Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

1,000 Feet Above the Streets

http://www.bloomberg.com/video/how-high-can-a-dollar-take-you-dY~~zjhqS3mViFdXR3~QBQ.html

How Jamie Dimon Whiffed on the Volcker Rule

By Steve Liesman | CNBC – 2 hours 49 minutes ago

If the Jamie Dimon hearing was ever going to be more than just political theater, it would have answered at least one essential question: Would the Volcker rule have prevented the so-called hedges that led to $2 billion in losses at JPMorgan?

Instead, and incredibly, Dimon contended twice that he didn't know what the Volcker rule says. "I don't know what the Volcker Rule is, it hasn't been written yet," the regaled banking chief told senators today.

Note to Mr. Dimon and his handlers: The proposed rule, mandated by the Dodd-Frank legislation, was published in November in the Federal Register and opened for public comment. Financial regulators are now in the process of finalizing it. That, after all, is why there's a discussion. If the trade and the losses inform the rule, there's still time to change it.

At least somewhat contradictorily, the chief of JPMorgan (JPM) had earlier said it wasn't clear that the rule would have prevented the trade. A little later he said, "It may very well have stopped parts of what this portfolio morphed into." Which is it? Does he not know what's been in the proposed rule that's been available for seven months, or does he know enough about the rule to say it would not have prevented the trade?

Fortunately for Dimon, the senators didn't seem to know much more than he did. Had they taken the time to read the rule, they would have known that proposed rule requires a series of compliance steps that would appear to have had a profound effect on the errant trades.

The proposed Volcker rule does allow for hedging of bank holdings, so-called macro-hedging. But it generally prohibits a hedge that "creates significant new risk exposure." (Read more about the Volcker Rule).

To Dimon's own statements that the trades were poorly vetted and supervised, the Volcker rule has a six-step process for ensuring that a hedge is allowed. It requires any bank that engages in hedging "to develop and implement a program" that ensures compliance with the rule. A written plan is required, monitoring is required, training is required.

On the issue of rogue traders or a rogue unit, the rule says: "A banking entity's compliance regime must include written hedging policies at the trading unit level and clearly articulated trader mandates for each trader to ensure that the decision of when and how to put on a hedge is consistent with such policies and mandates."

In short, even a cursory reading of the rule suggests JPMorgan would have been required to do many of the things that Dimon says were not done when it came to the big hedges.

It is intensely complicated. And there remains a debate about whether the traders would be considered hedges at all. Dimon speaks of the trades morphing and appears to mean from a hedge to a proprietary trade.

But what was the hearing for if not to figure out the best regulatory policy? Dimon should have come prepared to do battle over meaningful policy. If he was indeed unprepared, senators should have made it their business to point that out.

It was a missed opportunity.

http://finance.yahoo.com/news/jamie-dimon-whiffed-volcker-rule-203559811.html

No One But Paul -- Can Beat Obama

One thing that I have came to realize is that our world that we live in is under serve attack from all kinds of un-seen things, and we as a society must realize that everything around you is created by the creator and that is all mighty God and His Son Christ Jesus and the Holy Spirit.

God which is an invisible God, created the blue invisible sky, air, water and everything and we as a human race were created in GODs Image and His Son Jesus is God. We got to do what God in the 3rd Heaven tells us, as people in the image of God, tells us to do. We got to get back to the teaches from Christ and that's the Holy Bible.

This is real life, this is real news.

Whats that there putting in the water??? Fluoride??? Well its good for your teeth wink ;) ummm... NO! Real news wake up!!!

Quaint Aussie fog is actually a horrifying spider web

http://now.msn.com/now/0307-spider-forest.aspx

Spider Web Forest Is Beautiful And Terrifying

http://www.buzzfeed.com/gavon/spider-web-forrest-is-beautiful-and-terrifying

Bailout Total $154 trillion - added to the U.S. Public Debt? -

666 Bailout! Federal Reserve Now Backstopping $75 Trillion Of Bank Of America's Derivatives Trades -

Submitted by ronpaul_d_1 on Wed, 10/19/2011 - 01:35

the bottom lines....

You will also read below that JP Morgan is apparently doing

the same thing with $79 trillion of notional derivatives

guaranteed by the FDIC and Federal Reserve.

What this means for you is that when Europe finally implodes

and banks fail, U.S. taxpayers will hold the bag for trillions

in CDS insurance contracts sold by Bank of America and JP

Morgan.

Even worse, the total exposure is unknown because Wall Street

successfully lobbied during Dodd-Frank passage so that no

central exchange would exist keeping track of net derivative

exposure.

Note...

Total $154 trillion - added to the U.S. Public Debt -

http://www.dailypaul.com/183521/holy-bailout-federal-reserve-now-backstopping-75-trillion-of-bank-of-americas-derivatives-trades

This story from Bloomberg just hit the wires this morning.

Bank of America is shifting derivatives in its Merrill

investment banking unit to its depository arm, which has

access to the Fed discount window and is protected by the FDIC.

This means that the investment bank's European derivatives

exposure is now backstopped by U.S. taxpayers.

Bank of America didn't get regulatory approval to do this,

they just did it at the request of frightened counterparties.

Now the Fed and the FDIC are fighting as to whether this

was sound.

The Fed wants to "give relief" to the bank holding company,

which is under heavy pressure.

This is a direct transfer of risk to the taxpayer done by

the bank without approval by regulators and without public

input.

You will also read below that JP Morgan is apparently doing

the same thing with $79 trillion of notional derivatives

guaranteed by the FDIC and Federal Reserve.

What this means for you is that when Europe finally implodes

and banks fail, U.S. taxpayers will hold the bag for trillions

in CDS insurance contracts sold by Bank of America and JP

Morgan.

Even worse, the total exposure is unknown because Wall Street

successfully lobbied during Dodd-Frank passage so that no

central exchange would exist keeping track of net derivative

exposure.

This is a recipe for Armageddon.

Bernanke is absolutely insane.

No wonder Geithner has been hopping all over Europe begging

and cajoling leaders to put together a massive bailout

of troubled banks.

His worst nightmare is Eurozone bank defaults leading to

the collapse of the large U.S. banks who have been happily

selling default insurance on European banks since

the crisis began.

http://dailybail.com/home/holy-bailout-federal-reserve-now-backstopping-75-trillion-of.html

888 - Reasons to Impeach Obama - E.g., Terry Jones 2012 -

http://www.standupamericanow.org/articles/2012/01/terry-jones-2012-8-reasons-to-impeach-obama

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70694040

Koran-Burning Pastor: Impeach Obama -

Posted by Ben on January 9, 2012 ·

Comments (5)

http://www.impeachobamacampaign.com/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70671429

Bailout: $29.616 Trillion Dollars -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69839177

THE LOOTING OF AMERICA.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=65676391

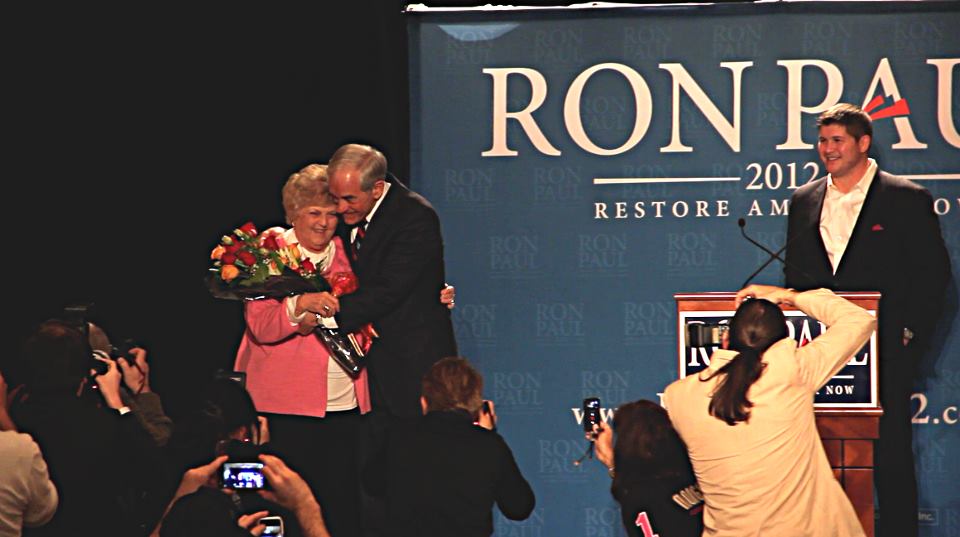

Ron Paul 2012 WELCOME -

http://www.ronpaul2012.com/

http://www.ronpaul2012.com/2011/07/20/ames-money-bomb-a-success/

http://www.facebook.com/ronpaul12?sk=wall&filter=2

http://www.ronpaul.com/

http://investorshub.advfn.com/boards/board.aspx?board_id=9201

The BS and the banksters cult...well, they should be in prison -

WAKE UP PEOPLE! Get $16 trillions back from the banksters who

robbed US PEOPLE -

and be $2 trillion ahead so...e.g.,

- NO MORE TAXES FOR PEOPLE - said by our RON PAUL -

http://endoftheamericandream.com/archives/the-looting-of-america-the-federal-reserve-made-16-trillion-in-secret-loans-to-their-bankster-friends-and-the-media-is-ignoring-the-eye-popping-corruption-that-has-been-uncovered

The super red banksters 666 cults -

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

Bush, Fed, Europe Banks in $15 Trillion Fraud, All Documented

http://www.veteranstoday.com/2012/02/21/intel-exclusive-trillion-dollar-terror-exposed/

Original post by Zardiw

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72604063

http://www.youtube.com/watch?v=eL5hqvTWkYg&feature=player_embedded

Ron Paul-Packed the house @ MSU;

http://www.dailypaul.com/216866/short-video-ron-paul-at-msu

Ron Paul receives a warm welcome from the 4000+ attendees at Michigan State University.

http://www.youtube.com/watch?feature=player_embedded&v=o9iEtZnrb3M

http://www.youtube.com/watch?v=GCIlX7hLYxQ

The crowd, just before Ron Paul enters the stage;

You are spirit, soul, and body. 1 Thessalonians 5:23. You are a spirit, that has a soul, that lives in a physical body

CNN WORRIED About Ron Paul's Success!

I looked-up the words; "Butt Ugly" and sure enough, there was an image of Dana Bash' face. lol

Look it up. lol

Next time a doctor or any medical professional try to push vaccines or ANY type of medicine on you, try to find out more about whats in it.

Watch and Learn

Mont. man gets 25 years prison for investment scam

By SCOTT SONNER | AP – 1 hr 45 mins ago

RENO, Nev. (AP) — A Montana man convicted of running an investment scam on the Internet was sentenced Tuesday to 25 years in federal prison and ordered to pay $13.2 million in restitution to more than 1,400 investors.

U.S. District Judge Larry Hicks in Reno told Rick Young, 52, of Lewistown, that the fraud carried out by his Nevada-based Global One Group from 2006 to 2007 was "incredibly repulsive."

Many of the victims, the judge said, were vulnerable, "middle-class working people taking money out of accounts, trading out of their 401(k) plans, their pension plans, even off of their credit cards."

"Frankly, it was nothing more than a type of Ponzi scheme, but it was incredibly sophisticated," he said.

Among other things, prosecutors said Young and his partner used the money for their own gain in 2006 and 2007 partly by falsely marketing the Global One as a licensed securities broker. A federal jury in March convicted Young of one count of conspiracy to commit mail and wire fraud, two counts of wire fraud, three counts of money laundering and one count of securities fraud.

Young appealed to the judge for "mercy and leniency" so that he might see his disabled 49-year-old wife again before one of them dies.

"This case is a big cluster. It's all messed up," said Young, who denied any criminal wrongdoing and said he was a victim of overzealous law enforcement and a former business partners who stole from him.

"I never thought in 1,000 years I'd be sitting here. It shows the glaring injustice of the justice system," he said. "Maybe I was a bad businessman. Maybe I made some mistakes. But never did I step out to do something criminal."

Hicks said that he had to give Young credit for one thing — his "smooth" sales techniques on his webcasts.

"It's the court's view the defendant obviously was impressed with his own skills in salesmanship that he could tell his story to the jury just as successfully," he said. He said Young may have begun with some good intentions but "got carried away" in a "snowball" of greed.

"By the time it was at the bottom of the hill, he was so deeply mired in the fraud of these people that this court finds it, frankly, incredibly repulsive," he said.

Young's co-defendant, William Willard, 68, of Bozeman, Mont., was sentenced later Tuesday to 15 months in prison. Prosecutors recommended that penalty based on his cooperation in the investigation and in the prosecution of Young. Willard pleaded guilty in February to conspiracy to commit wire fraud.

Assistant U.S. Attorney Steven Myhre acknowledged it was a harsh penalty to seek for white-collar crime but Young deserved 30 years in prison.

"Young molded and perfected a sophisticated and wide-ranging fraud perpetrated over a three-year period where he controlled all the money, manipulated information, drained the savings of victims, captivated and brainwashed others through repeated lies and false promises spewed over and over again through the Internet, defamed and denigrated those who dared challenge him and enriched himself in the process without a care for those who suffered enormous loss," Myhre wrote in a sentencing brief.

Hicks also rejected a defense request that Young be allowed to serve the sentences for various counts concurrently instead one after another, which have put his sentence somewhere between 17 and 20 years.

"I feel this case is so aggravated it calls for something more than a concurrent sentence," the judge said.

"This is such a massive fraud with so many victims who suffered such real loss and whose lives are still affected," said Hicks, who's been on the federal bench 10 years but said he couldn't recall a case where the criminal activity had adversely affected so many people so seriously.

Prosecutors said Young, Willard and others marketed Global One, which wasn't a licensed broker, as a company that provided educational opportunities on trading techniques on the foreign exchange market. Investors were charged $500 annual memberships for access to Global One's website, conference calls and Web-based seminars, and instructed to open accounts with foreign exchange brokers recommended by Global One.

In presentations, investors were told that Young made 8,000 successful trades in a year without suffering one loss, and that the company had a software program that could automatically execute trades.

Prosecutors said the claims were not true and there was no automatic trader, even though Young could be seen on webcasts telling investors it was "working its magic."

"Go Auto! Go Auto!" Young would say while three people manually executed the trades.

Prosecutors said they could not confirm it was a record, but that the 25-year sentence was one of the most significant ever for white-collar crime in that district of Nevada. The added length was due in part to Young portraying himself as a "man of God" and appealing to investors religious faith, they said.

Myhre said in a statement after the sentencing that the case shows consumers should be suspicious of so-called investment experts who offer above-average rates of return, as well as those who "appeal to your personal status, such as your religious beliefs, need for financial security and sense of belonging."

http://news.yahoo.com/mont-man-gets-25-years-prison-investment-scam-233625915.html

WOW who Wants to be a Trillionaire for only $5 bucks NO wait there's more who wants to be a Quadrillionaire for only $50 bucks well here you go!!!

www.templetoncollectibles.com/product/quadrillionaire-special-10-pack-of-100-trillion-zimbabwe-notes

en.wikipedia.org/wiki/Hyperinflation#Zimbabwe

U.S.A END THE PRIVATE FED NOW

Is it really ok for the congress to inside trade :-P

ummm...NOOOOOOOOOOOOOO!!!!!!!

Wake up to the private fed or we will end up like this www.ebay.com/itm/Vietnam-100K-Dong-1-100K-Note-Vietnamese-Circulated-/260905604863?pt=Paper_Money&hash=item3cbf2f96ff

or this www.ebay.com/itm/100-TRILLION-ZIMBABWE-DOLLARS-1-BILLION-YUGOSLAVIA-/330526458056?_trksid=p3286.m7&_trkparms=algo%3DLVI%26itu%3DUCI%26otn%3D3%26po%3DLVI%26ps%3D63%26clkid%3D4587487189086340190

All this is going on... Why are we Standing in line for china made mess and buying it on plastic Please WAKE UP

Prepare For Super Red Martial Law - US to be

the bolsheviks USSR next -

http://www.realzionistnews.com/?p=674

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69125572

Growing trust in gold makes it the perfect place to hide ![]() -

-

Nov 16th, 2011 15:37 by News

16-Nov (Mineweb) —

A loss of faith in the political system and the currencies

that underpin it has been growing over the past few months.

Its most visible manifestation is the “Occupy movement that

has moved from Wall Street all over the world.

Its second most visible manifestation, some would argue,

is the price of gold and the throngs of investors that

are buying the yellow metal in all shapes and forms.

Speaking to Mineweb.com’s Gold Weekly podcast, Erste Group

gold analyst, Ronald Stoeferle says that in recent months

there has been a distinct shift in investor attitudes

and a growth in fear.

“Where before at the end of presentations I was asked whether

or not gold was in a bubble and what my long term price targets

are, no I am increasingly asked for my views on gold

confiscation and what the chances are like for

further riots in the streets,” he said.

“The monetary aspect of gold is getting more and more important.

People don’t want to make big money, they just want to preserve

their purchasing power and their wealth.”

CALVF a profitable low cost Gold Producer -

with plenty of Golden hard rock treasure -

well hidden Gold chests - oversold & undervalued -

strategic Golden bargain play -

CALVF Caledonia Mining Cp - Technical Analysis -

Note. Bullish across the board on CALVF -

http://www.stockta.com/cgi-bin/analysis.pl?symb=CALVF&num1=11&cobrand=&mode=stock

CAL TA - Stock Technical Analysis -

http://www.stockta.com/cgi-bin/analysis.pl?symb=CAL.C&num1=11&cobrand=&mode=stock

Note. Bullish across the board on CAL -

The big boys keep adding...

Caledonia 3rd Q's Recorded Net Profit of $8,442,000 compared

to $742,000 in the comparative quarter which represents

an 11-fold increase -

history often repeat itself -

What if we invest in Caledonia Mining Corporation and

CALVF become a LION -

ex. in 1975?..

take a look at the past gains in

a few Gold mining juniors:

What if we invest in Caledonia Mining Corporation and

CALVF become a LION -

note.

it was in 1980 and the Gold price high @ fiat$875.-/oz -

when Gold goes higher the Gold stock prices

will explode compared to the above LION -

Blanket Gold Mines Field - 268 gold mines workings been discovered -

some hand dugg shafts etc. 1000yrs old and many recent workings

since the last 100yrs -

CALVF has only got a sniff of the golden mother load below -

Gwanda Greenstone Belt - Blanket Mine Producing Claims

Click on map to view larger version.

working on to extend the Lima shaft to 1000m deep base to

facilitate production capacity to Au 100,000 ounces per year ![]()

and with the great cash flow to reopen many more of the old

gold mines workings for the mill capacity is available - ![]()

http://www.caledoniamining.com/blanket4test2.php#

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68975731

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68970432

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

Lost kingdoms of Africa: Zimbabwe part 1

That's disappointing and to think I read they were involved in litigation that supported posters rights to free speach!

Karzai: Afghan backs Pakistan if US attacks it

KABUL, Afghanistan (AP) — Afghan President Hamid Karzai has said if the United States and Pakistan ever went to war, his country would back Islamabad, drawing a sharp rebuke Sunday from Afghan lawmakers who claimed the country's top officials were adopting hypocritical positions.

The scenario is exceedingly unlikely and appears to be less a serious statement of policy than an Afghan overture to Pakistan, just days after Karzai and U.S. Secretary of State Hillary Rodham Clinton said Islamabad must do more to crack down on militants using its territory as a staging ground for attacks on Afghanistan.

"If fighting starts between Pakistan and the U.S., we are beside Pakistan," Karzai said is an interview with private Pakistani television station GEO that aired Saturday. "If Pakistan is attacked and the people of Pakistan need Afghanistan's help, Afghanistan will be there with you."

He said that Kabul would not allow any nation, including the U.S., to dictate its policies.

Both Washington and Kabul have repeatedly said Pakistan is providing sanctuary to militant groups launching attacks in Afghanistan.

The comments set off a firestorm of criticism in the country. Afghan lawmakers argued they were particularly hypocritical coming just weeks after the assassination of former Afghan President Burhanuddin Rabbani by a suicide bomber.

While it is unclear who masterminded Rabbani's killing, the Afghan government has said it was planned in the Pakistani city of Quetta, the Taliban leadership's suspected base. In addition, the Afghan interior minister accused the Pakistani intelligence service of being involved — a claim that has not been substantiated.

"Pakistan has never been honest with Afghanistan, and the nation of Afghanistan will never forget those things that happen here" because of Pakistan, Shah Gul Rezaye, a lawmaker from Ghazni province told The Associated Press, citing Rabbani's death and other incidents of violence.

"They make deal with terrorists, and then with the international community ... to get $1 billion from the U.S. under the name of the struggle against terrorism," she said.

The U.S. Embassy in Kabul said it was up to the Afghan government to explain Karzai's remarks.

"This is not about war with each other," Embassy spokesman Gavin Sundwall told the AP. "This is about a joint approach to a threat to all three of our countries: insurgents and terrorists who attack Afghans, Pakistanis, and Americans."

Following her stop in Kabul, Clinton flew to Pakistan to deliver the blunt message that if Islamabad is unwilling or unable to take the fight to the al-Qaida and Taliban-linked Haqqani network operating from its border with Afghanistan, the U.S. "would show" them how to eliminate its safe havens.

Even so, she said the U.S. has no intention of deploying U.S. forces on Pakistani soil, and that the favored approach was one of reconciliation and peace — an effort that needed Islamabad's cooperation.

Pakistan has been reluctant to move more forcefully against the Haqqani, arguing such an act could spark a broader tribal war in the region.

While it weighs its options, NATO pressed ahead with its operations.

The U.S.-led coalition and Afghan forces on Saturday concluded two operations aimed at disrupting insurgent operations in Kabul, provinces south of the Afghan capital and along the eastern border with Pakistan — all places where the Haqqani network has launched attacks.

NATO did not release further details about the operations, but Army Lt. Col. Jimmie Cummings, a coalition spokesman, said Sunday that "a number of Haqqani affiliated insurgents plus additional fighters have been either detained or killed in the course of operations."

During her visit to Pakistan, Clinton said Haqqani fighters were among those killed and captured during the operations.

"Many dozens, if not into the hundreds, have been captured or killed on the Afghan side of the border," she said in Islamabad.

The push comes as NATO plans to pull out its combat forces by the end of 2014 and hand over full security responsibility to the Afghans.

But the attacks and assassination attempts continue.

In the latest such incident, bodyguards for Afghan Interior Minister Bismullah Khan Mohammadi shot and killed a would-be suicide bomber who was waiting for the minister's convoy Sunday in Sayyed Khel district of Parwan province, north of Kabul, the ministry said. The minister was not in the convoy at the time.

NATO also said three of its service members were killed separate clashes with insurgents in the south and east of the country. The coalition did not provide additional details, but the deaths, which occurred Saturday and Sunday, raised to 474 the number of NATO service members killed so far this year in Afghanistan.

Also, five villagers were killed while trying to remove a roadside mine planted by the Taliban in the western province of Herat, the provincial governor's spokesman, Mohyaddin Noori, said Sunday.

Associated Press writers Amir Shah and Deb Riechmann in Kabul contributed to this report.

http://news.yahoo.com/karzai-afghan-backs-pakistan-us-attacks-150818034.html

Russia bans entry to US officials in retaliation

MOSCOW (AP) — Russia has banned entry to U.S. officials allegedly involved in killings and abductions, a strong response to Washington's blacklisting of Russian officials involved in the prison death of a whistleblower.

The Foreign Ministry said in a statement Saturday it was blacklisting unspecified U.S. officials it claims were involved in the abductions of alleged terrorism suspects, the torture of inmates at Guantanamo prison, the killings of civilians in Afghanistan and Iraq, and the abductions or abuse of Russians in the United States. It did not say how many U.S. officials were affected.

The action was in response to the U.S. State Department's decision in July to ban entry to dozens of unidentified Russian officials allegedly involved in the death of lawyer Sergei Magnitsky.

The list supposedly includes some 60 officials, including relatively senior figures in the Russian Interior Ministry, as well as judges, prosecutors and prison officials that were named by Magnitsky's colleagues.

Magnitsky died in 2009 at age 37, when the pancreatitis he developed in jail was left untreated. He spent almost a year in pretrial detention on charges of tax evasion that were filed by the same police officials he had accused of illegally taking over the assets of an investment fund he worked for and fraudulently using them to reclaim $230 million in taxes from the state.

Although Russian President Dmitry Medvedev fired several top prison officials over Magnitsky's death and has pledged a full investigation, no one has been prosecuted in the case.

The Russian Foreign Ministry said it will expand the list of banned officials if the U.S. keeps pushing for the prosecution of those involved in Magnitsky's death.

"We're talking about an attempt of direct pressure on our government institutions that has nothing to do with neither human rights protection or an intention to find out the circumstances of what happened," the Russian statement said.

In December, the European Parliament urged the EU's 27 nations to freeze assets of the officials involved in Magnitsky's death in a nonbinding resolution.

(This version CORRECTS Corrects that number of officials affected is not known, clarifies circumstances of death. This story is part of AP's general news and financial services.)

http://news.yahoo.com/russia-bans-entry-us-officials-retaliation-105343482.html

Multivision's Nazerali wins order against U.S. site

2011-10-21 20:46 ET - Street Wire

by Mike Caswell

Vancouver promoter Altaf Nazerali has won a court order that has at least temporarily shut down the deepcapture.com website. He complained that the site, which purports to expose stock market wrongdoing, posted material portraying him as a criminal and a fraud artist. The order, handed down in the Supreme Court of British Columbia on Wednesday, Oct. 19, instructs the site's host to block access to any material referring to Mr. Nazerali and prohibits the domain's registrar from allowing a transfer of the domain.

While it is not clear how much of deepcapture.com directly referred to Mr. Nazerali, attempts to access any part of the site only returned a blank screen on Friday. The order was granted without any prior notice to deepcapture.com. Unless extended, it remains in effect until Dec. 2, 2011.

Nazerali's claim

The order came the same day that Mr. Nazerali filed a notice of claim against the site and its operators. He claimed that deepcapture.com linked him with Mafia figures and an associate of Osama bin Laden, among others. The defendants included naked short-selling conspiracist Patrick Byrne, who is the publisher of the site. (Mr. Byrne is also the chief executive officer of Internet retailer Overstock.com Inc.) Also a defendant was Illinois resident Mark Mitchell, who the suit identified as the author of much of the material that Mr. Nazerali complained of.

According to the suit, deepcapture.com posted the defamatory material in a series of chapters. One, dated July, 2011, stated that Mr. Nazerali was an important figure at Bank of Credit and Commerce International, "the massive criminal enterprise that did business with everyone from La Cosa Nostra and the Russian Mafia to Colombian drug cartels." His business partners, as listed in the passage, included Mufti al Abbar, "chief market manipulator for Muammar Qadaffi," and "an impressive number of securities traders who are also narco-traffickers (such as Paul Combs, until Combs was whacked by Nazerali's mobster friend Egor Chernov)."

Another chapter claimed that Mr. Nazerali's associates included Yasin al Qadi, "Osama bin Laden's favorite financier." It also linked with other Middle Eastern figures. "Nazerali, recall, has working relationships with ... members of Al Qaeda's Golden Chain, the regime in Iran, Pakistan's ISI, the chief of Saudi intelligence, the ruler of Dubai, the royals of Abu Dhabi, La Cosa Nostra, the Russian Mafia, and others in the Milken network."

Of the 21 chapters that Mr. Mitchell created, all but five referred to Mr. Nazerali. According to the suit, they meant that he is a criminal, arms dealer, drug dealer, terrorist, fraud artist, gangster, mobster and member of the Mafia. He is also dishonest, dangerous and not to be trusted.

In addition to Mr. Byrne and Mr. Mitchell, the suit named as defendants Deep Capture LLC, which operates the site, and an affiliated company, High Plains Investments LLC. Also named were the site's registrar, GoDaddy Inc., and its host, NoZone Inc. Other defendants were search provider Google Inc. and its Canadian subsidiary, which publishes a list of links to the defamatory statements along with brief quotes.

Mr. Nazerali is seeking a permanent injunction barring the defendants from defaming him. He is also seeking general, special, punitive and aggravated damages against Mr. Mitchell, Mr. Byrne, Deep Capture and High Plains. Vancouver lawyer Dan Burnett of Owen Bird Law Corp. filed the suit on Mr. Nazerali's behalf.

None of the defendants have responded to the suit.

While Mr. Nazerali has had roles with many junior companies, his only current role is as the president of Multivision Communications Corp., a mostly inactive TSX Venture Exchange listing.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:MTV-1891609&symbol=MTV&news_region=C

My Advice to the Occupy Wall Street Protesters

Hit bankers where it hurts

By MATT TAIBBI

OCTOBER 12, 2011 8:00 AM ET

I've been down to "Occupy Wall Street" twice now, and I love it. The protests building at Liberty Square and spreading over Lower Manhattan are a great thing, the logical answer to the Tea Party and a long-overdue middle finger to the financial elite. The protesters picked the right target and, through their refusal to disband after just one day, the right tactic, showing the public at large that the movement against Wall Street has stamina, resolve and growing popular appeal.

But... there's a but. And for me this is a deeply personal thing, because this issue of how to combat Wall Street corruption has consumed my life for years now, and it's hard for me not to see where Occupy Wall Street could be better and more dangerous. I'm guessing, for instance, that the banks were secretly thrilled in the early going of the protests, sure they'd won round one of the messaging war.

Why? Because after a decade of unparalleled thievery and corruption, with tens of millions entering the ranks of the hungry thanks to artificially inflated commodity prices, and millions more displaced from their homes by corruption in the mortgage markets, the headline from the first week of protests against the financial-services sector was an old cop macing a quartet of college girls.

That, to me, speaks volumes about the primary challenge of opposing the 50-headed hydra of Wall Street corruption, which is that it's extremely difficult to explain the crimes of the modern financial elite in a simple visual. The essence of this particular sort of oligarchic power is its complexity and day-to-day invisibility: Its worst crimes, from bribery and insider trading and market manipulation, to backroom dominance of government and the usurping of the regulatory structure from within, simply can't be seen by the public or put on TV. There just isn't going to be an iconic "Running Girl" photo with Goldman Sachs, Citigroup or Bank of America – just 62 million Americans with zero or negative net worth, scratching their heads and wondering where the hell all their money went and why their votes seem to count less and less each and every year.

No matter what, I'll be supporting Occupy Wall Street. And I think the movement's basic strategy – to build numbers and stay in the fight, rather than tying itself to any particular set of principles – makes a lot of sense early on. But the time is rapidly approaching when the movement is going to have to offer concrete solutions to the problems posed by Wall Street. To do that, it will need a short but powerful list of demands. There are thousands one could make, but I'd suggest focusing on five:

1. Break up the monopolies. The so-called "Too Big to Fail" financial companies – now sometimes called by the more accurate term "Systemically Dangerous Institutions" – are a direct threat to national security. They are above the law and above market consequence, making them more dangerous and unaccountable than a thousand mafias combined. There are about 20 such firms in America, and they need to be dismantled; a good start would be to repeal the Gramm-Leach-Bliley Act and mandate the separation of insurance companies, investment banks and commercial banks.

2. Pay for your own bailouts. A tax of 0.1 percent on all trades of stocks and bonds and a 0.01 percent tax on all trades of derivatives would generate enough revenue to pay us back for the bailouts, and still have plenty left over to fight the deficits the banks claim to be so worried about. It would also deter the endless chase for instant profits through computerized insider-trading schemes like High Frequency Trading, and force Wall Street to go back to the job it's supposed to be doing, i.e., making sober investments in job-creating businesses and watching them grow.

3. No public money for private lobbying. A company that receives a public bailout should not be allowed to use the taxpayer's own money to lobby against him. You can either suck on the public teat or influence the next presidential race, but you can't do both. Butt out for once and let the people choose the next president and Congress.

4. Tax hedge-fund gamblers. For starters, we need an immediate repeal of the preposterous and indefensible carried-interest tax break, which allows hedge-fund titans like Stevie Cohen and John Paulson to pay taxes of only 15 percent on their billions in gambling income, while ordinary Americans pay twice that for teaching kids and putting out fires. I defy any politician to stand up and defend that loophole during an election year.

5. Change the way bankers get paid. We need new laws preventing Wall Street executives from getting bonuses upfront for deals that might blow up in all of our faces later. It should be: You make a deal today, you get company stock you can redeem two or three years from now. That forces everyone to be invested in his own company's long-term health – no more Joe Cassanos pocketing multimillion-dollar bonuses for destroying the AIGs of the world.

To quote the immortal political philosopher Matt Damon from Rounders, "The key to No Limit poker is to put a man to a decision for all his chips." The only reason the Lloyd Blankfeins and Jamie Dimons of the world survive is that they're never forced, by the media or anyone else, to put all their cards on the table. If Occupy Wall Street can do that – if it can speak to the millions of people the banks have driven into foreclosure and joblessness – it has a chance to build a massive grassroots movement. All it has to do is light a match in the right place, and the overwhelming public support for real reform – not later, but right now – will be there in an instant.

This story is from the October 27, 2011 issue of Rolling Stone.

http://www.rollingstone.com/politics/news/my-advice-to-the-occupy-wall-street-protesters-20111012?link=mostpopular1

Used car salesman is the mastermind really? Is the administration trying to go to war with Iran to cover up fast & furious?

Wall St. Protestors Don’t Hate Success, They Hate Big Rewards for Failure

finance.yahoo.com/blogs/daily-ticker/randall-lane-wall-st-protestors-don-t-hate-140324959.html

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

62

|

|

Created

|

10/07/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |