Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$PTEL .0006 600 mil unrestricted. thin and can move fast

RNWF .01 massive buys coming in huge news coming $$$$

AEPT .0034 HUGE BREAKOUT $$ look inside!

https://seekingalpha.com/news/3595270-american-energy-partners-q2-indicates-strong-growth

SOMEONE, OR LOTSA U GUYS GO BUG MCDERMOT potlicker--is a crook @ MDRIQ

GOT ONE OFF GRAYS...…………..= MEMI-------------A MM PLAY right now---somebody wants to p nd it

do you mean DRNG OR DNRG? WHICH??

$PHIL $TSLA

Action Alert – Short Stock Indicator & PHI Group Announces Stock Repurchase Program Our Indicators feel that there is a substantial short position PHI Group, Inc. This holding company is tremendously undervalued currently trading at $.0001 and a 52 week high of $0.067 PHI Group, Inc., OTCQB: PHIL – See More Now: http://www.thestreetnow.com/spotlight/energy-stocks-now/

$DRNG Strong volume today! Might be worth a look!

Chart:

https://www.barchart.com/stocks/quotes/DNRG/technical-chart?plot=BAR&volume=total&data=DO&density=ML&pricesOn=1&asPctChange=0&logscale=0&indicators=SMA(10);SMA(50);SMA(200);ACCUM;RSI(14,100);MFI(14,100)&sym=DNRG&grid=1&height=500&studyheight=100

ACGX getting ready to break out HUGE Audited financials and almost debt free news on the way 850 Thousand in net income last quarter Getting ready to break out from the 200 day moving average $$$$

----------->MLHC <---------you will Thank me later, BOMB that may go SUPERNOVA!!!****

Major Distributor for exclusive water product backed by huge celebs (mark wahlberg, pdiddy, and alot more!! look into it-------->MLHC<--------

$$$$$$$$$$$$$$$$$ up 200%

$TRSI Next .0003 to .0011 Triple 000 Buy $$$$$$$$$$$$$$$$$

Theirs Currently 144 Followers watching $TRSI Only a fue Million Shares Remain @ .0003

Imagine Less @ .0004

Imagine Dragons - Thunder -

THAT ASK CAN GET EATEN IN SECONDS ONCE THE BUYERS COME-IN!!

Todays Chart

Anyone know of any stocks that have their main office in Kentucky?

PLSB in the 000 shorted big time, low OS 52wks hi 0.08++

Let's have a look , again.. :)

Let's have a look , again.. :) at what's going on with the company...

Must see to get the picture.. as of NOW situation, in the retail reality field.. no bogus:

https://investorshub.advfn.com/boards/replies.aspx?msg=134278030

We have been in operation with our first product, Natural Cabana® Lemonade, for just over five years. We expanded this brand into Limeade, which started selling in January 2014, and into Coconut Water, which started selling in March 2014.

We introduced Natural Cabana® Lemonade in a 20oz glass bottle in 2012 and since then have developed a US regional distribution system. During July 2016, we began eliminating a number of weaker, non-performing and slow-paying distributors and now have approximately 70 distributors and 20 wholesalers. This was a strategic decision as we moved our sales model concentration from direct store delivery through distributors to warehouse direct to retail which has led to reductions in overhead associated with direct store delivery distributors. The continued decrease in net sales during Q2-2017 compared to Q2-2016 was expected. As part of the restructure we switched our packaging for Natural Cabana® Lemonade/Limeade from a 20oz glass bottle to a 16.9oz European style glass bottle This change has been well received in the market place and we expect to continue to deliver our products in this packaging.

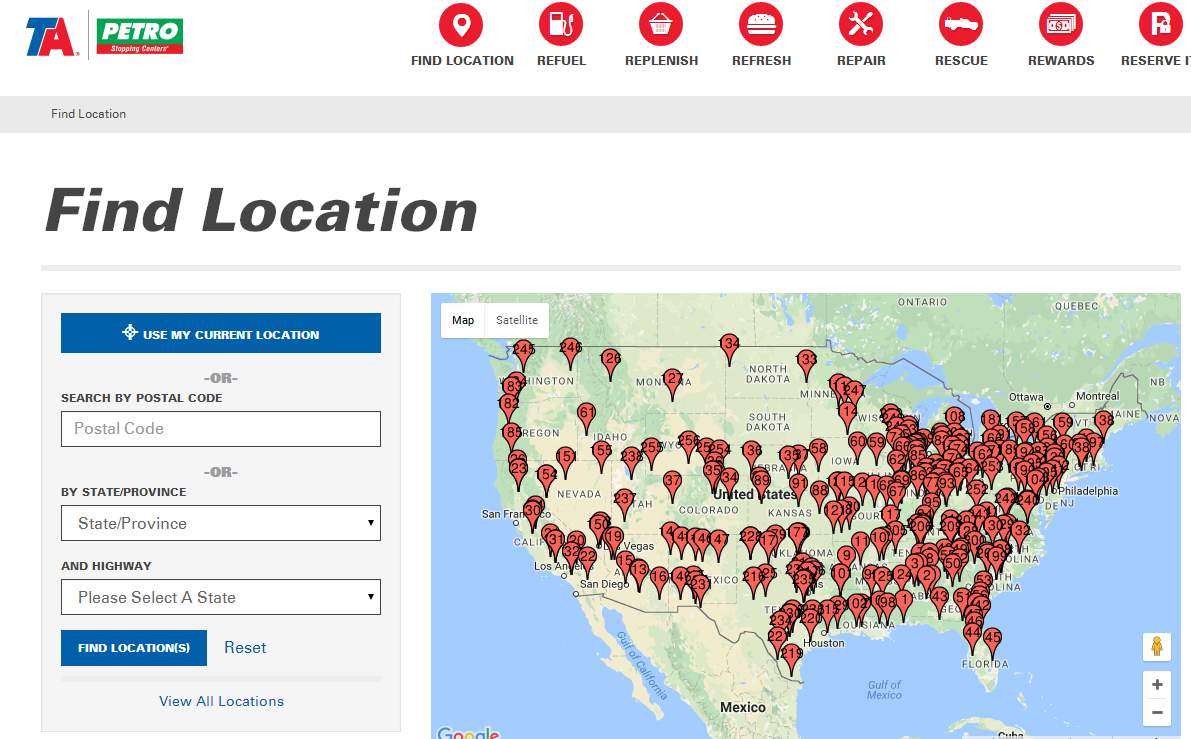

Some of the more notable regional and national grocery and convenience chain stores are: Albertsons/Safeway/Tom Thumb Markets, Walmart, Kroger/King Soopers/City Markets, Stater Bros, Food Max, Houchens/IGA/IGA Express/IGA Cross Roads, Kmart, 7-Eleven, United C-stores, Weis Markets, King Kullen, Dierbergs Markets, Hy-Vee Supermarket, WinCo Foods, Price Less Markets, Gristede’s Foods, Toot n Totem, Travel America, Smashburger, Bolla Markets, Shop-Rite Grocery, Natural Foods, Flash Foods and Associated Foods.

The impact of the 16.9oz European style bottles in the market place has been very positively received. These bottles fit comfortably in vehicle cup holders and have become a favorite of our convenience store buyers. Due to our efforts and the acceptance of these new bottles we have been able to open up some of the following outlets: Flash Foods, Bills Distributing, Travel Centers of America, Affiliated Foods, Inc, KeHe Distributors, Inc., Fiesta Mart, Inc., J-King, Inc., certain regions of 7-11, Shoprite and others.

"We are working on some very exciting developments for the Company that we would consider transformative in nature. There are several opportunities to expand our product portfolio that are in front of us. With the debt reductions in place, we are now actively looking for acquisitions to transform our Company for the benefit of our shareholders. We look forward to being able to announce progress in this area when the time is right."

"Our team is working hard to expand our customer base and build distribution channels. We made significant inroads in the second quarter and expect to continue winning accounts at an accelerated pace in the second half of the year

Quote:

J. Kings fits into our distribution strategy because they have a large business servicing food service operators. Wherever you find corporate cafeterias, local delicatessens or quick service restaurants ("QSR") in these counties, you will likely find J King's as a crucial vendor to those operations."

Pulse is very successful in other areas of the country and a national QSR brand whom we will be able to discuss in the near future is one of our largest customers today."

Quote:

5 Stars

LOVE THESE LEMONADES www.buypulsedirect.com/Natural-Cabana-Premium-Lemonade-Limeade-Variety-Pack-Case-of-12-_p_28.html

I stumbled accross this Lemonade in a deli in upper Manhattan. At 1st Taste- I LOVED IT....I generally don t like any juice or lemonade TOO SWEET- but this was a PERFECT COMBINATION of being TASTY- REFRESHING and "NOT" Overly SWEET....I Now Order Them By The Cases DIRECT From Pulse- THANKS

Did you find this helpful?

Reviewed by: TD from NEW YORK CITY. on 8/11/2017

.jpeg)

Quote:

________________________________________

Natural Cabana® Lemonades/Limeades are targeted to beverage consumers desiring a lower calorie, all natural, thirst quenching beverage for enjoyment and rehydration. Nationally, only a handful of companies’ market ready-to-drink lemonades. We believe Natural Cabana® Lemonades/Limeades have competitive advantages over existing lemonade brands as follows: has 60 calories per 8oz. serving compared to over 100 calories of most competing beverages and is made of 100% all natural ingredients. The fact that Natural Cabana® Lemonades/Limeades contain no preservatives or artificial sweeteners means that they can be sold in health food stores such as Whole Foods, GNC Live Well, Vitamin Cottage, Sunflower and others.

ST. LOUIS, Aug. 23, 2017 (GLOBE NEWSWIRE) -- A recent national survey* commissioned by Panera Bread revealed that 99% of Americans do not know the amount of added sugar in a 20 fl. oz. serving of standard cola, with 83% of Americans underestimating the amount. To better support and inform guests, Panera Bread today announced it will be the first national restaurant company to place calories and added sugar information directly in the hands of guests. Beginning this week, the company will roll out a new “sweet facts” fountain beverage cup that lists the calories and added sugar in each of its six new craft beverages, as well as regular cola. https://globenewswire.com/news-release/2017/08/23/1091294/0/en/The-Sweet-Facts-Panera-Bread-Announces-Next-Wave-of-Transparency.html

MMEG.0002-BIG NEWS-Cancelled Planned Dilution, Company Withdraw of S-1 that gave them Equity Line of $3 Million Dollars with Southridge LLC & states its because they no longer intend to offer any securities under the registration

Quote:

The Company is requesting withdrawal of the Registration Statement because there is no longer a present intention to request the effectiveness of, or offer any securities under, the Registration Statement.

Link to Withdrawal Form S-1

https://www.sec.gov/Archives/edgar/data/1602381/000107878217001260/formrw091317_rw.htm

link to S-1 filed 10/16 showing Equity Line for $3 Million Dollars from Southridge

Quote:

we have the right to “put,” or sell, up to $3,000,000 worth of shares of our common stock to Southridge.

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11635564

~Real DD 0001 ~ 0010 Plays~

http://investorshub.advfn.com/boards/board.aspx?board_id=22489

~All posts are my opinion and are not recommendations to buy or sell~

Read this $ ELED Exeled Holdings INC. All check: (OTCMKTS:ELED)

In our opinion we don’t believe that it is naked shorted. That usually just happens with commodity ETFs. Naked shorting sucks because there is nothing you can do about it. Market Makers will short a stocks like ELED because of the enormous break out it has already had. Having a market maker or a trader short is much better for investors than having it naked shorted. The reason why is they are more limited in the amount of time they can short. If their shorts don’t cause panic and major sell offs then the shorters will get very nervous. If some major rumors or catalyst come and the stock has built enough legs you will have the potential for a short squeeze.

That is what happened last year another Marijuana stock. The stock started out sub penny and ended up over 25 cents a share. Once you have the float locked up on a penny stock the only real enemy is if there are note holders selling or CEOs either increasing the Authorized shares or doing a reverse split. If either of those happen that is usually when you want to quickly exit the stock. That is why it is important to read the SEC filings. Here is a link to teach you how to do that. https://awesomepennystocks.com/learning-sec-filings/ The only other thing to watch is the Level 2. On the level two you want to learn to be able to tell the difference between someone selling a Note (toxic financing) or someone who is shorting. If MMs(Market Makers) are shorting they will be on both the bid and the ask. I have also put together a short training for reading level 2 at https://awesomepennystocks.com/reading-level-2/. It is always good to learn as much as possible when it comes to penny stocks. There is a lot of money to be made and also a lot to be loss.

As a group I always encourage being completely open with each other. Don’t criticize someone who ask questions even if they appear to be negative. Skepticism is good to have as well. Smart skeptical people help a group out and also help bring in big money investors that are more analytical with their decision making. With that being said there is a huge difference between an educated skeptic and someone that just bashes everything without backing up what they say with something you can read and learn from. In penny stocks there are people that get paid who have fake aliases to both bash stocks and to pump stocks. Each stock will most likely have a few paid promoters/bashers working both sides. I haven’t had a chance to dive in and read ELED sec filings but I would recommend doing it even if you are new. Our SEC Filings free training link shows you how you can search for a company’s SEC Filings.

As far as ELED is concerned shareholders should actually be rooting for the stock to stay in the .014-.02 range for the next 2-5 days. Especially if the great volume keeps up. If you go back in time when it was in the .003-.004 range there were a lot of investors who were scared thinking that it had peaked. What they didn’t realize is the stock was forming a leg. At the .004 range it formed its B leg. This is where the stock developed solid support. It had it’s traders that bought from .0008-.0013 (Where Obi Mbawuike first alerted it) and sold it from .003-.005. So new investors and savvy investors that understood it was developing legs bought at the .004-.005 so this was the new base. You want to see a new base or leg happen from .014-.02 This will allow anyone who is on the fence on whether or not they want sell to get out and take profit. As long as there is enough buying power to absorb the flippers shares and to lock in the short sellers it will develop and that is where magic run number 3 can happen.

If enough shares get locked up from .014-.02 What will happen is there will be a share shortage. Meaning that most of outstanding shares will be owned by people not willing to sell and the remaining shares will be hard to get. These creates a supply and demand surge. If an unfortunate market maker shorted 1 million shares at .015 hoping he could cover at .01 and make 50% from a sell off and the stocks does the opposite and goes up that Market Maker gets stuck in a short squeeze. The Market Maker has to buy back 1 million shares in a limited amount of time, and since they have taken the high risk of shorting a penny stock they usually have to a lot more money (sometimes millions) sitting in their margin that they can’t touch just incase things go bad and they guessed wrong. When a penny stock shorted at .015 quickly goes to .03, short sellers will start covering their shorts which means they will be taking quick losses and buying shares at the .03 to cover. Well when you buy a thinly traded stock fast its price shoots up even higher! When happens this creates a buying frenzy also what we call a blue sky break out. Now the Shorters who didn’t buy back quick enough will have Margin calls coming in. This is where their brokers will automatically start buying shares to cover. Most will also have stop loss kick in which will trigger and you can see penny stocks have unbelievable gains. Now an example of this happening was CYNK Technology. The stock went up 24,000% So investors lucky enough to buy $10,000 in shares when the stock was at the bottom saw their accounts go up as high as 2.4 million dollars! Now short squeezes like CYNK are not typical. That is why you want to actively watch the Level 2 and read SEC filings and learn as much as you can. Congrats to everyone who had already made money on ELED! Congrats to Obi on another 1,000%+ gainer!

Repost$ ELED Exeled Holdings INC. All check: (OTCMKTS:ELED)

In our opinion we don’t believe that it is naked shorted. That usually just happens with commodity ETFs. Naked shorting sucks because there is nothing you can do about it. Market Makers will short a stocks like ELED because of the enormous break out it has already had. Having a market maker or a trader short is much better for investors than having it naked shorted. The reason why is they are more limited in the amount of time they can short. If their shorts don’t cause panic and major sell offs then the shorters will get very nervous. If some major rumors or catalyst come and the stock has built enough legs you will have the potential for a short squeeze.

That is what happened last year another Marijuana stock. The stock started out sub penny and ended up over 25 cents a share. Once you have the float locked up on a penny stock the only real enemy is if there are note holders selling or CEOs either increasing the Authorized shares or doing a reverse split. If either of those happen that is usually when you want to quickly exit the stock. That is why it is important to read the SEC filings. Here is a link to teach you how to do that. https://awesomepennystocks.com/learning-sec-filings/ The only other thing to watch is the Level 2. On the level two you want to learn to be able to tell the difference between someone selling a Note (toxic financing) or someone who is shorting. If MMs(Market Makers) are shorting they will be on both the bid and the ask. I have also put together a short training for reading level 2 at https://awesomepennystocks.com/reading-level-2/. It is always good to learn as much as possible when it comes to penny stocks. There is a lot of money to be made and also a lot to be loss.

As a group I always encourage being completely open with each other. Don’t criticize someone who ask questions even if they appear to be negative. Skepticism is good to have as well. Smart skeptical people help a group out and also help bring in big money investors that are more analytical with their decision making. With that being said there is a huge difference between an educated skeptic and someone that just bashes everything without backing up what they say with something you can read and learn from. In penny stocks there are people that get paid who have fake aliases to both bash stocks and to pump stocks. Each stock will most likely have a few paid promoters/bashers working both sides. I haven’t had a chance to dive in and read ELED sec filings but I would recommend doing it even if you are new. Our SEC Filings free training link shows you how you can search for a company’s SEC Filings.

As far as ELED is concerned shareholders should actually be rooting for the stock to stay in the .014-.02 range for the next 2-5 days. Especially if the great volume keeps up. If you go back in time when it was in the .003-.004 range there were a lot of investors who were scared thinking that it had peaked. What they didn’t realize is the stock was forming a leg. At the .004 range it formed its B leg. This is where the stock developed solid support. It had it’s traders that bought from .0008-.0013 (Where Obi Mbawuike first alerted it) and sold it from .003-.005. So new investors and savvy investors that understood it was developing legs bought at the .004-.005 so this was the new base. You want to see a new base or leg happen from .014-.02 This will allow anyone who is on the fence on whether or not they want sell to get out and take profit. As long as there is enough buying power to absorb the flippers shares and to lock in the short sellers it will develop and that is where magic run number 3 can happen.

If enough shares get locked up from .014-.02 What will happen is there will be a share shortage. Meaning that most of outstanding shares will be owned by people not willing to sell and the remaining shares will be hard to get. These creates a supply and demand surge. If an unfortunate market maker shorted 1 million shares at .015 hoping he could cover at .01 and make 50% from a sell off and the stocks does the opposite and goes up that Market Maker gets stuck in a short squeeze. The Market Maker has to buy back 1 million shares in a limited amount of time, and since they have taken the high risk of shorting a penny stock they usually have to a lot more money (sometimes millions) sitting in their margin that they can’t touch just incase things go bad and they guessed wrong. When a penny stock shorted at .015 quickly goes to .03, short sellers will start covering their shorts which means they will be taking quick losses and buying shares at the .03 to cover. Well when you buy a thinly traded stock fast its price shoots up even higher! When happens this creates a buying frenzy also what we call a blue sky break out. Now the Shorters who didn’t buy back quick enough will have Margin calls coming in. This is where their brokers will automatically start buying shares to cover. Most will also have stop loss kick in which will trigger and you can see penny stocks have unbelievable gains. Now an example of this happening was CYNK Technology. The stock went up 24,000% So investors lucky enough to buy $10,000 in shares when the stock was at the bottom saw their accounts go up as high as 2.4 million dollars! Now short squeezes like CYNK are not typical. That is why you want to actively watch the Level 2 and read SEC filings and learn as much as you can. Congrats to everyone who had already made money on ELED! Congrats to Obi on another 1,000%+ gainer!

GDVM could be gearing up for another interesting day some big buys early!

SEGI huge dd and CATALYST sending this up story just unfolding and NO SELLING for 60 days with share lock out.

BETS, should move up big next week. Very cheap now and huge potential!

Allot in the works that will influence the stock and happening soon.

http://seaniemacinternational.com/press-release/

GRAS Buyable @.0001 on its way to .00`s

Greenfield Farms Food Inc. (GRAS)

http://investorshub.advfn.com/boards/board.aspx?board_id=21631

APYP. Super thin

Re: Nadendla Post# 8213

The Chief Administrative and Compliance Officer of CHRO is the NEW CEO for APYP

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=122184836&txt2find=Doug|McKinnon

"CEO is a Merger Specialist and TURN AROUND SPECIALIST"

"He worked for nine years as a CPA in the SEC and the oil and gas practice section of Coopers & Lybrand (now PricewaterhouseCoopers). Additionally, Mr. McKinnon has extensive merger & acquisition and turnaround experience."

https://www.sec.gov/Archives/edgar/data/1568969/000164033416000784/2016mar7-apyp_8k.htm

http://www.pwc.com/us/en/about-us/pwc-corporate-history.html

What many don't understand is that the last CEO passed away from cancer, the NEW CEO is working on putting things back in order

"On February 4, 2016, the Company’s sole director, Chief Executive Officer and Chief Financial Officer, Jackie Williams, passed away."

https://www.sec.gov/Archives/edgar/data/1568969/000164033416000719/2016feb18-apyp_8k.htm

Report TOS

Yes and since this post stock has run huge to .00s ![]() new CEO putting things together still so who knows what happens from here

new CEO putting things together still so who knows what happens from here

so what happened? did the merger ever go through?

SNMN HUGE REVERSE MERGER HAPPENING MUST SEE DD

SNMN is .0004 it started with the reinstatement on the NV SOS then they changed the name from SNM Global holdings to Metaphor Holdings. Along with that they made a new website www.metaphorholdings.com which linked over from the old website. This had a weed leaf and count down on it that has since expired causing some uncertainty in if the deal is real or not. Since then we have discovered from the TA that Troy Lowman as seen below is the new CEO and President I called personally to confirm with the TA. This has just be discovered today and confirms that this is indeed a new Reverse Merger play. Paired along with Troys company name is Metaphor Entertainment it all lines up. The O/S is tiny last known here 200 mil or so and has been dead since 2010 These R/M plays have huge upside and here at .0003 x .0004 i dont think we can go wrong with all the SOLID DD Presented in this post.

Updated SNMN DD: I called the SNMN transfer agent asked for the company contact info they have on file. The transfer agent said the company contact info they have on file for SNMN is Troy Lowman. Well guess what, Troy Lowman runs Metaphor Entertainment.

Metaphor is what SNMN just changed its name to. Getting closer to solving the puzzle. I didnt get a call back from Troy. I posted a link for Metaphor contact info. Maybe someone else can get a hold of him today.

Troy Lowman

Chairman at Metaphor Entertainment Company

University of Maryland, Baltimore County

Queen Anne's County High School

https://www.facebook.com/public/Troy-Lowman

http://metaphorentertainment.squarespace.com/

https://scontent-lax3-1.xx.fbcdn.net/hphotos-xap1/v/t1.0-9/226627_429902513804977_1595202846_n.jpg?oh=d27b3e3056f001f1e1524f01f36dd56d&oe=57677FAF

Transfer agent pacific stock transfer

Pacific Stock Transfer Co.

Transfer Agent

6725 Via Austi Parkway

Suite 300

Las Vegas, NV 89119

800-785-7782

http://www.otcmarkets.com/stock/SNMN/profile

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=120407691

PMCM Perfect-examples of why to Buy-the-Bottom while O/S-is-Small

these types of sub-Pennys give the Jumps n Huge Cash Profits for those who Buy .0001-.0003

Get in @ the Bottom!!!

What`s Comin,,,

heres afew things:

A simple list:

Updated otcmarkets.com

Becomin current on otc

Becomin Current SEC

New Filings comin for new CPA

Merger, Acquisition, ???

Name/Symbol Change

News "PR"

2016 Update

now add in if they are doing anything with MJ or Music?

what new projects could arise?

CEO has provided huge funding for other stocks, what would a PR of Millions$$$ do to pps? he does do that in his history.

pmcm has to do something, they have debt that is still due, yes in 2014 they paid off a lot of debt but not all. Know what your tradin,,,

now what will the ceo use to create a bounce/run/jump?

they did reduce the a/s to 2B so they have something like 1.5-1.7B shares to sell at some point, but with 2015 only dilution of 234M to 400Mish

idk the current o/s but based on Last Know O/S n Volume since Oct. they sure didn't give many shares away in 2015

could r/s happen? with such a low SS would it do enough to take care of any debt needs? I don't think so. with well over 1B shares available I'm expectin something New to create new buyers.

even a simple lookin forward PR into 2016 would bring in buyers

if the o/s really is under 500M which I think it is, imo its between 234-400ish

how thin would the ask really be,,, mix that with filings n the right news and notes that come due, what pps is possible?

I'm tradin for .002-.004 range

I'm thinkin quite afew of things I listed, plus what ever else New shows up will happen in 2016 n combine them into a huge jump with such a low SS

Tradin is Not about what was the pps

Tradin,,, is 100% about what pps you Buy and what pps you Sell

Invest in the Trade

Remember when the Right News Hits it will all become about how Thin the Ask really is!!!

with so little shares available Shareholders are likely to Lock-Up-The-Float!!!

That is How Jumps are Created When Reasons show up to bring in New Buyers.

do some DD on how thin the ask was when pmcm bounced to .0006 on no news or reasons just Ask-Slappin

Now the Question is who will get shares Available .0001-.0003?

whats left available@1, not much 16M-30Mish on ask @2, (last time 3`s showed it had 16M@3)

were in the process of performing audits

Primco is refiling it's K and getting current

you would have to wait for press releases

MHYS'.0001 movie "Exposed" nationwide TV commercials sponsored by xfinity now playing!

http://www.ispot.tv/ad/AtuQ/xfinity-on-demand-exposed ;

MHYS .0001 NEXT MOVIE CO-PRODUCED WITH KEANU REEVES CALLED "EXPOSED" OUT 1/22 IN THEATERS. TRAILER HAS 150K VIEWS ON YOUTUBE IN THREE DAYS AND FRONT PAGE OF ITUNES TRAILERS! MHYS ALREADY HAS MOVIE "HEIST" NOW IN 3250 THEATERS WORLDWIDE!

$DSCR on Alert > JV Partnership news to distribute Hemp Pet Care Product

http://finance.yahoo.com/news/discoverys-joint-venture-partner-ab-123000162.html

$LTNC Yes and they followed that with news today, looks like the sellers are leaving the building!

LTNC $0.0001 released 10Q last night after the close, maybe it's time to break open those $0.0001's! Watch it.

$EPAZ 1Q15 REVS increasd by 83%! It reported revenue of $461,661, compared to revenue of $252,552 for the three months ending March 31, 2015, an increase of $209,109 from the comparative period.

See News: http://www.marketwired.com/press-release/epazz-reports-83-percent-increase-in-revenues-for-first-quarter-of-2015-otcqb-epaz-2046640.htm

DRGV 0002! Profitable company runs every quarter on fins.

FINS COMING ON OR BEFORE FRIDAY THIS WEEK

$GRAS +12.5% yesterday, Rumors, Franchising, Revenues, Growth! Low O/S

10 to 100 BAGGER POTENTIAL HERE AS WELL

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115672192

MSMY - Thinnest .0001x.0002 on OTC

Pattern has been when daily PSAR flips, volume and price rise drastically. Getting crunched could see another 10bagger on technical analysis alone.

Also "darkside awakening" DD play - had government/top industry connections - went silent but timing may be right for them to come back due to the increasing green/sustainability movement. There is still vast untapped potential with them as a distributor of LBI-Renewable products. I have confirmed that this opportunity still exists with the creator of Fiscal Dynamics Limited in Nigeria.

http://www.dualzorb.net/

http://lbirenewable.com/page19.html

SREH ON MAJOR BREAKOUT WATCH !!

In a market where ever ticker is diluting into runs or just straight dumping shares so a stock can't run SREH is a breath of fresh air !! SREH has zero dilution or toxic notes to worry about also only has a 210 mil float ! In April the company announced a acquisition giving the company 5 million in revs ![]() that is huge and from the dd I have done they are in works to do a lot more including merger/acquisition brining another 10 million in revs !! This catalyst which is very near will send the pps soaring as the company has goals to uplist to QB! If you have any questions about dd please pm me this will not be one to miss plus sustains gains very well with no dilution so no fear of losing your you know what

that is huge and from the dd I have done they are in works to do a lot more including merger/acquisition brining another 10 million in revs !! This catalyst which is very near will send the pps soaring as the company has goals to uplist to QB! If you have any questions about dd please pm me this will not be one to miss plus sustains gains very well with no dilution so no fear of losing your you know what ![]() in this crappy market

in this crappy market

Check ICBT! 15 C 211 Due ANY DAY $$ No DILUTION in More Than 16 Months!!! * BASHERS are Surfacing $$$

Take a Position.. *Ive Been accumulating $$$

ICBT OWNS 70 % of Canwealth Minerals $$$ Canwealth should be assigned a Symbol IMMINENT $$$

$ 11 BILLION BUKS OF REE/ GOLD IN SHADOW MOUNTAIN ALONE!! $$$$$

http://www.prnewswire.com/news-releases/canwealth-minerals-corporation-second-assay-report-on-shadow-mountain-for-rare-earth-elements-135493918.html

I DID MY DUE DILIGENCE!! DO YOUR OWN IS RECOMMENDED!! AIMHO..

Due I diligence is essential !! I did mine, and I've been accumulating $$$$ (-:: (-::

AIMHO..

GLTA!!

MSPC LOOKING READY FOR A BREAKOUT!

3 days of accumulation

263 Million in Volume TODAY

No news - Pure loading up before the news drops

Solid Potential with a good background regarding management

M$PC

AVOP LONG here at .0002 .0003

This company as you can see below is growing leaps and bounds. Working int he hottest sector of MJ and continually building share holder value reducing share structure already twice this year and having no plans to R/S!!! Hearing lots of updates are still to come as you can see in the dd below it sure looks that way IMO

AVOP Security Details

Share Structure

Market Value1 $1,020,683 a/o Jun 05, 2015

Authorized Shares 7,500,000,000 a/o Jun 02, 2015

Outstanding Shares 5,103,415,242 a/o Jun 04, 2015

Float 3,394,422,829 a/o Jun 04, 2015

AV1 Group Reduces Authorized Shares by 7.5 Billion Reducing the Current Structure by Fifty Percent

After a comprehensive evaluation of all viable options, the Board of Directors has determined that it is against the Company's best interest, and the interest of its shareholders, to enter into any commitments involving toxic financing. The Company also seeks to reiterate that there are no plans to reverse split the common share structure in its strategy for 2015.

http://www.otcmarkets.com/stock/AVOP/news/AV1-Group-Reduces-Authorized-Shares-by-7-5-Billion-Reducing-the-Current-Structure-by-Fifty-Percent?id=106230&b=y

AV1 Group Continues Corporate Operations with Focus

on Growth and Preparation for Existing Divisions– May 21, 2015

DentalCannitizer: the Company has signed a definitive agreement for the purchase of a cutting edge technology that the Company is rebranding as the “Dental Cannatizer”; - Not Yet PR'd about

http://www.otcmarkets.com/otciq/ajax/showNewsReleaseDocumentById.pdf?id=15021

AV1 Group Prepares for Growth as VaporHighUSA.com Experiences Surge in Website Traffic

http://www.otcmarkets.com/stock/AVOP/news/AV1-Group-Prepares-for-Growth-as-VaporHighUSA-com-Experiences-Surge-in-Website-Traffic?id=97324&b=y

AV1 Group Submits 5.2 Billion Shares for Retirement

Management Continues Moves to Tighten Stock Structure by Over 50%

Company Reduces o/s means business and share holder value is building

http://www.otcmarkets.com/stock/AVOP/news/AV1-Group-Submits-5-2-Billion-Shares-for-Retirement?id=96010&b=y

LHPT good news. Name symbol change shortly

NEWS: DALLAS, TX / ACCESSWIRE / May 19, 2015 / Lighthouse Petroleum, Inc. ("Lighthouse") (PINKSHEETS:LHPT), today announces it has completed the name change with the State of Delaware from Lighthouse Petroleum, Inc. to Supurva Healthcare Group, Inc. , has filed all necessary documents, paid its taxes, and is in good standing with the State. The next step for the company will be filing all documents necessary to complete the name and symbol change with Finra, which it expects to file in the next several days.

|

Followers

|

222

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1344

|

|

Created

|

10/12/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |