Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Companies that imo will come stronger out of this crash (but of course DYOR):

- Blockstream

- Bitfinex

- Unchained

- Block

- Kraken

- NYDIG

- Trezor

- Swan

- Ledn

- Lightning Labs

- ColdCard

BDCM 11m O/S

HENI 7m float

LPHM 4m o/S

THDS 5m float.

INCC bad trade

https://twitter.com/jeff86331552/status/1395024707913670656/photo/1

https://twitter.com/jeff86331552/status/1395024707913670656/photo/2

Antonio F. Uccello

@baltic38dp

· May 18

Replying to @wurstner

I am. But I will save it for a detailed PR. Hang tight!

(NYSE: SPCE) was the first SPAC deal completed Shares of the space company are up 172.9% since the offering and up 15% in 2021.

Opendoor Technologies (NASDAQ: OPEN) is an on-demand digital experience to buy and sell a home. Opendoor shares are up 119.9% since IPOB went public. Shares of Opendoor are down 3.3% in 2021.

Clover Health (NASDAQ: CLOV) offers Medicare Advantage plans. The company has been the worst performing of the Palihapitiya SPACs. Shares are down 21.6% since the offering of IPOC and down 53.2% in 2021.

Social Capital Hedosophia Holdings Corp IV (NYSE: IPOD) has not named a merger target yet. Shares of IPOD are up 23.2% since the offering and down 10% in 2021.

Social Capital Hedosophia Holdings Corp V (NYSE: IPOE) announced a merger with fintech company SoFi in January. Shares of IPOE are up 77.2% since the offering and up 42.4% in 2021.

Social Capital Hedosophia Holdings Corp VI (NYSE: IPOF) has not named a merger target yet. Shares of the largest SPAC offering from Palihapitiya are up 22.9% since the offering and down 0.1% in 2021.

Related Link: 5 Things You Might Not Know About Chamath Palihapitiya

The PIPE Deals: Along with his own six SPACs, Palihapitiya has funded eight SPAC deals as a member of the PIPE (Private Investment in Public Equity — a way to attract investment from accredited investors).

MP Materials (NYSE: MP) is a rare earth mining company whose materials could be used to support electric vehicles and wind turbines in the future. Shares of MP Materials are up 291% since inception and up 21.5% in 2021.

Desktop Metal Inc (NYSE: DM) is a 3D printing company focused on additive manufacturing. Shares of Desktop Metal are up 57% since the offering and down 8.7% in 2021.

Metromile Inc (NASDAQ: MILE) is a pay-per-mile insurance company backed by Mark Cuban and Palihapitiya. Shares of Metromile are up 4.5% since the offering and down 32.8% in 2021.

ArcLight Clean Transition Corp (NASDAQ: ACTC) is taking electric bus company Proterra public in a SPAC deal. Shares of the SPAC are up 66.1% since the offering and up 49.9% in 2021.

TS Innovation Acquisition Corp (NASDAQ: TSIA) is bringing Latch, an enterprise SaaS company, public in a SPAC deal. Shares are up 13.5% since the offering and up 5.1% in 2021.

Spartan Acquisition Corp II (NYSE: SPRQ) is taking Sunlight Financial public. Sunlight is a residential solar financing company. Shares of the SPAC are up 12.9% since the IPO and up 11.6% in 2021.

RMG Acquisition Corp II (NASDAQ: RMGB) is taking Renew Power, India’s largest renewable energy company, public in an $8 billion deal. Shares of the SPAC are up 5.1% since the IPO and up 5.1% in 2021.

Revolution Acceleration Acquisition Corp (NASDAQ: RAAC) is taking Berkshire Grey public in a $2.7 billion deal. The company uses artificial intelligence for robotics and automation. Shares of the SPAC are up 8.4% since inception and up 8.4% in 2021.

SHORT TERM TRADE BECOME LONG TERM BAG

https://twitter.com/capital09_bull/status/1371788441848057858/photo/1

ZSAN

Momentum Continues for the Evolving Workplace and Consumer

Technological and societal trends are always in motion. Lately, some of the most significant changes are happening directly in our day-to-day with work and life. The workplace has changed dramatically over the years, in almost every way possible, and that was especially true in 2020. How consumers are engaging with every day products and services has also undergone structural change. That, too, was especially prevalent in 2020.

Going forward, where and how companies operate continues to develop and evolve. Businesses have become more distributed, teams have gone global, and employees have become more agile with a greater need for everything to be on-demand. Looking back, the “work from home” expression had become synonymous with 2020, but companies and businesses are set to continue to invest in and prioritize the digitization of the workplace.

The future of work is remote, and enterprise spend in the future reflects this paradigm. According to a recent Gartner survey1 on the global IT marketplace, worldwide IT spending is projected to total almost $3.8 Trillion in 2021, a 4% increase from 2020.

[1] Global IT Spending to Reach $3.8 Trillion in 2021 (Gartner 2020)

IT Investment is Expected to Grow 4% in 2021 with Enterprise Software seeing the Largest Increase of over 7% Worldwide IT Spending Forecast (Millions of U.S. Dollars).

2019 Spending 2019 Growth (%) 2020 Spending 2020 Growth (%) 2021 Spending 2021 Growth (%)

Data Center Systems 214,911 1.00 208,292 -3.10 219,086 5.20

Enterprise Software 476,686 11.70 459,297 -3.60 492,440 7.20

Devices 711,525 -0.30 616,284 -13.40 640,726 4.00

IT Services 1,040,263 4.80 992,093 -4.60 1,032,912 4.10

Communications Services 1,372,938 -0.60 1,332,795 -2.90 1,369,652 2.80

Overall IT 3,816,322 2.40 3,608,761 -5.40 3,754,816 4.00

Source: Gartner (October 2020). Forecasts are limited and may not be relied upon. There is no guarantee an increase in spending or investments in the IT sector will translate to favorable fund performance.

We believe these dynamics go beyond simply enabling the ability to “work from home,” but that companies and enterprises are actively becoming more digital. This is a secular shift, not a cyclical one. The core drivers behind the shift continue to be cloud technology, cyber security, online project and document management, and remote communication.

When it comes to the consumer, we continue to see new behavioral trends emerge across all areas of life. Beyond shopping and consumption, the way we learn, engage, play, and think about our health are all changing right before our eyes. New experiences and different mediums are playing a large role in meeting evolving consumer needs, and the core pillars of home entertainment, online education, remote health and well-being, and virtual and digital social interaction are set to benefit.

4Q earnings season is set to be an important one for many of the names within the major pillars driving change in the workplace and for the consumer. We will be looking for the numbers to match the rhetoric, and for cues around the ongoing environment. The busiest weeks for investors in regard to earnings releases will be during the first and last weeks of February.

Source: Bloomberg, L.P. as of 1/11/2021

ONLINE PROJECT AND DOCUMENT MANAGEMENT: PRIORITIZING PRODUCTIVITY FOR THE EVOLVING WORKPLACE

Along with investing in a more agile, more digital workplace, businesses have been working to support to productivity, creativity, and collaboration both internally and externally. Capabilities and use cases for productivity suites and collaboration platforms are poised to expand as needs develop from a more mobile workforce and a more demanding consumer.

Atlassian Corp (NASDAQ: TEAM, expected 1/22): Atlassian continues to become a player to watch in the enterprise software space, especially in the software development, IT, and work management markets. With software developers and project managers in mind, the current focus for TEAM has been migrating customers over to its cloud products. With over 185,000 customers today, the management team recently noted the long runway for growth in the 800,000+ company addressable global market. Atlassian is on pace to deliver their highest marks in single quarter revenue ($471.40M) and Earning Per Share (EPS)*($0.32) in their history as a public company.

Workday Inc (NASDAQ: WDAY, expected 2/23): Workday is becoming a household name for enterprise cloud applications. In other words, as demand for companies to implement longer-term digital strategies take fold, Workday’s solutions for managing human capital, finances, and products have benefited. Revenues grew 17.9% year-over-year last quarter, and are expected to grow 14.2% year-over-year ($1.12B) this quarter with an EPS of $0.56.

Source: Bloomberg, L.P. as of 1/11/2021.

REMOTE COMMUNICATION: COMMUNICATION DIGITIZED

Remote communication technologies and platforms are quickly becoming a standard, regardless of industry, for communication both internally and externally. This category goes beyond video communication platforms, and remote communication and the infrastructure for it is here to stay as it offers the scalability and flexibility needed for the mobile workplace and the customer that is always on the move.

RingCentral Inc. (NYSE: RNG, expected 2/10): Work together, from anywhere. RingCentral’s motto rings true for some of the core enterprise needs on the path to becoming more digital. Through their messaging, video, and phone products, mid-market and enterprise customers now account for over 50% of total revenue. Management has cited continued momentum in the accelerated adoption of UCaaS (Unified Communication as a Service), and the expected 25.5% year- over-year increase in revenues ($317.46M) is representative of that momentum.

Twilio (NYSE: TWLO, expected 2/5): The remote work revolution is fast-forwarding the demand for Communication Platforms as a Service (CPaaS), and Twilio sits at the heart of infrastructure being built to bridge the gap between voice and SMS communications and web-based applications. Twilio is becoming more likely to play a key role in the evolution of how businesses communicate with their customers via text, voice, video, and email. Revenues are expected to come in around $453.91M, a +37.0% increase year-over-year.

Source: Bloomberg, L.P. as of 1/11/2021.

REMOTE HEALTH AND WELL-BEING: HEALTH DIGITIZED

For as long as many of us can remember, medical care in both the U.S. and around the world has looked the same today as it did 20, 15, even 10 years ago. COVID-19, along with technological advances, has acted as a catalyst for change in the way consumers engage with traditional healthcare products and services. With increased adoption in different technologies for better equipment and better care, consumer needs and demands for healthcare products and services are changing. And like many other areas of our lives, healthcare is becoming more digital.

Teladoc Health (NYSE: TDOC, expected 2/26): The largest U.S. telehealth company has benefitted from an acceleration in adoption trends throughout 2020, and they are expected to report top-line growth of almost 139% year-over-year ($373.68M vs. $156.49M), which represents a significant increase from revenue growth from just a year ago (+ 27%). While Teledoc is seemingly well on its way on capitalizing on its vision of virtual primary care, we will be watching for rhetoric around further growth potential and their outlook for 2021.

1Life Healthcare (NASDAQ: ONEM, expected 3/18): A newly listed name in January, 2020, 1Life Healthcare (more commonly known as One Medical) is a west-coast based chain of primary healthcare clinics. Their membership-based primary care service with an integrated digital health system, One Medical delivers the benefits of easy and digital access to care and lower costs to its members. ONEM is expected to report consensus revenues of $106.91M in March with losses of $0.12 per share, which would represent significant increases from their first earnings report as a public company back in March, 2020.

Source: Bloomberg, L.P. as of 1/11/2021.

VIRTUAL AND DIGITAL SOCIAL INTERACTION: ENGAGING WITH THE WORLD AROUND US

Remote communication technologies and platforms are quickly becoming a standard, regardless of industry, for communication both internally and externally. This category goes beyond video communication platforms, and remote communication and the infrastructure for it is here to stay as it offers the scalability and flexibility needed for the mobile workplace and the customer that is always on the move.

Snap Inc (NYSE: SNAP, expected 2/4): Snap has continued to evolve its portfolio of products and have introduced new ways for users to engage with the platform, and each other. Snap Spotlight, introduced on 11/23, has given users the opportunity to create viral videos and engage with the community. Along with the Map, Chat, Camera, Stories/Discover, and Sounds functions, Snap continues to add momentum in engagement growth which is providing valuable scale to advertisers. SNAP is expected to deliver 51.5% year-over-year revenue growth ($849.70M), and we will be watching user activity as well.

Weibo Corp (NASDAQ: WB, expected 2/26): Weibo is a social media platform and microblogging website for people to create, distribute, and discover content. With over 523 million monthly active users (as of 3Q 2020), WB has taken steps to evolve their platform and prioritize engagement and social interaction by introducing more video content and promoting live events with major media partnerships. While 2020 represented challenges around the advertisement centric revenue model, they are expected to report year-over-year revenue growth of 5.9% in February.

Source: Bloomberg, L.P. as of 1/11/2021.

The COVID-19 Pandemic has not only caused major short-term impacts, but has also created long-term disruption to both living and working conventions. One of the long-term trends the coronavirus has accelerated is, “what, where and how” consumers and the workforce behaves.

Invest in these tectonic shifts in society, now.

Direxion Connected Consumer ETF (CCON)

Direxion Work From Home ETF (WFH)

CCON Top 10 Holdings (as of 12/13/2020)

Snap Inc 4.75

8×8 4.48

Biotelemetry 4.10

Peloton Interactive 3.72

John Wiley Sons – Class A 3.23

1life Healthcare 3.22

Mednax 2.93

Twilio – Class A 2.86

Twitter 2.77

PTC Inc 2.74

WFH Top 10 Holdings (as of 12/31/2020)

Plantronics 4.73

8×8 4.31

Fireeye 3.25

Crowdstrike Holdings 3.20

Palo Alto Networks 2.96

Netapp 2.95

Elastic Nv 2.95

Inseego Corp 2.84

Twilio – Class A 2.75

Ringcentral 2.70

* Earnings per share (EPS) is a company’s net profit divided by the number of common shares it has outstanding.

BEST OF BEST

?? E-Com

$AMZN

$BABA

$SHOP

$ETSY

?? FinTech

$PYPL

$SQ

$V

?? Cyber

$CRWD

$OKTA

$ZS

?? EVs

$TSLA

$NIO

$CCIV

?? Gaming

$SKLZ

$SE

?? Real Estate

$RDFN

$Z

$OPEN

?? Healthcare

$TDOC

$TMDX

$DMTK

@CathieDWood is blowing up her fund Sold her most stable cos

$AMZN 25%

$AAPL 18%

$CRM 100% ($100M)

$RGN 6%

$NVS

$TSM 33%

Added $TSLA $TDOC $SQ $BEAM $TWTR

Yellen's based on her financial disclosure statement that's been in the press lately.

http://blogs.barrons.com/focusonfunds/2013/10/11/fed-nominee-janet-yellens-cheap-and-effective-vanguard-funds/?mod=BOLBlog

http://online.wsj.com/public/resources/documents/Yellen-finrpt2010.pdf

According to that two year old disclosure statement she owned:

- DuPont

- Office Max

- Pfizer

- Direct TV

- ConocoPhilips

- Raytheon

- Terradata

- NCR corp

- Cytec Industries

That's a nice bunch of stocks. But nothing as good as ROK. Impossible to know for sure, but they've probably slightly beaten the S&P 500 in recent years. But most of those individual stock holdings are under $15,000... microscopic in view of her and her husband's wealth and income. (he has a Nobel prize in economics!)

"A big chunk – between $1 and $5 million — of Yellen’s money shows up in Vanguard Tax Managed Growth and Income Fund (VTGLX). This low-turnover, large-cap stock fund charges a microscopic 0.12%. It’s of chief interest because of its strong track record in taxable accounts — it’s never paid out any capital gains in its history,"

39 Old Beaver Run Rd, Lafayette, NJ 07848

Lot/landZestimate®: None

$199,90026.36 Acres

$165,00021.34 Acres

Hampton Rd, Newton, NJ 07860

$49,9004.35 Acres

83 Creek Rd, Andover, NJ 07821

$159,90033.74 Acres

37 Layton Rd, Sussex, NJ 07461

$185,00016.24 Acres

Rr 565, Wantage Twp., NJ 07822

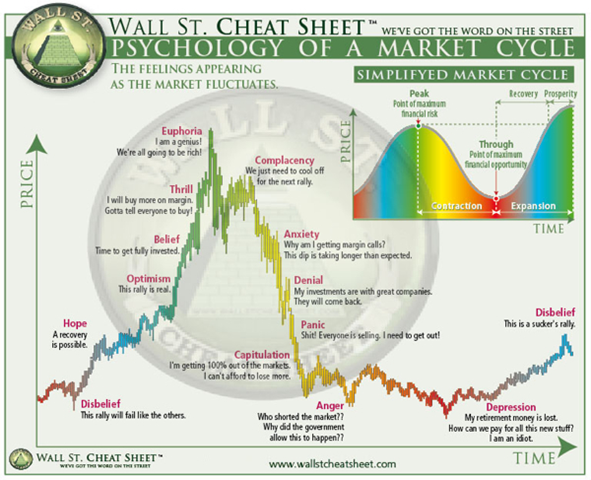

Emotion Trade:Emotional contagion is real, and we are deeply hard-wired to it even if we don’t realize it. I found decades ago that I am deeply susceptible. I tried trading on my emotions and got my hat handed to me. When people got bullish, I bought the top. When they got bearish, I sold the bottom. It was a disaster.

gtt

NBIO

Dirty Money: This is a docu-series about corporations built on lies and scandals, along with tales of greed and corruption in finance.

Saving Capitalism: Former labor secretary Robert Reich interviews Americans and examines the shifts in the economy.

Prediction by the Numbers: This documentary looks at how predictions inform our lives and the reliability of statistics and algorithms.

Broken: This docu-series shows how negligence and deceit in consumer items can lead to terrible outcomes.

Hank: 5 Years from the Brink: This documentary explains how Hank Paulson executed the $1 trillion bailout of the banking system in 2008.

Stink!: A single dad’s search for the strange odor in his children’s pajamas uncovers toxic secrets in the chemical industry.

Drugs INC.: This docu-series follows the entire supply chain of the illegal drug trade, from production to distribution and consumption.

Money Heist: The Phenomenon: Why the “Money Heist” sparked such a big wave of enthusiasm around the world for a group of thieves and their professor.

Cuba and the Cameraman: A chronicle of the fortunes of three Cuban families over the course of forty years.

The Trader: A window into the life of the rural republic of Georgia, where potatoes are currency and poverty crushes ambition.

MUST WATCH

CLEZ

ON THE WATCH

GFGU/ABPR/EMBR/STZU/CMIT/TRII/SVMB/GAFL

unpredictive technolgies 'PRED

PRED

WATCH THE SCAM TO COME CDIX

CDIX

Nothing can stop you BEST

BEST

RICH PEOPLE

STATE WISE RICHEST PEOPLE IN US

|

Followers

|

31

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2044

|

|

Created

|

01/28/11

|

Type

|

Free

|

| Moderator pennytradingnet | |||

| Assistants | |||

PennyTradingNet (www.pennytrading.net) Trading challenge goal is to help ordinary traders learn from his experience and pickup trading strategies and stock picks from a trading professional .Tracking the progress of one anonymous investor through thewebsite, www.pennytrading.net is providing ordinary traders.

We all know that money can't buy happiness … but many times we act as if we'd be happier with a bit more money. We are conditioned to want to be rich (when we know the rich aren't happy either); we are trained to want the latest gadget or style that television tells us to want; we want to earn more money because then we'll have the good life.

Positive thinking. I'm obviously a big proponent of positive thinking as the best way to achieve your goals, but it turns out that it can lead to happiness too. Optimism and self-esteem are some of the best indicators of people who lead happy lives. Happy people feel empowered, in control of their lives, and have a positive outlook on life. Action steps: Make positive thinking a habit. In fact, this should be one of the first habits you develop. Get into the habit of squashing all negative thoughts and replacing them with positive ones. Instead of "I can't" think "I can". It may sound corny, but it has worked for me, every time.

Trade the most active stocks and refrain from trading the slow moving markets. Trade "at the market" whenever possible and try to avoid a fixed buying and selling

price.

Write down your Trading goal(s).

Post it up somewhere visible.

Keep a log and make sure you write in it each day, noting whether you were successful or not for that day.

Post your daily results on your blog or on an online forum

Reward yourself for each day of success.

Actually, if you fail that day, take a minute to see what went wrong, and how to correct it. Now forgive yourself for failing, and tell yourself that you will do better starting now!

Find a way to keep yourself focused on this trading goal for at least 2-3 weeks.

Celebrate when you're done.

If you can conquer that it may take a month or more then move on to the next.

Do not try to do them all at once! Take baby steps, and you'll get there

When it comes to trading stocks, it's not about how hard you work. It's about knowing the right things to do, and putting that knowledge to work. Making money in the stock market isn't so hard when you apply a simple skill essential to converting the power of knowledge into profits ... planning

Trade Planning is one of the most important skills needed for successfully trade the stocks and Make it your strength and enjoy the results!

For an honest, transparent board, not a P&D board and don't want to see it tarnished with pinky P&D's.

List of promoters and there websites:

GROUP 1: "AWESOME PENNY STOCKS"

AwesomePennyStocks.com

Mybeststockalerts.com

SecretPennyStocks.com

PennyStockAdvice.com

PennyStockGains.com

PennyStocksExpert.com

PennyStocksUniverse.com

GROUP 2: "PENNY PIC"

PennyPic.com

InsidersLab.com

FreePennyAlerts.com

PennyStockAlley.com

GladiatorStocks.com

KillerPennyStocks.com

VictoryStocks.com

RumbleStocks.com

InsaneStocks.com

ExplicitPennyPicks.com

PennyStocksAlerts.com

StockAnnouncements.com

MonsterStox.com

StockPickTrading.com

TitanStocks.com

OxOfWallStreet.com

FreeInvestmentReport.com

GROUP 3: "BEST DAMN PENNY STOCKS"

BestDamnPennyStocks.com

JackpotPennyStocks.com

NoLimitStocks.com

SmallCapAllStars.com

EquitiesOnTheRise.com

GetRichPennyStocks.com

BlingBlingPennyStocks.com

EquityMarketReport.com

ThePennyStockJerk.com

HoleInOneStocks.net

XtremePennyStocks.com

Siri.biz

ParamountEquityResearch.com

TryPennyStocks.com

PennyStockParlay.com

BigShotPennyStocks.com

StockParlay.com

EquityMarketReport.com

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |