Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi uk. I'm not posting on the PLUG board anymore due to JB infuriates me by removing my posts and being so snarkily anti-PLUG, but I wanted to suggest that you try joining the Facebook group: PLUG POWER INC (SHAREHOLDERS). So I chased you down here.

There is a lot of good information on it. There is even a daily brief posted each morning by Robert Friedlander, PLUG's Director of Investor Relations.

Paymentus stock rallies to post-IPO high as fintech firm gains 45%+ in just three sessions

May 28, 2021 6:30 PM ET

By: Jerry Kronenberg

SA News Editor

Paymentus Holdings Inc. (NYSE:PAY) rallied for the second session in three days Friday, taking the fintech’s stock up more than 45% from its IPO price in less than a week.

PAY rose to a record $31.81 intraday high Friday before pulling back some to close at a post-IPO high of $30.50, up 8.9% on the day and 45.2% above its $21-a-share initial public offering price. Paymentus had already soared 36.2% in its first post-IPO session Wednesday before giving some of the gains back Thursday.

PAY’s platform helps landlords, utilities, auto-loan providers and other businesses electronically bill customers and accept instant payments. Its system is tied in with popular payments platforms like Amazon Pay and PayPal. Consumers can also pay bills with cash or plastic at more than 4,000 Walmart locations.

Paymentus is a leading provider of cloud-based bill payment technology and solutions.

We deliver our next-generation product suite through a modern technology stack to more than 1,300 business clients — our billers. Our platform was used by approximately 16 million consumers and businesses in North America in December 2020 to pay their bills and engage with our billers. We serve billers of all sizes that provide non-discretionary services across a variety of industry verticals, including utilities, financial services, insurance, government, telecommunications and healthcare. By powering this comprehensive network of billers, each with their own set of bill payment requirements, we have created an enviable feedback loop that enables us to continuously drive innovation, grow our business and uniquely improve the electronic bill payment experience for everyone in the bill payment ecosystem.

Our platform provides our billers with easy-to-use, flexible and secure electronic bill payment experiences powered by an omni-channel payment infrastructure that allows consumers to pay their bills using their preferred payment type and channel.

We have a valuable relationship with our controlling stockholder, Accel-KKR. In September 2011, affiliates of Accel-KKR, or AKKR, acquired a controlling equity interest in our company. We refer to this transaction as the AKKR Investment. Dushyant Sharma, our founder, chairman, president and CEO, has continued to retain a significant equity interest in our company since our inception and following the AKKR Investment.

AKKR is a technology-focused investment firm with over $10 billion in capital commitments. The firm focuses on investments in software and tech-enabled businesses. At the core of AKKR’s investment strategy is a commitment to developing strong partnerships with the management teams of its portfolio companies and a focus on building value alongside management by leveraging the significant resources available through the AKKR network.

(Note: Paymentus Holdings Inc. priced its IPO on May 25, 2021, at $21 – the top of its $19-to-$21 price range – on 10 million shares, the same of shares in the prospectus, to raise $210 million.)

WE ARE PASSIONATE ABOUT OUR MISSION TO ENHANCE BILLING AND PAYMENTS.

Powering the Next Generation of Electronic Bill Payments.™

In 2004, Paymentus was born from a desire to improve the way bills get paid. Vision, innovation and exemplary service have propelled Paymentus to become the leading paperless electronic billing and payment solution on the market, resulting in 1,300 clients including some of the largest billers in North America.

We know that in order to keep our solutions current and relevant, we need people with the know-how, drive and proclivity for fostering a supremely happy customer experience. Our highly committed, creative employees turned an idea into a secure, SAAS-based Customer Engagement and Payment Platform; one that enables direct-bill organizations to provide a unified customer experience and boost adoption of cost-saving electronic billing and payment services.

Recognized by Deloitte to be among the fastest growing North American companies for 4 years, Paymentus consistently strives to develop better, faster, more secure, cost-efficient billing and payment platforms. We continually seek higher value for our customers, in both solutions and service.

It’s what has led to our remarkable growth in the last decade. We succeed when our clients succeed. They succeed when their customer relationships are enhanced and, in turn, their customers participate in these cost-saving electronic services at high rates.

Will be taking over this board.

Reliable source $SQ in negotiations to buy taxi biz from $PAY

As we know Verifone reported early this month that they were getting out of teh taxi biz, http://www.digitaltransactions.net/news/story/VeriFone-Doubles-Down-on-New-Products-as-It-Exits-the-Taxi-Business-and-Retreats-in-China

They did not cross my pinhead brain till now, with the retailers closing stores, that's not good for business. No position.

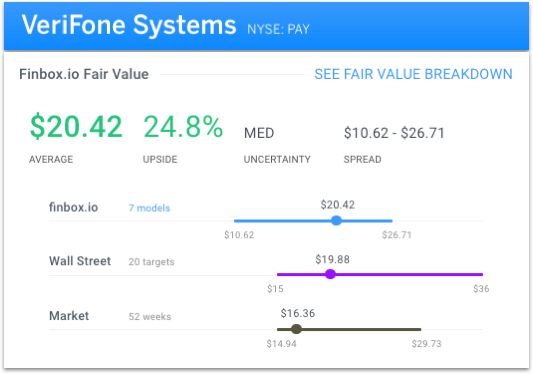

PAY is trading at a 25% discount to fair value before earnings (expected Monday). $20.42 fair value estimate is slightly above the Wall Street consensus price target of $19.88:

Earnings Analysis

Dead cat bounce off of $16.07 LOD to $16.45 watch out it's not done dropping

waitng to buy the bounce...off 15 or 16,!

Don't know...This might take some time , before trending up!

You thinking msft will buy this?

M-s0ft...75 next year

nailed it on the big down day! Riding a few free shares.

I hope I'm wrong for your sake

Once it finds a bottom. Are you getting rtq?

No. I took a loss. I will buy later few months before next earnings. It will trend down for now

Looks l like it took a big hit on Fri. You still in? I bought some at 19.66

will not be down for long!

jumping in today!

PAY Beats Uber to the IPO! PAY debuts Way2ride ehail app to compete with Uber and Lyft. "Verifone powers over 85,000 cabs in more than 100 cities across the globe", that would give Verifone the second largest footprint, ahead of Lyft and second only to Uber in North America.

Ride Charge has agreed to terms with PAY http://gocurb.com/. This will give PAY presence in the majority of US taxicabs in virtually every US city.

$PAY DD Notes ~ http://www.ddnotesmaker.com/PAY

bullish

quick trade

$PAY recent news/filings

## source: finance.yahoo.com

Wed, 24 Dec 2014 18:04:10 GMT ~ VERIFONE SYSTEMS, INC. Financials

read full: http://finance.yahoo.com/q/is?s=pay

*********************************************************

Sat, 20 Dec 2014 00:07:33 GMT ~ 10-K for VeriFone Systems, Inc.

read full: http://www.companyspotlight.com/routers/headline/25185/10004/6431665?cp_code=YAH1&1419034053

*********************************************************

Wed, 17 Dec 2014 22:45:00 GMT ~ Stock Pops & Drops: GIS, SDRL, PAY & CLF

read full: http://finance.yahoo.com/video/stock-pops-drops-gis-sdrl-224500004.html

*********************************************************

Wed, 17 Dec 2014 21:57:50 GMT ~ VERIFONE SYSTEMS, INC. Files SEC form 10-K, Annual Report

read full: http://biz.yahoo.com/e/141217/pay10-k.html

*********************************************************

Wed, 17 Dec 2014 14:37:00 GMT ~ VeriFone Systems (PAY) Stock Upgraded Today at Barclays

read full: http://www.thestreet.com/story/12988506/1/verifone-systems-pay-stock-upgraded-today-at-barclays.html?puc=yahoo&cm_ven=YAHOO

*********************************************************

$PAY charts

basic chart ## source: stockcharts.com

basic chart ## source: stockscores.com

big daily chart ## source: stockcharts.com

big weekly chart ## source: stockcharts.com

$PAY company information

## source: otcmarkets.com

Link: http://www.otcmarkets.com/stock/PAY/company-info

Ticker: $PAY

OTC Market Place: Not Available

CIK code: 0001312073

Company name: VeriFone Systems, Inc

Incorporated In: DE, USA

$PAY share structure

## source: otcmarkets.com

Market Value: $4,318,438,442 a/o Dec 26, 2014

Shares Outstanding: 113,344,841 a/o Dec 01, 2014

Float: Not Available

Authorized Shares: Not Available

Par Value: 0.01

$PAY extra dd links

Company name: VeriFone Systems, Inc

## STOCK DETAILS ##

After Hours Quote (nasdaq.com): http://www.nasdaq.com/symbol/PAY/after-hours

Option Chain (nasdaq.com): http://www.nasdaq.com/symbol/PAY/option-chain

Historical Prices (yahoo.com): http://finance.yahoo.com/q/hp?s=PAY+Historical+Prices

Company Profile (yahoo.com): http://finance.yahoo.com/q/pr?s=PAY+Profile

Industry (yahoo.com): http://finance.yahoo.com/q/in?s=PAY+Industry

## COMPANY NEWS ##

Market Stream (nasdaq.com): http://www.nasdaq.com/symbol/PAY/stream

Latest news (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/news - http://finance.yahoo.com/q/h?s=PAY+Headlines

## STOCK ANALYSIS ##

Analyst Research (nasdaq.com): http://www.nasdaq.com/symbol/PAY/analyst-research

Guru Analysis (nasdaq.com): http://www.nasdaq.com/symbol/PAY/guru-analysis

Stock Report (nasdaq.com): http://www.nasdaq.com/symbol/PAY/stock-report

Competitors (nasdaq.com): http://www.nasdaq.com/symbol/PAY/competitors

Stock Consultant (nasdaq.com): http://www.nasdaq.com/symbol/PAY/stock-consultant

Stock Comparison (nasdaq.com): http://www.nasdaq.com/symbol/PAY/stock-comparison

Investopedia (investopedia.com): http://www.investopedia.com/markets/stocks/PAY/?wa=0

Research Reports (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/research

Basic Tech. Analysis (yahoo.com): http://finance.yahoo.com/q/ta?s=PAY+Basic+Tech.+Analysis

Barchart (barchart.com): http://www.barchart.com/quotes/stocks/PAY

DTCC (dtcc.com): http://search2.dtcc.com/?q=VeriFone+Systems%2C+Inc&x=10&y=8&sp_p=all&sp_f=ISO-8859-1

Spoke company information (spoke.com): http://www.spoke.com/search?utf8=%E2%9C%93&q=VeriFone+Systems%2C+Inc

Corporation WIKI (corporationwiki.com): http://www.corporationwiki.com/search/results?term=VeriFone+Systems%2C+Inc&x=0&y=0

## FUNDAMENTALS ##

Call Transcripts (nasdaq.com): http://www.nasdaq.com/symbol/PAY/call-transcripts

Annual Report (companyspotlight.com): http://www.companyspotlight.com/library/companies/keyword/PAY

Income Statement (nasdaq.com): http://www.nasdaq.com/symbol/PAY/financials?query=income-statement

Revenue/EPS (nasdaq.com): http://www.nasdaq.com/symbol/PAY/revenue-eps

SEC Filings (nasdaq.com): http://www.nasdaq.com/symbol/PAY/sec-filings

Edgar filings (sec.gov): http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001312073&owner=exclude&count=40

Latest filings (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/filings

Latest financials (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/financials

Short Interest (nasdaq.com): http://www.nasdaq.com/symbol/PAY/short-interest

Dividend History (nasdaq.com): http://www.nasdaq.com/symbol/PAY/dividend-history

RegSho (regsho.com): http://www.regsho.com/tools/symbol_stats.php?sym=PAY&search=search

OTC Short Report (otcshortreport.com): http://otcshortreport.com/index.php?index=PAY

Short Sales (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/short-sales

Key Statistics (yahoo.com): http://finance.yahoo.com/q/ks?s=PAY+Key+Statistics

Insider Roster (yahoo.com): http://finance.yahoo.com/q/ir?s=PAY+Insider+Roster

Income Statement (yahoo.com): http://finance.yahoo.com/q/is?s=PAY

Balance Sheet (yahoo.com): http://finance.yahoo.com/q/bs?s=PAY

Cash Flow (yahoo.com): http://finance.yahoo.com/q/cf?s=PAY+Cash+Flow&annual

## HOLDINGS ##

Major holdings (cnbc.com): http://data.cnbc.com/quotes/PAY/tab/8.1

Insider transactions (yahoo.com): http://finance.yahoo.com/q/it?s=PAY+Insider+Transactions

Insider transactions (secform4.com): http://www.secform4.com/insider-trading/PAY.htm

Insider transactions (insidercrow.com): http://www.insidercow.com/history/company.jsp?company=PAY

Ownership Summary (nasdaq.com): http://www.nasdaq.com/symbol/PAY/ownership-summary

Institutional Holdings (nasdaq.com): http://www.nasdaq.com/symbol/PAY/institutional-holdings

Insiders (SEC Form 4) (nasdaq.com): http://www.nasdaq.com/symbol/PAY/insider-trades

Insider Disclosure (otcmarkets.com): http://www.otcmarkets.com/stock/PAY/insider-transactions

## SOCIAL MEDIA AND OTHER VARIOUS SOURCES ##

PST (pennystocktweets.com): http://www.pennystocktweets.com/stocks/profile/PAY

Market Watch (marketwatch.com): http://www.marketwatch.com/investing/stock/PAY

Bloomberg (bloomberg.com): http://www.bloomberg.com/quote/PAY:US

Morningstar (morningstar.com): http://quotes.morningstar.com/stock/s?t=PAY

Bussinessweek (businessweek.com): http://investing.businessweek.com/research/stocks/snapshot/snapshot_article.asp?ticker=PAY

$PAY DD Notes ~ http://www.ddnotesmaker.com/PAY

But do they hold the patent? Like MYECHECK for instance...

Just curious I have not done not one ounce of research on this stock but are the process of payment for these devices already equipped into the phone? Or is this a third party solution that you would attach to the device? Because idk... Like I said I don't know anything about Verifone I'm just digging into further DD on another stock and I would

Kinda say that this is a great idea and good business but for how long?... I like the way $MYEC has the patent for the new process of payment without having any extra devices or cases or any bulky item attachment...

Just curious.

GL

Curious if Verifone are running with $MYEC patented technology for the formal process of payment?...

Great from 16.00

MK

Love to see PAY at 35.00 on any Paypal news.

29.83 hod

nice

MK

Almost to the point for me to get my money back and sell!

27.40 weee

MK

26.60 now

and that after a strong sell rating from Zacks

happy...

MK

25.40 hodfrom 16.00s

MK

Yup, it's in my long term account but looking to sell covered calls if it really takes off.

Hit 24.0 today

from 16.00

MK

|

Followers

|

10

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

135

|

|

Created

|

04/06/11

|

Type

|

Free

|

| Moderators | |||

Paymentus Holdings (PAY) has filed to raise $200 million in an IPO of its Class A common stock plus $50 million in a concurrent private placement, according to an S-1/A registration statement.

The firm provides bill payment software to companies and their customers worldwide.

PAY is growing impressively while producing earnings and free cash flow, so the IPO is worth a close look.

Redmond, Washington-based Paymentus was founded to develop a cloud-delivered payment technology stack for financial institutions and other businesses to provide omni-channel payment services with customers.

Management is headed by founder, Chairman and CEO Dushyant Sharma, who was previously co-founder of Derivion, a SaaS electronic billing company.

The company’s primary offering features include:

IPN - Instant Payment Network

Engagement

Presentment

Empowerment

Payment

Intelligence

Paymentus has received at least $30 million in equity investment from investors including Accel-KKR and Ashigrace LLC.

The firm seeks relationships with billers via a direct sales and marketing model and with no development or implementation fees required.

In 2020, the firm's platform generated more than 195 million transactions from a network of over 1,300 billers representing 16 million customers.

Sales and Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

| Sales and Marketing | Expenses vs. Revenue |

| Period | Percentage |

| Three Mos. Ended March 31, 2021 | 8.9% |

| 2020 | 10.6% |

| 2019 | 11.9% |

(Source)

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, has increased to 2.8x in the most recent reporting period, as shown in the table below:

| Sales and Marketing | Efficiency Rate |

| Period | Multiple |

| Three Mos. Ended March 31, 2021 | 2.8 |

| 2020 | 2.1 |

(Source)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PAY’s most recent calculation was 38% as of March 31, 2021, so the firm is close to meeting this metric, per the table below:

| Rule of 40 | Calculation |

| Recent Rev. Growth % | 33% |

| EBITDA % | 5% |

| Total | 38% |

(Source)

Management reported that its net dollar revenue retention rate for both 2019 and 2020 was greater than 117%.

A figure of over 100% indicates the company is generating additional revenue from the same cohort of customers, showing strong product/market fit and an efficient sales & marketing process, so Paymentus has performed well in this regard.

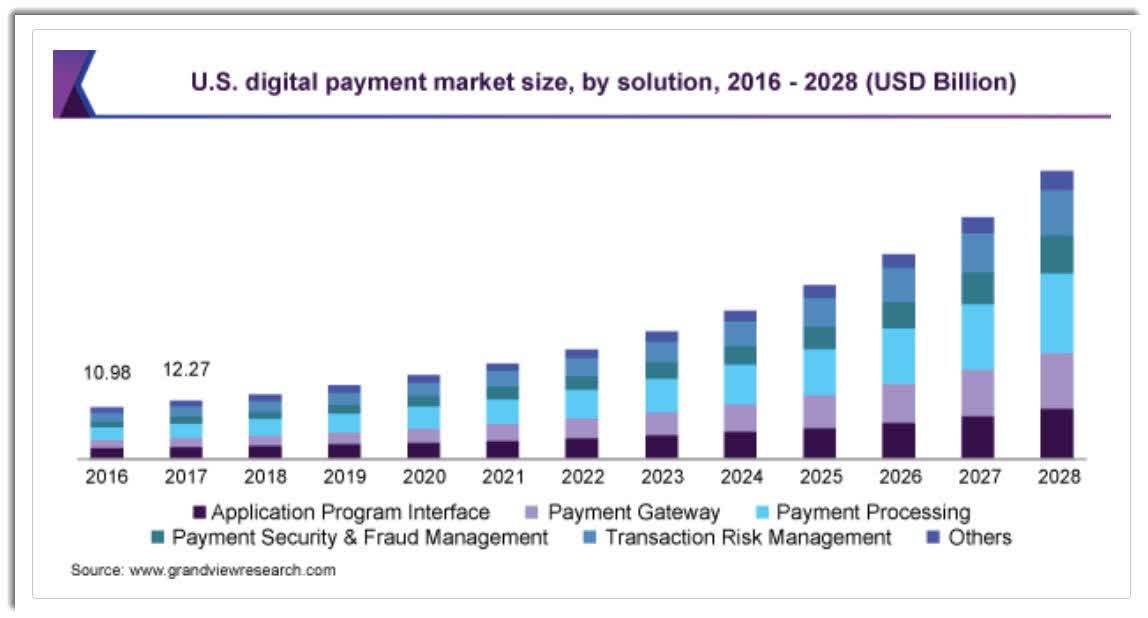

According to a 2021 market research report by Grand View Research, the global market for digital payments (as a proxy) was an estimated $58.3 billion in 2020 and is expected to reach $241 billion in 2028.

This represents a forecast very strong CAGR of 19.4% from 2021 to 2028.

The main drivers for this expected growth are continued high adoption of smartphones, growth in e-commerce and rising internet penetration and adoption of online payment technologies.

Also, the chart below shows the historical and projected U.S. digital payments market by solution type, from 2016 to 2028:

Major competitive or other industry participants by type include:

Legacy solution providers

Internal financial institution systems

Phone-based payments

Paymentus’ recent financial results can be summarized as follows:

Growing topline revenue, at an accelerating rate of growth

Increasing gross profit but reduced gross margin

Growing operating profit and net income

Uneven but upwardly trending cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

| Total Revenue | ||

| Period | Total Revenue | % Variance vs. Prior |

| Three Mos. Ended March 31, 2021 | $ 92,222,000 | 32.5% |

| 2020 | $ 301,767,000 | 28.0% |

| 2019 | $ 235,778,000 | |

| Gross Profit (Loss) | ||

| Period | Gross Profit (Loss) | % Variance vs. Prior |

| Three Mos. Ended March 31, 2021 | $ 27,547,000 | 32.6% |

| 2020 | $ 92,627,000 | 24.4% |

| 2019 | $ 74,434,000 | |

| Gross Margin | ||

| Period | Gross Margin | |

| Three Mos. Ended March 31, 2021 | 29.87% | |

| 2020 | 30.69% | |

| 2019 | 31.57% | |

| Operating Profit (Loss) | ||

| Period | Operating Profit (Loss) | Operating Margin |

| Three Mos. Ended March 31, 2021 | $ 4,853,000 | 5.3% |

| 2020 | $ 18,428,000 | 6.1% |

| 2019 | $ 18,371,000 | 7.8% |

| Net Income (Loss) | ||

| Period | Net Income (Loss) | |

| Three Mos. Ended March 31, 2021 | $ 2,278,000 | |

| 2020 | $ 8,525,000 | |

| 2019 | $ 9,000,000 | |

| Cash Flow From Operations | ||

| Period | Cash Flow From Operations | |

| Three Mos. Ended March 31, 2021 | $ 7,177,000 | |

| 2020 | $ 35,620,000 | |

| 2019 | $ 17,511,000 | |

(Source)

As of March 31, 2021, Paymentus had $49.6 million in cash and $45.4 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2021, was $22.3 million.

Paymentus intends to raise $200 million in gross proceeds from an IPO of its Class A common stock, offering 10 million shares at a proposed midpoint price of $20.00 per share.

Investors have indicated a non-binding interest to purchase up to $60 million of Class A shares in the IPO.

Existing investor Accel-KKR has agreed to purchase $50 million of Class A shares in a concurrent private placement and at the same price as the IPO.

Class A common stockholders will be entitled to one vote per share and Class B shareholders will receive ten votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $2.3 billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 8.62%.

Management says it will use the net proceeds from the IPO as follows:

We intend to use approximately $57.4 million of the net proceeds from this offering to redeem all of our issued and outstanding shares of Series A preferred stock (including accrued dividends), substantially all of which are held by AKKR and our founder and chief executive officer. We intend to use the remainder of the net proceeds from this offering and the concurrent private placement for general corporate purposes, including working capital, operating expenses and capital expenditures. Additionally, we may use a portion of the net proceeds to acquire or invest in businesses, products, services or technologies. (Source)

Management’s presentation of the company roadshow is available here.

Listed bookrunners of the IPO are Goldman Sachs, J.P. Morgan, BofA Securities, Citigroup, Baird, Nomura, Raymond James, Wells Fargo Securities, Fifth Third Securities, PNC Capital Markets, AmeriVet Securities and C.L. King & Associates.

Below is a table of relevant capitalization and valuation figures for the company:

| Measure [TTM] | Amount |

| Market Capitalization at IPO | $2,319,584,740 |

| Enterprise Value | $2,269,945,740 |

| Price / Sales | 7.15 |

| EV / Revenue | 7.00 |

| EV / EBITDA | 115.98 |

| Earnings Per Share | $0.08 |

| Float To Outstanding Shares Ratio | 8.62% |

| Proposed IPO Midpoint Price per Share | $20.00 |

| Net Free Cash Flow | $22,255,000 |

| Free Cash Flow Yield Per Share | 0.96% |

| Revenue Growth Rate | 32.52% |

(Source)

As a reference, a potential partial public comparable to PAY would be Fiserv (FISV); below is a comparison of their primary valuation metrics:

| Metric | Fiserv (FISV) | Paymentus (PAY) | Variance |

| Price / Sales | 5.16 | 7.15 | 38.6% |

| EV / Revenue | 6.58 | 7.00 | 6.3% |

| EV / EBITDA | 19.46 | 115.98 | 496.0% |

| Earnings Per Share | $1.28 | $0.08 | -93.8% |

| Revenue Growth Rate | 19.1% | 32.52% | 69.89% |

Paymentus is seeking public investment to redeem its Series A preferred stock and for its corporate expansion plans

The firm’s financials indicate increasing topline revenue and at an accelerating rate and growing operating and net profits.

Free cash flow for the twelve months ended March 31, 2021 was a reasonable $22.3 million.

Sales and Marketing expenses as a percentage of total revenue dropped as revenue has increased; its Sales and Marketing efficiency rate rose to 2.8x.

Additionally, the company’s Rule of 40 metric performance nearly cleared this hurdle and its dollar-based net retention rate was an impressive 117%, for both 2019 and 2020.

The market opportunity for providing legacy financial billers with modern software solutions is significant and the firm should enjoy very positive industry dynamics in its favor, especially after the COVID-19 pandemic and its effects on increasing consumer adoption of digital technologies.

Goldman Sachs is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 25.8% since their IPO. This is a mid-tier performance for all major underwriters during the period.

One risk to the company’s outlook is that it relies on U.S. Bank and JPMorgan Chase along with a payroll solutions provider (among others) to refer new billers to its platform, so if any of these referral relationships were to end, it may negatively impact the firm’s growth trajectory.

As for valuation, compared to much larger and diversified Fiserv, the IPO appears reasonably valued, as FISV is growing revenue more slowly although producing higher EPS.

Paymentus appears to be growing impressively due to its focus on modernizing the biller space while producing earnings and free cash flow, so the IPO is worth consideration.

Expected IPO Pricing Date: May 25, 2021

| Volume: | 357,085 |

| Day Range: | 25.24 - 26.42 |

| Last Trade Time: | 4:10:00 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |