Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$RDAR They will have to reverse split to get buyers for the Regulation A offering. That all this CEO cares about is lining his pockets.

$400 down $89,000 to go -_-

Anybody have $100,000 to throw down on .0002?

$RDAR Its an app they have that makes no money. CEO is only interested in selling Regulation A stock.

$RDAR They have to reverse to sell his Regulation A.

No RS for now

$RDAR We want all our investors/ shareholders to know WE ARE NOT doing another reverse split ! We’ve got huge updates coming soon regarding the app and our blockbuster new partnership 🏈!!#staytuned

— RAADR.com (@raadr_) June 18, 2024

I think that will hold off minimum for another year if you look at previous RS. Plus with liquidity moving to OTC this just needs some catalyst without massive dilution and you can have a runner.

$RDAR I am hearing a reverse split is in the works so that he can move his regulation a shares. The CEOs a scumbag.

GRL* was no bid and up to .0005. He can’t keep this thing out of no bid and no chance of getting it past .0001. He needs to call in more cronies

I wish I could suck at my other job as much as he does and keep it ha

$RADR He gets pd by companies to bring volume to dilute shares. He’s done this for years.

I’d rather not ignore him. That way I see where he posts and I know what to stay away from

$RADR Dude you have everyone on ignore but everyone should have you on ignore. You can’t still be getting paid to pump this turd are you? You should have been fired three months ago.

Well he sucks at it. And he’s stuck bag holding from his last failed pump

Nahh...He's a deliberate scam-pumper promoter, not a naive newbie

But gotta be little kind to him.

If everyone calls them a turd then they must be…….drumroll a turd. But gotta be little kind to him. He’s frustrated with himself for gettin stuck bag holdin

Awww....Booo-fukkin-hooo. You don't like scams being exposed.

$RDAR You and your buddies preloaded and dumped when this got over 001. Now you are simply pumping to bring volume for the CEO to sell his regulation A. Dude I know the story behind it now that I dug into it. You’re not gonna get this thing going again now that he’s flushing regulation A

Is it No Bid Friday? Lmao

Don’t ignore. We are here to help you!!! No one should have to suffer from

Incompetence in the OTC!!

Brickwall10 = Ignore...

GLTY

Poor guy can’t read a chart. Someone help him!!!

Obviously you didn’t lol.

No bags here...u have to know when to buy and when to sell..

Awww truth hurts. You’re probably grumpy because your arms are getting tired holding them bags

Yer a sharp one... Where are your crayons?

Another Golden Cross no bid pump

That’s exactly right lol

Learn to hold the bag

Ouch 🤡 scammed again

$RDAR NO BID AGAIN!!!!!

$RDAR Golden Cross is here pd by the company to stimulate volume for the CEO to dump Regulation A offerings. He’s not that good to move this diluted POS. SCAM!

Imagine being a pumper and you can’t even bring volume for any sort of consistency. More like golden piece of crap “You’ll do fine”. Lmfao

$RDAR LOL this is no play to play. Golden Cross is failing at his job to bring volume, so the company can sell regulation A.

$RDAR The play is the CEO dumping Regulation A stock. The buy price .0001 so no way this can go back up again. All it does is continue to get more shares added to the outstanding with the regulation a buys of .0001 death trap.

That’s right!!!

Reminder Folks,

If golden cross is pumping you better be dumping.

No one has pumped on more no bid stocks than him.

Awesome learn to play the play as you say. I’m excited for the 4-5x! Do you know when that will happen with 1/2 bill on the ask?

Learn to play the play people and you will do fine...

Oh great!!! Can’t wait!!!!

Well I can’t be a basher because there isn’t cheaper shares lol. .0001 is as cheap as it gets!!! #Pump

Yes of course it’s a pump. The entire thing not just the news

Posting news is now a pump??? Ok....

Done with the pump?

scumbag CEO

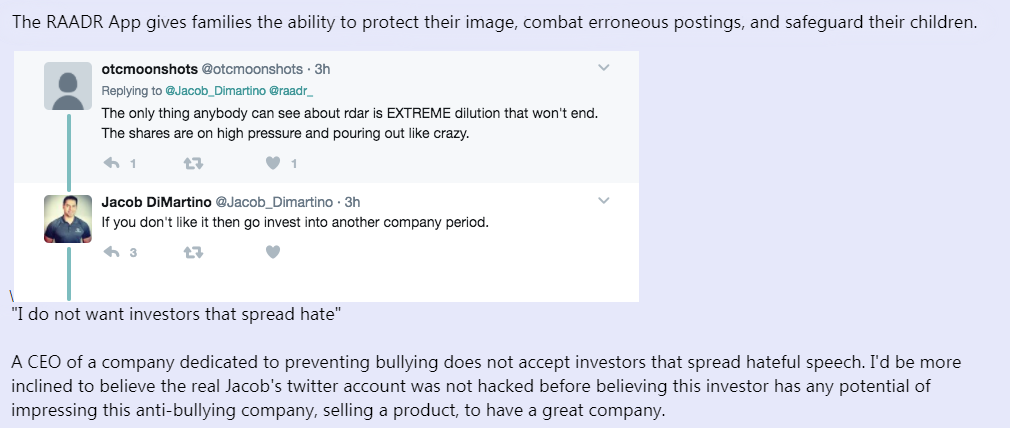

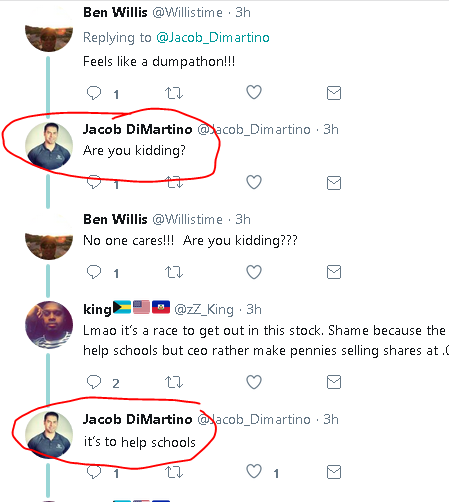

This POS is a career SCAM Artist, CAVEAT EMPTOR ??Information Request on RAADR, Inc.’s Jacob DiMartino ?Have you had dealings with Jacob DiMartino? We’d like to know about them. ??https://economicsentinel.com/information-request-on-raadr-inc-s-jacob-dimartino/ ???Bloggers Making Money Jacob Dimartino,Jake Dimartino Another Scam....Same Person - Different Companies Internet ??https://www.ripoffreport.com/reports/bloggers-making-money/internet/bloggers-making-money-jacob-dimartinojake-dimartino-another-scamsame-person-differe-861041 ??Jacob Dimartino Complaint 258651 for $9,500.00 ?https://www.scambook.com/company/view/111298/Jacob-Dimartino

2432 West Peoria Ave

Suite 1346

Phoenix, AZ 85029

_Page_1.jpg)

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |