Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Rentech Nitrogen Partners (NYSE:RNF): Q1 EPS of $0.23 beats by $0.11.

Revenue of $69.17M (+22.9% Y/Y) beats by $3.25M.

Natuaral gas prices are down, normally this puppy should head north...

The LT view here has highly improved...JMO

They handidly beat on revenue.

the stock is approaching 52 week low.

what's your estimate about the forthcoming earnings report?

I think these guys got out of alternative energy, which is probably good. Now they can focus on core competencies, imo.

No problem. Remember, it's only my opinion. The analyst's blame it on the wet weather. Gotta like the negative coverage.

thanks for your answer...

It declined substantially. This sector is at the bottom of the heap. Intrepid Potash looks to be most interesting, IMO. The CF MLP has had minimal Impact. I personally think one could leg in down here if you have a long term perspective. The longer it bases, all the better!

what happened here with the pps ?

Fertz and farm equipment moved in tandem yesterday, both up, fertz notably strong with a 5% move. Moving on the MLP news from CF Industries.

Playing the channel. Think there's more upside to come. Fertz advanced 1.2% yesterday.

I think we will see further weakness in this industry. The fertilizer industry all traded up today, looking at 24s to get in. Like the dividend ;)

Nibbling here as well. Grains starting to move in the right direction.

Time to get back in? Yest and so far today chart looks interesting. Would like to see more volume.

Is this a serious problem with the company or a great buying opportunity?

Nobody wants our genetically modified wheat: Genetically Modified Wheat

Headliner: Rain Dampens Fertilizer Makers; bottom must be getting close, imo. If prices get cheaper, some producers will be forced out of business.

EPS miss is not comparable because of delayed shipments attributable to wet soil conditions. /ZC retraced almost the entire move from 4/29. Cowen: Prospects for large corn crop remain.

Thanks for your analysis... what about this wedge pattern?

Here are all my other MOS charts. But look at the one below. Inception to date.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86709320

Surging Natural Gas Prices Takes Toll On Rentech

http://www.forbes.com/sites/zacks/2013/04/03/surging-natural-gas-prices-takes-toll-on-rentech/?partner=yahootix

For much of the latter half of 2012, nitrogen-based fertilizer companies were great investments. These firms often utilize natural gas as a key input for their processes, so when prices of this potent fuel are slumping, it is great news for their bottom lines.

However, the reverse is also true, and this has been the case so far in 2013 thanks to surging natural gas prices. In fact, prices for natural gas have stormed higher by roughly 50% since August, collapsing the outlooks for many companies that rely on natural gas as key inputs.

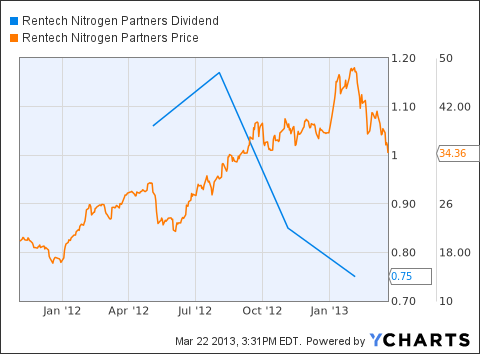

This situation is especially prevalent in one of the key names in the space, Rentech Nitrogen Partners LP (RNF). Prices of RNF shares moved higher by about 50% from August to February, but have nose dived since then as the higher price of natural gas has begun to finally take its toll.

Prices of Rentech have slumped by more than 12% in the past one month alone, largely driven by a weak earnings report and a tepid outlook for the coming quarters. Analysts are beginning to take note as well, slashing their profit forecasts for this now troubled stock.

Special Offer: What you don’t own is just as important as what investments you do own. Top investing experts named names when it comes to securities to avoid in the year ahead. Get the results in this free downloadable report, 24 Widely-Held Investments You Should Sell Now.

Analysts have universally lowered their estimates in the past sixty days, pushing the current quarter estimate down slightly and the current year estimate down significantly. In fact, analysts now expect negative growth for the next quarter and for the current year period as well, suggesting a rough stretch for the company going forward as well.

This poor outlook by analysts has pushed RNF to a Zacks Rank of 5 or ‘Strong Sell,’ further confirming the new-found bearishness about this firm. If that wasn’t enough the ‘fertilizer’ industry is currently ranked in the bottom 20% of industries, so there looks to be little hope from a rising tide lifting all boats in this troubled segment either.

The most important thing to consider for RNF is the price of natural gas. According to the most recent 10-K for the firm, 64% of production costs for ammonia (at their East Dubuque facility) in the most recent year were due to natural gas.

Also according to the annual report, the company has traditionally purchased natural gas, through the use of forward purchase contracts, in the spot market. This equaled about $3.59 for the 2012 calendar year, and as high as $4.79 in the 2010 fiscal year.

Average prices could certainly return to these lofty levels, especially if current trends in the natural gas market hold. There has been an extremely long winter in much of the northeast and the Midwest, while a reduction in drilling operations has also reduced supply. If this continues for a bit longer, it could increase natural gas withdrawals, and if we see a hot summer, it could add to the woes for Rentech going forward.

Clearly, RNF isn’t a very good choice for investors at this time. It is heavily dependent on natural gas prices as an input, and these costs could be surging if current trends hold.

Goldman Sachs Starts Rentech Nitrogen Partners (RNF) at Neutral

http://www.streetinsider.com/New+Coverage/Goldman+Sachs+Starts+Rentech+Nitrogen+Partners+%28RNF%29+at+Neutral/8208186.html

Goldman Sachs initiates coverage on Rentech Nitrogen Partners (NYSE: RNF) with a Neutral and $34 price target saying while expectations are reset but still cautious Nitrogen.

"The advantaged location of its East Dubuque, IL facility in the heart of the corn belt and a series of capacity expansion and de-bottlenecking opportunities should make 2013 a low point for distributions despite bearish nitrogen (N) view," the analyst said.

From 3/19/13: RNF: Q4 EPS 44c vs 30c Misses 55c Est

Tuesday , March 19, 2013 08:51ET

QUARTER RESULTS

Rentech Nitrogen Partners, L.P. (RNF) reported Q4 results ended December 2012. Q4 Revenues were $92.40M; +46.67% vs yr-ago; BEATING revenue consensus by +22.48%. Q4 EPS was 44c; +46.67% vs yr-ago; MISSING earnings consensus by -20.00%.

Q4 RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $92.40M $63.00M +46.67% $75.44M +22.48%

---------- ------------ ------------ ---------- ------------ ----------

EPS: 44c 30c +46.67% 55c -20.00%

---------- ------------ ------------ ---------- ------------ ----------

FY RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $261.60M $199.90M +30.87% $240.32M +8.85%

---------- ------------ ------------ ---------- ------------ ----------

EPS: $2.78 30c +826.67% $2.89 -3.81%

---------- ------------ ------------ ---------- ------------ ----------

Earnings for 2012

(reported on the 19th but updating board for future reference)

Rentech Reports 2012 Activities and Financial Results; Provides 2013 Guidance

Tuesday , March 19, 2013 07:00ET

LOS ANGELES--(BUSINESS WIRE)-- Rentech, Inc. (NYSE MKT: RTK) today announced its results for the three and twelve months ended December 31, 2012 and provided financial guidance for 2013. Rentech owns the general partner and approximately 60% of the common units representing limited partner interests in Rentech Nitrogen Partners, L.P. (NYSE: RNF). Rentech Nitrogen manufactures and sells nitrogen fertilizer products. Rentech also owns the intellectual property including patents, pilot and demonstration data, and engineering designs for a number of clean energy technologies designed to produce certified synthetic fuels and renewable power when integrated with third-party technologies.

Rentech's financial results reflect the consolidated results of Rentech, Inc. and its subsidiaries, including Rentech Nitrogen. The results of Rentech Nitrogen are reported as the nitrogen products manufacturing subsidiary of Rentech, which includes two operating segments: the East Dubuque Facility and the Pasadena Facility.

Commenting on results for the period, D. Hunt Ramsbottom, President and CEO of Rentech, said, "We reported solid results for the year as we re-position the Company, reflecting reduced R&D expenses and strong nitrogen prices and demand. We are confident about our future, with Rentech Nitrogen positioned to expand as it benefits from strong nitrogen fundamentals, and Rentech benefiting from reduced corporate spending and potentially entering a new business line with immediate global growth opportunities and attractive returns."

Mr. Ramsbottom continued, "Beginning with the successful IPO of Rentech Nitrogen in late 2011, we have taken deliberate, thoughtful actions which have resulted in significant shareholder returns. We continue to focus on further value creation, recently announcing the elimination of R&D activities and pursuing a new business line with immediate or near-term profitability. We are excited about the potential for growth and returns from a new business and are optimistic about announcing our entry into the new business line in the coming months."

Special Cash Distribution and Share Repurchases

As a result of Rentech's successful execution of its strategy and the Board's ongoing evaluation of the best steps to utilize its capital and create shareholder value, Rentech returned $58.6 million of cash to shareholders in 2012. Rentech paid a special cash distribution to shareholders of $0.19 per common share, which represented approximately $42.2 million in payments to holders, on December 27, 2012. Approximately 75% of the distribution was a return of capital. In addition to this cash distribution, Rentech repurchased approximately 9.1 million shares in 2012, at an average price of $1.81 per share.

Redemption of Convertible Notes

Rentech redeemed all of its 4.00% convertible senior notes with principal amount of $57.5 million on December 31, 2012, in advance of their April 15, 2013 maturity. The early redemption resulted in interest savings of approximately $0.7 million. Upon redemption of the notes, Rentech, Inc. has no outstanding debt obligations, but those of Rentech Nitrogen Partners continue to appear on the Company's consolidated balance sheets.

R&D Facility Closure and Elimination of R&D Costs

Rentech has decided to eliminate spending on research and development (R&D) activities and significantly reduce other expenses related to alternative energy technologies for the foreseeable future. On February 28, 2013, Rentech announced its decision to cease operations, reduce staffing at, and mothball its research and development Product Demonstration Unit (PDU), a demonstration-scale plant located in Commerce City, Colorado, and to eliminate all related research and development activities. Any ongoing activities related to the Company's alternative energy technologies will be to protect patents, to maintain the Commerce City site if efforts to sell the site are unsuccessful, to continue low-cost efforts to seek partners who would provide funding to deploy Rentech's technologies or to sell or license the technologies to third parties who are developing projects.

Strategy

Rentech Nitrogen

Given Rentech Nitrogen's structure as a master limited partnership, management is focused on increasing cash available for distribution. Three growth projects are underway at Rentech Nitrogen's facilities, which are expected to be accretive to per unit cash distributions in the beginning of 2014 or sooner. A fourth growth project is being planned to produce approximately 15 megawatts of power from waste steam at the Pasadena Facility, to reduce the facility's electricity expenses and to create an additional revenue stream by exporting the remaining power for sale in the deregulated Texas power market. If financing for this project is obtained on schedule, this project is anticipated to begin contributing to cash distributions upon completion in the fall of 2014. Beyond these growth projects, Rentech Nitrogen has an active M&A team working on a prioritized list of opportunities to further enhance the Partnership's growth prospects.

Rentech

As previously disclosed, Rentech is focused on immediate growth opportunities that meet the following criteria: unlevered, after-tax returns in the mid-teens or higher; certainty of revenue with long-term contracts for off-take, providing stability of cash flows; no reliance on new technology; and opportunities to leverage Rentech's expertise and resources.

Rentech is continuing low-cost efforts to seek partners who would provide funding to deploy its alternative energy technologies or to sell or license the technologies to third parties who are developing projects. The Company will attempt to sell the PDU, as well as approximately 450 acres of land in Natchez, Mississippi acquired for the development of an alternative energy facility.

2013 Outlook

Rentech Nitrogen

In its press release dated March 19, 2013, Rentech Nitrogen issued guidance for cash available for distribution for the twelve months ending December 31, 2013 of approximately $2.60 per unit. The 2013 guidance includes the impact of two scheduled outages at its facilities during 2013, and the impact of lost revenue in 2013 due to the unscheduled outage at the East Dubuque Facility in December 2012. Excluding the effects of these outages the forecast for 2013 cash available for distribution would have been approximately $0.65 per unit higher.

Assuming product and input prices equal to those expected in 2013, Rentech Nitrogen noted that the increased annual production from its expansion projects scheduled to come online by the end of 2013 would be expected to add approximately $0.90 per unit of cash distributions and approximately $41 million of EBITDA.

Based on Rentech Nitrogen's current guidance of $2.60 per unit, and assuming Rentech's current ownership of 23.25 million units of Rentech Nitrogen, Rentech would receive approximately $60 million in cash distributions in 2013.

Rentech

Rentech provided the following guidance for cash selling, general and administrative (Cash SG&A) and R&D expenses for 2013, excluding Rentech Nitrogen:

%

2012 Actual 2013 Guidance

Change

Cash SG&A Expenses $21.4 million Approximately $20 million based on current run rate

Plus: Former R&D Expenses1 N/A Approximately $5 million, to be incurred over the second through fourth quarters

Total Cash SG&A Expenses $21.4 million Approximately $25 million

Total Cash R&D Expenses $21.0 million Approximately $5 million, to be incurred in the first quarter

Total Cash Operating Expenses $42.4 million Approximately $30 million (30%)

Dollar down along with wheat and corn. These are commodities linked to these stocks because their products are used to grow them. Just wanted to be clear that there is a direct relationship for comparison purposes.

I see you caught that. ;)

On CVR's website they tout that they are America's only Petroleum Coke based nitrogen fertilizer producer in BIG letters and it's a little hard to miss if he had just pulled up their webpage to begin with. ;)

The author makes mention of natural gas because that is the beginning process for RNF (who 'woulda thunk', right? Ahhhh! The things you learn on google!)

Where as UAN is Petro coke.

http://www.cvrpartners.com/Operations/processFlash.html

(and is gasifier a real word? ;)

It probably is dead money for 2013 as foretold by guidance. CV's UAN division uses coal or coke, not sure why author makes mention of natural gas. And, majority of UAN produced by RNF is used to treat diesel per gubment mandates.

Rentech Nitrogen Partners Forecasts Smaller Dividend, Buy On Dips For Future Growth

(NOTE: aside from one little mistake on a company comparison - this is a pretty good article - East)

Mar 24 2013, 02:35 |by: Tim Plaehn

http://seekingalpha.com/article/1296861-rentech-nitrogen-partners-forecasts-smaller-dividend-buy-on-dips-for-future-growth?source=yahoo

The three nitrogen fertilizer plant MLP stocks have always been of interest to me, but, in my opinion, over the last couple of years the shares have gotten pricey in relation to the variable nature of product and input pricing. Although it outran the competition in total return for 2012, Rentech Nitrogen Partners LP (RNF) offers interesting prospects for 2013 and into 2014.

Note: MLP companies such as Rentech Nitrogen Partners have units and pay distributions. The words stock, shares and dividends may be used here with the understanding that the rules of MLP units apply including the tax consequences of investing in MLP units.

The fertilizer MLP companies, Rentech Nitrogen, Terra Nitrogen LP (TNH) and CVR Partners LP (UAN) all own production facilities that use natural gas as a feedstock to produce nitrogen-based fertilizer products such as ammonia and UAN. Terra Nitrogen and CVR Partners each have a single production plant, while Rentech Nitrogen Partners made an acquisition in 2012 to double its locations to two.

Producing nitrogen based fertilizers is very profitable if natural gas prices are low and fertilizer prices are high. Fertilizer prices go up when grain - corn and wheat - prices are up. The last couple of years have been very good for these companies with low gas prices, high grain prices and tremendous profit margins. Investors should always bear in mind that if natural gas prices ever increase significantly, profits for these companies could be severely squeezed.

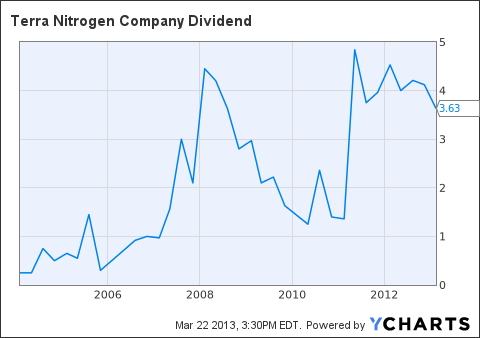

These companies all have a distribution policy of a full payout of the quarterly distributable cash flow. These distributions can and do vary significantly from quarter to quarter. The dividend volatility can be seen in this chart of the Terra Nitrogen quarterly distributions:

TNH Dividend data by YCharts

Rentech Nitrogen Grow Through Acquisition and Expansion

Breaking out of the mold of living off the production of a single production facility, Rentech Nitrogen acquired a second fertilizer plant in late 2012. The Pasadena, Texas plant acquired through the purchase of Agrifos Holdings is the third largest producer of ammonium sulfate fertilizer. According to the press release announcing the acquisition the product margins and seasonality of sales of the added product lines are generally less variable than those of ammonia.

Rentech Nitrogen plans to complete expansion projects at both plants in 2013, increasing capacity on several products by about 20%. For 2014 and 2015, the company is planning to add a 15 megawatt steam turbine at the Pasadena plant that will use steam producing by production to provide power for the plant and to sell into the power grid.

A Word on Rentech, Inc.

Rentech, Inc. (RTK) owns the general partner and 60% of the limited partner units of Rentech Nitrogen. The company does not receive incentive distribution rights from Nitrogen. The other businesses of Rentech, Inc. were attempts to produce viable operations from clean fuels and renewable energy technologies. For 2013, Rentech has all but shutdown its other operations and is currently just a cash collector of the Rentech Nitrogen distributions. The company is looking for ways to possibly sell some of its technology intellectual property and real estate and then find some new lines of business. At this point in time, I do not see any added value in Rentech, Inc. compared to Rentech Nitrogen Partners.

Buy On News of Lower 2013 Distribution

Rentech Nitrogen has provided guidance of $2.60 per unit in distributions for 2013, down from the $3.30 paid for 2012. A big part of the decline is due to a planned turnaround of the company's original East Dubuque, Illinois fertilizer plant. As of the March 19 year-end earnings report the company has orders for and hedged raw material costs for about 40% of the 2013 production.

Once the turnaround is complete and expansion projects completed, Rentech Nitrogen has the potential to generate $4.00 or better in distributable cash flow, assuming fertilizer and natural gas prices stay near their current levels. As a result, investors can expect to earn about a 7.5% distribution yield this year and look forward to potentially much higher payouts in future years.

Right now, Rentech Nitrogen shows an 8.4% to 11% yield - depending on the source, based on past distributions. When future, lower quarterly payouts are announced, it is very possible that the share price will drop on the news. The year 2013 should be viewed as an accumulation year for this fertilizer MLP, pick up units on the dips and profit from higher distributions in future years.

This sector is in drought and in need of one. All the farmers bought new Kubota's!

It's a young'n. Low float, great trade'n. Gotta use limit buy orders.

Is that a descending wedge on the dailies? Any upside here as we work our way into the apex? $34.80 was interesting if you didn't get shaken out yesterday.

Entire market is ugly. Not going to let this one get out of control. Will exit with a loss!

Buy limit @ 36.25 filled! We'll see what happens from here! Any details on the CC?

I think I'll be a buyer sometime today. Margins were down on plant shutdowns, but company still grew revs.

Yep. No problem. My analysis is worth exactly what you paid for it.

Thanks. I don't tend to follow patterns so I wasn't sure.

On the dailies? I kinda see one, but they should take much longer to develop and I like to see some symmetry in the left and right shoulder. I also think that the entire move in 2013 could be the head and that the right shoulder hasn't formed yet. Then again, you could say that what might be viewed as the left shoulder is consolidation and that we've broken out from there and have come back to test that area. Nonetheless, my timeframe is much shorter for a daily H&S to play out. I'm thinking a move up into earnings. I'll be out b4 then so it really won't be a concern for me.

Thinking about getting back in here with a really small position. I'd much rather buy near the 200 dma and it still can go there. I don't like that it broke trend, but it did go well beyond the gap that I see on the charts and earnings are coming up, so there might be a little bounce next week. Fertz are getting crushed over pricing concerns.

Sure looks like ya can!

Down -1.44 again

Getting out of this position at break even. Think I can reposition at a better price.

I don't look for news unless obvious. I pay more attention to technicals, but that's just me and how I trade.

There was something about RTK doing an IPO that was right around the time RNF started moving down, I believe , but I would have to go back and check. I was curious if that had something to do with it.

I'm not sure how that would fit into the whole picture - but let me snag the info.

It's a seeking alpha article (Go figure, right? lol)

http://seekingalpha.com/article/1157551-how-much-is-rentech-worth-as-a-standalone-company?source=yahoo

That was the only thing I saw on the day RNF started pulling back.

Also RNF went ex div on Feb 5th and a pullback isn't uncommon once they go ex dividend.

Oh wait...

Looking closer up - It's really Feb 8th that started it all for me. Okay UNCLE! I give up trying to figure it out! LOL

|

Followers

|

1

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

87

|

|

Created

|

08/02/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |