Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

There's so much potential here...

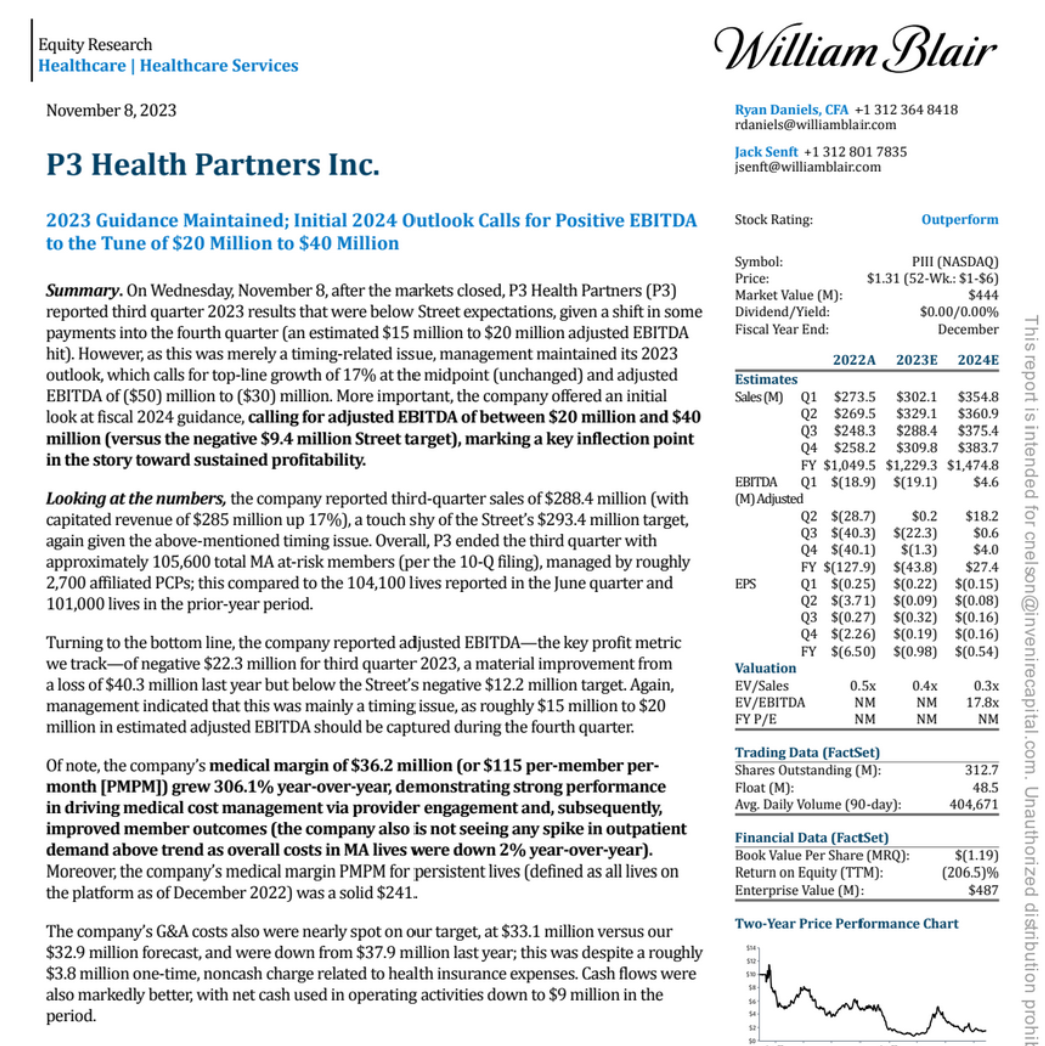

YTD total revenue growth of 16%

Continued strong performance across markets, re-affirming 2023 guidance

Provides preliminary 2024 Full-Year Adjusted EBITDA guidance of +$20 million to +$40 million

$PIII

How much does the service you work for pay?

Definitely some upside here, compared to the current price.

$PIII

Bottom in here, big upside from these levels, daily chart looks ready for a nice move my friend!

$PIII

$PIII BTIG Initiates P3 Health Partners With Buy Rating, Price Target is $5 #MarketScreener https://www.marketscreener.com/quote/stock/P3-HEALTH-PARTNERS-INC-130340627/news/BTIG-Initiates-P3-Health-Partners-With-Buy-Rating-Price-Target-is-5-44753656/?utm_source=twitter&utm_medium=social&utm_campaign=share $FSR $GOEV $GM $PHBI $BEGI $QS $F $TGGI $RDAR $AMC $GME $LCID

Certainly lots of upside to $4...

$PIII

It's trading nearly 2x over its 10-day average volume with about 2 hours left in the day... Nice volume and price action!

$PIII

Thoughts on buying $PIII now? Last time earnings hit we seen highs over $4!

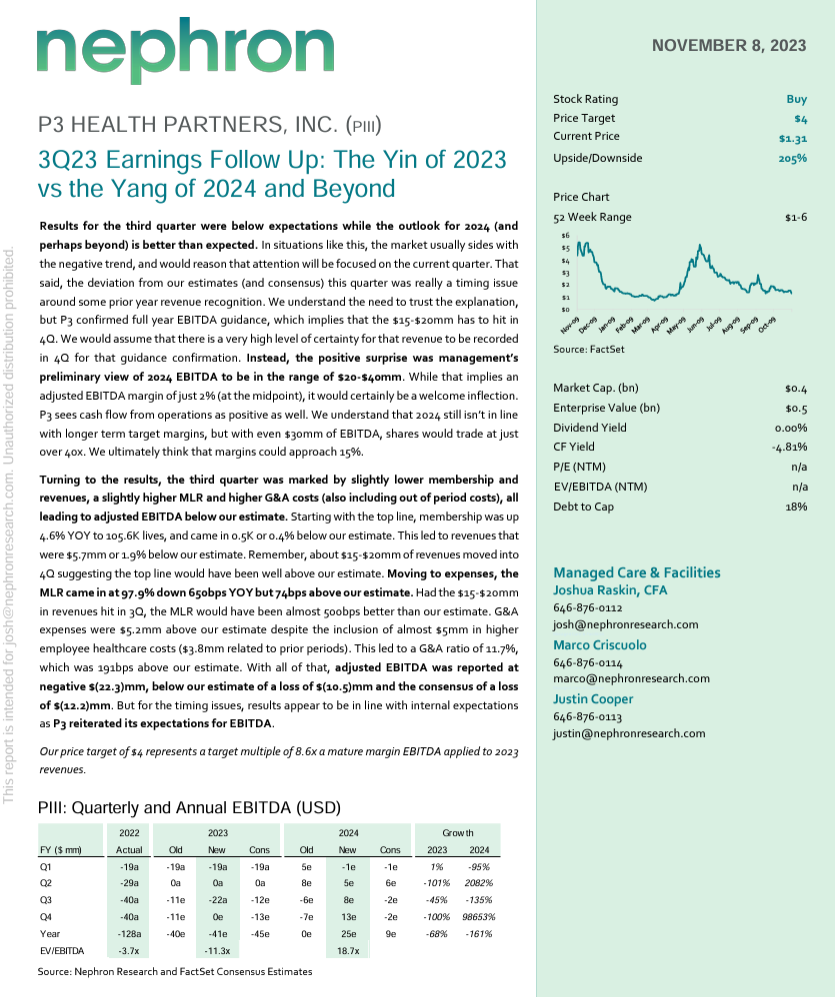

$PIII 3Q23 Earnings Follow Up: The Yin of 2023 vs the Yang of 2024 and Beyond! News Link: P3 Health Partners Announces Third-Quarter and Year-to-Date 2023 Results https://businesswire.com/news/home/20231108788331/en/P3-Health-Partners-Announces-Third-Quarter-and-Year-to-Date-2023-Results

$PIII $1.39 +6.11% Holding Gains! Over 300k in Volume! Heading much higher!

Agree! Medical margin showed a substantial increase of 306.1% for the quarter and 127.0% year-to-date!

$PIII heading towards multi-dollars! Huge improvement there Bud!

P3 Health Partners Inc. (NASDAQ:PIII) announces a 16% increase in total revenue for the third quarter of 2023 compared to the same period last year.

Net loss improved significantly, with a 43% decrease in Q3 and an 89% decrease year-to-date compared to the same periods in the prior year

$PIII The company provides preliminary full-year Adjusted EBITDA guidance for 2024, projecting a positive $20 million to $40 million.

Loading up this week! $PIII huge news today: P3 Health Partners Inc. Reports 16% Revenue Growth in Q3 2023, Narrows Net Loss https://finance.yahoo.com/news/p3-health-partners-inc-reports-225912535.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance

Looking for a bullish run to $3+ for this Nasdaq! $PIII

In conclusion, P3 Health Partners Inc. (NASDAQ:PIII) has demonstrated a strong financial turnaround in the third quarter of 2023, with significant revenue growth and a substantial reduction in net loss. The company's reaffirmed guidance and preliminary outlook for 2024 suggest continued operational efficiency and potential profitability in the coming year. Investors and stakeholders can look forward to the company's sustained growth trajectory as it continues to optimize its platform and deliver value-based care.

P3 Health Partners Inc. (NASDAQ:PIII) demonstrated a robust financial performance with key metrics showing positive trends. The company's gross profit turned positive at $9.1 million, a substantial improvement from a negative $6.5 million in the previous year. The medical margin, a critical indicator of the company's profitability from capitation revenue after medical claims expenses, soared by 306.1% to $36.2 million in Q3, reflecting a more efficient management of medical costs.

The company provides preliminary full-year Adjusted EBITDA guidance for 2024, projecting a positive $20 million to $40 million.

Great perspective...

$PIII

Thank you for sharing that...

$PIII

Thank you for sharing that link to the research report...

$PIII

Very impressive Financials...

$PIII

Nasdaq : $PIII News! 2023 Guidance Maintained; Initial 2024 Outlook Calls for Positive EBITDA

https://williamblair.bluematrix.com/links2/pdf/7a7fda2f-0d0c-433b-867f-cee327d20f05

P3 Health Partners Announces Third-Quarter and Year-to-Date 2023 Results

YTD total revenue growth of 16%

Continued strong performance across markets, re-affirming 2023 guidance

Provides preliminary 2024 Full-Year Adjusted EBITDA guidance of +$20 million to +$40 million

News Link:

https://www.businesswire.com/news/home/20231108788331/en/P3-Health-Partners-Announces-Third-Quarter-and-Year-to-Date-2023-Results

"The results for the second quarter of 2023 show the power and trajectory of the P3 model. I’m delighted to say we had solid improvement across all key metrics. The strength we have seen in 2023 has given us the stability and momentum to drive our next phase of success in 2024, and beyond," said Dr. Sherif Abdou, CEO of P3.

$PIII

NEWS: P3 Health Partners Announces Second-Quarter 2023 Results

Mon, August 7, 2023 at 4:05 PM EDT

In this article: PIII +4.6729%

Management to Host Conference Call and Webcast August 7, 2023 at 4:30 PM ET

HENDERSON, Nev., August 07, 2023--(BUSINESS WIRE)--P3 Health Partners Inc. ("P3" or the "Company") (NASDAQ: PIII), a patient-centered and physician-led population health management company, today announced its financial results for the second quarter ended June 30, 2023.

"The results for the second quarter of 2023 show the power and trajectory of the P3 model. I’m delighted to say we had solid improvement across all key metrics. The strength we have seen in 2023 has given us the stability and momentum to drive our next phase of success in 2024, and beyond," said Dr. Sherif Abdou, CEO of P3.

"We experienced approximately 1% medical cost trend for the quarter. That is a reflection of the effectiveness of P3’s model and the increasing maturity of the membership on P3’s platform. The value we deliver and demand for P3’s model is rooted in our ability to bend the cost curve for our patients, providers, and payor clients," said Bill Bettermann, COO of P3.

Second-Quarter 2023 Financial Results

Capitated revenue was $325.6 million, an increase of 21.9% compared to $267.1 million in the second quarter of the prior year

Net loss was $27.6 million, compared to a net loss of $903.1 million in the second quarter of the prior year. The second quarter of 2022 was negatively impacted by a goodwill impairment charge of $851.5 million

Net loss PMPM was $88 compared to a net loss PMPM of $2,995 the second quarter of the prior year

Adjusted EBITDA(1) was $0.2 million, compared to an Adjusted EBITDA loss of $28.7 million in the second quarter of the prior year

Adjusted EBITDA PMPM(1) was roughly breakeven, compared to an Adjusted EBITDA loss PMPM of $95 in the second quarter of the prior year

Gross profit was $26.8 million, an improvement of $24.8 million compared to $2.0 million in the second quarter of the prior year

Gross profit PMPM was $86, an improvement of $79 compared to $7 in the prior year

Medical margin(1) was $50.5 million, an increase of 132.1% compared to $21.8 million in the second quarter of the prior year

Medical margin PMPM(1) was $161, an increase of 123.2% compared to a medical margin PMPM of $72 in the prior year

First-Half 2023 Financial Results

Capitated revenue was $624.3 million, an increase of 16.3% compared to $536.8 million in the first half of the prior year

Net loss was $80.0 million, compared to a net loss of $963.9 million in the first half of the prior year. The first half of 2022 was negatively impacted by a goodwill impairment charge of $851.5 million

Net loss PMPM was $129 compared to a net loss PMPM of $1,613 in the first half of the prior year

Adjusted EBITDA(1) loss was $18.9 million, compared to an Adjusted EBITDA loss of $47.6 million in the first half of the prior year

Adjusted EBITDA PMPM(1) loss was $30, compared to an Adjusted EBITDA loss of $80 PMPM in the first half of the prior year

Gross profit was $43.3 million, an improvement of 345% compared to $9.7 million in the first half of the prior year

Gross profit PMPM was $70, an increase of 329% compared to $16 in the first half of the prior year

Medical margin(1) was $89.7 million, an increase of 92.6% compared to $46.6 million in the first half of the prior year

Medical margin PMPM(1) was $145, an increase of 85.9% compared to a medical margin PMPM of $78 in the prior year

About P3 Health Partners (NASDAQ: PIII):

P3 Health Partners Inc. is a leading population health management company committed to transforming healthcare by improving the lives of both patients and providers. Founded and led by physicians, P3 has an expansive network of more than 2,600 affiliated primary care providers across the country. Our local teams of health care professionals manage the care of thousands of patients in 18 counties across five states. P3 supports primary care providers with value-based care coordination and administrative services that improve patient outcomes and lower costs. Through partnerships with these local providers, the P3 care team creates an enhanced patient experience by navigating, coordinating, and integrating the patient’s care within the healthcare system. For more information, visit www.p3hp.org and follow us on LinkedIn and Facebook.com/p3healthpartners.

Non-GAAP Financial Measures

In addition to the financial results prepared in accordance accounting principles generally accepted in the U.S. ("GAAP"), this press release contains certain non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA, Adjusted EBITDA PMPM, medical margin and medical margin PMPM. EBITDA is defined as GAAP net income (loss) before (i) interest, (ii) income taxes and (iii) depreciation and amortization. Adjusted EBITDA is defined as EBITDA, further adjusted to exclude the effect of certain supplemental adjustments, such as (i) mark-to-market warrant gain/loss, (ii) premium deficiency reserves, (ii) equity-based compensation expense and (vi) certain other items that we believe are not indicative of our core operating performances. Adjusted EBITDA PMPM is defined as Adjusted EBITDA divided by the number of Medicare Advantage members each month divided by the number of months in the period. We believe these non-GAAP financial measures provide an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial measures with other similar companies. Medical margin represents the amount earned from capitation revenue after medical claims expenses are deducted and medical margin PMPM is defined as medical margin divided by the number of Medicare Advantage members each month divided by the number of months in the period. Medical claims expenses represent costs incurred for medical services provided to our members. As our platform grows and matures over time, we expect medical margin to increase in absolute dollars; however, medical margin PMPM may vary as the percentage of new members brought onto our platform fluctuates. New membership added to the platform is typically dilutive to medical margin PMPM. We do not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In addition, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. The tables at the end of this press release present a reconciliation of Adjusted EBITDA to net income (loss) and Adjusted EBITDA PMPM to net income (loss) PMPM, and medical margin to gross profit and medical margin PMPM to gross profit PMPM, which are the most directly comparable financial measures calculated in accordance with GAAP.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended. Words such as "anticipate," "believe," "budget," "contemplate," "continue," "could," "envision," "estimate," "expect," "guidance," "indicate," "intend," "may," "might," "plan," "possibly," "potential," "predict," "probably," "pro-forma," "project," "seek," "should," "target," or "will," or the negative or other variations thereof, and similar words or phrases or comparable terminology, are intended to identify forward-looking statements. These forward-looking statements address various matters, including the Company’s future expected growth strategy and operating performance; current expectations regarding the Company’s outlook as to revenue, at-risk Medicare Advantage membership, medical margin, medical margin PMPM and Adjusted EBITDA loss for the full year 2023, all of which reflect the Company’s expectations based upon currently available information and data. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected or estimated and you are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important risks and uncertainties that could cause our actual results and financial condition to differ materially from those indicated in forward-looking statements include, among others, our ability to continue as a going concern; our potential need to raise additional capital to fund our existing operations or develop and commercialize new services or expand our operations; our ability to achieve or maintain profitability; our ability to maintain compliance with our debt covenants in the future, or obtain required waivers from our lenders if future operating performance were to fall below current projections of if there are material changes to management’s assumptions, we could be required to recognize non-cash charges to operating earnings for goodwill and/or other intangible asset impairment; our ability to identify and develop successful new geographies, physician partners, payors and patients; changes in market or industry conditions, regulatory environment, competitive conditions, and receptivity to our services; our ability to fund our growth and expand our operations; changes in laws and regulations applicable to our business; our ability to maintain our relationships with health plans and other key payers; the impact of COVID-19, including the impact of new variants of the virus, or another pandemic, epidemic or outbreak of infectious disease on our business and results of operation; increased labor costs; our ability to recruit and retain qualified team members and independent physicians; and other factors discussed in Part I, Item 1A. "Risk Factors" of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023, as updated by Part II, Item 1A. "Risk Factors" in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2023 to be filed with the SEC, and in the Company’s other filings with the SEC. All information in this press release is as of the date hereof, and we undertake no duty to update or revise this information unless required by law. You are cautioned not to place undue reliance on any forward-looking statements contained in this press release.

Impressive addition to the PIII leadership team announced today. This is how you build a strong company that has the experience and skill to optimize all the corporate assets to their fullest.

P3 Health Partners Names William Bettermann as Chief Operating Officer

7:30 am ET June 20, 2023 (BusinessWire)

P3 Health Partners Inc. ("P3" or the "Company") (NASDAQ: PIII), a patient-centered and physician-led population health management company, announces William "Bill" Bettermann as its Executive Vice President and Chief Operating Officer.

Bill brings nearly 25 years of healthcare management experience to P3 with a strong track record of success in the value-based care arena. Previously Bill served in leadership roles at Optum Care, where he recently led the Pacific Northwest operations and where he also served as Chief Operating Officer of the Everett Clinic and the Seattle Polyclinic. Before that, Bill was a Senior Vice President of Strategic Operations at Aurora Healthcare. He began his career at the Mayo Clinic in operations. Bill has significant operational experience running physician-oriented and value-based care companies.

"We are excited to have Bill as part of the P3 family. His experience across payors, value-based care providers, and clinical practices aligns perfectly with P3's mission. His focus on excellence across operations, informatics, patient access as well as physician and patient satisfaction will accelerate our goal to be the partner of choice for payors, providers and patients," said Dr. Sherif Abdou, CEO of P3.

Mr. Bettermann commented on the appointment, "I am delighted to join the P3 family. The P3 leadership team have been trail blazers in bringing value-based care to fruition. I believe this mission is not just important but imperative, as we strive to improve patient outcomes while lowering the cost of care in the United States. It is a privilege to join this physician-led team of executives with an unwavering commitment to transforming healthcare."

About P3 Health Partners (NASDAQ: PIII):

P3 Health Partners Inc. is a leading population health management company committed to transforming healthcare by improving the lives of both patients and providers. Founded and led by physicians, P3 has an expansive network of more than 2,800 affiliated primary care providers across the country. Our local teams of health care professionals manage the care of thousands of patients in 15 counties across five states. P3 supports primary care providers with value-based care coordination and administrative services that improve patient outcomes and lower costs. Through partnerships with these local providers, the P3 care team creates an enhanced patient experience by navigating, coordinating, and integrating the patient's care within the healthcare system. For more information, visit http://www.p3hp.org and follow us on LinkedIn and Facebook.com/p3healthpartners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230620997486/en/

SOURCE: P3 Health Partners Inc.

Investor Relations

Karen Blomquist

Vice President, Investor Relations

P3 Health Partners

kblomquist@p3hp.org

Kassi Belz

Executive Vice President, Communications

P3 Health Partners

(904) 415-2744

kbelz@p3hp.org

$PIII NEWS! P3 Health Partners Names William Bettermann as Chief Operating Officer https://finance.yahoo.com/news/p3-health-partners-names-william-113000449.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance

$PIII heading back to new highs driven by profitability and hypergrowth.

https://seekingalpha.com/article/4611543-p3-health-partners-solid-path-to-profitability

$PIII heading back to new highs driven by profitability and hypergrowth.

https://seekingalpha.com/article/4611543-p3-health-partners-solid-path-to-profitability

Yeah about 3x undervalued... Thank you for sharing that link.

This report came out yesterday. It says P3 is way undervalued at this price from its peers...

https://williamblair.bluematrix.com/links2/pdf/c058f031-22cc-4fba-8c6a-93e6ccfb8b32

It's now trading just over its 10-day average volume as lunchtime draws to a close... UP almost 14%.

$PIII

It's trading nearly 20% of its 10-day average volume within the first 15 minutes of the open... UP almost 11%.

$PIII

$PIII $2.695 HOD $2.81 Last 30 Days trading thru the roof was under $1.20 in April.

Wow, it's already trading over 40% of its 10-day average volume within the first hour... UP 16% on today's research report!

$PIII

It's really undervalued compared to its price target!

$PIII

$PIII soaring $2.82 +22.08% on analysis reports -BUY Opinion $9PT

$PIII P3HealthClinic BUY target $9 ; report from Lake Street Capital Markets

$PIII @P3HealthClinic BUY target $9 ; report from Lake Street Capital Markets @frontpagestocks pic.twitter.com/H9rQ1wzZMm

— 🔥🔥🌐UltimateTraderX🌐🔥🔥 (@JediJazz22) May 12, 2023

Thank you for sharing that link to the research report...

$PIII

Pretty amazing results...

-Capitated revenue increases 11% vs. the same period in the prior year

-Q1 2023 operating loss improved 7% vs. the same period in the prior year

-Q1 2023 medical margin improvement of 58% vs. the same period in the prior year

-Increases Adjusted EBITDA guidance

$PIII

|

Followers

|

2

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

108

|

|

Created

|

02/17/23

|

Type

|

Free

|

| Moderators | |||

We support healthier patients and communities.

P3 is a leader in population health management because we embrace a care model and patient support team that is effective in:

P3 Health Partners is a population health management company that supports providers with administrative services and care coordination for Medicare Advantage patients. P3’s model aggregates and supports the community’s existing healthcare resources to build a strong network of community providers working together to deliver highly coordinated and integrated care to our patients with a shared commitment to improving patient outcomes, lowering cost, and delivering a better experience for all.

Founded and led by physicians, our team of healthcare providers and service professionals share a revolutionary vision for delivering patient care with passion and purpose.

Our leadership team consists of experienced healthcare professionals driven by a desire to change the healthcare industry for the better and improve the lives of patients and providers.

Our promise is to guide our communities to better health, enable providers to do the work they love, and enrich the health and quality of life for patients.

As 20-year veterans in population health management, we understand the unique challenges that come with providing value-based care. That’s why we’ve made it our mission to embrace a care model that gives patients the tools and resources they need to better manage their long-term wellness and allow providers the support they need to spend more time with patients and less time on administrative tasks and between-visit care.

For Fiscal Year Ending Dec 31, 2022

3Q 2023 Financial Results

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |