Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

SMXMF registration revoked:

https://www.sec.gov/litigation/opinions/2021/34-92943.pdf

SEC Suspension for severely delinquent Financials:

https://www.sec.gov/litigation/suspensions/2020/34-87980.pdf

Order:

https://www.sec.gov/litigation/suspensions/2020/34-87980-o.pdf

Admin. Proceeding:

https://www.sec.gov/litigation/admin/2020/34-87979.pdf

Anything happening with this company? Their email is dead. They haven't reported in years.

$SMXMF: Seeing some volume here today

Something in the works ?

$0.002

$SMXMF

SMXMF is severely delinquent in filing their Financials and corporate filing obligations to the SEC. On Feb. 20, 2015 the SEC suspended 8 stocks from the Delinquent SEC Filers list, and it is likely that more delinquent Filers will be suspended.

Since Jan 1st, 2010 the SEC has suspended over 1290 stocks for Financials delinquencies. All of those Suspended stocks had their stock registrations revoked.

Shareholders should contact the company and pressure the Mgmt to file their delinquent Financials because ALL shareholders would be wiped out IF the SEC suspends the stock.

SMXMF is on the list of delinquent filers:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=110680509

$SMXMF > Technical bounce watch this week >

SMXMF has hit the ol' scanner and has a fair chance of a bounce at these levels. Stocks that have declined this badly almost always retrace higher, bounce or dip some and come right back to this point before a further decline.

Contacting me with the fundamentals about the company does not change my criteria for scanning stocks.

If you just started shorting this stock, it might be a bad idea as this is totally oversold!

All of the "FASTLANE's BOMB's AWAY! SCANS" are of my own opinion and not to be used as investment advice.

$SMXMF - Investorshub Trades ~ http://ih.advfn.com/p.php?pid=trades&symbol=SMXMF

$SMXMF - Investorshub Board Search ~ http://investorshub.advfn.com/boards/getboards.aspx?searchstr=SMXMF

$SMXMF - Investorshub PostStream ~ http://investorshub.advfn.com/boards/poststream.aspx?ticker=SMXMF

$SMXMF - Investorshub Messages ~ http://investorshub.advfn.com/boards/msgsearch.aspx?SearchStr=SMXMF

$SMXMF - Investorshub Videos ~ http://ih.advfn.com/p.php?pid=ihvse&ihvqu=SMXMF

$SMXMF - Investorshub News ~ http://ih.advfn.com/p.php?pid=news&btn=s_ok&ctl00%24sb3%24tbq1=Get+Quote&as_values_IH=&ctl00%24sb3%24stb1=Search+iHub&symbol=SMXMF&s_ok=OK&from_month=3&from_day=15&from_year=2012&order=desc&selsrc%5B%5D=prnca&selsrc%5B%5D=prnus&selsrc%5B%5D=zacks&selsrc%5B%5D=money2&selsrc%5B%5D=djn&selsrc%5B%5D=bw&selsrc%5B%5D=globe&selsrc%5B%5D=edgar&selsrc%5B%5D=mwus&force=1&last_ts=1331855999&p_n=1&p_count=&p_ts=1331794260

Regular Candlestick Chart: http://stockcharts.com/h-sc/ui?s=SMXMF&p=D&b=3&g=0&id=p04384940601

Regular Candlestick Chart: http://stockcharts.com/h-sc/ui?s=SMXMF&p=W&b=3&g=0&id=p04384940601

PennyStockTweets ~ http://www.pennystocktweets.com/stocks/profile/SMXMF

OTC Markets Company Info ~ http://www.otcmarkets.com/stock/SMXMF/company-info

$SMXMF - OTC Markets Charts ~ http://www.otcmarkets.com/stock/SMXMF/chart

$SMXMF - OTC Markets Quote ~ http://www.otcmarkets.com/stock/SMXMF/quote

$SMXMF - OTC Markets News ~ http://www.otcmarkets.com/stock/SMXMF/news

$SMXMF - OTC Markets Financials ~ http://www.otcmarkets.com/stock/SMXMF/financials

$SMXMF - OTC Markets Short Sales ~ http://www.otcmarkets.com/stock/SMXMF/short-sales

$SMXMF - OTC Markets Insider Disclosure ~ http://www.otcmarkets.com/stock/SMXMF/insider-transactions

$SMXMF - OTC Markets Research Reports ~ http://www.otcmarkets.com/stock/SMXMF/research

Google Finance Summary ~ http://www.google.com/finance?q=SMXMF

$SMXMF - $SMXMF - Google Finance News ~ http://www.google.com/finance/company_news?q=SMXMF

$SMXMF - Google Finance Option chain ~ http://www.google.com/finance/option_chain?q=SMXMF

$SMXMF - Google Finance Financials ~ http://www.google.com/finance?q=SMXMF&fstype=ii#

$SMXMF - Google Finance Historical prices Daily ~ http://www.google.com/finance/historical?q=SMXMF

$SMXMF - Google Finance Historical prices Weekly ~ http://www.google.com/finance/historical?q=SMXMF&histperiod=weekly#

Y! < Company >

$SMXMF - Y! Profile ~ http://finance.yahoo.com/q/pr?s=SMXMF+Profile

$SMXMF - Y! Key Stat's ~ http://finance.yahoo.com/q/ks?s=SMXMF+Key+Statistics

$SMXMF - Y! Headlines ~ http://finance.yahoo.com/q/h?s=SMXMF+Headlines

$SMXMF - Y! Summary ~ http://finance.yahoo.com/q?s=SMXMF

$SMXMF - Y! Historical Prices ~ http://finance.yahoo.com/q/hp?s=SMXMF+Historical+Prices

Y! Order Book ~ http://finance.yahoo.com/q/ecn?s=SMXMF+Order+Book

Y! Message Boards ~ http://messages.finance.yahoo.com/mb/SMXMF

Y! Market Pulse ~ http://finance.yahoo.com/marketpulse/SMXMF

Y! Technical Analysis ~ http://finance.yahoo.com/q/ta?s=SMXMF+Basic+Tech.+Analysis

Y! < Analyst Coverage >

Y! Analyst Opinion ~ http://finance.yahoo.com/q/ao?s=SMXMF+Analyst+Opinion

Y! Analyst Estimates ~ http://finance.yahoo.com/q/ae?s=SMXMF+Analyst+Estimates

Y! Research Reports ~ http://finance.yahoo.com/q/rr?s=SMXMF+Research+Reports

Y! Star Analysts ~ http://finance.yahoo.com/q/sa?s=SMXMF+Star+Analysts

Y! < Ownership >

Y! Major Holders ~ http://finance.yahoo.com/q/mh?s=SMXMF+Major+Holders

Y! Insider Transactions ~ http://finance.yahoo.com/q/it?s=SMXMF+Insider+Transactions

Y! Insider Roster ~ http://finance.yahoo.com/q/ir?s=SMXMF+Insider+Roster

Y! < Financials >

Y! Income Statement ~ http://finance.yahoo.com/q/is?s=SMXMF+Income+Statement&annual

Y! Balance Sheet ~ http://finance.yahoo.com/q/bs?s=SMXMF+Balance+Sheet&annual

Y! Cash Flow ~ http://finance.yahoo.com/q/cf?s=SMXMF+Cash+Flow&annual

FINVIZ ~ http://finviz.com/quote.ashx?t=SMXMF&ty=c&ta=0&p=d

CandlestickChart ~ http://www.candlestickchart.com/cgi/chart.cgi?symbol=SMXMF&exchange=US

$SMXMF - Barchart Quote ~ http://barchart.com/quotes/stocks/SMXMF?

Barchart Detailed Quote ~ http://barchart.com/detailedquote/stocks/SMXMF

Barchart Options Quotes ~ http://barchart.com/options/stocks/SMXMF

Barchart Technical Chart ~ http://barchart.com/charts/stocks/SMXMF&style=technical

Barchart Interactive Chart ~ http://barchart.com/charts/stocks/SMXMF&style=interactive

Barchart Technical Analysis ~ http://barchart.com/technicals/stocks/SMXMF

Barchart Trader's Cheat Sheet ~ http://barchart.com/cheatsheet.php?sym=SMXMF

Barchart Barchart Opinion ~ http://barchart.com/opinions/stocks/SMXMF

Barchart Snapshot Opinion ~ http://barchart.com/snapopinion/stocks/SMXMF

Barchart News Headlines ~ http://barchart.com/news/stocks/SMXMF

Barchart Profile ~ http://barchart.com/profile//SMXMF

Barchart Key Statistics ~ http://barchart.com/profile.php?sym=SMXMF&view=key_statistics

OTC: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=SMXMF&MarketTicker=OTC&TYP=S

NASDAQ: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=SMXMF&MarketTicker=NASD&TYP=S

NYSE: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=SMXMF&MarketTicker=NYSE&Typ=S

Marketwatch Profile ~ http://www.marketwatch.com/investing/stock/SMXMF/profile

Marketwatch Analyst Estimates ~ http://www.marketwatch.com/investing/stock/SMXMF/analystestimates

Marketwatch Historical Quotes ~ http://www.marketwatch.com/investing/stock/SMXMF/historical

Marketwatch Financials ~ http://www.marketwatch.com/investing/stock/SMXMF/financials

Marketwatch Overview ~ http://www.marketwatch.com/investing/stock/SMXMF

Marketwatch SEC Filings ~ http://www.marketwatch.com/investing/stock/SMXMF/secfilings

Marketwatch Picks ~ http://www.marketwatch.com/investing/stock/SMXMF/picks

Marketwatch Hulbert ~ http://www.marketwatch.com/investing/stock/SMXMF/hulbert

Marketwatch Insider Actions ~ http://www.marketwatch.com/investing/stock/SMXMF/insideractions

Marketwatch Options ~ http://www.marketwatch.com/investing/stock/SMXMF/options

Marketwatch Charts ~ http://www.marketwatch.com/investing/stock/SMXMF/charts

Marketwatch News ~ http://bigcharts.marketwatch.com/news/symbolsearch/symbolnews.asp?news=markadv&symb=SMXMF&sid=1795093&framed=False

The Lion ~ http://thelion.com/bin/aio_msg.cgi?cmd=search&msg=&si=1&tw=1&tt=1&rb=1&ih=1&fo=1&iv=1&yf=1&sa=1&fb=1&gg=1&symbol=SMXMF

Search NYSE ~ http://www.nyse.com/about/listed/lcddata.html?ticker=SMXMF

StockTA ~ http://www.stockta.com/cgi-bin/analysis.pl?symb=SMXMF&num1=567&cobrand=&mode=stock

StockHouse ~ http://www.stockhouse.com/financialtools/sn_overview.aspx?qm_symbol=SMXMF

StockHouse Delayed LII ~ http://www.stockhouse.com/financialtools/sn_level2.aspx?qm_page=46140&qm_symbol=SMXMF

AlphaTrade ~ http://tools.alphatrade.com/index.php?t1=mc_quote_module&t2=mc_quote_module2&t3=historical&template=historical2html&sym=SMXMF&client_id=2740&a_width=680&a_height=1000&language=english&showVol=1&chtype=8

Reuters ~ http://www.reuters.com/finance/stocks/companyOfficers?symbol=SMXMF.PK&WTmodLOC=C4-Officers-5

StockWatch ~ http://www.stockwatch.com/Quote/Detail.aspx?symbol=SMXMF®ion=U

Search NASDAQ ~ http://www.nasdaq.com/symbol/SMXMF

NASDAQ Divy History ~ http://www.nasdaq.com/symbol/SMXMF/dividend-history

NASDAQ Short Interest ~ http://www.nasdaq.com/symbol/SMXMF/short-interest

NASDAQ Institutional Ownership ~ http://www.nasdaq.com/symbol/SMXMF/institutional-holdings

NASDAQ FlashQuotes ~ http://www.nasdaq.com/aspx/flashquotes.aspx?symbol=SMXMF&selected=SMXMF

NASDAQ InfoQuotes ~ http://www.nasdaq.com/aspx/infoquotes.aspx?symbol=SMXMF&selected=SMXMF

NASDAQ After Hours Quote ~ http://www.nasdaq.com/symbol/SMXMF/after-hours

NASDAQ Pre-Market Quote ~ http://www.nasdaq.com/symbol/SMXMF/premarket

NASDAQ Historical Quote ~ http://www.nasdaq.com/symbol/SMXMF/historical

NASDAQ Option Chain ~ http://www.nasdaq.com/symbol/SMXMF/option-chain

NASDAQ Company Headlines ~ http://www.nasdaq.com/symbol/SMXMF/news-headlines

NASDAQ Press Releases ~ http://www.nasdaq.com/symbol/SMXMF/news-headlines

NASDAQ Sentiment ~ http://www.nasdaq.com/symbol/SMXMF/sentiment

NASDAQ Analyst Summary ~ http://www.nasdaq.com/symbol/SMXMF/analyst-research

NASDAQ Guru Analysis~ http://www.nasdaq.com/symbol/SMXMF/guru-analysis

NASDAQ Stock Report ~ http://www.nasdaq.com/symbol/SMXMF/stock-report

NASDAQ Competitors ~ http://www.nasdaq.com/symbol/SMXMF/competitors

NASDAQ Stock Consultant ~ http://www.nasdaq.com/symbol/SMXMF/stock-consultant

NASDAQ Stock Comparison ~ http://www.nasdaq.com/symbol/SMXMF/stock-comparison

NASDAQ Call Transcripts ~ http://www.nasdaq.com/symbol/SMXMF/call-transcripts

NASDAQ Annual Reports ~ http://www.nasdaq.com/aspx/annualreport.aspx?symbol=SMXMF&selected=SMXMF

NASDAQ Financials ~ http://www.nasdaq.com/symbol/SMXMF/financials

NASDAQ Revenue & Earnings Per Share (EPS) ~ http://www.nasdaq.com/symbol/SMXMF/revenue-eps

NASDAQ SEC Filings ~ http://www.nasdaq.com/symbol/SMXMF/sec-filings

NASDAQ Ownership Summary ~ http://www.nasdaq.com/symbol/SMXMF/ownership-summary

NASDAQ Institutional Ownership ~ http://www.nasdaq.com/symbol/SMXMF/institutional-holdings

NASDAQ (SEC Form 4) ~

--------- All Trades ~ http://www.nasdaq.com/symbol/SMXMF/insider-trades

--------- Buys ~ http://www.nasdaq.com/symbol/SMXMF/insider-trades/buys

--------- Sells ~ http://www.nasdaq.com/symbol/SMXMF/insider-trades/sells

The Motley Fool ~ http://caps.fool.com/Ticker/SMXMF.aspx

The Motley Fool Earnings/Growth ~ http://caps.fool.com/Ticker/SMXMF/EarningsGrowthRates.aspx?source=itxsittst0000001

The Motley Fool Ratios ~ http://caps.fool.com/Ticker/SMXMF/Ratios.aspx?source=itxsittst0000001

The Motley Fool Stats ~ http://caps.fool.com/Ticker/SMXMF/Stats.aspx?source=icasittab0000006

The Motley Fool Historical ~ http://caps.fool.com/Ticker/SMXMF/Historical.aspx?source=icasittab0000004

The Motley Fool Scorecard ~ http://caps.fool.com/Ticker/SMXMF/Scorecard.aspx?source=icasittab0000003

The Motley Fool Statements ~ http://caps.fool.com/Ticker/SMXMF/Statements.aspx?source=icasittab0000009

MSN Money ~ http://investing.money.msn.com/investments/stock-ratings?symbol=SMXMF

YCharts ~ http://ycharts.com/companies/SMXMF

YCharts Performance ~ http://ycharts.com/companies/SMXMF/performance

YCharts Dashboard ~ http://ycharts.com/companies/SMXMF/dashboard

InsideStocks Opinion ~ http://www.insidestocks.com/texpert.asp?sym=SMXMF&code=XDAILY

InsideStocks Profile ~ http://www.insidestocks.com/profile.asp?sym=SMXMF&code=XDAILY

InsideStocks Quote ~ http://www.insidestocks.com/quote.asp?sym=SMXMF&code=XDAILY

InsideStocks Projection ~ http://charts3.barchart.com/procal.asp?sym=SMXMF

Zacks Quote ~ http://www.zacks.com/stock/quote/SMXMF

Zacks Estimates ~ http://www.zacks.com/research/report.php?type=estimates&t=SMXMF

Zacks Company Reports ~ http://www.zacks.com/research/report.php?type=report&t=SMXMF

Knobias ~ http://knobias.10kwizard.com/files.php?sym=SMXMF

StockScores ~ http://www.stockscores.com/quickreport.asp?ticker=SMXMF

Trade-Ideas ~ http://www.trade-ideas.com/StockInfo/SMXMF/HOT_TOPIC.html

Morningstar ~ http://performance.morningstar.com/stock/performance-return.action?region=USA&t=SMXMF&culture=en-US

Morningstar Shareholders ~ http://investors.morningstar.com/ownership/shareholders-overview.html?t=SMXMF®ion=USA&culture=en-us

Morningstar Transcripts~ http://www.morningstar.com/earnings/NoTranscript.aspx?t=SMXMF®ion=USA

Morningstar Key Ratios ~ http://financials.morningstar.com/ratios/r.html?t=SMXMF®ion=USA&culture=en-US

Morningstar Executive Compensation ~ http://insiders.morningstar.com/trading/executive-compensation.action?t=SMXMF®ion=USA&culture=en-us

Morningstar Valuation ~ http://financials.morningstar.com/valuation/price-ratio.html?t=SMXMF®ion=USA&culture=en-us

CCBN (Thompson Reuters) ~ http://ccbn.aol.com/company.asp?client=aol&ticker=SMXMF

TradingMarkets ~ http://pr.tradingmarkets.com/?lid=leftPRbox&sym=SMXMF

OTCBB ~ http://www.otcbb.com/asp/SiteSearch.asp?Criteria=SMXMF&searcharea=e&image1.x=0&image1.y=0

Insidercow ~ http://www.insidercow.com/history/company.jsp?company=SMXMF&B1=Search%21

Forbes News ~ http://search.forbes.com/search/find?tab=searchtabgeneraldark&MT=SMXMF

Forbes Press Releases ~ http://search.forbes.com/search/find?&start=1&tab=searchtabgeneraldark&MT=SMXMF&pub=businesswire,prnewswire&searchResults=pressRelease&tag=pr&premium=on

Forbes Web ~ http://search.forbes.com/search/web?MT=SMXMF&start=1&max=10&searchResults=web&tag=web&sort=null

YouTube Symbol Search ~ http://www.youtube.com/results?search_query=SMXMF

Buy-Ins ~ http://www.buyins.net/tools/symbol_stats.php?sym=SMXMF

Quotemedia ~ http://www.quotemedia.com/results.php?qm_page=47556&qm_symbol=SMXMF

Earnings Whispers ~ http://www.earningswhispers.com/stocks.asp?symbol=SMXMF

Bloomberg Snapshot ~ http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=SMXMF

Bloomberg People ~ http://investing.businessweek.com/research/stocks/people/people.asp?ticker=SMXMF

Financial Times ~ http://markets.ft.com/Research/Markets/Tearsheets/Summary?s=SMXMF

Investorpoint ~ http://www.investorpoint.com/ enter "SMXMF" and click search.

Hotstocked ~ http://www.hotstocked.com/ enter "SMXMF" and click search.

Raging Bull ~ http://ragingbull.quote.com/mboard/boards.cgi?board=SMXMF

Hoovers ~ http://www.hoovers.com/search/company-search-results/100003765-1.html?type=company&term=SMXMF

DD Machine ~ http://www.ddmachine.com/default.asp?m=stocktool_frame.asp?symbol=SMXMF

SEC Form 4 ~ http://www.secform4.com/insider/showhistory.php?cik=SMXMF

OTCBB Pulse ~ http://www.otcbbpulse.com/cgi-bin/pulsequote.cgi?symbol=SMXMF

Failures To Deliver ~ http://failurestodeliver.com/default2.aspx enter "SMXMF" and click search.

http://www.coordinatedlegal.com/SecretaryOfState.html

http://regsho.finra.org/regsho-Index.html

http://www.shortsqueeze.com/?symbol=SMXMF&submit=Short+Quote%99

~ $SMXMF ~ Daily Par Sar Buy Signal ~ Criteria alert triggered during a recent trading session!

$SMXMF has just triggered the "Parabolic SAR Buy Signals" scan criteria at Stockcharts.com

~ http://tinyurl.com/SAR-BUY ~

For a more in Depth study and DD profile, similar to the one contained in this link: ~ http://tinyurl.com/DDexample ~

Click the following link and type ticker or brief message asking me about the DD: ~ http://tinyurl.com/GET-THE-DD ~

What does the scan "Parabolic SAR Buy Signals" mean? Below is an image example and study link.

~ http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:parabolic_sar ~

To find other similar posts of "SMXMF" utilize the links that follow.

Search MACDgyver's "Parabolic SAR Buy Signals" posts: ~ http://investorshub.advfn.com/boards/msgsearchbymember.aspx?searchID=251916&srchyr=2013&SearchStr=ParSarBuyScan ~

Search MACDgyver's posts for symbol "SMXMF": ~ http://investorshub.advfn.com/boards/msgsearchbymember.aspx?searchID=251916&srchyr=2013&SearchStr=SMXMF ~

Search Ihub for "SMXMF" posts: ~ http://investorshub.advfn.com/boards/msgsearch.aspx?SearchStr=SMXMF ~

For more in depth training and information visit Chartschool on the Stockcharts page.

~ http://stockcharts.com/school/doku.php?id=chart_school ~

Also don't forget the Ihub Edu Channel.

~ http://investorshub.advfn.com/boards/education.aspx ~

c

~ $SMXMF ~ Parabolic SAR Buy Signals ~ Criteria alert for last trading session!

$SMXMF has just triggered the "Parabolic SAR Buy Signals" scan criteria at Stockcharts.com

~ http://tinyurl.com/SAR-BUY ~

For a more in Depth study and DD profile, similar to the one contained in this link: ~ http://tinyurl.com/DDexample ~

Click the following link and type ticker or brief message asking me about the DD: ~ http://tinyurl.com/GET-THE-DD ~

What does the scan "Parabolic SAR Buy Signals" mean? Below is an image example and study link.

~ http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:parabolic_sar ~

To find other similar posts of "SMXMF" utilize the links that follow.

Search FaStlane's "Parabolic SAR Buy Signals" posts: ~ http://investorshub.advfn.com/boards/msgsearchbymember.aspx?searchID=251916&srchyr=2011&SearchStr=ParSarBuyScan ~

Search FaStlane's posts for symbol "SMXMF": ~ http://investorshub.advfn.com/boards/msgsearchbymember.aspx?searchID=251916&srchyr=2011&SearchStr=SMXMF ~

Search Ihub for "SMXMF" posts: ~ http://investorshub.advfn.com/boards/msgsearch.aspx?SearchStr=SMXMF ~

For more in depth training and information visit Chartschool on the Stockcharts page.

~ http://stockcharts.com/school/doku.php?id=chart_school ~

Also don't forget the Ihub Edu Channel.

~ http://investorshub.advfn.com/boards/education.aspx ~

NEWS RELEASE – No. 1-12 March 22, 2012

SAMEX EXPLORATION UPDATE, LOS ZORROS PROJECT, CHILE

SAMEX is steadily advancing the exploration program at its Los Zorros property in Chile. Drilling since mid December includes over 4700 meters in 11 holes (two holes are currently in progress) and has variably encountered anomalous and massive sulphide mineralization including; pathfinder minerals, favourable sedimentary intervals and structurally controlled mineralization. Program highlights include:

• Milagro Project - Drill hole MW-12-01, located on the western edge of the Milagro gravity anomaly, encountered 22 meters of semi-massive to massive sulphide and oxide mineralization, composed of pyrite, magnetite, hematite and chalcopyrite. Logging and sampling is in progress, which will be followed by assaying. A 400 meter step out drill hole, MW-12-02 positioned more central within the Milagro gravity anomaly, has been started to follow up this encouraging intersection.

• Nora Project, Target Zones C/D - Logging, sampling and assaying have been completed on the four holes within the project area, N-11-01A, B, C and N-11-02A. Results are discussed below. Please also see PDF graphics plate at www.samex.com for map and section views.

• Nora Project, Target Zones A/B - Three deep holes have been drilled, N-11-03, -04, N-12-05 and a fourth N-12-06 is in progress. Logging, sampling and assaying are in progress and will be reported when completed.

• Lora SE Project - Two holes, LSE-12-01, -02 were drilled in this project area to test geophysical gravity low, resistivity and chargeability anomalies - intercepts of mineralized quartz-eye diorite porphyry and altered mineralized sediments were encountered. Logging, sampling and assaying are in progress and will be reported when completed.

• Cinchado Project - One deep drill hole SP-12-01, has been completed from the east side of Cinchado towards the west and underneath the old San Pedro gold mine. Logging, sampling and assaying are in progress and will be reported when completed.

• Drill pads have been prepared for continuation of drilling at the Virgen del Carmen, Colorina, Milagro, Florida, and the Salvadora project areas. Additional drill pads are in the process of being constructed in other project areas.

• A new road to access the more northern Cresta de Gallo area is under construction along the eastern range front region of the property. Current drilling at the Los Zorros Property is exploring for gold and silver at multiple project areas within the Company’s extensive land holdings that now cover more than 100 square kilometers. This round of drilling is following up exploration results from earlier drilling and is also testing anomalies identified by the Titan-24 geophysical survey which was completed last year.

Nora Project, Target Zones C/D - SAMEX has been drilling in the Nora Project area which hosts a complex swarm of copper-gold-mineralized barite veins and a series of broad zones of anomalous gold. Assay results have been received and compiled for four of the holes (DDH-N-11-01A, -01B, - 01C and N-11-02A) drilled in Zone C and Zone D of the Nora Project area. The holes were designed to follow-up on a significant interval of high-grade gold mineralization (15.96 g/t over 7.66 meters) in pyritized and silicified diorite-clast breccia intercepted in drill hole N-04-05 during 2004, and to test a target concept to determine if a gold-mineralized breccia mantos/stratigraphic unit was possibly widespread beneath the area.

A set of three drill holes (DDH-N-11-01A, N-11-01B, N-11-01C) were drilled at various angles from the same pad location (drill pad N-11-01) in order to test the concept of a mantos/stratigraphic control. A fourth drill hole (DDH-N-11-02A) was positioned to drill steeply southeastward across the target interval in similar fashion to the nearby original 2004 “discovery” drill hole. Three of the holes (DDH-N-11-01A, N-11-01B, and N-11-02A) holes made successful intact intersections through the targeted stratigraphic interval of “black silica” matrix diorite breccia, and hole N-11-01C intersected a similar layer much higher in the hole than anticipated - but the intersections in these mantos/stratigraphic units did not have any significant gold content.

However, highly anomalous amounts of gold and silver with highly anomalous copper were intersected from the surface (or near surface) to depths of about 40.0 to 60.0 meters in all three of the holes (DDH-N-11-01A, N-11-01B, N-11-01C) drilled from drill pad N-11-01) (see Table below). These shallow intersections appear to be related to two strongly quartz-sericite-pyrite altered vein/fault zones which trend through the vicinity of the drill pad (N-11-01). The respective true widths of these intersections can only be estimated to be between 5 to 16 meters because the orientation of the drill holes is angled at a very acute angle (<100 to 200) to the steep westward dip of the vein/faults, thus smearing out the highly fractured intersections (see cross section figure). Because of the highly fractured rock, core recovery in these intervals was overall poor. Other intervals of anomalous gold and copper were also intersected at greater depths in these holes and appear to be related to quartzsericite-pyrite altered vein/faults.

The additional information gleaned in these recent drill holes suggests that the interval of high-grade gold mineralization intersected in 2004 may be related to one of the steep (near vertical) fault/vein structures – perhaps comprising part of the wide mineralized quartz-sericite-pyrite alteration halo - instead of being part of a mantos-style (near horizontal/stratigraphic) layer. The intervals of highly anomalous gold and silver with highly anomalous copper in these new holes all appear to be associated with quartz-sericite-pyrite altered fault/veins (vertical/steep oriented structures).

The complex swarm of copper-gold-mineralized barite veins and broad zones of anomalous gold present at surface in the Nora Project area may be leakage up from deeper-seated mineralization in vertical/steep oriented structures beneath the area. The recent drill holes (DDH-N-11-01A, -01B, - 01C) were oriented as steep-angle holes in order to test through mantos-style (near horizontal/stratigraphic) layers; however, a program of low-angled holes would need to be considered in order to test the nature and true width of vertical/steep oriented structures at depth in prospective Zones C and D and in the broader and more-strongly veined prospective Zone A.

The Los Zorros land holdings now cover a 15 kilometer-strike of the prospective range front/anticline along which mineralization is exposed in old-time piquenero underground workings, open cuts, trenches and pits situated in the Colorina, Nora, Virgen del Carmen, Cresta de Gallo, and Trueno project areas that are yet to be systematically explored by SAMEX.

SAMEX is making steady progress in exploring this large and complex district and continues to develop a clearer understanding of the controls and influences that gave rise to mineralization on the property. SAMEX is well funded to advance the exploration of its high-priority precious metal projects at Los Zorros, while bringing forward numerous additional targets in the district. The Company holds a portion of its working capital in the form of gold and silver bullion.

The geologic technical information in this News Release was prepared by Robert Kell, Vice-President Exploration for SAMEX MINING CORP. and Philip Southam, Geologist. Mr. Kell and Mr. Southam are “qualified persons” pursuant to Canadian Securities National Instrument 43-101 concerning Standards Of Disclosure For Mineral Projects.

http://www.samex.com/files/6513/3245/3928/NR1-12-Mar22.pdf

SAMEX Answers Sasco

Date : 12/21/2011 @ 4:11PM

One of our shareholders, Sasco Investments, of Houston, Texas, published a letter on December 15, 2011 critical of SAMEX (TSX:VENTURE:SXG)(OTCBB:SMXMF) management and the speed of exploration work on SAMEX's Los Zorros property.

We are deeply disappointed with Sasco and its principal, Mr. Sadeghpour.

As a major investor, Sasco and Mr. Sadeghpour have been given extensive access to SAMEX's geological team and management - under terms of a confidentiality agreement (which may now be in breach) - they know - or ought to know - full well the things they now say are untrue.

Also, while SAMEX has always been open to comments and ideas from Sasco or other shareholders - even critical or misguided ones - Sasco has chosen to communicate by demands and defamatory letters - not by dialogue and discussion.

Sasco first contacted the Board with its complaints by letter dated December 12, 2011 making much the same complaints as in its "open letter". The Board met the next day (December 13), and, because of the nature of the complaints, formed an independent committee to deal with them. The Committee sent Sasco a letter on December 14, 2011 offering to engage in open and frank discussion. Instead of making a phone call, Sasco chose to publish its "open letter" on December 15, 2011, and has yet to respond to our invitation.

Sasco's action has left us little choice but to respond publicly and in writing.

While we take exception to most of Sasco's letter, there a few points on which we both agree. We agree that Los Zorros is an impressive property. We agree that it should be explored aggressively. We appreciate Sasco's confidence in our geological team which Sasco says is 'brilliant'. What we do not agree on is that Sasco/Sadeghpour - who to our knowledge have no experience or qualifications in geology - can run our drill programs better than our professional geological team.

Some of Sasco's comments are disingenuous or merely petty. Sasco criticizes the SAMEX website, yet Mr. Sadeghpour personally told SAMEX not to bother changing it. (Incidentally, we do agree the website needed updating. We already had a web designer working on it - as Mr. Sadeghpour knew. The new website is now up and running.)

Other Sasco comments are either seriously misinformed or outright false and misleading.

Sasco makes much of saying SAMEX delayed drilling on the "Nora" portion of the Los Zorros Property "for 10 months". He claims SAMEX "affirmed it would start drilling on the Nora project early in the first quarter of 2011". Sasco then goes on to say first, that drilling did not commence until November 2011 and then, in the next sentence, says that drilling did not resume until July 2011 after completion of the Titan 24 testing in February, 2011.

Aside from being confusing, this comment is completely disingenuous and misleading. Sasco knows full well why drilling was paused in February and resumed in July and why Nora was not drilled in the first quarter of 2011, and fully agreed with those decisions at the time. Sasco had several tours of the Property with SAMEX's chief geologist and CEO, and was fully informed of the activities of the Company during the time period in question.

The facts speak for themselves.

Drilling carried on at Los Zorros until February 3, 2011, then paused to allow completion and interpretation of Titan 24 geophysics survey announced on December 17, 2010. Sasco and its advisors strongly supported completion of the Titan 24 survey to help interpret and model the very complex and varied geology at Los Zorros. After receiving the Titan 24 results in early April, 2011, our geological team spent the next several weeks correlating geophysical results with existing geological data and models. As a result, our team identified a new target at Cinchado - which we announced on April 18, 2011 as our next top priority drilling target. Mr. Sadeghpour evidently agreed with our conclusion because the next day he purchased more than 2.4 million SAMEX shares in the market at prices in excess of $1.00, and continued to buy shares afterwards.

Our geological team continued the process of analysis, modeling, preparation of prioritized drill targets and construction of drill pads in May and June 2011. Drilling recommenced early July 2011 at Cinchado, as announced, and has continued since then at various Los Zorros projects in accordance with the drilling plan established by our professional geological team. The team decided for various reasons (and Sasco and its advisors agreed) to prioritize drilling at Cinchado first and then on other parts of Los Zorros before moving to Nora. This timing had nothing to do with delaying a program or extending 'salary longevity' as Sasco falsely claims - it had everything to do with prudent exploration.

Sasco's comments on hiring new geologists and adding drill rigs are both disingenuous and misleading. Sasco is well aware that SAMEX has been actively recruiting geologists throughout 2011. Exploration activity worldwide has been at an all time high in our industry, making the hiring of experienced geologists very difficult. SAMEX has now hired three additional geologists (for a total of five), and is seeking to hire a sixth. SAMEX practice has been to have two geologists for each rig to ensure adequate supervision and logging - something Sasco knew and agreed with. Our fourth geologist started December 4, only 5 days before the second rig started at Nora.

Sasco also makes a number of comments about SAMEX management and the SAMEX board which are not only false and defamatory, but completely reckless in their disregard for the truth.

Sasco claims SAMEX management is deliberately slowing the pace of work to stretch out their salaries rather than focusing on drilling. Not only is this claim baseless, it also defies common sense. All of SAMEX management have significant share and option positions - they stand to gain much more from a discovery than from years of collecting a salary. In fact, there were sound reasons for pausing drilling until after completion and analysis of geophysics, and there were many other things - both technical and administrative - SAMEX management needed to complete prior to resuming drilling.

In its closing sentence, Sasco says our mission is "drilling our prized projects in Chile". On this we must disagree. While we 'prize' our projects, our mission is not drilling, it is discovery - discovery of a major gold deposit. That takes thoughtful and systematic exploration - something we will continue to do.

Sasco claims none of the six directors adequately represent investors. This is utterly false and completely slanderous. The current board have been directors for over 16 years, other than Malcolm Fraser, who was only elected this year. Every year for the last 16 years more than 90% of all shares voted supported these directors. Until very recently, Sasco and Sadeghpour expressed strong support for the Board, and in fact voted for re-election of the Board at the AGM on June 7, 2011. It is only now, when it suits their purpose, that they make this false and defamatory allegation.

Sasco claims stock options are 'handed out like party favours'. Nothing could be further from the truth. In fact, although TSX policy allows junior companies to grant up to 20% of their issued shares as options, SAMEX options have never reached 10%. While TSX policy permits option grants at a discount to market price (the typical practice for junior exploration companies), almost all SAMEX options have been granted at, or more typically, well above the prevailing market price.

Further, Sasco's proposed plan to improve management - moving the President and CEO to Chile - is seriously misguided. SAMEX is a Canadian public company with a Tier 1 TSX-V listing. Of the 1,600+ mining issuers on the TSX/TSX-V, the vast majority have head offices in Canada. There is good reason for this practice. Canadian public mining companies have extensive regulatory and reporting obligations in Canada, and need to be close to regulators, professional advisors and financing sources here in Canada. While we do maintain a significant office in Copiapo, Chile managed full time by a Chilean mining engineer, we believe that moving our CEO to Chile would seriously hamper meeting our regulatory and other obligations.

Finally, while Sasco talks of 'broken promises' by SAMEX management, when it comes to mis-statements and broken promises, Sasco and Mr. Sadeghpour have themselves indulged in a 'whopper'. Prior to investing in November, 2010 and multiple times since Sasco and Sadeghpour promised to support management and the existing board of directors for at least five years. Numerous drafts of voting agreements were prepared and exchanged - always with the assurance by Sasco and Sadeghpour that they were ready to sign, with only minor changes. Yet now Sasco and Mr. Sadeghpour are seeking to use their voting power to replace half the board with their own nominees. We understand the pressures that can come from exploration challenges and difficult markets, but a promise is a promise. If Sasco and Sadeghpour cannot be trusted to keep their word on this, can they be trusted on anything else?

While Sasco and Sadeghpour's conduct make us suspicious of their motives, we remain open for discussion and again extend our offer to Sasco to engage in open and frank communication with a view to resolving any legitimate concerns.

However, whatever Sasco's decision or response, SAMEX management wishes to assure its shareholders that they will continue to do whatever is necessary to further and protect the interest of all SAMEX shareholders, both large and small.

For And On Behalf Of The Board Of Directors,

Jeffrey Dahl, President

http://www.samex.com/files/9613/2450/1440/NR10-11-Dec21.pdf

Financials for quarter ending March 31, 2011:

http://www.sec.gov/Archives/edgar/data/766504/000113717111000362/financials.htm

Key points:

* 122,285,219 outstanding shares. Increase of 2,817,500 shares based on warrant exercises.

* $668,596 spent on Los Zorros exploration, mapping, etc.

SMXMF's chart has been heating up since the July 11, 2011 PR announcing that drilling will recommence on Los Zorros. I'm bummed that I missed this announcement while on vacation.

SAMEX TO RESUME DRILLING AT LOS ZORROS DISTRICT, CHILE

Drilling will resume shortly at Los Zorros in Chile where SAMEX is exploring for multiple precious metal deposits within a district of widespread occurrences of gold, silver, copper and barite.

The drilling is following up exploration results from earlier drilling and a Titan-24 geophysical survey which refined understanding of existing project targets and also outlined important new targets (see News Release No. 4-11 dated April 18, 2011 "SAMEX Makes Exploration Breakthrough At Cinchado; Multiple Gold Intercepts At Milagro & Milagro Pampa – Los Zorros District, Chile" and graphic plates at www.samex.com). Drilling will start in the Cinchado Project area and is also planned for the high priority Nora Project. In addition, other targets outlined by the Titan 24 geophysical survey and recent reconnaissance work may be tested later in the program.

The Los Zorros property holdings consist of multiple project areas that cover approximately 80 square kilometers within a district of scattered numerous small mines and prospects where there was

sporadic attempts at small-scale production for gold and copper-silver in the past. The property is situated at the convergence of important geologic and structural features and significant gold and

copper-silver mineralized areas of Cinchado, Nora, Milagro, and Milagro Pampa. There are also many other mineral occurrences at Los Zorros yet to be systematically explored by SAMEX including: La

Florida and Lora (gold and copper-gold), Virgen de Carmen and Colorina (copper-silver; possible deeper-seated gold and copper-gold), and Salvadora and Cresta de Gallo (barite vein systems with possible deeper-seated gold and copper-gold). In addition to these areas, SAMEX is strategically expanding its Los Zorros land holdings over prospective geologic features in the surrounding area.

SAMEX is well funded to advance the exploration of its high-priority precious metal projects at Los Zorros, while bringing forward numerous additional targets in the district.

“Jeffrey Dahl”

http://www.samex.com/news/aa-news-2011/NR7-11-Jul8.pdf

Samex mentioned in May 2011 Clive Maund interview:

TGR: What about the Chilean economy, especially as it pertains to mining?

CM: Chile is actually a far more fiscally prudent country than the U.S. It does not have careening deficits, and the workforce is obliged to contribute to a private pension scheme that has in fact grown in value far more than government schemes in countries like the U.S. That means the Chilean government is not on the hook for massive pension obligations, as many other governments around the world are. Those governments will probably renege on these obligations, at least in part, by a combination of inflation and fiddling the inflation statistics.

Chile is very mining friendly and has a sophisticated infrastructure to support mining companies conducting operations. In addition, environmental factors are not such a concern here as most of the mining operations and prospects are located in northern Chile. The north is a rather sparsely populated desert but with towns dotted around to provide amenities, logistical support and a skilled workforce. It is still not widely appreciated that there is a line of hills or low mountains between the Andes and the coast that harbor massive as-yet-undiscovered copper-gold deposits that will be relatively easy to mine and much less complicated and expensive than Barrick Gold Corp.'s (TSX:ABX; NYSE:ABX) massive Pascua-Lama operation. That project is perched on Chile's border with Argentina, high in the Andes. To get an idea of the potential of these deposits located in this line of hills, you need only look at Codelco's (Corporacion Nacional del Cobre de Chile) massive

Chuquicamata Chuquicamata

open-pit copper mine near Calama, which is the biggest open-pit copper mine in the world, or Freeport-McMoRan Copper & Gold Inc.'s (NYSE:FCX) giant Candelaria open-pit and underground mine near Copiapo.

TGR: You have an on-the-ground view of what's happening in Chile. Are there some small-cap names with favorable projects in Chile?

CM: One that is coming along very nicely and continues to look most promising is Samex Mining Corp. (TSX.V:SXG; OTCBB:SMXMF). I have personally inspected its properties north and south of Copiapo with the company's chief geologist. I started the current bull market in this stock by recommending it to subscribers at $0.12 almost two years ago and, after a steady advance, it spiked for about a month on positive drilling results. Samex has tied up two nice parcels of excellent properties on that line of hills I mentioned earlier, which are actually very close to Freeport's Candelaria operation. These properties have huge potential, so there's a lot more upside for this stock with the company now undertaking a drilling program to define the potential of the properties.

http://www.gold-speculator.com/gold-report/55865-clive-maund-mitigate-investment-risk-until-end-dollar-rally.html

Thanks for sharing the information. Hope they start drilling next month.

Talked with management today after first post.

I had a great conversation today with Samex management, and wanted to share with other stakeholders. Management answered all questions, explained in detail the vision for company in relation to existing projects and future ventures. I am more excited than ever before with the potential and direction of Samex Mining. They expect more drill results late summer from multiple mines that should be extremely beneficial to all shareholders.

Does anyone have information on when Samex will be releasing the updates on the Cinchado drilling. Initially the Titan 24 was not available on the last drill results, but once they used it it allowed then to pinpoint new drilling spots.

Any info would be greatly appreciated

March 16, 2011 warrants extended to 2012

SAMEX MINING CORP. ("SXG")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: February 28, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has consented to the extension in the expiry date of the following warrants:

Private Placement:

# of Warrants: 2,871,250

Original Expiry Date of Warrants: March 16, 2009, extended to March 16, 2011

New Expiry Date of Warrants: March 16, 2012

Exercise Price of Warrants: $1.00

These warrants were issued pursuant to a private placement of 5,742,500 shares with 5,742,500 share purchase warrants attached, which was accepted for filing by the Exchange effective March 16, 2007.

$1.00 is always somewhat of a barrier. Once broken the mystic fades and we can get on with business.

Looks like SMXMF is gapping up today. .988 x .101 in pre-market.

16 Month Old Report on Samex, but still good information.

SAMEX MINING CORP: A Very Special Report

By Clive Maund

Published: October 28, 2009 by GoldSpeculator

------------------------------------------------------------------

On 17th October 2009 the Maund brothers, senior independant geologist Nigel Maund and stockmarket analyst Clive Maund visited Samex Mining Corp's Chimberos prospect in northern Chile with Samex President and Director Jeff Dahl and VP Exploration and Director Robert Kell. A complete assessment of the geologic potential of the prospect was undertaken by Nigel Maund and an update on the potential for the stock based on technical analysis has been added by Clive Maund. What follows below is a two part article featuring this work.

PART 1: Nigel Maund's Fundamental Analysis of SAMEX MINING CORP.

by Nigel H Maund

BSc(Hons)Lond. MSc, DIC, MBA, F.AusIMM, F.AIG, F.SEG, MIMMM

Westralian Exploration Consultants Limited (Australia) – Principal Geologist

TICKER – SXG.V

SAMEX MINING CORP: CHIMBEROS Cu – Au – Ag PROSPECT REVIEW - CHILE

“THE GEOLOGIC SCENE IS SET FOR A MAJOR IOCG DISCOVERY”

The writer visited the Chimberos Prospect in Region III of Chile with this website owner Clive Maund and SAMEX Directors, Mr. Jeff Dahl and Mr. Rob Kell on the 17th October 2009. A complete geologic review of the prospect was undertaken with a view to its overall exploration potential.

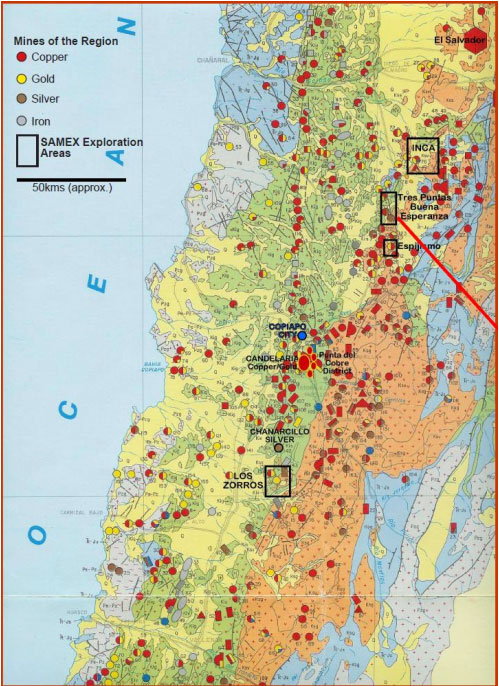

The location of the Chimberos Prospect is given on Plate 2 below together with other SAMEX properties in the region. SAMEX tenement holdings over this prospect are given on Plate 4 further down the page. A substantial Chilean mining company, Sociedad Contractuel Minera Carola (Carola), holds title to the balance of the ground over the Chimberos prospect. This company is currently mining one of the long established Punte del Cobre copper – gold mines immediately south and east of the regional centre of Copiapo (150,000 inhabitants) in Region III of Chile, as shown on Plate 2. The latter has produced more than 140Mt at a grade of nearly 2% Cu and 0.4 g/t Au, from extensive underground mines, working vein breccia and stacked manto deposits, developed on the NE flank of the large Candeleria open pit copper – gold mine, which is now owned and operated by Freeport McMoRan. Carola currently has three large diamond rigs drilling 600m to 800m deep and steep angled holes, as shown on Plates 1 and 4, in an initial 10,000m program. Their target is a Candelaria type IOCG (Iron Oxide Copper Gold) porphyry system with associated Punte del Cobre type higher grade copper – gold manto and vein breccia deposits which occur as stacked systems astride high angle to vertical input feeder structures. The Candeleria / Punte del Cobre system hosts a resource of some 5 to 7 Mt of copper metal and 3 to 5 M oz gold, making it a Class II copper – gold resource. This counts as a major exploration target.

Plate 1: A Sociedad Contractuel Minera Carola truck mounted diamond rig drilling an angled hole towards and near the boundary of SAMEX tenements at the Chimberos prospect - Chile

Plate 2: The location of the Buena Esperanza – Tres Puntas (Chimberos) Prospects – Region III – Chile – Metallogenic Geologic Map (SERNAGEOMIN). Red line points to Chimberos prospect.

The Candelaria Mine, illustrated on Plate 9, contains greater resources than the out-of-date published reserves of 450Mt at 1.0% Cu and 0.30 g/t Au and is the most significant mineral deposit in Chile’s Coastal Cordillera belt. Owing to the complex tenement holdings around Candelaria, Freeport’s scope for reserve expansion around the drilled out deposit is somewhat restricted. Hence, the reserve does not reflect the full scale of the Candeleria resource. The latter is thought to be in the vicinity of 1 Gt of similar grades from exploration drilling undertaken on adjacent ground.

SAMEX has to date largely focused their activities on securing all the tenements and in undertaking exploration work at their “Los Zorros” complex of prospects located some 60km south of Copiapo. Rob Kell has been assembling the SAMEX tenement package in Chile based on sound geologic area selection principles and his own extensive industry experience. The Chimberos prospect was built around the old Buena Esperanza silver – copper mines shown on Plate 2 and illustrated on Plates 3 and 4. These workings have extracted high grade silver and copper ores, principally as native silver, oxides and from disseminated metal sulfides, including freibergite – cuprite – chalcocite and chalcopyrite over more than 120 years. The workings extend to depths of up to 150m below surface in substantial vertical shafts and Buena Esperanza was the third largest silver producer up until the establishment of the huge mechanized porphyry copper mines in Chile. The structure that controls the vein and manto style deposits at Buena Esperanza can be traced along strike for more than 6km to the mine workings at Tres Punta to the north, and hence is a major geologic feature. At surface the mineral assemblage is high level epithermal to upper mesothermal with localized high grade gold – silver veining and replacement bodies, and copper – gold – silver. However, at depth it is strongly suspected that this mineralization style will morph into Punte del Cobre copper - gold type structure – lithology controlled steep vein breccia and gently dipping stacked “manto” replacement deposits offering significant tonnage potential.

Plate 3: A view south along the Buena Esperanza silver - gold - copper workings located entirely within SAMEX tenements at the Chimberos Prospect. The structural control to mineralization is apparent on the plate.

Plate 4: A Google Earth image showing the location of SAMEX tenements and areas where Sociedad Contractuel Minera Carola are currently drilling in their Phase 1 diamond drilling program.

Furthermore, and perhaps more significantly, the hydrothermal alteration envelope, in terms of mineralogy and scale, identified by SAMEX, and substantiated by the writer, points to a major IOCG system of the Candelaria type developed at unknown depth beneath the Chimberos project. However, the expected depth is unlikely to be more than a few hundred meters, given the hydrothermal alteration mineral assemblage and sheer scale of the alteration developed, as apparent on Plate 8. The geologic stratigraphy exposed on the property reveals members of the Abundancia Formation which comprises a sequence of interbedded limestones and andesitic volcaniclastic rocks. This formation is underlain by the main ore host at Punte del Cobre and Candeleria mines; i.e., the Punte del Cobre formation, which comprises a suite of andesitic volcanic lavas, tuffs, agglomerates and lahars (collectively known as volcaniclastics). At Chimberos, the writer observed major hydrothermal alteration and skarn development in the Abundancia Formation members with coarse andradite (garnet) – epidote – chlorite – carbonate ± specular hematite skarn rocks suggestive of proximal development to the heat source. This tabular gently south dipping skarn body is immediately underlain by substantial manto copper – gold mineralisation, developed over a distance of 1.5km as chrysocolla, cuprite, chalcocite and chalcopyrite as shown on Plates 5 and 6. This mineralization underlies the SAMEX tenements. There is evidence exposed on the Chimberos prospect of stacked skarn and copper – gold manto bodies typical of the Punte del Cobre style of mineralization. These areas have never been tested by drilling.

Table 1, below, has been prepared to summarize for the investor the main features of the Chimberos prospect. From Plate 4 above, it is apparent that SAMEX possesses a strategic tenement holding in the unfolding exploration play currently underway. Furthermore, the location of any resource defined by exploration drilling within 2 to 4 km from an “A” class asphalted road could hardly be better. The only problem the writer can foresee will be the availability of water. The terrain itself poses no problems to exploration or subsequent development.

SAMEX’s strategy should now be focused towards drill testing the deeper potential of the Buena Esperanza mine workings for Punte del Cobre copper – gold – silver mineralization where a substantial tonnage of stacked manto deposits may be expected. SAMEX are very well placed to benefit from the positive results of the unfolding IOCG exploration play currently underway, as Carola will be strongly constrained in any potential mine development by the SAMEX ground holding, as evidenced on Plate 4.

Plate 5: Copper Manto development immediately beneath the andradite garnet – epidote – carbonate – hematite skarn with blue (chrysocolla) – cuprite – chalcocite (grey) and ochreous hematite – limonite developed in the oxide zone after copper sulfides.

Plate 6: Extensive local miner (picaneros) workings developed within the copper gold manto immediately beneath the andradite – grossular – epidote – carbonate – hematite skarn at the Chimberos prospect.

Plate 7: Coarse euhedral andradite - grossular garnet IOCG skarn developed on the SAMEX Chimberos prospect – Abundancia Formation – Chile – skarn ridge shown on Plate 8 below.

Plate 8: A view south from the coarse andradite garnet – epidote – chlorite – hematite – carbonate skarn manto overlooking the main exploration target area currently being drill tested by Sociedad Contractuel Minera Carola for Candelaria – Punte del Cobre style copper – gold mineralization.

Table 1: Assessment Criteria for the SAMEX Chimberos Prospect

Plate 9: A view of Freeport McMoRan’s “Candeleria” open pit copper – gold (IOCG) mine near Copiapo – Region III Chile. This picture provides some idea of the target being sought within the Chimberos prospect area.

PART 2: Clive Maund's Technical Analysis of SAMEX MINING CORP.

by Clive Maund

Samex Mining is a stock that is still in the earliest stages of a major bullmarket advance. On its 3-year chart we can see that it has just started to emerge from a low Flat Pan base, which formed above a clear line of support after it finally hit bottom in October last year after a severe decline. The upside volume buildup that preceded the breakout, and the heavy volume on the breakout, which have driven the On-balance Volume line up, are signs that an important uptrend is beginning. What typically happens in a situation like this is that the stock takes off like a rocket as the market gets its collective head around the sudden improvement in fortunes and outlook for the company, and after a large percentage gain stalls out and runs off sideways for many months consolidating, which gives the steadily improving fundamentals of the company "time to catch up" and justify the higher stock price. This is the dynamic that creates the common and bullish Pan & Handle base pattern. On the Samex chart we see the price starting to ascend from the completed Pan - it should now ascend rapidly, probably to the resistance level in the 50 - 60 cent area - but possibly considerably higher due to its spectacular fundamentals, before it runs off sideways probably for many months forming a "Handle" to complete the Pan & Handle base formation, giving the company time to improve its situation on the ground.

On the 6-month chart we can see recent action in more detail. Here we see where the stock was first recommended on Clive Maund due solely to the correct assessment of its technical condition. After that the writer was shown around the Los Zorros goldfield by company senior geologist Rob Kell and saw at first hand the huge potential of this prospect. This led to the second recommendation of the stock in October at the strategic point shown following a reaction, and principally on technical grounds, as price - volume action following the first recommendation had been very bullish. Then Nigel Maund arrived from Australia and in addition to visiting Los Zorros we inspected the astonishing Chimberos prospect in the company of Rob Kell and CEO Jeff Dahl, where we witnessed the neighbour's diamond drilling rigs in action close to Samex's tenements. Returning to the chart we see that following the 2nd recommendation of the stock it soared, this time on huge volume as it broke out from the Pan base, since which time it inched higher before reacting back to ease the overbought condition. While further consolidation or reaction would be helpful before the advance resumes, this is considered to be one of those rare cases where the outlook for the company is improving so rapidly - and the market's appreciation of this fact - that the stock price could continue to advance, overbought or not, with only the briefest of pauses for consolidation or minor reaction. Even in the event of a general market cave-in it is considered unlikely that the price will drop back below the new support at the 20 cent level. Thus anyone wishing to take positions in the stock should not expect to see more than a minor reaction - waiting for a larger one may involve missing it completely.

For the benefit of those who require a little guidance regarding the outlook for the stock price in the event of a major discovery being made, the following chart shows what happened to the stock price of Arequipa after it made a major discovery...

Chimberos is not the only promising prospect in Samex Mining's possession. Look out for another Special Report in due course on the wholly owned Los Zorros goldfield which is also in the same rich coastal belt in northern Chile, not far south of Freeport's giant Candelaria copper mine.

Hurricane Rick! Thank you! Hope the rest of day doesnt blow it. Lol

Either way, you are correct. The party is just getting started.

Good call Mr. GP!!! Keep in mind there are only 7 board marks right now and you and I are the only ones posting. I have a feeling that will change in short order.

Since no one ekse is in here to pat me on the back, I'll pat myself for such a good call.....pat pat pat!

Still a screaming buy.

I think there is some big money coming into SMXMF.

It has above $1.00 written all over it.

Really sweet day today, up over 11% on more than 500K (more than 5x the recent average volume). The price kept bumping its head on the .83 resistance line. This move probably got SMXMF on more people's radars today. If we have a follow through on volume tomorrow, we should bust through .83 and head for blue skies.

Worth a read here at the very least:

http://blogs.miis.edu/trade/2011/01/11/chinas-big-move-into-latin-america/

Lots of jostling on LII today. It had been dormant for weeks. Nice to see buying volume come in...the most we've had since December and it's only 1:00.

Volume is Key. and it is here with more coming it appears.

That it is. Nice relative volume too. If we break .83, it should run.

Looks spot on to me. I was hoping to get a few around .70 but these shares are held tight.

Samex: In Search of a World Class Discovery

Adrian Douglas

Published 11/15/2010

Samex announced on Sept. 29 it had started its long-anticipated drilling campaign at several of the project areas at Los Zorros district in Chile.

On Oct. 15 the company made an eye-popping announcement it had arranged a private placement and on Nov. 3 announced the financing had successfully closed. What is so surprising is that at a time when juniors have been finding it hard to raise financing, Samex has not only secured a large $8.8 million of capital injection but has priced it at almost 40% above the stock price prior to the initial announcement. Jeff Dahl, president and CEO, said in the news release that this will allow the company to not only expand its exploration efforts but to accelerate them too. I have not seen any other junior achieve such a large financing under such favorable terms in recent years.

In the last year I have reviewed over 800 junior mining companies; while a handful have good exploration prospects, in my opinion, none come close to the potential that Samex has to discover a world class gold deposit (defined as being in excess of 5 million ounces of gold). It appears the company has attracted investors who hold a similar view.

In the January 2008 Morgan Report at www.silver-investor.com, Dave Morgan commented:

“Over many years, SAMEX has patiently accumulated an excellent group of quality gold-silver-copper exploration prospects located in some of the most prospective mineral belts in Chile and Bolivia. With the continuing strong metals markets supporting the exploration sector, the company stands out as an important contender for the next big discovery.”

The company has diligently advanced its geological field work since then which has led to a much better understanding of the geological model at Los Zorros. This is exciting to say the very least.

It is five years since the company completed its Phase 1 exploration drilling program. Many investors are not aware of the significant successes of that program. The company made two impressive gold discoveries. However, these discoveries were announced in news releases that had totally mundane headlines:

On Jan. 25, 2005, the company issued a release with the incredibly bland title of “Exploration Drilling Update - Exploration Area II - Los Zorros Property, Chile”

This release described a gold discovery of over 97 meters of 0.3 grams per tonne (g/tonne) of gold in which 4.7 meters had an impressive grade of 2.6 g/tonne of gold and 15.9 g/tonne of silver. The target A of Exploration Area II, where the discovery was made, was later identified as “Milagro”.

This was followed on April 5, 2005, with a release with the equally low key title of “Exploration Drilling Update - Exploration Area III - Los Zorros Property, Chile”

This unexciting headline gave no clue as to the outstanding high grade gold discovery announced within the news release. Drill hole DDH-N-04-05 in Target E (later to be identified as “Nora”) intersected two high-grade intervals, each having true widths of 1.53 meters, and containing gold of 35.4 g/mt (1.1 ozs per tonne) and 40.1 g/mt (1.25 ozs per tonne) respectively. These intervals were in a larger mineralized intercept that averaged 15.96 g/mt gold (1/2 oz per tonne) over a true width of 7.66 meters (25 feet).

So why didn’t Samex shout from the roof-tops about these stunningly good gold discoveries? Reading between the lines, the company was at the time involved in broader strategic land acquisition activities and most likely didn’t want to be disadvantaged in those negotiations. This notion is supported by the fact that the exploration areas were initially identified only as Exploration Areas I through VII with alphabetic letters to denote each target within the area. While Samex did successfully complete its acquisition of the targeted land positions on favorable terms the downside to this has been that many investors are unaware what outstanding gold discoveries were made in Phase 1.

In addition to the drill-hole gold discoveries, extensive surface trenching has revealed anomalous gold occurrences distributed across the property. For example, at Nora trenching yielded gold grades ranging from 0.1 g/tonne to an eye-popping 17.8 g/t.

But the most tantalizing aspect of this developing exploration story is the geological work that has been done since 2009 that has sought to understand the geological mechanisms that have been responsible for the gold deposition and that now underpin the on-going second phase of exploration.

The geological model is considered to be an analog of the Carlin Trend in Nevada. Such a hypothesis is supported by observations of geological phenomena on a large scale (regional), medium scale (district) and on a small scale (geology and mineralization).

The very nature by which Carlin-style deposits are formed infers the potential for laterally extensive mineralization and as a result the possibility of world class gold deposits.

The Carlin Trend is North America's most prolific gold-producing district and hosts the second-largest known gold resources in the world, after the Witwatersrand in South Africa. More than 100 million ounces of proven and probable reserves occur on the Carlin Trend and there may be up to 180 million ounces of resources.

Gold deposits have their origins in magmatic intrusions. In general the magmatic intrusion into a host rock creates massive fracturing of the rock. Water from an aquifer interacts with the hot magma giving rise to hydrothermal processes which percolate and concentrate mineral rich fluids. Over millions of years gold mineralization is deposited which fills the fractures and cracks in the host rock. This leads to rich gold veins that can be mined. If such deposits become exposed to the surface at high altitude then rivers and streams can erode the deposit and carry placers or fine grains of gold and deposit them in an alluvial plain or river delta.

Because the hydrothermal process deposits minerals in the cracks and fissures generated by the magmatic intrusion the mineralization is localized near to the intrusion. The Carlin-style deposition, however, is a variation on the typical hydrothermal process and requires a very particular geologic environment for it to occur. Carlin-style deposits typically have very large areal extent giving rise to multi-million ounce gold deposits.

The mechanics of a Carlin-style deposit are broadly described below and shown graphically in Figure 1. A fault or dyke is created in the earth’s crust by tectonic movement such as by strike/slip or wrench faulting. Such a fault has lateral displacement but very little vertical displacement of the fault blocks. Volcanic activity deposits an impermeable “cap rock” over the area which seals off the upper aperture of the fault. At some later stage magma squeezes into the fault. If an aquifer is present then a hydrothermal process commences and hot mineral enriched fluids percolate in the fault. If the faulted block contains a permeable layer, as pressure builds in the cap-rock sealed fault the mineral enriched fluids will flow into the permeable layer or layers. Such layers are typically quartz bearing calcitic siltstones. The hot and corrosive hydrothermal fluids dissolve the inter-granular calcite which increases the siltstone permeability and porosity while the quartz grains prevent the formation from collapsing. Over millions of years the formation is invaded with rich mineralized fluids which eventually crystallize into gold rich minerals that fill the void between the quartz grains. Unlike vein style deposits the gold is distributed throughout the rock in a micro-crystalline form and is often not visible to the naked eye and is only identified by laboratory assays.

The nature of the Carlin-style deposition means that deposits can be high grade and be volumetrically very large as has been demonstrated by the Carlin trend itself that has already produced more than 50 million ounces of gold and has underground mine grades that average more than 10 g/tonne and near surface open pit grades of more than 6 g/tonne.

Dr. Ken Snyder is a retired geologist who explored Nevada for more than 30 years and discovered the Ken Snyder (a.k.a. Midas) mine site on the Carlin Trend. He describes the Carlin-style deposition process as follows:

“it was also important to have silty quartz component siltstones as host rocks. The gold bearing fluids were slightly acidic, which dissolved the calcite and made the rocks more porous. There needed to be enough quartz within the siltstones to prevent their increased permeability from collapsing the rock. Once gold-bearing fluid came in contact with the carbonates in the rock, this changed the chemistry during the cool-down period and gold dropped out. Successive waves of gold-bearing fluids may have continually pulsed through these same rock formations over millions of years to build up gold mineralization within them”

The details of the geology at Los Zorros are too complex for an in-depth discussion in this article but I will summarize some of the key observations that justify the application of a Carlin-style geological model.

What is so unique about Los Zorros that the conditions exist there for Carlin-style gold deposits? A clue to this can be seen from the map of Chile shown in Figure 3. The circles on the map are mines. About 30% of the mines on the map fall on a very narrow north-south trend as indicated by the dashed blue line. This almost certainly implies there is a low displacement subterranean fault that is associated with this pronounced linear feature. There is no noticeable fault when looking at a Google Earth satellite map. But it should be noted that with a few small exceptions, none of the major Carlin faults or Cortez faults in Nevada are obvious from the ground or by aerial pictures or satellite reconnaissance, having been covered over by many events in relatively recent geological history, to include volcanic activity and the creation of cross rifts. I mentioned earlier that a strike/slip fault or a wrench fault covered by a cap rock is a general model for a Carlin environment.

Almost 60% of the mines in Figure 3 fall in the pink shaded area that trends NNE-SSW. This roughly corresponds to a cretaceous sedimentary-volcanic belt. This belt contains many horizons that are calcitic siltstones as well as thick overlying gabro. There is a confluence of these two geological features at Los Zorros. This represents the key macro-scale elements required for Carlin-style deposition: A buried fault overlain with volcanic cap rock and within the fault block, permeable calcitic siltstones that could have been invaded with mineral rich hydrothermal fluids. If this is the macro-level geological process that has given rise to the gold that has already been encountered at Los Zorros it would indicate that Los Zorros is ideally situated in the confluence of the regional geological features for such Carlin-style gold deposits.

The Los Zorros property is very large covering approximately 80 square kilometers. The property contains at least seven very prospective project areas any of which could potentially host world class gold discoveries.

The company is considering employing the latest state-of-the-art earth imaging technology to assist in fine tuning the exploration program. This technology is the Titan 24 developed by Quantec Geoscience. Embracing the use of such revolutionary geophysical tools certainly sets Samex apart from the majority of its peers.

The result of a four-year effort to develop advanced tools for very precise and deep subsurface information, the array-based Titan 24 Deep Earth Imaging system is the most advanced electrical earth imaging technology. The system images conductive mineralization, disseminated mineralization, alteration, structure and geology to 700 meters and beyond for reliable and cost-effective targeting of drill holes.

Measuring the parameters of DC (resistivity), IP (chargeability) and MT (magnetotelluric resistivity), Titan 24 measures to depths of 750 meters with IP and can explore beyond 1.5 kilometers with MT data. The depth of investigation coupled with the multi-parameter data make the system the best option available for obtaining subsurface pre-drilling information related to geologic structure and for the direct detection of mineral deposits.

Without a doubt the current drilling program at Los Zorros is what many long time Samex investors have been waiting for. The high-grade gold discoveries that were encountered over large intercepts in the phase 1 drilling campaign and the high-anomalous gold occurrences in surface trenching along with substantial geological field work have culminated in a Carlin-style geological model being postulated as the best description of the Los Zorros geology. If the model is substantiated by drill testing then the implications are that the gold discoveries already encountered could be part of a very big gold deposit or multiple deposits like the clustered gold deposits in the Carlin district.

In addition the company in a January 21, 2010, news release already outlined the potential for the Cinchado project that was not part of the Phase 1 exploration. It is, however, the first project being tested in the current drilling program. The information can be extrapolated to infer a target that could potentially host 3-4 million ounces of gold.

There are no guarantees in exploration but a junior that has such large prospective properties hosting multiple targets, having already made significant gold discoveries, having properties in a mining friendly country such as Chile, having a well experienced and knowledgeable exploration team headed up by someone of the caliber and track record of Rob Kell (vice president ofeExploration) certainly shortens the odds.

Samex has recently trading at approximately $0.50 on the TSX (SXG.V) and on the US Bulletin Board (SMXMF.OB). This puts its market capitalization at less than 50 million dollars. Considering that would indicate that Samex is undervalued and if the Phase 1 gold discoveries can be added to and extended, Samex could enjoy outstanding price appreciation in the very near future.

I don’t know of another junior mining company that has acquired 100% ownership of a district-sized property that incorporates multiple projects that each have the potential to host world class gold discoveries, is located close to a major highway and power lines and is in a mining friendly jurisdiction. The world-wide average for gold grade in producing mines is just two grams/tonne. It is, therefore, rare for a junior explorer to successfully hit good intercepts that contain gold mineralization in excess of one ounce of gold per tonne (32 grams/tonne) let alone achieve it in Phase 1 of exploration drilling.

Even if a junior has such phenomenal potential, the major obstacle to success is very often a lack of funds to prove up a discovery. Samex with its latest substantial private placement has resolved that problem and in doing so has shown a clean pair of heels to its peers by securing it at almost 40% above recent average market price which is no doubt being lauded by its shareholders.

Taken altogether Samex provides an extraordinary opportunity for speculative investors.

Samex: In Search of a World Class Discovery

Yes....i'm serious.

BUYINS.NET, http://www.buyins.net, a leading provider of Regulation SHO compliance monitoring, short sale trading statistics and market integrity surveillance, has updated coverage on SAMEX MINING (OTCBB:SMXMF) after releasing the latest short sale data through September 3, 2010. The total aggregate number of shares shorted since August 2009 is approximately 6.14 million shares. An average of 27.69% of daily volume is short selling. The SqueezeTrigger price for all (OTCBB:SMXMF) shares shorted is $0.32. A short squeeze is expected to begin when SMXMF closes above $0.32.

SAMEX Mining Corp.: "Los Zorros Gold Property Overview" Video-Gram

ABBOTSFORD, BRITISH COLUMBIA, Sep. 18, 2009 (Marketwire) -- A new video-gram entitled "Los Zorros Gold Property Overview" has been added to the SAMEX (TSX VENTURE:SXG)(OTCBB:SMXMF) website at www.samex.com. The video-gram utilizes maps, photographs and graphics to provide a brief overview of the Company's Los Zorros property in Chile.

The Los Zorros Property covers approximately 80 square kilometers of an old mining district of numerous small, gold, silver and copper mines and showings. This single property holding hosts a number of highly prospective project areas such as the "Nora Project", the "Cinchado Project", the "Milagro Pampa Project" and the "Milagro Project" that are being explored for gold deposits by SAMEX. Each of these targets represent an important separate project area for SAMEX. In addition, numerous other mineralized areas, which have yet to be rigorously investigated and explored, have also been identified within the property position and in close vicinity to these major gold targets. The "Los Zorros Gold Property Overview" video-gram is designed to acquaint the viewer with the location of various prospective areas within the property.

A common exploration strategy is to explore for new mineral deposits in areas where minerals have previously been found or mined and it's not unusual for numerous ore deposits to be clustered in districts or along trends. With these concepts in mind, SAMEX is exploring for multiple precious metal deposits that may be clustered beneath the widespread gold, silver and copper occurrences in this old mining district.

Information in the "Los Zorros Gold Property Overview" video-gram is summary in nature and should be considered together with more detailed documents and information upon which it is based that can be viewed in the Company's publicly filed documents at www.sedar.com and the SAMEX website at www.samex.com.

Jeffrey Dahl, President

The TSX Venture Exchange has neither approved nor disapproved of the information contained herein.

Source: Marketwire Canada (September 18, 2009 - 3:19 PM EDT)

News by QuoteMedia

i'm holding until gold goes over $1,000/oz

|

Followers

|

8

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

69

|

|

Created

|

03/17/04

|

Type

|

Free

|

| Moderators | |||

SMXMF on US OTC Market: http://www.otcmarkets.com/stock/SMXMF/quote

SXG on the Toronto Stock Exchange http://www.tsx.com/en/

Website: http://www.samex.com/

news http://www.samex.com/news/News.html

financials http://www.samex.com/financials/financials.htm

coreshack http://www.samex.com/Coreshack/corehome.htm

request info http://www.samex.com/request_info.htm

tour a quick profile http://www.samex.com/tour/quick_profile.htm

122,285,219 Outstanding Shares as of March 31, 2011

SAMEX - A Close-Up View of the Prospects by Adrian Douglas (2008)

SAMEX - The Elephant Hunters by Adrian Douglas (2006)

SAMEX PROPERTIES

LOS ZORROS PROPERTY, CHILE