Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Congratulations lol

BGADF: one for 30 reverse split:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Brigadier Gold Ltd changed to Pace Metals Ltd

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Nope lithium has no IMO bgdaf and brg

going much higher for sure:

Today’s lithium news…

Reuters.news via C&P Yahoo finance…

“ SANTIAGO (Reuters) - Shares in Chile's top two lithium miners, SQM and Albemarle Corp, slid on Friday after the Andean country, which has the world's largest reserves of the battery metal, unveiled plans to nationalize the sector over time.

The move would see Chile, the world's second largest lithium producer, shift to a model with the state holding a controlling interest in all new lithium projects through a public company that would partner with private mining firms.

The bid for state control in Chile reflects a wider wave of lithium nationalism around Latin America, home to the so-called "lithium triangle", which holds the world's largest trove of the metal essential for electric vehicle batteries.

It poses a fresh challenge to electric vehicle (EV) manufacturers scrambling to secure battery materials. Mexico nationalized its lithium deposits last year, and Indonesia banned exports of nickel ore, a key battery material, in 2020.”

This one is so thin! Less than 23k shares just took out the ask at .05 and now .098 is up on the ask. Share structure >>

https://www.otcmarkets.com/stock/BGADF/security

One lithium exploration stock for your watchlist is Brigadier Gold Limited (TSX Venture: BRG, OTC: BGADF). Brigadier is an exploration company led by an experienced management team with decades of experience, leveraging what they believe will be the next major bull market in the natural resource sector.

One of the major considerations to make when researching mining stocks is location, which is also ultimately one of the reasons BGADF is such an attractive buy. Brigadier has chosen Canada, specifically Quebec, as it is one of the best mining jurisdictions in the world.

Recently, Quebec issued a permit to restart the spodumene (a mineral hosting lithium) concentrate operation (Sayona’s North American Lithium mine) that will become one of Canada’s only lithium mines..

Furthermore, Canada has declared its intention to invest C$2 billion towards a mineral strategy aimed at creating a supply chain for EV batteries, indicating that this is not a one-time event.

Driven by a major lithium discovery by Patriot Battery Metals Inc., which recently sent their stock soaring to over a billion dollar valuation, the James Bay region in Quebec, where BGADF is preparing to explore their project, is expected to be the main hub for lithium production in Canada. Northern Quebec is experiencing a renaissance in lithium exploration with comprehensive Federal and Provincial support, a reason for investors to key into companies within the region for profit plays.

Additionally, the province is a very appealing location for investing in lithium project development as it is very supportive of resource development. The region has excellent access to skilled labor, and Quebec's close proximity to the growing electric vehicle markets in Europe and North America.

Another detail for investors to note is that Canada has free trade agreements in place with both the United States and the European Union, making it an even more advantageous location for companies looking to invest in the lithium industry.

On March 14th, BGADF announced the official closure on their flagship asset, the Nemaska2 lithium property. This 3,040-hectare property features over 20 underdeveloped and undrilled spodumene-bearing (a mineral typically hosting lithium) pegmatite outcrops, most averaging 1000 x 900 meters squared. Something that really sets BGADF apart from the rest of the field is their exceptional access to infrastructure, as the property has both an airport as well as a paved highway within its claims.

CEO Rob Birmingham commented on a recent press release: “"We are delighted to have closed the Nemaska2 transaction and have turned our attention to securing the best teams, equipment and technology available to quickly and effectively assess the lithium potential within the Property. Nemaska2 may be the most conveniently located property in the region for access, logistics and infrastructure, which will allow Brigadier to conduct its exploration programs and publish results in an efficient and timely manner."

Nemaska2’s location within the Nemaska Lithium District is adjacent to multiple successful lithium projects, including the Li-Ft Power Lithium Project and Critical Elements Lithium.

Most notably, Brigadier’s Nemaska2 is located ~23 kilometers (~14 miles) West of Nemaska Lithium’s Whabouchi mine, which is considered to be the 2nd richest and biggest lithium deposit in the world, with 27.3 Mt of proven and possible reserves, and a projected mine life of 33 years.

The Nemaska lithium district in Quebec is one of the most promising lithium developments in the world, and with BGADF, investors are able to take advantage of one of the cheapest valuations in the Nemaska lithium district.

Investors looking to get into potentially the next big Canadian lithium story on the market should keep their eyes on Brigadier Gold Ltd. (TSX Venture: BRG, OTC: BGADF). Brigadier is looking to aggressively explore the asset for its lithium potential this Spring, which further positions the stock as an attractive ground floor opportunity.

Buys are coming in. Once volume really picks up BGADF will be an easy mover. Now is a great time to accumulate before updates on current projects start hitting. I especially like this from today's update:

CEO Rob Birmingham commented on a recent press release: “"We are delighted to have closed the Nemaska2 transaction and have turned our attention to securing the best teams, equipment and technology available to quickly and effectively assess the lithium potential within the Property. Nemaska2 may be the most conveniently located property in the region for access, logistics and infrastructure, which will allow Brigadier to conduct its exploration programs and publish results in an efficient and timely manner."

Nemaska2’s location within the Nemaska Lithium District is adjacent to multiple successful lithium projects, including the Li-Ft Power Lithium Project and Critical Elements Lithium.

On March 14th, BGADF announced the official closure on their flagship asset, the Nemaska2 lithium property. This 3,040-hectare property features over 20 underdeveloped and undrilled spodumene-bearing (a mineral typically hosting lithium) pegmatite outcrops, most averaging 1000 x 900 meters squared. Something that really sets BGADF apart from the rest of the field is their exceptional access to infrastructure, as the property has both an airport as well as a paved highway within its claims.

*NEWS* These Four Lithium Stocks Have Investors Charged Up (BGADF, LTHM, ALB, LAC)

https://finance.yahoo.com/news/four-lithium-stocks-investors-charged-090000148.html

$BGADF $LTHM $ALB $LAC

BGADF could be a really explosive play once updates start hitting on status of their current projects. Especially with such a low float stock. Check out L2 >> only 2 MMs on deck leading up to .12. From article out today featuring Brigadier Gold Limited (TSX Venture: BRG, OTC: BGADF):

Driven by a major lithium discovery by Patriot Battery Metals Inc., which recently sent their stock soaring to over a billion dollar valuation, the James Bay region in Quebec, where BGADF is preparing to explore their project, is expected to be the main hub for lithium production in Canada. Northern Quebec is experiencing a renaissance in lithium exploration with comprehensive Federal and Provincial support, a reason for investors to key into companies within the region for profit plays.

$BGADF

On March 14th, BGADF announced the official closure on their flagship asset, the Nemaska2 lithium property. This 3,040-hectare property features over 20 underdeveloped and undrilled spodumene-bearing (a mineral typically hosting lithium) pegmatite outcrops, most averaging 1000 x 900 meters squared. Something that really sets BGADF apart from the rest of the field is their exceptional access to infrastructure, as the property has both an airport as well as a paved highway within its claims.

*NEWS* These Four Lithium Stocks Have Investors Charged Up (BGADF, LTHM, ALB, LAC)

https://finance.yahoo.com/news/four-lithium-stocks-investors-charged-090000148.html

$BGADF $LTHM $ALB $LAC

One lithium exploration stock for your watchlist is Brigadier Gold Limited (TSX Venture: BRG, OTC: BGADF). Brigadier is an exploration company led by an experienced management team with decades of experience, leveraging what they believe will be the next major bull market in the natural resource sector.

One of the major considerations to make when researching mining stocks is location, which is also ultimately one of the reasons BGADF is such an attractive buy. Brigadier has chosen Canada, specifically Quebec, as it is one of the best mining jurisdictions in the world.

Recently, Quebec issued a permit to restart the spodumene (a mineral hosting lithium) concentrate operation (Sayona’s North American Lithium mine) that will become one of Canada’s only lithium mines..

Furthermore, Canada has declared its intention to invest C$2 billion towards a mineral strategy aimed at creating a supply chain for EV batteries, indicating that this is not a one-time event.

Driven by a major lithium discovery by Patriot Battery Metals Inc., which recently sent their stock soaring to over a billion dollar valuation, the James Bay region in Quebec, where BGADF is preparing to explore their project, is expected to be the main hub for lithium production in Canada. Northern Quebec is experiencing a renaissance in lithium exploration with comprehensive Federal and Provincial support, a reason for investors to key into companies within the region for profit plays.

Additionally, the province is a very appealing location for investing in lithium project development as it is very supportive of resource development. The region has excellent access to skilled labor, and Quebec's close proximity to the growing electric vehicle markets in Europe and North America.

Another detail for investors to note is that Canada has free trade agreements in place with both the United States and the European Union, making it an even more advantageous location for companies looking to invest in the lithium industry.

On March 14th, BGADF announced the official closure on their flagship asset, the Nemaska2 lithium property. This 3,040-hectare property features over 20 underdeveloped and undrilled spodumene-bearing (a mineral typically hosting lithium) pegmatite outcrops, most averaging 1000 x 900 meters squared. Something that really sets BGADF apart from the rest of the field is their exceptional access to infrastructure, as the property has both an airport as well as a paved highway within its claims.

CEO Rob Birmingham commented on a recent press release: “"We are delighted to have closed the Nemaska2 transaction and have turned our attention to securing the best teams, equipment and technology available to quickly and effectively assess the lithium potential within the Property. Nemaska2 may be the most conveniently located property in the region for access, logistics and infrastructure, which will allow Brigadier to conduct its exploration programs and publish results in an efficient and timely manner."

Nemaska2’s location within the Nemaska Lithium District is adjacent to multiple successful lithium projects, including the Li-Ft Power Lithium Project and Critical Elements Lithium.

Most notably, Brigadier’s Nemaska2 is located ~23 kilometers (~14 miles) West of Nemaska Lithium’s Whabouchi mine, which is considered to be the 2nd richest and biggest lithium deposit in the world, with 27.3 Mt of proven and possible reserves, and a projected mine life of 33 years.

The Nemaska lithium district in Quebec is one of the most promising lithium developments in the world, and with BGADF, investors are able to take advantage of one of the cheapest valuations in the Nemaska lithium district.

Investors looking to get into potentially the next big Canadian lithium story on the market should keep their eyes on Brigadier Gold Ltd. (TSX Venture: BRG, OTC: BGADF). Brigadier is looking to aggressively explore the asset for its lithium potential this Spring, which further positions the stock as an attractive ground floor opportunity.

*NEWS* These Four Lithium Stocks Have Investors Charged Up (BGADF, LTHM, ALB, LAC)

https://finance.yahoo.com/news/four-lithium-stocks-investors-charged-090000148.html

$BGADF $LTHM $ALB $LAC

*NEWS* These Four Lithium Stocks Have Investors Charged Up (BGADF, LTHM, ALB, LAC)

https://finance.yahoo.com/news/four-lithium-stocks-investors-charged-090000148.html

$BGADF $LTHM $ALB $LAC

go copper co bgadf.

https://aheadoftheherd.com/copper-bull-market-far-from-over/

this is where bgadf goes to moon. got copper!!!!!!!

https://thegreatrecession.info/blog/shortages-and-inflation-are-to-ripping-the-worlds-face-off/

this is going much higher:

https://finviz.com/futures_charts.ashx?t=HG&p=m1

$BGADF Releases Amazing Results!

Vancouver, British Columbia – August 4, 2021 – Brigadier Gold Limited (the “Company” or “Brigadier”) (TSXV: BRG|FSE: B7LM|USA: BGADF) is pleased to announce it has received analytical results indicating a new silver-rich, copper discovery from a 110-metre trench across the Colinas prospect at its Picachos gold-silver-copper project Sinaloa, Mexico (the “Picachos Project”, “Picachos” or the “Property”).

The discovery trench at Colinas is 110 metres long and oriented northwesterly across the northeasterly trending stockwork veinlets mapped in this area. It was excavated to depths ranging from 1 to 2 metres then sampled at 1-metre intervals.

Trench highlights:

9 metres @ 135 g/t Ag, 0.05 g/t Au, 0.2% Cu, 0.3% Pb, 0.1% Bi and 47 g/t W

135G/Ton is about 4 Ounces of Silver/Ton!!!

(A Ton of dirt is about 6 Wheel Barrows)

Including:

2 metres @ 478 g/t Ag, 0.08 g/t Au, 0.2% Cu, 0.5% Pb, 0.3% Bi, 116 g/t W and 16 g/t Sn

478G/Ton is about 16 Ounces of Silver/Ton!!!!

1 metre @ 694 g/t Ag

694G/Ton is about 23 Oz of Silver/Ton!!!!!

“The significance of this geological finding is that these mineralized porphyritic apophyses with associated copper and other metals may expand at depth and intensify” said Michelle Robinson, Geologist for Brigadier. “We were fortunate to find this prospect at surface as the USGS porphyry copper forecast (Hammarstrom et al, 20191) implies that most economic copper mineralization in Sinaloa State will be found between 250- and 500-metres depth below surface”.

Recently, the Company completed three kilometres of new access intended to facilitate exploration of the copper potential of its property. Several outcrops of alkali granite porphyry with characteristic zoned phenocrysts are known from historic work. Although these were analyzed with an XRF and are known to contain copper and silver, limited trenching and scarce laboratory assaying has been performed for these prospects.

Rob Birmingham, CEO of Brigadier comments, “The most compelling aspect of this round of results is that they are coming from previously unexplored areas of Picachos. As we are located approximately 15 miles from bonanza grade silver discoveries to the north, these findings are truly exciting. With newly built access roads completed, Brigadier is well positioned to concentrate our efforts on this area and further our understanding of its extent and potential.”

z

$BGADF Brigadier Gold (BGADF) $4.2 Million in Funding Raised for Drilling Operations; Robust Mineralization Reported in Latest Sampling Results https://ownsnap.com/is-brigadier-gold-bgadf-a-fast-moving-precious-metals-explorer-focused-on-gold-and-silver-rich-mexico/

$BGADF is Hugely undervalued here.....Bounce will be Massive.....

z

Tweet today from BGADF management with the latest photos from ongoing exploration work at the Picachos property in Mexico:

Brigadier Gold Ltd. (TSXV:BRG, US:BGADF)@BrigadierGold

Another productive day of trenching across historic anomalies considered prospective for bulk-tonnage style #copper mineralization. The large, unexplored copper porphyry target is situated in the northern part of Picachos.

Twitter Link:

https://twitter.com/BrigadierGold/status/1414649099446538241

$BGADF Precious Metals will always be a focal point of a Portfolio

https://ih.advfn.com/stock-market/USOTC/brigadier-gold-pk-BGADF/stock-news/85006422/how-long-can-this-stock-market-continue-its-strong

New high of day up!

BGADF

$BGADF Drill Results: 1oz Gold/Ton!!!!

Highlights from underground sampling obtained prior to diamond drilling include:

*

31.4 g/t Au, 11 g/t Ag, 0.2% Cu, 0.5% Pb and 2% Zn across 0.3 meters from Tacuachas Underground Level 1030 (BRG-25139)

z

$BGADF News Out! Brigadier Reports Balance of Phase-1 Drill Results from Picachos https://www.marketwatch.com/press-release/brigadier-reports-balance-of-phase-1-drill-results-from-picachos-2021-07-06?reflink=mw_share_twitter

Brigadier Reports Balance of Phase-1 Drill Results from Picachos

https://finance.yahoo.com/news/brigadier-reports-balance-phase-1-130000303.html

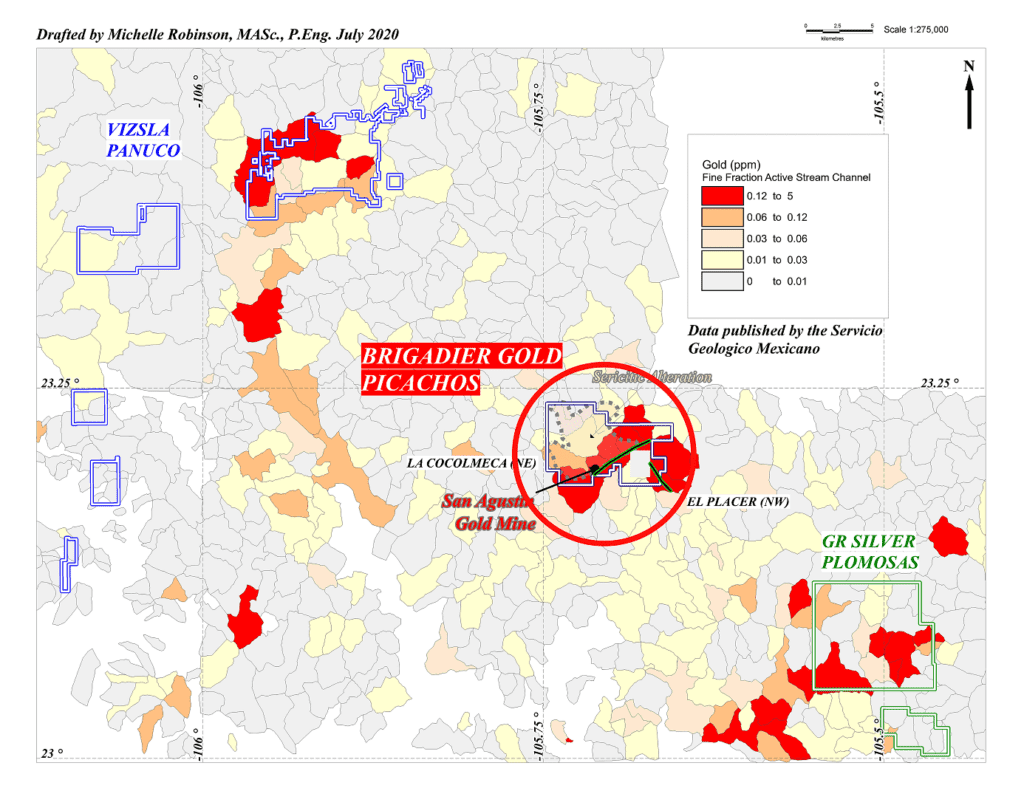

VANCOUVER, BC / ACCESSWIRE / July 6, 2021 / Brigadier Gold Limited (the "Company" or "Brigadier") (TSXV:BRG | FSE:B7LM | OTC PINK:BGADF) is pleased to announce further drill results from exploration of newly identified gold targets at its Picachos gold-silver-copper project Sinaloa, Mexico (the "Picachos Project", "Picachos" or the "Property").

Brigadier has received analytical results for diamond drill holes DH-BRG-044 to -050 from SGS Laboratory. Principal results are from 47, 48 and 49, a fence of holes drilled across the northwesterly trending El Placer Vein system (see table below).

In the winter of 2021, the Company completed underground sampling of several historic gold mines along the northwest part of El Placer.

Highlights from underground sampling obtained prior to diamond drilling include:

31.4 g/t Au, 11 g/t Ag, 0.2% Cu, 0.5% Pb and 2% Zn across 0.3 meters from Tacuachas Underground Level 1030 (BRG-25139)

2.14 g/t Au and 0.1% Pb across 8 m from a surface trench across Tacuachas Open Cut (BRG-117146)

7.43 g/t Au, 0.15% Pb, 0.23% Zn across 3.2 m from Lentes Underground Level 1024 (historic sample MCA-27431). This result includes 0.15 m of 40.63 g/t Au with 0.2% Pb and 0.2% Zn

4.64 g/t Au, 0.1% Pb and 0.1% Zn across 0.9 m from Corallio Underground Level 1035

38.88 g/t Au, 22 g/t Ag, 0.4% Cu, 1.7% Pb, 1.5% Zn and 538 ppm W (tungsten) across 0.5 meters in Chivera Underground Level 1177 (BRG-27106)

12.79 g/t Au, 8 g/t Ag, 0.1% Cu, 0.9% Pb, 0.9% Zn across 1 m in Los Huaraches Underground Level 1155 (BRG-25131). This includes 0.1 m of 117.45 g/t Au, 57 g/t Ag, 0.2% Cu, 3.2% Pb and 2.6% Zn

Host rocks to the mineralization are mainly rhyolitic ignimbrite. Regionally, these are pervasively silicified and brecciated within the El Placer Vein system. Microcrystalline quartz, epidote and base metal sulfides such as galena and sphalerite occur in the silicified matrix between rock fragments. Gold is concentrated in shear zones marked by argillic alteration with or without quartz veining.

DH-BRG-047 is completely mineralized and returned an overall result of 0.41 g/t Au with 0.2% Zn across 60.3 meters. From the geological model, it appears to have tested a series of shears in the hanging wall to La Botica represented by Tacuachas, Coralillo, Los Lentes and at least two newly defined structures in the footwall to Tacuachas. Notable individual results are 4.03 g/t Au, 4 g/t Ag, 0.2% Pb and 0.1% Zn across 0.5 m, correlated to the Corallio Vein and 1.49 g/t Au with 0.3% Zn across 1.8 m correlated to Los Lentes Vein.

The main results from DH-BRG-048 are in the top of the hole. The interval between 3 and 4 meters contains 6.89 g/t Au with 0.04% Cu, 0.1% Pb and 0.1% Zn and is correlated to the Tacuachas Vein. Between 14 and 18 meters an intercept of 1.85 g/t Au with 0.1% Pb and 0.1% Zn defines a new shear zone in the footwall to Tacuachas with a maximum value of 5.51 g/t Au across 1 m between 16 and 17 m.

DH-BRG-049 tested under Cerro La Chivera and returned an average result of 0.27 g/t Au with 0.01% Cu, 0.1% Pb and 0.2% Zn across the entire length of 123 m. Between 7 and 8 m, values of 2.85 g/t Au, 0.04% Cu, 0.1% Pb and 0.4% Zn correlate to the Tacuachas structure. La Botica, defined underground about 600 meters southeast of this drill hole, strikes through DH-BRG-049 between 40.5 and 56 meters downhole with a peak value of 1.08 g/t Au returned across 4 m between 52 and 56 m. Chivera is correlated to the interval between 77 and 95 meters with peak values of 1.1 g/t Au, 0.4% Pb and 1.7% Zn occur across 4 m between 77 and 81 m and 3.51 g/t Au and 0.1% Pb across 1 m between 92 and 93 m. Finally, Tatemales, historically exploited underground about 300 meters southeast of this drill hole fence, projects through DH-BRG-049 between 98 and 123 m.

Brigadier has cut a 69 meter long surface trench using the D6 along approximately the same line as DH-BRG-047. By using the bull dozer, a more accurate assessment of surface gold mineralization will be attained. This trench was sampled at 1 meter and 0.5 meter intervals using a chisel and hammer to channel across the rock (dry sampling). Results for the machine dug trench are pending.

https://www.accesswire.com/users/newswire/images/654305/image.png

Geological cross-section across Cerro La Chivera showing diamond drill holes DH-BRG-047 to -049 and a few of the underground samples within 5 meters of the plane of this cross-section. All the drill holes intercepted multiple gold-bearing shear zones.

In Q2 of 2021, Brigadier completed underground and surface trench sampling of La Gloria, El Salvador, El Cobre and Palodismo and made a significant copper-silver discovery in the porphyry area in the northwestern part of the Property. Analytical results are still pending for about 900 samples from these work areas. The laboratory developed a shortage of reagents in the spring and assaying is proceeding at a slower pace than usual. In May, the Company prepared the road to the campsite at La Flauta in the southeastern part of the Property and in June, Brigadier completed a new access road to the northwestern part of the Property, to better support exploration of the porphyry this fall. The Company installed a satellite camp at La Flauta in early June and started hand-trenching across selected locations of the El Placer Vein system within 1.5 km of the camp. Underground mapping and sampling of historic workings in the area is also in-progress. A route to copper-silver rich mineralization at Garabato has been surveyed and construction is in-progress.

Appendix

Drill hole results for gold, silver, copper, lead and zinc. Not enough is known about the mineralization to reliably estimate true widths. DL = at or near detection limit.

Drill Hole

From (m)

To (m)

Core Width (m)

Gold (g/t)

Silver (g/t)

Copper (ppm)

Lead (ppm)

Zinc (ppm)

DH-BRG-044

35

38

3

0.30

DL

80

283

418

DH-BRG-045

36.5

39

2.5

0.62

7

197

161

1140

DH-BRG-046

7.5

14

6.5

0.26

6

513

220

428

DH-BRG-046

35

36

1

0.55

8

78

134

146

DH-BRG-047

0

60.3

60.3

0.41

DL

115

596

1710

including

0

4.5

4.5

0.56

DL

321

1257

981

including

11.5

19

7.5

0.98

DL

136

739

1241

including

22

23

1

0.64

DL

258

1712

1502

Including

34

36

2

0.44

DL

65

493

1153

Including

39.5

42.5

3

1.27

15

142

1007

1364

And

41

41.5

0.5

4.03

4

347

1663

1331

Including

51.5

52.5

1

0.86

DL

28

110

979

Including

54

56.5

2.5

0.84

DL

49

366

2236

including

58.5

60.3

1.8

1.49

DL

55

375

3089

DH-BRG-048

0

113

113

0.19

DL

79

874

2197

including

3

4

1

6.89

DL

394

787

1268

including

14

18

4

1.85

DL

90

478

654

and

16

17

1

5.51

4

94

270

1035

including

27

28

1

0.71

DL

160

1118

1317

including

72

73

1

0.74

DL

42

229

236

DH-BRG-049

0

123

123

0.27

DL

137

1137

1991

including

7

8

1

2.85

DL

386

952

3076

including

14

17

3

0.57

DL

145

361

1297

including

40.5

49

8.5

0.40

DL

179

2271

698

including

52

56

4

1.08

DL

104

796

629

including

77

81

4

1.10

DL

28

3637

16630

including

89

95

6

0.82

DL

40

2534

5712

and

92

93

1

3.51

DL

44

1142

628

including

98

113

15

0.33

DL

382

1276

3168

DH-BRG-050

0

80

80

0.01

DL

80

127

226

Including

60

80

20

0.01

DL

142

272

340

National Instrument 43-101 Disclosure

The technical information in this press release has been reviewed by Michelle Robinson, MASc., P.Eng., a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Drilling was completed using PQ and HQ tooling. Core and sample handling procedures are documented in the Company's press release dated October 22, 2020. Standard pulps, field duplicates, pulp duplicates and blanks are inserted into the sample stream. The samples were analyzed by SGS Laboratories in Durango using fire-assay methods for gold, and ICP methods with a 4-acid digestion for silver and base metals. SGS is an accredited laboratory. It is the Qualified Person's opinion that the technical information disclosed in this press release is reliable.

Please visit our website to learn more about Brigadier Gold.

About Brigadier Gold Limited

Brigadier was formed to leverage the next major bull market in the natural resource sector, particularly precious metals. Our mandate is to acquire undervalued and overlooked projects with demonstrable potential for advancement.

Led by a management team with decades of experience in mineral exploration and capital markets development, we are focused on advanced exploration opportunities in politically stable jurisdictions.

For further information, please contact:

Brigadier Gold Limited

http://www.brigadiergold.ca

Robert Birmingham, Chief Executive Officer

rob@brigadiergold.ca

(604) 424-8131

Reader Advisory

This news release may contain statements which constitute "forward-looking information", including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company's future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Brigadier Gold Limited

View source version on accesswire.com:

https://www.accesswire.com/654305/Brigadier-Reports-Balance-of-Phase-1-Drill-Results-from-Picachos

$BGADF is pleased to announce, subject to approval by the TSX Venture Exchange (the "Exchange"), that Ms. Heidi Gutte of Lichtenwald Professional Corp. https://finance.yahoo.com/news/brigadier-announces-appointment-cfo-corporate-130000552.html

.10's thin here!

BGADF

Yes, BGADF is putting a top notch leadership team in place including Heidi Gutte as the new CFO/Corporate Secretary to take the company to the next level of growth and development. This is how you build a long term success story.

From the news:

Ms. Heidi Gutte of Lichtenwald Professional Corp. ("LPC") has been appointed as Chief Financial Officer and Corporate Secretary of the Company. Ms. Gutte is an Accounting and Finance Professional with over 15 years of experience in Canada and Europe, including nearly 10 years working as a senior finance professional in publicly traded companies. She specializes in providing corporate finance, financial reporting, consulting, taxation, and other accounting services. She also assists in many aspects of clients' administration, corporate compliance and other activities.

Ms. Gutte holds the professional designation of Chartered Professional Accountant (CPA, CGA), and is a member of Chartered Professional Accountants of B.C. and Canada. She also holds a Bachelor degree of computer engineering from the University of Applied Sciences in Brandenburg, Germany.

$BGADF is pleased to announce, subject to approval by the TSX Venture Exchange (the "Exchange"), that Ms. Heidi Gutte of Lichtenwald Professional Corp. ("LPC") has been appointed as Chief Financial Officer and Corporate Secretary of the Company. https://finance.yahoo.com/news/brigadier-announces-appointment-cfo-corporate-130000552.html

$BGADF Phase-one Drilling Highlights:

San Agustín past-producing gold mine with a principal result of 7.45 g/t gold and 51 g/t silver across 7 metres in DH-BRG-001. Significant widths and grades were intercepted in several holes from San Agustín.

San Antoñio historic gold-copper mine with 12.62 g/t gold and 78 g/t silver with 4.5% copper across 0.8 metres in DH-BRG-026.

La Gloria historic gold mine with values of 10.65 g/t gold across 1 metre in a larger interval of 2.29 g/t gold across 8 metres in DH-BRG-028.

Rob Birmingham, President & CEO, comments, "With Picachos' first ever diamond drill program concluded, Brigadier now has a robust dataset from which to plan the next phase of exploration. Over the course of the last eight months, exploration efforts have produced several high priority targets which the Company intends to follow up on, including a copper and base metals porphyry on the North end of the Picachos Project. With copper reaching all time high's, it is truly an exciting time to take a closer look at this aspect of the Property."

$BGADF Brigadier Announces Appointment of New CFO and Corporate Secretary

https://finance.yahoo.com/news/brigadier-announces-appointment-cfo-corporate-130000552.html

Looking forward to seeing the results of Phase One! $BGADF

There is a really nice section on the BGADF website dedicated to the company's Picachos Project in Mexico which is now being developed. Be sure to look this section over.

https://brigadiergold.ca/projects/ ;

From the site:

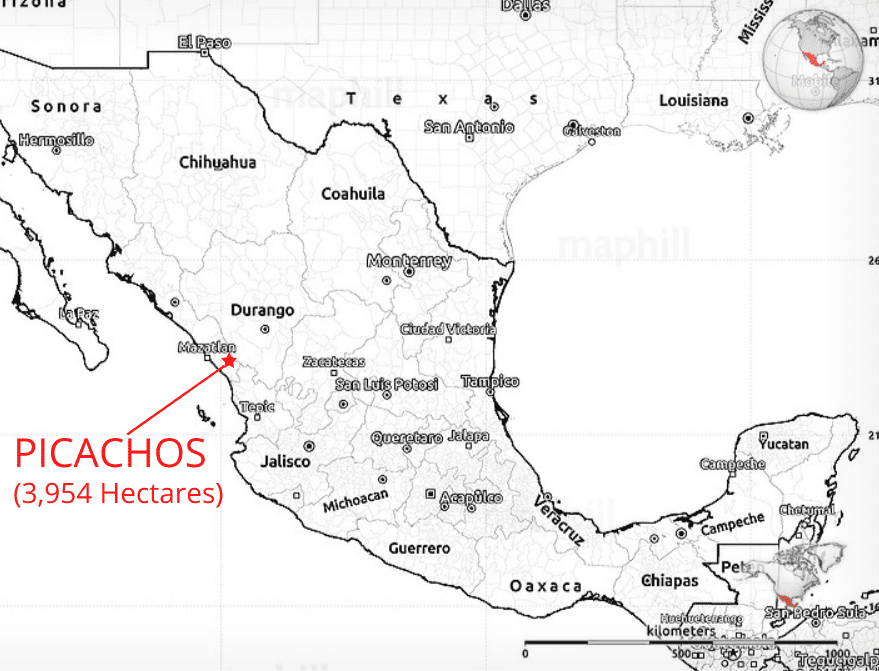

Brigadier’s 100% controlled Picachos Project is a 3,954 hectare gold and silver prospect located in the mining friendly jurisdiction of Sinaloa State, Mexico.

Picachos hosts over 160 underground historic mines, workings and prospects which have yet to undergo modern, systematic exploration and drilling.

Primary targets include under-explored gold veins within the historic San Agustin mine (underground sampling by Thunderbird Projects implies an average grade of 81.22 g/t Au and 73.36 g/t Ag across 1.2m [18 June 1997 News Release]) and La Gloria, a historic mine with rock samples containing 21.1 g/t Au and 6 g/t Ag across 0.8m (Sample #15659)

Brigadier Gold, the first company to initiate a modern, comprehensive exploration and diamond drill progam on Picachos,is currently completing its Phase One 5000 meter drill program focused on historic high grade San Agustin gold mine and has since expanded into the pervasively mineralized Cocolmeca Vein Structure.

$BGADF BID is higher than the current price...only 13k on 0.10.

.10's thin here!

BGADF

$BGADF 0.10s on the ASK!

Agree, closing the week strong, new high of day ready to fall!

BGADF

$BGADF has looked solid all week...

$BGADF is pleased to announce the discovery of bulk tonnage type copper mineralization in trenching and further results from exploration of newly identified gold targets at its Picachos gold-silver-copper project Sinaloa, Mexico (the “Picachos Project”, “Picachos” or the “Property”). Additional assays from phase-1 diamond drilling are anticipated to be received in June. https://brigadiergold.ca/brigadier-makes-copper-discovery-at-picachos-2/

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

290

|

|

Created

|

11/02/20

|

Type

|

Free

|

| Moderators | |||

Brigadier Gold secures rapid financing to advance newly acquired gold-silver asset in Mexico.

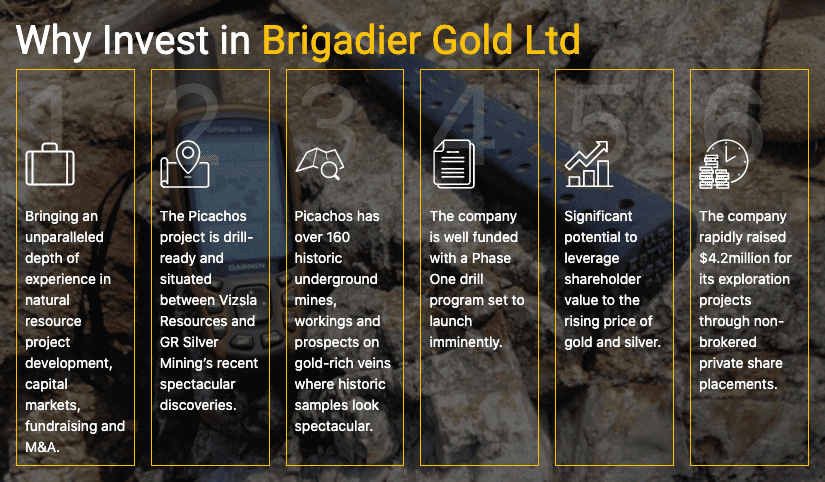

Brigadier Gold (TSXV:BRG, OTC: BGADF), is a Canadian listed gold and silver exploration company boasting a highly experienced management team. In June/July, the company rapidly raised C$4.2million for its exploration projects through a non-brokered private share placement.

Brigadier’s principle aim is to acquire undervalued and overlooked projects in stable jurisdictions that show demonstrable potential for lucrative advancement. It appears to have the experience and ability to do this in spades and has already begun kicking things off with a fantastic acquisition in Mexico.

The skills and expertise in its management team are paramount. Between them they have decades of experience in mineral exploration, natural resource project development and capital markets management. Now strongly funded, the Company is about to initiate a maiden exploration and drilling campaign on Picachos, its 3,954 hectare gold-silver asset situated between two recent bonanza-grade gold/silver discoveries.

The company is headed up by CEO Ranjeet Sundher, who himself has extensive entrepreneurial and business experience in resource project development and capital markets, having raised $100 million for various ventures. He currently heads up Brigadier Gold, Bolt Metals Corp and Canrim Ventures (a private Singaporean financial advisory firm). He previously founded Red Hill Energy, Inc. and Planet Ventures, Inc and has worked all over the world on resource projects, from mapping to drilling to pre-feasibility studies, putting projects into production. He knows the movers and shakers in the mining world and can tap knowledge from where and when it is required.

One such example of this comes in the appointment of Mr. Oscar Mendoza as Special Advisor for Mexico. Mr Mendoza is a man with extensive experience in the resource and capital markets sector. A Mexican national, he graduated in North Texas and obtained an MBA in Japan; he worked for investment banks, including Morgan Stanley and Frontier Securities, where he extensively covered the Natural Resources & Energy sectors. He frequently works as a guest speaker throughout the world discussing power, mining and money. He also makes regular appearances in the Mexican media as an expert in these areas. His knowledge and reputation make him a great asset to Brigadier Gold.

Working alongside Ranjeet Sundher is Steve Vanry, a senior executive with over 25-years professional experience in providing expertise in capital markets, strategic planning, corporate finance, and M&A. His wealth of experience spans mining, energy, technology and manufacturing.

Next up is Garry Clark, a Geologist by profession, currently serving as the Executive Director of the Ontario Prospectors. He also serves on the Minister of Mines Mining Act Advisory Committee as well as the Ontario Geological Survey Advisory Board. He has extensive experience in managing large-scale exploration and development programs internationally throughout Asia and North America. In addition to over 30 years of consulting experience, he held geological positions with several mining companies and other TSX listed companies.

Michelle Robinson is also a respected Geologist and has worked for several major metal mining companies during her career. She also has wide experience working in Mexico and is a fluent Spanish speaker. She regularly liaises with the Mexican Mining Chamber (CAMIMEX) and has gained esteem in her technical writings. She is a member of several prominent societies in the geology and mining sectors.

Educated in Paris and London, Geoffrey Fielding, recently appointed as Special Advisor to Brigadier, was an equity partner at Grenfell & Colegrave, one of London’s oldest city Stockholding firms before it was acquired by CIBC, Canada’s largest retail bank. During this time Geoffrey built up and managed funds of over US$1 billion in 3 years. He is now President and CEO of All State Asset Management in Asia, a Chinese asset investment management company and is Chairman of Wealth Technology Limited.

“I AM DELIGHTED TO WELCOME MR. FIELDING AS A SPECIAL ADVISOR TO THE COMPANY. WE LOOK FORWARD TO WORKING CLOSELY WITH HIM AS WE CONTINUE OUR QUEST TO BUILD DEMONSTRABLE ASSET WORTH AND ULTIMATELY SHAREHOLDER VALUE.”

– RANJEET SUNDHER, CEO Brigadier Gold Ltd.

Brigadier Gold will utilise this team of combined expertise to ensure projects are reviewed and rolled out in a timely manner to acquire and develop only those that meet Brigadier’s highest level of standards. The decades of combined knowledge these individuals offer gives Brigadier’s shareholders and potential investors confidence it is focused on developmental growth.

BRIGADIER GOLD LTD (TSXV:BRG | OTC: BGADF)

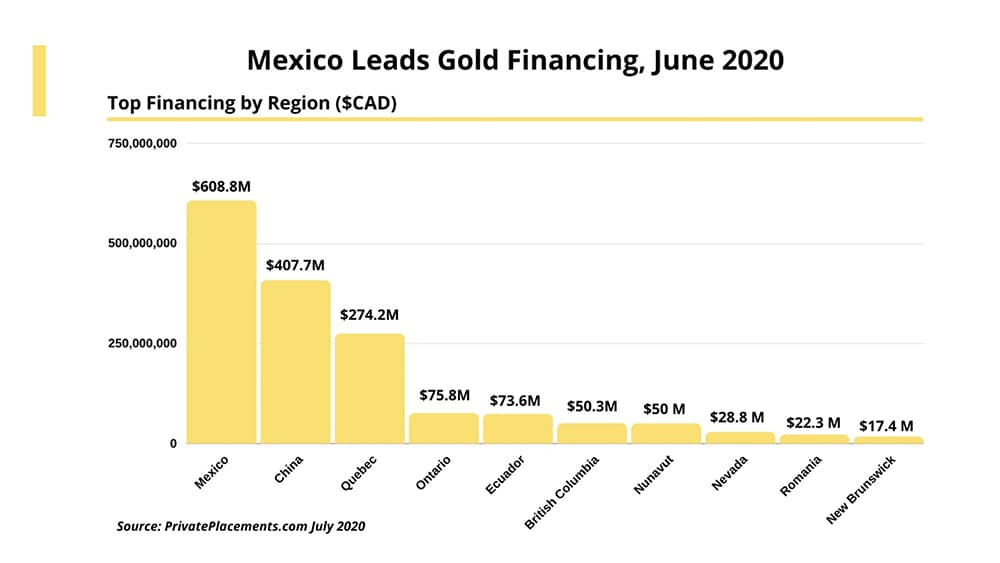

To demonstrate their combined value, the team has already raised gross proceeds of C$4.2 million in a rapid time frame to kick start its flagship gold-silver project in Mexico. It is important to note that Mexico led the globe in gold-related financing in June 2020, highlighting the country’s spectacular potential for new discoveries.

Brigadier recently acquired the option for an early stage exploration property with serious lustre. The Picachos gold-silver project in Mexico is in an area with a history of previous mineral discoveries and exploration opportunities. It is here that Brigadier plans to initiate its inaugural drill program to test historical high grade veins on the project.

Picachos is sitting on an area where previous mineral discoveries have been made, but lack of funds or permits meant mining efforts were abandoned. This puts Brigadier in the enviable position of exploring and drilling an area already known for its wealth of mineral deposits lying in wait. It is also an area that is enjoying a surge of exploration cash being spent on it this year. Picachos is located between two recent discoveries of note. Neighbours on either side of Brigadier Gold’s Picachos property are Vizsla Resources and GR Silver Mining, both of which have enjoyed a recent share price rise since discovering sizeable gold and silver deposits on their properties.

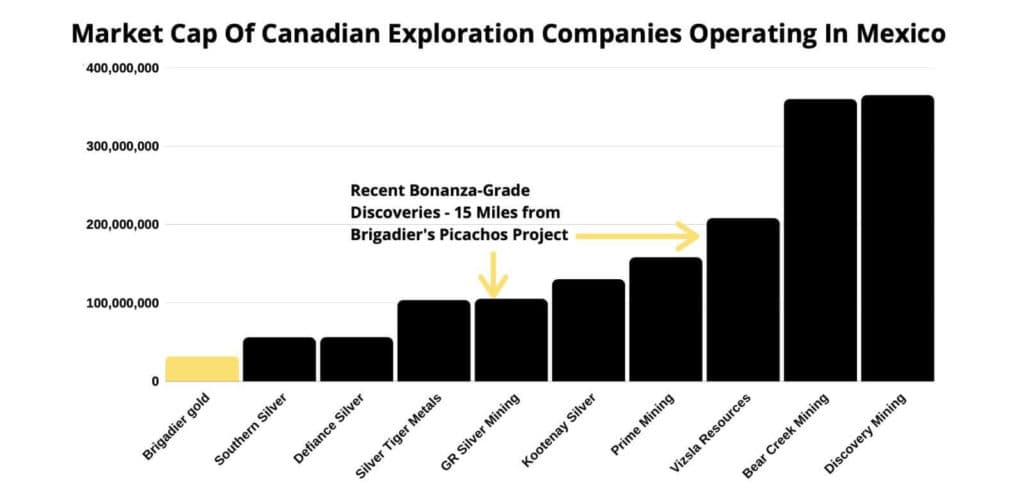

While Brigadier currently has a market cap of approximately $30 million, both its neighbours have market cap’s exceeding the $100 million range. This shows the exponential potential for the Brigadier share price to climb as it explores and develops this natural resource.

Picachos is in the Sierra Madre Occidental, which is a highly prospective gold-silver mining region with multi-million-ounce historic production. It hosts an extensive metal-rich vein system incorporating an underground gold-silver mine, the San Agustin mine, long since abandoned but known for spectacular grades on historic samples found there.

With this team of geological experts at the helm, and access to a comprehensive historical exploration data library, Brigadier is set to start its exploration and initial drill program with both confidence and clarity.

“PICACHOS MARKS AN IMPORTANT ACQUISITION FOR BRIGADIER, POSITIONING THE COMPANY IN A PROLIFIC GOLD AND SILVER REGION OF MEXICO. PICACHOS IS ROAD ACCESSIBLE AND DEMONSTRATES EXCEPTIONAL POTENTIAL FOR ADVANCEMENT. OVER 160 UNDER-EXPLORED HISTORIC MINES AND WORKINGS THROUGHOUT PICACHOS PROVIDE EXCELLENT POTENTIAL FOR DISCOVERY OF NEW GOLD-SILVER MINERALIZED ZONES. WE’RE LOOKING FORWARD TO GETTING BOOTS ON THE GROUND AND DRILLS TURNING.”

– RANJEET SUNDHER, CEO Brigadier Gold Ltd.

BRIGADIER GOLD LTD (TSXV:BRG | OTC: BGADF)

The prices of gold and silver are accelerating as both metals benefit from a surge in demand due to Covid-19 induced government debt piles and rising geopolitical tensions. It would be hard not to notice as the news is making headlines globally; Investment banks like Goldman Sachs and Bank of America have recently joined the gold bandwagon, BOA sees the gold price reaching $3000 in the next 12 months.

While the gold price continues to make new highs, interest in Silver has also started to grow, despite its recent gains, the price is still far below its 2011 peak of $41 an ounce or its all-time high of $49 an ounce in 1980. Silver is also gaining ground with its use in electronics, robotics and the future of technology. All this demand puts these sought-after metals on an upward trajectory that looks unlikely to come crashing down soon. That is what makes gold-silver exploration such an exciting sector to be investing in, as any interesting finds mean greater leveraged returns to further increases in the gold and silver prices.

Combined with a high-performing team, Brigadier Gold is on a mission to prosper and is perfectly poised to leverage these rocketing gold-silver prices in its favour. A large copper porphyry prospect was also recently discovered in the northern area of the property, which gives the Picachos project added potential to an already robust asset.

As an exploration area, Mexico has garnered incredible focus this year with a surge in exploration money currently being spent there.

Brigadier Gold is essentially offering investors the chance to invest in an early stage gold-silver exploration opportunity aligned for disruption in this blazing hot sector. Do NOT miss out!

COMPANY NEWS

DISCLAIMER:

Nothing in the contents transmitted on this board should be construed as an investment advisory, nor should it be used to make investment decisions.

There is no express or implied solicitation to buy or sell securities.

The author(s) may have positions in the stocks or financial relationships with the company or companies discussed and may trade in the stocks mentioned.

Readers are advised to conduct their own due diligence prior to considering buying or selling any stock. All information should be considered for information purposes only.

No stock exchange has approved or disapproved of the information here.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |