Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Have u read the latest shareholder letter on FMNJ web site? I Do not know what to say b/c of previous such declarations. How do u feel about this letter? Lot of things together. There are some I never heard of before.

Not to long before we get Justice, fair -

market with a level playing field -

crimes don't work to long! -

'Terrorist' banker plowing into group of bikers

'Terrorist' banker plowing into group of bikers

If you, along with FA, are hopeful then I think I should not worry. Question is, how long more to wait before there is some real news.

I will definitely info u when Mod position for FMNJ is available.

vozmil' on 'SILVER (Ag) PRODUCERS -

thanks, sit tight have patience ![]()

as our friend -

FA still with me, on the USA Silver Mother loads ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=59843091

Ps.

please, info me when a fmnj mod podition

is available?

TIA

God Bless

You mean that Bill has kept this alive so far inspite of all the negatives. That is right and if it was not b/c of Bill, FMNJ would have been all ready history. I give credit to him for that.

From what you wrote I have a feeling that you have some inside info that is not yet public. To me financing was reportedly the main hurdle in starting Cerro Rico. I do not have any update about whether that hurdle is overcome. There has been vague talk about project to project financing. Do not know what is the form and shape of that financing and who is willing to invest, if any?

If you do not want to share any more info, that is OK for me but will request to give some time line about the things to come in near future.

vozmil thanks, good standing -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60812214

e.g,

Apex lost the big mine and fr. 25/sh went down to a few pennies -

but kept some smaller properties and is now

back up in the shine again - above $20/sh ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=5810

http://investorshub.advfn.com/boards/board.aspx?board_id=5406

its good to see that FMNJ keep going -

the Mission to help the young miners ![]()

to a better future ![]()

we got CDE Att. to build a nice mine at Cerro Rico ![]()

when the waste piles gone -

more hidden old portals discovered -

to give better ventilation to

the old Ag mother ![]()

FMNJ may get another GO at the old Ag Cerro Rico mine ![]()

it just have to keep at it and help the miners -

the majors get back UP first -

and the old junior will be the next ![]()

God Bless

Ps.

666 evil demon deleted my post to you today -

and its the way the 666 cults destroyed FMNJ and killed

the miners and kids at Cerro Rico ![]()

for every fmnj positive message I wrote the 666 bashing

nss gave 10 more neg. bashing messages -

its all documented at FMNJ -

just a reflection of why I was taken out as moderator also!

It takes time before the 666 gone away in their

own fire of smokes -

e.g.,

in a dark 666-market -

http://www.deepcapture.com/manipulating-gold-and-silver-a-criminal-naked-short-position-that-could-wreck-the-economy/

we all have to try to carry a straw to the stack -

if we ever want to see a level playing field and

fair market place for the PEOPLES RIGHTS - ![]()

http://www.walkaboutventures.com/

One Day the 666 may wake UP - in the fire!

God Bless

A lot of pervs belong in cages.

Meanwhile, enjoy some music from an American icon.

Stevie Wonder performing at Library of Congress.

http://www.youtube.com/libraryofcongress

Skip the long winded hot air at the front. Stevie begins at about 8 minutes in.

PRISONS ARE THE 666 BANKSTERS GANGSTERS CULTS ONLY HOME

The barbarian 666 khazar banksters TO JAIL GO -

http://www.walkaboutventures.com/

http://www.walkaboutventures.com/

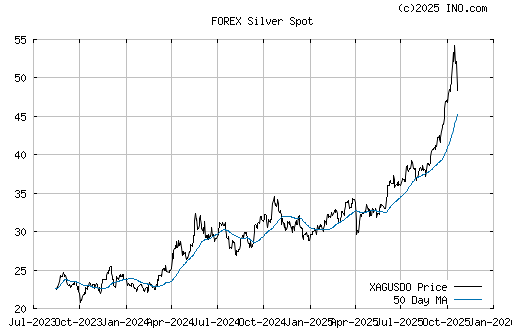

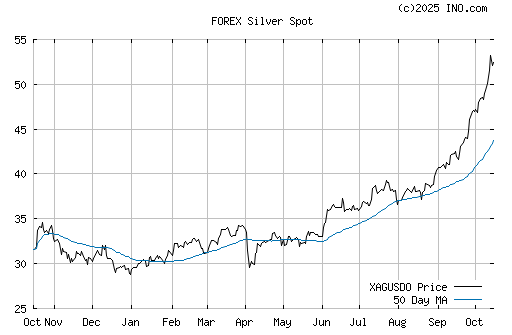

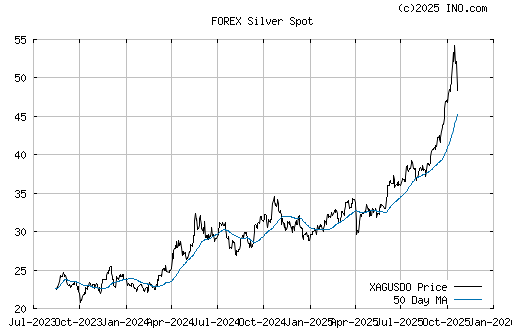

SILVER GOING HIGHER -

SILVER & GOLD THE ONLY REAL MONEY -

BTW. don't forget dd....USA / USSIF Ag National Treasure bargain play ![]()

U.S. Silver LT Safety -

http://www.us-silver.com/s/Home.asp

IN GOD WE TRUST -

888

God Bless

HI YO SILVER!!!!!

LET'S RIDE.... TONTO!!

Silver Ag bargains and nice to ride with Silver producers love Agbaby winner ![]()

CDE used to own USA Ag mine The Great US Galena Silver Mine ![]() made CDE Ag GREAT

made CDE Ag GREAT ![]()

CDE run at $350.00/share with IT & DON'T forgeT me Ag gate![]()

350 makes 8 to home start ![]()

CDE lost the Galena Ag Mother Mine -

U.S. Silver LT 1st target bull Ag run $350 UP + inflation ![]()

history often repeat itself ![]()

TO HONOR OF THE USA FLAG - BUY USSIF Ag MOTHER bargain - Salute the USA FLAG ![]()

http://www.thebullandbear.com/bb-reporter/bbfr-archive/USSilver.html

Well, the more U.S. Silver jumps the better -

its USSIF our Ag Turn Mother load AgOREaround ![]()

the higher Ag will GO U.S. Silver ![]()

USA / USSIF the next Silver love Agbaby

can't wait to we start to FLY 350+ HIGHER ![]()

its the US Ag basic fundamentals ![]()

hold on to your hat Alice ![]()

Soon the MOON ![]()

got the #6000 Ag firE ![]()

God Bless

Colloidal silver has been reputed by various studies to be able to kill over 650 micro-organisms

http://www.redicecreations.com/article.php?id=14352

CROSS POST FROM http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60429177

COLLOIDAL SILVER

It has been reported to be effective in fighting against: acne, aids, allergies, arthritis, athletes foot, boils, burns, candida, cystitis, diabetes, eczema, hay fever, indigestion, parasitic infections, psoriasis, ringworm, warts and yeast infections. It can also be used as an eye wash, to kill bacteria on the eyeball itself, topical astringent, to draw poisons from the skin, mouthwash, which, when left in the mouth for at least six minutes, kills the bacteria and germs that are present. Also, silver can be swallowed to provide daily antibacterial protection within the body. Silver is also efficient in the role of nose drops and ear drops. It is often used topically by spraying onto cuts, burns, skin infections or acne.

It can be used either orally or topically. When taken orally you can either place droplets directly under the tongue or it can be put into water and drunk.

Colloidal silver can be produced in your own home using a tiny electrical device (or a 9 volt battery and two 99.9% pure silver strips) and does not involve complicated procedures. In most cases, when purchased in a store, the same product that you can make at home yourself, can cost a small fortune and turn out to be less pure. For convenience sake however, some have found the expense is worth it in the long run.

How to Make Colloidal Silver

SEE ARTICLE, LINK ABOVE

As of January 1, 2010, colloidal silver has officially been banned (by the EU food authorities) throughout the European Union. It can no longer be legally sold in any health food store or by any internet vendor in the EU as a nutritional supplement. There is a concerted worldwide effort to either ban colloidal silver completely, or to so heavily regulate it as a “toxin” or “pesticide” that you would need a prescription or permit to use it. Many believe this is all part of the looming one-world plot to “harmonize” all nutritional supplement laws on a global basis, and dramatically restrict your rights to use natural substances like colloidal silver as you see fit. The beneficiary of all of this Codex pseudo-science is, of course, the global pharmaceutical industry – aka Big Pharma – which has waged war for decades now against nutritional supplements in general, and colloidal silver in particular.

In the U.S., the Environmental Protection Agency (EPA) is meeting regularly to consider the fate of all silver-based products, including colloidal silver. In 2009, U.S. bureaucrats also re-categorized one of the most active forms of Vitamin B-6, pyridoxamine, as a “drug” by the FDA, even though it’s been sold as a nutritional supplement since the 1980’s. With the stroke of a pen, pyridoxamine was simply banned from ever being sold as a nutritional supplement again.

The US housing market remains under pressure,

with talk of a double dip mounting.

The December S&P/Case-Shiller home price index

for 20-cities showed that prices fell 2.4% y/y.

While US existing home sales rose 2.4% in January,

up 4.92% from a year ago, prices are down 2.7%

from January 2010.

The HousingPulse Distressed Property Index suggests

that nearly half of all home sales in January were

bank owned or short-sales.

New home sales plummeted 12.6% in January, well below

market expectations, due to substantial inventory

overhang and upward pressure on mortgage rates.

This poses a real problem for the Fed, as tighter monetary

policy for the PEOPLE is likely to put PEOPLES housing under

further pressure from the banksters to rob the PEOPLE,

undoing the wealth effect they've created

by underpinning the stock market.

Great U.S. Silver Real money safety bargain ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60304359

Hunt brother dream silver mine -

http://www.canadianzinc.com/content/investor/press/western-standard.php

Video Gallery

http://www.canadianzinc.com/content/gallery/video/

http://www.canadianzinc.com

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

God Bless

That is one good looking chart!

Cdn Zinc Corp J (CZN) fiat$1.09 UP $0.11 +11.22% ![]()

Volume: 558,537 @ 11:40:59 AM ET Strong Demand ![]()

Bid Ask Day's Range

1.09 1.1 1.0 - 1.12

TSE:CZN Detailed Quote

The Hunt brother Ag dream mine bull run started -

funny that the fiats still can get any CZN ![]()

one day no way to catch it with any -

of the funny fiats papers ![]()

Video Gallery

http://www.canadianzinc.com/content/gallery/video/

http://www.canadianzinc.com

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

Welcome to U.S. Silver Corporation (USA)(USSIF ![]()

US Silver Corporate NEW Presentation - January 2011

http://www.us-silver.com/i/pdf/2011-Jan-Corp-presentation.pdf

http://www.us-silver.com/s/Presentations.asp

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=59603922

---- ----

Ending the Fed From the Bottom Up

http://www.tenthamendmentcenter.com/2010/04/11/ending-the-fed-from-the-bottom-up/

A New World Order is Okay - as long as it's run by We, The PEOPLE.

http://beforeitsnews.com/story/409/678/A_New_World_Order_is_Okay_-_as_long_as_its_run_by_We,_The_People..html

Former CEO of Nation’s 10th Largest Bank

https://foreclosureblues.wordpress.com/2011/01/19/bankruptcy-of-u-s-is-%E2%80%98mathematical-certainty%E2%80%99-says-professor-former-ceo-of-nations-10th-largest-bank/

Gold on inflation Gold should be trading at $2,800 a ounce so Gold is cheap !

JPMorgan and friends are in deep trouble.

http://harveyorgan.blogspot.com/2011/02/silver-in-complete-backwardation.html

Check out this one:

http://investorshub.advfn.com/boards/board.aspx?board_id=19268

Bear Creek Mining Corp.

BCEKF

Also...good read today:

King World News has received word from James Turk that silver is in extreme backwardation. Turk stated, “There is a huge story that is brewing. Silver is in backwardation to 2015, which is 13-cents cheaper than spot. This is unbelievable. Money does not go into backwardation except ‘in extremis’!”

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/2/10_Turk_-_Silver_Backwardation_for_Years,_Possible_Hyperinflation.html

Amour the miners, he and his red left team left

the city to avoid a violent demonstration

by miners throwing dynamite,lol

http://www.bbc.co.uk/news/world-latin-america-12427057

guess, the didn't wanted to be sent down a

shaft with a lighted stub in the back

pocket -

God Bless

The Silver Log (01.23.2011) - Silver in EURO's -

http://www.youtube.com/user/endlessmountain#p/a/u/2/ZP5fUdPemZI

US Silver Corporate Presentation - January 2011

http://www.us-silver.com/i/pdf/2011-Jan-Corp-presentation.pdf

Profitable Production from the Worlds Most Prolific Silver Belt

http://www.us-silver.com/i/pdf/factsheet/ussilver-factsheet.pdf

http://www.us-silver.com

First I would like to thank the people on this board

for providing me with some good insights on USA.

There's a lot of noise going around in the silver space,

but when it comes to silver ounces in the ground and production,

this company's valuation, lowest amongst peers with RVM,

provides an excellent risk-reward investment.

The stock has been beat up a lot by all the short term traders

and makes for a nice contrarian play for the next 1-2 years

when silver gets back into uptick mode.

I attended Mr. Parker's presentation on Monday -

I did however appreciate his honesty when, at the end, he said

that the market has been discounting the stock -

on all expectations -

He expects that this situation will be rectified

starting this year.

by DetVicMackey

DEATH OF THE DOLLAR... & BULLION CONFISCATION?

True Blue thanks, is this -

the masons Au Key -

The name Zimbabwe comes from Shona,

the language of the Mashona

people meaning 'stone houses -

The Masons - key old home -

the story behind -

the Masonic Order -

the story behind the Masonic ...

Lionel Fanthorpe, Patricia Fanthorpe - 2006 - History -

Another of the important proto-Masonic legend associated

with King Solomon was the location of

his semi-legendary gold mines.

These mines were said to be ...

Great Shona Mashona Zimbabwe

From the 1500s onwards many rumours made their way to Europe

about stone cities in the interior of southern Africa.

However, because Africa was considered an uncivilised continent,

they were passed off as the work of outsiders like King Solomon

and the Queen of Sheba, or of the wealthy Christian priest,

Prester John, who was thought to live somewhere in Africa.

So widespread were these ideas that the first European to

encounter the remarkable ruins of Great Zimbabwe in 1871 was

convinced that it was indeed the palace of the Queen of Sheba.

The earliest researchers who worked at Great Zimbabwe were so

certain that a mysterious race built it that they interpreted

everything that they saw according to this belief.

Their science and archaeology were so poor in some cases

that they actually damaged the sites.

However, the idea that Great Zimbabwe was built by a very ancient

race that lived some three to four thousand years ago

suited some people for political and economic reasons.

People like Cecil Rhodes, for example, actively promoted

this notion, as it provided an excuse to move into the area

and exploit its gold reserves.

He was able to justify his actions by arguing that he and

his British South Africa Company were members of a white

race that had formerly ruled in the area.

To his credit, Rhodes did try to stop the destruction

and ransacking of the site by treasure hunters.

In 1902, it was estimated that at least 2 000 ounces of

ancient gold ornaments had been stolen from the ruins.

Masses of gold bangles were found round the arms and legs of

the skeleton.

Heavy coils of iron bangles round one leg had rusted to a

solid mass, in which gold and glass spacing beads could

be distinguished.

The arms and neck had been surrounded by great numbers of gold

wire bangles… .

Where the skull had lain were found pieces of curiously shaped

gold plate, the convolutions of which suggest they had adorned

the wooden headrest of the corpse.

A bowl of gold plate … was found, together with a gold plate

bangle and a gold circlet and sheath or point, which

probably ornamented a staff of office.

Source: Leo Fouche, Mapungubwe: Ancient Bantu Civilization on the Limpopo. Cambridge, Cambridge University Press, 1937, p.2.

Great Shona Mashona Zimbabwe

the “land of Ophir -

Jacob Hungwe (Zimbabwe):

I am a descendant of the royal house of Great Zimbabwe.

The Hungwe Dynasty.

The ruler was a Great Woman Queen, and her known name is

"Queen Of Sheba".

The Great Zimbabwe was a trading post, ant the ruler queen,

was a great traveller, as she had Gold to back her travels,

which became known as "King Solomon's Mines".

This can be proved by the fact that the surrounding area all

the way to Johannesburg South Africa is still Rich and

has an abundant supply of Gold,not to mention diamonds.

The Great Zimbabwean ruins according to biblical scriptures

and prophecy are to be there until the Messiah

(Jesus Christ) comes back to reign in the millenium

(1000 years)golden age, as it says that Kingdoms will

come to give tribute to the lion of Judah in Jerusalem,

inclusive of Queen of Sheba kingdom.

There are also some detailed secret things l am aware of

but am not supposed to reveal for cultural reasons

and the traditional law.

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=29147933&l=0&r=0&s=CAL&t=LIST

At one point in time, they tried to divide up the white owned farming land in Zimbabwe but found that the indigenous people were incapable of farming the land to the extent of the previous white land owners. This sort of about face change in policy is "normal" in that country. I suspect that the "leaders" in Zimbabwe are a bunch of greedy scum and would rather benefit themselves at the expense of the people.

Type SPOOK into keywords and do a board search - my recent post might interest you :)

True Blue thanks, is this -

the masons Au Key -

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=29147933&l=0&r=0&s=CAL&t=LIST

U.S. Silver Mines Is Super Rich and Important

for USA Economy -

http://www.us-silver.com/s/Projects.asp

The fiat$currency is paper -

the fiat$yuan currency is paper -

the seeds, shells, essential oils etc. -

long before Christ -

The PM's Gold Standard has been the only Real Currency -

for 1000s of years -

China's chairman Hu: Dollar-Based System 'Product of the Past'? -

http://abovetopsecret.com/forum/thread652071/pg1

he called the present U.S. dollar-dominated currency system a

"product of the past" and highlighted moves to turn the yuan

into a global currency.

To move yuan to be the global reserve currency!

In princip he said,

the fiat$dollar is bankrupt

and all US banks black spiders also -

the 0-administration and the banksters are all

brain-washed money mongler mongrel gangsters!

so the fiat$yuan should be the new global reserve currency

for the black spiders have taken US PEOPLES fiats

to china to fool the PEOPLE again!

If he 666 nwo gets what he want -

The Western Societies People have become the new slaves for

the nwo totalitarian 666 mao-communistic dictators with iron

tortures brutality against all PEOPLE! -

Ag catching UP on Au to be a frontrunner again as in 1979 ![]()

history often repeat itself -

FREEDOM & LIBERTY IS PEOPLE 888 RIGHTS -

NOT china - ussr-bolsheviks mao-communist 666 nwo khazars -

Elliott Wave System TA Identifying Trends Contain 5-Wave Pattern - ![]()

- Silver Chart TI Alert 3rd Wave Strong Start The Best To Come ![]()

- Ag in 3rd Wave bull start # 4 - 5 Wave Bulls still to GO ![]()

Not to worry my friends! USSIF must be very valuable

or the MM's would not be trying so hard to keep

the price down.

When it starts to move, it will move very quickly.

The potential buyout companies are keeping it low.

by Rick thanks good info ![]()

http://www.ceoclips.com/companyclip.aspx?id=837 ![]()

Silver is the place to be..

Massive silver shortage and fall of fiat currencies:

http://www.silverhoarders.com/content.php?218-COMEX-Massive-silver-shortage-and-fall-of-fiat-currencies

Ted Butler: China behind the massive silver shorting?

http://news.silverseek.com/SilverSeek/1293027946.php

INSIDE JOB: New Documentary Exposes How 'Banksters' Continue To Steal Our Money

U.S. Silver Corporat (USA) fiat$0.7 UP $0.05 +7.69% ![]()

Volume: 1,188,228 @ 1:52:31 PM ET Strong Demand ![]()

Bid Ask Day's Range

0.69 0.7 0.64 - 0.71

U.S. Silver Corp Com (USSIF) fiat$0.678 UP $0.034 +5.28% ![]()

Volume: 1,380,808 @ 2:07:58 PM ET Strong Demand ![]()

Bid Ask Day's Range

0.678 0.68 0.6101 - 0.682

Ted Butler interview on silver.

b4

http://www.24hgold.com/english/news-gold-silver-interview-of-ted-butler-on-silver-price-manipulation.aspx?article=3229604434G10020&redirect=false&contributor=Theodore+Butler

RE: It's estimated that there's 3.3 billion ounces of silver short

http://www.24hgold.com/english/news-gold-silver-to-the-top-shareholders-of-jp-morgan.aspx?article=3215074148G10020&redirect=false&contributor=Jason+Hommel

The JPM666-Fix is Simple - To Get A BS bail-out -

To make the People liable to the Fed -

Cash-Strapped States Delay Paying Income-Tax Refunds -

dailypaul.com/node/128154

Prosperity Can Return, And The Peoples 888-Fix is Simple -

E.g.,

Income tax to the Federal Government is not for income

to the government—not one penny.

What is it for then?

It is for social 666 control.

This is a fiat 666 money syndrome.

Fiat paper money causes more direct 666-government control

over the 888-People Citizens.

In filing Federal Income Tax forms People reveal a complete profile

of their public as well as their private lives.

The system requires that the People must believe that Federal income

taxes are for income flow to the Federal Government.

Nonsense, nonsense.

No fiat (money) goes to Washington as taxes!

Where does it go?

It returns to ether, from whence it came.

Where does the Federal Government get its money?

Modern government money is electronic. It is not your taxes.

And in reality, Federal Government has no debt.

How can the Federal Government have debt with electronic money

that is nothing more than computer symbols that can be created

to infinity?

Many in the land believes that there is Federal debt.

The Federal debt have gotten into our heads but

we may totally misunderstand monetary realism.

Oh yes, the Federal debt hoax has a serious purpose.

It throws sand in our eyes to keep the people from waking up

to the fact that the Federal Government just creates all the

“fiat - money.”

There might be an “income tax” rebellion if a goodly number of people

discovered the Federal debt hoax.

Come now, if you could create trillions in electronic money,

would you have debt?

No, you wouldn’t, and neither does the Federal Government.

The income tax is totally a propaganda system to keep the population

from discovering the nature of Federal Government finance.

Income tax is not about money going to Washington as taxes.

It is about control and social engineering of transferring

production and wealth from the producers to the non-producers,

and it comes right out of Karl Marx’s Manifesto.

And dear friends, can you even imagine the parasite load of

accountants and lawyers pretending to help

the Federal Government collect taxes?

They actually believe that they are collecting taxes.

They have no concept of reality.

I challenge any living being to disprove what I have written here.

What we need is truth.

The hour is past late.

Greed and vested interest have brought America to a state of collapse.

Accountants and lawyers are the elites parasites on

the income tax fraud.

Since the income tax does not supply income to the government

it can be permanently abolished.

After all, Federal income tax was nil until 1939.

It’s all very simple except for the giant cover of deceit and fraud

in America.

Elimination of the Federal income tax would restore confidence

and a new day of prosperity and economic relief.

Domestic labor could and would be cheaper and corporations

which have moved offshore would move back.

America is not in economic trouble except for the fraud

of politicians and vested interests.

The US people Presidents should have to know this is

our Constitution of Rights, Liberty and Freedom -

Abolishing the income tax would eliminate the oppression of

a whole army of tax collectors and their lackey accountants

and lawyers.

This would make way for sound and honest people healthcare and

Social Security Safety Net for all people.

Abolishing the income tax would not cost the United States government

a dime.

Federal income tax is the scam of and scourge of history

used by tyrants to oppress the our people and make them support

a perpetual increase in the size of nwo 666-government.

What I have said here does not apply to state and local governments.

All of you know that they can’t print money or create money

electronically as does the Federal Government.

The American people need to know the truth now about the fraud

and deceit of the Federal income tax.

It will never be debated in the controlled media or by

the 666-politicians.

They don’t want you or any 888-people to know.

But only 1 percent of the “taxpayers” could start an income tax

rebellion simply by telling the truth to fellow Americans.

It is one of our last 888-chance before 2012!

--

Are you liable for income tax?

http://www.dailypaul.com/node/111257

NO INCOME TAX!?....

WAKE UP FOLKS... End The Fed Movement is a False Flag.?..

says Andrew Gause

...its a must see..NO INCOME TAX!?....

Fact, along with the GOLD technical picture lead us to believe Au

is getting ready to accelerate into 2011 and this will catch

most by surprise -

Going forward we have strong targets at $1,500, $2,100 and $2,300 ![]()

Yet, for the time being traders and investors need to be prepared

both mentally and financially for an accelerating market.

by Byrne thanks good info ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=55561557

thanks for reading it ![]()

Silver follows gold?<<<<<<<<The gold selloff could be here now

Thursday, October 07, 2010

From Bloomberg:

Gold futures fell from a record as some investors sold the precious metal on speculation that the rally was overdone.

Gold reached an all-time high of $1,366 an ounce in New York, posting a record for the 14th time in the past month. The 14-day relative strength index for gold futures has been above 70 since Sept. 22 and reached 86 yesterday, a signal for some traders that prices are poised to fall.

"From a technical standpoint, there is no support for gold at these prices," said Leonard Kaplan, the president of Prospector Asset Management in Evanston, Illinois.

Gold futures for December delivery fell $11.30, or 0.8 percent, to $1,336.40 an ounce at 11:35 a.m. on the Comex in New York. Before today, the metal was up 23 percent this year.

"Gold is way overbought," said Frank McGhee, the head dealer at Integrated Brokerage Services in Chicago. "The world has been looking for a correction, and it's going to be fast and ugly."

Bullion for immediate delivery in London rose to a record $1,364.77 before retreating.

Losses may be limited as some investors see the decline as a buying opportunity, said Adam Klopfenstein, a senior market strategist at Lind-Waldock in Chicago.

Citigroup Raises Forecast

Citigroup Inc. raised its forecast for the "short and medium" terms for gold to $1,450. The bank said stimulus measures by central banks may reduce currency values.

The dollar fell to a 15-year low versus the yen on speculation that the Federal Reserve will ease monetary policy to help boost the economy. The Bank of Japan this week lowered its main benchmark rate to "virtually zero."

"The consistent weakness in the dollar is fueling buy orders for gold," said Klopfenstein of Lind-Waldock. "People are very uncomfortable being in any currency market now."

Silver futures for December delivery fell 27.3 cents, or 1.2 percent, to $22.77 an ounce. Earlier, the price climbed to $23.53, the highest level since 1980.

U.S. SILVER CORPORATION's - Agenda -

U.S. Silver Corporation's plan to reopen the Coeur Silver Mine -

in Osburn -

The Coeur Silver & Copper Mine -

An investment in the valley

Posted: Thursday, October 7, 2010 9:52 am

By NICOLE NOLAN

Staff writer

WALLACE - Seating was filled in the back room of the 1313 Club

as community members gathered over breakfast to hear about

U.S. Silver Corporation's plan to reopen the Coeur mine in Osburn.

U.S. Silver Corp. President and CEO Tom Parker made an appearance in

the Silver Valley as the guest speaker during the

Historic Wallace Chamber of Commerce's monthly breakfast.

*

"We're excited to get started," Parker declared of the company's plans

to return the Coeur mine to its former status as an active,

silver-producing mine.

"It should be a fun time."

Recently, $7 million in Canadian dollars was raised by U.S. Silver

Corp., which will in turn be invested to repair infrastructure

and stock the mine with the necessary manpower and equipment

in preparation for long-term operations.

Over the span of 2 to 2-1/2 years, $5 million will be spent on

the Coeur mine as the company mines known resource blocks.

"The intent is to, in the sixth month, produce silver,"

Parker explained.

The reopening of the Coeur mine is also expected to open 30

to 35 mining jobs.

According to Parker, stope miners within the U.S. Silver Corp.

generally make from $75,000 to $85,000 per year.

They are looking for local hires, and will also be hiring

Silver Valley miners who had moved away for work and have

expressed a desire to return.

The bottom level of the mine sits at the 3900 level.

There will be some mechanized mining at the 2800 and 3900 levels,

but Parker said that the mining will mostly involve jacklegs

and slushers, similar to their Galena mine operations.

"It's safe to say this won't be easy," Parker said.

"These are not virgin stopes."

Seven new raises will be run, which is a time consuming operation.

Parker said that a good miner can run six feet in three days.

"We are at a whole different silver environment with pricing,"

Parker admitted, explaining the timing of the reopening of

the Coeur mine.

Exploration in the near future will include a full-time diamond

drill and an annual budget of $600,000.

"The Caladay mine is something we'll explore in the future,"

Parker said, adding that they hope to continue operations at

the Galena mine and get the Coeur mine up and running first.

"We're not going into this thinking we'll be here only three years,"

Parker declared.

The known resource blocks are expected to give three years of

production to the mine, but with exploration they expect

the Coeur mine to remain productive for a longer period of time.

Output at the Coeur mine is expected to reach close to 50,000 ounces

of silver and 50,000 pounds of copper a year after the start of

the project, which is scheduled to kick off the first of 2011.

Parker said that no expansion of their two mills will be necessary

as the Coeur mine begins producing.

They currently process 1,000 tons each day, and have a capacity

for 1,400 tons per day between the mills.

All the required permits to run the Coeur mine have also

already been obtained.

Historically the Coeur mine has produced 14 ounces of silver per ton.

"We think the company has a good future, we have no doubt,"

Parker added.

--

The Coeur Silver & Copper Mine -

Ag Rich Beauty Producer we get re-commissioned

for fiat$5mil ![]()

- would cost about fiat>$200mil

to develop from grass-root for an exploration company

if they ever would be lucky to

find anything near as rich ![]() very unlikely?

very unlikely?

The Coeur Silver & Copper Mine -

produced from 1969-1998.

The total production was 39 million ounces of silver

and 33 million pounds of copper from 2.4 million tons of ore.

Average ore grades were 16.6 ounces per ton silver

and 0.72% copper.

The company decided in 2007 to reactivate the Coeur mill

to process lead-silver ore produced at the Galena mine.

To achieve this, the company rehabilitated the 3400 level of

the Coeur mine (the 3700 level of the Galena mine) haulage way

connecting the Galena mine to the Coeur shaft,

a distance of about 1.5 miles.

The reconditioning involved ground support and installing

new rail and utilities as well as moving the primary

ventilation fans.

The mill was also reconditioned and commissioned in early

September, 2007.

The mill ran until January, 2009 when it was placed

on care and maintanence after the second circuit in

the Galena mill was activated.

The Company is examining the possibility of reactivating the

Coeur mine to access some of the mineralized zones of

silver-copper ore that were left when the mine was shut down

in 1998.

While the Coeur mine would not supply sufficient feed to fill

the Coeur mill until significant exploration and development

work has been done, a combination of the Coeur mine and

additional ore from the Galena mine could fill

the Coeur mill.

The Company overall objective is to utilize

the Coeur mine and mill in a manner to enhance the Company's profitability - ![]()

The Coeur d’Alene Mining District

leads the world in recorded silver production -

Since lode mining began here in 1884, the mines have produced over :

* 1.2 billion ounces of silver

* 8.5 million tons of lead

* 3.2 million tons of zinc

* ..and substantial amounts of gold, copper, antimony and cadmium.

http://www.us-silver.com/i/pdf/2010_Denver_Gold_Handout.pdf

USSIF / USA has a long hike back UP to a more fair share price -

e.g.,

.. the investors who bought the IPO shares -

.. they listen to the banks brokers promo -

.. and their investment is down a lot -

.. would like to see USSIF in a more fair share price ![]()

.. to give back the confidence for a LT good return for the old-.

.. timers who got USSIF up running in the first case ![]()

.. they are well worthy and should be honored to see >$3.-/sh ![]()

.. USSIF is a steal at this low bargain prices -

.. way to undervalued and oversold -

.. the low prices makes it a shame for the whole mining industry -

.. in the US silver mining -

Sprott Securities, $6mil investment ![]()

at the right place at the right time ![]()

well looking for >10 bagger ![]()

and they are pretty good at finding -

the golden treasure chest bargains -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=54277558

Got PM's Ag USA/USSIF silver mine penny play ![]()

great profitable silver mines dd.. ![]() ..

..

http://www.us-silver.com

http://www.us-silver.com/s/Projects.asp

http://www.us-silver.com/s/PhotoGallery.asp

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

The historic mining town of Wallace

(population 960) is nestled beneath Interstate 90,

halfway between two ski and recreation areas

in northern Idaho's beautiful Silver Valley.

http://wallace-id.com/

Sierra Silver Mine Tour -

http://silverminetour.org/

USSIF/USA's agenda priority should be to establish the

control of at least 51% of the outst. shares -

USSIF/USA's shareholder we should all be encouraging the company

to look at buying shares back and all the way up -

while the silver Ag price is below $30 per ounce -

and the USA/USSIF share are undervalued and oversold -

its a great opportunity of USSIF below -

a fiat$/sh to start the buy back -

"U. S. Silver

generates 6% of U.S. silver production from its

Galena Mine and Mill.

The company's holdings are a combination of fee land,

patented mining claims, mining claims and mining leases.

As of 2010, it is profitable, carries no debt and produces silver

at an average cost of $11.50/oz.

With completion of rehab efforts/opening of the Galena shaft,

the company can now move ore from two shafts.

Two distinct ore combinations are present—a lead/silver ore and

a silver/copper ore. . .With both shafts now operating,

the company expects to produce 3.3 Moz. Ag (not silver-equivalent)

in 2011.

Current production is running at about 2.7 Moz. annualized."

David Morgan, Morgan Report (07/06/10)

Got your Christmas Ag Gifts early for LT safety bargain ~<![]()

thank you for reading it ![]()

Trish, Ot.,

I don't own them and isn't the right

person to ask about it? -

please, what more to you know about -

Tomboy mine -

are they working on it? -

will it be re-open?

have you been to it?

Tia

Bob,

you have an old picture of Tomboy mine. I am making a collage of pictures from Tomboy Mine. Can i use your picture in my collage for this collage in my office?

Trish

The Hunt Brothers Forgotten Mine -

Let’s take a look at another forgotten Silver security -

Canadian Zinc (CZICF, TSX:CZN)

has the advantages of almost complete mining infrastructure

and extremely high value ore for a pre-producer.

A recent interview with CZN’s Chief Operating Officer is here.

ttp://seekingalpha.com/instablog/503905-marco-g/94118-the-hunt-brothers-silver-speculation-canadian-zinc-interview-tsx-czn-otcbb-czicf

This Summer’s performance of Canadian Zinc is displayed following.

Figure 7: Canadian Zinc (CZICF, TSX:CZN)

Silver, Zinc, Lead mine in northern Canada

The price movement upwards for Canadian Zinc

calculates to be 72% as of this writing.

Invisible reader: Sputter….Sputter……..but………but this can’t be happening! This is not making sense at all!

U.S. Silver Corp. (TSX:USA)(USD)$0.275 UP $0.025 (+10.00%/day ![]()

Bid 0.26

Ask 0.275

Volume 1,176,085 Strong Demand ![]() Tom's boys? some waking UP

Tom's boys? some waking UP ![]()

Days Range 0.255 - 0.275

Last Trade 9/1/2010 3:59:42 PM

Click for detailed quote page

Wallace Idaho A Mining Town "Then and Now" Part 1 -

Will Sprott's new silver fund become MorganChase's biggest nightmare?

Submitted by cpowell on Thu, 2010-07-15 14:45.

Section: Daily Dispatches

10:45a ET Thursday, July 15, 2010

Dear Friend of GATA and Gold (and Silver):

Zero Hedge has some encouraging words about the new Sprott Physical Silver Trust, whose taking "a few thousands tonnes of the precious metal out of circulation is sure to create quite a few sleepless nights for [JPMorganChase's] Jamie Dimon's precious metals manipulation club, which may suddenly find itself with a massive short position covered by even less actual deliverable, bringing the much-anticipated monumental short squeeze one day closer."

Zero Hedge's comments are headlined "Will Sprott's Brand New Physical Silver Trust Become JPMorgan's Biggest Nightmare?" and you can find them here:

http://www.zerohedge.com/article/will-sprotts-brand-new-physical-silver-trust-become-jpmorgans-biggest-nightmare

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=52358425

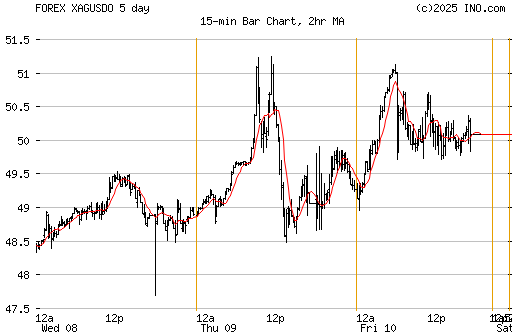

Silver Spot (FOREX:XAGUSDO) $17.98 per ounce -

Silver 5 Day chart - normal fib. correction -

Silver 1 year - long term trend UP -

The Silver Price Spiral, Part III: tomorrow -

http://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=11360:the-silver-price-spiral-part-iii-tomorrow&catid=49:silver-commentary&Itemid=130

The Silver Price Spiral, Part II: paper "inventories"

http://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=11302:the-silver-price-spiral-part-ii-paper-qinventoriesq&catid=49:silver-commentary&Itemid=130

The Silver Price-spiral -

Part I: today -

http://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=11299:the-silver-price-spiral-part-i-today&catid=49:silver-commentary&Itemid=130

Got PM's Ag USA/USSIF Silver Mine penny play ![]()

the great profitable silver mines dd.. ![]() ..

..

http://www.us-silver.com

The historic mining town of Wallace

(population 960) is nestled beneath Interstate 90,

halfway between two ski and recreation areas

in northern Idaho's beautiful Silver Valley.

http://wallace-id.com/

http://www.us-silver.com/s/Projects.asp

http://www.us-silver.com/s/PhotoGallery.asp

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

Sierra Silver Mine Tour -

http://silverminetour.org/

God Bless

Jim Rogers: Silver is one of the few safe refuges left

Wednesday, July 07, 2010

From Bloomberg:

Investors should sell bonds and buy commodities like silver and rice as a “refuge” as the world economy may continue having problems, Jim Rogers, chairman of Rogers Holdings said.

“Bonds are not a good place to invest in,” Rogers said at a conference in Kuala Lumpur today. “You should own commodities because that’s your only refuge” whether it’s silver or rice, said Rogers, who predicted the start of the global commodities rally in 1999.

Gold has gained 8.3 percent this year, leading advances in precious metals, as investors seek haven assets to protect their wealth amid concern the global economic recovery will falter. Still, commodities overall capped their worst quarter in more than a year on investors’ concern that slower growth from China to the U.S. will sap demand.

The best place to be is in commodities and other natural resources, including precious metals like silver, platinum and palladium, said Rogers, who co-founded the Quantum Hedge Fund in 1970. Commodities are good to buy as supply shortages are already developing, the Singapore-based investor said.

Gold prices will rise to more than $2,000 per ounce, said Rogers, without giving a timeframe. Bullion for immediate delivery declined 0.4 percent at $1,187.85 an ounce at 6:34 p.m. in Singapore. It reached a record $1,265.30 on June 21.

‘Straight Up’

“I do own gold,” he said. “Gold has been extremely strong of late, but I’m not rushing out to buy gold. I don’t like to buy things that have been going straight up.”

While gold has been trading at all-time highs, silver remains 60 to 70 percent below its peak and is a better investment, he said. Silver reached an all-time high of $50.35 in New York in 1980.

Silver for immediate delivery fell 1 percent to $17.6413 an ounce at 6:22 p.m. Platinum dropped 0.6 percent to $1,507.68 and palladium declined 1.2 percent to $433.35.

Still, agricultural commodities are better than metals as prices are “very depressed,” he said, pointing to sugar which is 75 percent below its all-time high in 1974. Raw sugar for October delivery slid 1.2 percent to 16.49 cents a pound on ICE Futures U.S. in New York. It reached a record of 66 cents in November 1974.

“Not many things are 75 percent cheaper that 36 years ago, but that’s true of sugar,” Rogers said. “Agriculture commodities are desperately cheap compared to 20, 30, 40 years ago.”

Rice futures on June 30 touched $9.55, the lowest price since October, 2006, on rising production and declining demand. The contract for September delivery gained 0.7 percent to $9.935 per 100 pounds on the Chicago Board of Trade at 6:15 p.m. in Shanghai.

To contact the reporter responsible for this story: Ranjeetha Pakiam in Kuala Lumpur at rpakiam@bloomberg.net.

U.S. Silver; New demand sources to bolster silver prices

Investment demand remains a big driver but, growing, new

industrial uses are expected to eat away at the supply

surplus

Author: Geoff Candy

GRONINGEN -

Demand for silver from new sources like the solar energy, medical and water purification sectors is likely to quadruple in the next 10 years.

This is one of the forecasts made in the VM Group/Fortis Bank Nederland, Silver Book. According to the research, demand for such products is likely to rise to at least 230 Moz to account for roughly 25% of world silver demand.

And, coming on the back of significant, continued inflows into silver ETFs, means that the fundamentals over the medium to long term for the metal are "more convincingly bullish that they have been for some time".

Part of the reason for this is that such an uptick in industrial demand, which has waned significantly as the photographic industry has used less and less of the metal, would result in a decrease in the current metal surplus.

As, the Silver Book explains, "For years the silver market has been characterised by falling demand in the photographic industry and tepid jewellery offtake, while supply has seen rapid growth. The resulting market surplus has thus risen from 1,800t in 2000 to an estimated 7,200t in 2010."

One just needs to look at the price of aluminium to see what normally happens to a sector with such a large supply overhang but, as it turns out, silver prices have done rather well, primarily because of the massive demand for silver ETFs.

As the Silver Book says, "Investment demand has soared since the launch of the first silver-backed ETF in 2006, and now accounts for more than 400 Moz (12,440t) of silver held in bullion bank vaults. Physical investment in the form of coins and bars has also helped support prices in the face of this explosive growth in supply".

The caveat, of course, as the research points out, is that price support has increasingly come to depend on investment demand, especially because, by and large, the supply side of the silver market is independent from the fundamentals affecting the price.

This is because a significant portion of silver is mined as a by-product or a co-product metal.

Indeed, according to the VM Group research done on behalf of Fortis Bank Nederland, "About 30% of total annual silver output is from primary production, with 15%-20% as a co-product and the balance a byproduct. Primary supply is set to fall to a low of 23% by 2020, as co- and byproduct silver mine supply becomes more dominant."

According to the Silver Book, supply is expected to increase at a CAGR of around 2.4% over the next ten years, from more than 22,000t in 2009 to more than 28,500t in 2020, so keeping supply running well ahead of potential demand could be a very tall order."

"Our supply-side estimate includes advanced projects as well as existing mines and mine expansions. It also includes identified uncommitted projects that might come online in the next 10 years, and it is these latter projects that will determine the market balance by 2020. Should none of the uncommitted ounces be brought online, but ETF demand dip slightly, to say 1,500-2,500t/year, then we estimate a market surplus of just 800t in

"If ETF demand grows to more than 2009 levels (more than 4,000t) in the period 2014-2020, then we estimate a market deficit of as much as 2,400t in 2020. But if mine supply, including uncommitted output, all comes online without delay, and ETF demand declines to as low as 1,500t/year, then our market balance will show a surplus of about 4,900t. The market balance scenario considers that all the uncommitted ounces of mine supply come online while investment demand rises.

It does warn, however, that while a compound annual growth (CAGR) rate of more than 12% in the next 10 years for demand from these new sources is likely, a significant rise in prices would inevitably threaten some of the new areas of demand.

"The higher the silver price rise, the more some of these new silver consuming technologies would seek to substitute the metal with cheaper products," the report says.

But adds, "Tighter silver market fundamentals are very likely to fuel investment demand growth...as the current surplus begins to erode over the next few years we expect a reaction among the investment community, with ETF demand likely to hit new records, possibly bringing about a deficit. However under these circumstances, and rising prices, miners will be incentivised to bring on greater supply."

"Demand growth in the new end use sectors, as well as investment demand (coins, bar hoardings or ETFs), therefore will have an increasingly critical influence over the silver market balance in the medium to longer term - and prices."

--

America Falling to Foreign Bank Takeover - PT 1/2

How The Banksters Serve The Gold-Buyers -

http://www.gold-eagle.com/editorials_08/nielson070510.html

bottom lines -

If the banksters don't self-destruct in the gold market, they

could simply run out of silver.

As I detailed in my last commentary; supply, demand, and

inventory numbers have been so ridiculously contrived in

the silver market that we have no way of knowing (by examining

the bogus "data") whether default will occur five years

from now, or five days from now.

Finally, all it takes is for one of the big-buyers to get greedy

(or impatient), and to start buying "aggressively", and that

could trigger an instant "gold rush" in global gold markets.

Should this occur, it implies gold (and silver) moving to

fair-market value in the near term, which in turn implies

default in those markets.

While "white knights" don't exist in the gold market,

the reckless, scheming bankers are all too real.

As I have pointed out several times before, such psychopaths

frequently self-destruct before they are ever "caught" and held

accountable for their crimes.

Thus, we must always view the precious metals market as one

where our "last chance to buy" could be today.

Do not waste any time in filling your own quota for this

necessary insurance.

by Jeff Nielson

--

the addicted khazars banksters hungry $power$ by

NWO & OWG - polo-ticz 666 bolsheviks banksters work to control

the population etc.

to wipe out all other people - incl.

our Jewish brothers and sisters -

E.g., dd....

Zionism DataPage Jews Against Zionism:

http://www.rense.com/Datapages/zionismdata.htm

By Brother Nathanael's truth in this debate -

its a banksters super 666 red agenda target goal -

http://www.realzionistnews.com/?p=183

http://www.realzionistnews.com/?cat=296

Got PM's Ag USA/USSIF Silver Mine penny play ![]()

the great profitable silver mines dd.. ![]() ..

..

http://www.us-silver.com

The historic mining town of Wallace

(population 960) is nestled beneath Interstate 90,

halfway between two ski and recreation areas

in northern Idaho's beautiful Silver Valley.

http://wallace-id.com/

http://www.us-silver.com/s/Projects.asp

http://www.us-silver.com/s/PhotoGallery.asp

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

Sierra Silver Mine Tour -

http://silverminetour.org/

God Bless

Steve thanks, U.S. Silver Corp Com (USOTC:USSIF)(USD) $0.23 talk about undervalued - oversold strategic silver bargain ![]()

Change 0.0 (0.00%)

Bid 0.2251

Ask 0.2385

Volume 483,096 Very Strong Demand ![]() still early strategic Ag Silver producing profit bargain

still early strategic Ag Silver producing profit bargain ![]()

Days Range 0.226 - 0.2373

Last Trade 6/18/2010 12:23:46 PM

Click for detailed quote page

Steve a good chart telling a very undervalued Ag alert

Gold just broke up out of that tough $1,250 resistance....its on

its way to fiat$1,500 rest camp before the next hike up the

Golden Mountain - its a long way up to the sugar TOP ![]()

Will silver finally, FINALLY break that concrete $19 resistance?

If silver can break $20, it's off to the races to $30 before 2011

US Silver would benefit exponentially.

That's great let's take up a pen to calculate....

at the comfy seat in the train to

Ag-Profitville ![]()

This could be it!

..or not, lol.

Montanore thanks, well is Ag-silver taking up the front runner position

again for the Au mother gold?

Montanore well, how many more $millions are USSIF making for every

fiat$ Ag going higher?

USA/USSIF Silver $19.24/oz UP $0.51/oz the PM-train leaving for

Ag profitville me a hobo taking a comfy sofa seat ![]()

the train will pick up speed -

its hard to jump on -

US Silver

From Wikipedia, the free encyclopedia

http://en.wikipedia.org/wiki/US_Silver

Gold $1261.20/oz UP $16.00/oz

http://www.us-silver.com/s/Projects.asp

http://www.us-silver.com/s/PhotoGallery.asp

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

U.S. Silver Corp Com (USOTC:USSIF)(USD)$0.1978 UP $0.0178 (+9.89% ![]()

Bid 0.1772

Ask 0.1978

Volume 739,550 good demand ![]()

Days Range 0.183 - 0.2

Last Trade 5/26/2010 3:41:51 PM

Click for detailed quote page

Silver spot $18.16/oz UP $0.11/oz

Carter's Wave of inflation Caused Everything To Rise In Value.

During Canter's Presidency precious metal prices soared with rising inflation and fuelled by a falling dollar. Here's what happened from 1976 to 1980:

Gold rose............................................................+467%

Silver soared......................................................+922%

Platinum soared.................................................+700%

Palladium soared...............................................+600%

Copper rose.......................................................+170%

US Housing prices rose on average.................+50%

However, during the same period T-Bonds plunged -35%, while the Dow Index flat-lined, hugging the 800 level for four long years.

http://www.investmentpitch.com/media/576/The_Silver_Summit_2010_Spokane_WA/

history repeat itself -

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

Silver tells a volatile story of Earth's origin: Water was present during its birth -

Tiny variations in the isotopic composition of silver in meteorites and Earth rocks are helping scientists put together a timetable of how our planet was assembled beginning 4.568 billion years ago. The new study, published in the journal Science, indicates that water and other key volatiles may have been present in at least some of Earth's original building blocks, rather than acquired later from comets, as some scientists have suggested.

Compared to the Solar System as a whole, Earth is depleted in volatile elements, such as hydrogen, carbon, and nitrogen, which likely never condensed on planets formed in the inner, hotter, part of the Solar System. Earth is also depleted in moderately volatile elements, such as silver.

"A big question in the formation of the Earth is when this depletion occurred," says co-author Richard Carlson of the Carnegie Institution for Science's Department of Terrestrial Magnetism. "That's where silver isotopes can really help."

Silver has two stable isotopes, one of which, silver-107 was produced in the early Solar System by the rapid radioactive decay of palladium-107. Palladium-107 is so unstable that virtually all of it decayed within the first 30 million years of the Solar System's history.

Silver and palladium differ in their chemical properties. Silver is the more volatile of the two, whereas palladium is more likely to bond with iron. These differences allowed the Carnegie researchers, which included Carlson lead author Maria Schönbächler (a former Carnegie Institution postdoctoral scientist now at the University of Manchester) Erik Hauri, Mary Horan, and Tim Mock to use the isotopic ratios in primitive meteorites and rocks from Earth's mantle to determine the history of Earth's volatiles relative to the formation of Earth's iron core. Other evidence, specifically from hafnium and tungsten isotopes, indicates that the core formed between 30 to 100 million years after the origin of the Solar System.

"We found that the silver isotope ratios in mantle rocks from the Earth exactly matched those in primitive meteorites," says Carlson. "But these meteorites have compositions that are very volatile-rich, unlike the Earth, which is volatile-depleted."

The silver isotopes also presented another riddle, suggesting that the Earth's core formed about 5-10 million years after the origin of the Solar System, much earlier than the date from the hafnium-tungsten results.

The group concludes that these contradictory observations can be reconciled if Earth first accreted volatile-depleted material until it reached about 85% of its final mass and then accreted volatile-rich material in the late stages of its formation, about 26 million years after the Solar System's origin. The addition of volatile-rich material could have occurred in a single event, perhaps the giant collision between the proto-Earth and a Mars-sized object thought to have ejected enough material into Earth orbit to form the Moon.

The results of the study support a 30-year old model of planetary growth called "heterogeneous accretion," which proposes that the Earth's building blocks changed in composition as the planet accreted. Carlson adds that it would have taken just a small amount of volatile-rich material similar to primitive meteorites added during the late stages of Earth's accretion to account for all the volatiles, including water, on the Earth today.

God Bless

Canadian Zinc Corporation (TSE:CZN) Silver spot price -

http://www.canadianzinc.com

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

TYVM for that NYBOB..

To 'brucegorman' on 'SILVER (Ag) PRODUCERS'

don't forget to pass it on to all brothers, tia ![]()

The U.S. Mint just reported another record -

but this time it wasn’t for gold.

The Mint sold more Silver Eagles in March and in the first quarter

of the year than ever before.

A total of 9,023,500 American Silver Eagles were purchased

in Q110, the highest amount since the coin debuted in 1986.

While this is certainly bullish, there’s something potentially

more potent developing in the background.

Namely, how this matches up with U.S. silver production.

Like gold, the U.S. Mint only manufactures Eagles from

domestic production.

And U.S. mine production for silver is about 40 million ounces.

In other words, we just reached the point where virtually all

U.S. silver production is going toward the manufacturing

of Silver Eagles.

This is especially explosive when you consider that roughly 40%

of all silver is used for industrial applications,

30% for jewelry,

20% for photography and other uses,

and only 5% or so for coins and medals.

To be sure, mine production is not the only source of silver.

In 2009, approximately 52.9 million ounces were recovered from

various sources of scrap.

Further, the U.S. imported a net of about 112.5 million ounces

last year.

(Dependence on foreign oil? How about dependence on foreign silver!)

So it’s not like there’s a worry there won’t be enough silver

to produce the Eagle you want next month.

Still, why so much buying?

The silver price ended the quarter up 15.5% from its February 4 low –

but it was basically flat for the quarter, up a measly 1.9%.

We tend to see buyers clamoring for product when the price takes off,

so the jump in demand wasn’t due to screaming headlines about

soaring prices.

For some time, silver has been known as the “poor man’s gold.”

Meaning, silver demand tends to increase when gold gets too “expensive.”

The gold price has stubbornly stayed above $1,000 for over six

months now and spent much of that time above $1,100.

You’d be lucky to pay less than $1,200 right now for a one-ounce

coin (after premiums), an amount most workers can’t pluck out of

their back pocket.

But Joe Sixpack just might grab a “twelve-pack” of silver.

What would perhaps lend evidence to my theory is if gold sales

were down in the face of these higher silver sales.

Is the rush into “poor man’s gold” underway?

Silver could signal we’re inching closer to the greater masses

getting involved in the precious metals arena.

And that – for those of us who’ve been invested for awhile now –

would be music to the ears.

Because when they start getting involved, the mania will be underway,

and from that point forward, it’s game on.

Before the mania is starting as clues like these begin to build up,

we’ll know we’re getting closer.

(And any drop to those ranges would clearly be a

major buying opportunity.)

A meaningful portion of one’s precious metals portfolio

should be devoted to silver.

The market is tiny, making the price potentially explosive.

Remember that in the ‘70s bull market gold advanced over 700%,

but silver soared over 1,400%.

Don’t be a “poor man” by ignoring gold’s shiny cousin -

While buying silver is a must, it’s the silver stocks

that will truly soar in a mania -

Is Silver Ag following Gold Au -

Au the front runner ![]() down Up mirror reflexion

down Up mirror reflexion ![]()

history often repeat itself ![]()

It's often fast down - FAST UP ![]()

in bull market correction -

U.S. Silver Corp., Video - Tom Parker President & CEO -

USSIF - TSX.V: USA -(6 mon. old)

http://www.investmentpitch.com/media/552/U.S._Silver_Corp._-_TSX.V__USA/

This is about 4 mon. old still gives facts info,

how oversold and undervalued we are;

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

http://www.us-silver.com/s/NewsReleases.asp

http://www.us-silver.com/i/pdf/factsheet/ussilver-factsheet.pdf

http://www.us-silver.com/s/Presentations.asp

http://www.us-silver.com/s/InfoRequest.asp

http://www.us-silver.com

God Bless

SILVER 1000 $/oz ! ---

Mike Maloney °°•.?.•°?°.°•.?.•°?

The Silver from the 4824 m high Cerro Rico (Rich Mountain) -

once made Potosi the biggest city in the Americas -

and one of the richest in the world -

"I am rich Potosi -

Treasure of the world -

The king of all mountains -

And the envy of all kings" -

Legend on 16th-century Potosi -

Potosi - coat of arms -

http://www.boliviaweb.com/photogallery/potosi0.htm

Potosi -

the city which grew up at the foot of the hill -

was said the streets to be paved with Silver -

and became a byword for luxury and splendour -

At the height of its splendour -

in the 17th Century, Potosi was one -

of the largest cities in the world -

Cerro Rico, or "Rich Mountain" -

The Worlds Richest Silver Mine -

has been mined for more than -

- 500 years.

Indeed, so rich did Cerro Rico -

prove to be that the Spanish -

colonists dreamt of building -

a bridge of solid silver all -

the way from Potosí to Madrid.

Since the date mentioned until 1719 -

great bonanza periods have been reported -

for the quality of the mineral -

with ore contents between 1,500

and 9,000 silver ounces per ton.

http://tinyurl.com/uq8b5

http://whc.unesco.org/en/list/420

I AM RICH POTOSI:

The Mountain That Eats Men -

or is it - the el tio ? - 666 - That Eats Men -

the 666 bobo is a nono -

to normal Safety Standard Mining methods of precautions -

http://www.culturesontheedge.com/gallery/archives/potosi/index.html

History short snippet reflexion -

When the Spanish conquistadors first arrived in the new world -

in the 1500s, they were surprised to find a highly advanced

civilization the Aztecs of Mexico at one time their empire

stretched throughout central and North America.

Their capital city featured towering pyramids and beautiful

palaces.

But the conquistadors were shocked to discover that the Aztecs

practiced a barbaric religious ritual of human sacrifice.

In fact, the Aztecs, from ancient times to the 1500s, may have

sacrificed more people to their gods than any other culture

in human history.

When the great temple was dedicated in 1487, priests sacrificed

thousands of people in a single day.

The Aztecs sacrificed to all the gods and goddesses often

through bloodletting on the heights of the pyramids.

Again, we find that this was not a primitive culture compared

to the rest of the world at that time.

It was a highly advanced society of artists, craftsmen, and

priests. Yet they spilled more human blood tot heir gods

than any other culture in history.

One account by a Spanish conquistador tells of a skull rack

containing 136,000 heads of victims who had been ritually

murdered.

The Spanish were horrified. In response, they massacred the

Aztecs, tore down their temple and built -

a cathedral in its place.

Gold and silver are higher this morning with the dollar, the British pound and commodity currencies falling in value. It is too early to tell whether the recent margin driven, paper sell off on the COMEX is over but physical supply remains limited while demand remains robust, particularly in China, India and wider Asia.

Knowledgeable experts continue to urge investors to own gold and silver due to the likelihood of much higher prices, currency and inflation risk.

One of the most respected global technical and macro strategists in the world, Robin Griffiths has said that silver and gold could rise to $450 and $12,000 per ounce respectively due to the debasement of paper currencies.

Dow Jones to Gold Ratio - 50 Years (Quarterly)

Griffiths was chief technical strategist with HSBC for over 20 years, has 44 years investment experience and now works for Cazenove Capital, one of the oldest investment houses in the world tracing its origins back to the 17th century. It manages money on behalf of blue blooded clients and is widely believed to manage some of the British Royal family's wealth.

When asked by King World News if his $350 target was a realistic price level for silver Griffiths stated, "That is absolutely not unrealistic. If you adjust the old all-time high for inflation...that gives you $450 for silver. Then you add in the fact that they are printing money, you can take it higher than that without any difficulty at all."

Dow Jones Industrial Average - 50 Years (Quarterly)

Griffiths told King World News that "Bulls (bull markets) are very successful at wobbling people out at the wrong time. "

Griffiths has previously said that not owning gold today is a form of insanity and "may even show unhealthy masochistic tendencies, which might need medical attention." (see here)

He has also critiqued the western media's superficial coverage of gold and their resort to Warren Buffett's ignorant comments on gold despite money printing and international currency debasement on a scale never before seen in history .

Meanwhile perhaps the leading commodity expert of our time, Jim Rogers, has said that silver was not and is not a bubble.

Regarding the recent price correction he said, "I don't know what caused it maybe it was short covering, maybe it was rumors. I have no idea." He continued "silver went down a great deal but if you raise margin requirements 150%-200% you would expect something to collapse," he added.

"I hardly see how silver could be a bubble when, even at its top, it's still below its all-time high. That's not much of a bubble."

If it goes to $150 this year, all other things being equal, then I'd say you better sell your silver. If it goes to $150 in 10 years then I would say that's a normal progression up and that's the way things work. But if the U.S. dollar suddenly turns into confetti then you better hold your silver at $200. So it depends on the circumstances and the timing more than anything else.

Since 2003, GoldCore have said that gold and silver would reach their inflation adjusted highs of $2,400/oz and $130/oz. Our estimates appear increasingly conservative especially given the fact that the official inflation statistics have been debased over the years and are not an accurate reflection of real inflation.

Predicting the future price of any asset class is impossible. Predicting that gold and silver will continue to protect against financial and economic shocks and crashes and global currency debasement is possible.

The current correction should be used as another buying opportunity in order to protect against the continuing extraordinary degree of macroeconomic, monetary and geopolitical risk in the world.

SILVER (Ag) PRODUCERS

& Related Juniors:

in no particular order

Franklin Mining, Inc. -

http://www.franklinmining.com/aboutfranklin/ourhistory.html

http://www.investorshub.com/boards/board.asp?board_id=5810

CDE Mission -

http://www.investorshub.com/boards/read_msg.asp?message_id=19737387

http://www.investorshub.com/boards/read_msg.asp?message_id=14119376

2005, Pan American -

increased its interest in San Vicente to 55% -

the Company also negotiated another toll milling

agreement with EMUSA -

under which ore will be processed at a nearby -

facility until the mill on site at -

San Vicente - is to be refurbished in 2006 -

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

http://www.investorshub.com/boards/read_msg.asp?message_id=12004807

Atlantis in the Andes -

http://video.google.ca/videoplay?docid=-3316733253690634802&q=INCA+bolivia

Bolivia is the landlocked "heart" of South America -

http://www.investorshub.com/boards/read_msg.asp?message_id=15778588

http://video.google.ca/videoplay?docid=-5321262859749832389&q=INCA+bolivia

Looking down from the 6088m high summit -

of Huayna Potosi in Bolivia -

http://www.investorshub.com/boards/read_msg.asp?message_id=15778088

http://video.google.ca/videoplay?docid=-7631799111262366547&q=INCA+bolivia

http://video.google.ca/videoplay?docid=165116598393419221&q=INCA+bolivia

http://video.google.ca/videoplay?docid=3517786178230461443&q=INCA+bolivia

Silver LT following Rhodium -

Rh is frontrunner to Ag -

The Old Franklin Mines -

The Old Franklin Mines -

- has been trading above $100.00/share by Franklin Mines -

owned in US - still own them -

FMNJ - now also Cerro Rico interest -

- history often repeat itself -

http://www.franklinmining.com/Home/tabid/1215/Default.aspx

THE FRANKLIN WANTS YOUR:

SUPPORTS, Tia -

Amen

Franklin Mining, Inc. -

(OTC Pink Sheets:FMNJ - News), working through two

Bolivian subsidiaries, is today confirming that a

Letter of Intent has been signed with COMIBOL for

mining operations at - The Cerro Rico Mine -

in Potosi -

http://tinyurl.com/y54k7r

Silver - history - very Long Term LT oversold - undervalued -

the manipulation creates hardship for Silver miners worldwide -

in the future it will explode - the more manipulation -

the higher Silver will fly -

(to see the 600yearsilver chart chart - put your mouse arrow to the box -

use the right side -

button on your mouse -

click view image)

"We have gold because we cannot trust Governments."

President Herbert Hoover

dd....

http://www.publicgold.com/tryit

dd....

http://www.PublicGold.com/tryit.net

Biggest Scam In History -

(speakers on )

http://www.wtv-zone.com/Mary/FEDERALRESERVE.HTML

Video Info - What is -

Money, Banking and the Federal Reserve -

Link (on the left index-column) -

http://www.ivarkreuger.com

- are the banksters naked short selling? -

- US stock shares? -

- You to be the judge! -

SILVER Monthly Long Term -

http://www.mrci.com/pdf/si.pdf

SILVER Monthly Short Term -

This oscillator shows strength & weakness in the price movements

with highs being in the sell zone & lows being in the buy zone.

http://www.silverinstitute.org/news/index.php

First Quarter Silver News 2006

http://www.silverinstitute.org/news/1q06.pdf

Commodity Fundamentals -

http://www.apexsilver.com/home.html

Welcome to join and enjoy SILVER (Ag) PRODUCERS -

InvestorsHub forum...

tell us your opinion and

ask your questions...

Imo. Tia.

Brgds.

Bob

Precious Metals Spot Price's -

Silver Charts In Global Currencies

Australian Dollar British Pound Canadian Dollar

Chinese Renminbi European Euro Indian Rupee

Japanese Yen Swiss Franc South African Rand

updated weekly

http://www.goldrush21.com/

The Hebrew word for money is "keceph", which

is translated to mean "silver."

Silver Supply & Demands -

Banking cartel info -

http://www.netcastdaily.com/broadcast/fsn2006-1028-2b.m3u

Money Masters: Federal Reserve History part 1 of 3

http://video.google.com/videoplay?docid=8442305921010099392&q=conspiracy

Money Masters: Federal Reserve History part 2 of 3

http://video.google.com/videoplay?docid=5020331178524208549&q=conspiracy

Money Masters: Federal Reserve History part 3 of 3

http://video.google.com/videoplay?docid=6666372716915416357&q=conspiracy

Precious Metal Charts Page -

http://tinyurl.com/8bhho

Gold Bullion Weekly compared to fiat Currency Chart Page -

http://www.netcastdaily.com/broadcast/fsn2006-1118-1.m3u

http://www.netcastdaily.com/broadcast/fsn2006-1202-2b.m3u

http://www.netcastdaily.com/broadcast/fsn2006-1202-2c.m3u

A must see video clip on the Federal Reserve -

and the current state of the Dollar...

http://www.freedomtofascism.com/blog/2006/12/michael-badnarik-on-federal-reserve.html

Those who make peaceful REVOLUTION impossible will

make violent REVOLUTION inevitable.

- John F. Kennedy

Shut Down The Federal Reserve: Save America!

http://www.ipetitions.com/petition/AFTF_P_1/

†With God all things are possible†

by: todd h

ROB-TV in exposing the Gold price suppression scheme -

http://www.youtube.com/watch?v=GbPetrK_6Lc&mode=related&search=

Join GATA -

http://www.GATA.org.

Gold Show -

2007 Vancouver Resource Investment Conference

Vancouver Convention and Exhibition Centre

http://www.cambridgeconferences.com/

TIA.

Silver - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

Gold - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

(Elliott Wave 5-wave Elliott Pattern)

2007 Outlook for Gold and Silver -

http://tinyurl.com/ueno9

of GoldSeek.com and SilverSeek.com says that

dollar weakness could push up price...

Silver Brothers -

http://www.silverbrothers.com/index.html

THE FIRST GREAT GOLD RUSH began in 1971....

and Gold followed Silver Bull....

Second wave LT trend started - of the 5-wave Elliott pattern -

THE FIRST GREAT GOLD RUSH began in 1971...

gold prices ran from $35 to over $700, a twentyfold rise!

A decade later, prices settled near $300,

nearly a tenfold increase!

THE SECOND GREAT GOLD RUSH, Phase One began in 2001....

gold prices have run from $275 to over $675 (25% growth/year!)

Not bad, but this is still just the warm up phase!

THE SECOND GREAT GOLD RUSH, Phase Two begins in 2007...

gold prices are expected to climb above $750 this year!

If gold prices rise twenty-fold from $275,

that's a $5,500 peak price,

with gold settling near $2,750,

a tenfold increase and 400% higher than today's price.

Investing in Silver: Silver Has Enduring Value

http://www.sim.org/

http://tinyurl.com/y824mv

http://www.flw.com/merry.htm

http://www.victorious.com/reports/ccane.htm

http://www.vatican.va

http://tinyurl.com/365wag

Gold & Silver is Money = not paper, not electronic credits,

not chips and not polo-ticz fiatz666counterfeitz -

The Fiat Money System -

Dr. Bill Veith in studio w/ Alex Jones -