Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

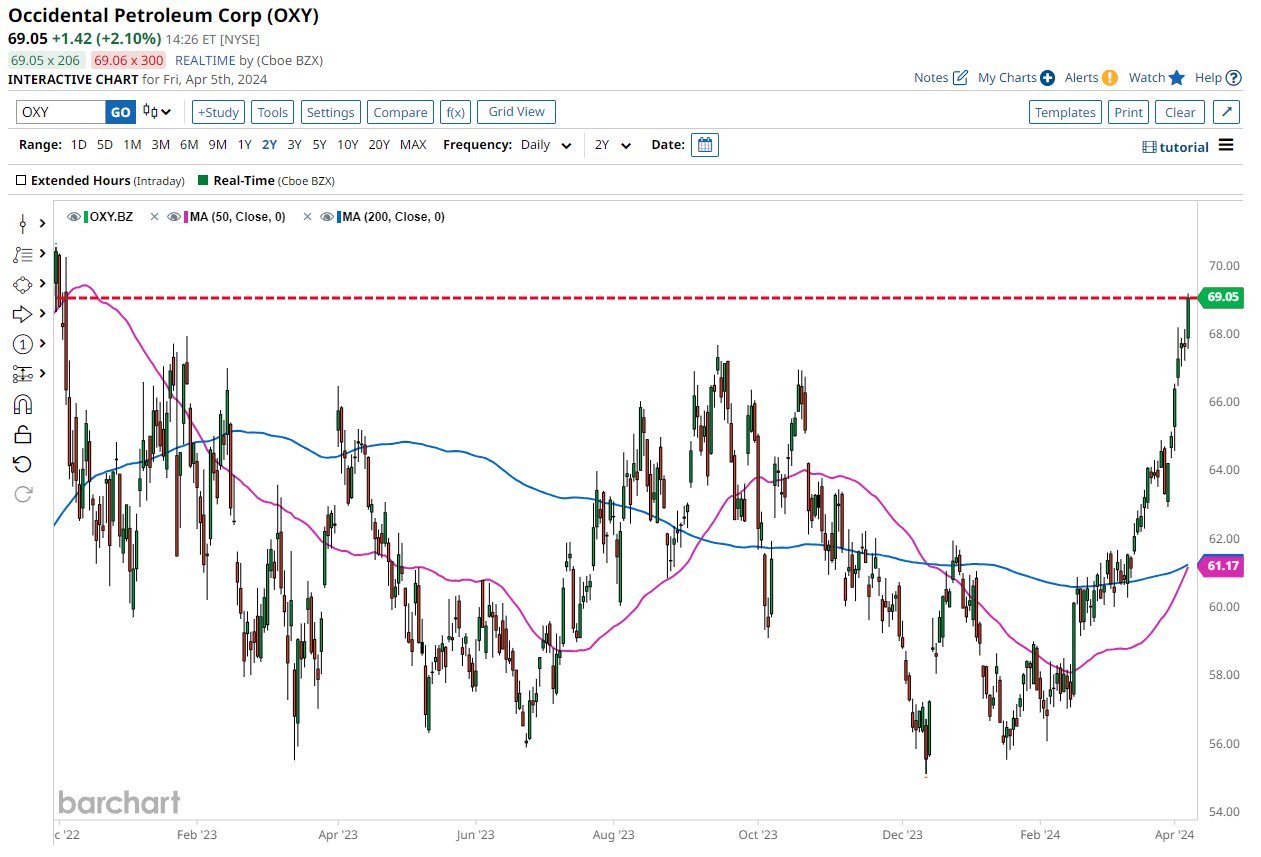

Occidental Petroleum $OXY jumping to highest price since December 2022, and a Golden Cross formation is imminent

By: Barchart | April 5, 2024

• Occidental Petroleum $OXY jumping to highest price since December 2022, and a Golden Cross formation is imminent.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum Insider actions indicator

By: TrendSpider | March 31, 2024

• There's a million reasons for insiders to sell, but only one reason to buy. $OXY

Insider actions indicator: http://trendspider.cc/insideractions.

Read Full Story »»»

DiscoverGold

DiscoverGold

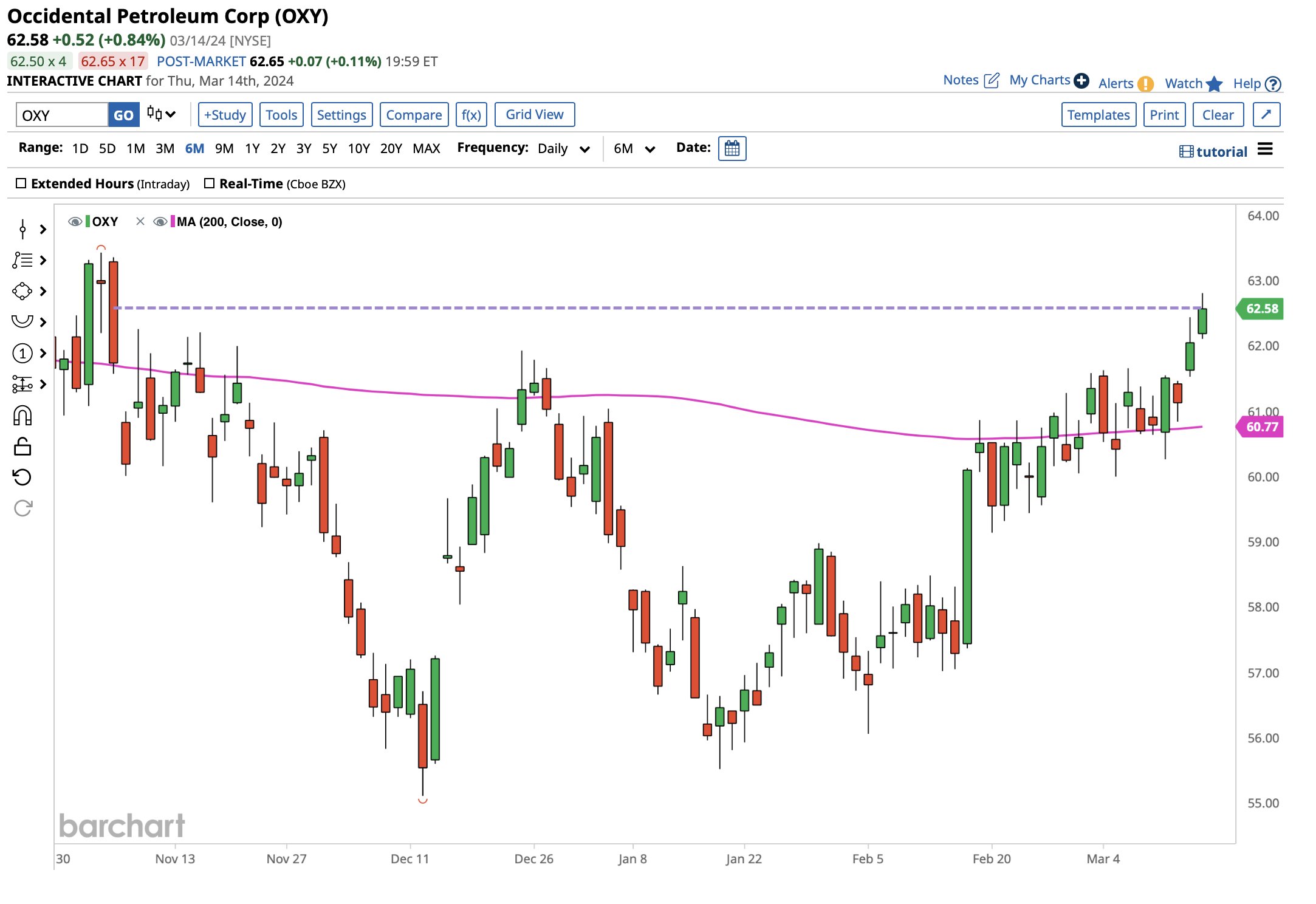

Occidental Petroleum has now traded green for 5 consecutive days, its longest winning streak since September and closed at its highest price since October.

By: Barchart | March 19, 2024

• Occidental Petroleum $OXY has now traded green for 5 consecutive days, its longest winning streak since September and closed at its highest price since October.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY Two year breakout in the making

By: TrendSpider | March 18, 2024

• $OXY Two year breakout in the making.

Read Full Story »»»

DiscoverGold

DiscoverGold

$OXY If energy stocks keep ripping, this monthly setup from Occidental should not be overlooked...

By: TrendSpider | March 15, 2024

• $OXY If energy stocks keep ripping, this monthly setup from Occidental should not be overlooked...

Doesn't hurt that Buffett has been loading the boat, either.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY with a nice breakout above its 200D moving average. Now trading at its highest price since early November.

By: Barchart | March 14, 2024

• Occidental Petroleum $OXY with a nice breakout above its 200D moving average. Now trading at its highest price since early November.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum Corporation (OXY) Is a Trending Stock: Facts to Know Before Betting on It

By: Zacks Investment Research | March 6, 2024

Occidental Petroleum

OXY

is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this oil and gas exploration and production company have returned +5.2% over the past month versus the Zacks S&P 500 composite's +2.9% change. The Zacks Oil and Gas - Integrated - United States industry, to which Occidental belongs, has gained 3.9% over this period. Now the key question is: Where could the stock be headed in the near term?

Although media reports or rumors about a significant change in a company's business prospects usually cause its stock to trend and lead to an immediate price change, there are always certain fundamental factors that ultimately drive the buy-and-hold decision.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company's future earnings over anything else. That's because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Occidental is expected to post earnings of $0.67 per share for the current quarter, representing a year-over-year change of -38.5%. Over the last 30 days, the Zacks Consensus Estimate has changed -26.8%.

The consensus earnings estimate of $3.67 for the current fiscal year indicates a year-over-year change of -0.8%. This estimate has changed -14.2% over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $4.75 indicates a change of +29.4% from what Occidental is expected to report a year ago. Over the past month, the estimate has changed -3.2%.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Occidental.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

While earnings growth is arguably the most superior indicator of a company's financial health, nothing happens as such if a business isn't able to grow its revenues. After all, it's nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it's important to know a company's potential revenue growth.

In the case of Occidental, the consensus sales estimate of $6.83 billion for the current quarter points to a year-over-year change of -5.9%. The $29.87 billion and $32.48 billion estimates for the current and next fiscal years indicate changes of +3.3% and +8.7%, respectively.

Last Reported Results and Surprise History

Occidental reported revenues of $7.53 billion in the last reported quarter, representing a year-over-year change of -9.6%. EPS of $0.74 for the same period compares with $1.61 a year ago.

Compared to the Zacks Consensus Estimate of $7.14 billion, the reported revenues represent a surprise of +5.47%. The EPS surprise was 0%.

Over the last four quarters, the company surpassed EPS estimates just once. The company topped consensus revenue estimates two times over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

Comparing the current value of a company's valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Occidental is graded B on this front, indicating that it is trading at a discount to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Conclusion

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Occidental. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term.

DiscoverGold

DiscoverGold

$OXY $1.5 Million Unusual Put Sell Order

By: Cheddar Flow | February 26, 2024

• $OXY $1.5M Unusual Put Sell Order

This whale is looking to collect the premium on these contracts

Vol > OI so it is being sold to open

*Below the Bid*

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum (OXY) Stock Edges Higher Before Earnings

By: Schaeffer's Investment Research | February 12, 2024

• The company will report fourth-quarter earnings after the close on Thursday, Feb. 15

• Shares are down 11.6% in the last 12 months

Occidental Petroleum Corp (NYSE:OXY) is set to report fourth-quarter earnings after the close on Thursday, Feb. 15. The equity was last seen up 1.1% to trade at $58.09 at last check, but is still under the 60-day moving average, despite a brief foray above the trendline in December. Shares are down 11.6% in the last 12 months, and also carry a slim year-to-date deficit.

As far as as post-earnings reactions are concerned, OXY's history is less than stellar. The stock finished five of the past eight next-day sessions lower, including an 9.2% dip in November 2022. Shares averaged a move of 3% in the past two years, regardless of direction, but the options pits are pricing in a larger-than-usual swing of 4.5% this time.

Options traders lean overwhelmingly bullish. This is per the stock's 10-day call/put volume ratio of 4.82 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) that sits higher than all but 4% of readings from the past year.

Analysts are skeptical, with 12 of the 19 firms in coverage calling OXY a tepid "hold" or worse, while the average 12-month target price of $66.84 is a 14.8% premium to current levels. It's also worth noting the 52.11 million shares sold short makes up 8.3% of the stock's available float.

Read Full Story »»»

DiscoverGold

DiscoverGold

$OXY Wedging into earnings week after another $245M dip buy from Uncle Warren

By: TrendSpider | February 12, 2024

• $OXY Wedging into earnings week after another $245M dip buy from Uncle Warren.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY If Buffett is bullish, so am I.

By: TrendSpider | February 9, 2024

• $OXY If Buffett is bullish, so am I.

Read Full Story »»»

DiscoverGold

DiscoverGold

Warren Buffett filed for their purchase of 4.3M additional shares of Occidental $OXY for $245.9M

By: Evan | February 6, 2024

• Warren Buffett and Berkshire Hathaway $BRK.B filed for their purchase of 4.3M additional shares of Occidental $OXY for $245.9M.

Read Full Story »»»

DiscoverGold

DiscoverGold

Supply constraints for oil are on the horizon, according to Occidental

By: Markets & Mayhem | February 5, 2024

Supply constraints for oil are on the horizon, according to Occidental pic.twitter.com/bvmjIBqWDf

— Markets & Mayhem (@Mayhem4Markets) February 5, 2024

DiscoverGold

DiscoverGold

Warren Buffett and Berkshire Hathaway $BRK.B just filed that they currently own 34% of Occidental $OXY

By: Evan | January 10, 2024

• Warren Buffett and Berkshire Hathaway $BRK.B just filed that they currently own 34% of Occidental $OXY

Read Full Story »»»

DiscoverGold

DiscoverGold

yep, he isnt no dummy. But he makes a fortune off of his preferred shares here. But, that is ok with me as long as he takes me for the ride too

He knows something.

More conflict in the Middle East?

OPEC cuts?

Warren Buffett and Berkshire Hathaway $BRK.B just filed for its purchase of 5.2M shares of Occidental $OXY for $312.1 Million

By: Evan | December 21, 2023

• Warren Buffett and Berkshire Hathaway $BRK.B just filed for its purchase of 5.2M shares of Occidental $OXY for $312.1 Million

Read Full Story »»»

DiscoverGold

DiscoverGold

Hey bruh, enjoy the ride, nothing lasts forever. But Riding with old warren is better than most.

yea this keeping up with the joness wont last too long. you know hes going to sell those 10mil shares soon to make his nut on this little pump.

happens all the time.

Occidental Petroleum (OXY) Eyes Best Day Since October

By: Schaeffer's Investment Research | December 14, 2023

• Berkshire Hathaway bought 10.5 million shares of OXY

• Options traders are chiming in on the oil name's newsy day

Occidental Petroleum Corp (NYSE:OXY) stock is on the rise today, after news that Warren Buffet's Berkshire Hathaway (BRK.A) bought 10.5 million shares worth about $588.7 million. This news came the same day as reports that Occidental Petroleum is purchasing oil & gas producer CrownRock for $12 billion.

At last look, OXY was up 3.5% to trade at $59.18, moving further from its recent Dec. 12 52-week low of $55.12, and now on track to log its best daily performance since October. Today's pop has the stock back above its 20-day moving average, which has helped guide the shares lower since October, and the shares are now on track to snap a five-week losing streak.

Options bulls are blasting the oil name in response. So far, 56,000 calls have been exchanged -- six times the call volume typically seen at this point -- in comparison to 17,000 puts. Expiring tomorrow, the December 60 call is the most active contract, with new positions being bought to open there.

Bullish sentiment in the options pits has been the standard for a while now, too. OXY's 50-day call/put volume ratio of 3.38 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks higher than 98% of readings from the past year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Old Warren repeated what Dak Prescott said to the Eagles, "Yea, here we goooooo....." LOL

Yep, Old Warrens Good Buy is that guys goodbye

Occidental Petroleum (OXY) stock adds 2% as Buffett buys more shares

By: Investing | December 14, 2023

Occidental Petroleum (NYSE:OXY) disclosed that Berkshire Hathaway purchased $590 million of its stock, acquiring 10.5 million shares between December 11-13, 2023.

The average share price for this transaction was $56.16, which was 1.9% below the closing price on the reported day of $57.22.

The stock rose 2.2% on the news.

“We expect OXY to have a slightly positive reaction vs. peers” on Thursday, analysts at Roth MKM said in a note.

“We rate Occidental Petroleum Neutral due to its more levered balance sheet, the potential peak of chemicals earnings in 2022, its lower long-term production growth rate vs. peers and we don't think Buffett buys the entire company.”

Read Full Story »»»

DiscoverGold

DiscoverGold

oh yea. imminent. lmao this is going above 70 soon.

lol howd yu make out with THAT analysis? keep getting left behind. He only bought over 10 mil shares. lmao. byebye

Copy that, I loaded quite a bit this week. Let’s rock..

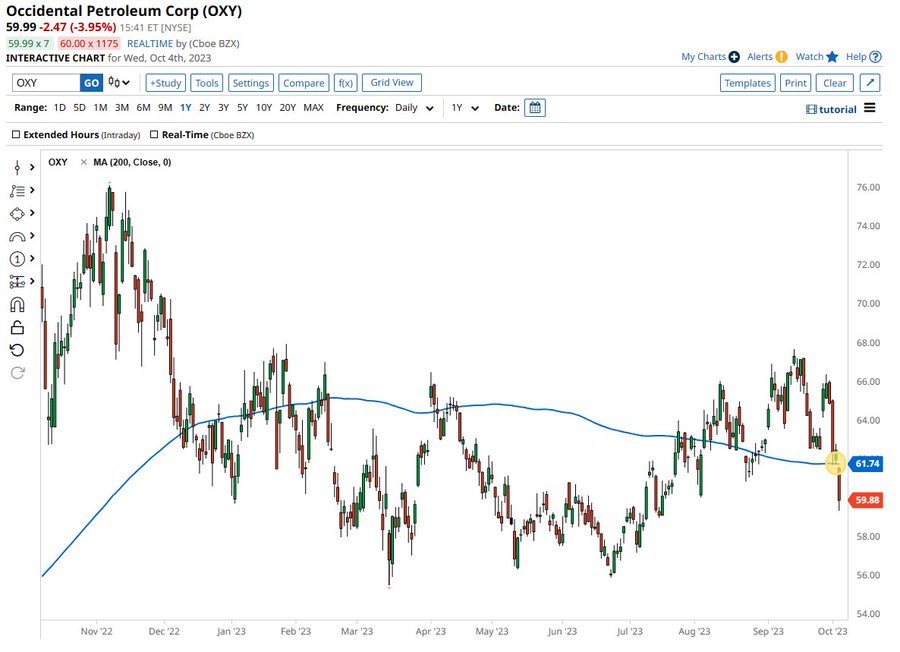

Occidental Petroleum $OXY closed at its lowest price in almost 20 months along with an imminent Death Cross. How is Warren reacting to this?

By: Barchart | December 12, 2023

• Occidental Petroleum $OXY closed at its lowest price in almost 20 months along with an imminent Death Cross. How is Warren reacting to this?

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum (OXY) to acquire CrownRock for $12 billion

By: Investing | December 11, 2023

Occidental (NYSE:OXY), the energy giant, has announced its acquisition of CrownRock LP, an oil and gas producer based in Midland.

The deal, valued at approximately $12 billion, encompasses both cash and stock, and involves assuming CrownRock's existing debt.

“We believe the acquisition of CrownRock’s assets adds to the strongest and most differentiated portfolio that Occidental has ever had. We found CrownRock to be a strategic fit, giving us the opportunity to build scale in the Midland Basin and positioning us to drive value creation for our shareholders with immediate free cash flow accretion,” said Occidental President and Chief Executive Officer Vicki Hollub.

“We are excited about combining CrownRock’s high-performing team into our organization and expect to continue Occidental’s exceptional operational and financial results for years to come.”

CrownRock LP is a joint venture between CrownQuest Operating and Lime Rock Partners.

The acquisition is strategically aimed at enhancing Occidental's financial position, with expectations of delivering increased free cash flow on a diluted share basis.

The company anticipates generating $1 billion in the first year following the acquisition, based on a reference price of $70 per barrel for WTI crude oil.

Earlier today, Morgan Stanley analysts upgraded OXY's stock rating to Overweight.

OXY shares are down 0.3% in pre-market Monday.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY Death Cross is imminent

By: Barchart | December 8, 2023

• Occidental Petroleum $OXY Death Cross is imminent

Read Full Story »»»

DiscoverGold

DiscoverGold

all i know is warren buffet has a 25% stake in this company. im in

Occidental Petroleum falls on report of deal to acqurie CrownRock

By: Investing | November 30, 2023

Occidental Petroleum (NYSE:OXY) is in talks to buy Permian operator CrownRock for well over $10 billion, including debt, the Wall Street Journal reported overnight citing people familiar with the matter.

A deal between the two could be announced over the near term as long as talks don't fall apart or another suitor doesn't outbid Occidental.

Shares of Occidental traded down 1.5% mid-day amid the report.

CrownRock is one of the last remaining privately held companies in the Permian and produces about 150,000 barrels of oil equivalent a day.

Warren Buffett's Berkshire Hathaway owns a 26% stake in Occidental and commented in the past that they wouldn't seek to acquire the entire company.

Earlier in the fall, speculation suggested that oil giant Chevron (NYSE:CVX) was kicking the tires of Occidental, but talks between the two fizzled. In October, Chevron agreed to acquire Hess (NYSE:HES) in a $53 billion all-cash deal. This deal closely followed Exxon Mobil's nearly $60 billion all-stock deal for Pioneer Natural Resources (NYSE:PXD), highlighting the frenzy of deal activity in the sector.

Read Full Story »»»

DiscoverGold

DiscoverGold

Trexquant Investment LP Acquires Shares of 104,517 Occidental Petroleum Co. (OXY)

By: MarketBeat | November 25, 2023

• Trexquant Investment LP acquired a new stake in shares of Occidental Petroleum Co. (NYSE:OXY) during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm acquired 104,517 shares of the oil and gas producer's stock, valued at approximately $6,146,000...

Read Full Story »»»

DiscoverGold

DiscoverGold

$OXY $2.1 Million Put Seller • Strike: 60 • Expiration: 5/17/24

By: Cheddar Flow | November 16, 2023

• $OXY $2.1M Put Seller Looking to Collect Premium (Unusual)

Strike: 60

Expiration: 5/17/24

*At the Bid*

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum (OXY) beats quarterly profit estimates

By: Investing | November 7, 2023

(Reuters) - Occidental Petroleum (NYSE:OXY) beat estimates for third-quarter profit on Tuesday, as the U.S. oil and gas producer was aided by higher output amid sustained demand for energy.

On an adjusted basis, the company earned $1.18 per share, compared with average analysts' estimate of 84 cents per share, according to LSEG data.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY close below its 200D moving average

By: Barchart | October 30, 2023

• Occidental Petroleum $OXY close below its 200D moving average.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum's (OXY) debt situation raises potential risk for shareholders

By: Investing | October 30, 2023

Warren Buffett's stance on risk has highlighted the need for a thorough examination of Occidental Petroleum Corporation's (NYSE:OXY) debt status, which could present substantial risks to its shareholders. As of June 2023, the company's net debt stands at $18.6 billion, showing a decrease from the previous year's $22 billion. This figure takes into account cash reserves amounting to $486 million.

The company is faced with short-term liabilities of $7.15 billion, due within a year, and long-term liabilities amounting to $34.6 billion. The value of Occidental Petroleum's cash and near-term receivables is estimated at $3.33 billion, which creates a significant imbalance compared to its liabilities.

Despite Occidental Petroleum's considerable market capitalization of $55.1 billion, the company's financial situation could potentially lead to shareholder dilution. This arises from the possibility that the company may issue more shares to raise capital in order to manage its debt, which would reduce the proportionate ownership of existing shareholders.

Read Full Story »»»

DiscoverGold

DiscoverGold

Occidental Petroleum Insider Trading Alert...

By: Barchart | October 26, 2023

• Occidental Petroleum Insider Trading Alert

Warren Buffett is back! Berkshire Hathaway boosted its stake in $OXY with a purchase of 3.9 million shares. Berkshire now holds a 25.8% stake in the company worth $14.5 billion.

Read Full Story »»»

DiscoverGold

DiscoverGold

The sponsor OXY patch on the Houston Astro's baseball team shirts, didn't help. Might have been a target, don't swing until you see the white of the patch. Or the stadium sign for OXY. I think the team lost all of their games at home for the League playoff.

Occidental Petroleum (OXY) shares dip amid broader market slump

By: Investing | October 20, 2023

Occidental Petroleum Corp (NYSE:OXY).'s shares closed at $65.18 on Friday, reflecting a 1.93% decrease and marking a second consecutive day of losses amid a broader market downturn. The energy company's share price is now $10.93 below its one-year peak value of $76.11, which was achieved on November 7th, 2023.

The Friday slump also saw a notable drop in trading volumes for Occidental Petroleum, with only 8 million shares changing hands, significantly lower than the daily average trading volume of 9.3 million shares.

The downward trend was not confined to Occidental Petroleum alone. Other energy companies, such as Chevron Corp. (NYSE:CVX), EOG Resources Inc (NYSE:EOG)., and Pioneer Natural Resources (NYSE:PXD) Co., also experienced a fall in their stock prices on Friday, indicating a sector-wide impact of the market downturn.

Read Full Story »»»

DiscoverGold

DiscoverGold

Buffett's $OXY buy zone in 2023

By: TrendSpider | October 13, 2023

• Buffett's $OXY buy zone in 2023.

Read Full Story »»»

DiscoverGold

DiscoverGold

Chevron $CVX was reportedly interested in acquiring Occidental Petroleum $OXY as recently as the start of the year

By: Evan | October 8, 2023

Chevron $CVX was reportedly interested in acquiring Occidental Petroleum $OXY as recently as the start of the year

— Evan (@StockMKTNewz) October 8, 2023

Chevron has since moved on to other, smaller targets, people familiar with the matter said - WSJ

DiscoverGold

DiscoverGold

Occidental Petroleum $OXY poised to close under its 200 Day moving average

By: Barchart | October 4, 2023

• Occidental Petroleum $OXY poised to close under its 200 Day moving average.

Read Full Story »»»

DiscoverGold

DiscoverGold

New Mexico Educational Retirement Board Raises Stock Position in Occidental Petroleum Co. (OXY)

By: MarketBeat | September 27, 2023

• New Mexico Educational Retirement Board lifted its position in shares of Occidental Petroleum Co. (NYSE:OXY) by 5.1% during the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 35,359 shares of the oil and gas producer's stock after acquiring an additional 1,700 shares during the quarter. New Mexico Educational Retirement Board's holdings in Occidental Petroleum were worth $2,079,000 at the end of the most recent quarter...

Read Full Story »»»

DiscoverGold

DiscoverGold

Golden Cross is in for Occidental Petroleum $OXY

By: Barchart | September 12, 2023

• Golden Cross is in for Occidental Petroleum $OXY.

Read Full Story »»»

DiscoverGold

DiscoverGold

Wow, EIA expects higher oil prices through the remainder of 2023 as a result of declining global inventories

|

Followers

|

72

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

952

|

|

Created

|

08/16/05

|

Type

|

Free

|

| Moderators DiscoverGold | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |