Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Good morning, folks

The mods, Discover Gold, SkeBallLarry and myself have decided to close the board today. We want to get on to other life pursuits.

We are ending on a high note, as one of ihub's top boards. The board's founder, StockLobster and then Tuff-Stuff would be pleased how the board thrived.

There have so many contributors over these seventeen years; EZ2, Hoosier Hoagie, dDt, Trueheart,- 3,451 posters and 648,882 posts in all!

And many quiet readers like fuzzy, Theo and sdheart. It would not have been a parade without them on the sidewalk clapping :)

On behalf of my colleagues, thank you all.

MG, for Ske and DG

Apple's RSI is now at 29. Anything below 30 is considered oversold.

CNBC

Constellation Brands reports tomorrow.

Symbols active on the streams today: $AMC (-5.02%), $QS (+43.08%), $ALT (+17.72%), $LFMD (-32.05%), $MCD (-0.90%), $NKLA (+7.47%), $MARA (+12.10%), & $OMGA (+94.69%).

3 of 11 sectors closed green. Healthcare (+0.50%) led, & energy (-1.75%) lagged.

TDRip

Today's heat map: https://finviz.com/map.ashx

Supermarket Giant Drops Pepsi and Lay’s Over Price Increases

Carrefour ditches PepsiCo products in France, Italy, Spain and Belgium

By Mauro Orru and Jennifer Maloney for the Wall Street Journal

Updated Jan. 4, 2024 2:55 pm ET

(MG Note: Clearly Pepsi overplayed its hand. Good for Carrefour!)

One of the world’s biggest supermarket chains said it would drop several PepsiCo products to protest what it called unacceptable price increases, a rare public standoff between a grocer and food maker after more than two years of rising prices.

Carrefour, which operates thousands of stores across more than 30 countries, said it would stop selling Pepsi, Doritos and other products in France, Italy, Spain and Belgium. A spokesman for the French company said Thursday that it had decided to add notes to store shelves to explain the changes to customers.

Notes seen by The Wall Street Journal say the company is no longer selling Lay’s, Doritos and Benenuts snacks, Alvalle gazpacho, Lipton teas, Pepsi and 7 Up soft drinks and Quaker food products. 7 Up is sold outside the U.S. by PepsiCo.

“We’ve been in discussion with Carrefour for many months and we will continue to engage in good faith in order to try to ensure that our products are available,” a PepsiCo spokeswoman said. She declined to comment further.

In October, PepsiCo finance chief Hugh Johnston told The Wall Street Journal that product price increases would slow in 2024 and would be roughly in line with the overall rate of inflation. The slowdown follows two years of sharp price increases by PepsiCo on its soft drinks, snacks and packaged foods.

The company, which is slated to report its latest quarterly results next month, has forecast earnings growth of 13% and revenue growth of 10% for 2023, excluding currency impacts.

Through the Covid-19 pandemic, a number of companies boasted about their ability to raise prices without significantly damaging sales as a sign of brand strength. Johnston has said that PepsiCo products appeal to a wide range of shoppers and that people tend to indulge in items such as chips and soda as affordable luxuries even during hard economic times.

Supermarket operators in the U.S. have also signaled concerns about rising prices in some aisles of stores, even as the overall rate of inflation has slowed. Walmart Chief Executive Doug McMillon said in November that “we may be managing through a period of deflation in the months to come, and while that would put more unit pressure on us, we welcome it, because it’s better for our customers.”

Europe represented about 14%—or roughly $9 billion—of PepsiCo’s global revenue in the first nine months of 2023. Bernstein analyst Callum Elliott estimates that Carrefour stores in France, Italy, Spain and Belgium represent 0.25% of PepsiCo’s global revenue.

In France, food-price inflation surged into double digits in 2022 and reached nearly 16% in March 2023. In December, food prices rose 7.1% over the past 12 months. The French government has also criticized major manufacturers and said it would push them to bring down prices.

Carrefour’s decision on PepsiCo products comes roughly four months after the retailer began attaching labels to products it claims are subject to so-called shrinkflation—when the quantity of a product diminishes in its packaging but the retail price is unchanged. Reuters and local media earlier reported on Carrefour’s decision.

Joshua Kirby contributed to this article.

Nasdaq closes lower for a fifth day, its longest losing streak since October 2022

By Lisa Kailai Han and Sarah Min for CNBC

The Nasdaq Composite closed lower on Thursday for a fifth consecutive session — its longest losing streak since October 2022.

The tech-heavy Nasdaq Composite dipped 0.56% to end at 14,510.30. Since the Dec. 27 close, the index has lost nearly 4%. The S&P 500

slid 0.34%, marking a fourth day of declines, finishing at 4,688.68. The Dow Jones Industrial Average

was the outlier, eking out a 10.15-point gain, or 0.03%, to close at 37,440.34.

Mega-cap tech stocks such as Apple are underperforming to start the year, as overstretched valuations and uncertainty around when the Federal Reserve will begin to cut rates have investors worried that markets have gotten overly optimistic.

Apple stock is down more than 5% this week. Shares of the tech giant fell more than 1% on Thursday following a downgrade by Piper Sandler, two days after Barclays also lowered its rating on the name.

The recent performance on Wall Street comes in stark contrast to how the market ended 2023. The S&P 500 ended last year up more than 24% while enjoying its best weekly win streak going back to 2004.

But Steven Wieting, chief investment strategist of Citi Global Wealth, doesn’t believe that the recent pullback will have many long-term repercussions on the market.

“Whether any of this lasts, I wouldn’t really look to the last few days as mattering very much,” he told CNBC. “It’s really a statistical coin toss.”

In fact, Wieting thinks the S&P 500 could end the year around the 5,000 level, which would indicate more than 6% upside from her

Crude Oil

72.36 -0.47%

Gold

2,050.80 +0.39%

US 10 Year

39.91 +2.15%

CLOSE

DJIA

37,440.34

+10.15 (+0.03%)

NASDAQ

14,510.30

-81.91 (-0.56%)

S&P 500

4,688.68

-16.13 (-0.34%)

CLOSE

The Bullish Percent Index (BPI) The indicator helps you know the market's health and when it's overbought or oversold

By: Bonnie Gortler | January 2, 2024

• The Bullish Percent Index (BPI), developed by Abe Cohen in the 1950s, is a breadth indicator based on the number of stocks based on Point and Figure Buy signals. The indicator helps you know the market's health and when it's overbought or oversold.

When the bullish percent index is above 70%, the market is overbought, and when the indicator is below 30%, the market is oversold. Like other overbought indicators, sometimes it does not get as high or as low.

In 2022 and 2023, the indicator reached 70 (overbought) six times (red circles). All occurrences were near market peaks (red lines).

The BPI fell closing today (1/2/24), at 78.80 (purple circle). A reading over 70, followed by a retracement below 70, would give a sell signal on this indicator.

Read Full Story »»»

DiscoverGold

DiscoverGold

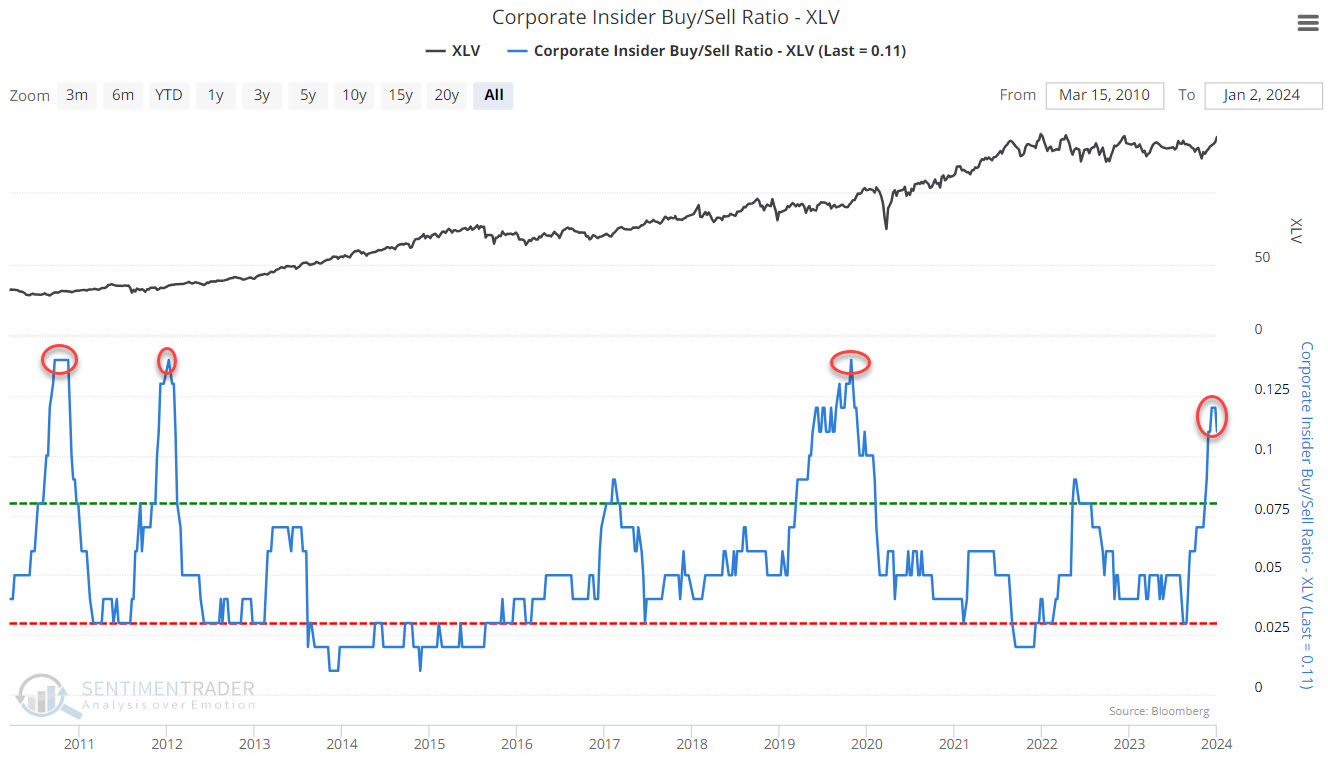

Health Care Sector $XLV Continued insider buying in healthcare sector DOES NOT necessarily translate into an imminent breakout. BUT when the breakout does come the run tends to be substantial. A good time to keep a close eye on this sector’s action.

By: Jay Kaeppel | January 4, 2024

• Continued insider buying in healthcare sector DOES NOT necessarily translate into an imminent breakout. BUT when the breakout does come the run tends to be substantial. A good time to keep a close eye on this sector’s action.

Read Full Story »»»

DiscoverGold

DiscoverGold

All these stocks hit new 52 week highs at some point today

By: Evan | January 4, 2024

• All these stocks hit new 52 week highs at some point today

JPMorgan $JPM

Eli Lilly $LLY

Citi $C

Novo Nordisk $NVO

$AIG

Allstate $ALL

Amgen $AMGN

Boston Scientific $BSX

$GSK

Marathon Petroleum $MPC

OneOk $OKE

Petrobras $PBR

Progressive $PGR

Phillips 66 $PSX

Regeneron $REGN

Vertex $VRTX

Read Full Story »»»

DiscoverGold

DiscoverGold

Decision Time for Treasury Bonds - Will the 200D moving average hold for $TLT?

By: Barchart | January 4, 2024

• Decision Time for Treasury Bonds - Will the 200D moving average hold for $TLT?

Read Full Story »»»

DiscoverGold

DiscoverGold

Why Allegro MicroSystems (ALGM) Stock Is Falling Today

By: Investing | January 4, 2024

What Happened: Shares of chip designer Allegro MicroSystems (NASDAQ:ALGM) fell 9.8% in the morning session after auto-related semiconductor stocks experienced a decline after auto-chip maker Mobileye provided preliminary estimated financial results for Q4'2023 and FY 2024, which fell below Wall Street's expectations.

Mobileye cut its Q4'2023 revenue guidance to a range of $634 million to $638 million, falling below both its initial forecast ($623 million to $648 million) and analysts' consensus estimates. Looking ahead, the company provided FY'2024 revenue guidance of $1,830 million to $1,960 million, below market expectations. For the first quarter of FY'2024, it expects revenue to drop about 50% from a year earlier.

The weak outlook was attributed to "excess inventory" built up by Mobileye's Tier 1 customers. Management elaborated, stating, "Based on our discussions, we understand that much of this excess inventory reflects decisions by Tier 1 customers to build inventory in the Basic ADAS category due to supply chain constraints in 2021 and 2022 and a desire to avoid part shortages, as well as lower than-expected production at certain OEM's during 2023." Moving on, Mobileye expects this excess inventory to be largely consumed in Q1 2024, leading to lower volume in its EyeQ® SoC business and a temporary hit to profitability.

Overall, the weak outlook signals potential challenges for semiconductor stocks in the near term.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy Allegro MicroSystems? Find out by reading the original article on StockStory.

What is the market telling us: Allegro MicroSystems's shares are quite volatile and over the last year have had 12 moves greater than 5%. In context of that, today's move is indicating the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was 8 months ago, when the stock gained 5.9% on the news that the company reported fourth-quarter revenue, gross margin, operating income, and earnings per share (EPS) ahead of analysts' estimates. As minor negatives, free cash flow missed, and inventory levels rose. However, revenue and EPS guidance for the next quarter came in ahead of expectations. The company highlighted some of the projected gains discussed during the recent analyst day presentation as it continued to deliver technology to companies in the growing electric vehicles and automation markets. Management added that "E-Mobility increased to 43% of fiscal year 2023 Automotive sales, up from 36% in fiscal year 2022." The combination of the quarter's outperformance, the guidance above expectations, and bullish management commentary made for a very good quarter.

At $27.03 per share Allegro MicroSystems is trading 48.7% below its 52-week high of $52.72 from July 2023. Investors who bought $1,000 worth of Allegro MicroSystems's shares at the IPO in October 2020 would now be looking at an investment worth $1,527.

Read Full Story »»»

DiscoverGold

DiscoverGold

Why Is Simply Good Foods (SMPL) Stock Soaring Today

By: Investing | January 4, 2024

What Happened: Shares of packaged food company Simply Good Foods (NASDAQ:SMPL) jumped 5.1% in the morning session after the company reported first-quarter results with adjusted EBITDA and EPS exceeding Wall Street's expectations. On the other hand, revenue and operating margin missed by a bit during the quarter. Looking ahead, the company reaffirmed its full year outlook, showing that things are very much on track. Notably, management highlighted the impressive momentum in the Quest segment, revealing that the nutritional snacking business achieved nearly $700 million in revenue in fiscal 2023, doubling its sales since the November 2019 acquisition. In summary, it was a positive quarter marked by reassuring commentary, and setting a promising tone for the start of the new year.

Is now the time to buy Simply Good Foods? Find out by reading the original article on StockStory.

What is the market telling us: Simply Good Foods's shares are not very volatile than the market average and over the last year have had only 4 moves greater than 5%. In context of that, today's move is indicating the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

Investors who bought $1,000 worth of Simply Good Foods's shares 5 years ago would now be looking at an investment worth $2,239.

Read Full Story »»»

DiscoverGold

DiscoverGold

QuantumScape skyrockets after dazzling with Volkswagen battery test

Jan. 04, 2024 11:30 AM ETQuantumScape Corporation (QS) StockVLKAF

By: Clark Schultz, SA News Editor26 Comments

https://stockcharts.com/h-sc/ui?s=QS

QuantumScape Corporation (NYSE:QS) soared in afternoon trading after the company reached an important milestone in a test of its anodeless solid-state lithium-metal cells technology by Volkswagen (OTCPK:VLKAF).

In a test confirmed by PowerCo, QuantumScape's (QS) solid-state cell significantly exceeded the requirements in the A-sample test and successfully completed more than 1,000 charging cycles. PowerCo noted that for an electric car with a WLTP range of 500-600 kilometres, this corresponds to a total mileage of more than half a million kilometres. Notably, the cell barely aged and still had 95% of its capacity or discharge energy retention at the end of the test.

PowerCo CEO Frank Blome: "These are very encouraging results that impressively underpin the potential of the solid-state cell. The final result of this development could be a battery cell that enables long ranges, can be charged super-quickly and practically does not age. We are convinced of the solid-state cell and are continuing to work at full speed with our partner QuantumScape towards series production."

The tested solid-state cell consists of 24 layers and thus already corresponds to the planned series cell. Looking ahead, the next step on the way to series production is for QuantumScape (QS) to perfect and scale the manufacturing processes.

QuantumScape (QS) was up 28.85% at 11:25 a.m. on Thursday to $8.38. That is the highest level for the stock since early August. Short interest on QS stands at 15.6% of the total float, which could add some volatility. QuantumScape (QS) is expected to report Q4 earnings sometime during the middle part of February.

McClellan Oscillator has moved below zero, and no that is not bullish for $SPX $SPY

By: David Keller | January 4, 2024

• McClellan Oscillator has moved below zero, and no that is not bullish for $SPX $SPY.

Read Full Story »»»

DiscoverGold

DiscoverGold

Ford posts highest US auto sales since 2020

REUTERS - 11:43 AM ET 1/4/2024

https://stockcharts.com/h-sc/ui?s=F

(Reuters) -Ford Motor ( F ) on Thursday posted its best annual auto sales in the United States since 2020, fueled by sustained demand for the automaker's crossover SUVs and pickup trucks, a day after many of its peers reported double-digit gains in new vehicle sales.

The Detroit automaker said vehicle sales rose 7.1% to 1.99 million units in 2023. In 2020, Ford posted new vehicle sales of a little over 2 million units.

Overall, U.S. new vehicle sales last year finished at around 15.5 million units, of which electrified vehicles including hybrids made up nearly 17%, according to data from Wards Intelligence.

(con't)

Vivek Ramaswamy offloads $33M Roivant stock

Jan. 04, 2024 2:57 PM ETRoivant Sciences Ltd. (ROIV) Stock

By: Dulan Lokuwithana, SA News Editor

The U.S. presidential hopeful Vivek Ramaswamy sold more than $33M worth of shares of Roivant Sciences (NASDAQ:ROIV), the U.K.-based biotech he founded, the Republican candidate disclosed in a regulatory filing on Wednesday.

Ramaswamy, who is currently trailing former president Trump, Florida Gov. Ron DeSantis, and former UN ambassador Nikki Haley in his presidential bid, reported the sale less than two weeks before the GOP primaries kick off in Iowa.

Part of the proceeds will be channeled towards a "significant investment" in his campaign, Axios reported, citing a spokesperson for Ramaswamy.

According to the SEC filing, Ramaswamy sold 3M ROIV shares for $11.05 apiece on Tuesday in a transaction valued at $33.2M. He continues to own ~51.9M Roivant (ROIV) shares.

Ramaswamy, who led ROIV until January 2021, last sold ~$31.8M worth of company shares in February 2023, just after resigning from its board and chairmanship to focus on his presidential bid.

Stocks Edge Higher, Nasdaq Looks to Snap Skid

By: Schaeffer's Investment Research | January 4, 2024

• Upbeats jobs data is driving today's optimism

• The Do and S&P 500 boast solid midday gains

Stocks are attempting to regain their 2023 form today. Both the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are comfortably back to gains this afternoon, while the Nasdaq Composite (IXIC) furiously pares earlier losses. The tech-heavy index -- looking to snap a four-day skid -- broke into the black midday, as the broader market enjoys upbeat jobs data.

Continue reading for more on today's market, including:

• Can YETI withstand a new competitor?

• Chip stock bucking broad market selloff.

• Plus, WW puts pop; MRK's big upgrade; and a chip supplier in the red.

Put traders are loading up on WW International Inc (NASDAQ:WW) stock today, after Eli Lilly (LLY) launched a website and home delivery option for its weight-loss drug. At last check, 12,000 puts have already exchanged hands -- 11 times the intraday average volume. The weekly 1/5 7-strike put is getting the most attention, with positions opening there. WW is down 12.5% to trade at $6.69 at last check, but is 54% higher-year-over-year.

Merck & Co., Inc. (NYSE:MRK) stock is near the top of the SPX today, last seen up 2.2% at $117.28, after TD Cowen upgraded it to "outperform" from "market perform," with a price-target hike to $135 from $125. The firm is bullish on the pharma giant's Keytruda cancer immunotherapy, as well as other drugs in the pipeline. MRK added 4.8% in the last 12 months.

NXP Semiconductors NV (NASDAQ:NXPI) stock is in the SPX gutter, down 3.4% to trade at $208.63 at last check. Automobile-related semiconductor stocks like NXPI and Wolfspeed (WOLF) are lower after sector peer Mobileye Global's (MBLY) inventory warning. NXPI has shed 8.6% already in 2024, but is 32.9% higher year-over-year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Pharma Stock Novo Nordisk (NVO) Surges on New Drug Partnerships

By: Schaeffer's Investment Research | January 4, 2024

• Mobileye Global is one of the worst stocks on the Nasdaq today

• AAPL is eyeing its fourth-straight day in the red

Stocks are fighting tooth and nail to stay in positive territory today, as the sluggish start to 2024 continues. Notable movers today include self-driving tech stock Mobileye Global Inc (NASDAQ:MBLY), drugmaker Novo Nordisk A/S (NYSE:NVO), and tech titan Apple Inc (NASDAQ:AAPL).

MBLY was last seen down 26% to trade at $29.38, one of the worst stocks on the Nasdaq Composite (IXIC) today and heading for its worst single-session drop on record. The bear gap comes after the company disclosed fiscal first-quarter revenue will fall about 50% year-over-year, with orders pulling back as customers clear inventory. MBLY earlier hit a 52-week low of $28.19, and is headed for its lowest close since November 2022.

Options traders are chiming in. MBLY has seen over 36,000 calls and 28,000 calls exchanged so far, or 30 times the intraday average volume, with new positions being bought to open at the January 30 call, the most popular contract.

AAPL was last seen down 0.7% to trade at $182.92, on the heels of a Piper Sandler downgrade to "neutral" from "overweight." The shares are testing support at their 100-day trendline, and are pacing for their fourth-straight day in the red. Longer term, the Magnificent Seven stock has added 44.8% in the past 12 months.

NVO is enjoying a 4.5% pop to trade at $108.26 at last check, after announcing new partnerships with both Cellarity and Omega Therapeutics (OMG) that could lead to treatments for people living with obesity. The stock earlier scored a record high of $108.98, and blasted through overhead pressure at the $104 level, which capped a handful rallies since October. In the last year, NVO added 58.1%.

Options volume is running at four time the intraday average for NVO, with 29,000 calls and 14,000 puts traded. The most active is the February 110 call, with positions being bought to open.

Read Full Story »»»

DiscoverGold

DiscoverGold

Orders by Fidelity customers

Rank is based on the total of buy and sell orders for the security.

Information shown below in the table is based on the aggregate number of orders entered by Fidelity Brokerage Services LLC self-directed retail customers “as of” the date and time shown.

As of Jan-4-2024 2:02 PM ET

Symbol % Change # Buy orders Buy/sell ratio # Sell orders Sector

TSLA +0.35% 2,511

Buy 43.73%

Sell 56.27%

3,231 Consumer Discretionary

OMGA +101.47% 1,270

Buy 39.23%

Sell 60.77%

1,967 Health Care

AAPL -0.90% 1,693

Buy 55.51%

Sell 44.49%

1,357 Information Technology

TQQQ -0.99% 1,447

Buy 49.35%

Sell 50.65%

1,485

NVDA +1.27% 1,129

Buy 38.7%

Sell 61.3%

1,788 Information Technology

SOXL -2.49% 1,498

Buy 53.39%

Sell 46.61%

1,308

AMZN -2.15% 1,599

Buy 58.98%

Sell 41.02%

1,112 Consumer Discretionary

MINM +120.47% 1,116

Buy 42.73%

Sell 57.27%

1,496 Information Technology

SQQQ +1.10% 793

Buy 31.73%

Sell 68.27%

1,706

MARA +9.67% 788

Buy 37.81%

Sell 62.19%

1,296 Information Technology

AMD +0.92% 1,005

Buy 48.41%

Sell 51.59%

1,071 Information Technology

MSFT -0.18% 612

Buy 33.66%

Sell 66.34%

1,206 Information Technology

SIDU +2.66% 62

Buy 3.56%

Sell 96.44%

1,680 Industrials

SPY -0.06% 1,001

Buy 60.56%

Sell 39.44%

652

SOXS +2.41% 494

Buy 33.15%

Sell 66.85%

996

QS +47.38% 395

Buy 26.64%

Sell 73.36%

1,088 Consumer Discretionary

QQQ -0.29% 853

Buy 58.3%

Sell 41.7%

610

WNW +1.15% 7

Buy 0.51%

Sell 99.49%

1,372 Consumer Staples

LLY +0.55% 534

Buy 46.76%

Sell 53.24%

608 Health Care

COIN +2.80% 442

Buy 39.08%

Sell 60.92%

689 Financials

WBA -6.86% 476

Buy 47.6%

Sell 52.4%

524 Consumer Staples

INTC -0.58% 556

Buy 56.28%

Sell 43.72%

432 Information Technology

VOO -0.05% 839

Buy 86.23%

Sell 13.77%

134

BOIL +8.40% 322

Buy 35.7%

Sell 64.3%

580

PLTR +1.86% 596

Buy 67.5%

Sell 32.5%

287 Information Technology

MBLY -25.97% 516

Buy 59.45%

Sell 40.55%

352 Consumer Discretionary

SHOP +1.95% 573

Buy 66.71%

Sell 33.29%

286 Information Technology

GOOGL -1.38% 456

Buy 56.37%

Sell 43.63%

353 Communication Services

FNGU -0.59% 513

Buy 63.73%

Sell 36.27%

292 Financials

SOFI +1.99% 488

Buy 61.93%

Sell 38.07%

300 Financials

Tesla (TSLA) Stock Has Technical Support in Place

By: Schaeffer's Investment Research | January 4, 2024

• TSLA just pulled back to several layers of support on the charts

• A round of upgrades could provide tailwinds as well

The shares of electric vehicle (EV) powerhouse Tesla Inc (NASDAQ:TSLA) just pulled back to the round $250 level, an area that coincides with its $800 billion market cap. There's additional support from its 126-day moving average that was supportive in August and resistant in November, as well as the October breakdown level from a trendline connecting April, August, and September lows. The $246.36 represents a 100% year-to-date gain for TSLA, and the shares are trading well above that mark heading into 2024.

It seems like the only thing going against Tesla stock is sector skepticism in the media in recent weeks. However, despite this suspicion, the security broke out above a trendline connecting lower highs from July to late-November. The brokerage bunch, meanwhile, is also hesitant on the EV stock, with 27 of 44 covering brokerages rating the equity a “hold.” A shift in analyst sentiment could help the shares move higher still.

Lastly, within the options market, total open interest (OI) is relatively low. In fact, total OI is below 80% of the readings from the past 12 months. Our recommended call option has a leverage ratio of 7.7, and will double on a 14.9% in the underlying equity.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tiktok Deal Draws Options Traders to Peloton (PTON) Stock

By: Schaeffer's Investment Research | January 4, 2024

• Peloton and TikTok agreed to collaborate on a new workout content hub

• Options volume is running at double the intraday average

Peloton Interactive Inc (NASDAQ:PTON) is surging today, last seen up 8.9% at $5.86 at last glance, following another partnership announcement. The company inked a deal with TikTok to create an online workout hub called #TikTokFitness, which will house custom Peloton content.

Traders are taking aim at the stock following the news. So far, 24,000 calls and 9,962 puts have crossed the tape, with options volume running at double the intraday average. New positions are opening at the most popular weekly 1/5 6-strike call, which expires at the end of tomorrow's session.

Looking back, calls have been more popular than usual over the past two weeks, per Peloton stock's 10-day call/put volume ratio of 7.32 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks higher than all other readings from the past year.

Meanwhile, short interest is rapidly unwinding, down 10.8% in the last month. Still, the 3.84 million shares sold short account for 13.7% of the security's total available float.

On the charts, PTON continues to struggle after a mid-August bear gap culminated in all-time lows below the $4.30 area. However, the stock has managed to add nearly 13% over the last three months, though it remains 34.2% lower in the last 12 months.

Read Full Story »»»

DiscoverGold

DiscoverGold

Analyst: Stanley Is a Big Problem for Yeti Holdings (YETI)

By: Schaeffer's Investment Research | January 4, 2024

• Canaccord Genuity downgraded YETI to "hold"

• The stock has already shed nearly 10% this year

Yeti Holdings Inc (NYSE:YETI) is 1.4% lower at $46.48 this morning, after Canaccord Genuity downgraded the stock to "hold" from "buy." And though the analyst hiked its price target by $1 to $50, it said Stanley is proving to be a tougher-than-expected rival to Yeti, and Owala is making more noise than anticipated as well.

The brokerage bunch is still mostly optimistic towards YETI, with seven of the 17 analysts in question calling it a "buy" or better. Plus, the 12-month consensus target price of $47.63 is a 3.1% premium to current levels. All of this demonstrates there's more room for optimism to unwind.

Meanwhile, over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Yeti stock's 10-day put/call volume ratio of 1.54 ranks higher than 76% of readings from the past year. This shows put traders have been more active than usual of late.

For those looking to bet on the pop, doing so with options looks to be an affordable route. The security's Schaeffer's Volatility Index (SVI) reading of 38% stands in the low 17th percentile of its 12-month range, meaning options traders are pricing in less volatility at the moment.

In the three sessions since the start of 2024, YETI is already down 9.7% for the year. And though its up 25.1% over the last nine months, the stock is on pace for a fifth consecutive daily loss.

Read Full Story »»»

DiscoverGold

DiscoverGold

Eli Lilly (LLY) Stock Hits Record on Drug Prescription Website

By: Schaeffer's Investment Research | January 4, 2024

• LillyDirect enables consumers to get prescriptions for weight-loss drug Zepbound

• LLY added 71.8% in the last 12 months

Eli Lilly And Co (NYSE:LLY) today launched LillyDirect, a website that allows consumers with obesity to get prescriptions for its weight-loss drug Zepbound via telehealth, and offers home delivery options. The move stands in direct competition with WW International (WW), which bought telehealth provider Sequence to offer users access to drugs that suppress appetite, such as Novo Nordisk's (NVO) Ozempic and Wegovy.

LLY was last seen up 1.6% at $627.50, and earlier surged to a record high of $631.18. Shares are today on track for their fourth-straight daily win, after yesterday staging their biggest single-day percentage pop since November. In the last 12 months, LLY added 71.8%.

Options traders are blasting Eli Lilly stock, with 25,000 calls and 11,000 puts exchanged so far today, which is four times the intraday average volume. Most popular is the weekly 1/5 630-strike call, where new positions are being opened.

This penchant for bullish bets has been the norm lately. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX, the stock's 50-day call/put volume ratio of 2.10 ranks higher than 99% of readings from the past year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Micron (MU) Stock Looks to Snap Losing Streak After Upgrade

By: Schaeffer's Investment Research | January 4, 2024

• Piper Sandler upgraded MU to "overweight" from "neutral"

• The stock is moving back toward recent highs

Piper Sandler this morning upgraded semiconductor stock Micron Technology Inc (NASDAQ:MU) to "overweight" from "neutral," with a price-target hike to $95 from $70. Micron stock is up 1.3% at $83.33 at last glance, on track to snap a five-day losing streak and moving back toward its Dec. 26 52-week high of $87.87.

This bull note has Piper Sandler joining an overwhelmingly bullish majority. Of the 38 analysts in coverage, 31 carry a "buy" or better rating on MU. Plus, the 12-month consensus price target of $93.89 is a 12.4% premium to current levels.

Options traders have been optimistic as well. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security's 10-day call/put volume ratio of 1.92 ranks higher than 88% of readings from the past year.

Now looks like a good time to weigh in on MU with options, too. The stock's Schaeffer's Volatility Index (SVI) of 29% ranks in the 12th percentile of its annual range, meaning options traders are pricing in low volatility expectations at the moment.

Read Full Story »»»

DiscoverGold

DiscoverGold

Will the Dollar Decline Before Any Rally?

By: Marty Armstrong | January 2, 2024

The year 2024 will be met with challenges and distortions that are certain to create a major trading trap for the majority of people before the chaos that will be unleashed post-2024. Generally speaking, While the main currencies failed to elect any Yearly Bullish Reversals, the overwhelming pool of fundamental analysts keep calling for the crash in the dollar and others a crash in the stock market. We have a lot of conflicting fundamentals. The now painfully obvious rigged election for 2024 in the USA where they are not just trying to remove Trump from the ballot, they are also blocking any Democratic challenger to Biden, claiming that would only support Trump. In other words, nobody but Biden is allowed to run in 2024.

Then we have the rising tension for war. Even the leader of North Korea has instructed its military to prepare for war. For the life of me, these Neocons are insane. They are trying to instigate war on every possible front simultaneously. The post-2024 period looks just unimaginable.

We have 2024 showing up as Directional Changes and higher volatility in so many markets. The US Dollar Index has a DOUBLE Directional Change for the 1st Quarter 2024. We have a Directional Change in interest rates in 2024, and pattern recognition still points to higher rates into 2027. There is no possible way for interest rates to decline in the face of war. The yearly array for 2020 showed a turning point for a high in 2022 and a possible correction into 2024.

January is often the strongest target for a turning point in many markets.

DiscoverGold

DiscoverGold

The Dow & The Year-End Closing

By: Marty Armstrong | January 1, 2024

The Dow Jones Industrials for 2023 opened at 3314890 and produced a trading range of 3777885 to 3142982 closing the year at 3768954, which was above the 2022 high by 1.99%. This market closed in a bullish position on all 5 of our indicating range projections. This market closed closer to the top of the trading range for the year showing some core strength. This market has also closed the year above our normal trading range envelope by 4.41% in a positive position this time.

Thus far, this market has rallied for one year, after a previous decline for one year. Looking at our Stochastic, this market remains in a bullish position for now but we are at the extreme upper band suggesting there is at least some reduction in the upward momentum. This market has closed the year at 3768954 in a bullish position with support forming at 3063747. As we look ahead to 2024, we see support forming at 3667944. There is also key overhead resistance at 3898754.

The strongest target in the Yearly array is 2032 for a major turning point ahead, at least on a closing basis. It does appear we have rising volatility in 2024 with choppiness into 2025 with a key target in 2026 followed by sharply higher volatility from 2027 onward. We do not see any sustainable major crash ahead and in fact we expect to see a major high by 2032. There are rising tensions on the international war front and we expect rising civil unrest come 2025 which is most likely the cause of a retest of support.

DiscoverGold

DiscoverGold

Stock Indices Daily Market Movers (% Price Change)

By: Marty Armstrong | January 4, 2024

• Top Movers

US - CBOE VIX Index 6.36 %

Global - S&P GSCI Energy 3.2 %

US - Oil & Gas Stock Index 2.03 %

Global - S&P GSCI 1.65 %

Estonia - OMX Tallinn (OMXT) Index 1.52 %

• Bottom Movers

UK - FTSE London Gold Mines Index 3.31 %

S&P Regional Banks Industry 3.16 %

Turkey - BIST National 100 Index 2.78 %

Europe - STOXX 600 Construction and Mats 2.76 %

US - Russell 2000 E-mini 2.74 %

*Close from the last completed Daily

DiscoverGold

DiscoverGold

ETFs Daily Market Movers (% Price Change)

By: Marty Armstrong | January 4, 2024

• Top Movers

US - ProShares UltraPro Short Russell 2000 8.28 %

US - ProShares Ultra Bloomberg Natural Gas 7.6 %

US - ProShares Ultra Bloomberg Crude Oil 6.35 %

US - Proshares Ultrashort Silver ETF 5.37 %

US - United States Natural Gas Fund LP 4.82 %

• Bottom Movers

US - ProShares UltraPro Russell 2000 8.13 %

US - Proshares Ultrashort Bloomberg Natural Gas 7.45 %

US - ProShares UltraShort Bloomberg Crude Oil Commodity 6.14 %

US - ARK Innovation ETF 3.92 %

US - Invesco Solar ETF 3.82 %

*Close from the last completed Daily

DiscoverGold

DiscoverGold

Daily Global Capital Flows

By: Marty Armstrong | January 4, 2024

• Most Recent Daily Capital Flows:

• USA Inflows 0.38%

• Canada Inflows 0.24%

• Mexico Outflows 0.01%

• China Inflows 0.10%

• Japan Inflows 0.90%

• Thailand Inflows 0.68%

• Indonesia Inflows 0.17%

• Germany Outflows 0.20%

• France Outflows 0.20%

• Italy Outflows 0.20%

• United Kingdom Inflows 0.36%

• Brazil Outflows 0.03%

• Australia Inflows 0.44%

• Russia Neutral 0.00%

• India Inflows 0.03%

• South Africa Inflows 0.79%

DiscoverGold

DiscoverGold

Today's 4 Stock Market Movers: $MINM $OMGA $KROS $MBLY

By: Barchart | January 4, 2024

• Today's 4 Stock Market Movers: $MINM $OMGA $KROS $MBLY

Read Full Story »»»

DiscoverGold

DiscoverGold

SPX Some Longer-Dated 5,000+ Strike Calls Are Starting To Hit The Tape

By: Cheddar Flow | January 4, 2024

• $SPX Some Longer-Dated 5,000+ Strike Calls Are Starting To Hit The Tape

Read Full Story »»»

DiscoverGold

DiscoverGold

$NVDA Millions Worth of Call Sellers Today. This is an abrupt change to the aggressive call buying from last month

By: Cheddar Flow | January 4, 2024

• $NVDA Millions Worth of Call Sellers Today

This is an abrupt change to the aggressive call buying from last month

Read Full Story »»»

DiscoverGold

DiscoverGold

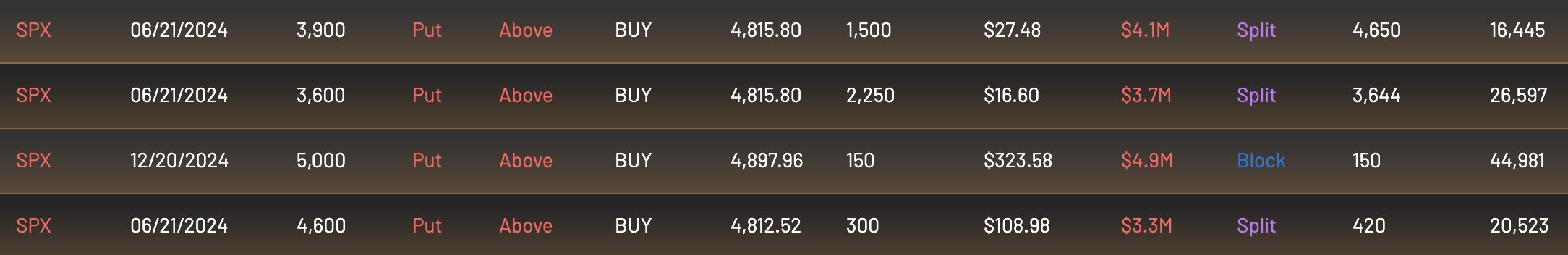

SPX Millions worth of Puts starting to roll in

By: Cheddar Flow | January 4, 2024

• $SPX Millions worth of Puts starting to roll in

Read Full Story »»»

DiscoverGold

DiscoverGold

Select Sectors Performance % Change

By: Thom Hartle | January 4, 2024

• $SPX seemingly range bound between 0.75 and 1.0 std dev. Waiting to see signs of direction.

Read Full Story »»»

DiscoverGold

DiscoverGold

Santa Fails to Call, But Trifecta 2 Out of 3 Ain’t Bad

By: Almanac Trader | January 4, 2024

With the Santa Claus Rally a no show we will be watching for a positive First Five Days (FFD) and January Barometer (JB), the second and third legs of our January Indicator Trifecta. Since 1950 there have been only three occurrences when SCR was down and both the FFD and JB were positive. Two out of three of those years were up over 20% and 1994 was a flat -1.5% with a 14.8% average gain on all three.

There are only three down SCR years with up FFDs and JBs we present to you the other years with one of the Trifecta components down and the other two up. Of these 18 years 14 years were up and 4 were down with an average gain of 7.9%. 2 out of 3 ain’t bad for our January Indicator Trifecta.

Profit taking in January has become more commonplace in the last 25 years or so and January is notably softer in election years like 2024. But the selling over the past few days is notable and a warning sign. Don’t forget Yale Hirsch’s famous line, “If Santa Claus should fail to call, bears may come to Broad and Wall.” Click here for more

https://stocktradersalmanac.com/Alerts.aspx

Read Full Story »»»

DiscoverGold

DiscoverGold

Sentiment Signals Mixed

By: Bespoke Investment Group | January 4, 2024

The S&P 500 has gotten off to a rocky start to the new year, but it hasn't knocked down bullish sentiment yet. This week's bullish sentiment reading from the American Association of Individual Investors (AAII) rose from 46.3% in the final week of 2023 up to 48.6% this week. That edges bullish sentiment back towards the multi-year high of 52.9% put in place two weeks ago and still leaves bullish sentiment over a full standard deviation above its historical average.

As for bearish sentiment, things are not as extended, though at 23.5%, the share of bears is still several percentage points lower than the historical average (31%).

That means the bull-bear spread is also still historically in favor of bulls with a 25 percentage point gap between the two.

Including other weekly sentiment surveys, the picture is a bit more muddled albeit still showing a bias towards bullishness. For starters, after its holiday hiatus, the Investors Intelligence survey posted its highest reading on bullish sentiment since November 2021. Conversely, this week's reading in the NAAIM Exposure index tracking active managers' equity exposure plummeted from a reading above 100 (meaning managers reported they were fully invested long) all the way down to 71. That is the lowest reading in the index since early November.

Read Full Story »»»

DiscoverGold

DiscoverGold

Money managers Reduced their exposure to the US Equity markets since last week...

DiscoverGold

DiscoverGold

NAAIM Exposure Index

January 4, 2024

The NAAIM Number

70.95

Last Quarter Average

67.81

»»» Read More…

Crude inventory decreased by 5.5M barrels for week ended Dec. 29 - EIA

Jan. 04, 2024 11:53 AM ETCrude Oil Futures (CL1:COM)UCO, USO, DBO, USL, SCO, BNO

By: Gaurav Batavia, SA News Editor

Commercial crude stocks for the week ended Dec. 29: 431.1M barrels

Crude inventory change: -5.5M barrels vs. -7.11M barrels for the week ended Dec. 22. Consensus estimate -3.2M.

Gasoline inventory change: +10.9M barrels vs. -0.67M barrels for the week ended Dec. 22.

Distillates inventory change: +10.1M barrels vs. +0.741M barrels for the week ended Dec. 22.

Futures (CL1:COM -1.93%)

ETFs: USO, UCO, SCO, BNO, DBO, USL.

DYN goes without me onboard!

$18.94 +4.1694 (+28.23%)

I got out at 17.18 for a thin dime.

Well, there's satisfaction in knowing we were in a good play.

https://stockcharts.com/h-sc/ui?s=DYN

(Mark) Making money

https://stockcharts.com/h-sc/ui?s=META

2023 was a bumper year for Meta Platforms (NASDAQ:META), becoming the best-performing Magnificent 7 stock after AI darling Nvidia (NVDA). Shares soared 178% during the "year of efficiency," in which CEO Mark Zuckerberg refocused the business on digital advertising and social media market share and away from moonshot projects like the Metaverse. As growth returned and the stock neared all-time highs, the captain of the ship also decided to cash in. New filings show that Zuckerberg offloaded nearly half a billion dollars of Meta shares in the final two months of the year, selling stock on every trading day between Nov. 1 and the end of 2023 (his last sales occurred in November 2021).

WSBreakfast

Today's Markets

In Asia, Japan -0.6%. Hong Kong -0.1%. China -0.4%. India +0.7%.

In Europe, at midday, London +0.2%. Paris +0.3%. Frankfurt +0.1%.

Futures at 6:30, Dow +0.2%. S&P +0.1%. Nasdaq -0.1%. Crude +1.1% to $73.52. Gold +0.5% to $2052.30. Bitcoin +2% to $43,387.

Ten-year Treasury Yield +5 bps to 3.95%

S&P 500, Nasdaq muted after upbeat private payrolls data

REUTERS - 10:19 AM ET 1/4/2024

By Johann M Cherian and Shristi Achar A

The benchmark S&P 500 and the Nasdaq were subdued on Thursday after a jobs report indicated resilience in the labor market, tempering expectations of how early interest-rate cuts could begin.

Wall Street stumbled in the first two sessions of 2024, with the S&P 500 notching its worst two-day performance since late October as investors booked profits after a blistering rally last year.

(con't)

A commenter on the bankrupcy blurb

Value Digger

Today, 6:19 AM

Numerous publicly-traded large-caps and mid-caps filed for bankruptcy in 2023 due to high debt such as Pennsylvania Real Estate Investment Trust (PRET), Yellow Corporation (YELL), Rite Aid (RAD), Bed Bath & Beyond (BBBY), Amyris (AMRS), Tattooed Chef (TTCF), Sono Group (SEVC), Proterra (PTRA), several SPACs such as WeWork (WE), Lordstown Motors Corp. (RIDE), Bird Global (BRDS) etc.

These facts teach investors a timeless lesson.

Investors need to avoid the leveraged (indebted) companies (i.e. REITs, utilities etc.) and buy companies with fortress balance sheets including ZERO leverage, if they want to sleep well at night.

Stock market news today: Dow rises as stocks try to shake off dismal 2024 start

Karen Friar·Yahoo Finance Editor

Thu, Jan 4, 2024, 11:29 AM EST

US stocks stalled on Thursday, struggling to shake off a dismal start to the year after Federal Reserve policymakers left hopes for an early interest-rate cut hanging.

The Dow Jones Industrial Average (^DJI) popped about 0.2%, while the benchmark S&P 500 (^GSPC) was down about 0.1%. Tech stocks signaled a return to their Wednesday selloff, as the Nasdaq Composite (^IXIC) dropped about 0.4%.

Investors looking for confirmation of bets on a March rate cut got uncertainty instead in the Fed minutes released Wednesday. While officials agreed rates had reached a peak and should be lower by the end of 2024, some signaled that they could stay at their historically high levels "for some time" depending on the path of inflation.

Multiple data points released Thursday morning showed the labor market remains intact while wages continue to cool, a welcome sign in the fight against inflation.

The latest ADP employment report showed private companies added 164,000 jobs in the month of December, above November's reading of 103,000 and higher than analysts expectations for 115,000 additions.

Elsewhere, the Department of Labor reported that 202,000 jobless claims were filed last week, below economist estimates for 216,000.

Meanwhile, US bond yields returned to gains, with the 10-year Treasury yield (^TNX) edging closer to 4% after falling away from that level on Wednesday.

In commodities, oil prices rose to build on the previous day's jump as supply troubles in Libya and Red Sea tensions kept the market on edge. West Texas Intermediate crude (CL=F) futures traded around $73 a barrel, while Brent crude (BZ=F) was above $78 a barrel.

More in store?

U.S. commercial bankruptcy filings jumped 72% to 6,569 in 2023, primarily due to increased interest rates, tougher lending standards and pushback from the pandemic. "These facts teach investors a timeless lesson," SA Investing Group Leader Value Digger declared. "Investors need to avoid the leveraged (indebted) companies (i.e. REITs, utilities etc.) and buy companies with fortress balance sheets including ZERO leverage, if they want to sleep well at night." Among the notable firms that filed for bankruptcy last year were Yellow Corporation (OTC:YELLQ), Rite Aid (OTC:RADCQ) and Bed Bath & Beyond (OTCPK:BBBYQ) as well as SPACs like WeWork (OTC:WEWKQ), Lordstown Motors (OTC:RIDEQ) and Bird Global (OTC:BRDSQ).

WallStreetBreakfast

I am not an investor*. I am a trader. But if I were an investor, I thoroughly agree with the main point of this poster's thesis, protecting ones portfolio from market risk with shorting.

MG

Z-alpha Trading System

Today, 10:03 AM

Our 100% focus is on mitigating market risk drawdown, mainly because the upside mostly takes care of itself if the portfolio constituents are quality.

There is market risk and portfolio risk, and they are entirely different. The biggest disrupter in any investment portfolio comes from the "market" exposure risk, without doubt, if one assumes the portfolio constituents are quality.

We've also removed the portfolio risk factor from the equation. By our metrics, portfolio diversification shuffling has little benefit in controlling the specific market risk.

We've done intensive studies in-house over many complete market cycles and have found that diversification, in effect, decreased portfolio performance by a few standards in our investment process.

Importantly, we have nothing against portfolio diversification - it's simply not how we manage market volatility. With machine-driven transactions accounting for approximately 90% of the daily volume of the S&P 500®, this reality has caused the term structure order flow to be negative/neutral for about 47% of the 252 trading days each year.

We have the 53% upside days in the bag with the no-work required portfolio constituents, and for this, the 47% downside days are our primary focus and the battleground where we compete.

Massive alpha resides in that 47%. The most easily identifiable patterns occur within this 47%, without any exceptions. It is crucial to prioritize capital preservation protocols in every investment process. By tapping into a portion of that 47%, your Compound Annual Growth Rate (CAGR) can experience a substantial boost from a mathematical standpoint. Unfortunately, regulatory restrictions prevent us from elaborating further on this matter.

By effectively managing market exposure risk during extreme situations and acknowledging that negative beta can be an acceptable level of risk, you will experience a peaceful sleep akin to that of a contented infant.

Best of trades.

*Unless I become a bagholder from trading, lol.

|

Followers

|

1146

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

648882

|

|

Created

|

12/19/06

|

Type

|

Free

|

| Moderators SkeBallLarry fuzzy DiscoverGold Tuff-Stuff MiamiGent | |||

DISCLAIMER:

1. DO THE MATH!!! - Before placing any trade, do the math. Where is the trigger? Where is the proper stop based on the chart setup? How many shares should I buy? This is easy to figure out. You never want to lose more than 1% of your trading account balance on any given trade. So, if you have a $30,000 account, your maximum acceptable loss on any given trade should be $300. If the stop is .20 cents below the entry price (again, based on the chart setup), then you should not buy more than 1500 shares (for the purpose of this lesson I have left commissions out of the equation for simplicity).

2. PAY YOURSELF!!! - Once you have a small profit (I use a dime as a rough personal guideline) sell part of your position and move your stop to breakeven on the rest. You will have very few losing trades if you do this, and the losses you do have will be small.

3. STOP TRADING!!! - What do I mean by this? If you hit your daily goal (everyone should have one and make it realistic) stop trading. Afternoons are tougher to trade than mornings anyway, so take the money and run....tomorrow is another day.

4. STOP TRADING!!! - Didn't we go over this already? Well, this one has another meaning. If you lose 1/2 the amount of your daily goal, stop trading and come back tomorrow. For instance, if your goal is to make $500 a day, and you are down $250 on the day, quit for the day. This is the best way to avoid falling into a 'trading death spiral'.

DOW 30 HEATMAP

http://www.stockmarketdrama.com/dow30heatmap.php

http://finviz.com/futures_charts.ashx?p=m5

This is a great free site to get some good info about technical analysis.

www.informedtrades.com/trades.php

http://stockcharts.com/school/doku.php?id=chart_school

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns

Charting tools

http://www.stockcharts.com

http://www.chartpatterns.com

http://stockcharts.com/education/IndicatorAnalysis/

http://www.investopedia.com/categories/technicalanalysis.asp

http://www.candlesticker.com/Default.asp

http://candlestickforum.com/PPF/Parameters/16_332_/candlestick.asp

http://www.incrediblecharts.com/technical/candlesticks.htm

http://www.chartpatterns.com/

http://www.investopedia.com/university/technical/techanalysis8.asp

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators

http://www.freestockcharts.com/

http://www.barchart.com/

|

Posts Today

|

0

|

|

Posts (Total)

|

648882

|

|

Posters

|

|

|

Moderators

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |