Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Material phase classification by means of Support Vector Machines

Jaime Ortegon, Rene Ledesma-Alonso, Romeli Barbosa, Javier Vazquez Castillo, Alejandro Castillo Atoche

(Submitted on 12 Dec 2017)

The pixel's classification of images obtained from random heterogeneous materials is a relevant step to compute their physical properties, like Effective Transport Coefficients (ETC), during a characterization process as stochastic reconstruction. A bad classification will impact on the computed properties; however, the literature on the topic discusses mainly the correlation functions or the properties formulae, giving little or no attention to the classification; authors mention either the use of a threshold or, in few cases, the use of Otsu's method. This paper presents a classification approach based on Support Vector Machines (SVM) and a comparison with the Otsu's-based approach, based on accuracy and precision. The data used for the SVM training are the key for a better classification; these data are the grayscale value, the magnitude and direction of pixels gradient. For instance, in the case study, the accuracy of the pixel's classification is 77.6% for the SVM method and 40.9% for Otsu's method. Finally, a discussion about the impact on the correlation functions is presented in order to show the benefits of the proposal.

https://arxiv.org/abs/1712.04550

I disagree.

The board has to approve a new auditor. They didn't have a choice about changing!

Just my interpretation of the law and circumstance. I'm sure L2 and SBI see it your way.

However, if you refer to the SEC filing it says that the board voted and approved the decision to change accountants. Seems they should've consulted with SBI and L2 before doing so.

c. Our Board of Directors participated in and approved the decision to change independent accountants.

Noted 1 difference in claims between L2 and SBI.

L2 claims that QMC didn't file a required registration of shares for puts. SBI clearly doesn't make the same claim. I don't see that any puts were every called by QMC, therefore registration was not required.

I'm not a lawyer, but I think their claims are weak for the following 2 initial default claims. The rest are tied to these 2 defaults actually occurring, if 1 and 2 didn't occur QMC will win assuming they paid the correct amount when due. SBI claims QMC did make a payment which based on my calculation accurately reflects principal and interest due.

1) QMC filed an amended 10Q that damage SBI and L2. I don't think there's anything in the 10Q that was damaging to their position as note holders.

2) QMC changed auditors without consulting SBI an L2. QMC clearly put out an 8k that said their current auditor had decided to stop representing QMC. I don't see this as a decision by QMC to replace the auditor, but as a requirement for QMC to replace and SBI and L2 would not be allowed to pick an auditor or have any say in selection of a new auditor.

Just my 2 cents as a non-lawyer.

that seems to be what QMC stock is good for.

Perhaps we could ask the SEC?

We? You seem to insinuate that QMC is doing this. There is no reference to QMC or anyone associated with QMC that I can find. Perhaps you have additional information?

We fabricate the first mixed-quantum-dot solar cells and achieve a power conversion of 10.4%, which surpasses the performance of previously reported bulk heterojunction quantum dot devices fully two-fold, indicating the potential of the mixed-quantum-dot approach

www.nature.com/articles/s41467-017-01362-1

Ding Ding DING...

Sid Riggs - Researcher and Editor at Fitz-Gerald Research Sept,11 2014

"The publisher describes the newsletter’s promise this way:

“In his thousands of hours of number-crunching, editor Sid Riggs discovered a pattern of profits that’s almost foolproof. He identified seven ‘sparks’ – catalysts – that consistently propel small-cap stocks to new highs, making investors potentially life-changing gains in the process. Now he’s showing members exactly how this works – what to buy, how to buy, what to sell, and when to do it. This blows the small-cap market wide open for retail investors.”

Those “game-changing sparks” he talks about are the catalysts that every investor looks for — key management changes or decisions, big contracts or “game-changing” deals, new institutional buying interest, upward profit revisions, biotech clinical trial results or breakthrough technology developments, etc."

https://www.stockgumshoe.com/reviews/small-ca...gy-stocks/

Sid Riggs search and results:

https://search.yahoo.com/yhs/search?hspart=ad...emaff_0_ff

Indeed. Stealth mode and lockdown!

Stevie’s in stealth mode

Shouldn’t there have been an 8-K filing for these cases like there was for the $125k filing by the payroll company in Hays County?

I posted links to the two contracts. Jurisdiction is spelled out there. Dade County came from the SBI agreement.

I didn’t know about Dade.

I still haven’t read that one yet.

I differ in opinion. Why would this case cause panic selling? I’ve stated before that under default L2 and SBI would get about 8-9 million shares. That doesn’t bankrupt QMC. It dilutes shares a bit, but now much.

I read the appeal and the agreements. I’m not a lawyer, but the only potential default I see is the registration filing. Even that isn’t clear to me as the languages says they are registering “put and underlying shares.” To my knowledge, QMC never gave a “put.”

The other 3 claims are suspect.

1) Filings until due date, 9/29/17, we’re on time and met SEC filing requirements. They filed an amended 10Q, but I don’t think that was a violation of the terms of the agreement.

2) Squires stated that they paid the full balance on time per the agreement.

3) QMC’s auditor quit. They weren’t fired. QMC did not willfully seek out a new auditor, therefore the clause is void in this circumstance. The clause didn’t say that L2 had to approve a new auditor, it said that QMC has to have their permission to switch auditors. QMC was forced to switch.

Just my $0.02!

hard to believe how long for qtmm to suckseed.if at first you dont suckseed keep sucking till you do suckseed :o) needed to sell out around 0.12 but still watching for entry point if ever.hoping they suckseed.merry christmas to all.

In March 2017, a similar situation occurred when QMC received a civil citation from plaintiff Trinet HR Corporation alleging that QMC owed Trinet approximately $125,000 plus collection costs related to a payroll payment they made on behalf of the Company on or about December 31, 2016.

This resulted in an SEC 8-K filing

https://seekingalpha.com/filing/3470987

Why did these 3 cases that were finally shared on this board today not made public though an SEC filing the same way this filing from March was? Is there some sort of difference?

And Jamis how did you know to search in Kansas, County of Johnson, and federal courts of Miami-Dade County, Florida? What clues led you to searching in these court databases and locate these court filings? I guess this explains why the volume has been surging up someone has been dumping that knows something everyone else doesn't.

Where's the dots? I don't think there are any dots back there. Where's the dots?

Actually, I’m getting tired of attitudes on both sides of the isle. Call it political fatigue.

I found 3 of the cases last month, but there’s little info on any of them. We now can read the appeal brief. Have at it.

We’ve stated multiple times that cases were outstanding.

We’ll get QMC’s side of appeal after 1/2/18 per due dare of their brief.

Item 1) confusing language. Not sure if a registration is required unless there is a put. A put never occurred.

Item 2) nothing in contract about filing amended returns.

Item 3) the auditor resigned. By law they had to get another. That’s not something the lender has a say if I understand things correctly. Only if it was a decision by QMC did L2 have a right.

Item 4) Squires claims they made all payments.

Last thought, if L2 and SBI want to claim default, why not back in May when the first claim occurred (45 days after contract signing per some of the language)? Why did they wait 5 months and only upon QMC filing an injunction.

Maybe QMC did default, but it should be based on share price as of date of default. Theirs a default conversion clause for QMC shares for all amounts due and penalties. Share price was $0.14 on May 15.

Here's the crux of the matter. Is this predatory?

Default Claims:

C. Quantum Defaults on the Agreements with Appellants.

Quantum failed to perform several of its obligations in the

agreements with Appellants, including (1) failing to file its initial

registration statement with the Securities and Exchange Commission,

(2) improperly restating its financials with the SEC, and (3) replacing

its auditor without seeking or obtaining the consent of Appellants.

2.RR.94-95, 108-109. Quantum also failed to pay the amounts owed

under the agreements. 2.RR.102, 108.

Quantum’s defaults triggered Appellants’ rights to recover the

amounts due and payable by Quantum, in whole or in part, through the

common stock in Quantum that was being held in escrow by Empire.

3.RR.IX.1-2, 4-5; 2.RR.94, 103. On October 2, 2017, L2 and SBI

delivered to Quantum a notice invoking these rights. 2.RR.104.

However, Quantum did not issue or deliver the shares to L2 and SBI,

which constituted another default under the relevant agreements.

2.RR.104.

I'm not sure what the big secret is. Oh well, here are two contracts and two cases against QMC:

L2 - EQUITY PURCHASE AGREEMENT

Section 10.1 GOVERNING LAW; JURISDICTION. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Kansas without regard to the principles of conflicts of law. Each of the Company and the Investor hereby submits to the exclusive jurisdiction of the United States federal and state courts located in Kansas, County of Johnson, with respect to any dispute arising under the Transaction Documents or the transactions contemplated thereby.

https://www.lawinsider.com/contracts/7qIpHxUvpYLR079532h2Xm/quantum-materials-corp/1403570/2017-04-04

Case History

http://www.jococourts.org/civroa.aspx?which=17CV06093

SBI - Securities Purchase Agreement

8. GOVERNING LAW; MISCELLANEOUS.

a. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Florida without regard to principles of conflicts of laws. Any action brought by either party against the other concerning the transactions contemplated by this Agreement shall be brought only in the state or federal courts of Miami-Dade County, Florida.

https://www.lawinsider.com/contracts/1By6F1FDkYXN9vlhtysPgV/quantum-materials-corp/1403570/2017-04-04

Complaint

https://www2.miami-dadeclerk.com/ocs/Search.aspx

https://www2.miami-dadeclerk.com/ocs/ViewerHTML5.aspx?QS=B6%2f9EwnZlIiih%2bgqiU8rawLJW%2bj4E30XGWoN6L%2b82TlPeBnFcsg8Glywwh6ySB8URO0pU2NNu%2baJNif1%2bCBiiucCOd0j7MwV9NhYnxkZBCCl31Xxu8KPCUh2ORrxrh0HSyo5ii3MvsSAJEdh%2bHal%2f%2fbhIkhdcPzjhP29jeixTOGFzMvtM8eNeTRLnILQzWKeWMWlVMraQrxGGS4aPmPibffTI%2bF6jfVA

These are PUBLIC DOCUMENTS. Thanks Jamis

How about everyone take a chill pill!

There are for a fact 3 legal cases in court.

1) QMC suing for injunction to stop L2 and SBI from receiving shares

2) an appeal to the injunction by L2 and SBI

3) a case where L2 and SBI are suing QMC for breech of contract

That’s all the info I will provide. Do some sleuthing and you’ll likely find it too! It’s all public info since the cases are all filed in our public court systems. You’ll just have to find which court of the thousands in the USA.

looks like we didn't get that "golden pass" by the OTC as advertised.

I’ve always done my own due diligence. You are the one who plagiarizes other people you little copy and paste bandit you.. There is no court case but since you are so good at the old control C control V trick why don’t you enlighten all of us with this case number and reference where you found information pertaining to said court case.

Yeah, QMC and CAD Free Flow has no future. lol

Does anyone bother to look at previous filings? or research this online? I did'nt think so.

Well I sold my buy back at a small loss! Granted I only bought back in for 50k, but I'm willing to bet this goes far below .065.

Do your own DD FOR ONCE lol

Looks like what court case has been delayed?

Uniglobe Kisco still references QMC. I blame this lender not QMC. Looks like L2 and the court case has been delayed.

http://uniglobekisco.com/products/quantum-dots

Yeah, that's new this week; I've been checking. They were otcqb last week, with a "delinquent" status.

To me this says that either something huge is just over the horizon and they couldn't care less about their OTC listing status/grade...or QMC is up s*&^'s creek with a turd for a paddle.

I'm actually surprised Squires let this happen. Is there some sort of listing downgrade clause in their agreement with their malicious lender? Time for an update Mr. Squires.

This is starting to smell like horse sh$t!

Steve what have you done?

Has the QD industry passed QMC by? Answer is No.

I don't know how new it is, but its definitely looks like they are OTC Pink and most certainly have the big stop sign.

Yet we have people talking about OEM contracts coming soon haha.

A predatory lender forced QTMM to get delisted? Is that the new reason their product can't sell?

You have literally been saying things like this since 2012.

Quote from share holder news letter..."we will be filing the 10k within the allotted grace period..."

Has the grace period passed?http://investorshub.advfn.com/boards/read_msg.aspx?message_id=135541068

A Lender screwing QMC. An OEM will solve..

I thought it was no big deal ? No reason to be concerned, right?

Noticed OTC Markets has QTMM as pink no current information with a stop sign...is this new? as of today?http://www.otcmarkets.com/stock/QTMM/quote

Unless Jokers are wild!

;)

I am curious about your Elliotwave (I have no idea what it is), but if it is some sort of analytics, I am not sure there are any analytics that pertain to a company that does not have any sales or revenue of any kind. This is pure unadulterated speculation.

Speculation on commodities is one thing, where there is long history and there is a real tangible value.

This is speculation based on no history and no known value. It is a completely new territory. that makes it exciting and the potential is only limited by our imagination. But it also makes it so unknown that any kind of analytical analysis does not apply. IMO.

I still think it is a feel play... a gut feeling, based on what we all perceive is the technology of the future and that QMC is our best bet to get in on the emerging tech. We could be correct and I hope we are, but the odds are against us. Everyone here should at least recognize that.

I spade is a spade until it is not. I just hope we are not all holding a deck full of jokers.

Hook'em!!!!

You are right that people seem to be getting excited. There is no news and Monday 780K shares trade and Tuesday 1.2M shares trade and the share price close is the same - .063. That seems to me to indicate we may be close to a bottom, with maybe tax end year selling, but not panic selling. Maybe its the start of building a base.

Volume picks up at stock turns, Volume increases interest. Does anyone know why QMC traded over 1.2M shares today on no news? It sure doesn't say 'wait till next year' to me.

One last technical point. Elliottwave theory is not for everyone, but I looked at a QMC chart starting in 2014 until present, and thought I could see a corrective 5-3-5 3-wave pattern, which means it could be getting close to the start of an upturn. I just dabble in it, so FWIW, just sayin'.

I wasn't saying they should announce a product, they should let us know that they will be there with something to show. no need to say what it is.

I just do not think anyone should be surprised if they have nothing to show and if that is they case, they should be less surprised when the share price gets cut in half the week following.

People are getting excited and ramped up for possibly and highly likely a huge disappointment.

The anticipation of big news is unwarranted especially in light of the current state of affairs with missed reports and cut and paste PR's.

(as someone else on the board referred to them).

We have a long way to go and it probably isn't happening in 2018. just say'n..

Hook'em!!

I never said they should divulge the OEM. I said they should give a PR that they will be there with something to show. Invite us all out to see it because it will be big.

But no, there will probably be nothing significant there.

and yes... you should know by now. I am the eternal pessimist when it comes to QTMM.

I will not be satisfied until it hits $5.00 a share.

I just don't believe it can happen to me.

So who is Sid? I assume a stock advisory newsletter author? Thanks.

Never satisfied. QMC cannot disclose an OEMs plans if they expect to continue doing business with that OEM. What would you say if QMC announced something and then the OEM changed its timetable? You would blame QMC for speaking prematurely.

Silence is a source of great strength. - Lao Tzu

US company Solterra has already begun to build a commercial plant in Jeddah City in Saudi Arabia, which will supply its Quantum Dot solar cells to the booming construction market there. It expects to begin mass production early in 2010. ‘Several solar module manufacturers are waiting to transfer our printed cells into large area devices,’ says ceo Steve Squires. ‘We expect to start shipping at the end of Q1.‘

Quantum Materials Corp and Freschfield PLC Execute Funded Collaboration Agreement for SmartSkinz Development

LONDON and SAN MARCOS, Texas, April 27, 2017 (GLOBE NEWSWIRE) -- Quantum Materials Corp (OTCBB:QTMM) and Freschfield PLC today announced the execution of a funded collaboration agreement by which Quantum will work with Freschfield to integrate Quantum Materials Corp advanced Nanomaterials including quantum dot-based solar photovoltaics into Freschfield's SmartSkinz.

Freschfield has synthesized solar and hydrogen fuel cell technologies into an outer layer building skin – SmartSkinz – which creates a perpetual carbon-free energy source, under any weather condition, time of day and location.

Quantum Materials’ development will focus on developing and deploying advanced nanomaterials to optimize system performance on several levels including the building-integrated photovoltaics (BIPV) component of SmartSkinz.

“The Freschfield SmartSkinz technology represents a masterful combination of state-of-the-art advances in diverse technologies into one building material, the Freschfield SmartSkinz,” stated Freschfield PLC board member Dr. George Koo. “It will revolutionize the way new cities will be built and by retrofitting, will convert existing buildings into energy self-sufficient structures.”

“Quantum was a natural fit for us, Stephen and I have great synergy and see a similar future,” said Freschfield PLC founder and executive chairman Dr. Randolph Allen St James II. “We look forward to this first step in an extremely important relationship as we develop ground breaking products.”

Under terms of the agreement, Freschfield will fund development by providing $1 million over four quarters to Quantum Materials beginning June 2017.

“This is an ideal application for a number of our high performance nanomaterial technologies not the least of which being quantum dot photovoltaics and we are excited to work with Freschfield to optimize system efficiencies of their revolutionary SmartSkinz offering,” stated Quantum Materials Corp founder and CEO Stephen Squires.

Quantum Materials Corp and Nanoaxis Announce Technology Alliance

Biocompatible quantum dots to enable industrial scale production of Nanomedicines

TEMPE, Ariz., Sept. 20, 2011 /PRNewswire/ -- Quantum Materials Corporation (www.qdotss.com) (Pink Sheets: QTMM) Quantum Materials Corp. and Nanoaxis, LLC announce the formation of a technology alliance combining Quantum Materials tetrapod quantum dot mass production technology with Nanoaxis advanced research expertise and intellectual property in gene therapy biomedical nanotechnology. The aim of the alliance is to develop Tetrapod Quantum Dot based Cancer diagnostic kits and theranostic applications including Alzheimer's, Type 1 and Type 2 Diabetes, Breast Cancer and Major Depression.

Quantum Materials Corporation will develop specialized quantum dots for Nanoaxis to functionalize with their proprietary biomedical nanomaterials for a multiplexing drug delivery platform for drug/gene therapy and diagnostic medical devices technologies. The technology alliance allows these technologies to be developed rapidly due to Quantum Materials' ability to create the highest quality quantum dots in quantities necessary to support multiple projects with timely deliveries.

The immediate goal is to develop a QD microarray device for detection, diagnosis and quantification of early cancers. The QD-MI device will be designed for rapid detection and grading of various multiple cancers using blood assays, with higher accuracy and at less cost than current single ELISA assays. All diagnostic and pharmaceutical products will include QMC quantum dots functionalized by Nanoaxis biomedical IP nanotechnology.

According to a recent report published by BCC Research the total market for nanobiotechnology products is $19.3 billion in 2010 and is growing at a compound annual growth rate (CAGR) of 9% to reach a forecast market size of $29.7 billion by 2015.

Stephen Squires, CEO and President of Quantum Material Corporation and its subsidiary Solterra Renewable Resources, added, "This alliance will foster a breakthrough in theranostic science as it enables mass production of Nanoaxis nanomedicine product pipeline. The goal is to make these biologically adapted quantum dots the ideal choice for in vitro and in vivo applications for high throughput, efficient and cost effective applications in the biological and medical market spaces. Quantum Materials' ability to create tetrapod quantum dots of various materials, shapes, sizes and characteristics that can serve as delivery platforms for Nanoaxis products will allow for rapid commercial development."

"This is an exciting moment for our industry. We see this Technology Alliance between Nanoaxis and Quantum Materials Corp as bringing industrial scale production to the cutting edge of nanomedicine research. The synergy of the combined technologies is enhanced by the cooperation of our two companies' seasoned management and research teams and we believe this partnership will be the catalyst of many biomedicine advances," said Dr. Krishnan Chakravarthy, Nanoaxis, LLC President and CEO.

Siddhartha Kamisetti, Director of Global Strategy at Nanoaxis, commented, "This alliance opens the door for pioneering developments in the biomedical space and presents a significant opportunity to assist people suffering from a host of diseases and ailments throughout the world."

From June 24, 2021 10-Q filing:

"Following the filing of this Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2019, the Company will be entering into an Offer of Settlement with the SEC which will result in the revocation of the registration of Company’s securities pursuant to Section 12 of the Exchange Act, thereby terminating the Company Section 12(g) reporting obligations with the SEC ."

Warning! Grey Market securities are not traded on the OTCQX, OTCQB or Pink markets

OTC Markets Group Inc. ("OTC Markets") has discontinued the display of quotes on www.otcmarkets.com for this security because it has been labeled Caveat Emptor (Buyer Beware). OTC Markets Group designates certain securities as “Caveat Emptor” and places a skull and crossbones icon next to the stock symbol to inform investors that there may be reason to exercise additional caution and perform thorough due diligence before making an investment decision in that security.

The Caveat Emptor Designation may be assigned when OTC Markets becomes aware of one or more of the following:

OTC Markets will resume the display of this security’s quotes once adequate current information is made available by the issuer pursuant to the Alternative Reporting Standard or by the SEC Reporting Standard, and until OTC Markets believes there is no longer a public interest concern. Investors are encouraged to use caution and due diligence in their investment decisions. Please read our Investor Protection page and OTC Markets Policy Regarding Caveat Emptor for more information.

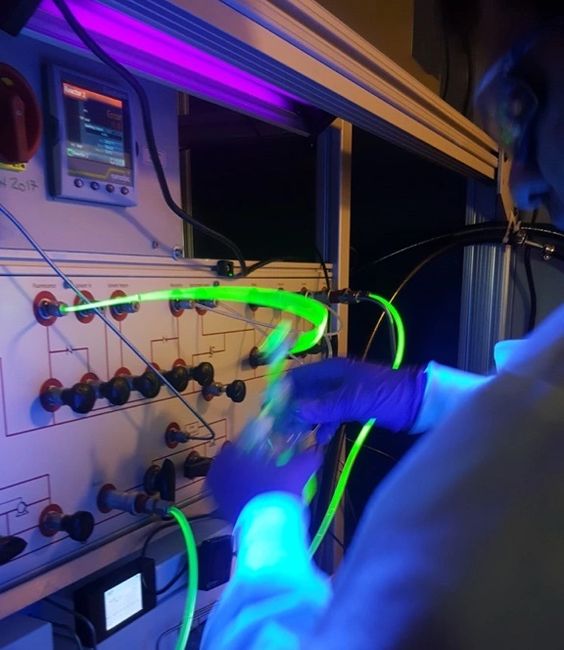

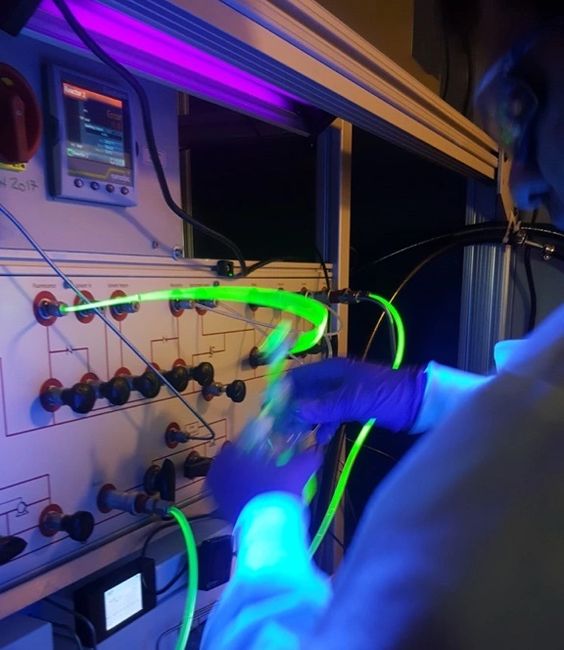

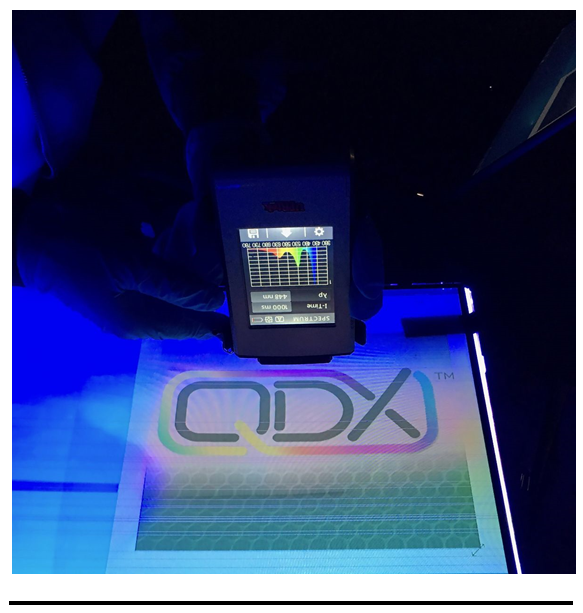

The QDX™ Platform combines the molecular power of quantum dots and the security of distributed ledger technology (blockchain) to address the $1.2 trillion global counterfeiting and product liability problem.? The QDX platform is a cost effective passive additive technology that dramatically enhances tracking and security utilizing smart device technology.? Multiple global companies have begun exploration of the technology and how it can be implemented into their product lines and supply chains. Sectors such as apparel, luxury brands, oil & gas, high security ink and paper, defense, environmental, cannabis and many more are looking for solutions such as the QDX platform with the desire to integrate across their supply chains. Stay tuned for more exciting news to come about the QDX platform in 2020.

2019 Was an exciting year for QMC! We achieved significant steps to monetization of our quantum dot technology. We hit many important milestones technologically and commercially. QMC made a key acquisition with the purchase of Capstan platform digital assets and key hires to support expansion and growth. Solar production demand is increasing dramatically as does demand for quantum dots in the display space all of which QMC is leveraging to produce revenues and position itself as the leader in high volume, high quality, environmentally friendly quantum materials and production technologies.

Another major development is the QDX platform and our integration of quantum dot production and DLT/blockchain. It has become clear that quantum dots have the potential to be used in many applications as markers to identify physical items in specific locations in time and space. Up until now there was no way to identify the dots uniquely or serialize the dots. The QDX platform for the first time in history bonds the physical and the digital in a tamper proof highly secure digital environment. For the first time dots will be “branded", registered and serialized as they are produced and associated with a cryptographic hash identifier in the blockchain.

In another industry first QDX Ledger incorporating the latest distributed ledger protocols including Hyperledger Sawtooth and DAML. We will be sharing more details as the development nears completion in the third quarter. In the meantime, we are seeking proof of concepts with a number of significant companies that see the benefits of being early adopters of industry use cases. This technology opens up a myriad of business use cases and opportunities to fight the global $1.2 trillion counterfeit and product liability problem we are all affected by. We are well positioned to be the first quantum dot enabled revenue producing use case in the global track and trace marketplace.

Display manufacturers continue to court us and our cadmium free quantum dot technologies. As mentioned in our 2019 highlights, the achievement of the industry first 100% cadmium free RoHS compliant, quantum dot LCD display film to exceed 95% Rec. 2020 color gamut created inquiries for testing with multiple display OEMs to potentially license our capabilities. As many of you may have seen this last holiday shopping season, QLED and quantum displays are now mainstream. The demand for environmentally friendly quantum dots is exponentially higher than 12 months ago as evidenced by this headline: "Samsung to invest $11bn in cutting-edge quantum dot displays" - Nikkei Asian Review Moving into 2020. QMC is well positioned to take advantage of this new mass adoption of quantum dot displays and is hard at work to validate its next generation technology to the display screen marketplace.

There seems to be much misinformation regarding the uptake of quantum dots in displays. The marketplace is very dynamic and is rapidly become commoditized. Other than Samsung all, other QD displays are using some cadmium. As the Chinese display manufactures have now embraced cadmium solutions inexpensive cadmium display films are entering the market at low prices. All other current solutions require a barrier film in order to pass the long-term stability testing. QMC recognized that in order to succeed in this marketplace we need to deliver a cadmium free product that is RoHS compliant, provides superior REC 2020 performance and meet the stability requirements at a price point competitive with the Chinese pure cadmium offerings. The only way to achieve this was to eliminate the need for the barrier film. QMC has just completed the stability testing of this product and anticipate introducing it to the market during 2020. In parallel to this effort we remain active in our effort to license our display technologies to one or more significant display industry companies.

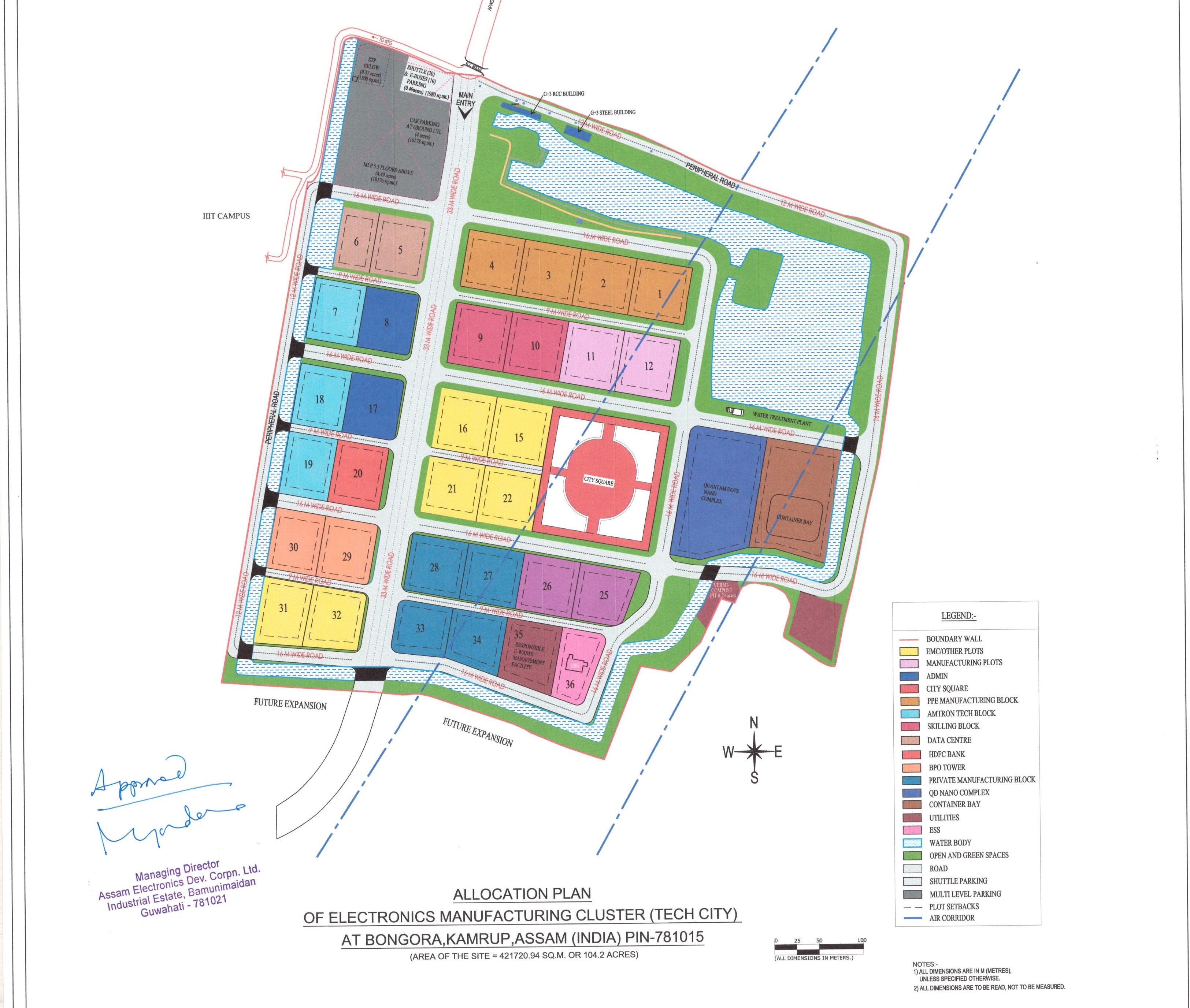

Solar demand and opportunities continue to grow. Though the Assam India solar project, our licensee had delays due to weather and is now moving forward and back on track and projections for our licensees’ quantum dot production have increased which is welcome news. We have also identified additional regions in India and the Middle East who desire to license our technologies in the same way. We are working to upgrade micro reactor equipment to be more secure, handle greater demand and work more efficiently and with less maintenance.

We know many of you have questions about the company’s filing status. We have been working with our auditors and counsel to complete our disclosures, particularly in regard to equities. The company has a number of complex transactions and we are making an extra effort to detail these in our disclosures.

Our Assam licensees have assured us that they are working diligently to make up for time lost due to the recent historical flooding that the Assam region experienced. We have been informed that the site work is nearing completion and that some construction is being conducted offsite as prefabricated components. Our licensee has already made significant payments and additional payments are due to us once the reactors are setup and tested. This will allow us to recognize revenue once these benchmarks are met. We will also be delivering pre and post processing equipment this year.

We have continued to maintain aggressive cost control measures, never forgetting this is a marathon and not a sprint. We believe we will be able to duplicate our Assam license model in other regions and we are working diligently to monetize our quantum dot solar technology and display material technologies via licensing.

Our Assam India licensee has reported that now that the flood waters have subsided, site work is being completed and as much construction as feasible is being prefabricated off site. They have expressed their dedication to making every effort to make up for time lost due to mother nature wrath.

We believe our QDX Ledger Platform can help solve the worldwide counterfeit products problem. We also believe this will create significant value for QMC as a foundation for numerous recurring revenue income streams. We are continuing to focus more resources on R&D and with our continuous flow technology we have been able to leverage every dollar spent. To further streamline our operations we have continued to analyze our operating costs and make reductions whenever and wherever possible.

2020 looks to be another exciting year as we build and grow on our successes of 2019. The whole team is grateful for your continued support. The future is bright!

Stephen B. Squires Chairman and CEO

August 2019 QMC Acquires Capstan Blockchain Technologies in Austin TX Link

Quantum Materials Corp. intends to leverage the technologies that Capstan has developed to introduce additional products into new global market verticals in the near future.The Capstan Enterprise Trust Platform is designed for companies to easily build track and trace workflows for their business. Capstan Link

August 2019 Two New Corporate Officers Positions Created

1) Capstan’s Co-Founder Jay M. Williams joins Quantum Materials leadership team

as Corporate Technology Officer CTO LinkedIn Link

ABOUT QUANTUM MATERIALS CORP

Quantum Materials Corp (QMC) develops and manufactures quantum dots and nanomaterials for use in display, solar energy and lighting applications through its proprietary high-volume continuous flow production process. Combined with its proprietary blockchain technology, QMC’s unique quantum dots are also used in anticounterfeit applications.

QMC's volume manufacturing methods enable consistent quality and scalable cost reductions to provide the foundation for technologically superior, energy efficient and environmentally sound displays, the next generation of solid-state lighting and solar photovoltaic power applications. By leveraging the highly tunable emission quality of its quantum dots, combined with its scalable blockchain platform, QMC also offers products that underpin anti-counterfeit initiatives.

For more information, visit Quantum Materials Corp at http://www.quantummaterialscorp.com.

QUANTUM MATERIALS OVERVIEW

Headlines/ Details/ Filings/ Highlights/

Blockchain/ Anti Counterfeiting/ Amtronics India Collaboration

Cadmium Free & Perovskite QD/ Patented Continuous Flow Reactor/ Heat Resistant QDX™

Licensing & Manufacturing/ Displays/ Solar/ Lighting/ Details Below:

Quantum Materials Takes on Counterfeiting with Blockchain Link

Texas-based Quantum Materials Corp claims to be the first to combine nanotech and blockchain with their anti-counterfeiting solution.

These signatures can be scanned via inexpensive hand-held devices, digitized and stored on QMC’s QDX Ledger blockchain.

Oct 2019 Demonstration in Italy Demonstrating the Power of our QDX Ledger & Quantum Dot Technology to the Giants in #tobacco #f1 and #motogp see LinkedIn & Link

Tobacco Giant Philip Morris Int'l Is Building a Different Kind of ‘Public’ Blockchain Link

Tech City dot India Website Link

.png)

New Quantum Dot Facility to be built in Assam - QMC LinkedIn 1/29/19

Quantum Materials Corp Acquires Blockchain Technology to Address New Market Opportunities, Aug 2019 Link

Blockchain Adoption Link

Privacy Link

Potential Link

Quantum Materials Granted Patent, Honored By Gartner as 2017 Cool Vendor in 3D Printing, May 2017 Link

Gartner, Inc. has named Quantum Materials as one of five 2017 Cool Vendors in 3D Printing for the Company’s solution to the problem of counterfeit 3D printed parts – embedding light-emitting quantum dots in 3D printing plastic resins for product identification that is nearly impossible to counterfeit.

| a) | Within 60 days of execution of this agreement licensee will provide proof of funding in the amount of Twenty million U.S. dollars ($20,000,000.00) for this project. | |

| b) | Within 120 days of execution of this agreement licensee will provide proof that construction on the facility has commenced. | |

| c) | Within no later than 120 days of execution of this agreement licensee will place purchase orders and pay deposits on the purchase of the initial lab equipment to include but not be limited to the Schlenk lines, Micro reactors and support equipment. | |

| d) | Within 210 days of execution of this agreement licensee will provide proof that construction on the facility has been completed. | |

| e) | Within 300 days of execution of this agreement licensee will provide proof that quantum dot production has commenced at the Assam facility. | |

| f) | Within 30 months of execution of this agreement licensee will provide proof that solar cell production has been established. |

October 2018 Quantum Materials Corp Receives Innovator of the Year Award from YTEXAS

"We're so far ahead of everybody in the space." - Stephen Squires in CEO Y-Texas interview

QMC sues K&L law firm for $100 million for malpractice

“This is an important milestone in consolidating and protecting our intellectual property for large scale volume synthesis of non-cadmium quantum dots,” Quantum Materials founder and CEO Stephen Squires stated. “Continuous synthesis micro-reaction technology is the solution for synthesis of high-quality nanoparticles due to the many advantages our patented process provides, including precise temperature control, mixing efficiencies, fast reaction speed and parallel operation for scalable volume production.

Quantum dots refer to one of several promising materials niche sectors that recently have emerged from the burgeoning growth area of nanotechnology. Quantum dots fall into the category of nanocrystals, which also includes quantum rods and nanowires. As a materials subset, quantum dots are characterized by particles fabricated to the smallest of dimensions from only a few atoms and upwards. At these tiny dimensions, they behave according to the rules of quantum physics, which describe the behavior of atoms and sub atomic particles, in contrast to classical physics that describes the behavior of bulk materials, or in other words, objects consisting of many atoms.

Quantum dots refer to one of several promising materials niche sectors that recently have emerged from the burgeoning growth area of nanotechnology. Quantum dots fall into the category of nanocrystals, which also includes quantum rods and nanowires. As a materials subset, quantum dots are characterized by particles fabricated to the smallest of dimensions from only a few atoms and upwards. At these tiny dimensions, they behave according to the rules of quantum physics, which describe the behavior of atoms and sub atomic particles, in contrast to classical physics that describes the behavior of bulk materials, or in other words, objects consisting of many atoms.

Quantum Dots measure near one billionth of an inch and are a non-traditional type of semiconductor. They can be used as an enabling material across many industries and are unparalleled in versatility and flexible in form.

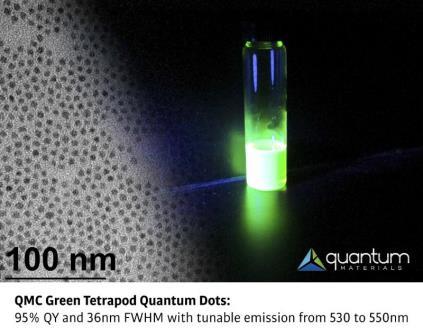

These highly efficient tetrapod QD are available across the entire light wavelength from UV to IR spectra and very narrow bandwidth is common. Selectivity of arm width and length is very high allowing different characteristics to be emphasized. Capping with shells and dyes adds desired properties. A custom mixture of quantum dots tuned to optimal wavelengths is easy to create, and projects will have the advantage of unprecedented flexibility and quantities for determining the optimal quantum dot without the time, expense and poor quality of batch synthesis methods.

Stephen Squires

Founder & CEO Quantum Materials & Solterra Renewable Technologies

Stephen Squires

Stephen Squires has more than 30 years experience in advanced materials, nanotechnology and other emerging technologies. Prior to forming Quantum Materials Corporation, Mr. Squires consulted on these fields with emphasis on applications engineering, strategic planning, commercialization and marketing. From 1983 to 2001, he was Founder and CEO of Aviation Composite Technologies Inc., which he grew to more than 200 employees and $20 million in revenue. ACT was merged with USDR Aerospace in 2001. In the late 1970s at McDonnell Douglas he developed and adapted advanced materials for combat aircraft applications.

Mr. Squires continues to pursue his lifelong interest in advanced materials, especially Tetrapod Quantum Dots and other semiconductor nanocrystals with unique nanoscale quantum features. Under his leadership, Quantum Materials has gathered or originated quantum dot technology related to unique QD synthesis, scaling of QD production, and QD printing technologies to position the company for leadership and growth in these areas.

"Review of Quantum Dot Technologies for Cancer Detection and Treatment" http://www.azonano.com/article.aspx?ArticleID=17

Robert Phillips

Robert Phillips has extensive experience as a consultant with positions in accounting, finance, Securities and Exchange Commission (SEC) financial reporting, Sarbanes Oxley (SOX) compliance and strategic planning in industries as diverse as software, hardware manufacturing, medical technology and global communication services.

?Less than two years after completing his MBA at Texas A&M, he became CFO of a publicly traded company that was experiencing a difficult turnaround. A few years later he again became CFO and Chief Strategy Officer at publicly traded SecureCare Technologies, a medical technology spin-out.

His early CFO experience led him to positions and consulting engagements ranging from the CFO of iStream Technologies, a startup business process management company specializing in regulatory compliance, to global scale Apple, where he was a managing consultant of a high transaction volume stock operations team. There he managed accounting and related 10-Q and 10-K financial equity disclosure and technical accounting assessments, as well as the transitioning of the department's operational site from Cupertino to Austin.

He was also VP of Venture Development at a venture backed e-commerce startup incubator in Austin. He has served as Controller of Rocket Gaming Systems as well as Financial Reporting and Planning Director at Multimedia Games, and at Rignet during its IPO.

As financial consultant at Bridgepoint Consulting Group, he has held CFO services, Interim Controller and SEC Financial Reporting positions at Phunware, Crossroads Systems, ActivePower, Harden Healthcare, ArthroCare, Boardbooks.com, Rainmaker Technologies and Fallbrook Technologies. He also undertook financial consulting and CFO services engagements at multinational companie,s including BMC Software, Natco Group, Respironics and FIC Group.

Jay Williams has been a Chief Technology Officer and consultant to many companies in the Fortune 500. As a consultant, he has developed a highly refined process for managing a company’s technology infrastructure, including applications, security, and network assets.

Mr. Williams is a highly sought-after enterprise systems architect and problem solver. He has advised a number of high profile technology companies on their products and is known for a rare combination of deep technology expertise, expert problem solving ability and business acumen.

He is widely respected by peers and has influenced many pivotal technology consortia and industry steering groups. Mr. Williams regularly consults with senior technology and business executives and is frequently consulted by venture and capital investors for analyses of new technology strategies.

John Hartigan founded the first of his many businesses at 15 years of age: a tennis court washing service. When the rapid growth of the business began to interfere with his education, his parents made him sell it and focus on his schoolwork. Now, 30 years on, Mr. Hartigan has founded and led multiple startups and early growth projects, achieving success through strategic partnerships with a number of Fortune 500 companies.

Over the past four years, he has focused on practical business applications of blockchain and distributed ledger technologies. Most recently, Mr. Hartigan served as CEO of Intiva Health, launching the first enterprise decentralized application for healthcare provider credentialing.

As a blockchain and DLT evangelist, Mr. Hartigan is frequently invited to speak at events around the world to share and discuss the impact of blockchain

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |