Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Sleeping Giant, the graph looks amazing.

Happy to see Reliq performing, for a little long position.

Seems like they finally managed to turn a pilot into an order that that is a massive show of approval by clients, further validating the platform.

Reliq still suffers from SERIOUS Corporate issues I discussed in prior posts without any sign of improvement.

In addition, Reliq financial condition is precipitous and much more dilution is coming before shareholders are rewarded (possibly the reason why our CEO is carefully keeping HER own money elsewhere than invested on Reliq Equity:

Curren liabilities - -1.42 M

Current Assets - 0.374

A deficit of over 1 M dollar.

plus:

S&M -0.22M

G&A - 1.03

R&D - 0.46

Operating -1.72

Well over 2 M D loss per annum.

At 70% Gross - you need about 3 M$ per Annum to BE, and that is before expense expansion comes when some revenues show up (bank on it).

These type of numbers usually translate into massive selling pressure on the stock.

Wait and see how our Hero CEO does another PP at 7 cents (she already did one and diluted the hell out of shareholders who were too starry-eyed to realize what she did (that is the controlling shareholders who brought her aboard and pay her salary).

They need to really scale up sales fast, mHealth is a HOT sector, and they do not yet have any competitive advantage that is not easily breached.

Dilution is coming and with it the inevitable stock drop.

a good trading pattern will be to sell here and wait for the stressed out funding to pummel the stock way lower before buying again.

Stay safe.

Just beginning here.

I invested in LISA CROSSLEY as RQHTF CEO.

She's one of the best CEO out there.

glta:)

Wow! I held this one a long time @ .10. It did not do anything for months. Looked at it today and this thing is flying.

BOOM!

RQHTF will reach $$$ by next year.

Jmo.

NEWS OUT!

I am slowly ACCUMULATING HERE.

RQHTF IS A SLEEPING GIANT folks!

gltaLONGS:)

http://www.otcmarkets.com/stock/RQHTF/news/Reliq-Health-Announces-Appointment-of-Dr--Richard-Sztramko-as-Chief-Medical-Officer?id=169724&b=y

I understand what you're SAYING here.

But, imo, you better GRAB some more..

Soon WHALES will be here.

RQHTF is prime for a major run..

And I mean DEEP DEEP SILVER RUN.

Next week my FUNDS will be in.

I will SLAP the heck out without any WAITING good sir.

Jmho.

glta:)

I also hold a small long position.

Mind you, watch the FD Outstanding figure. The larger it is (due to dilution) the LESS impact the good news WILL HAVE on your holding.

The LARGER stock (not derivatives) position EXECUTIVES own, the LESS they are inclined to allow dilution.

Earlier caution is still warranted

News out today's.

I'm still here.

I still OWNED RQHTF.

If this doesn't MOVE RQHTF?

I don't know what will?

gltaLONGS!

https://www.yahoo.com/amphtml/finance/news/reliq-health-technologies-announces-live-120000258.html

That's good news for the Reliq Health Technologies.

However, what serious Investors will be paying very close attention to is this:

Will Dr. Lisa Crossley establish (at the market) a sizable position of the stock (trading now at 0.125$CAD, M.Cap 10 Mill)?

will IUGO Health (the underlying business) founders @LeoGodreault and Giancarlo De Lio @gdelio be buying ANY STOCK AT ALL?

Pay close attention to this indicator.

When all founders (Leo, Giancarlo, Lisa) come to the conclusion their IUGO Health (held by Reliq Health Technologies) is going to make investors rich, they will be the first ones to buy at the market at least a year's salary worth of Stock.

If they Don't - trust they have serious doubt of know not to risk their hard earned dollar, and you should follow what they do, not what they say.

careful study of financials and reports and deep DD on the people involves raises serious issues, per our opinions:

- Serious issues with the Board.

- Serious issues with the credibility of the financial backers.

- Serious issues with the Capital structure and massive dilution.

- Serious issues with compensation of the CEO.

- Serious issues with the stock holdings of the KEY terminals and leaders.

This business is still third rate nano business, being gutted for insiders.

Dr. Lisa Crossley has yet to succeed in bringing the credibility the business needs, even when the issues at stake were communicated to her.

Some paid stock promotion is going on on the internet, pay attention to cheerleaders who fail to point out the obvious failures of the business or fail to ask the CEO serious questions and just pump "good news" on twitter.

IUGO + Lisa's contacts may be a great idea.

Wrapped in the current corporate envelope and managed as it is right now - it should be off long term investor's list.

We will be monitoring the situation closely.

The best path forward for investors is a serious R/S (at least 10:1), bringing the S. count to single millions FD, wiping out old shady owners in the company and bringing in serious investors, board and large fully paid holding by execs, IUGO staff, and Board. Shrinking the Board to under 7 participants who actually bring serious value (no puppet board, no individuals reprimanded by Canadian securities commissions).

in other words, real business.

Until that time, the likelihood (IOHO) is any dollar value created will be funneled out by behind the curtain controllers of the company.

So, Reliq Health Technologies Inc $RHT.V had am amazing full ZERO revenues the last report (for 1Q2017), after CEO Lisa forcasted millions in the Bank for shareholders.

to fund its 1.5 million net loss with hardlly ANY CASH LEFT, the company issued more and more stock and warrants creating a very unfavourable FD share Count.

some posters here did not understand why leading figures, led by Lisa, made sure NOT to buy shares at the market, and the results explain well why.

Dr. Lisa Crossley gets an F in Financial control and D in Execution for first quarter 2017.

Massive damage to the Share count and massive damage to credibility.

The Board is a MESS of dilitants (IMHO), count the number of Directors! Google has less Directors.

Still heavy influence of stock promoters trying to offload.

Lisa KEEPS on making a point of not building a position in the business. It seems she knows her hard earned cash is better off elsewhere.

You just might take here lead. do as she does, not as she says.

Next up: second quarter 2017 results.

will we see breaking even business or more losses?

BTW. No CEO who is personally well invested dilutes herself by holding a PP @ sub 10 cents after the stock was way higher.

Check out the last PP.

But for someone who works there, it's just not important, as the upside comes form paycheck rather than stock appreciation.

All of this is investing 101.

I have seen many microcap with amazing ideas fail. They all had one thing in common: Terrible Incentive System - read: no owner operator at the helm.

Perhaps it will change.

LOOK, DON'T LISTEN!

A. 29G stock is Ridiculous amount in real $. She should own 1% of the outstanding stock to be able to say she has skin in the game with straight face, and no less than 200,000$ worth of stock, at this size.

B. The argument that Options & Stock provides "skin in the game" is ridiculous insufficient. Why? Because IT LACKS DOWNSIDE. Without downside risk an Exec IS AND WILL NEVER BE TRUELY ACCOUNTABLE. It is a "Heads - I win, Tail - you lose" situation.

C. The CFO, I believe and suspect is connected with the guys who funded the failed business before Lisa, and most likely hired, brought in and control Lisa and the business. They are so deep in losses, they have no choice but to keep funding the business if they ever want to recoup their losses.

I would not give much weight to that debt.

Once again,

Where are the 3 new leaders of the business in terms of real stock holding? Close to Zero.

Sorry, that's reality.

They can change it any time!

;)

Hey man..

Slow your roll dude.

My comment was regarding with the other poster.

Relax.

I got as much in this like ANYONE here.

Jeez.

Why risk your $$$ when MANAGEMENT is not risking theirs RIGHT?

This MESSAGE BOARD NEEDS more posters commenting on here.

Why the DEAD silence?

I would THINK several HUGE news are on the way should get RQHTF more EXCITED on ihub.

GLTA!

I get what you're SAYING.

Why risk your $$$ when MANAGEMENT is not risking theirs RIGHT?

Why dive in a swimming pool when there's NO WATER correct?

Suicide way to invest.

Point taking.

Imo..

This 2017 will be PIVOTAL YEAR for RQHTF.

SHOW improvement and ownership partnering then we are good to GO.

Glta!

Yes, it could.

The translation of profits to pps is not very attractive, and, eventually, this is what will drive Your Capital Gains.

The Incentive Structure is Terrible, and as Charlie Munger (BRK) says: Incentives are Everything.

These two factors might improve, and when they do, we might establish a significant position.

Until that time, we're doing what the insiders are doing! ;)

Calculate the FD including all the warrants and options.

Then, go compare with Constellation Software, whose CEO is an owner operator, to gain perspective how an OWNER treats issuing shares.

Check out how what is his FD outstanding figure and study what is the impact of every Cent of earning on the share price.

Check out how well or be did the investors do there...

Then you will be able to tell if $RHT.v is shareholder friendly or well managed.

" So far, NOT in building a successful business, as the past track shows "

----------------------------------------------------

The PAST hasn't been successful for this company.

Yes. I AGREE.

However, the fact that this SaaS PLATFORM software is being PILOTING with multiple POTENTIAL VENUES/CLIENTS should put some ease for investors GOING FORWARD.

Jmo..

GLTA!

Regarding OS SHARES..

OtcMarkets.com has RQHTF @....

Market Value1 $6,516,098 a/o Apr 07, 2017

Authorized Shares Unlimited a/o Nov 04, 2016

( Outstanding Shares ) 61,356,854 a/o Nov 04, 2016

What's so DISASTER with the OS around 60+ Millions shares?

Am I missing something here?

Did RQHTF INCREASED OS since then?

I may have to DIG DEEPER into this previous management team.

However, I've SEEN WORSE SS then RQHTF ATM.

*The RED ALERT I see is UNLIMITED AS..

Anytime I see anything UNLIMITED SS I CRINGED.

Thoughts?

Yes, and until I see here building a sizable % above 1, she has the burden of proof to show otherwise.

Why she is there?

Better Salary as a public company CEO than private?

Hope to achieve something great?

To be clear, not saying she is a crook. I don't believe she is.

But there is a VAST difference between being a hired gun and drawing large salaries and being AN OWNER OPERATOR GETTING RICH FROM SHARE OWNERSHIP WITH INVESTORS,

Even if she is as great as we think she is, whose interests does she promote?

Yours and mines?

Or the person who hired her and will fire her?

What his/their interest and objectives? So far, NOT in building a successful business, as the past track shows.

It's as simple as that.

She must, by here actions show investors she is NOT a pawn but rather someone with power to decide.

How will she do that with close to ZERO holding?

She can't.

Worse, she is not the source of the Tech!

And those that are, own even less.

WATCH the BOARD,

WATCH the INSIDER FILINGS

WATCH the 3 key personas holdings.

WATCH the ratio between cash compensation and % holdings.

When she will know she stands to make 10X here cash income by rise in pps, that's when she will be focused on Investors interests.

Lisa is the one good thing about this company. As an executive.

But to make it a great investment, she would have to think and treat it as here business. She must be an owner.

Having 20kCAD invested will not make it.

The owner calls the shots.

So far, they've been disastrous, as the OS shares will attest.

Will Lisa grow up to be an owner?

I don't know,

She was brought in by the owner, presumably to solve his problems.

She is a good talker.

But her actions tell the tale.

You STATED Dr. Lisa is their ( FRONT )?

Can you be more SPECIFIC?

Is Dr. Lisa just a PAWN? Lame duck?

Hire guns?

Q is...

Why would a SUCCESSFUL CEO, like Dr. Lisa, foolishly enter a bad situation in the FIRST PLACE?

Can you shed some input?

Tia!

GLTA..

Great POST.

You have given me something to THINK about.

Appreciated.

I followed Dr. Lisa as CEO.

Perhaps, ATM her authority is not in charge fully with RQHTF.

However, she is still the face of RQHTF currently.

That account for something.

Why Dr. Lisa has not taking OWNERSHIP yet?

I will MONITOR closely and perhaps email her INQUIRING as to why?

Regarding..previous management.

You're absolutely CORRECT this is still OTC MICRO and we KNOW shady CEOS are everywhere.

Thanks.

-chaka

What I don't like about reliq health technologies inc. $RHT.V - 2017 version.

1. Lisa makes a point of NOT Building an equity position, and only buying the least amount when pressured. She says options give her exposure, carefully avoiding mentioning the protect her downside.

2. The Technical Brains carefully hide from talking to investors. They make a point to have ZERO ownership. They prefer cash. That's zero trust in their work.

3. The filling suggests this company's board is bigger than Google. Although I talked with Lisa, this is not solved. It means the control of this business is out of her hand.

4. I can't establish who is the decision maker in the business, as he hides himself. I guess it's the PR/Financial backer who ousted the lady CEO. They never built IMHO a real successful business. It seems Lise is their "front".

5. The share structure is a disaster. With so many shares out, shareholders will see very little upside from pilot wins. They should have a massive reverse split, take FD share count under 10 millions and then start posting revenues.

Then again, perhaps that's what they are aiming at and that's why no insider establishes position.

6. Old CEO position overhang is providing a constant selling pressure.

Otherwise, the strategy is ok and the product is interesting.

Telemedicine is HOT. they need to execute, well, fast, or be left behind.

There are many ugly hairs on this one. Don't mistake it for great company. It's still shady little micro, and the CEO doesn't want or CANT resolve it.

When she straightens up the Board, when the she buys 1% of the business herself, when she demands all Board members to be owners or replaces them, when the other 2 key tech terminals start to buy significant stock at the market, these will be the signed Lisa wants to be a businesswoman and not "for hire" CEO, puppet for the financial predator firm that gave too much money to a failing CEO and just want to pump the stock high enough to be made whole on their failed involvement.

Remember, Lisa has GREAT reasons not to own 1%. If she know this is the chance of her live, she would invest at these low prices in a heartbeat! By here actions we know she is of firm opinion she doesn't think so.

As they say: Look, don't listen!

GLTA

Although, I got in late on RQHTF.

Imo..

This is the BOTTOM FLOOR for RQHTF ( .05-.10 level )

I OWNED ATM 25K SHARES.

But, I intend to owned between 50k-100k before the end of this year.

Hopefully, RQHTF can stay under .20 deep into 2017.

I DON'T like to GUARANTEE anything in life's, except death/taxes/prostitution )

But, RQHTF is as safe investment as they COME.

12-24 months MAJOR BOOMAGE SOON.

GLTA!

Way undervalued stock for sure.

Won't be long thou.

When CONTRACT and REVENUES report end of this year and beginning of next year?

The CHASE is on.

RQHFT already near profitable company.

I see HUGE EXPANSION within next 12-24 months.

Remember..SaaS software can be sold anywhere part of the world.

Doctors/nurses/physicians/family care is NEVER ENOUGH.

Imo..

This is my RETIREMENT stock investment.

Always BANK $$$ on successful CEO.

Dr. Lisa Crossley is just that.

She's a TOP of the cream in terms of entrepreneur.

GLTA!

Wow!

This stock move so fluidly..

What a GEM here.

Dr. Lisa Crossley is what I'm BANKING on this stock.

I'm GLAD I'm in @ such low prices indeed.

LOCK n LOAD.

HOLD RQHTF in 2-5 years..

$$$RQHTF$$$

Fundamental CASH COW

Reliq is a future cash cow, and i should even say cash cows. The news today represents just 1 agreement, let us not forget Reliq currently has 4 other ongoing pilots...

- Sacred Heart is a member of the very large Ascension Health. With 2,500 sites of care in 24 states and the District of Columbia, Ascension Health is the US’s largest non-profit health system and the world’s largest Catholic health system.

- The National Health Service (NHS) is the publicly funded healthcare system for England and it is the largest and the oldest single-payer healthcare system in the world.

- The Feldman Institute in Louisiana is an interventional pain management clinic and surgical center, and is considered to be a regional center that serves a large group of patients within Louisiana and its surroundings.

- Hamilton Health Sciences (HHS) is a family of seven unique hospitals, a cancer centre and an urgent care centre, serving more than 2.3 million residents of Hamilton and south central Ontario, Canada. HHS is the second largest hospital group in Ontario.

Now...just this 1 agreement with Paz home health represents a ANNUAL RECURRING REVENUES of +6M USD

And that represents only 40% of the potential clients on just this 1 deal.

Do the numbers using market multiples on revenue.....$80 Million,,,,

Now imagine if they lock in the other 4 ongoing pilots,,,,,

We are talking about MASSIVE numbers,,,

One day investors will be running after RHT shares....and times flies..

News out....signed contact....8m/year.....

Grab all you can at these bargain prices.

I´m in a hurry

just read those news from today

weeeeeeeeeeeee

Nw12

Reliq Health is gonna be a Marijuana Beast

It Just entered into a Memorandum of Understanding (MOU) with Invictus MD Strategies Corp. ("Invictus MD") to develop a mobile application for cannabis patients and consumers and their clinical care teams. Reliq Health

RQHTF a healthcare technology company focused on developing innovative mobile health and telemedicine solutions, has developed a novel SaaS (software as a service) solution for the community health care market. The solution provides automated remote patient monitoring in the home and secure cloud-based communication, care planning and collaboration for all members of the patient's circle of care. Reliq's secure platform allows clinicians to collect comprehensive data on patients' clinical conditions, medication usage, symptoms, side effects and behaviours - creating a wealth of population health data. Read this full release and recent news releases for Reliq Health Technologies ( RQHTF )

Canada closed at 0.16 with almost 700.000 in volume.....

This stock and the company looks quite interesting,

guess i will buy some shares in the coming days as an appetizer.

The company´s presentation should be studied as it offers a real investment opportunity, imo.

http://reliqhealth.com/wp-content/uploads/2016/05/Reliq-Health-Investor-Deck-November.pdf

NW12

Just wandering around

Anyone have an idea of the float here w/o me reading through the fillings ?

Great post !!! Looking for a strong day .

They will and chase I'm adding. Mj and health care from Canada. $$$$$

same here. The masses will find it ![]()

This will be huge I'm holding my shares for a lot higher price. $RQHTF

This sector is about to boom, These apps make it easy for the Dr's to keep track of what going on with their patients. I'm expecting a big week next week.

For investors looking for a growth stock that is disrupting a multi-billion-dollar market, market expert Michael Berger — President of Technical420 — highlights a Canadian-based development-stage healthcare technology company that is very undervalued and has remarkable growth potential.

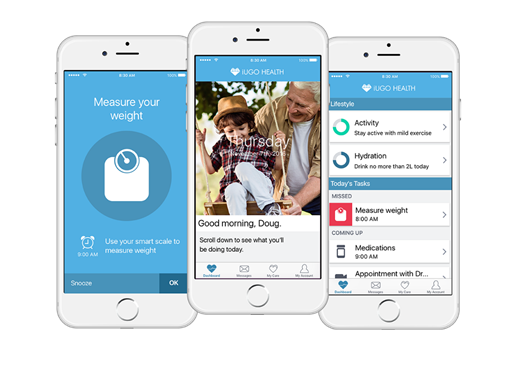

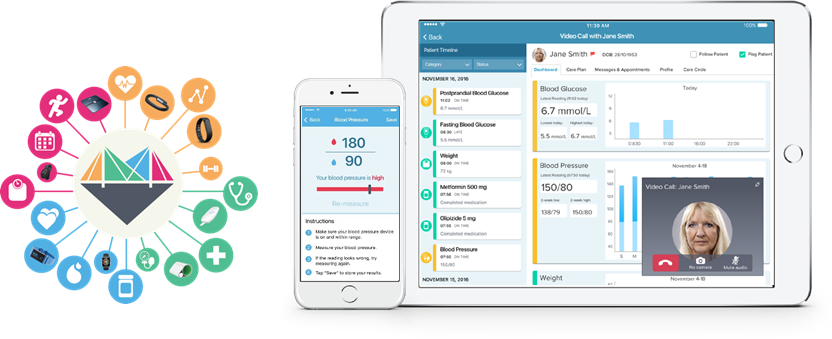

Reliq Health Technologies (RHT: TSX Venture) (RQHTF: OTC) is a healthcare technology company that specializes in developing innovative, secure mobile software solutions for the multi-billion-dollar community care market.

Reliq offers a state-of-the-art iUGO Care platform, a comprehensive hardware and software solution that allows patients to receive high-quality care at home, which leads to improving health outcomes, a better quality of life for patients, and a lower cost of care.

The iUGO Care solution integrates wearables, sensors, a proprietary voice technology hub, and mobile apps and desktop interfaces for patients, clinicians and healthcare administrators. Reliq Health's proprietary iUGO Care hardware and software supports patients and their caregivers in the home, providing remote monitoring with alerts to clinicians as needed, audible reminders to improve patient compliance with prescribed medication regimens and lifestyle changes, tailored digital patient education materials and secure communication with the entire care team.

Investment Thesis

We are favorable on Reliq due to its ability to disrupt a multi-billion-dollar market, its strong management team that continues to execute on its initiatives, its four pilot programs, and its attractive valuation.

Piloting its Virtual Care Technology in the UK

In August 2016 Reliq announced that it had secured a pilot with the National Health Service in the UK. The pilot is focused on congestive heart failure and diabetes, two of the most common chronic conditions in the UK. Currently there are more than 15 million people in England that live with at least one long-term health condition.

Earlier this month, Reliq Health announced that it has started enrolling patients in the pilot of its remote patient monitoring and care collaboration solution with the NHS England. The goal of the pilot is to demonstrate the value of Reliq Health's self-care solution in improving health outcomes and reducing the cost of care delivery for chronic disease patients after they are discharged home from hospital. Imperial College Hospital, London, UK will serve as the clinical partner for this pilot.

The NHS England is the largest single-payer healthcare system in the world, with an annual budget of over £100 Billion. There are over 15 million patients in England who are coping with at least one long-term health condition. NHS England has estimated that improvements in self-care in this population could result in £584m in savings by 2021.

Executing on Two Pilots and a White-Label Contract in the United States

Reliq Health has announced two pilot programs in the United States. In one of these pilots, the company will be working with the interventional pain management clinic and surgical center at The Feldman Institute in Baton Rouge, Louisiana. The pilot will evaluate the use of Reliq Health’s technology with patients who have been discharged home after interventional pain management surgery, or have returned to their homes between treatments at The Feldman Institute.

The second pilot, which we are very excited about, is its program with Sacred Heart Health System in Florida. The Sacred Heart Health System is a healthcare network in Northern Florida consisting of three hospitals and Sacred Heart Medical Group, a large regional network of primary care and specialty physicians with offices across seven coastal counties. Sacred Heart is part of Ascension Health, the nation's largest system of Catholic and non-profit health care facilities.

The company has also secured a US$1.22M contract to provide professional services and a limited license to Reliq’s proprietary iUGO Care platform, specifically for the development of a consumer focused mobile health app (Mindful Health App) that will be provided by the City of San Antonio, TX to its residents to support them in proactively managing their own health.

Led by a Strong Management Team

Reliq Health is led by a strong management team with a proven track record of success before joining the company. Reliq’s CEO Lisa Crossley is an experienced healthcare IT executive and had previously served as the CEO of VitalHub Corp., Quantum Dental and Natrix Separations.

Giancarlo De Lio is the company’s Chief Visionary Officer. Giancarlo has a strong background in healthcare and information technology and a global network in the healthcare space. Giancarlo is a serial entrepreneur who previously founded and/or led successful businesses in the digital, mobility, healthcare and IT industries.

Reliq Health CFO Aman Thindal is a key component of Reliq’s team given his background in financial reporting, corporate structuring and tax management. He was previously the CFO of a mid-tier real estate development firm where he had been able to successfully raise capital.

Leo Godreault serves as the Vice President of Products and his background as a healthcare IT entrepreneur is a major benefit for Reliq. Prior to joining Reliq Health, Godreault founded SmartMED, a successful healthcare startup.

In late July, Reliq Health strengthened its Board of Directors through the addition of Brian Storseth. Prior to joining Reliq, Storseth was a Member of Parliament with the Conservative Party of Canada for 9 years from 2006 to 2015. During his tenure as an MP he served on committees for Aboriginal affairs, agriculture and agri-food.

Attractive Valuation

Reliq Health currently has a very small market capitalization, but with pilots in progress with multiple large hospital networks in North America and Europe, we feel it is poised for tremendous growth and associated increase in market cap. For this reason, we believe Reliq is significantly undervalued and underappreciated by Wall Street.

Reliq Health offers a very attractive opportunity for investors after it secured several pilot programs and this provides the market with a visible path for growth.

If Reliq is able to close at least one of the pilot programs, the company will be positioned for significant growth. Reliq currently has four pilot programs and this is very attractive since we expect to see them secure deals from at least two of these clients.

Tickers Mentioned: Tickers: RHT.V, RQHTF

http://www.moneyshow.com/articles/daytraders-45327/a-healthcare-disruptor-in-a-multi-billion-dollar-industry

Decent churn today let's crack .15 tomorrow

$RQHTF .15 got tapped this morning let's see .15 become new support today.

|

Followers

|

31

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

644

|

|

Created

|

06/13/09

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |