Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Same is true for the last couple of dips.

This is not a typical dip to buy, IMO.

Looks like $3's on horizon.

This is the problem:

9/19/24 Newcomer Mark

Chief Executive Officer Sale 60,500 4.25 – 4.51 9,486,886 $259.6 K

0n 7/31 378,000 options were exercised!

If memory serves, all the sales in August from the officers were to satisfy tax withholding requirements from the vesting of restricted stock, which happens annually in August.

From Mark's August Form 4:

Explanation of Responses:

1. These shares of common stock were sold to satisfy certain tax withholding obligations associated with the vesting of restricted stock.

It appears Mark's selling in August alone was for an additional approx 340,000 shares. Other officers sold substantial shares in August. Was all of it a "trading plan"? All of this certainly had an effect on share price relating to the last 2 months slide. Shorts had to love it. Bad result for shareholders in an up stock market. Shorting in late summer and early fall is an opportunity I should have noticed previously. Lesson learned. Time to cover shorts??

Here's the story that neglects to mention prior exercise options.

"Paysign Insider Sold Shares Worth $259,646, According to a Recent SEC Filing

8:15 AM ET 9/24/24 | MT Newswires

Related Quote

4:00 PM ET 9/24/24

Symbol Last % Chg

PAYS

4.18 0.00%

Real time quote.

Paysign Insider Sold Shares Worth $259,646, According to a Recent SEC Filing

08:15 AM EDT, 09/24/2024 (MT Newswires) -- Mark Newcomer, 10% Owner, Director, CEO, around September 19, 2024, sold 60,500 shares in Paysign (PAYS) for $259,646. Following the Form 4 filing with the SEC, Newcomer has control over a total of 9,486,886 shares of the company, with 9,486,886 shares held directly."

SEC Filing:

Jp, we probably have to wait for Q3 #'s for a strong rally into $5 territory.

RE negative comments on Stocktwits, I suspect a dual situation has created current selling:

Shorting

Weak longs bailing or getting stopped out.

Two months of declining share price is overdone....to say the least.

Last financial report showed the 5 million allocated is not fully expended.

We can hope they fire up the buy-back program. That would sit well with investors

Thank you for the clarification.

From Mark's Form 4:

1. Transaction was effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on June 12, 2024, which plan is intended to satisfy the affirmative defense conditions of Rule 10b5-1 (c) under the Securities Exchange Act. The plan expires on June 11, 2025 and provides for the purchase or sale of an aggregate of 1.2 million shares of common stock.

True in part....but see reported action on stocktwits in post at 2:22 this morning showing much more action from 8/6/24 to 9/23/24. Perhaps I am not reading this correctly as not all are option related????

They all exercised options first:

9/13/24 Newcomer Mark

Chief Executive Officer Sale 1,500 4.50 – 4.50 9,547,386 $6.8 K

8/5/24 Newcomer Mark

Chief Executive Officer Sale 69,593 4.54 – 4.54 9,548,886 $316.0 K

Herman Joan M.

Officer and Director Sale 15,854 4.54 – 4.54 799,743 $72.0 K

Strobo Robert

Officer Sale 29,690 4.54 – 4.54 209,811 $134.8 K

Lanford Matthew Lou...

Officer and Director Sale 29,340 4.54 – 4.54 135,091 $133.2 K

Baker Jeffery Bradf...

Chief Financial Officer Sale 34,032 4.54 – 4.54 187,065 $154.5 K

7/31/24 Newcomer Mark

Chief Executive Officer Exercise of Options 150,000 -- – -- 9,618,479 $--

Herman Joan M.

Officer and Director Exercise of Options 36,000 -- – -- 815,597 $--

Strobo Robert

Officer Exercise of Options 64,000 -- – -- 239,501 $--

Lanford Matthew Lou...

Officer and Director Exercise of Options 64,000 -- – -- 164,431 $--

Baker Jeffery Bradf...

Chief Financial Officer Exercise of Options 64,000 -- – -- 221,097 $--

7/1/24

Check out Newcomer's stock action in August.

pps dancing around $4.50. If pps hangs around this neighborhood till Q3 earnings, we should run to $5.00 and above.

IMO,

still holding for next earnings and growth------not trading it

WOW, already have my share. Mr D MIA lately.

Continuing to buy dips. Trading activity last few days tells me shorts still around.

Looking to seeing them caught by the short hairs.

Friday Sept option expiration might bring some surprises.

MY small cap and microcaps are getting pounded today. I am trying hard not to buy more now, but still waiting and ready to buy.

If the three of you would do a combined market order of say 1M shares id appreciate it

BUY DEM DIPS, FLIP FOR STEAK DINNERS.

Volume

44,706

Average Volume (10 days)

116,916

I think these low volume days are not short sellers, but weak longs bailing on down market days. (but often my thoughts are convoluted.

seems to be thin on the way up

Bought some recently at 4.11 and 4.19. Next buys will be in 4.08 area if it slides more in a bad market. Fine company all the way around.

I believe good earnings will help support individual stocks in a bearish environment .

Pays has the capacity to surprise. Stay long and strong. Buy dips and flip for exercise while

holding core position.

IMO

Financial channel just reported that this Sept was the worst stock market in 23 years. Time for the tough to get going soon.

flipped out some of the cheapies picked up last week.

BUY DIPS!!

Lack of enthusiasm . I grabbed some @ 4.17 thinking things might settle down over weekend. Additionally, if Fed cuts rates 1/2 rather than 1/4 it MIGHT rally Mr Stock Mkt.

Reading the tea leaves: A nearby community to me normally has copious political signs in their yards for either party. Strangely, this fall election there are almost NONE in the yards. Not sure what to think of that as it relates to the markets. Just reporting what I see as being unusual. I miss the old days for many reasons.

Yes it is difficult not to buy at this price today. But market sentiment is so nasty overall for sept and oct (presently) that I wait.

Difficult not to buy

Buying on dips has been an excellent trading vehicle here. Since there is so much bearishness out there on stocks right now I am in a waiting mood. Lot of shorts making money. Sometimes holding cash appears to be right and is king. So I wait and am ready!

I have to agree

2/3's through Q3.

Next earning report in early December will provide all here a very Merry Christmas.

ALL IMO of course.

Summary

Niche Focus: Paysign specializes in healthcare payment solutions, primarily in plasma donor compensation and patient affordability programs.

Revenue Growth: Significant growth in the patient affordability segment is now a substantial part of total revenue.

Financial Resilience: The company has shown strong revenue and margin recovery post-pandemic, with promising future growth.

Market Potential: Paysign is well-positioned to capitalize on expanding healthcare payment markets, offering a mix of stability and growth potential.

Money and healthcare policy concept. Colorful medical pills cover Benjamin Franklin"s face on one hundred american dollar bill. Macro top down view.

cagkansayin

Paysign (NASDAQ:PAYS) is a fintech company with a niche focus on healthcare, specifically Plasma donor compensation and patient affordability programs. It is a small-cap company with a quarter of a billion dollars in market cap, volatile revenue, and earnings, and it has been having a great year.

Price Revenue & EPS

Price Revenue & EPS (TrendSpider)

The pandemic hit its affordability hard, as seen in the image, but it also increased its revenue and size. It seems that it may finally be returning to its former glory, but with greater revenue, a better outlook, and improved product lines and efficiency.

The article will explore

Basics of the company and products

Financial Outlook and Valuation

Risks and considerations

The Tortoise and the Cat portfolio.

The company and its products

The company's two main segments are plasma donor compensation and patient affordability; as we can see in the chart below, Plasma has had sustainable and stable revenues with some growth. However, Patient affordability has been growing remarkably since last year.

Revenue Split and Growth

Revenue Split and Growth (Investor Relations)

This growth has been obscured in the total company growth as initially, the segment represented only a tiny part of the total revenue. Now, it represents a substantial portion of the revenue. If the segment continues to grow, it will be reflected in the total revenue.

The company expects this trend to continue and even strengthen in future years, not only in patient affordability, but also in "other" segments that currently represent a minuscule amount of revenue.

2026 US Open Loop Prepaid Market forecast

2026 US Open Loop Prepaid Market forecast (Investor relations)

Plasma cards represent less than 3% of the TAM the company is targeting. Insurance claim cards have a forecasted TAM of 3x Plasma and a CAGR of 9% vs. the 6% of Plasma. Payroll and healthcare benefits are 10 times the TAM and have growth prospects similar to Plasma's.

This is to say that while Paysign may control a substantial portion of the Plasma TAM and has relative security there as the market leader, its growth in other segments may be smothered at first, considering the size of the market and the small part and niche benefits the company has.

The company obtained AstraZeneca as a customer in Q3 of 2023, and in the last earnings call, it explained that it expanded the number of programs.

Since then, we have increased the number of programs from their initial four to a total of 12 by the end of the second quarter. The AstraZeneca programs encompass a mix of retail and specialty therapies, covering a wide array of therapeutic classes, and include both new launch and transition programs. This is only one example as we currently manage programs for six of the 20 largest pharmaceutical companies in the world. - Mark Newcomer - President and CEO

Having expanded the number of pharma companies and the programs they run seems promising for the company's growth. New programs tend to be low revenue, and scale from there, if the company manages these programs well, it could represent a higher growth in revenue than the one the market expects.

Financial Outlook

Let's look at the stock's past performance and its fundamentals. On the top part, we can see revenue growth has been increasing since 2022, and revenue is much higher than in Q1 of 2021 and 2019, both previous times when the company traded at this price.

Revenue, EBITDA, EPS

Revenue, EBITDA, EPS (TrendSpider)

The same holds true for EBITDA and gross margin, while EPS is comparable. While this alone does not show the company as undervalued when we compare its revenue prospects, we can see that revenue growth is expected to be higher than in 2021 and 2019.

Revenue estimates

Revenue estimates (My Charts)

Revenue growth prospects seem higher or comparable, even in the low range, where pharma does not shine particularly well.

Gross Margin and Profit Margin Estimates

Gross Margin and Profit Margin Estimates (My Charts)

In every scenario here, the gross margin remains within the bounds shown in previous quarters; this may be overly pessimistic, as Pharma revenue may have a higher margin than Plasma.

This translates almost directly to profit margin, considering the economics of scale that the company has shown. This is where the company's previous pandemic experience managing its operations may come in handy.

Revenue and EPS Forecast

Revenue and EPS Forecast (My Charts)

For 2024, the low range of the estimates is more pessimistic than the one shown in Seeking Alpha, as the valuation normalizes the P&L figures. Even on the high side of the valuation, 2025 EPS shows a much lower level than the one forecasted by Seeking Alpha.

Seeking Alpha Revenue EPS Estimates

Seeking Alpha Revenue EPS Estimates (My Charts)

At even extremely optimistic levels, 2027 EPS in the high range barely reaches the high side of the 2025 estimates.

Low earnings do not necessarily translate to cashflows; the firm's accounts payable are higher than its receivables, and this variation has increased for the past few years.

Cash Convertion Cycle

Cash Conversion Cycle (My Charts)

This Cash Conversion cycle would likely change as not all accounts payable are the same and depend on product mix; however, if the company maintains this cash conversion cycle structure, it could sustain its growth while generating enormous amounts of cash in the process.

FCFE Estimates

FCFE Estimates (My Charts)

Free cash to equity reflects revenue growth with relatively low margins but a highly beneficial cash conversion cycle. This is the basis of the valuation, and below-market gross margins are even considered to increase revenue and show promising cashflows.

Fair Value Estimates

Fair Value Estimates (My Charts)

With this valuation, the company would be 30% above the most pessimistic range of the estimates, while the "most likely scenario" shows a fair value of 23% above the current price. The highest side of the valuation shows remarkable upside potential.

Risks and considerations

When considering the risk of a stock, I believe it makes sense to separate the financial aspects, the industry and macro perspective, and the market risk.

Financially

The company has virtually no debt and a strong working capital position, so risks are scarce. It also has a substantial amount of cash (over 130 Million), representing about $2.4/share, which is significant and should eliminate any liquidity concerns.

Industry & Macro

The number of fintech companies seems to grow like weeds from an industry perspective. There is a relatively low barrier to entry, and the true test of them is whether they can capture a niche and facilitate services that traditional banking or low-tech solutions cannot provide.

While Paysign has demonstrated these differentiators in the plasma space, it is too early to tell for the pharma segment. While they have captured important partners, their time in the space should help them. Bigger fish and newcomers to the space will not make this easy. This may reduce the growth of the pharma segment or at least make it more bumpy than expected, which could reflect volatility in the stock price.

Market Risk

The market risk with stocks below a billion dollars is not to be neglected. Small caps, in general, are more sensitive to Macro turns as arguably they are less prepared and have narrower moats than Blue-Chip companies. So, the market tends to punish them under those circumstances.

A good example of this is Paysign's stock price performance during the pandemic. While its results took a hit, the overall picture remained quite impressive, and its financials were strong. Nevertheless, the price took a substantial dive. This was arguably because of the company's size.

The Cat, The Tortoise, and my portfolio

The stock is exciting. On the one hand, it has plasma revenue that may act as a buffer for harsh financial conditions. In economic downturns, the company would arguably have higher plasma donations and activity.

On the other hand, the pharma business seems to be growing smoothly, and it likely has the strength and edge to carve out a substantial portion of its share of the insurance and payroll areas. This shift in company segment revenue is similar to the one Aspen Aerogels (ASPN) has been experiencing since last year.

If the stock is not widely covered or the coverage is not profound, it is likely that the growth in pharma was not noticed by many, as it did not have a meaningful impact on total revenue.

Let's look at the Tortoise and Cat portfolio outlook.

The Tortoise portfolio would allocate a portion to this stock. The relatively low downside risk and the risk parameters that the plasma donation segment represents, paired with a good business model, fit well with the portfolio objectives. The only complex issue here is the company's market cap, which may make it more volatile than other stocks. For that reason, the portfolio would allocate 2/3 of the position and increase the other 1/3 if the next quarter's information confirms the investment thesis.

The Cat portfolio would take a position in the company. The risk-reward opportunity is there, and the catalysts seem to be clear and have enough upside potential for an allocation in the risk-seeking portfolio.

For my portfolio, my biggest issue with the stock is that it does not fit perfectly within the 7 most important trends in the XXI century. However, the portfolio is missing some exposure to the healthcare industry.

The closest trend in which it fits is the transformative shifts in demographics.

Transformative Shifts in Demographics and Healthcare: As demographic conditions evolve, the healthcare industry undergoes a radical transformation propelled by technological and data-driven innovations.

While the company does not perfectly fit these, Plasma's antifragile nature, paired with its strong undervaluation, makes a compelling case to include it in the portfolio, at least for a while.

This article was written by

Mauro Solis Vazquez Mellado, CFA profile picture

Mauro Solis Vazquez Mellado, CFA

3.53K Followers

Hello there! I'm an M&A Manager by day and a passionate financial analyst by night. As a Chartered Financial Analyst (CFA), I've seamlessly merged my background in Mechanical Engineering with a decade of experience in the Fast Moving Consumer Goods Supply chain.My mission? To harness the power of engineering and financial analysis, breathing life into numbers and charts and uncovering value in the most sustainable and insightful ways possible. With a diverse portfolio of projects under my belt, ranging from automation to zero waste initiatives, I've honed my skills in managing, controlling, and constructing portfolios, all while keeping a keen eye on sustainability.My philosophy is simple: I believe in the alchemy of engineering, mathematics, and statistics blended seamlessly with rigorous financial analysis. I don't just see stocks; I understand the companies behind them, delving deep to decode the DNA of every investment opportunity.I'll take you on a journey transcending stock tickers and charts in my articles. I'll unravel the intricate tapestry of risk, examining it from myriad perspectives and shedding light on the cognitive and emotional biases that can sway even the savviest investor.Join me as we explore the world of finance, where numbers come to life and investments become more than just assets on paper. Together, we'll navigate the exciting realm of sustainable wealth creation, always focusing on what truly matters to me – the future and sustainability.

Show more

Show more

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASPN, PAYS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I recently became a TrendSpider Affiliate, and I received an account for free.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Like

Saved

Share

Print

Comments (2)

Recommended For You

Comments (2)

Sort by

Newest

About PAYS Stock

Symbol Last Price % Chg

PAYS

4.72 -1.36%

Post 4.98 5.59%

1D

5D

1M

6M

1Y

5Y

10Y

Market Cap

$254.27M

PE (FWD)

100.74

Yield

-

Rev Growth (YoY)

26.45%

Short Interest

0.82%

Prev. Close

$4.79

More on PAYS

Paysign GAAP EPS of $0.01 in-line, revenue of $14.33M beats by $0.33M

Paysign Q2 2024 Earnings Preview

Paysign: Expect Rapid Growth In Its Pharma Business

Paysign: Expect Rapid Growth In Its Pharma Business

Sandeep Nital David

Paysign GAAP EPS of $0.01, revenue of $13.2M beats by $0.81M

3P

Symbol Price % Chg

PAYS

4.72

-1.36%

Give yourself the b

A new article on SA

Paysign: The Return Of The King Of Medical Fintech

Inbox

SA Analysis

3:54?PM (2 hours ago)

to me

Paysign: The Return Of The King Of Medical Fintech

Aug 19, 2024 04:52 PM | Paysign, Inc.(PAYS) | By: Mauro Solis Vazquez Mellado, CFA

UNABLE TO POST DON'T HAVE SUBSCRIPTION

Gold suppository. LOL

Not much for sale, it seems. With the two recent conferences, I'd suspect there's a few new buyers in the mix. We sit on Gold here

Short covering event soon would be nice.

volume today about 1/2 average. patiently waiting for one of those million share days

Volume

112,915

Average Volume (10 days)

243,043

Number of Floating Shares 32.3 M

Short Interest as % of Float 1.34%

I wish we could get a legit #

Exercise of options & Sales:

Interesting to note they all sold @ $4.54 on the same day (8/5). Did anyone notice a huge sale on 8/5, or did the company "buy the shares" on the buyback program?

Insider Activity

Ownership

Insider Activity

Show All Types of Transactions

3 Months

6 Months

1 Year

Weekly Insider Transactions Award of Options Exercise of Options Planned Sale Purchase Sale Stock Gift

Mouseover chart for more detail

Insider Sentiment

MINA BRUCE A. purchased a total of 1,206 shares on May 14, 2024. Presumably, insiders expect the stock price increase to continue. Over the last 3 years insiders have on average purchased 8,333 shares each year.

Insider Transaction History

Date Name-Position Transaction Shares Price Range ($) Shares Held Mkt Value

8/5/24 Newcomer Mark

Chief Executive Officer Sale 69,593 4.54 – 4.54 9,548,886 $316.0 K

Herman Joan M.

Officer and Director Sale 15,854 4.54 – 4.54 799,743 $72.0 K

Strobo Robert

Officer Sale 29,690 4.54 – 4.54 209,811 $134.8 K

Lanford Matthew Lou...

Officer and Director Sale 29,340 4.54 – 4.54 135,091 $133.2 K

Baker Jeffery Bradf...

Chief Financial Officer Sale 34,032 4.54 – 4.54 187,065 $154.5 K

7/31/24 Newcomer Mark

Chief Executive Officer Exercise of Options 150,000 -- – -- 9,618,479 $--

Herman Joan M.

Officer and Director Exercise of Options 36,000 -- – -- 815,597 $--

Strobo Robert

Officer Exercise of Options 64,000 -- – -- 239,501 $--

Lanford Matthew Lou...

Officer and Director Exercise of Options 64,000 -- – -- 164,431 $--

Baker Jeffery Bradf...

Chief Financial Officer Exercise of Options 64,000 -- – -- 221,097 $-

Getting exposure (twice)

Paysign, Inc. to Participate in the August 2024 Sidoti Micro-Cap Virtual Conference

4:15 PM ET 8/8/24 | BusinessWire

Related Quotes

4:00 PM ET 8/9/24

Symbol Last % Chg

PAYS

4.55 -0.55%

Real time quote.

HENDERSON, Nev.--(BUSINESS WIRE)--August 08, 2024--

Paysign, Inc. (NASDAQ: PAYS), a leading provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing, today announced their participation in the Sidoti Micro-Cap Virtual Conference, taking place August 14-15, 2024. Jeff Baker, Paysign's Chief Financial Officer, will be available for one-on-one and small group meetings with investors during the event.

Paysign is scheduled for a group presentation on Wednesday, August 14, at 4:00 p.m. EDT.

To register or learn more about the conference, investors may visit the event website or visit the webinar registration page to attend the live group presentation.

Forward-Looking Statements

Certain statements in this news release may contain forward-looking information within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6 under the Securities Exchange Act of 1934 and are subject to the safe harbor created by those rules. All statements, other than statements of fact, included in this release, including, without limitation, statements regarding potential future plans and objectives of the companies, are forward-looking statements that involve risks and uncertainties. There is no assurance that such statements will prove to be accurate, and actual results and future events could differ materially. Paysign undertakes no obligation to publicly update or revise any statements in this release, whether as a result of new information, future events or otherwise.

Paysign, Inc. to Present at the Oppenheimer Technology, Internet & Communications Conference

4:15 PM ET 8/7/24 | BusinessWire

Related Quotes

4:00 PM ET 8/9/24

Symbol Last % Chg

PAYS

4.55 -0.55%

Real time quote.

HENDERSON, Nev.--(BUSINESS WIRE)--August 07, 2024--

Paysign, Inc. (NASDAQ: PAYS), a leading provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services and integrated payment processing, today announced they will be presenting at the Oppenheimer 27(th) Annual Technology, Internet & Communications Conference to be held August 12-14, 2024, through a virtual format.

The focus of the virtual conference is to provide an expansive look across the dynamic sector of the world economy at existing and emerging technologies and provide potential investors the opportunity to evaluate public companies at the forefront of these technological innovations.

Paysign's Chief Financial Officer, Jeff Baker, is scheduled to present on Tuesday, August 13, at 3:45 p.m. EDT.

Investors may learn more about the conference here.

Forward-Looking Statements

Certain statements in this news release may contain forward-looking information within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6 under the Securities Exchange Act of 1934 and are subject to the safe harbor created by those rules. All statements, other than statements of fact, included in this release, including, without limitation, statements regarding potential future plans and objectives of the companies, are forward-looking statements that involve risks and uncertainties. There is no assurance that such statements will prove to be accurate, and actual results and future events could differ materially. Paysign undertakes no obligation to publicly update or revise any statements in this release, whether as a result of new information, future events or otherwise.

About Paysign

Paysign, Inc. is a leading provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services and integrated payment processing designed for businesses, consumers and government institutions. Incorporated in 1995 and headquartered in southern Nevada, the company creates customized, innovative payment solutions for clients across all industries, including pharmaceutical, healthcare, hospitality and retail. Built on the foundation of a reliable payments platform, Paysign's end-to-end technologies securely enable digital payout solutions and facilitate the distribution of funds for donor compensation, copay assistance, customer incentives, employee rewards, travel expenses and per diem, reimbursements, gift cards, rebates, and countless other exchanges of value. Paysign's solutions lower costs, streamline operations and improve customer, employee and partner loyalty. To learn more, visit paysign.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240807446992/en/

CONTACT: Investor Relations

ir@paysign.com

888.522.4853

paysign.com/investors

Media Relations

Alicia Ches

888.522.4850

pr@paysign.com

SOURCE: Paysign, Inc.

Copyright Business Wire 2024

> Dow Jones Newswires

August 07, 2024 16:15 ET (20:15 GMT)

I can't keep my hands off $2.50 calls.

the short sellers have backed off a bit today.

|

Followers

|

54

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

9868

|

|

Created

|

07/02/10

|

Type

|

Free

|

| Moderators chilar4567 | |||

- Revenue for the year ending December 31, 2018 was $23.4 million, an increase of 54% compared to $15.2 million the prior year.

- Gross profit increased 70% to $11.4 million or 49% of revenues, compared to $6.7 million or 44% of revenues in 2017.period last year.

- Non-GAAP Adjusted EBITDA was $4.9 million, an increase of 65% compared to $3.0 million in 2017. Non-GAAP Fully Diluted EPS was $.09 as compared to $.06 the prior year.

- The company reiterates its previously released revenue guidance for 2019 of $38.0 to $40.0 million, representing a 62% to 71% increase compared to $23.4 million for full year 2018

as well as an adjusted EBITDA guidance at $10.0 to $12.0 million, representing a 104% to 145% increase compared to $4.9 million for full year 2018.

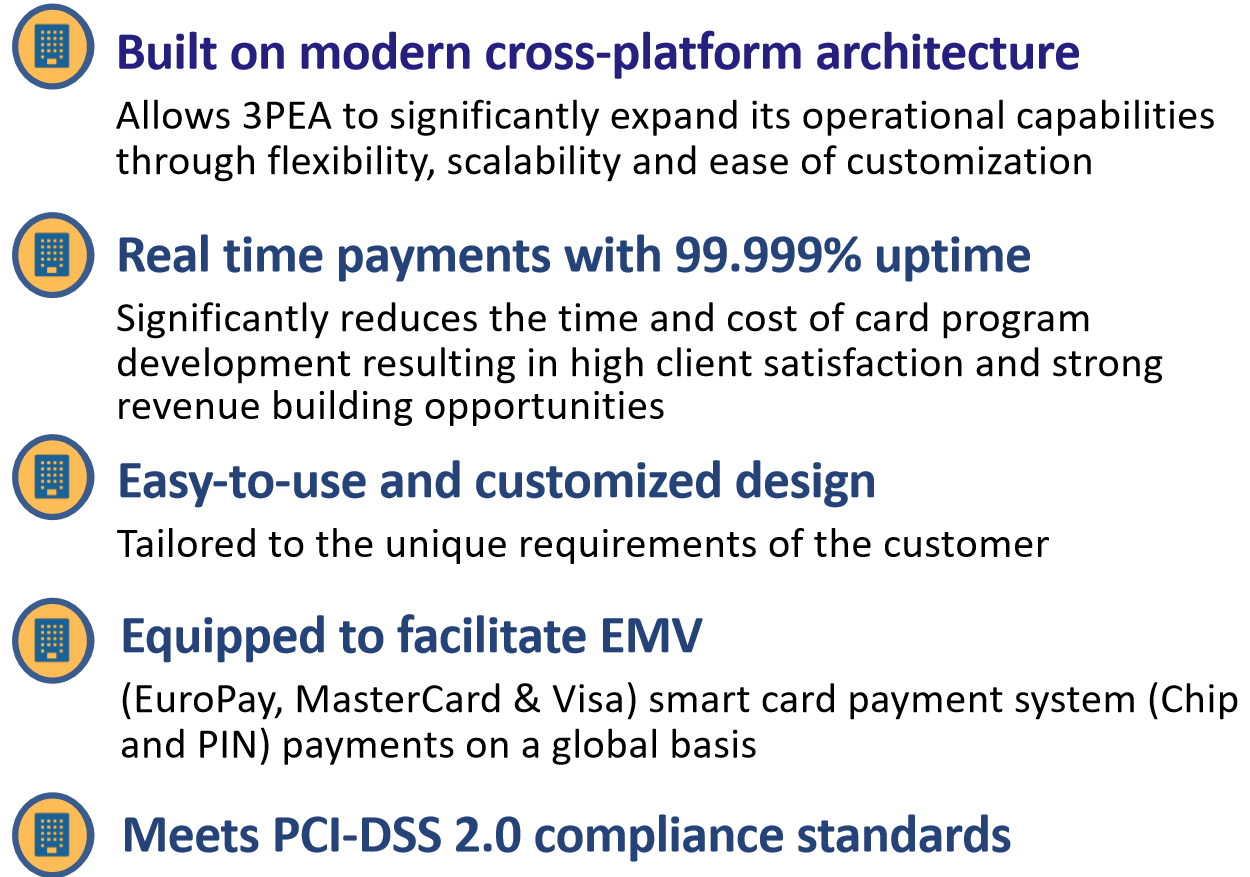

The PaySign platform represents a revolutionary payment processing solution that took years of development. It is a reflection of the Company's commitement to providing innovative, cost effective, customizable payment solutions to a variety of industries for multiple purposes. The platform was designed to easily incorporate new payment technologies and applications as they evolve, keeping Paysign at the forefront of payment innovation.

--> Corporate Incentives: In a market that is expected to grow to $26.5 billion by 2016, PaySign® corporate incentive cards are the perfect vehicle for

corporations looking to engage and motivate their customers, employees, and trade partners. PaySign cards are perfect for customer rebates, employee

bonuses and trade partner commissions. Examples of corporate incentive cards include prepaid cards used as incentives to purchase big ticket items such

as automobiles, smartphones and major appliances.

--> Payroll: PaySign payroll cards reduce administration costs and streamline operations for companies looking to provide an efficient payment method for

unbanked employees. The overall market for prepaid debit cards for payroll is expected to reach $66.4 billion by 2016.

--> Public Sector: Federal and local governments, educational institutions, and other public sector organizations are constantly looking to improve efficiency

and reduce costs. The PaySign card for the public sector provides an effective way to reduce costs and inefficiencies, whether related to disbursements of

public benefits or internal payments. The total prepaid card market for government payments is projected to reach $119.4 billion by 2016.

--> Pharmaceutical Co-Pay Assistance: Paysign's Allegiance Rx card is now available under the PaySign brand. Co-pay assistance cards have been

utilized by major pharmaceutical companies for brands such as Viagra®, Vyvance® and Restasis® to name a few.

--> Source Plasma Donors: Plasma collection companies nationwide can turn to the PaySign brand of cards for a customized payment solution for plasma

donors. The PaySign solution offers either a customized Plasma Web portal solution or direct integration into donor management software.

- Co-founded the Company in 2001; and driving force behind the Company's significant growth and strategic direction

- Shaping the future of the business as a premier prepaid card services leader, delivering a strong value proposition for clients and over 2 million cardholders; oversees all financial, operational, technological and strategic decisions for the company, including: technology investments, the evaluation of strategic acquisitions,new product development and the formation and cultivation of third-party relationships

- Served on the X-9 committee which developed standards for the electronic payments industry alongside IBM, Diebold, First Data, KPMG, MasterCard, Melon Bank, Visa, Wells Fargo, the Federal Reserve and others

- Attended Cal-Poly San Luis Obispo where he majored in Bio-Science

- Co-founded the Company in 2001

- 30+ years of senior IT experience

- Prior experience includes Director of Technology Planning at the Associated Press, Project Manager of implementation of Medicare Easyclaim for ANZ Bank in Australia, Coca-Cola Business Operations & Business analyst for Australia Post

- 30+ years of experience in Financial Services and BPO industries with concentration in Finance, Operations and executive leadership

- Prior experience includes CEO and CFO of Zxerex, CEO of Affina, and Vice President at American Express and Vice President at NextCard

- Bachelor of Science in Finance, minor in Accounting; and Masters in Business Administration (MBA) from Brigham Young University

- 30+ years of industry experience

- Previously at Sunrise Banks as Senior Vice President, Payments Division where she led the new prepaid business

- Prior experience includes various management positions in operations, product development, and sales and marketing at UMB Bank, Heartland Bank, and Boatmen’s Bank

- Board member of the Network Branded Prepaid Card Association and serves as Treasurer

- 13+ years of legal experience in non-traditional banking

- Previously at Republic Bank & Trust Company (Louisville, KY) as Deputy General Counsel and Vice President where he managed all legal affairs for Republic’s non-traditional bank programs, including payments, small-dollar consumer lending, commercial lending and tax related products

- B.A. in Psychology and Philosophy from the University of Kentucky and J.D. from DePaul University College of Law in Chicago, Illinois

- 20 years of experience working in the card industry, focusing on prepaid and credit products

- Previously with Global Cash Card, Inc., Sunrise Banks and Meta Payment Systems (a division of Meta Bank)

- Certified member (CAMS) of the Association of Certified Anti-Money Laundering Specialists.

- Bachelor of Science Degree from South Dakota University

- 30+ years experience in various technical roles providing enterprise IT services at several global companies

- Former Associate Director, Hosting Solutions Bristol-Myers Squibb

- Former Manager of Server Technology, The Associated Press

- 25+ years experience in various marketing roles within the Fintech industry

- Former Senior Product Marketing Manager at Fiserv

- Former Vice President, Marketing, NYSE Governance Services

Board of Directors

- Former CEO of NetSpend (2008-2013). Grew annual revenue from $129M to $351M, with over 2.4 million cardholder accounts. NetSpend acquired by Total System Services: (NYSE: TSS) for $1.4B

- Co-founder, Former President and Chief Operations Officer and Director at Euronet Worldwide (NASDAQ: EEFT). A leader in secure electronic financial transaction processing. Current market cap: 5.4B

- Sits on Board of The Brinks Company. (NYSE: BCO), CARD Corporation (Card.com), RxSavings Solutions, Balance Innovations and Align Income Share Fund

- Received a B.S. in Business Administration with majors in Finance, Economics and Real Estate from the University of Missouri,Columbia

- 35+ years in the banking industry including serving as the President and CEO of two banks in the Midwest

- Former CEO of Healthcare Services at UMB Bank, N.A a leading provider of healthcare payment solutions including health savings account (HSAs), health care spending accounts and payments technology

- 30+ years of legal experience focusing on mergers and acquisitions, public and private securities offerings, and venture capital transaction

- Serves as corporate counsel for numerous public/private companies and was formerly general counsel and board member of Swensen’sInc.

- Mr. Williams is a shareholder with Greenberg Traurig LLP and admitted to the Bar in New York and Arizona

- 30+ years of experience as a Certified Public accountant

- Founder and Managing member of Mina Llano Higgins Group, LLP

- Former CFO of Coal Brick Oven Pizzeria, Inc.

- Currently CFO for Academy of Aviation in Long Island, NY

3PEA International:

Jim McCroy

Investor Relations

Tel: 702.749.7269

IR@3PEA.com

www.3pea.com

Website

Click Here For the Company's Investor Presentation

Articles About 3PEA International

Seeking Alpha (SC Capital Group) - 3Pea Is A Payment Processor With >40% Organic Growth Selling For Half Of Peer Multiples - 2018-05-22

Seeking Alpha (Inefficient Market) - 3Pea: Strong Guidance, Uplisting, Should Propel Shares Higher - 2018-04-03

Seeking Alpha (BW Investment Visibility) - 3Pea International: Undervalued And Undercovered Turnaround Story - 2017-11-20

Analyst Coverage

Cannacord Genuity: Buy 17$ Target

Ladenburg Thalmann: Buy 14.50$ Target

Maxim Group: Buy 10.00$ Target

*This document contains projections and other forward-looking statements regarding future events. Such statements are predictions, which may involve known and unknown risks, uncertainties and other factors, which could cause the actual events or results and objections to differ materially from those expressed.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |