Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Precious metals Gold and Silver move upward as the middle east, china and taiwan and Ukraine and Russia wars continue to hit the news channels worldwide. $SPXU

Good place to be.

"The S&P for example, should probably be more fixated on the 50 DMA at 3979".

https://www.zerohedge.com/markets/4000-more-just-round-number

Just broke 4000,..

SPXU

ProShares UltraPro Short S&P500

14.8399

+0.8499 (+6.08%)

SQQQ

ProShares ETF - UltraPro Short QQQ

38.789

+2.499 (+6.89%)

Cheers

Dow is being manipulated by Powell .. inflation is killing normal people.. can only be held up so long .. this economy is getting ready to tank hard ..

"Biggest-Ever Mega-Adjustment of Health Insurance CPI" skewed last Thursday's inflation report to look better than it was. https://wolfstreet.com/2022/11/10/services-inflation-spiked-to-second-highest-in-4-decades-would-have-hit-new-high-if-not-slowed-by-biggest-ever-adjustment-of-health-insurance-cpi/

"Consumers’ median inflation expectations for one year out, after dropping three months in a row, jumped by 50 basis points, to 5.9% (red line), according to the New York Fed’s Survey of Consumer Expectations today." https://wolfstreet.com/2022/11/14/inflation-expectations-throw-a-curveball/

Calendar of events for this upcoming week (further down in the article): https://finance.yahoo.com/news/what-to-know-this-week-in-markets-june-27-184417186.html

I believe a recession is defined by two consecutive quarters of negative growth, please correct me if I'm wrong....wellllllll...quarter 1 of this year was negative growth, so if quarter two is negative also...the recession has arrived and few are even mentioning it.

I should note that most analysts I'm reading are expecting a small positive reading for this quarter.

well jumped in , don't see things getting much better for a while....Holding long , crazy Time will tell.......

Crude heading back to the mid to low 60s

Weeeeeeeeeeeee

If the market is gonna start giving anything back this summer, it needs to start this week. Russell 2000 smelling like a nice violent rollover from highs, need to see it in the next day or 2, otherwise the plan for a summer short will have to be re-evaluated

really hard to say. commodities have been rising even as the dollar has been rising. so if the dollar were to weaken and weaken significantly, commodities will continue to soar, the only thing to stop commodity prices from rising now are demand, a surging dollar or the FED.

i think the second half of 2021 will be very volatile

https://tradingeconomics.com/commodity/steel

Crude looks vulnerable as well, will wait on the signal to grab some SCO

the algos are in buy mode, just waiting for that flip to sell :)

Just finished scaling in here today, let the bodies hit the floor

I just want to know who paid off Jerome Powell in December 2018 and January 2019.

the infamous Powell Pivot had to be one of the most disgusting things I ever seen.

Hawkish to squeamish in a BLINK

Yes, SQQQ should be a good bet too NAS's deserves to be plucked as well and is way overdue.

markets can definitely overshoot to the upside (looks like that is what is taking place)

note the SPY and AAPL lately ;)

I am long AAPL but buying SQQQ PSQ HIB SH and SPXU as hedges bc this market is looking very expensive on all metrics

True ... It maybe time to start a small position in it again and add as it grows ... this time it would probably work in our favor ... ;)

Neb, I do not know, but I got out some time ago because they seem to pull a split on you when you start to make any progress, or at least that is what happened to me with it ... ;)

John

it's splitting again?

i think it will be green after this over extended rally reverses

... what is everybodies opinion on SPXU's reverse split on Thursday ... 1 share for each 5 shares ... ???

At least SPXU is back to my average price of $7.05

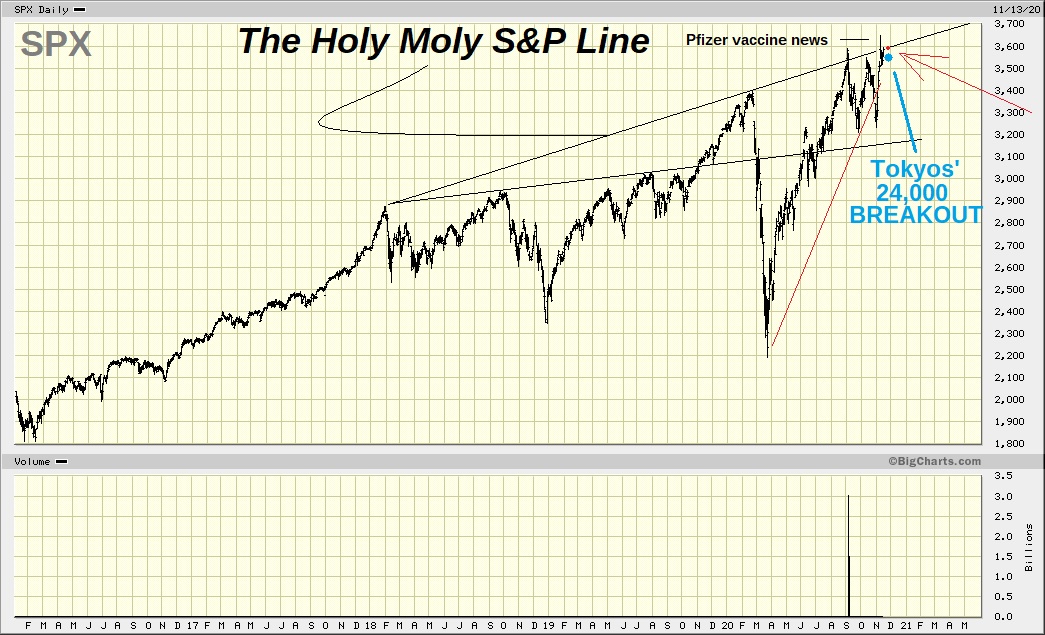

Some folks haven't drawn these lines : Perhaps they haven't seen them.

What has the top line begun to suggest ?....Click on link to see !

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=159495612

Tokyos' 24,000 Breakout

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=159495612

I loaded up at fire sale prices bringing may average price down to $7.05! Next few weeks should be interesting.

Trump will win, way too much obvious election fraud from the Dems. Globalists won't be happy.

“Something tells me, this forum will get a but more exciting in the coming weeks”

December, we’re gonna be like Europe is now. (March) This went to $42. Plus Biden’s gonna win. IMO

Keeping an eye on it as well. Election turmoil may get a pay day here.

SP gonna go down hard. Best place to watch Fantasy FAANG stocks come back to earth. I’m in no hurry, it’s all still full of hot air. But I am also not sure which is best way to go SPXU or SPXS. It’s still a 3x but I don’t trust Direxion.

loading up on SPXU and PSQ next week as early as monday unless future are green, then ill wait but this is insane

SPXU-200 at 14.45 just now

SPY hitting 295-295 resistance. sure it could hit 300-305 but then SPXU is DEFINITELY A BUY around 12.50-13.50

would go with 500 at 12.50 if it gets there as this market could still sell off big as market is priced for a very good 2021 which I doubt will happen

Took a small position earlier. Currently trending slowly up.

We'll see what tomorrow brings.

It sure does seem like we are about to see the biggest economic downturn in the history of the world.

I cannot imagine the S&P 500 hanging tough...

That pop on UPRO I'm thinking will be short lived.

Will the US pump another Trillion in this market?

|

Followers

|

36

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

189

|

|

Created

|

07/01/09

|

Type

|

Free

|

| Moderators | |||

ProShares Launches ETFs to Provide Triple Exposure to S&P 500

July 1, 2009

ProShares Launches First ETFs to Provide Triple Exposure to S&P 500

ProFunds Group, the world’s largest manager of short and leveraged funds1, announced today that it is launching the first ETFs designed to seek triple exposure to the S&P 500 on a daily basis. ProShares UltraPro S&P500 (UPRO) seeks 300% of the performance of the S&P 500 for a single day, while ProShares UltraPro Short S&P500 (SPXU) seeks 300% of the inverse performance of the S&P 500 for a single day (before fees and expenses). The new ETFs will be listed on NYSE Arca today.

“The S&P 500 has the largest following in the ETP industry with nearly $90 billion of assets benchmarked to it,” said Michael L. Sapir, ProFunds Group Chairman and CEO. “As the leader in short and leveraged ETFs, we are committed to giving investors more choices to manage risk and pursue returns.”

About ProFunds Group

ProFunds Group includes 86 ProShares short and leveraged ETFs, and 115 ProFunds mutual funds. ProShares, which introduced the first short and leveraged ETFs in 2006, continues to be a leader in launching innovative new products—for two years in a row, ProShares has led the industry in attracting assets to newly launched ETFs2 and is the fourth largest manager of ETFs3 in the nation. Since 1997, ProFunds mutual funds have provided investors with access to sophisticated investment strategies, with offerings that include funds that seek to magnify daily index performance and funds that seek to increase in value when markets decline. The group also manages the Canada-based Horizons BetaPro ETFs.

[chart]stockcharts.com/c-sc/sc?s=SPXU&p=D&b=5&g=0&i=t45100127534&r=4326[/chart]

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |