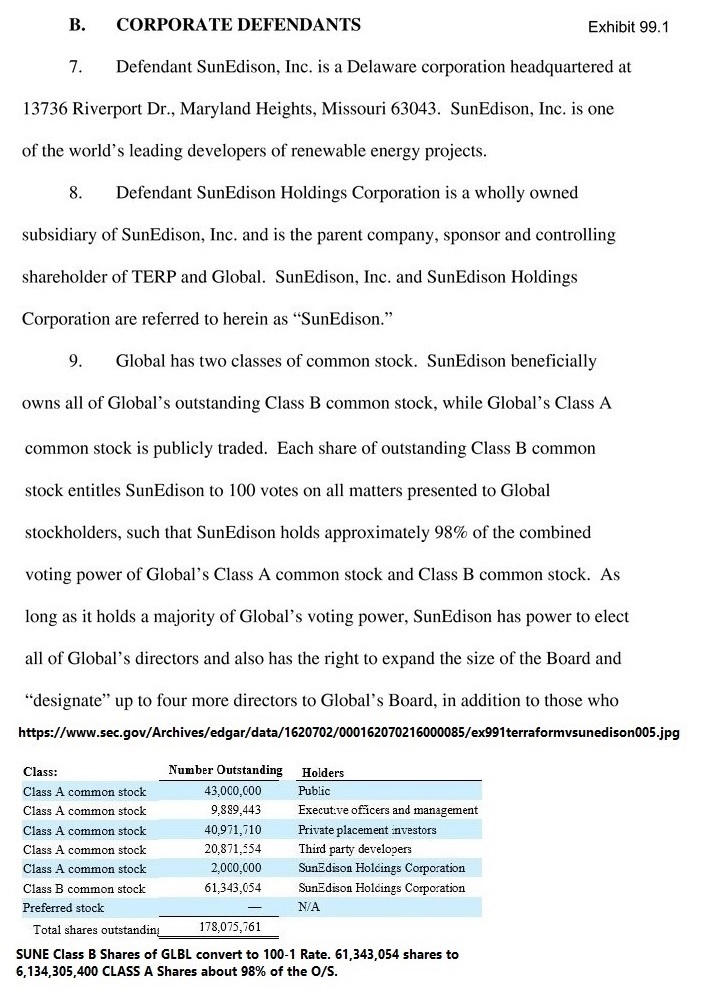

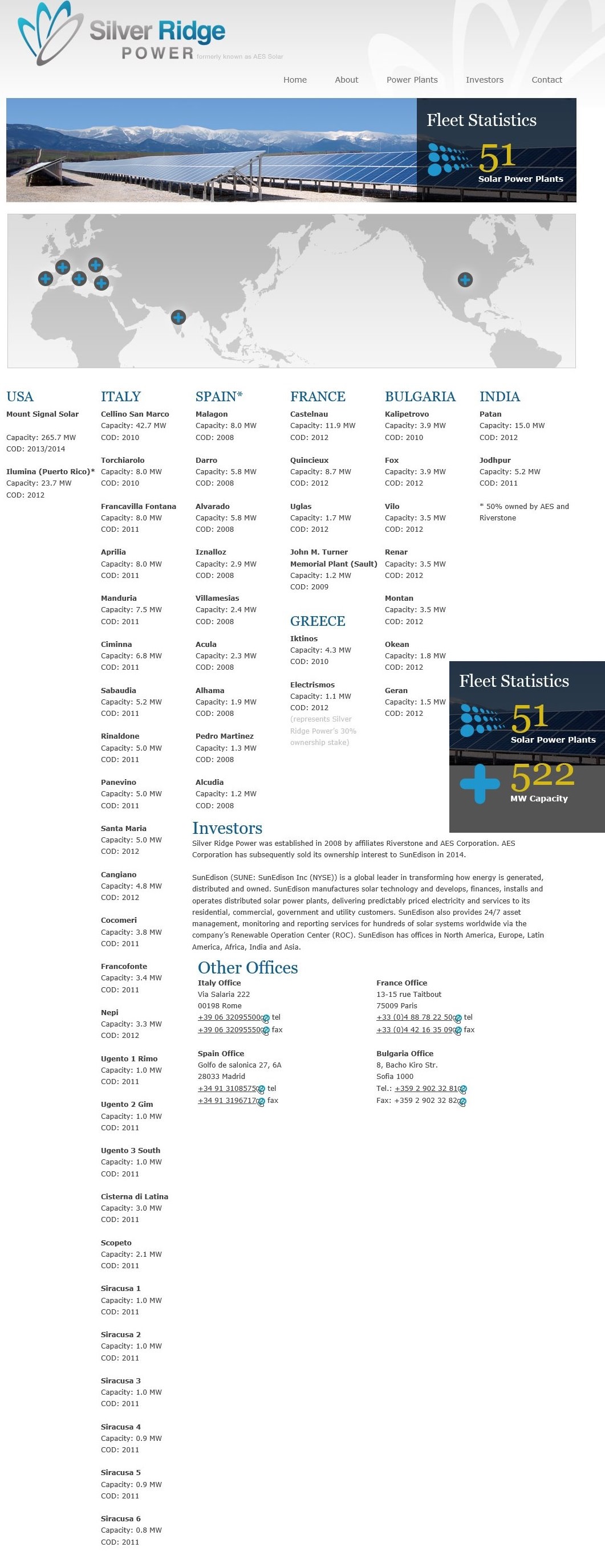

1. What percentage of yeildco shares (voting and otherwise) were owned by SUNE, it's officers and the banks and other entities that have relationships with those officers?

2. What is the relationship between SUNE officers and the banks, funds, individuals, etc. that bought assets for pennies on the dollar?

3. Did Goldman Sachs violate SEC rules with the secret 15% loan and will KKR win that lawsuit. If so, will SUNE shareholders sue GS?

4. With no chap 7 and complete liquidation, did SUNE lie about the true value of its worldwide assets?

5. Did any executives get any sort of kickback / bribe / compensation from any of the bankruptcy dealings?

Actually, a few questions would make this a bit more clear:

1. What percentage of yeildco shares (voting and otherwise) were owned by SUNE, it's officers and the banks and other entities that have relationships with those officers?

2. What is the relationship between SUNE officers and the banks, funds, individuals, etc. that bought assets for pennies on the dollar?

3. Did Goldman Sachs violate SEC rules with the secret 15% loan and will KKR win that lawsuit. If so, will SUNE shareholders sue GS?

4. With no chap 7 and complete liquidation, did SUNE lie about the true value of its worldwide assets?

5. Did any executives get any sort of kickback / bribe / compensation from any of the bankruptcy dealings?

And on and on...

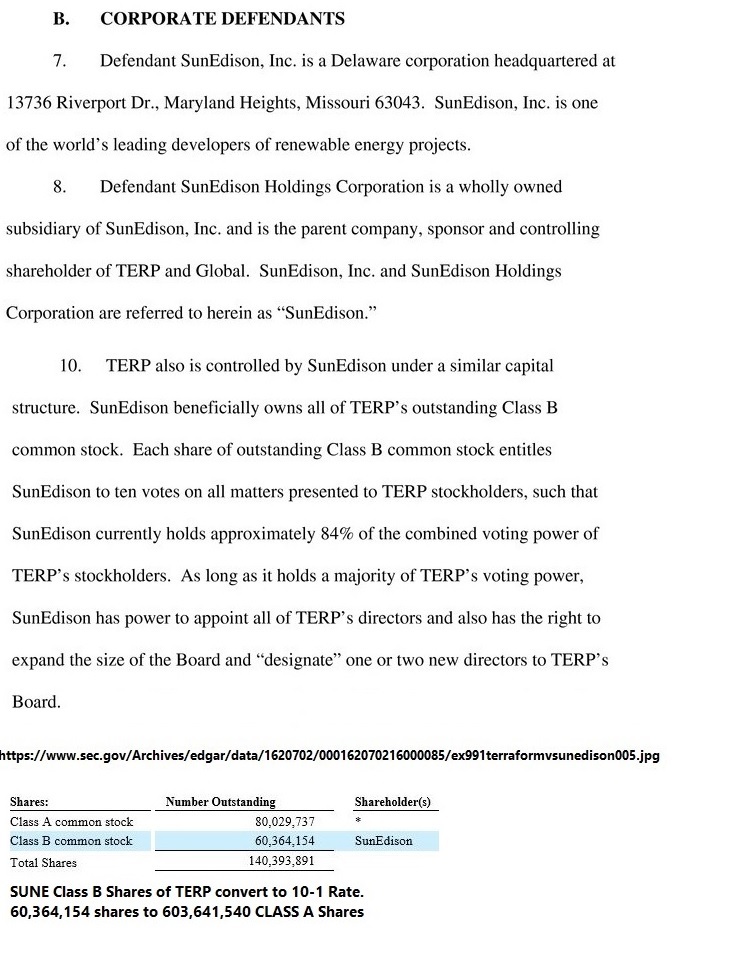

Voting shares have nothing to do with physical ownership of a business. Learn the difference.

What % of the voting shares were owned by SUNE and SUNE management?

lets see what happens in next few weeks. I hope that it hit 52 weeks high in next few weeks.

Yeah, that's not what happened. The yieldcos weren't wholly owned subsidiaries. They weren't even subsidiaries. They were spin-offs. Spin-offs aren't subsidiaries. They're companies wholly owned by their shareholders, which aren't SunEdison shareholders.

Step 1: Put huge money up front for projects with 20 - 30 guaranteed payments

Step 2: Create a wholly owned subsidiary and keep the debt in the parent and the 30 years of future payments in the subsidiary

Step 3: Repeat until debt load is unsustainable. Accept a secret loan at 15% interest from Goldman Sachs

Step 4: Declare bankruptcy for the parent while the subsidiary retains those 30 years of guaranteed payments

Step 5: Sell assets for pennies on the dollar

Step 6: Try to dump shareholders and sell new shares

For this to work, none of the involved parties would have any illegal conflicts of interest, kickbacks, etc.

Shares may be cancelled, but lawsuits will continue for years.

They will be soon enough.

Dumping assets into a spin-off is the definition of what a spin-off is. Clearly, you don't understand what a spin-off is.

I know what a spin off it. Stop. Just stop. Read it. They dumped all the assets into the spin off LOL whatever you think they are which you are wrong and made sune go bk. Look at it. Geez. You don't even know all the filings I see

I directly participated in the court case. It's a shame you've invested for 22 years and never heard of a spin-off.

Actually read all the filings. Been investing for 22 years. I know a lot. It's there.

TERP & GLBL were spin-offs. There's nothing fraudulent about a spin-off. They're all pre-approved by the Department of Justice and SEC before they're even allowed to spin-off. Seems you're very new to investing.

Get a cushy chair and keep rewinding that tape.

Some dip picketed hedge funds are fighting back to stop the 300mil dip funding.

Shares will be cancelled no matter what. Bk is almost over.

They did fraud I know it as well as others. He dumped all the assets into terp and glbl. Fact. That is fraud using sune as a front. Total BS. He never even paid them and took money out of terp to pay sune. Read the filings.

No it didn't. If they had committed fraud, there'd be a case for fraud. There isn't. The CEO simply over-leveraged the business. Borrowing too much money isn't fraud.

How is this at 2 cents wasnt this trading at .009 or lower? Wtf is going on

I am expecting to grow old one day but I am not afraid.

Sure it is only to be cancelled one day LOL

It's going higher!

|

Followers

|

284

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

36208

|

|

Created

|

08/05/06

|

Type

|

Free

|

| Moderators | |||

This board is for fundamental and technical discussion about Sunedison, Inc.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |