Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Why are you here ????????????????

IB_🤴🏻

Mgmt should be pleasing shareholders with share buybacks. Simply put, this pig is overweight

SAYONA MINING LIMITED SYA

Last Price / Today's Change

$0.026 -$0.001 (-7.142%)

Volume

225,048,023

Bid / Offer Range

$0.025 - $0.027

https://www.asx.com.au/markets/company/sya

HUGE Tesla 4680 Battery Production Update | Exponential Growth!

Lithium stocks surge as Chinese giant suspends major mine

By Kerry Sun

Wed 11 Sep 24

https://www.marketindex.com.au/news/lithium-stocks-surge-as-chinese-giant-suspends-major-mine

Major lithium and battery manufacturer CATL has officially announced the suspension of its lithium lepidolite operation in Jiangxi. While rumors of CATL cutting or suspending lithium production in Jiangxi have circulated before, UBS expresses higher conviction this time. According to their channel checks with several contacts, CATL made the decision to suspend operations after a meeting on September 10.

Copilot

The cost of producing lithium carbonate from lepidolite is relatively high compared to other sources. In China, it costs between 80,000 yuan ($11,230) and 120,000 yuan ($16,860) to produce one tonne of lithium carbonate equivalent (LCE) from lepidolite1. This is significantly higher than the cost of extracting lithium from brine deposits or spodumene, which ranges from 40,000 yuan to 60,000 yuan per tonne1.

Given these high production costs, lepidolite-based lithium production is often less economically viable, especially when lithium prices are low. This has led to some producers cutting back on lepidolite-based production to balance supply and demand

Two ways this goes up:

Lithium prices rally (not some brief shortage coming out of China)

Company announces a share buy back. Doesn’t need to be huge, just substantial enough to make an impact on SP.

Tesla Semi Factory Construction Video - 9/4/24

2025, New Tesla refinery should be up and running?

Tesla semi building is moving along.

2-shift working the cybertruck?

MinRes (ASX:MIN) lithium boss Josh Thurlow says supply is starting to come out of the market, after the reported closure of China’s largest lepidolite mine sent downtrodden share prices surging this morning.

UBS lithium analyst Sky Han said there was 11-23% upside on 2024 chemical prices after reporting to clients that the Jianxiawo lepidolite mine in the Jianxi province had been shut by the world’s largest battery maker.

Reports of the Jianxiawo mine’s closure sent share prices in the Aussie market soaring.

Lithium stocks surge as Chinese giant suspends major mine

By Kerry Sun

Wed 11 Sep 24

https://www.marketindex.com.au/news/lithium-stocks-surge-as-chinese-giant-suspends-major-mine

Flying today in asx. Hopefully it is sustained

Is this garbage going to sub penny? Brett Lynch and Co truly screwed shareholders, then bounced

Uglier than SXOOF ?????????????????

LoL LoL,

IB_🤴🏻

Ugliest chart I’ve seen in a long time

Northvolt EV battery plant in Quebec could be delayed up to 18 months

September 2, 2024

https://batteriesnews.com/northvolt-ev-battery-plant-in-quebec-could-be-delayed-up-to-18-months/

With the way things go, anyone fhink this will go under maintenance?

When Lithium prices shoot up again, we'll see lotsa action~

Why’s the stock .012? Because mgmt screwed investors with issuing billions of shares.. a fleece job imo

SYAXF .019 - News -

Sayona Mining Limited (ASX:SYA) Moblan Mineral Resource increases 81% to 93Mt

Brisbane, Aug 27, 2024 - (ABN Newswire) - North American lithium producer Sayona Mining Limited (ASX:SYA) (FRA:DML) (OTCMKTS:SYAXF) announced today the results from updated Mineral Resource Estimates (MRE) at its Moblan Lithium Project (Sayona 60%; Investissement Quebec 40%), demonstrating t he potential of this highly strategic asset.

Sayona has significantly expanded its Canadian lithium resource base with this updated JORC Mineral Resource estimate for the Moblan Lithium Project. Results from the updated MRE reinforce the project' s status as the centrepiece of Sayona's Eeyou-Istchee James Bay hub in northern Quebec.

Sayona now has a total estimated JORC Measured, Indicated and Inferred Mineral Resource of 93.1 million tonnes @ 1.21% Li2O at a cut-off grade of 0.55% Li2O ( Table 1). For comparison to the previous MRE (17 April 2023), the tonnage at a cut-off grade of 0.25% Li2O is 107.7Mt @ 1.10% Li2O, an increase of 52% from 70.9 Mt @ 1.15% Li2O.

Approximately 70% of the total tonnage is in the higher confidence M easured and Indicated categories. The mineral resources are constrained by the claim limits and within a resource level conceptual pit shell.

The substantial increase in mineral resources at Moblan reflects the addition and integration of all the drilling results from the 2023 program (addition of 368 drillholes for 75,022 m) and from a major revision of the geological model (Figure 1).

Sayona has commenced further testing the extent of mineralisation through 70,000 m of additional drill ing to be completed by the end of 2024. This drilling will continue to utilise Flow Through Shares funding that was raised in March 2023 specifically for exploration and resource definition drilling as allowed under the Income Tax Act (Canada) (refer ASX release 7 March 2023).

Sayona's Managing Director and CEO, Lucas Dow commented, "The significant expansion of our Moblan Lithium Project's resource base is a testament to Sayona's commitment to unlocking the full potential of our assets in t he Eeyou-Istchee James Bay region. Increasing the total resource to 93.1 million tonnes at 1.21% Li2O represents a substantial enhancement of our strategic position in the North American lithium industry.

"The 59% increase in Measured and Indicat ed categories, now totalling 65.1 million tonnes at 1.25% Li2O, provides a strong foundation for the future conversion of these Mineral Resources into Ore Reserves.

"Looking ahead, the planned 70,000 metres of drilling in 2024 will further test t he extent of mineralisation. As we continue to invest in exploration and development, we remain focused on strategically growing our resource base to deliver value to our stakeholders and positioning Sayona as a leading North American lithium produce r."

Moblan JORC Mineral Resource Estimates Statement

The MRE was prepared in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the "JORC Code") and comply with the JORC Code disclosure. The breakdown of MRE results by zone (pegmatite domain) and by category is shown in Table 1.

The updated mineral resource block model covers an area of 2,350m strike length and 1,250m width, extending to a depthof 350m b elow surface. The mineralisation model consists of seven lithium pegmatite dykes modelled as the Main dykes, 13 as the South dykes, 13 as the New South domain and 10 as the Moleon dykes, for a total of 43 lithium pegmatite dykes in the project's geol ogical model (Figure 2). Moblan 2024 MRE includes all available data on the Project including extensive additional drilling coverage from the 2023 exploration program. The MRE database includes 49,910 assay data from 771 surface drill holes (130,633m ), drilled between 2002 and the end of 2023, and 10 surface trenches sampled between 2004 and 2009 (Figure 3).

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/039FC1P3

WEB: Moblan Mineral Resource increases 81% to 93Mt

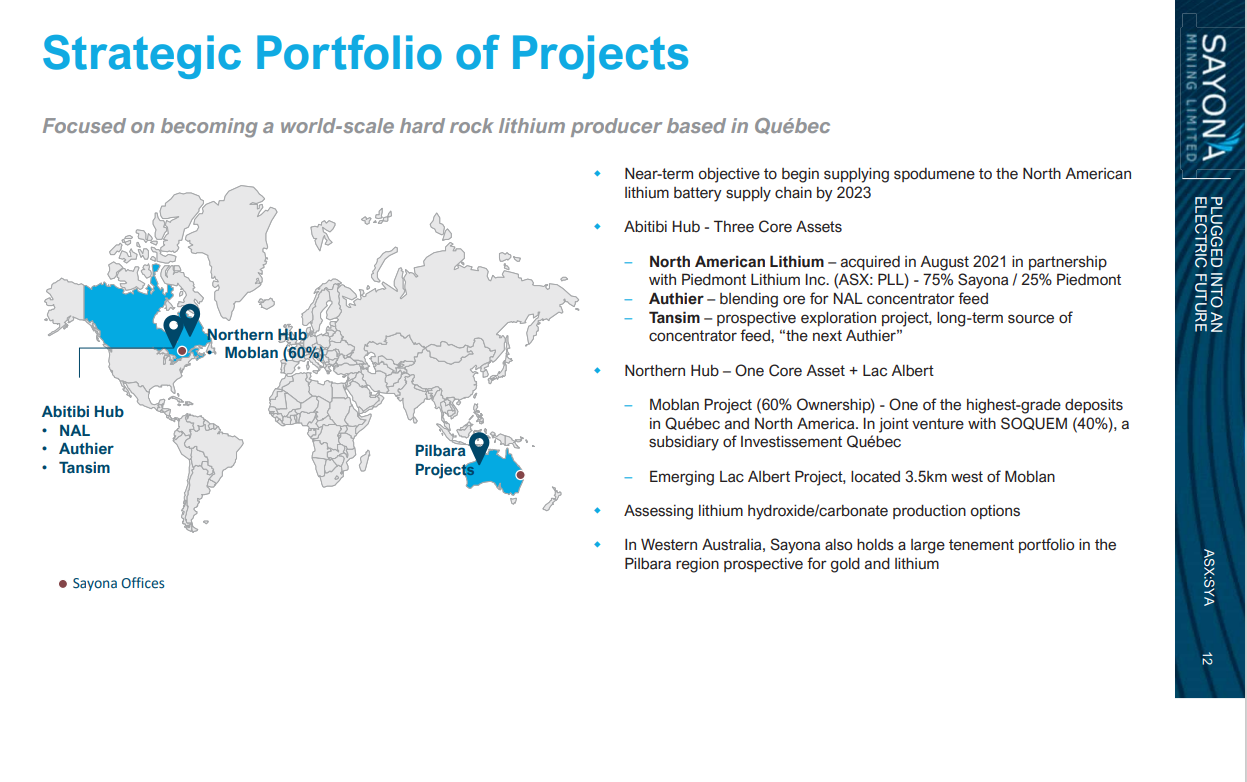

About: Sayona Mining Limited

Sayona Mining LtdSayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region

prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation (ASX:1MC).

That China recession thing... If that makes lithium chart start climbing...I'm good with that~

Time will tell… but the issue Imo remains, the share count is bloated and that is a huge problem. Who knows when lithium market will surge again, it’s very unpredictable as we know. I still feel Lynch “lynched” shareholders

I disagree. Board has nothing to do with poor lithium market due to recession and china manipulation which is about to end because chinas economy is out of leverage and starting to crack. Lots of corporate BK in china currently, they are in trouble which is great for us. Very undervalued here. Proven resources and assets are worth over ten times market cap. IMO this has always been a buy and hold until 2027. You think the last little run was good, wait until the next when there is significantly less competition. $SYAXF long and strong!

Great opportunity to do what, lose more money with further irresponsible corporate dilution?!!! C’mon man, these guys at the top aren’t running things correctly and you and I both know it

Great Opportunity here IMO!!! Current market cap AUD$223M>>>>>DEFINITIVE FEASIBILITY STUDY CONFIRMS NAL VALUE WITH A$2.2B NPV<<<<< Net Present Value of NAL alone is 9.86 times higher than Sayona's current market cap! China is entering a severe recession and will not be able to sustain the Market manipulation. Sayona long and strong!!!!

Trash stock. Thx Sayona mgmt,,great job delivering shareholder value!!!!!!!

So to agree with that opinion one must believe the old Sayona CEO from a year ago must be responsible for the current global market price of all forms of lithium. He must have been one incredibly powerful guy to control a global market. All lithium miner charts are tracking lithium market price and that is all there is to it. Next run will be fantastic as our asset has significantly increased in size and value since the last run. Sayona long and strong!!!

Lmao.. I bought 3 years ago sub .03 usd and made 75k on run up. I knew this jerk Brett Lynch would pump and dump and here we are with sayona delivering no fundamental value for shareholders with current bloated float. That’s a ceo problem and you know it!!!

Brett Lynch helped the value of my shares tremendously. Just becasue one buys high due to FOMO doesn't mean the a guy who used to be the CEO a year ago somehow caused share price to decrease. The entire market is in the gutter, IMO this is the time to buy not complain about investment mistakes made earlier..... SAYONA LONG AND STRONG!!!!

Lol, Brett truly screwed investors with his share offerings that crippled investor value. CEO’s like that are truly dirtbags as they did whatever they could to bring in money to advance their own agendas, yet destroyed their investors.

Not sure, maybe if we whine some more Sayona's share price will increase.........but I doubt it😉 $SYAXF LONG👍️

What’s up with this POS stock? I mean c’mon, the share count is ridiculous. What’s leadership gonna do to create shareholder value now that Brett and Co have bloated this pig?!!!!

Dr. Stefan Wolf

Senior Innovation Consultant | R&D&I Strategy | Innovation Policy | Energy | E-Mobility | Batteries

4 hours ago

https://www.linkedin.com/feed/update/urn:li:activity:7213487985604857857/

The Chinese hashtag#battery industry is barely making any profit. The market for battery electric vehicles is growing more slowly than expected. The resulting overcapacity has led to massive price cuts, causing profits to hashtag#collapse.

📊 Industry magazine ICCSINO provides the latest hashtag#data on this:

* LFP at EUR 52/kWh (-50 % compared to January 2023)

? No more profit margins since November 2023

* NMC523 at 63 EUR/kWh (-47 % compared to January 2023)

? No more profit margins since June 2023

* NMC811 at EUR 79/kWh (-45 % compared to January 2023)

? Profit margins have fallen by 30 %, but still exist

💸 It is unclear how long the industry will be able to withstand this predatory hashtag#competition. In addition, the Chinese government recently announced first steps to consolidate the battery industry. In order to survive, the entire Chinese battery value chain is pushing into the global markets to win new customers.

🏭 This comes at the worst possible time for hashtag#European ambitions to establish their own battery value chain. Important investments have been made, but the factories are not yet running at full capacity and scrap rates still need to be reduced. Decisive political support is needed more than ever.

👉 Further information:

* Chinese battery prices: https://lnkd.in/e2rxsrhA

* Chinese battery industry regulation: https://lnkd.in/e_Tcqs8e

Brett Lynch the ex ceo irresponsibly bloated this pig

Small floater? The OS is huge

As of June 18, 2024, Sayona Mining Ltd. (SYAXF) had 10.29 billion shares outstanding and a public float of 9.29 billion.

With a float like this, the SP will not go above .10 usd unfortunately. Mgmt screwed shareholders

Investor Presentation June 2024

https://wcsecure.weblink.com.au/pdf/SYA/02818778.pdf

18/06/2024 Further high-grade drill results at North American Lithitium

1.76% is darn good numbers and the rest are nice as well.

https://www.asx.com.au/markets/company/sya

Lithium prices.

https://tradingeconomics.com/commodity/lithium

Tesla Corpus Christi Lithium Plant Review & Discussion! 3 June 2024 Construction Update (9:00 AM

Period when to buy stocks.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173781558

ASX ANNOUNCEMENT

13 June 2024

https://wcsecure.weblink.com.au/pdf/SYA/02816872.pdf

North American lithium producer Sayona Mining Limited (“Sayona”) (ASX:SYA; OTCQB:SYAXF) announced

today the results from 34 new drillholes totalling 7,853 metres at its Moblan Lithium Project (Sayona 60%;

Investissement Quebec 40%), demonstrating the potential of a single, large continuous orebody

LITHIUM DRILLING PROGRAM COMMENCES AT EAST VALLÉE

June 3, 2024

TORONTO, June 03, 2024 (GLOBE NEWSWIRE) -- Consolidated Lithium Metals Inc. (TSXV: CLM | OTCQB: JORFF | FRA: Z36) (“CLM” or the “Company“) is pleased to announce that the Phase I 2024 drilling program has commenced on the Company’s East Vallée Lithium Project, located in the Abitibi Greenstone Belt approximately 30 km northwest of Val-d’Or, Quebec (see Figure 1). The East Vallée Project is located immediate east and adjacent to the Company’s Vallée JV Project (75% CLM and 25% Sayona Mining) and only 1,000 m east and along strike of Sayona’s North American Lithium (“NAL”) Mine, the largest operating lithium mining facility in North America.

On February 14, 2024, the Company announced that the Vallée JV partners had successfully traced the NAL Mine Pegmatite swarm from the Sayona NAL Mine Property across the entire Vallée JV Property right to the western boundary of the Company's East Vallée Project (see CLM News which is available under the Company’s SEDAR+ profile at www.sedarplus.ca). The Core Pegmatite Dyke, the key dyke within the NAL Mine Swarm, has been traced over a 4.2 km strike length and remains open for expansion along strike to the east on CLM’s 100%-owned East Vallée Project. The Company believes that the Core Pegmatite and adjacent spodumene-bearing dykes likely continue onto East Vallée. The East Vallée Project overlies an additional 5 km of the highly prospective Vallée Lithium Trend that has never been drill-tested for lithium (see Figure 2). Several other parallel lithium-bearing dykes have also been traced eastward to the East Vallée Property boundary.

The Phase I program will consist of 12 drill holes totaling approximately 2,400 m and will test the Core Pegmatite and flanking pegmatites along drill fences spaced 400 metres apart starting at the western property boundary. All necessary permits required to commence the program have been received which include authorization for supplemental drill sites which will allow the Company to immediately follow-up successful drill holes at tighter hole spacings. Forage Lamontagne Fortier has been contracted to provide drilling services.

27 May 2024 Moblan drilling delivers thick, high grade

intersections

(I tried to post results but ihub website add names to it click link to look at results)

North American lithium producer Sayona Mining Limited (“Sayona”) (ASX:SYA; OTCQB:SYAXF) announced

today the results from 94 new drillholes totalling 20,735 metres at its Moblan Lithium Project (Sayona 60%;

Investissement Quebec 40%), demonstrating the high grade nature of this highly strategic asset.

https://wcsecure.weblink.com.au/pdf/SYA/02810794.pdf

SYAXF - News -

Sayona Mining Limited (ASX:SYA) Drilling of High Priority Targets Commences at Tabba Tabba

Brisbane, May 23, 2024 - (ABN Newswire) - North American lithium producer Sayona Mining Limited (ASX:SYA) (FRA:DML) (OTCMKTS:SYAXF) has commenced RC drilling (Figure 1*) at its wholly owned Tabba Tabba Lithium Project, E45/2364 in Western Australia where previous air core drilling identified high potential pegmatite systems.

A recently completed gravity survey has helped focus deeper RC drilling over two areas along a 7.5km prospective corridor (Figure 2*). The northern area is located immediately south of the historic Tabba Tabba t antalum mine, where recent exploration by Wildcat Resources has identified encouraging lithium mineralisation including the Leia and Luke Pegmatites.

The initial 2,000+ metre RC drilling program consists of 14 holes with nine located in the North Area immediately south of Wildcat Resources tenements and a further five holes located at the Roadside Prospect approximately 4.5km south and along strike. Further drilling will be conducted throughout 2024 as geological information is built up over the area, largely under thin colluvial cover.

Sayona has secured a co-funding grant for drilling at Tabba Tabba under Round 29 of the Western Australian Governments Exploration Incentive Scheme (EIS). The grant of up to $180,000 will help fund i nnovative exploration drilling in the search for flat lying spodumene pegmatite systems within the Tabba Tabba lease.

Sayona's Director and Interim CEO, James Brown commented, "We are excited to have commenced RC drilling over the highly prospect ive Tabba Tabba lease which has known lithium mineralisation in close proximity and along strike.

"Previous soil sampling and air core drilling identified areas of anomalous geochemistry that have been confirmed to also contain gravity features o f significance. We now intend to test these targets with RC and possibly diamond drilling as supported by results.

"We are highly committed to our wholly owned Western Australian lithium assets and intend to continue an active exploration program over the 2024 field season."

The recently completed gravity survey, covering a 7km x 2km area has identified prospective trends and areas of potential gabbro host units and structural settings which facilitate emplacement of the targeted north s triking spodumene pegmatite mineralisation.

In the north drill area, targets are sited along the southern extension to the Tabba Tabba mine stratigraphy and mineralisation identified by Wildcat. A western target zone comprises a gravity feature u nder cover which links to outcropping gabbro 2km to the south. An eastern gravity feature, coincident with a zone of alteration identified in air core drilling, is also being targeted in the current and follow up drilling.

At the Roadside prospec t five 5 deeper RC drill holes to 160m+ depth are planned, following up narrow pegmatites intersected in shallow air core drilling margined by more extensive geochemical anomalism. Gravity data in this area outlines a discrete weak gravity feature wh ich may represent a medium density intrusive, or gabbro intercalated with other, less dense rocks. Pegmatite hosted within gabbro has been observed at surface within the prosect.

Geologically, the planned exploration is benefiting from an enhance d understanding of pegmatite occurrences, including flat lying pegmatite hosted by gabbro such as the South Pegmatite Zone at Moblan, Quebec which was discovered by Sayona in 2022.

Flat lying pegmatite systems often have limited surface expressio n and require a systematic exploration approach to best focus drilling into the most prospective target areas. Sayona is advancing this process, being guided by gravity data, mapping, rock and soil sampling and drill information.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/43ZV94BP

SYAXF .038 - Accumulation continues for this small floater. Gotta love it~

.056 was the high on the ASX last night with high volume.

LAST PRICE / TODAY'S CHANGE

$0.053 +$0.004 (10.416%)

VOLUME

691,214,193

https://www.asx.com.au/markets/company/sya

They're cleaning up the bottom this week~

Those are great numbers, it is going to help alot to produce 6% spod.

ASX knows it too.

https://www.asx.com.au/markets/company/sya

Something strange happened when I copied and pasted the drill hole results

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174419804

SYAXF - I like the steady action here~

|

Followers

|

79

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

4196

|

|

Created

|

12/11/17

|

Type

|

Free

|

| Moderators | |||

Cathie Wood: This ENTIRE Sector Is About To 130X (And Spread Explosive Growth) - Jul 6, 2021

https://www.youtube.com/watch?v=JHqdzbtJvzY

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |