Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

LOOK INTO MSMY......CURRENT YESTERDAY, SKULL BOUT TO "POOF" ANYDAY, REPUTABLE CEO JOHN STIPPICK, REAL PLANS, DELIVERED PROMISES, LOW FLOAT.....THIS BABY IS GOING TO OUTERSPACE.....IT MOVES HARD ON A BABIES SNEEZE!!!!

MAYBE BEST PENNY PLAY OF THE YEAR!!!

$VIDA is definitely Nuts making me insane Profits up 4% today and still going

$.05 coming

http://otcshortreport.com/company/VIDA

Can you ask him how many VOTING SHARES he and Toby still hold?

Does he plan on getting current soon?

I've always liked TBEV and know Mike personally, but can't figure out what has held them up from really moving. It's great to trade for a few ticks here and there though.

You mean over diluted don't you? They gave out so much paper it will take a tug boat to move it an inch.

$TBEVD ~ "We are also currently negotiating with several new professional athletes to endorse our product and look forward to announcing any additions to our growing family of professional athlete endorsers."

- Mike Holley, High Performance Beverage President

http://finance.yahoo.com/news/high-performance-beverage-co-initiates-130000734.html

$TBEVD Website: http://bev.highperformancebeverage.com/

$TBEVD News: http://finance.yahoo.com/q/h?s=TBEVD+Headlines

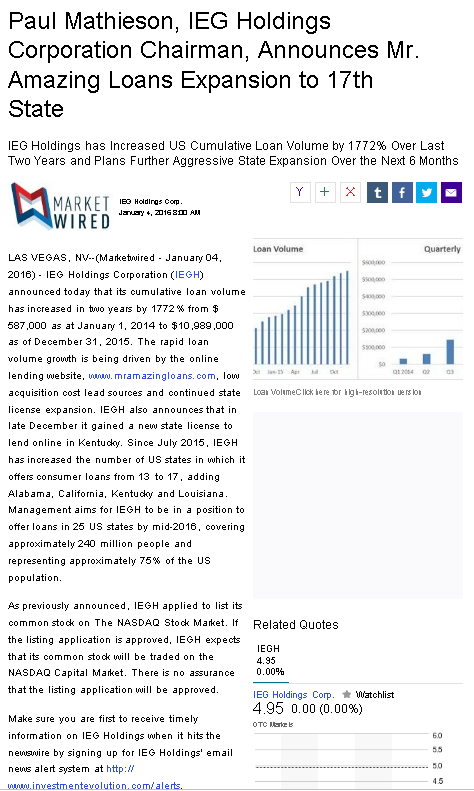

$IEGH on alert, huge loan growth revenues! Since January 2014, cumulative loan volume has increased by 1,825% from $587,000 to $11,304,023 as of January 31, 2016. Other highlights of 2015 were the full repayment of all debt and an increase in net assets to $7.65 million. Please visit http://ir.investmentevolution.com/financial-results for a copy of IEGH's full year report on Form 10-K, as filed with the Securities and Exchange Commission.

The rapid loan volume growth is being driven by the online lending website, http://www.mramazingloans.com, low acquisition cost lead sources and continued state license expansion. Management aims for IEGH to be in a position to offer loans in 25 US states during 2016, covering approximately 240 million people and representing 75% of the US population.

http://finance.yahoo.com/news/ieg-holdings-corporation-announces-mr-130934319.html

$IEGH huge upside here Roger$! Definitely big board potential http://www.investmentevolution.com/

$IEGH ~ If the NASDAQ listing application is approved, IEGH expects that its common stock will be traded on the NASDAQ Capital Market.

$IEGH Websites: http://www.investmentevolution.com/ ~ https://www.mramazingloans.com/

$IEGH News: http://finance.yahoo.com/q/h?s=IEGH+Headlines

$IEGH ~ MZ will assist IEGH with communicating its corporate, financial and investor developments to shareholders, while building a strong public brand and investor base. Ted Haberfield, President of MZ North America, and the MZ Group team will be advising the Company in all facets of corporate and financial communications.

http://finance.yahoo.com/news/ieg-holdings-corporation-retains-mz-160500953.html

$IEGH Websites: http://www.investmentevolution.com/ ~ https://www.mramazingloans.com/

$IEGH News: http://finance.yahoo.com/q/h?s=IEGH+Headlines

$FDBL oversold now, ready for a bounce soon!

$IEGH on radar, otcqb stock here: The Company offers $5,000 personal loans over a five year term at 23.9% to 29.9% APR. IEG Holdings plans future expansion to a total of 25 US states. For more information about the Company, visit www.investmentevolution.com

http://www.investmentevolution.com/

$SRGL on radar, nice bids coming in, ready for power hour!

$IMNP ~ Bertilimumab was originally developed by Cambridge Antibody Technology (now part of MedImmune, the biologics division of AstraZeneca). CAT licensed Bertilimumab to iCo Therapeutics, who retains the rights to develop ophthalmic indications (Kerato-conjunctivitis, wet Age-related Macular Degeneration) while Immune Pharmaceuticals took responsibility for product supply and all non-ophthalmic indications in June 2011.

http://www.immunepharma.com/product-portfolio/bertilimumab-draft/

$IMNP Website: http://www.immunepharmaceuticals.com/

$IMNP News: http://finance.yahoo.com/q/h?s=IMNP+Headlines

$IMNP Live Chart: http://stockcharts.com/c-sc/sc?s=IMNP&p=d&b=7&g=0&i=p87425001600

$FDBL ~ Join Friendable today and let someone know what you're "Friendable" for!Join Friendable today and let someone know what you're "Friendable" for!

$FDBL Website: http://friendable.com/

$FDBL News: http://finance.yahoo.com/q/h?s=FDBL+Headlines

$FDBL Live Chart: http://stockcharts.com/c-sc/sc?s=FDBL&p=d&b=7&g=0&i=p87425001600

$URHY = Urban Hydroponics, Inc.

http://urbanhydroponics.com/

$URHY Website: http://urbanhydroponics.com/

$URHY News: http://finance.yahoo.com/q/h?s=URHY+Headlines

$EPAZ on alert, strong earnings this year, chart due for a major bounce!

$NTEK Annotated Daily Chart, on the breakout

$CRWG .043 nice support here! Company Profile Video:

$NTEK with a diverse portfolio of products and technology, 4K Studios creates digital Ultra HD 4K content using both licensed materials as well as original productions. NanoTech is redefining the role of developers and manufacturers in the global market.

$NGEY 1.39 green here this afternoon!

BSGM "It's a great place to recruit skilled personnel," Cash says.

$WOGI on alert, rsi heating up!

http://stockpumpers.blogspot.com/2015/10/world-oil-group-inc-otc-wogi-has-signed.html

$CRWG on high alert! CrowdGather CEO Sanjay Sabnani has been buying the stock in the open market, having purchased 50,000 shares in mid-June of this year at prices of $0.075 to $0.08 per share, according to Form 4 filings with the SEC.

* Plan on building out WeedTracker.com into a fully-featured on-line cannabis community

* Turning WeedInHollywood.com into its first cannabis themed gaming title

$HKUP Placed On Breakout Watch from Wall Street Newscast

Highlights

- Move to Friend and Following Aspect of Mobile App

- Now has 600,000+ Mobile Users

- Anticipate Dramatic User Growth

- $1.5 Million in Funding in Place

- Toxic Notes Locked into Friendly Hands

- Strong Accumilation on Chart Indicator

- 140 Million Shares outstanding, tight float

Short-Term Target: $0.04+

"It is a very exciting time for the company and we intend to communicate actively over the next few months as new roll-outs, designs, members and more continue to emerge from Friendable," stated Robert Rositano, Jr., CEO, iHookup Social, Inc. "As always, we will be highly transparent and inform our shareholders of all new or relevant developments."

Toxic Notes Placed in Friendly Hands

As any experienced trader knows the biggest killer to any investor rally is when outstanding notes are converted and dumped into any run by known toxic funders. These have been a major issues over past few years as small public companies find their only source of working capital is from these known toxic note funders, which always results in sharp dilution and price decreases. These toxic funders have little to no interest in the long-term prospects of companies they fund, and tend to sell once matured deep below the bid usually resulting in major losses for small investors in these stocks.

On June 9, 2015, HKUP effected a major consolidation of its convertible debt on June 5, 2015, with Coventry Enterprises, LLC becoming the major note holder of the Company. Coventry entered into Debt Purchase Agreements totaling $240,818 with the Company's other convertible note promissory holders, thus placing a large overhang of potential converting notes into friendlier hands.

This is a major development as this now gives HKUP room to run without fear of constant selling of new shares from note conversions from group of toxic funders.

$1.5 Million in Funding

In addition to this note roll-up, HKUP also announce it has secured $1.5 million in financing from Alpha Capital, through way of introduction from Coventry Enterprises, providing the Company with necessary funds to execute its 12 month growth plan of its mobile GPS social networking platform.

About iHookup Social:

iHookup Social is a mobile-social app positioned at the intersection of location based connections, love and adventure, stimulating hyper-local opportunities for our user community as well as the venues and merchants competing for their business.

The company seeks to redefine the way people connect, find love or embark on an adventure. iHookup Social is where real people make real connections and businesses pay to be their host. The by-product of our business model inherently produces "hyper-local" advertising opportunities for the company, driving customers to local venues and / or businesses. The laws of attraction or making a new connection have shifted, with the traditional meaning of "being social" or "meeting up," now taking a backseat to meeting online or through a mobile device and apps.

Making connections through online or mobile devices has become a dominant part of today's mobile-social lifestyle, across various social circles, age groups, race, gender and demographics. iHookup Social takes the virtual connection and moves it toward a real-life interaction, facilitating connections and offering-up locally relevant hot spots and locations to meet up with these new connections, allowing iHookup Social to become both matchmaker and concierge. This combination provides a unique opportunity for consumer brands to offer incentives to a growing network of socially active mobile users on a hyper-local basis.

About Wall Street Newscast

Located in New York City, Wall Street Newscast (WSNC) has been providing Wall Street investor presentations for both public and private companies since 1998. WSNC offers a wide-range of services to companies and investor relation professionals to discuss their recent news announcements, earnings reports, and corporate events to a diverse network of individual and institutional investors on Wall Street. www.wallstreetnewscast.com

$CRWG the launch of Weed in Hollywood™! The Company’s first cannabis themed social slot game. Available for download on Google Play: https://play.google.com/store/apps/details?id=com.crowdgather.winh

$EPAZ ~ Very Interesting DD Epazz AutoHire Subscription Renewal Rates Above 90%; AutoHire has Helped to Increase Epazz's Revenue

http://finance.yahoo.com/news/epazz-autohire-subscription-renewal-rates-121500984.html

$EPAZ - Revenue Based Crowdfunding Campaign

http://finance.yahoo.com/news/epazz-launching-revenue-based-crowdfunding-123500895.html

AIMH 0085 Tiny 6.8 Mil. Float! OTC Markets updated! New attorney, new CPA, confirmed share structure!

http://investorshub.advfn.com/AimRite-Holdings-Corp-AIMH-5977/

Alex I

ANY Not a crazy runner yet but could be very shortly

Listen to their technology and partners

$EPAZ

Epazz AutoHire Subscription Renewal Rates Above 90%; AutoHire has Helped to Increase Epazz's Revenue

http://finance.yahoo.com/news/epazz-autohire-subscription-renewal-rates-121500984.html

CHICAGO, IL--(Marketwired - August 19, 2015) - Epazz, Inc. (EPAZ), a leading provider of cloud based business software solutions, announced its subscription renewal rates for AutoHire recruiting software are well over the 90% level. AutoHire has helped to increase Epazz’s revenue. AutoHire, recruiting software, continues to receive positive responses on our support and customization IT consulting services.

“We acquired AutoHire back in 2010, we have been upgrading the solution for the past two years onto the latest technologies. The new version of AutoHire is called Provitrac and will include a learn management system. Our goal for AutoHire is to create a complete human resources cloud suite,” says Shaun Passley, Ph.D., CEO of Epazz, Inc.

Investor-focused companies use the quality-controlled OTCQX platform to offer investors transparent trading, superior information and easy access through their regulated U.S. broker-dealers.

6 Proven Methods For Selling Stocks

Choosing a time to sell a stock can be a very difficult task. It is especially difficult because, for most traders, it is hard to separate their emotions from their trades. The two human emotions that generally affect most traders with regards to selling a stock are greed and fear of regret. The ability to manage these emotions is key to becoming a successful trader.

Rising Profits

For example, many investors dont sell when a stock has risen 10 to 20% because they dont want to miss out on more returns if the stock shoots to the moon. This is due to their greed and the hope that the stock they picked will be a big winner. On the flip side, if the stock fell by 10 to 20%, a good majority of investors still wont sell because of their fear of regret. If they sell and the stock proceeds to rebound significantly, theyll be kicking themselves and regretting their actions.

So when should you sell your stock? This is a fundamental question that investors constantly struggle with. You need to separate out the emotion from your trading decisions. Fortunately, there are some commonly used methods that can help an investor make the process as mechanical as possible. In this article, I will look at six general strategies to help decide when to sell your stock.

Valuation-Level Sell

The first selling category well look at is called the valuation-level sell. In the valuation level sell strategy, the investor will sell a stock once it hits a certain valuation target or range. Numerous valuation metrics can be used as the basis, but some common ones that are used are the price-to-earnings (P/E) ratio, price-to-book (P/B), and price-to-sales (P/S). This approach is popular among value investors who buy stocks that are undervalued. It can be a good signal to sell when a stock becomes overvalued based on certain valuation metrics.

As an illustration of this method, suppose an investor holds stock in Wal-Mart that they bought when the P/E ratio was around 13 times earnings. The trader looks at the historical valuation of Wal-Mart stock and sees that the five-year average P/E is 15.5. From this, the trader could decide upon a valuation sell target of 15.5 time earnings as a fixed sell signal. So the trader has used a reasonable hypothesis to take the emotion out of his decision making. (For more on the P/E, see Profit With The Power Of Price-To-Earnings.)

Opportunity Cost Sell

The next one well look at is called the opportunity cost sell. In this method, the investor owns a portfolio of stocks and would sell a stock when a better opportunity presents itself. This requires a constant monitoring, research and analysis on both your own portfolio and potential new stock additions. Once a better potential investment has been identified, the investor would reduce or eliminate a position in a current holding that isnt expected to do as well as the new stock on a risk-adjusted return basis.

Deteriorating Fundamentals Sell

The deteriorating fundamental sell rule will trigger a stock sale if certain fundamentals in the companys financial statements fall below a certain level. This sell strategy is slightly similar to the opportunity cost in the sense that a stock sold using the previous strategy has likely deteriorated in some way. When basing a sell decision on deteriorating fundamentals, many traders will focus mainly on the balance sheet statement with emphasis on liquidity and coverage ratios. (Learn more about the balance sheet in Breaking Down The Balance Sheet.)

For example, suppose an investor owns the stock of a utilities company that pays a relatively high and consistent dividend. The investor is holding the stock mainly because of its relative safety and dividend yield. Furthermore, when the investor bought the stock, its debt-to-equity ratio was around 1.0 and its current ratio was around 1.4.

In this situation, a trading rule could be established so that the investor would sell the stock if the debt/equity ratio rose over 1.50, or if the current ratio ever fell below 1.0. If the companys fundamentals deteriorated to those levels – thus threatening the dividend and the safety - this strategy would signal the investor to sell the stock.

Down-from-Cost and Up-from-Cost Sell

The down-from cost sell strategy is another rule-based method that triggers a sell based on the amount, in percent, that youre willing to lose. For example, when an investor purchases a stock he may decide that if the stock falls 10% from where he bought it at, he would sell the stock.

Similar to the down-from cost strategy, the up-from cost strategy will trigger a stock sale if the stock rises a certain percentage. Both the down-from-cost and up-from-cost methods are essentially a stop-loss measure that will either protect the investors principal or lock in a specific amount of profit. The key to this approach is selecting an appropriate percentage that triggers the sell by taking into account the stocks historical volatility and the amount you would be willing to lose.

Target Price Sell

If you dont like using percentages, the target price sell method uses a specific stock value to trigger a sell. This is one of the most widely used ways by which investors sell a stock, as seen by the popularity of the stop-loss orders with traders and investors. Common target prices used by investors are typically ones based on valuation model outputs such as the discounted cash flow model. Many traders will base target price sells on arbitrary round numbers or support and resistance levels, but these are less sound than other fundamental based methods.

Bottom Line

Learning to accept a loss on your investment is one of the hardest things to do in investing. Oftentimes, what makes investors successful is not just their ability to choose winning stocks, but also their ability to sell stocks at the right time.

Ascending Trend Channel: An ascending trend channel is a basic chart pattern used in technical analysis.

Ascending trend channels are a useful tool due to their ability to predict overall changes in trend. As long as prices remain within the ascending trend channel, the upward trend in price can be expected to continue. As soon as prices exceed either trendline forming the channel, however, a strong signal either to buy or to sell is generated. A break through the upper trendline generates a strong buy signal, while a break through the lower trendline generates a strong sell signal.

Good stories replaced hard news. Increased media exposure led to more advertising and this simply fed the public appetite for stocks. The media continues to pour it one with Mad Money debuting in 2005

As an “OTC Pink Current Information” company, the company is required to post quarterly and annual financial and disclosure reports on the OTC Markets site. This information is then available for the public (investors) to examine. As an OTCQB company, the company is required to have its financial reports audited by a Public Company Accounting Oversight Board Accounting Firm (PCAOB). These financial reports as well as disclosure and other reports are filed with the Securities Exchange Commission.

At or better: Instruction given to a dealer to deal at a specific rate or better. Hence-"at or better."

Remember that a bear market will give back in one month what a bull market has taken three months to build.

Bar Chart

Perhaps the most popular charting method is the bar chart. The high, low and close are required to form the price plot for each period of a bar chart.

To sell on the news relates to the event itself. You sometimes get the seeming paradox of a price reaching a new high before the event and falling lower immediately after the event, even when the news matches the forecast. The lower price comes about because the early birds take profit on the up move that they themselves engineered. The new low is usually short lived. After all, the forecast was for good news and the good news occurred, so the news was properly built in and the new high is the appropriate price.

The tipping point for the market comes when leadership shifts from energy to consumer staples. This is a sign that commodity prices are starting to hurt the economy.

A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" (OTC) markets. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange, are called "third market makers." Many OTC stocks have more than one market-maker.

Furthermore, the tools shown in this article should be used in conjunction with other technical analysis techniques.

A limit order allows you to limit either the maximum price you pay or the minimum price you are willing to accept when buying or selling a stock. The primary difference between a market order and a limit order is that your stock broker cannot guarantee that the latter will be executed.

Measure Your Results. You're trading online to make a profit. If your figures don't add up, stop putting money at risk until you know why your stock trading method isn't working.

Intermarket Analysis is a valuable tool for long-term or medium-term analysis. While these intermarket relationships generally work over longer periods of time, they are subject to draw-downs or periods when the relationships do not work.

Don’t take the market home with you even if you trade at home

After Lucent declined, a trading range was established between 40.5 and 47.5 for almost two months (green oval).

|

Followers

|

116

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8163

|

|

Created

|

07/16/11

|

Type

|

Free

|

| Moderator Hooka | |||

| Assistants Let's Roll NYC Trader Screech691 Mick Dodge DITRstocks | |||

.png)

.png)

|

Posts Today

|

0

|

|

Posts (Total)

|

8163

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |