Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Can't blame 'em for wantin' it though (CATL & Volkswagen).....

Sorry - Just noticed this now.......OMG

And it's left me confused !

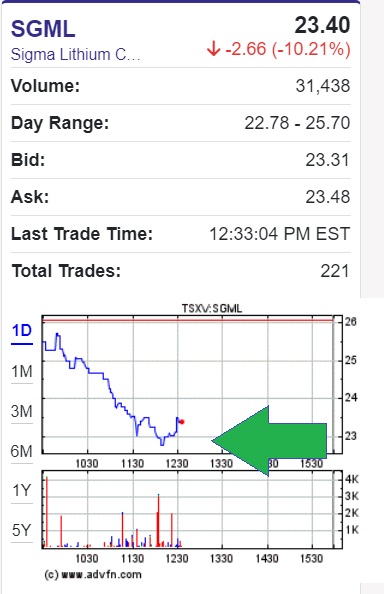

With the sp hitting 22.50 today I'm like -Boy...... sure seems like it's getting attractive.......but.......huh ?

And then that (your) "confusing link !??/ ha-ha

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=ca%3Asgml&x=45&y=16&time=100&startdate=4%2F8%2F2010&enddate=6%2F10%2F2024&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

And then there's the DAMMIT NO KIDDING PART eh ?

They're gonna get frickin' DELISTED ?????

fak !.........

Future 4th largest producer of lithium in the world..........and some "private" (untradeable) co's are taking them over ?

.

I mean, sumpthin' almost tells me that "Hey, that's about it".......

But I don't LIKE "uncertainty" !

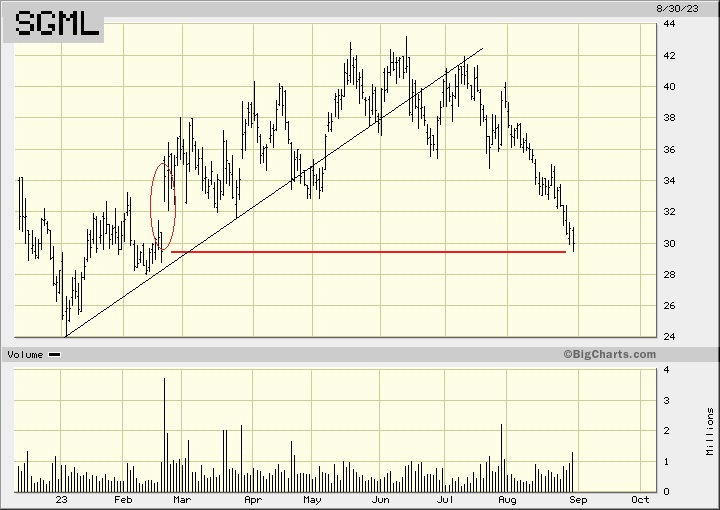

August 2022 A full-on full pullback to that / the old consolidation zone !

CATL & Volkswagen are in the final stages of acquiring Sigma Lithium

https://www.insightwoo.com/general-8-1

Sigma Lithium reveals 1Q results, groundbreaking innovations, and green lithium milestones

SIGMA LITHIUM CEO ANA CABRAL NAMED "MINING PERSON OF THE YEAR" DURING LONDON METAL EXCHANGE WEEK 2023

Published: Oct. 12, 2023

https://www.wymt.com/prnewswire/2023/10/12/sigma-lithium-ceo-ana-cabral-named-mining-person-year-during-london-metal-exchange-week-2023/?outputType=amp

Yeah - It's quite the story https://www.reuters.com/world/china/markets/commodities/sigma-lithium-eyeing-buyout-sues-ex-ceo-daughter-in-law-over-trade-secrets-2023-08-22/

https://ceo.ca/sgml

But meanwhile is there also this to consider ?

Okay maybe it is time me to pay attention.

NEW YORK, Aug 22 (Reuters) - Sigma Lithium (SGML.V), , which produces metal used in electric vehicle batteries, has sued a former co-chief executive officer, accusing him of stealing trade secrets to undermine the company's effort to sell itself.

The complaint was filed on Monday in federal court in Manhattan against Calvyn Gardner, who until January was Sigma's co-CEO with Ana Cabral-Gardner, who he is divorcing and who remains CEO. Luisa Valim, Gardner's daughter-in-law, is also a defendant

Oh wow.......THIS has gotta factor in too here eh (they're gettin' divorced and they've lost some of thier secret sauce)

https://www.reuters.com/world/china/markets/commodities/sigma-lithium-eyeing-buyout-sues-ex-ceo-daughter-in-law-over-trade-secrets-2023-08-22/

Regardless.......Knew I should'a grabbed some early this morning when it was ntrading at 36 (last 38)

Weeks earlier ;

Anyhoo......C'est la vie

.

Thanks for the heads up. I have been doing battery companies most of the summer, been staying away from minerals, until December.

Sigma just closed its' gap down there where its' volume is 100 times that of up here.

Hasn't closed it up here yet though

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=sgml&time=100&startdate=12%2F11%2F2020&enddate=10%2F9%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&x=46&y=9&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

https://www.reuters.com/markets/deals/sigma-lithium-ceo-says-talks-with-potential-buyers-2023-07-28/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=171898757

Wanted so badly to load on the recent dip down to 35.....

Because if something develops, it'll get rocketed to $50 or maybe just to $46 but still

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=sgml&x=47&y=5&time=9&startdate=2%2F4%2F2020&enddate=9%2F29%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

Anyways........Quite the side-channel in Cdn resources (where if you'll recall I was sayin' that NO RESOURCES WILL GET MOVING UNTIL Vancouver GETS MOVING......)

And it sure looks like SOMETHING is "in the cards" there (here).....

Will it break out over 630 ?.....or DOWN thru 600 ?

Because The Battery Metals should strongly reflect what occurs

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=xx%3Ajx&x=38&y=22&time=9&startdate=2%2F4%2F2020&enddate=9%2F29%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

hmmmmmm.......

Perhaps it' could even be Sigma announcing a pertnership which quote "gets that ball rolling" !

I dunno

The alternative is a broad market risk-off meltdown......which ALSO seems HIGHLY plausible !

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Index&symb=spx&x=57&y=9&time=13&startdate=2%2F4%2F2020&enddate=9%2F29%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

.

SIGMA LITHIUM AND BRAZILIAN GOVERNMENT OFFICIALS RING NASDAQ OPENING BELL TO CELEBRATE THE LAUNCH OF LITHIUM VALLEY BRAZIL INITIATIVE

NEW YORK, May 11, 2023 /CNW/ -- SIGMA Lithium Corporation ("Sigma Lithium" or the "Company") (NASDAQ: SGML, TSXV: SGML), Sigma Lithium Corporation, a Brazil-based company dedicated to powering the next generation of electric vehicle batteries with Green Lithium, and representatives from the government of Brazil celebrated the launch of Lithium Valley Brazil by ringing the opening bell at Nasdaq MarketSite in New York.

https://ih.advfn.com/stock-market/NASDAQ/sigma-lithium-SGML/stock-news/91035586/sigma-lithium-and-brazilian-government-officials-r

SIGMA LITHIUM TRUCKS GREEN LITHIUM AND TAILINGS TO VITORIA PORT IN PREPARATION OF 15,000 TONNE SHIPMENT OF EACH PRODUCT IN MAY

April 27 2023

The loading consisted of two trucks with approximately 74 tonnes of Green Lithium, and three trucks with tailings, approximately 116 tonnes in total. The loading process was completed quickly, with each truck taking approximately five minutes to load. The logistics chain beginning in the plant in Araçuaí, which is specially designed to handle Sigma Lithium's concentrate and tailings operations simultaneously, has proven effective and the trucks' loading and transition were completed quickly and seamlessly from plant to warehouse. The two products are being stored in a segregated manner and each one has a tailored logistical approach, ensuring safe transport and accurate forwarding of the material. The trucks arrived at the warehouses in Brazil's Vitoria Port on Wednesday for discharge.

Product shipment volume continues to increase daily and is on track to achieve the expected ramp-up volumes.

A buyout offer would definitely benefit the chart.....

I believe it is poised to become like one of the worlds' top 5 producers and yet,

its' valuation is about a third of what its' peers is, so.....

Sure appears to ME as tho a bust out is imminent !

But, MAN how the battery metals sector has been nullified !

https://www.livewiremarkets.com/wires/lithium-developers-brace-yourself-for-the-recovery

.

.

Sigma Lithium said Monday, April 10, that it received an operating license from Brazilian regulators to sell and export lithium and that its metal production for electric vehicle batteries should begin within days.

The approval for Sigma to operate its Grota do Cirilo hard rock lithium mine and processing equipment was confirmed by the State Secretariat for Environment and Development (SEMAD), the environmental regulator of the Brazilian state of Minas Gerais.

The Vancouver-based company should be producing "in a few days" and shipping lithium "in a few weeks," Ana Cabral-Gardner, Sigma's chief executive, told Reuters.

U.S.-listed Sigma shares closed slightly higher on Monday after the news, having fallen more than 4% earlier in the day.

Rumors have surfaced in recent months that Tesla or Chinese lithium rival Ganfeng Lithium Group could bid on Sigma. Cabral-Gardner declined to comment when asked if Sigma is in any acquisition discussions. "I'm focused on what I can control, which is bringing this company into production," said Cabral-Gardner, who is also managing partner of A10 Investimentos, which owns 45% of Sigma's shares.

Production is expected to increase slowly in the coming months and reach an annual production rate of 270,000 tonnes of spodumene concentrate in July.

In 2021, Sigma agreed to supply at least 60,000 tonnes to LG Energy Solution starting this year. The remaining production is expected to be sold in the spot market to customers who will likely process the metal in China, and Sigma is currently "determining which customer will receive the first shipment," Cabral-Gardner said.

Because lithium demand is low in Brazil, focused on biofuels, Cabral-Gardner said Sigma's project is "geared towards enabling energy transition in the northern hemisphere."

Sigma has projected that the mine will achieve an annual free cash flow of US$455 million for its first phase of production.

Seven analysts recommend buying Sigma shares and believe it should trade 69% higher than current levels.

Activate to view larger image,

https://www.linkedin.com/feed/

Tesla considering takeover of battery-metals miner Sigma Lithium Corp

Sigma Lithium is one of multiple mining options Tesla is exploring as it mulls its own refining

Topics

Tesla | Elon Musk | Companies

Bloomberg

Last Updated at February 18, 2023

https://www.business-standard.com/article/international/tesla-considering-takeover-of-battery-metals-miner-sigma-lithium-corp-123021800635_1.html

Sigma Lithium and LG Energy Solution Sign Milestone Six-Year Binding Term Sheet for Lithium Offtake Agreement

https://www.prnewswire.com/news-releases/sigma-lithium-and-lg-energy-solution-sign-milestone-six-year-binding-term-sheet-for-lithium-offtake-agreement-301392472.html

HIGHLIGHTS OF COMMISSIONING AND GO FORWARD LEADERSHIP

• Sigma Lithium announces the initiation of the commissioning of the Dense Medium Separation

module of the production plant (the “Greentech Plant”) one month ahead of schedule and within

budget.

o Commissioning of the crushing module of the Greentech Plant is also ahead of schedule

and projected to have first ore crushed mid-February.

• The Company remains on track to commence commercial production in April 2023 and expects

to start generating cash flow in the second quarter this year, producing battery grade

environmentally and socially sustainable lithium concentrate (“Battery Grade Sustainable

Lithium”).

• Brian Talbot, Sigma Lithium’s Chief Operating Officer, will continue to lead operations on site in

Brazil.

o Mr. Talbot has been instrumental to the successful execution of the Greentech Plant

optimized design and detailed engineering and has played a pivotal role in the

construction and commissioning of the project since joining the Company in 2021.

• Ana Cabral-Gardner continues to be the Chief Executive Officer of the Company and will continue

as Co-Chair of the Board.

o Ms. Cabral-Gardner has been sharing the helm of Sigma Lithium for the past five years

during which she has and will continue to serve on the Finance, Technical and ESG

committees of the Board.

o She has led Sigma Lithium to become a global pioneer in environmental and social

sustainability within the battery supply chain.

• Gary Litwack has been appointed as a Non-Executive Co-Chair of the Board and will serve together

with Ana Cabral-Gardner.

o Mr. Litwack has been Sigma Lithium’s Lead Independent Director. He serves as the Chair of

the Audit Committee and has been a Director since the Company went public in 2018.

• Rodrigo Menck has been named Chief Financial Officer of Sigma Lithium.

o Mr. Menck will be working closely with Felipe Peres, the prior Chief Financial Officer, who

will remain as part of the Finance Team leadership in the capacity of Senior Advisor to the

Company.

o Mr. Menck joined the Company last year from Nexa Resources, a NYSE listed mining

producer with assets in Brazil and other countries.

o Calvyn Gardner, who had been Co-Chief Executive Officer and Co-Chair, will remain as a Director

of the Company

Episode 152: Sigma Lithium - Ana Cabral

The Global Lithium Podcast • Jan 08

https://anchor.fm/globallithium/episodes/Episode-152-Sigma-Lithium---Ana-Cabral-e1t7j4e

DD is so darn easy.

More videos than you can shake a stick at.

https://vimeo.com/762809306

922 views Dec 13, 2022 #lithium #NASDAQ #proactiveinvestors

Sigma Lithium Co-Chair Ana Cabral Gardner joins Natalie Stoberman from the Proactive studios to share its latest expansion and financing milestones.

Gardner says this new expansion in scalability and financing may potentially position Sigma Lithium as one of the world's largest fully integrated lithium producers from mine to lithium materials

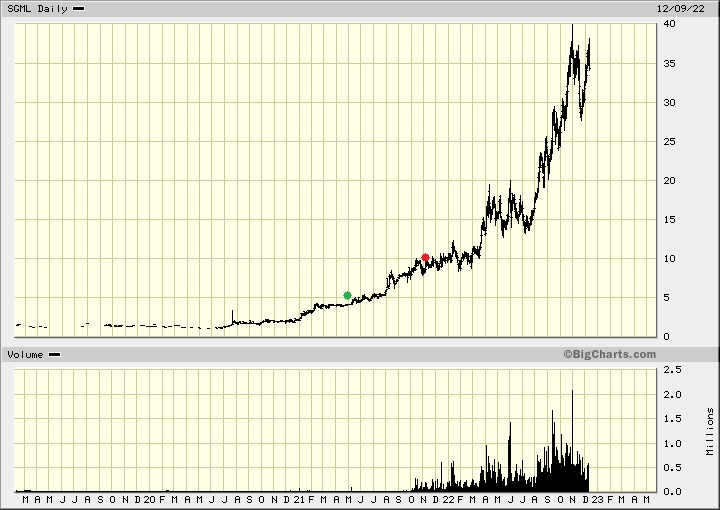

Sigma's gonna be right up there wi Albermarle and SQM

Whilst their markwet cap is about 5 times less than theirs'....

So......Can ya' tell me where my thesis may be wrong ?....

They SEEM to be undervalued.

7 views Dec 12, 2022 Sigma Lithium Co-Chair Ana Cabral Gardner joins Natalie Stoberman from the Proactive studios to share its latest expansion and financing milestones.

Gardner says this new expansion in scalability and financing may potentially position Sigma Lithium as one of the world's largest fully integrated lithium producers from mine to lithium material

Just STEAMROLLING ahead these guys (whislt the 10 minute mark of your video there states that there were mostly just Canadians? tuned into that conference call?)

This interview came out 3 days ago.......

I remember hearing back about over a year ago about how they were slated to become one of the worlds top 5 producers

And now they've got their sights on becoming nimber 3

What's the market cap of Albermarle and SQM ?

29 billion and 26 respectivly - whilst SGML's = just 4

sheesh

https://www.youtube.com/watch?v=Q_QRw0mPfF4

Thanks shall listen to that soon !

Am almost certain that the answer to your question would be NO though !

That they're simply TOTALLY pegmatite.

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=ca%3Asgml&x=45&y=15&time=100&startdate=2%2F4%2F2020&enddate=1%2F19%2F2023&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161564487

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161846146

Might try looking for others this wknd https://www.google.ca/search?q=brazil+lithium+tsx&sxsrf=ALiCzsaUk_mdc2t82sbr7J67cDB0UA2kJw%3A1670614105367&ei=WYyTY4KLFszB0PEP39OaMA&ved=0ahUKEwjCm7rCou37AhXMIDQIHd-pBgYQ4dUDCA8&oq=brazil+lithium+tsx&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQDDIFCAAQogQyBwgAEB4QogQyBQgAEKIEMgUIABCiBDoKCAAQRxDWBBCwAzoKCCMQsAIQJxCdAjoICAAQCBAeEA06BQgAEIYDOgcIABCABBANOgYIABAeEA1KBAhBGABKBAhGGABQ8whY-UhgzHBoAXABeAGAAZIGiAGvE5IBCjE5LjAuMS42LTGYAQCgAQHIAQjAAQE&sclient=gws-wiz-serp

.

536 views Nov 18, 2022

Sigma Lithium Corp (TSX-V:SGML, OTCQB:SGMLF, NASDAQ:SGML) Co-CEO Ana Cabral-Gardner tells Proactive's Stephen Gunnion that construction activities at the Grota do Cirilo project in Brazil advanced significantly during the third quarter of 2022.

Do you know if Sigma has brines?

Sigma Lithium Presenting at the Kinvestor Battery Metals & Mining Conference

Benchmark Mineral Intelligence

13,709 followers

9h • 9 hours ago

Brazil is forecast to more than double its share of the global mined lithium market over the next few years, becoming a significant new producer in South America.

Benchmark forecasts the country is set to account for 4.4% of global production by 2024, half of the forecast global market share of Argentina.

Brazil is often overshadowed by Chile and Argentina when it comes to lithium production, yet the country is forecast to more than triple its output in the next two years.

Luiz Inácio Lula da Silva, who was voted in as Brazil’s next president in October, has also pledged to work towards a sustainable energy transition, with a role for “greener” mining.

A further boost to Brazil’s position in the battery supply chain could come from BYD. The Chinese electric vehicle maker has plans to build electric vehicle production facilities and lithium processing plants in the state of Bahia in the northeast of the country.

Read more on Benchmark Source: https://lnkd.in/e9UwYTFF

Request a Benchmark Source trial to read this article: https://lnkd.in/eSG5_vuh

https://www.linkedin.com/feed/update/urn:li:activity:7006894727459438592/

Benchmark Mineral Intelligence

12,373 followers

35m • 35 minutes ago

Benchmark is delighted that Ana Cabral-Gardner, Co-Chairperson and Co-CEO of Sigma Lithium Corp. (Nasdaq:SGML), will be speaking at Cathodes 2022 as part of Benchmark Week.

Join Ana and other leading industry figures at Benchmark Week in Los Angeles in November - https://lnkd.in/dikMUYjv

#lithiumionbatteries #electricvehicles #energystorage

https://www.linkedin.com/feed/update/urn:li:activity:6986685054231969792/?origin=SHARED_BY_YOUR_PAGES

She is a monster that is for sure.

You did very well with this one. Did you first buy at .25?

Funny thing back when you showed me I was into brines only, now I am hard rock only and one boron.

Sigma Lithium Provides Update From A Transformative Second Quarter, Appoints COO For Operational Readiness And Preparing Phase 1 Pit For Mining

https://www.juniorminingnetwork.com/junior-miner-news/press-releases/2590-nasdaq/sgml/126644-sigma-lithium-provides-update-from-a-transformative-second-quarter-appoints-coo-for-operational-readiness-and-preparing-phase-1-pit-for-mining.html?utm_source=newsletter_1433&utm_medium=email&utm_campaign=junior-mining-brief-for-date-b-j-y

Marcelo Paiva

• Following

Co-Founder at A10 Investimentos; Board Member at Sigma Lithium

3h • Edited • 3 hours ago

On Dec 23rd Sigma Lithium (SGML US, SGML CN) raised over USD 100mm from global ESG-oriented equity investors. The offering book was comprised mostly of current shareholders who have been with us throughout our journey - thank you all!

Ana Cabral-Gardner Calvyn Gardner Marina Bernardini Daniel Abdo Vítor Ornelas Roberto Coelho Alessandro Roncari

https://www.linkedin.com/feed/

|

Followers

|

10

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

136

|

|

Created

|

02/05/21

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |