Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

PLYN: SEC Admin. Proceeding for severely delinquent Financials

https://www.sec.gov/files/litigation/admin/34-100922.pdf

Can come back with a couple of filings

Congratulations this is now on the expert market.

Scam

Still playing with pennies I see. ;)

yes agreed 10% of where it was in 2021 sec reporting isnt cheap

$PLYN - .0239, I have some also BB, think it could be big reward for those of us that are patient as you say....time will tell.... small SS.....

building a position down here a shell 800K mkt cap, sec current, sec filings worth a lot more than most shells , quite a bargain for those with patience https://www.otcmarkets.com/stock/PLYN/security

What is the best exchange for trading this stock?

$PLYN I still agree with this statement. Friends with money get ready for round 2.

6 month chart is terrible. This thing is on its way to .01 if nothing changes

Single buyer today?...

Or maybe 2?

fake merger was the plan of attack!!!

Thanks Hokie for pumping and dumping this

You'll have to do DD on it to know the answer.

Why is this still trading so high?

in second Qtr. any day now we may hear of the pending merger.

Looks like someone got a margin call this morning…,

looks forward to 10-Q this month...

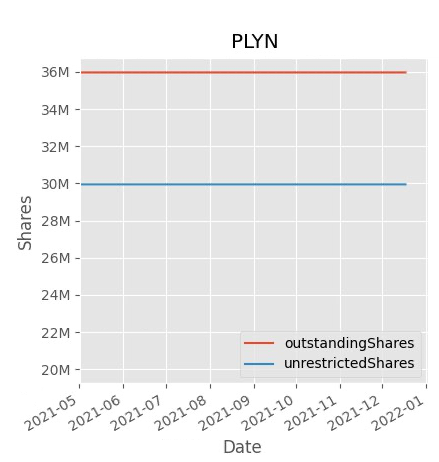

$2.9M market cap. only 29million shares in the float. nice!

Nice write up! A lot of $ to be made here…

$15-25M investment into company with current market cap of $3.1M is a no-brainer buy in my book, and also a vote of confidence that this is a legitimate opportunity here.

People involved with SBDG have access to $300MM line of credit… big guns.

i believe this is a rare opportunity in OTC to get into legitimate company in hot fintech sector at ground floor price levels.

Another Drew Steegman Pump and Dump?

Thank you. I checked out after the first few paragraphs lol.

Raising $15 to $25M capital for preferred shares. I guess the owners of the company will get those shares. Not tracking with the $80M anticipated value though. Perhaps that needs to be subtracted to calculate price per share. Not entirely sure.

Lol, "is completing..." not HAS completed.

What's the point of the PR? There IS a point of course.

Also "Palayan is expecting to close this transaction in the second quarter of 2022, subject to a capital raise of $15 to $25 million..."

GLTA

Agreed but progress has been made and the market cap is now a measly $2.5 million. That is it!

A little pumpy at this point after 4 months of “DD”.

Digital Payment Remittance and PLYN

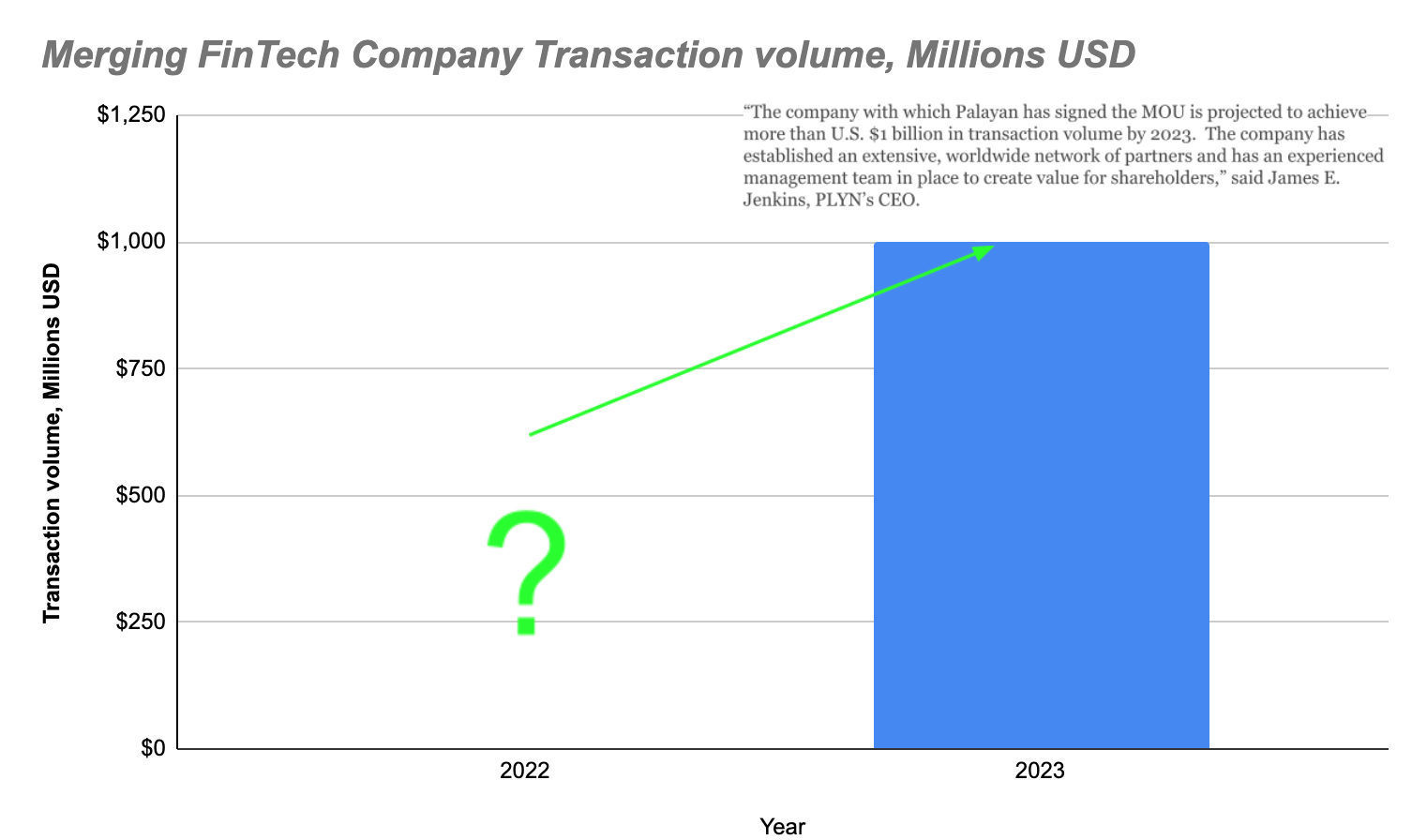

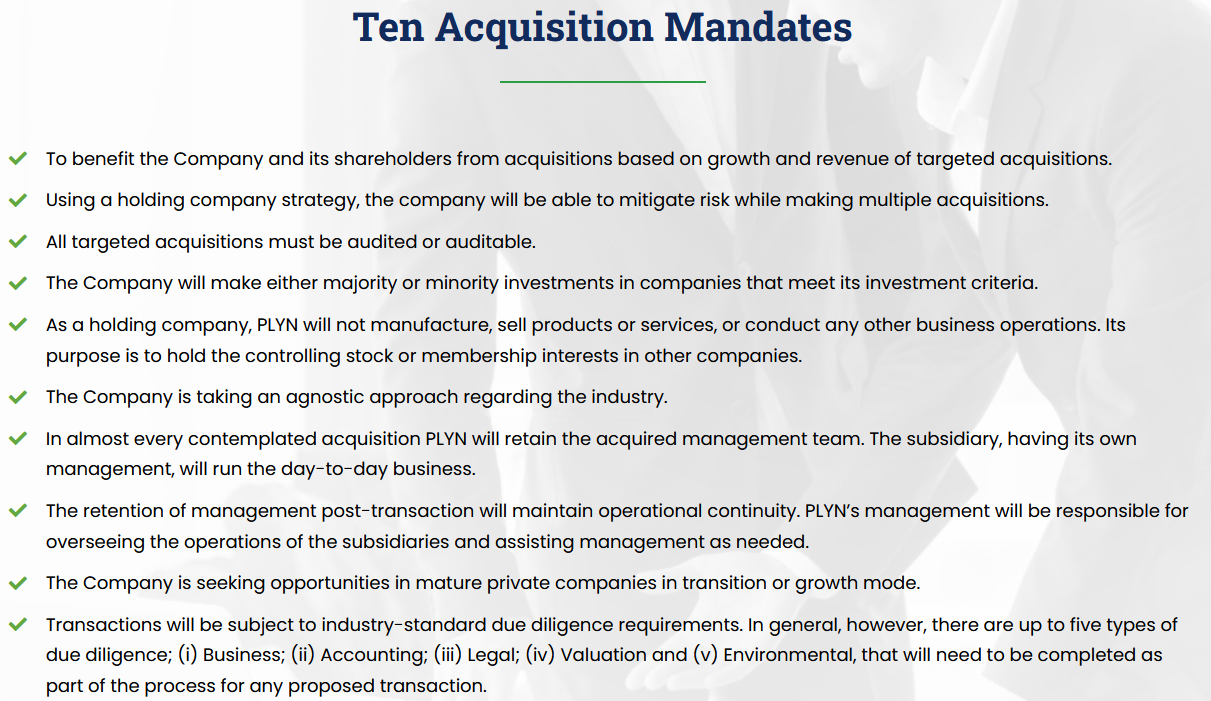

We are deep in due diligence on a FinTech acquisition for our publicly traded holding company, Palayan Resources (Stock Symbol: PLYN). The target is an operating entity in the global digital payment remittance sector, a marketplace that Business Insider sees at $774 Billion in 2022, increasing to over $810 Billion in 2023.

Small Business Development Group, Inc. (Stock Symbol: SBDG) is advising and managing the due diligence process.

C2C Private Investment Company

https://www.sbdgstock.com/post/digital-payment-remittance-and-plyn

It’s been 2 months since the last update! I wish they’d tweet an estimated timeframe or something. I know this will 5X to 10X easy with news but sometimes the silence is hard lol.

i know. lots of 5 star reviews recently. they are pretty active. PLYN is b...s deep in the due diligence process right now. Im waiting for the update soon just like many others here. Current market cap is only $4.1M. Conservative merging company valuation is more than 10x current market cap. easily.

This is no-brainer.

Cat try this for fun: Google iPay remit Australia and read the reviews. They seem to be doing well.

The press release had wording so similar to this company’s website. If it’s them and the merger gets announced this month we’re off to the races!

Thanks for responding. Sometimes it feels like the majority of people have sold and moved on. Still hanging in here with hope..

agreed. just waiting for merger / due diligence progress update.

Thanks cat! It’s found a base around 10 cents. With only 37 million shares outstanding and the possibility of a FinTech merger Im liking the odds here. They are overdue for an update and sure hope it’s good news!

we have to be close to the update. current <$4M PLYN market cap is 10-20x lower than the merging company value which represents great investment opportunity here. IMHO.

It’s been close to 4 months since this event mentioned in the February Form 10 filing. If the deal does go through the share price math shows anticipated $80M value divided by 37 million shares outstanding = $2.16. Waiting for news from the company to make this board buzz again lol.

“Using this new strategy, on December 9, 2021 we executed a Memorandum of Understanding (the “MOU”) with a Singapore based holding company whose subsidiaries are engaged principally in foreign exchange remittance services. Under the MOU, our Company desires to acquire 100% of the Singapore based company for a purchase price of $80,000,000, consisting of common and preferred stock totaling $70,000,000 and subordinated debt of $10,000,000. The proposed acquisition is subject to due diligence customary to transactions of this type. There can be no assurance that a definitive agreement between the parties to the transaction can be reached.

Added a bunch today. Here’s why: a contrarian view that’s helped me. This stock has gotten beat up in the absence of news since mid February when the SEC Form 10 was filed. Went back to read it and also found this online from the first PR. They put out another statement at the end of February stating “deep in due diligence”. Liking the odds of an easy 2X to 5X at least from this level. Let’s see what happens and as always only invest what you can afford to lose when it comes to speculative investments.

Curious what other shareholders are thinking of this stock’s prospects. It’s been a while OG’s.

https://www.c2cpic.com/post/palayan-resources-inc-stock-symbol-plyn-updates-on-fintech-merger

Lady Lake, FL, Jan. 13, 2022 (GLOBE NEWSWIRE) -- via NewMediaWire -- Palayan Resources, Inc. (the “Company”) (OTCMarkets: PLYN), a publicly traded company, announced today the Company is moving forward with our Due Diligence on the Fin-Tech merger. The preliminary valuation of the transaction is $80 million USD. The Fin-Tech operations will become subsidiaries of PLYN and file consolidated financial statements.

The transaction is subject to customary due diligence and the audit of the Fin-Tech company.

As part of the transaction PLYN/Fin-Tech will seek financing to expand operations in the primary business sector Multi-Corridor Multilateral Remittance (Hub), Multi-Currency Digital Remittance Solutions, Blockchain Remittance Solutions and Remittance as a Service for institutions. The Fin-Tech company has country-centric network partners in 62 countries.

The Fin-Tech company has a simple, fast and secure way of transferring funds globally. They offer lowest transfer fee and competitive exchange rate without any hidden costs. They have collecting agents at convenient locations and for the disbursement, they have a large number of world-wide network partners for "just-in-time" delivery.

The target company has been in business for 10 years and has developed a robust and scalable global infrastructure network as the underpinning for growth.

Every day we are getting closer to the news. In the meantime Market Makers love to run stops.

it takes time to get all ducks in a row. i'll be waiting picking up cheapies in the meantime...

they are moving forward with the merger. updates should be coming.

they are not pumping and they are definitely not scammers.

load up the cheapies.

I hear ya but when it hits it will hit hard towards a buck

Won’t call it a farce but they did have a couple of failed mergers in the past. hoping third time’s the charm but the lack of communication from SBDG or whatever the advisory company is worrying. And the share price has trimmed from highs.

PLYN is a farce.

Get out while you can.

IMO

this will spike out of nowhere on due diligence completion news LOL

The lack of news is my guess. They’ve dragged this for 3 months now. OTC traders have the attention span of a few days lol.

usually stronger....think somebody needed some cash or did I miss something n in twitterland?...

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1480

|

|

Created

|

06/01/20

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |