Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It's a bust, it's always been a bust and it always will be a bust.

Bbradley8, I could not disagree with you more. However, I appreciate your opinion and take it into consideration, it is possible that you are correct and if more information because available, I might change my opinion.

With all do respect and I don't mean this in a mean way, ok? I think you are naive and that you don't fully understand the past business history of OVIT, Dr.W.

The reason I'm no selling is because I've already lost so much here, that my best chance to recoup some losses is to just stay in it.

If you or anyone wants to take a position in OVIT now, now would be the time, because the pps is so low.

However, in order to get the pps up, it's going to take a lot more than overly optimistic people buying shares of this dormant company, it's going to take the company selling its shell into a reverse merger to someone else, or come out of dormancy with a new protocol or patent.

I think OVIT has totally missed the boat with Oncology, there are so many real biotech/pharma's that are so far ahead of anything OVIT could do, so I'd even like to see OVIT get out of Oncology and be done with CEO, Dr.W and totally move into another area.

Let's hope that you are correct thought, that something BIG is brewing with OVIT and that it will come out of dormancy.

gi97845 I couldn't disagree with you more. In fact this would be the perfect time to sell your shares if you're underwater due to end of the year tax selling, especially since we've been in one of the biggest bull markets in history. Investors that have huge gains elsewhere could sell OVIT and use that loss against other gains for tax purposes. I also disagree with you when you say $7,500 is not a lot of money to invest. There are so many opportunities out there and I have a very hard time believing someone would risk this amount on a dormant company when they could allocate those funds elsewhere. Lastly maybe you don't realize that before the current bid of 500,000 shares at $0.015, there was another bid of 500,000 shares that was partially filled. If I remember correctly, about 200,000 or 300,000 shares were filled at this price and then right afterwards the same individual immediately put in another bid for 500,000 shares that's been sitting there for some time. That means this individual already owns at least a few hundred thousand shares so they are willing to spend more than $7,500. I also believe there's a good chance that if there current bid was filled they would again put in another large bid.

So my question to you is if you're so bearish, why don't you sell your shares now and fill some of the pending bids? If you have any gains in other stocks this would be a great time for you to sell and use your loss against other gains you may have.

For years hopeful, yet scammed investors have been wanting OVIT somehow come out of dormancy and it hasn't happened yet.

The reason why no one wants to sell their shares is because they are already so far under water and they don't need that money to live on...

They would rather wait as long as possible to hopefully recoup as much of their lost money as possible...

Trust me, they are not holding because they think OVIT is a winner.

Also, someone wanting to by $7,500 worth of shares is a small amount of money, obviously this person is a bit of a gambler, with money to burn, so if they lose it on OVIT, it does not hurt them one bit.

No one is spending $7,500 on 500,000 shares of a dormant stock because they have money to blow. Something is definitely up. I also agree it's meaningful that no one is willing to sell and this order has been sitting there for quite some time.

What does it really mean though? Is OVIT going to be reborne as a reverse shell merger? Or, does some just have to gamble with and/or does someone just not want to give up their shares and wants to hold onto a long shot.

Their is more to a company than trading shares, gee...It would help if it was not dormant!

Bbradley8 is correct here. I’m guessing the SP doesn’t move up until that 500k bid is filled. The fact that no one is willing to part with half a mill shares is also saying something. If that bid goes thru it will not be a sale from myself.

Your response makes zero sense gi197845 and if I was that individual I would have someone just like you posting nonsense trying to discourage people to sell their shares cheap. I've been watching this stock and this individual has been accumulating slowly over time. In fact any chance they get to buy under $0.02 they buy. I can almost verify with certainty that their goal is to buy as much as they can under 2 cents. Anyone who's reading this can ask themselves why gi197845 keeps posting messages about lottery tickets, etc. on a message board of a dormant company. Anytime there is an order for sale under $0.02 it gets taken out right away. Hmmmmm

They want 500,000 shares of this cheap stock/dormant company, because they have money to burn and can take the risk, it's not because they know someone who knows something, or because the company is going to be reverse shell merged.

It's clear someone is trying to accumulate shares in OVIT and it's also clear they are trying to do it quietly. The bid for 500,000 shares at $0.015 has been there for quite some time. This individual doesn't seem to be in a rush either. Since this is a dormant company that does nothing, you have to ask yourself why would this individual want to own this stock. Regardless of the reason be sure they have a good reason and we won't find out the answer until it's to late and the share price is much higher. Looks like a pretty decent opportunity to me with the stock trading under two cents.

I agree GI, OVIT is screwed and so are we.

One has a greater chance of winning the lottery than with anything positive ever happening with OVIT.

In general, little bio’s cause huge losses, 93.25% of them never get an approved drug and they are riddled with pumps, dumps, secondary offerings and of course reverse splits.

I think a privately traded company, like OVIT can stay dormant indefinitely, without a custodianship hearing and if that's required, it's probably already take place multiple times throughout they year, meaning the CEO states "Yep, I'm still the CEO and yep, we're still dormant."

Why wasn't there a custodianship hearing years ago? Why would a custodianship hearing happen now?

Yes, very dormant..... I expect a custodianship hearing in its near future. It’s a lotto as most OTC plays are but with a clean SS so it’s getting a place at the table early but not so early your on dead money or you’ve bought before basing has occurred. It’s a solid play but timing is all speculative.

Chop chop, someone hurry up and buy this turd shell of a company and reverse merger it!

I don't think OVIT can do anything until there is a reverse shell merger. What do you mean it's ready?

Well, you do realize that Onco Vista Innovative Therapies is a dormant company, correct.

L2 very thin. It’s ready.

Interesting - ask is very this with little to no dumping this past week while 400k blocks sit on the bid. She’s ready to rip with just a shred of a catalyst. This low float is primed for a massive breakout IMO

I won't sell, because you keep saying that there will be a reverse shell merger.

@gi well there’s a 500k bid sitting there so why not sell your shares?

To date, I have now lost $40,000 in OVIT, but I have not sold and will never get any of that money back.

Oh, totally awesome! This stock/biotech rocks!!!

Not sure about awesome, but they are the biggest blue-balling stock I've ever been in. Hahaha. Another 100k in volume. Is it finally time??????

Agreed, yup any day now...

Any day now, OVIT will be reverse shell merged into a new company with new technology and we'll make a profit.

There has been a fair amount of volume over the past month or so for dormant OVIT. I wondering if OVIT will ever come out of dormancy or if it will be reverse-shell merged as a new company.

no. Don't think it got executed. That also would require someone(s) to sell that much though.

Right, just wondered if the bid/buy order actually went through, or if it expired, thanks.

Yes. A bid is a buy order. Ask is a sell order.

Ya, that's awesome, did the 500,000 bid go through as a buy?

Just a matter of days before this shell is bought and merged into another company...

It's interesting that the ask is at 200.00, is it a mistake? Or a split or a merger or a reverse shell merger? I'm guessing it's a mistake.

Almost there

I just saw over 200k shares yesterday, which is a crazy amount compared to the typical daily 0. I was hoping something was up.

I saw the volume yesterday, wasn't it like 6 figures worth of shares, bought and sold, or vise versa? Do you have L2 access? How can we find out the details? I just assumed it was another negative sigh of someone bailing out...Wish it was a sign that OVIT was going to have a new protocol and/or do a reverse shell merger.

|

Followers

|

23

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

774

|

|

Created

|

01/16/10

|

Type

|

Free

|

| Moderators | |||

OncoVista Innovative Therapies, Inc. (OVIT)

Please see the bottom of the iBox for a contrary view on this stock.

http://www.oncovista.com/

Company Information:

OncoVista Innovative Therapies, Inc.

14785 Omicron Drive

Suite 104

San Antonio,, TX 78245

Phone: 210-677-6000

CIK: 0001094847

The latest 10Q can be found here: http://filings.issuerdirect.com/data/1094847/000114420411063209/v240119_10q.pdf

Link to clinical trials register: http://www.clinicaltrials.gov/ct2/results?term=cordycepin

Neither of the two cordycepin studies registered with clinical.trials.gov has been updated for over two years, which is a breach of registration conditions.

OncoVista Innovative Therapies, Inc., is a bio-pharmaceutical company that claims to be dedicated to providing innovative, safe and efficacious treatments for cancer through the use of biomarkers in order to extend and improve the quality of life for patients.

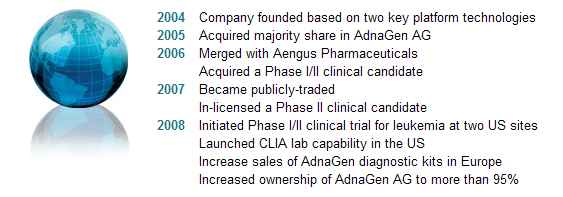

Based in San Antonio, Texas, OncoVista was incorporated in 2004 and says it utilizes state-of-the-art drug discovery technologies, innovative clinical development and registration strategies as well as emerging technologies to bring to market new, safe and highly effective anti-cancer drugs. Although no such drugs have yet been brought to market, and the "incubator" behind Onco Vista, Technology Innovations, LLC, has a long and inglorious history of transferring monies from its publicly held spin-offs such as Biophan and Natural Nano into private hands.

Management:

http://www.oncovista.com/index.php?option=com_content&task=view&id=67

Claims made by Onco Vista regarding its Core Capabilities for Accelerated Drug Development

Lipitek International

Well-equipped research labs for chemical synthesis and biological evaluations; GMP manufacturing suite

UT Health Science Center (Prof. Luduena)

Biological evaluation and testing of new anti-mitotics, including tubulin isotype-specific assays

University of Alberta (Prof. Tuszynski)

Molecular modeling, computer simulation of new molecules, molecule design and in silico screening

AAI Oncology (Paris)

Global oncology-focused clinical Contract Research Organization (CRO)

Cancer Therapy & Research Center (CTRC)/Institute for Drug Development (IDD)

In vitro and in vivo capabilities; Phase I/II clinical trials

Other Local Resources (nothing to do with Onco Vista per se: probably included here to give an impression of referred respectability).

Southwest Oncology Group

Southwest Foundation for Biomedical Research

Press Releases:

http://www.oncovista.com/index.php?option=com_content&task=view&id=91

http://finance.yahoo.com/q/h?s=OVIT.OB+Headlines

-----------------------

AdnaGen

News from AdnaGen site, which is majority owned by OVIT

http://www.adnagen.com/HTML_Dateien/e_news_news.htm

OVIT used to own 78% of the issued and outstanding shares of AdnaGen*

* On November 2, 2010, OncoVista Innovative Therapies, Inc. (the "Company") entered into a Stock Purchase Agreement with Alere Holdings Bermuda Limited Canon's Court ("Alere Holdings"), whereby the Company sold all of its shares, representing approximately 78.01% of the total issued and outstanding shares, of its majority-owned German operating subsidiary AdnaGen AG ("AdnaGen"). Under the terms of the Stock Purchase Agreement, the Company and the other AdnaGen shareholders agreed to sell their respective shares of AdnaGen, and all AdnaGen related business assets, to Alere Holdings in consideration of: (i) a $10,000,000 up-front; (ii) $10,000,000 in potential milestone payments contingent upon the achievement of various balance sheet objectives within 24 months; and (iii) up to $63,000,000 in potential milestone payments contingent upon the achievement of various clinical, regulatory and sales objectives within 36 months (collectively, the "Consideration"). The Company is entitled to receive its pro rata portion of approximately 78.01% of all Consideration.http://www.sec.gov/Archives/edgar/data/1094847/000114420410057309/v200923_8k.htm

----------------------

Filings:

Share Structure:

Authorized Shares

147,397,390 as of September 30, 2011

Outstanding Shares

21,370,725 as of September 30, 2011

All messages, including iBox content, are the opinion of the posters, are no substitute for your own research, and should not be relied upon for stock trading or any other purpose.

Please keep your posts on topic because your message(s) will probably be deleted when:

* Posting content that's off-topic to the subject of this board;

* Posting statements that don't add value to the discussion; or

* When you violate any other posting term of the iHub User Agreement: http://investorshub.advfn.com/boards/complex_terms.asp

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |