Monday, March 25, 2013 10:38:24 AM

(NOTE: aside from one little mistake on a company comparison - this is a pretty good article - East)

Mar 24 2013, 02:35 |by: Tim Plaehn

http://seekingalpha.com/article/1296861-rentech-nitrogen-partners-forecasts-smaller-dividend-buy-on-dips-for-future-growth?source=yahoo

The three nitrogen fertilizer plant MLP stocks have always been of interest to me, but, in my opinion, over the last couple of years the shares have gotten pricey in relation to the variable nature of product and input pricing. Although it outran the competition in total return for 2012, Rentech Nitrogen Partners LP (RNF) offers interesting prospects for 2013 and into 2014.

Note: MLP companies such as Rentech Nitrogen Partners have units and pay distributions. The words stock, shares and dividends may be used here with the understanding that the rules of MLP units apply including the tax consequences of investing in MLP units.

The fertilizer MLP companies, Rentech Nitrogen, Terra Nitrogen LP (TNH) and CVR Partners LP (UAN) all own production facilities that use natural gas as a feedstock to produce nitrogen-based fertilizer products such as ammonia and UAN. Terra Nitrogen and CVR Partners each have a single production plant, while Rentech Nitrogen Partners made an acquisition in 2012 to double its locations to two.

Producing nitrogen based fertilizers is very profitable if natural gas prices are low and fertilizer prices are high. Fertilizer prices go up when grain - corn and wheat - prices are up. The last couple of years have been very good for these companies with low gas prices, high grain prices and tremendous profit margins. Investors should always bear in mind that if natural gas prices ever increase significantly, profits for these companies could be severely squeezed.

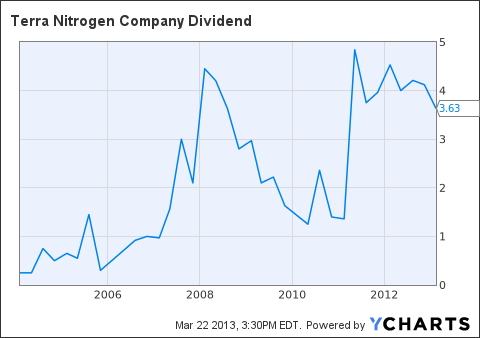

These companies all have a distribution policy of a full payout of the quarterly distributable cash flow. These distributions can and do vary significantly from quarter to quarter. The dividend volatility can be seen in this chart of the Terra Nitrogen quarterly distributions:

TNH Dividend data by YCharts

Rentech Nitrogen Grow Through Acquisition and Expansion

Breaking out of the mold of living off the production of a single production facility, Rentech Nitrogen acquired a second fertilizer plant in late 2012. The Pasadena, Texas plant acquired through the purchase of Agrifos Holdings is the third largest producer of ammonium sulfate fertilizer. According to the press release announcing the acquisition the product margins and seasonality of sales of the added product lines are generally less variable than those of ammonia.

Rentech Nitrogen plans to complete expansion projects at both plants in 2013, increasing capacity on several products by about 20%. For 2014 and 2015, the company is planning to add a 15 megawatt steam turbine at the Pasadena plant that will use steam producing by production to provide power for the plant and to sell into the power grid.

A Word on Rentech, Inc.

Rentech, Inc. (RTK) owns the general partner and 60% of the limited partner units of Rentech Nitrogen. The company does not receive incentive distribution rights from Nitrogen. The other businesses of Rentech, Inc. were attempts to produce viable operations from clean fuels and renewable energy technologies. For 2013, Rentech has all but shutdown its other operations and is currently just a cash collector of the Rentech Nitrogen distributions. The company is looking for ways to possibly sell some of its technology intellectual property and real estate and then find some new lines of business. At this point in time, I do not see any added value in Rentech, Inc. compared to Rentech Nitrogen Partners.

Buy On News of Lower 2013 Distribution

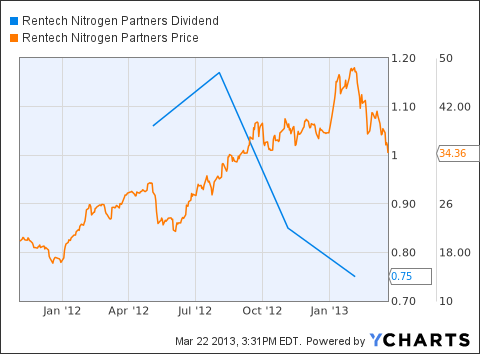

Rentech Nitrogen has provided guidance of $2.60 per unit in distributions for 2013, down from the $3.30 paid for 2012. A big part of the decline is due to a planned turnaround of the company's original East Dubuque, Illinois fertilizer plant. As of the March 19 year-end earnings report the company has orders for and hedged raw material costs for about 40% of the 2013 production.

Once the turnaround is complete and expansion projects completed, Rentech Nitrogen has the potential to generate $4.00 or better in distributable cash flow, assuming fertilizer and natural gas prices stay near their current levels. As a result, investors can expect to earn about a 7.5% distribution yield this year and look forward to potentially much higher payouts in future years.

Right now, Rentech Nitrogen shows an 8.4% to 11% yield - depending on the source, based on past distributions. When future, lower quarterly payouts are announced, it is very possible that the share price will drop on the news. The year 2013 should be viewed as an accumulation year for this fertilizer MLP, pick up units on the dips and profit from higher distributions in future years.

FEATURED ELEMENT79 ANNOUNCES UPLISTING TO OTCQB VENTURE MARKET • Aug 26, 2024 10:03 AM

North Bay Resources Announces Gold Assays up to 2.2 Ounces per Ton, Fran Gold Project, British Columbia • NBRI • Aug 26, 2024 10:00 AM

PickleJar Unveils Latest Venue Managed Services Innovations in Upcoming Webinar • PKLE • Aug 23, 2024 1:11 PM

Element79 Gold Corp Provides Update on Nevada Portfolio • ELMGF • Aug 23, 2024 8:00 AM

Maybacks Adds Award Winning Show to Its Lineup Discusses Maybacks Opportunity • AHRO • Aug 22, 2024 11:30 AM

North Bay Resources Announces First Gold Concentrate at Mt. Vernon Gold Mine, Assays 12 oz/ton Gold, 17.5 oz/ton Platinum, and 8 oz./ton Silver, Sierra County, California • NBRI • Aug 22, 2024 10:28 AM