Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

China's high demand for silver is driving up prices and causing a supply and demand gap. Silver is used in many applications in China, including solar panels, electronics, and automotive components. In fact, China is the world's leading producer of photovoltaic panels. Demand from solar PV panel manufacturers in China is expected to increase by almost 170% by 2030, which could account for one-fifth of total silver demand. $PHYS

In May, Poland’s central bank, Narodowy Bank Polski, bought 10 tonnes of gold; Turkey’s central bank bought six tonnes of gold; the Reserve Bank of India bought four tonnes of gold; and the Czech Nation. Central banks buy 10 tonnes $PHYS

Silver to see second-highest deficit in 20 years, as record industrial demand rises 9% in 2024 - Silver Institute’s World Silver Survey https://www.kitco.com/news/article/2024-04-17/silver-see-second-highest-deficit-20-years-record-industrial-demand-rises-9 $PHYS

Silver can be a better investment than gold in some scenarios, largely due to its industrial uses. https://cbsnews.com/news/is-gold-or-silver-a-better-investment-when-inflation-cools/ $PHYS

‘Big Short’ investor Michael Burry piles into physical gold fund, making it his biggest bet

https://twitter.com/SafeHavenMoney/status/1791241015346524598 $PHYS $PSLV

Added today

I hate black candles and dojis can spell trouble, albeit indecision in this situation is warranted. Sure would like to see the 200dma get taken out (again)

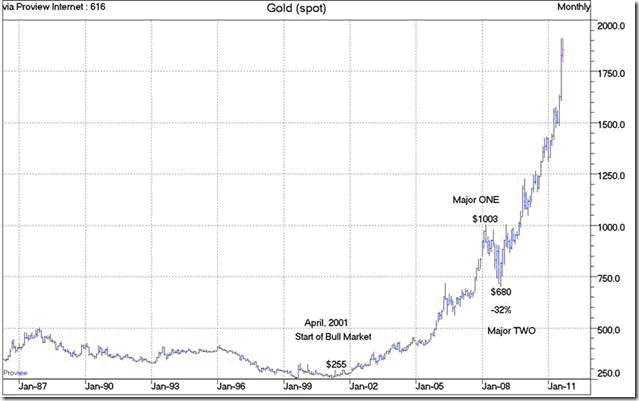

I am reminded of the quote by FOFOA, "gold will only reset once in your life, and once will be enough". h/t @LukeGromen

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) March 5, 2022

Wow... that is deep and complex. TY!!!

Grabbing couple here. Reset to gold coming

$Sprott Research - Moneta a Monster Project

https://sprott.com/media/3870/210430-me-scp-initiation.pdf

$MONETA EXTENDS GOLD MINERALIZATION ON THE DISCOVERY DEPOSIT AT

GOLDEN HIGHWAY

Toronto, Ontario – April 29, 2021 -

$Moneta Porcupine: One of the Largest Undeveloped Gold Projects in North America.

$Moneta Porcupine Mines Inc. (TSX:ME) (OTC:MPUCF) (XETRA:MOP)

(“Moneta”) is pleased to announce the results from drilling on

the extensions of the Discovery Deposit

outside of the current NI 43-101 resource.

The drill holes were drilled as part of the expanded 2020/2021

winter drill program on the Golden Highway Project, 100 kilometres

(“km”) east of Timmins, Ontario.

Highlights:

Drilling has intersected significant gold mineralization to extend

the NI 43-101 underground gold

resource estimate at Discovery:

• MGH20-165, located up-dip of the current Discovery resource:

o Intersected 13.00 m @ 1.80 grams per tonne “g/t” gold “Au”,

including 3.00 m @ 3.34g/t Au,

including 1.00 m @ 4.05 g/t Au

o Intersected 4.00 m @ 2.70 g/t Au,

including 2.00 m @ 4.25 g/t Au,

including 1.00 m @

5.63 g/t Au

• MGH20-166, located west and up-dip of the current Discovery gold

resource:

o Intersected 7.00 m @ 2.06 g/t Au,

including 1.00 m @ 3.91 g/t Au

• MGH20-167, located west and down plunge of the current Discovery

resource:

o Intersected 20.40 m @ 0.89 g/t Au,

including 0.90 m @ 2.39 g/t Au

• MGH20-171, located 500 m west of the current Discovery resource:

o Intersected 6.50 m @ 1.30 g/t Au,

including 2.70 m @ 2.28 g/t Au,

including 1.00 m @

4.55 g/t Au

“We are pleased to be continuing to intersect new gold mineralization

outside of our current gold resources with our latest drilling,”

commented CEO, Gary O’Connor.

“The drilling has intersected extensions of gold mineralization at

Discovery, located on the northern splay of the Destor Porcupine

Fault Zone, north of the South West underground resource and

Windjammer South open pit deposit.

Significant gold mineralization has been intersected up to 500 m west,

150 m east and up to 100 m below

the current Discovery resource.

$The drill results highlight the opportunity to continue to expand

the underground resources at Discovery.

$The adjacent Discovery and Windjammer North underground

resources currently contain 39,100 ounces gold in the indicated

category and 191,200 ounces of gold in

the inferred category at a 3.0 g/t Au cut-off,

within a total project gold resource endowment

of 3,967,000 ounces gold indicated and

4,399,000 ounces gold inferred.”

The latest assay results are from seven (7) drill holes,

including one hole extension, for a

total of 2,680.0 m of drilling, completed as part of

the current 70,000 m 2020/2021 winter drill program.

The seven

reported holes were targeting extensions of the Discovery resource

that occurs north of the current

Windjammer South and South West resources.

Drilling was focussed on extending the mineralization to

the west and east as well as at depth.

The resource expansion drill program is continuing on the

2

Westaway, 55 Zone, South West, Windjammer South and

new Halfway areas and further results are

pending.

Discussion of Discovery Drill Results

https://www.monetaporcupine.com/uploads/ME-PR-08-2021.pdf

Figure 1: Location Map- Golden Highway Project

To view an enhanced version of Figure 1, please visit:

Figure 2: Discovery Deposit - Drill Hole Locations

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4852/82195_14d9b42b24f7daa1_003.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/82195

$Moneta Porcupine: One of the Largest Undeveloped Gold Projects in North America.

And it’s even closer now. Tick tock tick tock. PHYS

LBMA colludes with the COMEX – To lockdown the global gold market?

25 Mar 2020 04:54 - Ronan Manly

https://www.bullionstar.com/blogs/ronan-manly/lbma-colludes-with-the-comex-to-lockdown-the-global-gold-market/

Conclusion

COMEX 100 oz gold futures contracts are deliverable in name only. In terms of COMEX gold futures trading, practically no contracts ever reach delivery. Just a few basis points of a percent. And delivery on the COMEX just means a warrant (receipt) from one of the approved COMEX warehouses changes hands. Getting any gold bar out of the COMEX vaults once you have a warrant is a totally different ballgame. The vast majority of COMEX 100 oz gold futures are never delivered, they are offset (closed out) and cash-settled, or else rolled over. his is essentially the same as unallocated gold in the London market, both are just cash-settled gold derivatives. In fact, 100 oz gold bars are really not common at all. Why then would the LBMA and its bullion banks be even concerned about 100 oz bars that rarely ever get delivered.

So what is exactly going on here? Who is bailing out who? The same bullion banks operate in both markets. Is the LBMA bailing out some of its bullion bank members that have blown up while at the same time propping up the COMEX edifice? If so, with the LBMA just being a trade association with the bullion banks at the helm, where are the 400 oz gold bars coming from? The HSBC or JP Morgan vaults in London? Or that famous gold lender of last resort, the Bank of England?

Or is it just a management of perceptions exercise with no gold bars involved, to try to coax back the spot and futures prices by telegraphing that the gold that is backing the spot price (which is actually unallocated non-existent gold) is now also backing COMEX gold futures. While neither of the two can be delivered, the same non-gold now backs both, so voila, there is no need for any price divergence!

i-Box/i-Message could use some housekeeping.

Not many follow this on the hub but the trading was healthy with 3M traded today.

It's so near... same with the hyper bubble readily apparent in bonds.

The day has come where fake paper contracts imploding

I was reminded that this ETF is worthwhile... and that is real... backed by real... and that's the truth.

Jetpilot thanks, Sprott demand billions in Silver - Billion Dollar Lawsuits Filed

Following Deutsche Bank's Admission Of Gold, Silver Rigging -

Tyler Durden's pictureSubmitted by Tyler Durden on 04/16/2016 13:38 -0400

http://www.zerohedge.com/news/2016-04-16/billion-dollar-lawsuits-filed-following-deutsche-banks-admission-gold-silver-rigging

Silver Price Manipulation Class Action Brought on Behalf of Canadian ...

The class action alleges that the defendants, including

The Bank of Nova Scotia, conspired to manipulate prices ...

investors who bought and sold physical silver, ...

Read more at -

https://ca.finance.yahoo.com/news/silver-price-manipulation-class-action-210400933.html

Gold & Silver Price Manipulation Class Action Brought on Behalf of Canadian Investors

Fri, 15 Apr, 2016 5:04 PM EDT

TORONTO, April 15, 2015 /CNW/ - A class action lawsuit seeking

$1 billion in damages on behalf of Canadian investors was launched

today in the Ontario Superior Court of Justice.

The class action alleges that the defendants, including

The Bank of Nova Scotia, conspired to manipulate prices

in the silver market under the guise of the benchmark

fixing process, known as the London Silver Fixing,

for a fifteen-year period.

It is further alleged that the defendants manipulated the bid-ask

spreads of silver market instruments throughout the trading day in

order to enhance their profits at the expense of the class.

This alleged conduct affected not only those investors who bought and

sold physical gold & silver, but those who bought and sold gold &

silver-related financial instruments.

Law enforcement and regulatory authorities in the United States,

Switzerland, and the United Kingdom have active investigations into the

defendants' conduct in the precious metals market.

The case is on behalf of all persons in Canada who, between

January 1, 1999 and August 14, 2014, transacted in a

silver market instrument either directly or indirectly,

including

investors who participated in an investment or equity fund, mutual

fund, hedge fund, pension fund or any other investment vehicle that

transacted in a gold & silver market instrument.

A copy of the Notice of Action can be found at

http://www.sotosllp.com .

Potential class members can register on the website to obtain

more information as the case progresses.

The plaintiffs and the proposed national class are being represented

by a national team of lawyers from

Sotos LLP ( http://www.sotosllp.com ),

Koskie Minsky LLP ( http://www.kmlaw.ca ) and

Camp Fiorante Matthews Mogerman ( http://www.cfmlawyers.ca )

with offices in Ontario and British Columbia.

SOURCE Sotos LLP

https://ca.finance.yahoo.com/news/silver-price-manipulation-class-action-210400933.html

Note.

please, pass it along to all Sprott old shareholders etc. >>>>>>>>>>>

TIA.

- God Bless -

Sprott Unleashed: “Everything is a Lie… I Dream of the Day Comex Paper Exchange Can’t Deliver Gold”

Mac Slavo November 22nd, 2015

http://www.shtfplan.com/headline-news/sprott-unleashed-everything-is-a-lie-i-dream-of-the-day-comex-paper-exchange-cant-deliver-gold_11222015

Everything says to me that the demand for gold is in excess of the supply. And, of course, you wonder why the price would go down, but people look at the COMEX which stays manipulated, which is so obvious to me what’s going on. We have 5 tons of physical gold. We have something like 1500 tons of claims against that 5 tons. So to be quite direct about your question, yes, I kind of wonder any day, is somebody going to snatch those 5 tons of gold, and we end up with some kind of cash settlement. But then you have to think, if we would have a cash settlement, having taken gold from 1900 down to 1100, all under the threat of a rate increase for the last 5 years, which has never happened and may not ever happen, and then all of a sudden they’re like “well, really there is no gold here, we’ll just cash settle it at $1,100.” Meanwhile, we’ve lost $800 on a false claim. And perhaps maybe people in the know know about this, they keep the price of precious metals suppressed because they are the canary in the coal mines.

Sprott Announces $898m Hostile Bid For Physically-Backed Gold & Silver Funds

By Kitco News

Tursday April 23, 2015 2:10 PM

http://www.kitco.com/news/2015-04-23/Sprott-Announces-898m-Hostile-Bid-For-Physically-Backed-Gold-Silver-Funds.html

(Kitco News) - In an attempt to better position its products, Sprott Asset Management announced an $898 million hostile bid for two competing funds backed by gold and silver.

According to the company’s latest press release, Sprott intends to acquire the Central Gold Trust (GTU) and Silver Bullion Trust (SBT), two funds similar to its own physical gold and silver funds. The offer would entail GTU and SBT unitholders to trade their units for units into Sprott’s funds.

“Sprott today announced that it intends, together with Sprott Physical Gold Trust, to commence an offer (the "GTU Exchange Offer") to acquire all of the outstanding units of GTU and, together with Sprott Physical Silver Trust, to commence an offer (the "SBT Exchange Offer") to acquire all of the outstanding units of SBT,” the release said.

“The aggregate value of these proposed transactions would be approximately US$898 million and the resulting Sprott Physical Trusts would be highly-liquid, best-in-class bullion vehicles managed by a firm with a globally-recognized precious metals franchise,” it added.

According to the details of the offer, the proposed exchange offer would unlock $3.33 per unit for CGT holders and $0.96 per unit for SBT holders.

“Together, the offers would unlock US$69.5 million in unitholder value,” the release said.

Sprott’s CEO, John Wilson, said in the press release that through physical trusts, the company is providing unitholders with “access to a secure, convenient and exchange-traded way to hold physical gold and silver.”

The company also announced that it is exploring the option of adding coin delivery alternatives to Sprott Physical Trusts “to make their existing physical redemption features more accessible to smaller investors.”

“Adding coin delivery to the Sprott Physical Trusts would be subject to approval by the unitholders of the applicable Sprott Physical Trust,” it added.

According to the company website, Sprott’s Physical Gold Trust has roughly 1.3 million gold ounces held under management as of March 31. Sprott’s Silver Trust holds about 49 million ounces as of the same date.

By Sarah Benali of Kitco News sbenali@kitco.com

Sprott Physical Gold (PHYS)

12.23 ? -0.07 (-0.57%)

Volume: 184,374 @ 11:08:18 AM ET

Bid Ask Day's Range

- - 12.19 - 12.26

Sprott Physical Gold (PHYS)

13.27 ? -0.13 (-0.97%)

Volume: 1,192,889 @ 4:00:00 PM ET

Bid Ask Day's Range

- - 13.24 - 13.45

PHYS Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79496971

Sprott Physical Gold (PHYS)

14.46 ? 0.01 (0.07%)

Volume: 841,214 @ 3:59:57 PM ET

Bid Ask Day's Range

- - 14.39 - 14.55

PHYS Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79496971

Metals Raid - Sprott Raises $392 Million For Gold for PHYS - Dalio Says 'Shift Assets Into Gold'

12 SEPTEMBER 2012

On the bright side, the Sprott Physical Gold Trust (PHYS) completed its secondary offering and the underwriters allotment, raising $392 million to buy additional gold bullion to be held in the trust.

The report does not indicate if they have secured title to the gold yet. Even after they have secured title, it often takes weeks and even months to achieve actual delivery to their vaults. The recent lag times in their Silver Trust expansion, and the types of bars they received, suggested a tight market for the real thing.

As you may recall, I think that it will be in the high quality bullion bar bulk market where the initial signs of failure to deliver will occur. The peripheral and coin markets will stay relatively healthy until the dawning comes, and then dry up overnight. The retail crowd are always the last to know. So lets keep an eye on this.

The metals were smacked hard today in what *looked like* a secondary reaction to the complications in Europe over their rescue funds. What initially looked like good news for the fans of Draghi was tarnished by a misunderstanding about the role and scope of the German Parliament. There are also quite a few unanswered questions about how it could be implemented in specific countries.

Stocks recovered quickly but the metals remained a bit subdued.

USGIF Gold Target $4,500.- + + ![]()

From Jim Sinclair...

My Dear Extended Family,

Monty Guild, a friend of mine for more than forty years, is

the most honest and capable man, in my opinion,

in money management.

I respect Monty's feelings on many matters, certainly

the macro picture.

Monty, like I, believe it is possible that coordinated central

bank actions in the USA, EU, Japan and China are being discussed.

The economic problems are so severe, so international, so global,

so entwined, so insoluble and still caused primarily by the greed

of 1990 to present finance in the form of OTC derivatives that

only coordinated global action can kick this can one more time.

Gold is truly going to and through $3500.

The gold business is the best business to be in.

Respectfully,

Jim

$SILVER Chart P&F TA Alert AgBull Price Objective $58.0 per ounce

Silver Ag-bull often front-runner of Au-bull ![]() -

-

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79135482

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79153750

U. S. SILVER Alert - Investors have nowhere left to hide and

will start running to silver and gold: Sprott

http://www.mining.com/bondholders-heading-to-gold-since-they-have-no-where-left-to-run-sprott-66084/?utm_source=digest-en-au-120823&utm_medium=email&utm_campaign=digest

Silver Update 9/9/12 Inflation Adjusted Silver

Sprott Physical Gold (PHYS)

15.1 ? 0.12 (0.80%)

Volume: 1,309,424 @ 5:16:55 PM ET

Bid Ask Day's Range

- - 14.99 - 15.12

PHYS Detailed Quote Wiki

Sprott Physical Gold (PHYS)

13.59 ? -0.15 (-1.09%)

Volume: 528,029 @ 3:59:54 PM ET

Bid Ask Day's Range

- - 13.5618 - 13.7

PHYS Detailed Quote Wiki

Sprott Physical Gold (PHYS)

13.52 ? 0.39 (2.97%)

Volume: 1,870,000 @ 7:36:42 PM ET

Bid Ask Day's Range

- - 13.22 - 13.5491

PHYS Detailed Quote Wiki

Sprott Physical Gold (PHYS)

14.93 ? -0.0645 (-0.43%)

Volume: 408,415 @ 3:30:37 PM ET

Bid Ask Day's Range

14.93 14.94 14.9 - 15.03

PHYS Detailed Quote Wiki

http://www.sprottphysicalgoldtrust.com

performance compare with a few Gold miners -

Unloaded a portion of my position at 15.28 for a 9.5% gain from 13.94

Just a little diversification and taking some profits off the table.

A nice day today. Gold and PHYS continue the march north. As I previously posted, I'm in at 13.94.

Looking for around 16 to 17 before I sell. I think we will see another correction. Watching the daily chart.

I agree. holding my PHYS now in my retirement accounts.

Hey shoot me an email if you would like: jetpilot1101 @ gmail . com

GOLD POG target for the Intermediate Wave III of Major THREE

should be around bargain fiat$$4,500.-- per ounce -

ot....

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69422143

Merry Christmas

God Bless

|

Followers

|

14

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

76

|

|

Created

|

08/28/10

|

Type

|

Free

|

| Moderators | |||

Sprott Physical Bullion Trusts

https://sprott.com/investment-strategies/physical-bullion-trusts/

https://sprott.com

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |