Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I wonder why the SEC is taking so long to issue the Solid Waste permit? 2000 lbs an hour run rate about to double, # 3 machine getting closer everyday. Never ending thirst for fuel on this planet. TIC TOCK

I'm back. JBI on YOUTUBE:

you left "not profitable" off your list. plastic pyrolysis has yet to be proven to generate any kind of profit.

JBI will be yet another unprofitable failure.

Every other P2O technology company I know of is private, and thus:

. cannot use stock promoters to help sell their shares

. cannot have iHub boards

. cannot be investigated by the SEC

Who is "abusively shorting" JBI? For the good of all shareholders, can someone please identify this "jury tampering" unicorn?

I think this particular game has been pushed too far and it is going to implode on the people who have gotten away with abusively shorting start up companies.

That being said, this will get more obvious and pushed further. If we go to trial I am expecting jury tampering.

JBII Complete Summary DD. On Discovery Channel!:

Latest Developments:

3-20-12: Discovery Channel Segment on JBII: http://watch.discoverychannel.ca/#clip641572

2-27-12: Processor #2 now On Line

THOROLD, Ontario, February 27, 2012 (GLOBE NEWSWIRE) – JBI, Inc. (the "Company") (OTCQB:JBII) is pleased to announce that in Q1 the Company has been successful in bringing its second Plastic2Oil® (“P2O”) processor (the “Processor No. 2”) online at the Niagara Falls, NY facility.

1-20-12: Viability of JBII Plastic2Oil ReConfirmed

THOROLD, Ontario, Jan. 20, 2012 (GLOBE NEWSWIRE) -- After completion of audit and peer reviews of the stack test conducted on December 5-6, 2011 by Conestoga-Rovers & Associates ("CRA") on its Plastic2Oil ("P2O") processor, JBI, Inc. (the "Company") (OTCQB:JBII.PK) has received the final emissions report from CRA. This report further validates the viability of the P2O process and allows the Company to apply to the New York Department of Environmental Conservation ("NYSDEC") for a modification to its Air Permit to run at significantly higher feedstock rates.

In December 2011, three separate stack tests were performed on the existing P2O processor with a pre-melt system. Only unwashed, unsorted waste plastics, including various industrial plastics (buckets & barrels, waste meat packaging, bags, etc.) and gas tanks from scrap cars, were used as feedstock for the test, consistent with the feedstock the processor is currently converting into ultra-clean, ultra-low sulphur fuel.

The three tests were conducted at feed rates of 3,258 lbs/hr, 3,233 lbs/hr and 3,932 lbs/hr, respectively. Ultimately, the test results proved that emissions decreased with increased feed rates. Emissions were considerably reduced through the addition of the pre-melt system (Q3) and more efficient and higher combustion of the off-gas generated by the P2O process.

Residue was not removed from the pre-melt reactor so that the internal walls could be examined. When the reactor was opened, the inside walls were remarkably clean. Two small "tumbleweeds" of clean dense bailing wire bunches were present from processing some paper mill ragger tail waste. Normally, residue and metals would be removed from the pre-melt periodically during operation.

The final report included particulate matter (PM) and hexane testing, both of which showed exceptionally low results.

Comparative emissions results from all of the stack tests performed on the Company's P2O processor were as follows:

"In-spec" end-user fuels produced (Fuel No. 6, Fuel No. 2, and Naphtha) were also tested and verified as ultra-low sulphur, consumer-ready fuel. The conversion ratio for waste plastic into fuel averaged 86%.

"This report is very exciting for the Company as it allows us to apply for a modified Air Permit from the NYSDEC which should enable us to effectively double the capacity of our P2O processor," notes John Bordynuik, CEO and President. "Increasing the feedstock supply rate to almost 4,000 lbs/hr will significantly increase the rate at which we are able to produce fuel from waste plastic."

1-9-12: 13 Investors put up $2.8M.

JBI, Inc. (the "Company") (OTCQB:JBII.PK) is pleased to announce that it closed agreements on January 6, 2012 for equity financing in the amount of US$2.795 million to build its Plastic2Oil ("P2O") technology.

Thirteen accredited individuals participated in this recent round of financing, which consisted of units purchased at $1.00 per unit. Each unit included a share of common stock and a warrant to purchase an additional one-half share at an exercise price of US$2.00 at any time for a period of 18 months.

"I think this is further validation of our business model by sophisticated investors who believe in the innovations and proprietary technology that JBI, Inc. has developed," commented John Bordynuik, CEO of the Company. "This financing will continue to support the operational build-out of our P2O processors at the Company's Niagara Falls facility and the initial site in our agreement with Rock-Tenn Company."

The Company believes that this new injection of capital will assist in increasing its production capacity more quickly in order to satisfy the recent fuel distribution agreements made with Indigo Energy Partners, LLC and XTR Energy Company Limited. It is yet another step in the development of the Company as it executes its vision of becoming a vertically integrated plastic recycling, fuel processing and fuel distribution company.

1-4-2012: Response to SEC Lawsuit:

JBI, Inc. (the "Company") (OTCQX:JBII) is profoundly disappointed by the erroneous allegations of fraud contained in the civil lawsuit filed by the Securities Exchange Commission ("SEC") earlier today. The Company regrets that its attempts to negotiate settlement of this dispute failed, and, in consultation with its litigation counsel and Board of Directors, looks forward to vigorously defending itself in court, where the Company believes it will prevail on the merits.

The allegations in the complaint concern legacy accounting issues that have since been corrected. Among other things, since restating its financial statements, the Company has hired a new chief financial officer and engaged additional experienced accounting staff as well as a reputable independent audit firm.

Contrary to the allegations made by the SEC, the Company believes that its officers acted in good faith in valuing the media credits discussed in the complaint, based on the information available at the time. The Company further maintains that after learning of potential problems relating to these credits, it took appropriate steps in compliance with its obligations to shareholders and the public markets at large.

JBI, Inc. is acutely aware of its responsibility to its shareholders and values the trust shareholders put in the Company. The defense of this lawsuit will further demonstrate the Company's commitment to transparency and ethical business practices.

The Company is proud of its recent successes and will continue to focus on building out its business growth plan with its corporate partners

12-29-2011: Progress and Key Milestones of 2011 by John Bordynuik, CEO:

As 2011 comes to a close, John Bordynuik, Founder and CEO of JBI, Inc. (the "Company") (OTCQX:JBII), offers a recap of the Company's progress and key milestones over the past 12 months.

"It's been an exciting year for the Company," states Bordynuik. "We've taken significant steps forward and on many levels have out-paced traditional industry timelines -- and it has been a team effort." He continues, "The successes we've seen in 2011 have involved many months of extensive testing, third party analysis and validation, and corporate due diligence. We are proud of our accomplishments and are confident about our growth moving into the next fiscal year."

In May 2011, JBI, Inc. announced its first sale of fuel produced by the Company's patent-pending Plastic2Oil(R) ("P2O") process. Shortly thereafter, Coco Asphalt Engineering, a division of Coco Paving, Inc., entered into a Supply and Service Agreement for the Company's ultra-clean, ultra-low sulphur fuel.

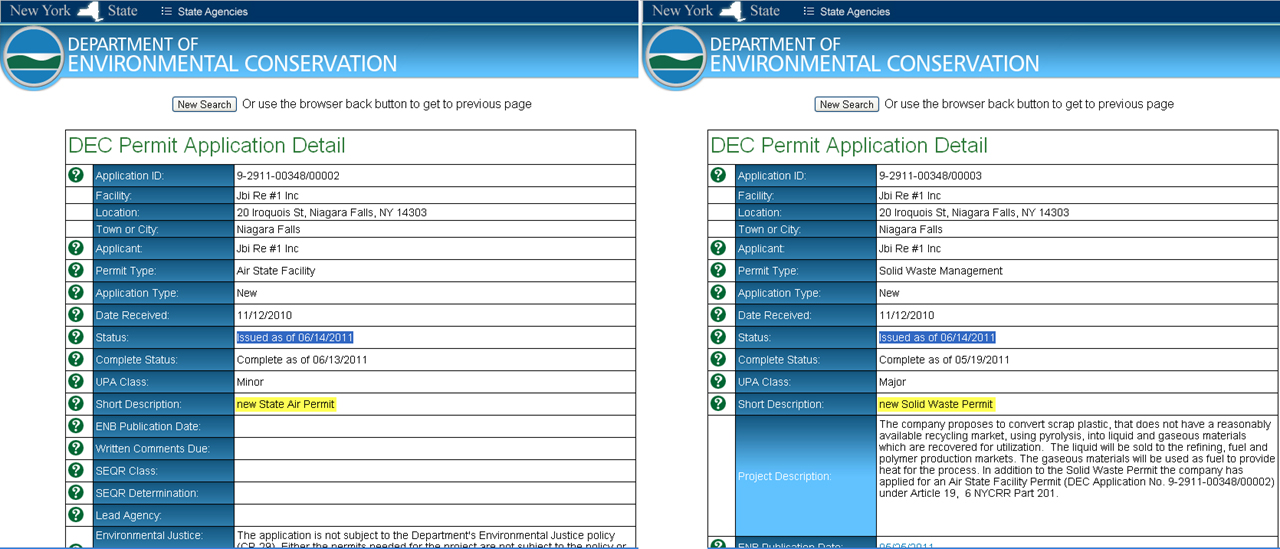

June 2011 brought more good news. "On June 17, 2011, we cleared a significant hurdle when the New York State Department of Environmental Conservation ("NYSDEC") issued a permit to JBI, Inc. to operate 3 separate P2O processors at our Niagara Falls facility," comments Bordynuik. "At the same time the NYSDEC also issued a Solid Waste Permit which allowed us to store plastic feedstock materials on-site."

During the summer months of 2011, the Company continued to make enhancements to its P2O processor, giving it the ability to produce specific fuel types to meet the needs of its customers. Bordynuik continues, "This paid huge dividends later in the year when new customers with diverse fuel requirements came onboard."

In July, the Securities and Exchange Commission ("SEC") issued a Wells Notice to the Company in relation to its legacy accounting issues from 2009. "The Company is acutely aware of its responsibilities to its shareholders," states Bordynuik. "As part of our internal corrective actions, we hired a highly respected auditor, an American Certified Public Accountant Controller, and retained the services of another highly ranked auditing firm and numerous financial consultants to advise the Company and assist in preparations of the 10Q and 10K filings. Most recently, we welcomed our new CFO, Matthew Ingham, CPA. Matthew will lead our financial reporting and will continue the improvements which began with the amending of the 2009 10K filing."

The highlight of summer 2011 was the signing of a 10-year exclusive agreement with Rock-Tenn Company (RockTenn) to convert mill by-product waste into fuel using the Company's P2O technology. "The significance of this agreement is impressive as it provides a solution to waste plastic challenges," notes Bordynuik. "And JBI, Inc. will have access to free feedstock supplies for our P2O processors, which we will locate on RockTenn sites."

The fall months of 2011 were spent enhancing the P2O processor in preparation for the final NYSDEC stack test scheduled for December. Upgrades included the installation of low NOx burners and the addition of a pre-melt system to increase through-put volumes. The Company worked with third party fabricators to produce standardized reactors and towers and has received the assembled modules.

"December 2011 has been busy, to say the least," Bordynuik states with a bit of grin. "We kicked off the month by completing the final stack test required by the NYSDEC. It was a very exciting day -- the emissions from the second stack test were found to be cleaner than the first test in August 2010, even with close to double the quantity of waste plastic through-put, while maintaining an 86.7% conversion rate to liquid fuel."

This success was quickly followed by the news of an Air Permit exemption in the state where the first RockTenn P2O site will be located, reducing the lead time for roll-out of the RockTenn agreement in that state.

The year came to a close with the signing of two major fuel supply agreements, the first with Indigo Energy Partners, LLC ("Indigo Energy") for the Company's No. 6 Fuel Oil and the second with XTR Energy Company Limited ("XTR Energy") for road transport fuels. The XTR Energy agreement will require the Company to purchase third party fuels to blend with its P2O fuel output until it can build out the capacity to meet the full quantities required by the customer.

"The beauty of the agreement with RockTenn, in combination with the fuel supply agreements with Indigo Energy and XTR Energy, is that we will be free to focus solely on the manufacturing of additional P2O processors as we move into 2012," says Bordynuik. "It's a huge step forward in achieving our vision of becoming a vertically integrated plastic recycling, fuel processing and fuel distribution company."

12-23-11: JBI Inc. Signs Multi-Year 'Transport Fuel' Take-Off Agreement With XTR Energy

THOROLD, Ontario, Dec. 23, 2011 (GLOBE NEWSWIRE) -- JBI, Inc. (the "Company") (OTCQX:JBII) is pleased to announce today the signing of a multi-year transport fuel supply agreement with XTR Energy Company Limited ("XTR Energy").

XTR Energy is one of the largest and fastest growing independent retail petroleum brands for regular and premium gasoline and diesel products in Canada. XTR Energy focuses on well-priced products, timely deliveries and innovative customer retention programs. This focus has enabled XTR Energy to establish network locations in Ontario, Nova Scotia, New Brunswick, P.E.I., Manitoba and Saskatchewan.

XTR Energy will be purchasing Regular Transport Gasoline, Premium Transport Gasoline, Diesel Ultra LS Clear and other acceptable road transport products from JBI, Inc. These products are the fuel output of JBI, Inc.'s Plastic2Oil(R) ("P2O") process, which will then be blended and made available through the Company's Blending Site in Thorold, Ontario ("Thorold Terminal").

"XTR Energy looks forward to acquiring products from JBI, Inc. in Ontario and across Canada. This new relationship is directly aligned with XTR Energy's strategic objective to have a diversified secure supply of quality petroleum products from a variety of sources to meet the growing demands of the XTR Energy network and preferred customers," stated Ken Wootton, President of XTR Energy, upon signing the agreement.

"We were attracted to XTR Energy because of their corporate values and distribution reach across much of Canada," commented John Bordynuik, CEO of JBI, Inc. "They are committed to green alternatives, high operational standards and maintaining long-term winning relationships with both their customers and suppliers."

The agreement with XTR Energy is a step forward in achieving the Company's vision of becoming a vertically integrated plastic recycling, fuel processing and fuel distribution company. It allows the Company to utilize the value of one of its key assets, the Thorold Terminal, a registered and licensed TSSA fuel blending and distribution facility with fuel storage capacity in excess of 250,000 U.S. gallons.

12-21-11: JBI, Inc. Signs Long-Term Fuel Supply Agreement with Indigo Energy Partners, LLC

THOROLD, Ontario, December 21, 2011 (GLOBE NEWSWIRE) -- JBI, Inc. (the "Company") (OTCQX:JBII) is pleased to announce today the signing of a long-term fuel supply agreement with Indigo Energy Partners, LLC (“Indigo Energy”).

Indigo Energy is a service-driven, wholesale distributor of petroleum products and renewable fuels that utilizes an expansive network of distribution terminals and bulk plants across the continental United States.

Under the terms of the agreement, Indigo Energy will off-take No. 6 Fuel Oil, from the JBI, Inc. Plastic2Oil (“P2O”) facility in Niagara Falls, NY.

The timing of this agreement in the early stages of the Company’s growth allows it to focus singularly on increasing production and growing capacity, instead of the marketing and distribution of its fuel products.

“We are very impressed with JBI, Inc.’s proprietary technology and the quality of their fuel products,” stated Martin N. Underwood, Jr., COO of Indigo Energy. “Additionally,” continues Mr. Underwood, “We feel this partnership is a natural fit for both companies and we look forward to bringing JBI, Inc.’s products to market as they expand production capacity to future plants across the U.S.”

John Bordynuik, CEO and Founder of JBI, Inc., commented, “We are excited about this partnership on several levels. First of all, we are proud to be affiliated with a company with the profile of Indigo Energy; a company which believes that green fuels can make a significant contribution to supplying clean, reliable energy.”

“Secondly,” continues Mr. Bordynuik, “After securing plastic feedstock supplies and creating a commercially viable, ‘green’ process for transforming plastic into oil, this agreement fulfills the final stage of our business growth plan, the distribution of our ultra-clean, ultra-low sulphur fuel to end-users.”

12-19-11: New CFO Hired. Background : Ernst+Young, Price Waterhouse:

THOROLD, Ontario, Dec. 19, 2011 (GLOBE NEWSWIRE) -- JBI, Inc. (the "Company") (OTCQX:JBII) is pleased to announce the appointment of Matthew J. Ingham as the Company's Chief Financial Officer ("CFO").

As CFO, Mr. Ingham will report directly to CEO, John Bordynuik. He will be responsible for establishing the Company's financial strategies while ensuring the Company has the appropriate financial systems in place to manage current operations. He will lead the development of financial planning models and cost-benefit analysis to forecast and support future growth. Mr. Ingham will also be responsible for all financial filings required by the SEC, and will serve as a financial and business advisor to the leadership team.

"We are extremely pleased to welcome Matthew Ingham as our new Chief Financial Officer. Matthew brings the experience and skills the Company needs to support both our short and long term growth plans. Not only is he a seasoned auditor, but he possesses extensive experience managing a successful corporate finance division," states CEO, John Bordynuik, on the appointment of Mr. Ingham.

Prior to joining JBI, Inc., Mr. Ingham held, successively, senior positions with two of the "Big 4" audit firms, PriceWaterhouseCoopers LLP and Ernst & Young LLP, specializing in auditing assurance, financial reporting and transaction analysis, and developed a broad base of auditing and financial reporting skills through assignments on publicly traded and privately held companies.

At Ernst & Young, LLP Mr. Ingham held the position of Audit Manager, Assurance Advisory Business Services, working directly with firm partners and company executive management on audits to finalize findings and issue audit reports. He assisted with client implementation of first year compliance with the Sarbanes-Oxley Act for three SEC accelerated filers, including the coordination of international scoping and testing and participated in cross service line initiatives which included working on an internal audit engagement team to assist a new client in their first year Sarbanes-Oxley implementation.

Most recently, Mr. Ingham was Senior Manager, Technical Accounting, Insight Enterprises, Inc., a $4.8 billion international Fortune 500 information technology company. Reporting to Executive Management and Senior Financial Staff, his responsibilities included managing all communications with the external auditors, providing evaluations of technical accounting research and analysis matters. He led a global team of finance personnel in formalizing and documenting accounting policies and procedures, including working with multi-national teams on sales operations improvement initiatives.

12-15-11: JBI, Inc. Receives Air Permit Exemption

THOROLD, Ontario, December 15, 2011 (GLOBE NEWSWIRE) – JBI, Inc. (the "Company") (OTCQX: JBII) is pleased to announce it has received an exemption from air permitting by the environmental protection agency in the state where the initial Rock-Tenn Company (“RockTenn”) Plastic2Oil ® (“P2O”) site is being constructed.

Additionally, the Company will not require a Waste permit, because the plastic being processed is already located on-site.

“The extra time we took to make enhancements to our processor during Q2 and Q3 to maximize its efficiencies and reduce emissions is now starting to pay dividends as we expand into other states,” stated CEO John Bordynuik.

12-7-2-11: JBI, Inc. Successfully Completes Its Final P2O Stack Emissions Test

THOROLD, Ontario, Dec. 7, 2011 (GLOBE NEWSWIRE) -- JBI, Inc. (the "Company") (OTCQX:JBII.PK - News) announces the successful completion of its final P2O Stack Test performed by Conestoga-Rovers and Associates ("CRA") on the Company's Plastic2Oil ("P2O") commercial processor. The stack test, which is a measure of emissions from the processor vent, was conducted by CRA beginning on December 5, 2011, with completion on December 6, 2011. The New York Department of Environmental Conservation ("NYSDEC") was also present during testing.

Three stack tests were performed on the existing commercial processor with a pre-melt system. Unwashed, unsorted waste plastics, including various industrial plastics and gas tanks from scrap cars, were used as feedstock for the testing. This type of feedstock is consistent with the day-to-day waste plastic that the processor is currently converting into fuel.

The stack tests were conducted at feed rates of 3,258 lbs/hr, 3,233 lbs/hr and 3,932 lbs/hour (Edit: This calculates to 281 Barrels/day) respectively. Ultimately, the test results proved that emissions decreased with increased feed rates, further validating that P2O is a highly "green," clean and scalable process. The addition of the pre-melt system, which was designed and installed in Q3, greatly improved feed rates for the process.

Draft emissions data was provided by CRA staff following the completion of each test. Emissions were significantly reduced through more efficient and higher combustion of the off-gas generated by the process.

Final average emissions for 3,923 lbs/hr were 15.97% O2, 3.05% CO2, 3.1ppm (parts per million) CO, 15.1 ppm NOx, 2.88 ppm TNMHC and 0.02ppm of SO2. The NOx emission was approximately one-fifth that of the original P2O processor tested 1 year ago.

The P2O processor did not have any stack filters or scrubbers.

"In-spec" end-user fuels produced were also tested and verified as ultra-low sulphur.

Management anticipates receiving final reports from CRA after audit and peer reviews of the testing are concluded. These reports and permit modifications, which allow a higher feed rate, will be filed in accordance with NYSDEC permit regulations.

The Company believes that the successful stack test results will aid significantly when seeking permit exemptions in other U.S. states. Additionally, the Company believes that these results will contribute to maximizing production at the existing New York processing plant.

11-16-2011. Plastic2Oil at NYSAR3 Conference: 11-16/17-11.

JBI, Inc. took part in the 22nd Annual New York State Recycling Conference and Trade Show in Cooperstown, NY on November 17, 2011.

The conference’s successful turnout drew corporations, academic institutions, municipalities and government agencies from across the state. Members from the New York State Department of Environmental Conservation (NYSDEC) and Empire State Development (ESD) were in attendance at this year’s conference and vendor participants included leading waste management companies, such as Rock-Tenn and Covanta Energy.

John Bordynuik, President & CEO of JBI, Inc., was among the elite three-person panel presenting on innovative recycling solutions. He was joined by delegates from Lubo USA and Axion International.

“At the annual NYSAR3 recycling conference, John Bordynuik presented an impressive solution to the problem of what to do with unmarketable plastic left over when the recyclable plastics are sorted out,” commented James Gilbert, Environmental Project Developer/Manager – Plastics Recycling Specialist at Empire State Development. “We are excited about the ability of Plastic2Oil to refine these unrecyclable plastics into useful fuels. Being able to process ag films and waste industrial plastic is also significant. The company’s goals of stimulating the local economy and strengthening communities go hand-in-hand with ESD’s own mission of promoting business investment and growth that leads to job creation and prosperous communities across New York State.”

Bordynuik’s presentation created considerable interest from municipal waste companies. In particular, these companies expressed interest in partnering with neighboring counties and JBI, Inc. to resolve local waste plastic challenges.

Public and private industry representatives also had the opportunity to meet Bordynuik as well as members of his team at the company’s vendor booth, and to learn more about the pioneering Plastic2Oil technology.

The conference was sponsored by the New York State Association for Reduction, Reuse & Recycling (NYSAR3) and the NYSDEC. For more information about NYSAR3 & this year’s conference, please visit www.nysar3.org/.

10-20-2011. Air and Waste Management Association toured the JBII Production Plant on Thursday 10-20-11.

JBI, Inc. hosted a tour of the Plastic2Oil facility in Niagara Falls, NY for the Niagara Frontier Section of the

Air and Waste Management Association (A&WMA-NFS) on Thursday, October 20, 2011. Following the tour, the group met for dinner

and a presentation by JBI, Inc.

A&WMA-NFS is a non-profit organization for individuals involved in the environmental profession and consists of

approximately 200 independent and corporate members from the Western New York area. http://www.awmanfs.org/

The event at JBI, Inc. attracted both local and international A&WMA members with a diverse representation from NYSDEC,

local and global waste management, and local and global environmental consulting. "The group was very excited

about today's event,” commented Bruce Wattle, an International member and Co-Chair of the A&WMA-NFS.

“It was a rare opportunity to tour a plant where a new environmental technology is in operation, as well as attend a talk by the CEO."

CEO John Bordynuik commented: “It's an honor to present to a group of people like the A&WMA-NFS members who are scientists, engineers

and business professionals all with a vested interest in the environment."

Full Story: http://www.plastic2oil.com/site/events/1214/

10-9-2011: CEO John Bordynuik speaks at Buffalo TEDx:

8-4-11: RockTenn(NYSE:RKT) Supplies Plastic to JBII:

On July 29, 2011, JBI, Inc. (“JBI” or the “Company”) and RockTenn Company (“RockTenn”) entered into a Master Revenue Sharing Agreement (the ‘Agreement”) for a ten (10) year term with an automatic 5 year renewal term.

In accordance with the terms and provisions of the Agreement, JBI has an exclusive 10-year license to the following:

1. Build and operate Plastic2Oil processors at RockTenn facilities.

2. Process RockTenn's waste plastic from paper mills and material recovery facilities (MRF).

3. Mine and process plastic feedstock from plastic-filled monofill sites.

4. Monofill sites contain years of waste plastic from mills.

5. Waste plastic from RockTenn facilities exceeds thousands of tons per day.

8-22-2011: General Motors Automaker Supplies Plastic to JBII:

After a full review, General Motors is also now providing free waste plastic to our P2O facility.

7-22-11: Chrysler Automaker Supplies Plastic to JBII:

Waste plastic from Chrysler Canada’s Brampton Assembly Plant is helping to keep neighboring factories running instead of eating up precious landfill space.

JBI, an Ontario-based company, has developed technology that converts waste plastic to fuel ranging from heating oil to diesel.

“Because plastic is made from the same hydrocarbons that make regular fuel, we can make and blend what we want,” CEO John Bordynuik tells Ward’s. “It can also be used to make plastic again.”

http://WardsAuto.com

7-5-11: Scientific American (The Wall Street Journal of Science) picks up on JBII

http://www.scientificamerican.com/article.cfm?id=plastic2oil-converts-waste-plastic-2011-07

6-14-11: JBII Gets PERMITS:

6-13-11. JBII 8K: More Fuel Sales!:

Pursuant to the Agreement, the Company has agreed to supply Coco Asphalt on a weekly, per demand basis with petroleum distillate at a cost of $109.80 per barrel.

http://knobias.10kwizard.com/filing.php?param=&ipage=7665730&DSEQ=1&SEQ=&SQDESC=SECTION_BODY&exp=

6-11-11. JBII AGM was awesome:

Link to detailed info: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64164756&txt2find=JBII

5-26-2011: JBII was a Tour Destination hosted by Canadian Plastics Industry Association (CPIA) on Thursday, May 26, 2011.

Stocker11 Report on the Event:

There were about 5 dignitaries cutting the ribbon with JB. I hope the entire event will be on the JBI website as it was obvious that the speakers were extremely excited at the prospect of being involved with JBI in the State of New York.

There were about 40 who came from the plastic convention. They all appeared mesmerized by John’s presentation. They had a number of questions that, when answered, appeared to remove any doubts about the technology.

Great day for JBI.

Local TV Station WIVB Report:

Local TV Station CHCH Report:

Buffalo, NY TV Station YNN Report:

Tour of Recycling & Waste Recovery Facilities, Niagara Falls Region:

Visit # 3: A pilot plant showcasing an emerging technology that converts residual plastic waste into fuels.

JBI, Inc. (Plastics to Oil plant), 20 Iroquois Street, Niagara Falls, NY, USA

JBI converts plastics-to-fuel and natural gas, ensuring that the embedded energy in residual plastics is managed and conserved

as an important and useful resource, rather than treated as a disposable waste. JBI’s fully automated process vaporizes plastics and

cracks their hydrocarbon chains using a proprietary catalyst. The New York Department of Environmental Conservation (NYDEC)

has recently granted the plant a consent order to operate commercially.

http://www.plastics.ca/home/events/recyandwasettour.php

5-9-2011: JBII First Fuel Sales to Occidental Petroleum (NYSE:OXY)!:

JBI, Inc. (the "Company" or "JBII") (OTCQX:JBII) announced today that Oxy Vinyl Canada, a wholly owned subsidiary of Occidental Petroleum (NYSE:OXY),

has agreed to purchase JBI's low sulphur heating oil for $109.80 per barrel. Low sulphur heating oil is a product of our Plastic2Oil™ process.

Under the terms of the agreement, the first order of approximately 214 barrels of low sulphur heating oil is expected to be delivered this week.

http://www.oxy.com/Pages/Home.aspx

http://finance.yahoo.com/news/JBI-Inc-to-Supply-Oxy-Vinyl-pz-404707702.html?x=0&.v=1

5-2-2011: JBII Enters into Referral Agreement With Smurfit-Stone. (Now a part of of Rock-Tenn) (NYSE: RKT):

Rock-Tenn is a multi billion dollar company: http://www.rocktenn.com/

Smurfit-Stone clients to be referred to JBII and JBII will install processors at their facilities.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7897367

4-27-11: JBII CEO on BNN 'The Pitch'. High Points:

. $587K/processor

. $2-3M RD costs

. Being innundated with requests to bolt down machines at high waste plastic feed sources

. Process is Green. Emissions less than a gas furnace.

. Filing prospectus with TSX next week

. Filing 5 patents on the process.

. Upgraded to an accounting firm that can file both Canadian and US.

. Agreements gone through legal with a large cardboard recycler that generates a huge amount of plastic. 30 Tons/day.

. Make spec fuel. Comes out of the machine that way. Directly to commodity price.

. Sales this week.

. Filling tankers now.

. Revenues Q2.

4-20-11: 10K Released. Interesting excerpt found by Steady_T:

"It is possible that industrial partners may wish to provide financing for the construction and other costs associated with building and operating a P2O processor."

Translation.....If you want one any time soon, finance it for us. That way you can start saving money a lot sooner.

Very nice way to obtain capital.

4-20-11: 8K/PR Released. Excerpts:

The Company notes that on March 16, 2011 it signed a non-binding letter of intent with a potential customer for the purchase of the naphtha produced from the Company's Plastic2Oil process. At this time, a definitive fuel supply agreement is being negotiated

Additionally, on April 14, 2011, after much discussion and exchanges of drafts, the Company received what management believes is a final referral agreement with a large company that has a significant number of material recycling facilities and high volume waste plastic streams.

Additionally, JBI has been negotiating Joint Venture agreements with both the aforementioned company and one of its customers. These companies have sent in excess of 141,640 lbs of waste plastic to date. This plastic was processed and evaluated for qualitative and quantitative analytical data. Over the last few months, JBI has met with executives and representatives from these Companies at their respective locations and our Plastic2Oil factory.

The contemplated structure of a Joint Venture with JBI is:

· JBI will build and operate a Plastic2Oil processor at the source of the plastic waste.

· JBI will receive plastic waste at no cost.

· JBI will share in the revenue from the sale of fuel generated by the machine, 80% / 20% (JBI receives 80%).

· As JBI staff will operate the process, JBI will assume all risks.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7870575

4-13-11:

JBII attended and John Bordynuik gave a presentation at the Air and Waste Management Association Seminar on April 13. Among the attendees

were Waste Management Inc, Conestoga-Rovers &Associates, and URS.

Report from the Conference. Thank you Justice!:

The presentation was well received and you were right, no material information was disclosed.

I have a few notes I want to share as there was some new information. Another company has tested the fuel, the Alberta Research Council. They are the Gold Standard in Canada when it comes to testing fuel. Guess what, just like we have been told all along, JBI produces light naphtha (pure unblended gasoline) and diesel #2. There is one difference, the fuel is even cleaner now. Previously the sulfur content was 8 parts per million, it now has 0.5 parts per million (500 parts per billion) and no sediment or water content. The ratio of diesel and gasoline is 70% and 30% (and yes the fuel is separated during the P2O process). John is still reporting that the fuel is produced for less than $10 a barrel.

One of the questions after the presentation was if a car used the JBI fuel would it void the warranty. The answer was JBI fuel would absolutely not void a warranty, the fuel is no different than what you would get from a refinery. It started out as fuel and is converted back into fuel.

John was asked about how much a recycling facility would save if they had a P2O processor and the answer was that some large facilities send 170 tons of plastic to landfill per day. Smaller facilities send 120 tons per day.

Now I figure that for a large recycling facility, if JBI only processes half that amount, just to be extremely and overly conservative, using the average tipping fees in the states as a base, $43 per ton, a large facility saves $3655 a day in tipping fees and that does not include transportation costs. Taken to a five day work week, it's just under a million dollars a year, again this does not include transportation costs (truck, fuel, driver).

The JBI staff at the presentation were extremely upbeat and enthusiastic about what has been happening recently and look forward to when they can let us know what all the new developments are.

Letter of Intent for 144,000 Gallons/Week

The company has signed a letter of intent with a confidential party for the purchase of 144,000 gallons of naphtha per week.

Naptha is produced from the Company's Plastic2Oil process and is the technical term for gasoline without the additives that pump gas has.

The sales agreement is expected to be signed in April, 2011.

Extensive improvements have been made to the P2O processor:

Since receiving the Consent Order, JBI has simplified the configuration of the Plastic2Oil process using modular racking.

The modular racks are prewired and plumbed, and constructed as complete units to simplify installations and reduce costs at remote sites.

Also since receiving the Consent Order, our Plastic2Oil process has been extensively and successfully stress tested to ensure its operational integrity

in preparation for operations at remote sites.

2 IHub Shareholders (Brigg and Rawnoc) recently visited the facility and reported their observations and thoughts.

Their reports verify that there is an unending supply of waste plastic available, that the machine is running non stop,

that employee morale is extremely high, and the quality of the output is everything the company has said it is.

In short, both of them are impressed to the nth degree.

Brigg has also tested the gasoline which came straight from the P2O processor. Results: Ran in a lawnmower like a champ!

Extensive DD and Information: http://www.jbiglobal.blogspot.com/

JBII just fired Ernst and Young for apparently not giving the company the attention that was expected:

we performed only limited audit planning procedures during this period and we did not report on any financial statements of the Company.

Yours truly,

/s/ Ernst & Young LLP

The company has hired MSCM LLP, auditors that will give JBII a higher priority in addressing their needs:

MSCM, LLP has differentiated themselves for JBI by offering a responsive, partner-led audit team that has proven to us practical and timely client services.

MSCM, LLP also has the international proficiency to meet the needs of JBI's future growth. MSCM Web Site: http://www.mscm.ca/

1. Commercial Production has been approved by the NY DEC. (Only time in history a company has been given commercial production

approval while other permits are pending).

2. The process has been proven to work by at least 3 independent firms.

3. Two NY Senators have endorsed P2O.

4. Each processor will generate 100+ Barrels of fuel daily.

5. 2 more processors are being built.

6. JBII owns an operational Fuel Blending Facility with a storage capacity of 250,000 gallons.

7. Company just signed a 20 year lease on A waste management recycling facility with 1,000 Ton/Day capacity.

8. Colin Robbins recently appointed as Sr. Vice President:

Mr. Robbins brings more than 30 years of knowledge and expertise in operations, marketing, and manufacturing of renewable fuels to this key post.

He specializes in the blending of ethanol, bio-diesel, butane, and petroleum. He has been engaged in the petroleum and bio-fuels industry

in a leadership capacity since 1989 with experience extending across North America--but he is most passionate about

producing a profitable, environmentally responsible energy product.

9. Waste Management Inc. is currently doing an audit on the process.

Feast your eyes on this 3 minute clip:

JBII: It's Raining Diesel:

Just listen to the excitement in their voices!

JBII Fuel Output from 20 Ton Production Processor:

Best JBII Video. Peek at P2O Sight Glass:

Free Plastic Stockpiled and ready for Processing:

Firing up the lawnmower with JBII gasoline! From Techisbest:

My unrehearsed video:

This lawnmower has not been run this season. The smoke you see when I first fire it up is from it sitting idle. Note that the longer it runs the cleaner it runs.

The jar used is the one on the left in this pic:

Fuel Ouput:

EMail to Techisbest:

Nice to hear your lawnmower ran well with the fuel tapped directly off our gasoline condenser.

Our gasoline is no different than highly refined gasoline from a refinery. Our gasoline is different than gas found at the pump because we do not inject the additives and low cost cutting agents (butane injection), aromatics, and other additives to artificially inflate the octane thereby reducing the amount of high-cost gasoline. Many additives are injected in pure gasoline to increase the margin on gasoline at the pump. Our fuel was tested in a new engine long ago and the spark plug, head, valve seats and valves were inspected. There was no carbon build up, pitting, burns, or oxidation on those parts. We were quite impressed by how cleanly it burned.

Regards,

John Bordynuik

Validation:

Plastic2Oil Why Us

We are a domestic alternative fuel company that developed, scaled, enhanced, and commercialized a process that converts difficult-to-recycle waste plastics into separated, refined fuels. We have successfully overcome significant barriers in this field, namely:

* Our process accepts mixed waste plastics.

* Our process is continuous, 20T/day and small (less than 1000 sqft)

* Residue is removed automatically without shutdown.

* The product is refined and separated fuels without the high cost of a distillation tower.

* Our equipment is not susceptible to costly pinhole leaks.

* Our process operates at atmospheric pressure.

* Our process is permitted to use its off-gas as fuel (8% of feedstock) therefore conversion costs are very low: 67kWh electricity for motors, and pumps, and approx. $7/hr for natural gas top up (if required).

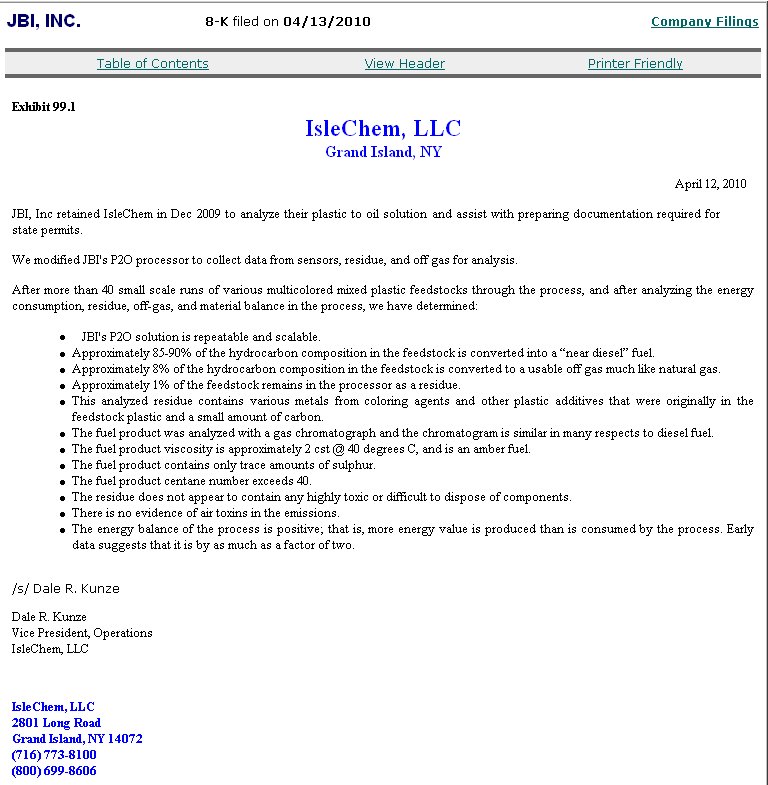

* Significant labs have validated our technology: IsleChem (process), CRA (Stack Test), Intertek and Petrolabs (fuel testing), and a rigorous permit process with the NYSDEC (NY State).

* Our emissions are less than a natural gas furnace. We are not required to monitor our emissions or install scrubbers.

* Fuel additives are injected inline while the fuel is produced.

* We have significant downstream technology to ensure fuel quality control.

z

Doubtful. The SEC has plenty of time to compose their letter to ask for clarification. The recent K will be no exception.

Get ready for more amended filings.

the financial statements themselves were audited and opined they were PERFECT

You didn't address his point.

I DID see the video and I believe that he was correct to "doubt rather seriously if the economic viability of the P2O process and Bordynuick's management was demonstrated to the viewers". It was certainly the best video presentation from a technical standpoint that I've seen about the company, but it in no way demonstrated the economic viability of the P2O process and Bordynuik's management, something that is normally done numerically.

If you believe it did, please point out the sections of the video that demonstrated economic viability.

BTW, the "inevitability" of a thing is not necessarily enhanced by the fact that it typically "takes time".

we'd see the mother of all short squeezes take place

Thank you for bringing up MOASS. This pinkie could not get stinkier now.

3 tankers a week * 8800 gallons per tanker * $3 per gallon = $75k a week revenue. That's barely 1/3 of the $10M per year a single P2O machine is supposed to kick out. And I think my $3 per gallon is probably high for the fuel they are selling.

So they have 1/3rd of a P2O machine running 24x7. Or they have one P2O machine running an eight hour shift a day more likely.

I want to see these things running 24x7. Makes me think they are having process problems when they aren't running them 24x7.

i rested *my case* on the 5th of jan :)

but i do welcome *discovery* and what will be revealed ..

===

nice 15k *feed* to csti on bid (500 size)

done at open >> at 1.32 >> i'd expect to

see a few more of those littered thru out

today's *tape* ![]()

sort of like the 1300s' just done :)

these were the *pair* from yesterday's tape

$1.2900 1,300 OTO 12:10:21

$1.2900 1,300 OTO 12:10:13

Remember the JBI 500k in revenue discussion? I know i do and i don't think that event is very far off....just eventin'

Sounds reasonable. I think it's worth 1.38 per processor at 4000 lbs an hour. So, we should expect to see some movement north here shortly.

About "crying wolf" JB has been overly, enthusiastically, impatient in the past. I think that is because the mind can create quicker than the body. However, recently it seems it is the opposite with understating and lowering expectations.

...I admire JB and believe him be very ethical.

Compared to who...Ponzi, Madoff, the US senators from your state?

Louisiana?

sec doesn't have a leg to stand on

due to the gross and egregious hypocrisy

in play specific to these self same media

credits >> and how and when *addressed* to

domark >> vs when and how jbi addressed them

did the sec even question any pipe investors

specifically did they even locate one who bought

into JBI due to media credits?

i'm hard pressed to believe their <sec> *baseline* has

any validity >> and i loved their total lack of *awareness*

as to what P2O is and does >> to say nothing of MMs' DOMINANT

whose manipulation is well documented of the co.s *stock* over

the past 20+ months

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=70570788

but as i've posted b4 >>

i want a trial by jury with the name of the author of that

complaint revealed >> (among other aspects) >> since it doesn't

jive (style wise) with other complaints out of the boston office of the sec >>

to say nothing of learning who financially benefited

from the >> er >> timing of info released in JAN 2012 and earlier

how many other sec complaints were *posted about* 2 weeks in advance

of their release via various stock msg boards as jbi's was

that is damning in its own right to the sec (circumstantially

of course) >> no matter which way it's sliced and imo is just

one of the reasons the sec would prefer to *negotiate*

regardless with the immediate goal impacting co.s (planned) uplist

the next *goal* would be the removal of the CEO

at this stage of the co.s development >> JB is JBI >>

whomever is *orchestrating* events >> knows exactly what they

are doing and asking for

there are no coincidences

it will be very interesting to see how this plays out

i never underestimate any entity when there is this much $$$$$$$ at stake

==

4kids

all jmo

I doubt big oil is concerned about JBI. JBI would barely put a dent in the oil demands here in the US even if they fully populated every recycling facility available with their machines. As you said, if big oil did take an interest, it would be for a 'green' marketing stunt more than anything else.

The fun part is that if someone did make an offer, we'd see the mother of all short squeezes take place.

Just crunching some numbers, but the pps should move north of $3.50 assuming they get the 4000lb/hr permits and if they are in fact running 24/7 now. That number goes up proportionally for each machine added beyond the current 2 units. However, they need to start posting numbers to make that happen since they've cried wolf too many times already.

Yes, and 500m is a drop in the bucket for them. I would imagine that P2O would almost immediately be mothballed or used at minimum capacity. Big oil is for big oil. But they would love to show the govt they are attempting to be alternative, just to get the govt off their back.

Don't really care. That said, I admire JB and believe him be very ethical. However, no matter what happens what do you suppose Exxon or GE would be willing to pay for the processor blueprints and the formula for the catalyst. I would suspect an opening bid of 500 Million. What's that roughy 6.50 a share?

Every other P2O technology company I know of is private, and thus:

. cannot use stock promoters to help sell their shares

. cannot have iHub boards

. cannot be investigated by the SEC

And while they certainly could have lied to their shareholders, I'm not in any position to be able to confirm this.

I agree with you that the SEC is not about killing companies. If there is a conspiracy involving the SEC as has been suggested many times on this board, isn't it much more likely that the SEC is trying to help JBII by getting Bordynuik out of the way? The company would stand a much better chance of success with Bordynuik banned, it makes more sense than the alternative conspiracy theory and the irony is crime story worthy. :)

Oh, I think we have a lot of clues.. you just need to open your eyes (or mind).

Okay, I'll issue an invitation for both of us to peek out of our respective corners. Assuming for the sake of argument that the P2O process is viable (a magnanimious concession given the strength of my view, wouldn't you agree :), do you really believe that the company has any chance of success at all with Bordynuick at the helm?

specific to the jury >> one of the questions

i asked of marty's asst on jan 5th was where

trial by jury would be held (if it proceeds

to that stage) >> commonwealth is indeed it

thee most educated state in the country

(per cnbc) and imo as aware as any are of

the *manipulation endemic* as it pertains

to wall street >> forensics undertaken to

show *exactly* who financially benefited

from the events of jan 2012 (and earlier)

will be all it takes to prove what is what

and who exactly *pulled the strings* and

dictated terms

i'm not underestimating the time that will take

or the resources involved >> i'd expect a hint

of which way the wind blows >> by the 3rd Q 2012

==

4kids

all jmo

Right now I would say that JBII is undervalued. When JBII becomes overvalued and rides that for a period of time I would suggest the short covering has begun.

The fight for shares is going to put a smile across my face. I completely agree that the SEC complaint's real purpose was to prevent uplisting and create a dark cloud for new investors.

Unfortunately, this game is old and the powers that be know the Playbook. I think this particular game has been pushed too far and it is going to implode on the people who have gotten away with abusively shorting start up companies.

That being said, this will get more obvious and pushed further. If we go to trial I am expecting jury tampering.

It would likely take 500000M to 7500000M to get JBI to the point of being "ready for an uplist".

That's assuming they get rid of Bordynuik, shed their CAVEAT EMPTOR status and survive the disrgorging of their ill-gotten gains, hire a competent CEO who doesn't commit fraud, and change business models from a share-printing-shell to one that sells some goods or services for a profit.

it would be closer to 500M to 750M shares

which is why in advance of uplist there

would be the usual r/s done along the lines

of say 1 for 10 >> this in just one dilemma

the abusive short stuck on stupid has re: JBII

there is a certain MO followed >> short >> reset/swap

short some more >> expect a r/s >> short again post r/s

then if JBI actually succeeds/outlasts >> ladder JBII's

pps up slowly as covering is undertaken in preparation of

co.s uplisting >> that would culminate (pps wise) approx 2 weeks

after co.s uplisting to the naz

JBI didn't accommodate the *usual* in any manner >> that is

why the immediate goal of the sec complaint pertained to co.s

uplisting (b4 said complaint i'd have put that at some time this summer)

after JBI became CFP >> proc no 3 was running essentially 24/7 and

national media exposure was embraced via p2o's unveiling at rock tenn's first site

that is why i've posted >> the longer this goes >> the more

parabolic the covering will be >> and that covering shouldn't

be confused with co.s market cap (tho' i'd expect to read posts

about it)

mgmt will also be under pressure to do a forward split (my guess)

within 12 months of uplisting >> my advice dont' play the street's

game >> rather go the berkshire route >> look at the SS (share

structure) of some of the most respected co.s in existence and

take notes >> some were far *wiser* than others in that aspect

while it may come sooner >> imo i'd expect aspects with the sec

will be resolved by mid summer 2013 >> which works for me since

my expectation is that fy 2012 (uploaded in march 2013) will be

the K that is the baseline for the co. going forward

==

4kids

all jmo

500,000 dollars of fuel might have been produced and sold since the second processor came online. Not bad since that occurred Feb 27, 2012. Three weeks.

We will find out over the coming quarters. Q2 numbers is what I'm really interested in seeing.

Makes sense. I don't think JBI built the machines to look pretty. They are running and producing spec fuels for customers.

I am simply amazed that JB was able to design and build these machines with as little share dilution. If this was about "selling shares" don't you think we would at least be at 150M shares instead of 73M.

IMO JB has not lied but changed the business model to capture the possibility of more revenue in the future. No need to discuss 2010. This is 2012 and we have a scalable, repeatable, machine design. Oh yah, two are running full time with a third in construction phase.

WRT stock promoters? They look like enthusiastic share holders to me. I'm excited about P2O's future.

Maybe the SEC is too. After all this looks like a job creator and that is governments focus for 2012. The SEC is not about killing companies.

How many of those guys lied to their shareholders and used stock promoters to help sell shares. Do they have busy boards on IHub???? Did the SEC investigate them yet???

For example, there are some very big players chasing P2O technologies today, including well-known silicon valley VCs, WasteManagement Inc, Dow Chemical, private equity firms, etc. So if these people believe P2O can overall be viable (whether it's Agilyx, Cynar, NillTech, or Splainex...) then JBI has at least as good a chance. I say "at least" because as has been pointed out here hundreds of times before, JBI's technology seems to be superior in many (or every) respect: capex costs, automation & safety, efficiency, fuel quality output, feedstock tolerance, physical footprint, etc.

These are the "clues" as to whether Plastic2Oil® will be profitable, and they are all around you.

Oh, I think we have a lot of clues.. you just need to open your eyes (or mind).

We don't have a clue about the economic viability of the P2O process

It does depend on what you choose to look at. A new company will not bat 500. Your pointing out past failures using words like "inflicting" reveal a bias in your viewpoint--You haven't even looked at the video???

I would say now that there is an inevitability based on continuing progress and a reasonable acceptance that developing and launching a disruptive industry changing technology takes time. It took Haber and Bosch 4 years to scale up from a lab demo to industrial production of ammonia.

That's a stretch. I didn't see the video but I doubt rather seriously if the economic viability of the P2O process and Bordynuick's management was demonstrated to the viewers. We have seen some of the economic effects of what Bordynuick's management is capable of inflicting and it doesn't exactly fall into the category of viable. We don't have a clue about the economic viability of the P2O process except that the recent 10K exploded some of the previous speculation.

The video is much more convincing evidence that a lot of time and investor money has gone into a finished NEW technology that will make investors a nice return on their money.

That's a stretch. I didn't see the video but I doubt rather seriously if the economic viability of the P2O process and Bordynuick's management was demonstrated to the viewers. We have seen some of the economic effects of what Bordynuick's management is capable of inflicting and it doesn't exactly fall into the category of viable. We don't have a clue about the economic viability of the P2O process except that the recent 10K exploded some of the previous speculation.

The video is much more convincing evidence that a lot of time and investor money has gone into a finished NEW technology that will make investors a nice return on their money. The biggest piece of the plan has always been to get P20 from desktop concept to full scale production. You haven't been keeping your eye on the ball if you missed that.

MASSIVE FUEL SALES -- LET ME WALK YOU THROUGH THIS

(1) In 2011 JBII did a lot of testing that involves full tankers of production be given to potential customers. Full tanker samples were produced but many were used as samples for testing during months of due diligence by customers.

(2) Those tests lead to major fuel supply agreements at the end of 2011:

See Indigo Energy:

http://plastic2oil.com/site/news-releases-master/2011/12/21/jbi-inc-signs-long-term-fuel-supply-agreement-with-indigo-energy-partners-llc

See XTR Energy:

http://plastic2oil.com/site/news-releases-master/2011/12/23/jbi-inc-signs-multi-year-transport-fuel-take-off-agreement-with-xtr-energy

And the CC where a huge purchase orders with a fortune100 company began:

http://plastic2oil.com/site/events/1515/

(3) Now just after halfway into Q1 "boots on the ground" are reporting production from two machines being shipped to the above. Calls to Indigo Energy early in the quarter confirm receipt of a purchase of a rail car of fuel (400 barrels) with them eager for more. We have confirmation that the Fortune 100 company has a 500,000 liter purchase order that is actively being filled.

(4) No wonder Discovery Channel and National Public Radio are catching on. Any thoughts on what happens when JBII shows annualized fuel sales of $2 million or $500,000 in a single quarter? I figure I should get opinions now. I made a bet with a "friend" about it who I don't think I'll be hearing from ever again if I win so I'm kind of in suspense. YaknowwhatImean? :)

"I think you have to learn that there's a company behind every stock, and that there's only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies."

~~Peter Lynch

JBII has gone from doing poorly (partnering with the Florida Group in 2009) to doing well (2010 onward). JBII is in the process of growing from a small company to a large company.

By the way, a little known CEO named Warren Buffett started out as CEO of a little known company called Berkshire Hathway -- Warren Buffett's first company as CEO that he then "managed into the ground" and to this day admits that buying and running Berkshire Hathaway was his biggest investment mistake of his career. Those people who judged Warren Buffett at the time by his brand spanking new experience as CEO while ignoring his vast talent in other areas remind me of the same type of mistake people are making when they thumb their nose at John Bordynuik. Warren Buffett made a mistake buying Berkshire Hathaway. John Bordynuik made a mistake buying PAK-IT. Buffett focused on his insurance businesses and got rid of Berkshire and went on to build an insurance investment monster. Bordynuik got rid of PAKIT and has gone one to build the first and only viable green energy process in history. They're both forgiven for their first years as CEO. :)

Nice story but that's not what happened. The original business model was to fund P2O development internally from the profits of Javaco, Pak-It and the tape reading biz. Monumental miscalculation, certainly, but not a very convincing rewrite of history. As an admittedly dull aside, the financial statements have never reflected a development stage company.

Boots on the ground are all saying that's NOW.

Can't we cite more authoritative sources than "boots on the ground"? How about a message from the company itself such as what appeared on the website during the third quarter saying that P2O production was proceeding 24/7? Wouldn't a more creditable source than boots on the ground be the production VP who was quoted as saying that business was booming last fall? Rather than boots on the ground, why not rely on the CEO himself who said that tankers were being filled early last year?

The first quarter 10-Q will reveal whether JBII is the business turnaround story of the third millennium or if the latest comments are just part of the continuing scam. Based on how well Bordynuik has managed this company thus far, I place my bet.

All development years in developmental companies have "losses". The Discovery Channel video of the processor speaks convincingly that those "losses" are better described as prudent investments in a disruptive plastics recovery technology that will redirect industry resources and close a wasteful throwaway industry into a leading resource recovery industry.

Thanks for reminding everyone of that specious wording. Maybe there is some reason to think that there are influences biasing the prosecution of JBII by the sec.

Who here would claim that the sec is immaculate???

Try this for some references then:

http://www.plastic2oil.com/site/current-partnerships

Get the point?

Not one of those links contained a single G.D. reference to JBI. What is your point?

You better buy some shares before they get too high. Feed the Beast!

Beautiful day in Niagara Falls, NY. Home of JBII beasts. I advise all to pay attention closely. Don't be distracted, or allow yourself to be misled.

Opportunity is slipping away.

As always, accumulating and happy to be long.

"I think you have to learn that there's a company behind every stock, and that there's only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies."

~~Peter Lynch

http://watch.discoverychannel.ca/daily-planet/march-2012/daily-planet---march-20-2012/#clip641572

I guess this is your wake up call...

Great day to be a jbi shareholder.

National news with probably more to come

2 processors getting fed plastic like the beasts that that are.

Processor number 3 is expected to be finished soon.

All this equates to pure satisfaction as a shareholder.

As cramer would say. Buy buy buy!

transcript:

http://www.npr.org/templates/transcript/transcript.php?storyId=147506525

< Startup Converts Plastic To Oil, And Finds A Niche

Copyright ©2012 National Public Radio®. For personal, noncommercial use only. See Terms of Use. For other uses, prior permission required.

text size A A A

Heard on Morning Edition

March 19, 2012DAVID GREENE, HOST:

A new and possibly more environmentally friendly way to produce oil: it involves plastic - yes, like those soda bottles you discard.

Only 7 percent of plastic waste in the U.S. is recycled each year, according to the Environmental Protection Agency. Well, now a startup company in Niagara Falls says it can increase that amount while also reducing the country's dependence on foreign oil.

From member station WBFO, Daniel Robison has more.

(SOUNDBITE OF MACHINERY)

DANIEL ROBISON, BYLINE: This machine's known as the plastic-eating monster. Thousands of pounds of shredded milk jugs, water bottles and grocery bags tumble into a large tank where it's melted together and vaporized. This waste comes from landfills and dumps from all over the United States.

JOHN BORDYNUIK: Basically, they've been mining their piles for us and sending them here.

ROBISON: John Bordynuik runs his namesake company, JBI, Inc. He's invented a process that converts plastic into oil by rearranging its hydrocarbon chains. According to tests by the New York Department of Environmental Conservation, JBI's patented technology is efficient, with close to 90 percent of plastics coming out as fuel. Bordynuik says that makes the case for this kind of recycling to go mainstream.

BORDYNUIK: When there have been attempts in the past to make fuel from plastic, it's been a low quality, low flashpoint, kind of sludgy. In this case here, we're making a very highly refined, consistent product that's within specifications of any standardized fuel.

ROBISON: JBI executive Bob Molodynia points to a spout at the other end of the plastic-eating machine dripping a thin, brown liquid.

BOB MOLODYNIA: You could tap this right now, and this is ready to go. That's a number six fuel. That's what a lot of like U.S. Steel uses, a lot of major companies. That's what they pay the big bucks for, right there.

ROBISON: Each barrel of oil costs about $10 to produce, which JBI can sell for around $100 through a national distributor. The young company is already producing a few thousand gallons of oil a day. They've signed lucrative deals to set up operations next to companies with large volumes of plastic waste. But in its rush to grow, JBI has been accused by the SEC of overvaluing some of its assets in order to raise more funds. And John Bordynuik says it's been hard to find acceptance from potential oil buyers because JBI's product has been dubbed a green fuel.

BORDYNUIK: We don't make a synthetic other product that has problems. We make an in-spec fuel just like everyone else. In fact, if anything, the word "alternative" has a stigma attached to it, more so because of prior attempts.

ROBISON: If JBI has its way, plastics will become a significant source of domestic fuel that reduces the country's dependence on foreign oil. But just how green is JBI's recycling when it produces a fossil fuel that pollutes just like any other?

CARSON MAXTED: To enter themselves into this industry, I think that they've all bought into the idea of producing a fuel.

ROBISON: Carson Maxted is with Resource Recycling, the plastic recycling industry's trade journal. He's not sure whether converting plastic to oil can be considered recycling or even environmentally-friendly. But he says JBI's methods can co-exist and even complement current recycling practices.

MAXTED: So they're getting value from something that would otherwise go into the landfill, because the plastics, most of them are looking for, the plastics that are either not easily recycled. They're of low quality or of mixed plastic types, or that they're dirty, things that wouldn't be accepted into a recycler.

ROBISON: And since there's no lack of plastic supply or demand for oil, Maxted says this technology has the potential to transform both industries.

For NPR News, I'm Daniel Robison in Buffalo, New York.

Copyright © 2012 National Public Radio®. All rights reserved. No quotes from the materials contained herein may be used in any media without attribution to National Public Radio. This transcript is provided for personal, noncommercial use only, pursuant to our Terms of Use. Any other use requires NPR's prior permission. Visit our permissions page for further information.

NPR transcripts are created on a rush deadline by a contractor for NPR, and accuracy and availability may vary. This text may not be in its final form and may be updated or revised in the future. Please be aware that the authoritative record of NPR's programming is the audio.

Boots on the ground are all saying that's NOW.

Interesting comment found elsewhere on the internet:

>>>> The second plastic to oil machine is operating. 3 tankers shipped a week since operational. No tankers or fuel inbound. As I stated in my prior post, fuel transportation is a small world. <<<<

Interesting about Agigoo -- they got a many year headstart and didn't get a lick of funding until they started selling some tankers. Now we've advanced to Agigoo's stage and more.

Me thinks all heaven is going to break loose. Whales of all sorts love a good environmental clean-up story that makes money and will be lining up in droves to help out now that proof of concept is official.

Item 4. Use of Proceeds. as of April 6, 2009

USE OF PROCEEDS

The selling stockholders are selling shares of common stock covered by this prospectus for their own account.

We will not receive any of the proceeds from the resale of these shares.

We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

that is sooooooo 3 years ago :)

Great video right!? It showed the new P20 machines making clean desired fuel that has been paid for by OTC shareholders and pipe investors who believe in this spectacular company.

It is my understanding that only smart people are shareholders and or partners with JBII....

http://media.gm.com/media/us/en/gm/news.detail.html/content/Pages/news/us/en/2012/Mar/0312_greenleaders

http://www.chrysler.com/crossbrand/intl_site_locator/index.html

http://www.cocogroup.com/

http://xtrenergy.ca/wholesale-fuel-supply.php

http://indigoenergy.com/terminal_locations/terminal.html

http://www.rocktenn.com/about-us/smurfit-stone/supplier-zone/WhatWeBuy.htm

Really REAL!

|

Followers

|

799

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

312030

|

|

Created

|

04/27/09

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |