Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Awesome so the GE buyout is coming!

$SUNEQ

This should be the last month this trades.

And yes all 316 million - they all vanish when the POR goes into effect.

No, you don't get it. Shares don't evaporate into space when they are sold. Some else buys them.

Still 316m, right?

Interesting why most holding.

Judge already said shares will be cancelled. I don’t get it

They are all held. The share structure has not changed since BK was declared.

https://www.law360.com/articles/983332/sunedison-judge-limits-reach-of-3rd-party-releases

How many shares of common are being held still?

It's a posibility. Did you hear some rumor?

Might . . . shareholders will never see a cent.

Can't wait for GE to Buy this ;)

$suneq

Thanks to both of you for your update. I had TDA take BINDQ out of an account this past week for $0.00, after sitting there for >year...a minor speculative investment that can now be used as partial offset for LTCGs elsewhere. May let SUNEQ sit for another few weeks for same reason, checking 1st when original shares were bought—in street name so no certificates to keep as a “souvenir.”

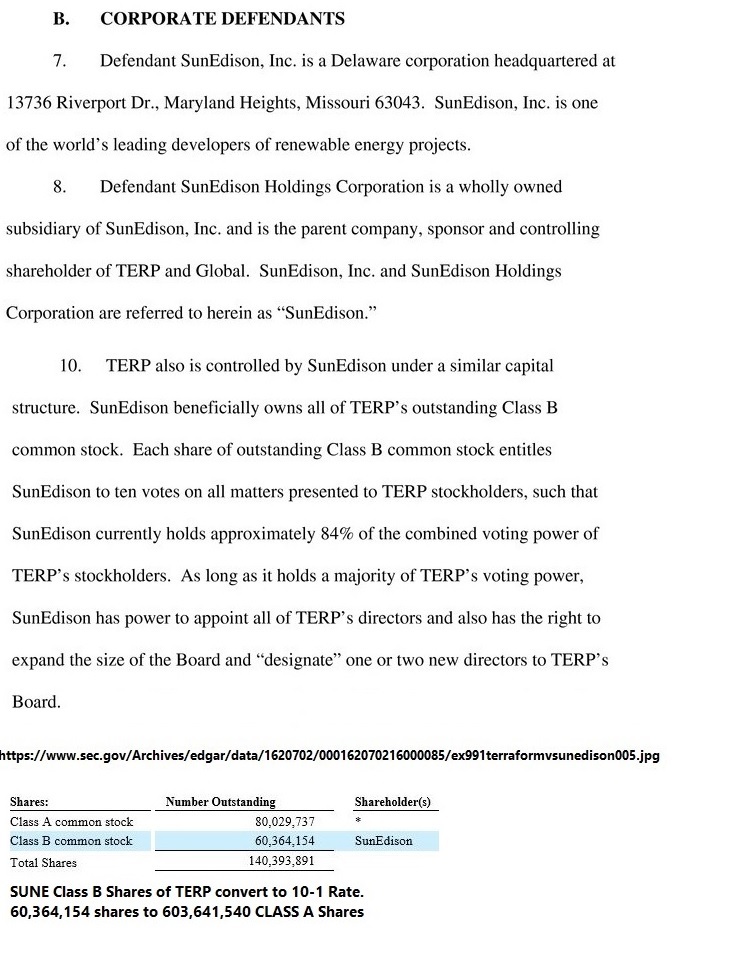

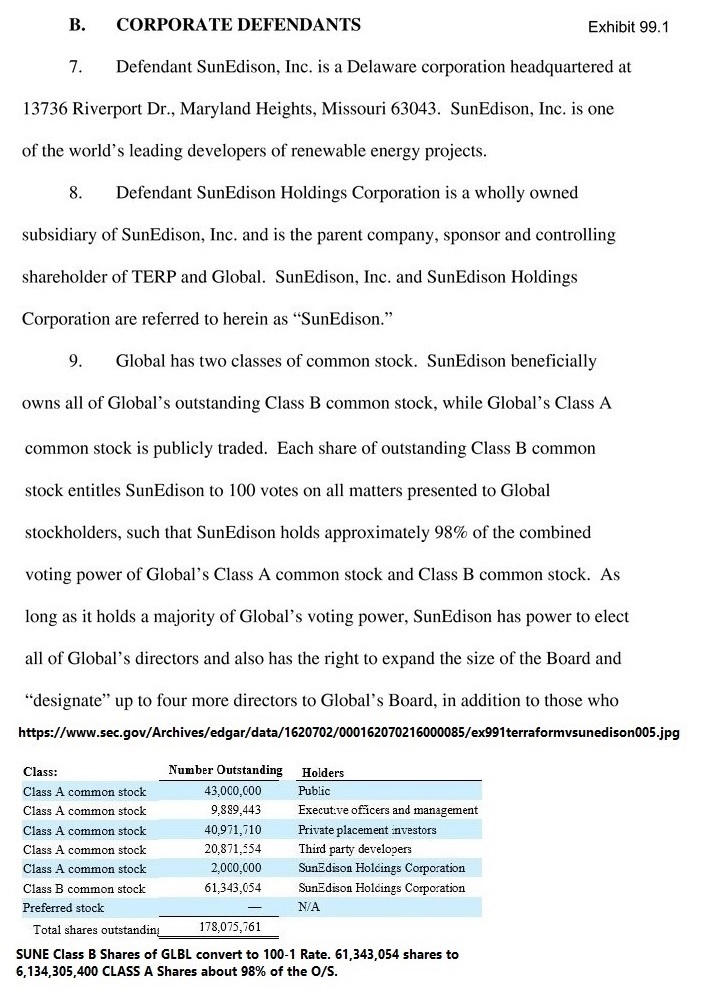

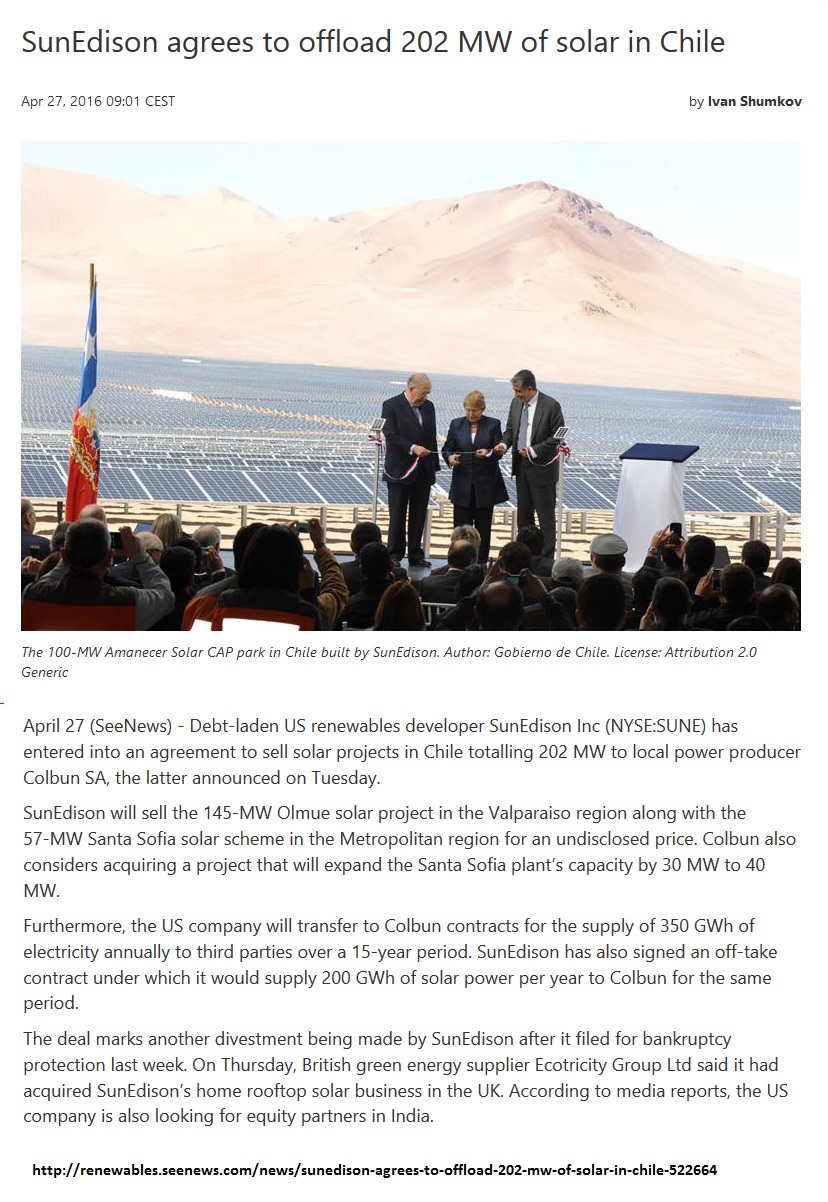

Just read the POR. Once the TERP (already closed)and GLBL (special stockholders meeting 11/13) mergers with Brookfield are completed and SUNEQ has received the cash proceeds and any stock to be issued therein, then OLD SUNE stock will be cancelled (SUNEQ to you) and NEW SUNE stock will be issued to just the Qualified Creditors in accordance with the hierarchy of Payments. So unless there is a major hiccup SUNEQ will disappear the week of November 13th. The only value of SUNEQ stock thereafter will be in pre-petition ownership if a successful suit against third parties can be launched. So put the stock certificates in your safety deposit box and forget about it.

Right to the extent that there will be no distribution. Shares must trade until the bankruptcy is finalized and the POR is executed. Then shares are cancelled and SUNEQ will be no more and shares disappear from your account. The reorganized company may continue with new equity and new shareholders, or may go private. Under Chapter 7 the entire company gets sold and disappears, and there may or may not be a distribution to shareholders, only if all the creditors get paid. It will not even be close here. No shot.

What do you mean by cancelled? That the shares will have no value as they sit in our account? That will be the effect if no assets remain to be distributed to shareholders after company creditors finish any squabbling over remaining assets to which each creditor may be entitled--- all or a portion.That's the way I understand after talking with TDA rep

They will be cancelled when the POR goes into effect. They must trade until then but a minute longer.

In another recent BK proceeding, shares were not “canceled’ as such, but remained visible to both TDA rep and me in a TDA account. He explained it was up to me whether to, or how to, dispose of or remove those shares.

From the looks of the most recent monthly operating report the wind power business is very profitable, that is the only thing that is profitable.

How can you be "certain to hold" when the judge already came out and explained why shares would be cancelled? Do you even have a reason as to why your holding? Obviously you feel commons will survive but what are your reasons?

My convictions have always been to hold. If your Club 33 was certain last year they would survive and now certain they won't, then that questions their integrity. Does it not?

I will reach out to my friends at Club 33 sometime tomorrow and see what they are saying, last I spoke to them they informed me shares were going to be cancelled with certainty. Let me ask you, what makes you so confident shares will survive? I'm intrigued.

I'm aware of what the Judge said. Why was your club 33 people so confident that share holders would survive several months ago?

The judge has already came out and explained why shareholders won't get anything, I don't understand what you are waiting on? It's over, there is nothing left.

Not playing, still holding. Haven't wavered either.

Now you might try to make something playing hot potato with this turd, whatever melts your butter.

Yes. Never wavered an inch.

The outcome is guaranteed, shares will be cancelled, the judge has already came out publicly and explained why.

Does that mean you are still a 100% certain of the outcome?

Cool - people were idiots or crooks to have even bought this in the first place. It was probably worth zero all along.

It's not just class action lawsuits. Goldman Sachs and JP Morgan are being sued. From law360:

Funds Say Goldman, Others Flubbed $157M SunEdison Buy

By Cara Mannion

Law360, New York (November 15, 2016, 6:19 PM EST) -- Banking heavyweights including Goldman Sachs and JPMorgan underwrote a $157 million SunEdison preferred stock purchase without disclosing the renewable energy company’s hefty loan that hinted at its coming free fall into bankruptcy, according to a suit by two investor funds owned by KKR Corp.

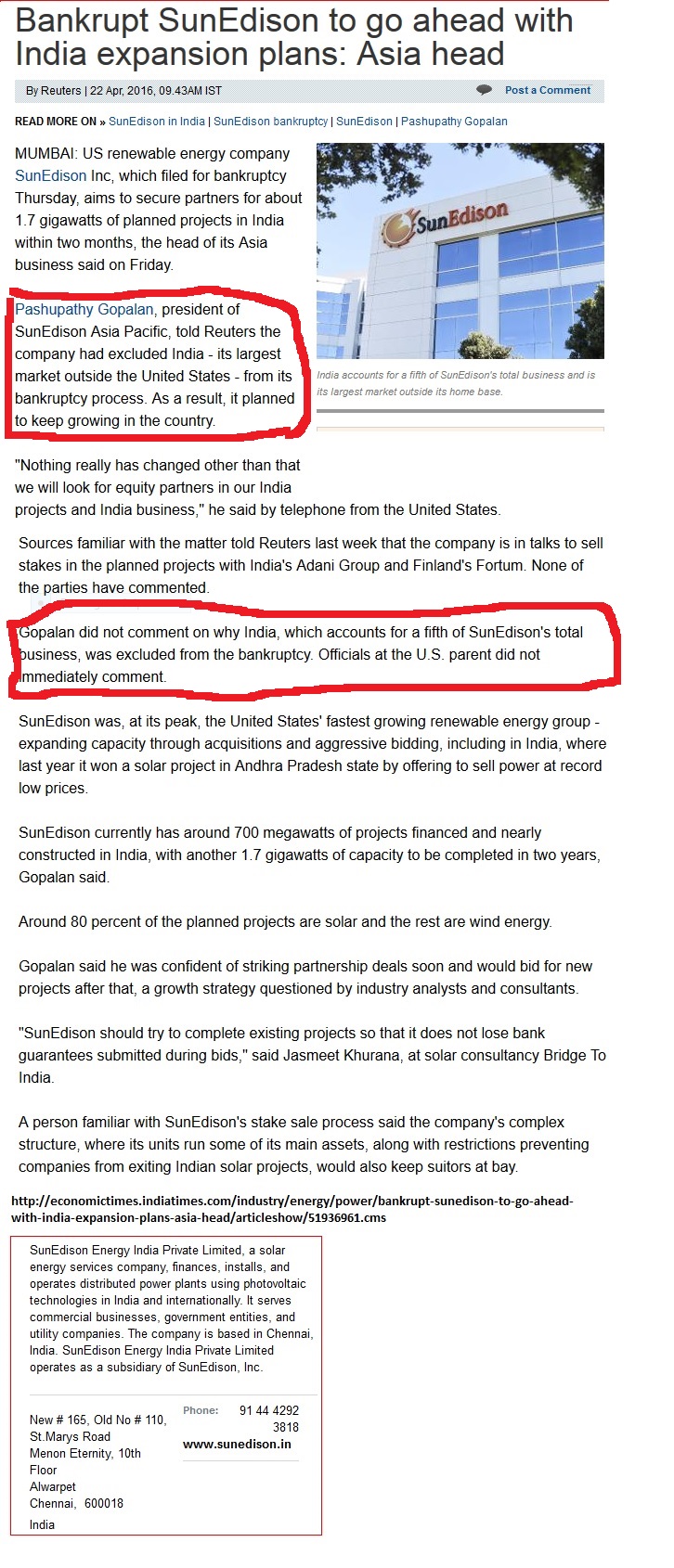

SunEdison Inc. raked in $650 million in an August 2015 preferred stock offering despite already being entrenched in an economic downward spiral, Kearney Investors SA and Powell Investors LP alleged in their suit removed to California federal court Monday. But SunEdison’s executives and a slew of big banks misled investors about the now-bankrupt company’s financial outlook by neglecting to disclose its $169 million loan taken out just one week before the stock offering, according to the suit.

“By misleading plaintiffs and other investors about [SunEdison] while earning lucrative underwriting fees, [SunEdison]’s underwriters are every bit as culpable as [SunEdison] and its officers and directors for the over $100 million of losses that plaintiffs suffered on their investments,” the investor funds said.

SunEdison took out the $169 million loan with a 15 percent interest rate from Goldman Sachs & Co. in August 2015. But the company waited three months to disclose the loan, which was a “glaring red flag” for its future financial woes, the investor funds said.

The funds alleged it’s likely SunEdison got the Goldman loan to pay off a $410 million loan issued in January 2015. Some banks that issued the margin call on the earlier loan were the same banks that underwrote Kearney Investors’ and Powell Investors’ August 2015 stock purchases, according to the complaint. Despite being the very banks whose loans allegedly forced SunEdison to take out the extra $169 million, they still failed to disclose the Goldman loan and cashed in on handsome underwriting fees, the funds said.

“These entities suffered conflicts of interest between their interests as lenders that needed [SunEdison] to remain afloat and underwriters charged with the responsibility of ensuring that [SunEdison] accurately presented its financial condition to the public,” the KKR funds said.

The Goldman loan’s extremely high interest rate, sheer size and reason why it was taken out should have tipped off JPMorgan Securities LLC, Goldman Sachs, Deutsche Bank Securities Inc., Bank of America Merrill Lynch, Morgan Stanley & Co. LLC and MacQuarie Capital Inc. to disclose its existence, the funds argued.

The underwriters also failed to catch SunEdison’s liquidity issues, the funds said. The now-bankrupt company frequently assured investors that it had enough cash flow to fund projects needed to reach growth estimates despite its deep liquidity crisis, according to the suit. It was up to these underwriters to alert investors of issues like this as gatekeepers against securities fraud, according to the suit.

KKR declined to comment Tuesday. The investor funds’ counsel on Tuesday declined to comment past public record.

Goldman Sachs, Morgan Stanley, Merrill Lynch and Macquarie Capital all told Law360 Tuesday that they had no comment. SunEdison also declined to comment on behalf of its executives Tuesday.

JPMorgan and Deutsche Bank were not immediately available for comment Tuesday.

Kearney Investors and Powell Investors are represented by David M. Grable, Andrew J. Rossman, Jordan A. Goldstein and Kimberly E. Carson of Quinn Emanuel Urquhart & Sullivan LLP and Frank J. Broccolo and Mark D. Baute of Baute Crochetiere Gilford LLP.

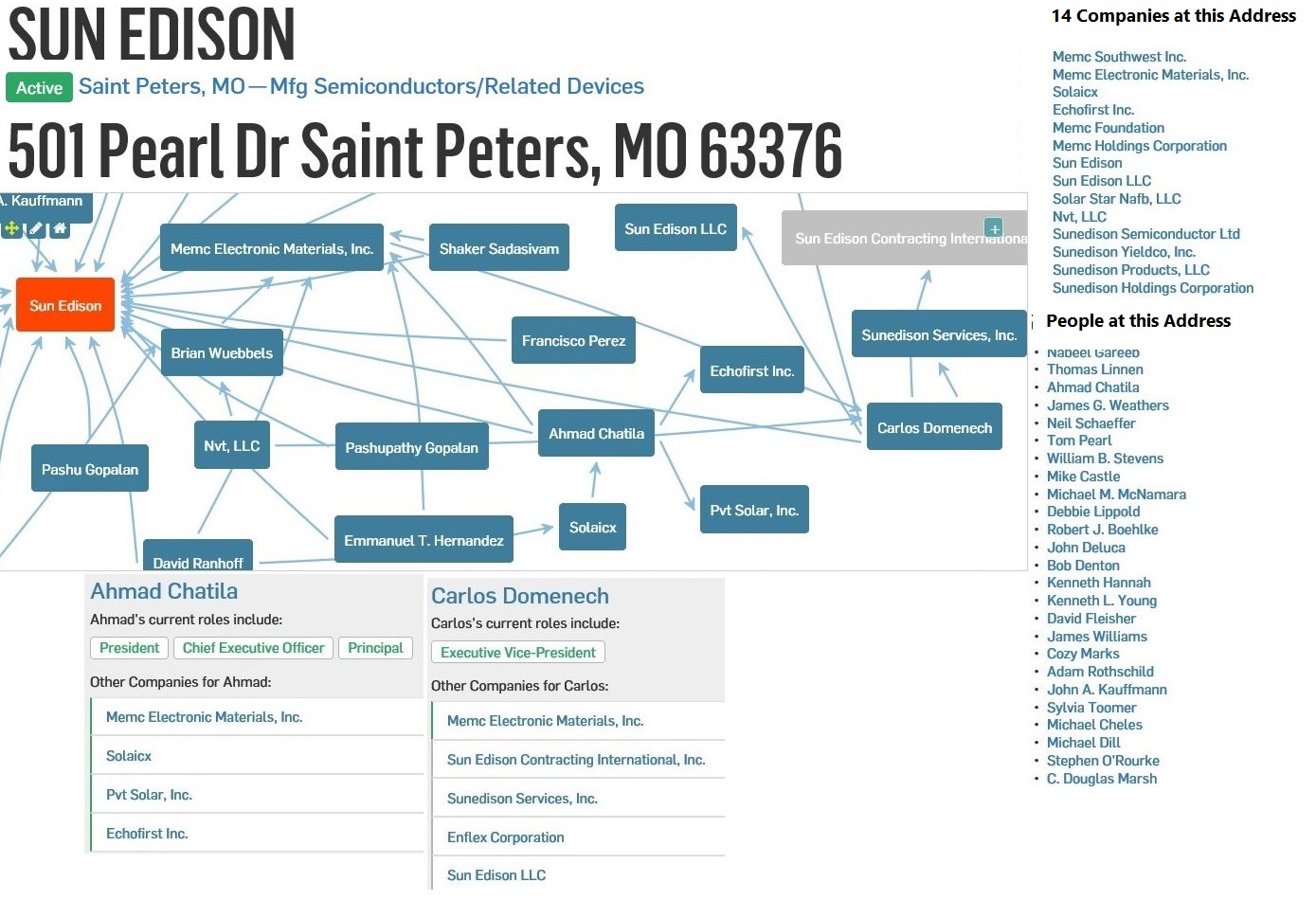

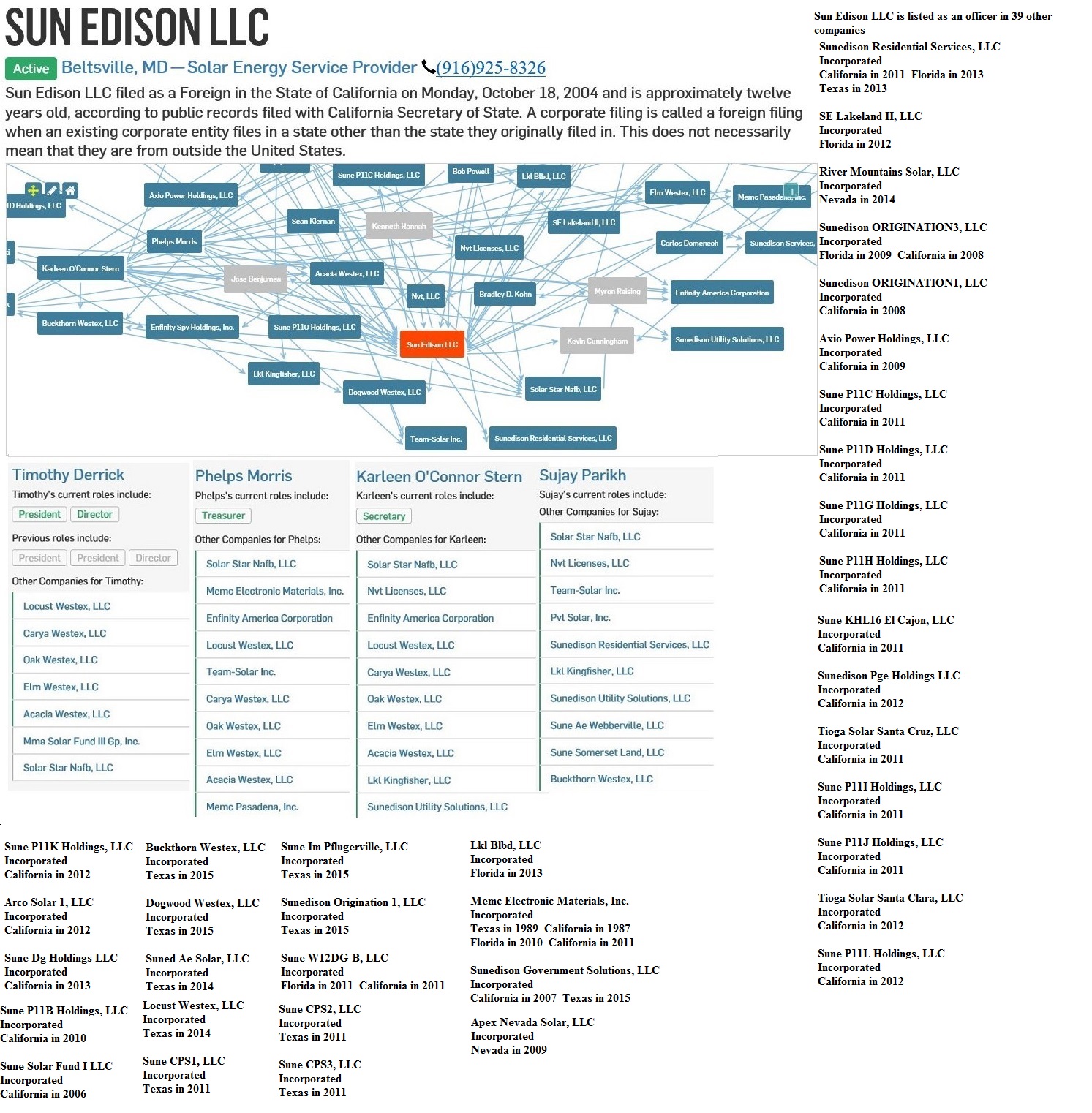

Peter Blackmore is represented by Gregory Peter Boden and Jessica L. Lewis of Wilmer Cutler Pickering Hale & Dorr LLP. Ahmad Chatila, Martin Truong, Emmanuel Hernandez, Antonio Alvarez, Clayton Daley Jr., Georganne Proctor, Steven Tesoriere, Marshall Turner, James Williams, Randy Zwirn and Brian Wuebbels are all represented by Sara B. Brody of Sidley Austin LLP.

The underwriter defendants are represented by Patrick D. Robbins, Jonah P. Ross, Adam S. Hakki and Daniel C. Lewis of Shearman & Sterling LLP.

The case is Kearny Investors S.A.R.L. et al. v. Goldman Sachs & Co. et al., case number 3:16-cv-06582, in the U.S. District Court for the Northern District of California.

--Editing by Bruce Goldman.

Google sun edison class action lawsuit - the websites should give instructions. You should be getting something in the mail if you are qualified anyway.

Look for under .015 soon, maybe even by the end of the week.

Just out of curiosity how many billions was SUNE short of paying their creditors? I know it was a lot but I don't have the exact figure.

How do I join the class action suit

That's a lot of money to lose, sorry to hear that. Management should be incarcerated, I'm still trying to figure out exactly when shares will be cancelled.

Thanks for comment, so did you sell all shares or did you join the lawsuit?

Stories like this are so very hard to hear. I'm sorry man. Many lost their retirement here and more. The shares are worthless and food luck with the class action suit. Could take 3-7 years or more. I doubt we will ever see anything. I lost at least $377,000 on this crap. I hate the CEO and Sune.

Yes. You have nothing to loe whatsoever by joining the class action, as many of them that are out there. Do it now.

You just had to have held shares during the class period. When you owned them will figure in as to how much you get, generally. How much who knows.

Thanks, MB, But if the shares are canceled, whether we still have the right to join the class action?

You just had to have held shares during the class period. When you owned them will figure in as to how much you get, generally. How much who knows.

Dear Top Penny: I still hold 70k shares with average of $1.5 per share My question is if I sell all shares, whether I can still join the law suite later, or I need to keep the share to join the legal action. What is the best for me. I am a 80 years old senior, I lost every thing of my retired money! Need your advise, thanks!

There might very well be lawsuits from now until the cows come home once SUNEQ shares are cancelled, however those who bought post bankruptcy won't be entitled to anything.

I was hoping for an explanation of the December dates and what the motion itself is referring to in layman's terms. I don't doubt the stock is likely to get cancelled. I think the lawsuits against many of the banks and individuals involved will go on for years. If the free market and very experienced investment banks valued the company well into the multiple billions and it turns out it was worth less than zero, tracing all those dollars will certainly lead to not just unethical, but very likely illegal activity. The saga will likely long outlive the shares.

SUNEQ is toast my friend, the judge has already explained why shareholders will get zilch, what else do you need to hear?

I saw this, but I think we can use a bit of commentary in layman's terms as to exactly what it means:

SunEdison filed with the U.S. Bankruptcy Court a second motion for entry of an order subordinating and reclassifying claims based on the purchase or sale of securities of the Debtors or their affiliates.

The motion explains, “Consistent with section 510(b) of the Bankruptcy Code and the express terms of the Debtors’ confirmed Plan…the 510(b) Claims should be subordinated to all other creditor claims and reclassified as Class 6 ‘Other Subordinated Claims’ because such claims purport to be based on the purchase or sale of securities of the Debtors or an affiliate of the Debtors or a claim for reimbursement or contribution in connection with such claims. Ordinarily, a party seeking to subordinate a claim must request such relief by way commencing an adversary proceeding, except where, as here, the confirmed Plan expressly provides for the subordination of section 510(b) claims and separately classifies such claims for treatment purposes.”

In addition, “Accordingly, the Debtors file this Motion in an abundance of caution to give express effect to the terms and conditions of the Plan.”

The Court scheduled a December 21, 2017 hearing to consider the motion, with objections due by December 14, 2017.

Yup. This one is toast. Wait for it. It will happen. How can anyone be bullish on this POS?

POR hasn't been finalized yet but it will be soon.

November is coming. What date is this going to stop trading per the court ruling?

What news? There is no news to come other than the cancellation of shares. The judge has already explained why shares will be cancelled. There is nothing left.

gonna run boyzzzzzz,,,hold tite myop $$$$

|

Followers

|

284

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

36208

|

|

Created

|

08/05/06

|

Type

|

Free

|

| Moderators | |||

This board is for fundamental and technical discussion about Sunedison, Inc.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |