Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hi mick, mining companies lagging in pps to ppo gold....

the bail outs & tarp have made trillions for the banksters -

about fiat9trillion sitting on the fence and look at

the trains going bye -

1929 was the same -

let the gen. market go down -

before all copycatz at the same tone -

got in and took over for peanuts the hard asset companies -

the one who wasn't in - had to stay out of the trains -

the picked up to much speed very fast -

history often repeat itself -

got gold ... its strategic safety bargains.. ![]()

NGX is a nice oldy gold producer ![]() dd....

dd....

http://www.northgateminerals.com ![]()

imo.

God Bless

mining companies lagging in pps to ppo gold.

nxg? maybe $5.00 soon.

Northgate Minerals C (AMEX:NXG) (USD) $3.36 UP $0.24 (+7.69% ![]()

Bid 3.36

Ask 3.37

Volume 4,241,438 good demand ![]()

Days Range 3.16 - 3.38

Last Trade 5/11/2010 3:45:43 PM

Click for detailed quote page

NXG

MONTHLY VOLUME REPORT;

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issue=nxg&SortBy=volume&Month=2-1-2010&IMAGE1.x=14&IMAGE1.y=5y

Northgate Minerals C (TSE:NGX)(USD)$3.21 UP $0.02 (+0.63% ![]()

Bid 3.20

Ask 3.21

Volume 580,306

Days Range 3.14 - 3.24

Last Trade 5/4/2010 3:16:17 PM

Click for detailed quote page

NXG

MONTHLY VOLUME REPORT;

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issue=nxg&SortBy=volume&Month=2-1-2010&IMAGE1.x=14&IMAGE1.y=5y

Northgate Minerals (TSE:NGX)(USD)$3.34 UP $0.14 (+4.38% ![]()

Bid 3.33

Ask 3.34

Volume 634,603 Good Demand ![]() khazars elite banksters nss gangs

khazars elite banksters nss gangs

have to dive cover ![]()

Days Range 3.22 - 3.39

Last Trade 4/30/2010 12:34:14 PM

Click for detailed quote page

it would be 33++++ with a level playing field -

without 666gov bailouts to the bankster gangster

traitors of US & Can Liberty & Freedom and some Law and Justice

to give the banksters live time in prison for robbing the people!

http://www.bibliotecapleyades.net/biggestsecret/biggestsecretbook/biggestsecret10.htm

Canada's 75 Billion Dollar Bank Bailout

It is directly related to a 75 billion dollar bank bailout program for Canada's chartered banks, announced, virtually unnoticed, four days before the ...

http://www.globalresearch.ca/index.php?context=va&aid=12007

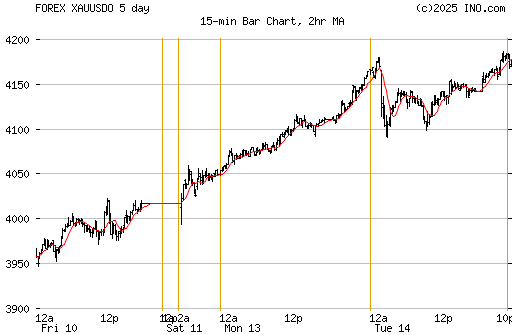

nice TA fer gold. seems like everytime gets into lower 60 rsi it goes higher. so 1400 gold looks like it may hit this summer.

mick thanks, NGX/NXG is on the right Au double bull track -

A good looking picture of Alan -

http://jessescrossroadscafe.blogspot.com/

on Tv he looked much worse -

Asian buyers to support gold as balance of power shifts

* ProactiveInvestors

Published 3/26/2010

Gold is likely to remain becalmed in the short to medium term,

as investors wait for significant signs that inflation

is coming back into the system.

But, in the longer term, a better understanding of Asian economies

is needed to fully understand where gold is going.

Investec investment strategist Michael Power, speaking to Mineweb

says that while the dollar is likely to remain the most important

currency cross to look at when considering the price of gold it is

becoming less and less important.

A significant positive move still seems more likely

than a negative one.

http://www.mineweb.co.za/mineweb/view/mineweb/en/page31?oid=101500&sn=Detail&pid=31

----

The cabals - banksters - fraudsters - feds ponzy schemes -

Khazar - Rothschilds -

CHAPTER FOUR - The Federal Advisory Council

http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed06c.htm#CHAPTER%20FIVE

The Thirteenth Tribe / Jázaros - La Treceava Tribu

http://www.bibliotecapleyades.net/esp_sociopol_khazar.htm

- An Introduction to The History of Khazaria -

http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_khazar07.htm

- The Khazars -

http://www.bibliotecapleyades.net/sociopolitica/audioletters/audioletters_50.htm#KHAZARS

#######

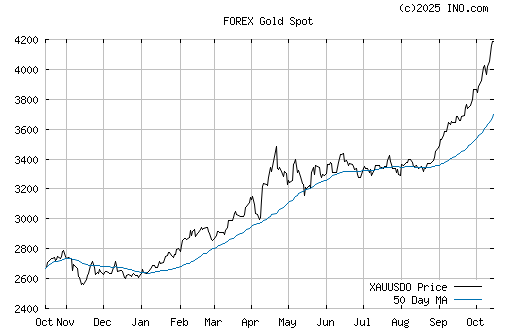

The Au bull has just started the bull run -

its a long bull run to the fair market price - ![]()

e.g.,

John Williams of Shadowstats calculates government numbers as they

were once reported before the inputs were changed in order to

make results appear better than they are in reality.

Using metrics of days gone by and not using seasonal adjustments

he calculated the inflation adjusted;

1980 high of $850,

to be $7,494/oz in today's devalued dollars

(i.e. 700% Higher gold).

That's more like it! ![]()

Northgate's Stawell Gold Mine Produces its Two Millionth Gold Ounce -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=47899798

dd..Au 100 year gold mines producer safety....

http://www.northgateminerals.com

God Bless

this is why i like point and figure chart. shows support and p.o.

i like,

now that is a gold mine.

Northgate's Stawell Gold Mine Produces its Two Millionth Gold Ounce

03.11.2010

Download this Press Release

STAWELL, VIC, Australia, March 11 /CNW/ - Northgate Minerals is pleased to announce that the Stawell Gold mine produced its

two millionth ounce of gold in the first week of March 2010. The mine hosted a special ceremony that was held at site, where local dignitaries and business representatives stood alongside past and present personnel at Stawell to celebrate this historic achievement.

Ken Stowe, President and CEO, commented: "The history of mining in the Stawell region is undeniable. With modern production of 26 years and an even longer history of gold production dating back to the mid-19th century, the Stawell mine has solidified itself as a world class operation with an excellent track record of resource conversion. Today not only represents a significant achievement for the company, but it also signals a bright future. With production forecast at 100,000 ounces and an exploration budget of over

$7 million to define additional reserves, we look to continue a long and successful operation for many more years to come."

The Stawell mine is located alongside the township of Stawell in central Victoria, approximately 250 kilometres west of Melbourne. The mine currently employs close to 400 people, including full-time employees and contractors. Together with the Fosterville Gold mine, located near Bendigo, the two operations are the largest gold producers in the state of Victoria.

Northgate wishes to congratulate all of those who have contributed to the successful and long history of the Stawell Gold mine and would also like to thank those who were in attendance at the commemorative event.

* * * * * *

Northgate Minerals Corporation is a gold and copper producer with mining operations, development projects and exploration properties in Canada and Australia. Our vision is to be the leading intermediate gold producer by identifying, acquiring, developing and operating profitable, long-life mining properties. We are forecasting gold production of 316,000 ounces in 2010.

* * * * * *

these look awfully good.

Northgate NXG P&F Bullisch Price Obj. $9.38 per share -

NXG chart TA 6 mon. consolidation -

building strength, breakout often be stronger ![]()

the more consolidation the higher it run ![]()

Detrended Price Oscillator (DPO) to turn UP start the bull run ![]()

Gold TI P&F chart Bullish Price Obj. $1,300.00 per ounce

Silver often follow Gold bull run or the Ag bull outperform it ![]()

God Bless

Northgate Minerals C (TSE:NGX)(USD)$3.08 UP $0.03 (+0.98% ![]()

Bid 3.06

Ask 3.08

Volume 1,073,683 strong demand ![]()

Days Range 2.99 - 3.08

Last Trade 3/4/2010 4:10:01 PM

Click for detailed quote page

Northgate Minerals C (AMEX:NXG)(USD)$2.96 UP $0.06 (+2.07% ![]()

Bid 2.96

Ask 3.00

Volume 2,507,710 good demand ![]()

Days Range 2.90 - 2.99

Last Trade 3/4/2010 4:00:38 PM

Click for detailed quote page

http://investorshub.advfn.com/boards/board.aspx?board_id=3041

Big Ego, Obama's Achilles' Heel

Our master of deception president accuses republicans of standing

in the way of his government run health care plan.

While in reality, the republicans do not have enough votes

to stop any item on Obama's unprecedented far left radical agenda.

Obama believed he could silence all descent from "we the people"

by playing the race card.

Yes, Obama, the all powerful, seemed unstoppable.

Who could have ever predicted that the weight of Obama's own

arrogance would trigger his demise?

Ego is Obama's......

http://www.newswithviews.com/Marcus/lloyd114.htm

by Lloyd Marcus

Government bailout/Tarp was a scam that made the situation worse?

http://taxfreeoffshoregold.blogspot.com/2010/02/sigtarp-barofsky-promises-handcuffs.html

FED GAVE Banks Access to 23.7 TRILLION DOLLARS NOT $700 Billion -

Yes fundamentals are in play BUT IMO short term ins and outs using 90 % TAs is more my style and enjoy it much more than keeping up with the talking heads and back door manipulation. IMO GOLD should be heck of a lot more than it is trading at current prices. I gave up on trying to play fundamentals LONG LONG time ago. I love daytrading for about 1 hour a day AND having the rest of the day for ME and my fam. My money and others I trade for is not in the markets more than 30 min a day. I'm NOT a buy on what he said she said type of guy BUT GOLD is one of a few "investments" that is good for insurance.

GLTY

jason

Jason thanks, all is well and I hope all

is well with you and the family,

nice to hear from you.

>>Even if he is right ?? JUST buy more LOL,<<

that's right, its on the long term LT my way.

He is a very good technician who looking at

the TA technical method of Elliott Wave swings;

to identify trends that contain the 5-wave Elliott

pattern.

Its a very good technical TA analys & indicator;

for ST and LT trading but the whole technical side

of the market is about 50%;

the fundamental side about 50%.

The Elliott wave TA analysis methods;

is one TA of 10 other good TA TI;

so its to try compare all of them and

the fundamental side.

>>Looks as if the dow is AND will be sinking along with

good opps for buying gold coming !!<<

Well, I think you are right;

Long Term LT; the dow down and gold UP -

Short term ST;

often when it goes fast down -

it goes fast Up again ![]()

even if its a consolidation period

in between -

..on the fundamental side a few;

700 TRILLION..that is what the estimate is for banksters derivatives!!

Don't forget;

FIAT CURRENCIES DOOMED!

http://www.dailypaul.com/node/46810

The Dollar Bubble -

Even if hes right ?? JUST buy more LOL. NYbob >> IC where you have posted to me on a private board >> I can't respond because I am not a paying customer on ihub any longer. I'm a flipper/trader sos many of my posts get deleted. As a customer I don't like paying for all the baby sitting BIG mods on ihub scanning my speach LOL. Hope all is well with ya and UR family !!!

Looks as if the dow is AND will be sinking along with good opps for buying gold coming !!

GLTY

jason

Gold still in a reflexion of 1979 -

1980 reflexion is still around the corner -

we have to get patience -

he had one good call in da 80's and since then not any with bites.

mick thanks.

http://www.ivarkreuger.com/chart.htm

reflexion is not at 1/3 up yet of 1979-80 ![]()

its a long bull run UP ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=5487

In The News

Posted: Jan 28 2010 By: Jim Sinclair

Post Edited: January 29, 2010

Filed under: In The News

http://jsmineset.com/

The government plans to raid our retirement savings too, will hijack 401ks to pay for it all since they refuse to stop spending.

"The government is like cancer. It will continue to grow and choke off its host until we die.

We need good surgeons like Dr. Paul";

by Montanore thanks,

http://moneymorning.com/2010/01/27/retirement-plans/

Money and Banking

Article 1, Section 8, Clause 5 grants only to Congress the power

"To coin Money [and] regulate the Value thereof", with no provision

for such power to be delegated to any other group.

Congress began immediately to fulfill this obligation with the

Mint Act of 1792, establishing a US Mint for producing

Gold and Silver based coin, prescribing the value and content

of each coin, and affixing the penalty of death to those

who debase such currency.

Article 1, Section 10: "No State shall ... coin Money;

emit Bills of Credit;

make any Thing but gold and silver Coin a Tender

in Payment of Debts".

Thus, the Constitution forbade the States from accepting or using

anything other than a Gold and Silver based currency.

Money functions as both a medium of exchange and a symbol

of a nation's morality.

The Founding Fathers established a system of "coin" money

that was designed to prohibit the "improper and wicked"

manipulation of the nation's medium of exchange while

guaranteeing the power of the citizens' earnings.

The federal government has departed from -

the principle

of "coin" money as defined by the U.S. Constitution and

the Mint Act of 1792

and has granted unconstitutional control

of the nation's monetary and banking system

to the private Federal Reserve System.

The Constitution Party recommends a substantive reform

of the system of Federal taxation.

In order for such reform to be effective, it is necessary

that these United States:

* Return to the money system set forth in the Constitution;

* Repeal the Federal Reserve Act, and reform the current

Federal Reserve banks to become clearing houses only; and

* Prohibit fractional reserve banking.

It is our intention that no system of "debt money" shall be imposed

on the people of these United States.

We support a debt free, interest free money system.

history often repeat itself -

http://www.constitutionparty.com/party_platform.php#Money%20and%20Banking

The Devaluation of the Dollar -

The Crash of 2009

(Mr. Glen Beck's Presentation)

he had one good call in da 80's and since then not any with bites.

is robert prechter wrong on fall back 40% gold?

To 'mick' on 'NORTHGATE MINERALS CORP (NGX:TSX) (TSE:NGX)' -

NGX/NXG LT trend goes with the Gold ![]()

Gold goes up - NGX goes Up Higher ![]()

http://www.northgateminerals.com/NewsReleases/NewsReleaseDetails/2010/NorthgateMineralsReportsRecordGoldProductionof362743Ouncesin20091121455/default.aspx

God Bless

thank you fer da chat.

U got it mick !!

time to step way >> I have also been flipping AAPL and am getting tired of setting in front of the streamer LOL. BUT that puppy was really good before the earnings came out. It was good for multiple flipps daily. It was like clock work the way the mms were pulling it back and forth WEEEEEEEEEEEE.

Have a good one my freind.

jason

if possible keep us in da circuit fer info. thanx,

well the chart and my indicators said get out around 1160. 40 % seems a little high to me also BUT There will be trading opps on the way down anyway. The chart will let me know when a BUY is confirmed ,-) which my lines and other indicators are very close for that to happen for a quick swing trade as we speak.

GLTY

jason

he even picked on gold drop to 40% which i think is high.

i think we have something like this every qtr.

Funny >> Got to talking to a roach coach vendor about 2 months ago and he was very happy he got most of his money back from the lows. I recommended to him >> look for an exit right now sos U can load up again in the 7000s LOL. Yes I agree with pretcher >> don't buy and hold anything other than GOLD for insurance reasons. My dad took it all out before the crash BUT he should have put it back in for the next ride IMO. Now it's time to take the money out and wait for the next crash.

j

OH BTW >> speaking of happy hour >> I have a real close friend of the family down here that WON the million dollar holiday raffle. Florida does 2 a year >> one on the 4th of July and then another on Dec 31. Only 9 people in the whole stae of Fl win a million and he was one those people !!!

He went and dropped BIG money on Apple >> don't know if that would have been my way to go >> well who am I kidding it would NOT be my choise. The hype behind the new product and earnings can reach up and bite a guy IMO BUT wish him well. Gotta have a plan and only put small %ages of an account on each trade BUT what do I know LOL.

jason

how did ya like robert prechter's thoughts?

Happy hour >> NOPE not for another 6 months or so >> still have some healing issues mick ,-(. But getting much better.

Right now I'm testing the waters sos let me have another few months to half a year trading and then I will post some links ,-).

I'm also thinking of testing ETFs out. Found a guy that has a very good track record with around 6 to 12 % a month average over 3 years with his tools depending if ya day trade em or just throw UR trades in before the market opens.

I still like trading the waves on the emotions and TAs with some pinkies LOL.

again >> GLTY >> in trading and life in general !!

jason

can you say where?

aren't you allowed happy hour?

OT: Hey mick >> I see where U asked me how I'm doing on Rush is the man board. I went free on ihub sos I can't talk with ya on the private boards. I'm doing much better and am working on my options. found another site and groups that are good for trading those puppies.

Hope all is well with ya mick and U 2 BOB

jason

Northgate Minerals (AMEX:NXG)fiat(USD) $ 3.37 UP $0.18 (+5.64% ![]()

Bid 3.35

Ask 3.40

Volume 3,827,471 Strong Demand ![]()

Day's Range 3.30 - 3.40

Last Trade 8:00:00 PM EST

Click for Detailed Quote Page

NXG gap has been filled ![]()

golden bargain opportunity ![]()

>>I think we go higher first.<< ![]()

well. NXG is a nice ride to profitville ![]()

dd...

http://www.northgateminerals.com

imo. tia.

God Bless

both could do it. with dubi it is partly done today.

NXG gap has to be filled ![]()

golden bargain opportunity ![]()

Well not bad but hopefully more Friday and next week. ![]()

well. NXG is a nice ride to profitville ![]()

dd...

http://www.northgateminerals.com ![]()

imo. tia.

God Bless

very closely related to each other.

NXG compared to Gold performance ![]()

NXG Chart TA LT signal bull outbreak ![]()

TI alert bull hiking back UP to Top Trend Line ![]()

Interesting but you cant fight momentum and IMO 4 is a given and hopefully much more longer term.... ![]()

LT Top trend line point at about +1500% ![]()

imo. tia.

God Bless

Northgate Reports Third Quarter Cash Flow of $50.5 million

11.03.2009

Cash on Hand Reaches $235.9 million

VANCOUVER, Nov. 3 /CNW/ -

(All figures in US dollars except where noted) -

Northgate Minerals Corporation ("Northgate" or the

"Corporation") (TSX: NGX; NYSE Amex: NXG) today announced its

financial and operating results for the fiscal quarter

ended September 30, 2009.

<<

Third Quarter 2009 Highlights

- Generated excellent cash flow from operations of $50.5

million or $0.20 per share, for a year-to-date

total of $145.7 million

- Reported adjusted net earnings of $7.7 million

or $0.03 per share

- Produced 80,791 ounces of gold

and 11.9 million pounds of copper at

an average net cash cost of $539 per ounce of gold

- Sold 85,397 ounces of gold

at a realized price of $982 per ounce

and 12.8 million pounds of copper

at a realized price of $3.39 per pound

- Successfully completed an equity offering for

net proceeds of $88.5 million to fund

the development of the Young-Davidson mine

- Northgate's cash balance at the end of

the third quarter 2009 was

$235.9 million

- Successful organic growth at Northgate's operations:

- Discovered a significant extension of mineralization

at Fosterville, confirming that the Phoenix fault

system continues down plunge

- Discovered a new gold zone located 300 metres (m)

east of current reserves at Young-Davidson.

The new zone is completely open down dip.

In addition to this discovery, Northgate also

reported drill results for 29 shallow diamond drill

holes located in and around historic mine workings

immediately east of current reserves, which

have the potential to add to the 2.8 million ounces

of reserves already on the property

- Identified approximately 870,000 tonnes of additional

mineral reserves containing 93,000 ounces at

Stawell, extending the mine-life until Q2-2012

>>

http://www.northgateminerals.com/NewsReleases/NewsReleaseDetails/2009/NorthgateReportsThirdQuarterCashFlowof505million1121187/default.aspx

Ken Stowe, President and CEO, stated:

"Northgate continued to generate excellent cash flow from

operations in the third quarter and is poised to generate

our highest annual operating cash flow in 2009, which is

highlighted by another record year of gold production.

In addition to this milestone, we have made great strides

at the Young-Davidson project through the signing of an

Impact and Benefits Agreement with the Matachewan First

Nation, the completion of a positive pre-feasibility study

and an $88.5 million equity offering at the end of September

to fund the development of the new Young-Davidson mine.

The feasibility study is well underway and we have approved

the restart of ramp development and shaft dewatering in the

fourth quarter in advance of breaking ground on construction

of the new mine infrastructure in 2010. With our treasury in

excellent shape, we look forward to building Young-Davidson

over the next two years and creating additional value for our

shareholders during the same period through continued reserve

additions at our mines and projects."

Financial Performance

Northgate recorded consolidated revenue of $120.2 million in

the third quarter of 2009, compared with $99.3 million in the

same period last year. Revenues were higher due to a 25%

increase in gold production over the same period last year

combined with higher realized metal prices for gold and

copper in the most recent quarter.

Revenues for the nine month period ending

September 30, 2009 were $374.3 million.

The net loss for the quarter was $8.6 million or $0.03 per

share compared with a net loss of $29.4 million or $0.12 per

share in the corresponding quarter of 2008.

Adjusted net earnings were $7.7 million or $0.03 per share

in the third quarter of 2009, which was significantly higher

than the adjusted net loss of $28.4 million or $0.11 per

share in the same period last year.

Adjusted net earnings do not include certain non-cash items

from its calculation of net earnings prepared in accordance

with Canadian generally accepted accounting principles.

Northgate has prepared this figure as it may be a useful

indicator to investors. Non-cash items in the third quarter

of 2009 include a $10.4 million write-down of investments

in auction rate securities and a $5.8 million (net of tax)

mark-to-market loss on Northgate's copper forward sales

contracts.

During the third quarter of 2009, Northgate generated

excellent cash flow from operations of $50.5 million or

$0.20 per share, which was a dramatic improvement over

the $0.6 million or $0.00 per share generated in the

corresponding quarter of 2008.

In the first three quarters of 2009, Northgate has generated

cash flow from operations of $145.7 million.

In the third quarter of 2009, Northgate's cash and cash

equivalents increased by $115.2 million following the

completion of a bought deal financing with net proceeds

of $88.5 million and strong free cash flow from operations.

Northgate's balance sheet now boasts cash and cash

equivalents of $235.9 million and each operation is expected

to generate strong operating cash flow for the balance of

the year.

Results from Operations

Fosterville Gold Mine

During the third quarter of 2009, a total of 201,130 tonnes

of ore were mined, following on the excellent performance

of 206,829 tonnes of ore mined in the previous quarter.

In addition, mine development advanced a record 2,362m

during the quarter.

Year-to-date mining rates have increased by over 60% since

Northgate took ownership of the mine in February 2008.

A total of 201,866 tonnes of ore were milled at a grade

of 4.51 grams per tonne (g/t) during the third quarter.

Although the mill continued to operate at higher than plan

throughput, mill head grades during the quarter were lower

than expected due to dilution on some of the stopes mined

and lower development grades.

Mill head grades are expected to improve in the fourth

quarter with the availability of higher grade stopes.

Fosterville produced a total of 25,550 ounces of gold during

the quarter, which was 65% higher than the 15,491 ounces

produced in the corresponding quarter last year.

However, production was lower than plan as a result of lower

than expected head grades mined, delays in the start up of

the carbon-in-leach (CIL) tails retreat and a five-day mill

shutdown in late September due to a process upset in

the BIOX(R) circuit caused by a power outage at site.

These issues have since been resolved and gold production

forecast in the fourth quarter remains unchanged

at 28,000 ounces.

Fosterville is expected to produce over 105,000 ounces

of gold for the full year 2009, which is a dramatic

improvement over the 66,959 ounces produced in

the previous year.

The net cash cost of production during the quarter was $612

per ounce of gold, dramatically lower than

the $940 per ounce recorded in the same period last year,

but significantly higher than the costs recorded earlier

in 2009 due to the rapid appreciation of the Australian

dollar relative to the US dollar.

Stawell Gold Mine

Record quarterly ore production was achieved at Stawell in

the third quarter, as 193,538 and 195,813 tonnes of ore

were mined and milled, respectively.

Underground mine development advanced a record 1,937m, which

will allow for more mining front flexibility in the future.

Gold production of 20,319 ounces was lower than forecast

as lower grade ore was mined due to changes in the stoping

sequence.

However, the record development advance in the third quarter

has established additional production fronts, which has

improved ore availability.

Stawell is forecast to produce 25,000 ounces of gold in

the fourth quarter,

for a total of 88,000 ounces of gold in 2009.

Unit operating costs were at record lows during the quarter,

as mining costs were A$56 per tonne of ore mined and

milling costs were A$23 per tonne of ore milled.

The net cash cost of production during the quarter

was $694 per ounce of gold,

which was lower than the $738 per ounce of gold recorded

in the same period last year.

The net cash cost in the most recent quarter was also

adversely affected by the strength of the Australian dollar

relative to the US dollar.

Kemess South

During the quarter,

Kemess posted gold and copper production of 34,922 ounces

and 11.9 million pounds, respectively, which was in line

with Northgate's production forecast.

The net cash cost of production was $395 per ounce of gold,

which was significantly lower than the $597 per ounce

reported in the corresponding quarter of 2008.

For the full year 2009,

Kemess is forecast to produce 172,000 ounces of gold

and 51.8 million pounds of copper

at a net cash cost of $403 per ounce.

While gold and copper production is in line with guidance,

the net cash cost is forecast to be significantly lower,

as a result of higher copper prices.

During the third quarter of 2009,

approximately 8.3 million tonnes of ore and waste were

removed from the open pit compared to 5.9 million tonnes

during the corresponding quarter of 2008.

The higher tonnes moved in the most recent quarter resulted

in significantly lower unit mining costs of

Cdn$1.25 per tonne moved compared with

Cdn$1.99 per tonne moved in the same period last year.

Gold and copper recoveries in the third quarter were higher

at 63% and 79%, respectively,

compared with 60% and 69% reported

in the third quarter of last year.

Recoveries in the most recent quarter are dramatically higher

due to improvements in the metallurgical process made earlier

in the year, which have made the flotation circuit more

efficient in processing lower grade ore with higher

sulphide content.

These improvements are noteworthy, as they will continue

to have a positive impact on the profitability of

the lower grade ore, which currently makes up

the remaining reserves at Kemess.

2009 Production Forecast

Northgate's production forecast is set to achieve an annual

record of 365,000 ounces of gold

at a net cash cost of $493 per ounce,

which has been revised slightly downwards form

the previous forecast of 382,500 ounces.

The annual production forecast for Kemess is in line with

initial estimates, however, the production forecasts

for Stawell and Fosterville have been reduced

as previously discussed.

Cash costs for the balance of 2009 are expected to be

slightly higher as a result of the stronger Canadian

and Australian dollar relative to the US dollar

and declining ore reserves at Kemess.

Northgate's production forecast for the balance of 2009

is outlined in the following table:

<<

Forecast Forecast

Actual (ounces) (ounces) 2009

--------------------------------------- Total Cash Cost

Q1 Q2 Q3 Q4 (ounces) ($/oz)(1)

-------------------------------------------------------------------------

Fosterville 25,779 25,416 25,550 28,000 105,000 $555

Stawell 22,392 20,066 20,319 25,000 88,000 $596

Kemess 59,306 47,895 34,922 30,000 172,000 $403

-------------------------------------------------------------------------

107,477 93,377 80,791 83,000 365,000 $493

-------------------------------------------------------------------------

(1) Assuming copper price of $2.75/lb and exchange rates of US$/Cdn$0.95

and US$/A$0.925 for Q4 2009.

>>

Moving Ahead with Young-Davidson

In July, Northgate released positive results from its pre-feasibility study for the Young-Davidson project and based on these results, immediately began work on a final feasibility study. During the third quarter, a trade-off study was completed on the underground shaft design required for mine operation. The decision was made to deepen the existing Matachewan Consolidated Mine (MCM) shaft to provide access to raise (rather than sink) a new Young-Davidson production shaft, with the potential to advance the start of underground ore production by up to one year. As a result, the MCM shaft dewatering activities and driving of the underground ramp at site have resumed. The feasibility study is progressing on schedule and is expected to be completed by the end of 2009.

Northgate took a critical step toward its goal of building a new mine at Young-Davidson during the quarter with the successful closing of an $88.5 million equity issue to fund the development of the mine. Preparations are underway to begin construction at Young-Davidson in 2010.

Environmental and permitting activities continued throughout the quarter in support of the project. In addition, the Young-Davidson management team continued to work with local First Nations, with consultations taking place on environmental permit applications and on the implementation of the recently signed IBA.

Exploration Overview

Fosterville Gold Mine

During the third quarter, Northgate's exploration efforts at Fosterville continued to deliver excellent results. Drilling in the Phoenix Deeps returned an intersection of 10.1 g/t gold over 6.7m, including 17.6 g/t gold over 3.7m, confirming that the Phoenix fault system continues down plunge. Follow-up drilling is now underway to confirm the width and grade of the mineralization in the area.

Drilling on the Phoenix Extension located just south of existing reserves was conducted in order to upgrade inferred mineral resources to reserve classification. Drilling in this area confirmed the continuity of mineralization down plunge from the current Phoenix orebody, indicating that any reserves ultimately defined can be mined using the existing infrastructure from the current production zone.

In the fourth quarter of the year, drilling will continue in the Phoenix extension area and these results combined with the results of the Harrier exploration program will be incorporated into an updated year-end reserve statement, which will be released in the first quarter of 2010.

Stawell Gold Mine

Following the increase in mineral reserves and resources announced in August, the exploration focus at Stawell has turned to definition and exploration drilling at newly discovered and existing zones in support of resource conversion and further mine-life extensions. To date, 39 holes totalling 39,600m have been completed.

Young-Davidson

At Young-Davidson, a new area of gold mineralization was discovered 300m east of current ore reserves when two geotechnical/condemnation holes intersected what appears to be the faulted off extension of the current syenite hosted Young-Davidson ore body. Several follow-up holes are currently being drilled to examine the extent of the mineralization in the area.

In addition, 29 shallow exploration holes totalling 2,424m were drilled immediately east of the current ore reserve in and around historic mine workings. The purpose of the drill program was to assess the potential for high-grade mafic volcanic hosted gold mineralization within 50m of surface, which would have the potential to add open pit reserves in and around existing mine workings.

The mafic volcanic exploration program returned a substantial number of gold intercepts: hole YD09-120 intersected 7.6 g/t gold over 13.5m and hole YD09-114 intersected 13.8 g/t gold over 2.0m and 7.1 g/t gold over 3.8m. Future work will include additional holes along strike to the east and a compilation of data to determine if there are further open pit resources.

<<

Summarized Consolidated Results

(Thousands of

US dollars,

except where

noted) Q3 2009 Q3 2008 YTD 2009 YTD 2008(1)

-------------------------------------------------------------------------

Financial Data

Revenue $ 120,163 $ 99,267 $ 374,278 $ 324,240

Adjusted net

earnings(2) 7,660 (28,385) 45,030 9,871

Per share

(diluted) 0.03 (0.11) 0.18 0.04

Net earnings (8,563) (29,438) 18,249 (7,926)

Per share

(diluted) (0.03) (0.12) 0.07 (0.03)

Cash flow from

operations 50,452 638 145,651 56,947

Cash and cash

equivalents 235,929 71,700 235,929 71,700

Total assets $ 787,940 $ 608,589 $ 787,940 $ 608,589

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Operating Data

Gold production

(ounces)

Fosterville 25,550 15,491 76,745 40,561(3)

Stawell 20,319 20,956 62,777 72,126

Kemess 34,922 28,141 142,123 123,848

---------------------------------------------------

Total gold

production 80,791 64,588 281,645 236,535

---------------------------------------------------

Gold sales (ounces)

Fosterville 27,114 14,866 78,352 32,551

Stawell 20,172 22,367 64,415 55,651

Kemess 38,111 27,452 149,886 122,303

---------------------------------------------------

Total gold sales 85,397 64,685 292,653 210,505

---------------------------------------------------

Realized gold price

($/ounce)(4) 982 868 944 900

---------------------------------------------------

Net cash cost

($/ounce)(5)

Fosterville 612 940 526 1,086

Stawell 694 738 573 650

Kemess 395 597 373 212

---------------------------------------------------

Average net cash

cost ($/ounce) 539 725 459 465

---------------------------------------------------

Copper production

(pounds) 11,934 9,195 40,746 37,515

Copper sales (pounds) 12,816 8,633 40,795 38,089

Realized copper price

($/pound)(4) 3.39 2.04 2.70 3.49

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(1) Gold sales, cash costs and Financial Data in YTD 2008 include the

results for Fosterville and Stawell from the date of acquisition of

February 19, 2008.

(2) Adjusted net earnings is a non-GAAP measure. See section entitled

"Non-GAAP Measures" in the Corporation's third quarter MD&A Report.

(3) Production in YTD 2008 for Fosterville excludes the change in gold-

in-circuit inventory previously recorded.

(4) Metal pricing quotational period for Kemess is three months after the

month of arrival (MAMA) at the smelting facility for copper and gold.

Therefore, realized prices reported will differ from the average

quarterly reference prices, since realized price calculations

incorporate the actual settlement price for prior period sales, as

well as the forward price profiles of both metals for unpriced sales

at the end of the quarter.

(5) Net cash cost per ounce of production is a non-GAAP measure. See

section entitled "Non-GAAP Measures" in the Corporation's third

quarter MD&A Report. Cash costs in YTD 2008 include the results for

Fosterville and Stawell from the date of acquisition of February 19,

2008.

Interim Consolidated Balance Sheets

September 30 December 31

Thousands of US dollars 2009 2008

-------------------------------------------------------------------------

(Unaudited)

Assets

Current Assets

Cash and cash equivalents $ 235,929 $ 62,419

Trade and other receivables 32,126 18,310

Income taxes receivable - 6,837

Inventories (note 3) 35,914 41,546

Prepaids 886 1,989

Future income tax asset 6,670 5,259

-------------------------------------------------------------------------

311,525 136,360

Other assets 27,172 53,606

Deferred transaction costs (note 6) - 775

Future income tax asset 4,638 3,741

Mineral property, plant and equipment 408,491 357,725

Investments (note 4) 36,114 39,422

-------------------------------------------------------------------------

$ 787,940 $ 591,629

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Liabilities and Shareholders' Equity

Current Liabilities

Accounts payable and accrued liabilities $ 51,026 $ 56,469

Income taxes payable 26,891 -

Short-term loan (note 5) 41,825 43,096

Capital lease obligations 4,996 4,533

Provision for site closure and reclamation

costs 24,905 8,420

Future income tax liability - 1,895

-------------------------------------------------------------------------

149,643 114,413

Capital lease obligations 4,014 6,211

Other long-term liabilities 5,903 3,368

Site closure and reclamation obligations 25,564 37,849

Future income tax liability - 14,350

-------------------------------------------------------------------------

185,124 176,191

Shareholders' Equity

Common shares (note 6) 401,993 311,908

Contributed surplus 6,091 5,269

Accumulated other comprehensive loss (11,281) (89,503)

Retained earnings 206,013 187,764

-------------------------------------------------------------------------

602,816 415,438

-------------------------------------------------------------------------

$ 787,940 $ 591,629

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The accompanying notes form an integral part of these unaudited interim

consolidated financial statements.

Interim Consolidated Statements of Operations and Comprehensive Income

(Loss)

Thousands of

US dollars,

except share

and per share

amounts, Three Months Ended Sep 30 Nine Months Ended Sep 30

unaudited 2009 2008 2009 2008

-------------------------------------------------------------------------

Revenue $ 120,163 $ 99,267 $ 374,278 $ 324,240

-------------------------------------------------------------------------

Cost of sales

(note 3) 81,959 83,720 228,011 249,087

Depreciation and

depletion 27,804 20,172 77,393 49,005

Administrative and

general 2,424 2,963 7,062 9,190

Net interest income (112) (1,157) (1,022) (6,320)

Exploration 3,132 10,247 11,872 27,765

Currency translation

loss (gain) 1,262 (40) 4,638 (6,947)

Accretion of site

closure and

reclamation

obligations 802 665 2,301 1,619

Write-down of

auction rate

securities

(note 4) 10,440 16,912 10,948 16,912

Other expense

(income) (note 11) (125) (106) (953) (10,682)

-------------------------------------------------------------------------

127,586 133,376 340,250 329,629

-------------------------------------------------------------------------

Earnings (loss)

before income

taxes (7,423) (34,109) 34,028 (5,389)

Income tax

recovery (expense)

Current (5,333) 2,779 (30,453) (5,658)

Future 4,193 1,892 14,674 3,121

-------------------------------------------------------------------------

(1,140) 4,671 (15,779) (2,537)

-------------------------------------------------------------------------

Net earnings (loss)

for the period (8,563) (29,438) 18,249 (7,926)

Other comprehensive

income (loss)

Unrealized gain

(loss) on available

for sale

securities (3,622) (15,713) (3,308) (22,838)

Unrealized gain

(loss) on

translation of

self-sustaining

operations 29,527 (59,809) 70,582 (44,124)

Reclassification

of other than

temporary loss on

available for sale

securities to net

earnings 10,440 16,912 10,948 16,912

-------------------------------------------------------------------------

36,345 (58,610) 78,222 (50,050)

-------------------------------------------------------------------------

Comprehensive

income (loss) $ 27,782 $ (88,048) $ 96,471 $ (57,976)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Net earnings

(loss) per share

Basic $ (0.03) $ (0.12) $ 0.07 $ (0.03)

Diluted (0.03) (0.12) 0.07 (0.03)

Weighted average

shares

outstanding

Basic 256,014,978 255,467,109 255,876,448 255,157,746

Diluted 256,014,978 255,467,109 256,390,058 255,157,746

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The accompanying notes form an integral part of these interim

consolidated financial statements.

Interim Consolidated Statements of Cash Flows

Thousands

of US dollars, Three Months Ended Sep 30 Nine Months Ended Sep 30

unaudited 2009 2008 2009 2008

-------------------------------------------------------------------------

Operating

activities:

Net earnings

(loss) for

the period $ (8,563) $ (29,438) $ 18,249 $ (7,926)

Non-cash items:

Depreciation

and depletion 27,804 20,172 77,393 49,005

Unrealized

currency

translation

loss (gain) 3,828 (42) 3,819 (4,311)

Unrealized gain

on derivative - - - (9,836)

Accretion of site

closure and

reclamation

obligations 802 665 2,301 1,619

Loss on disposal

of assets 93 156 276 112

Amortization of

deferred charges 89 54 196 161

Stock-based

compensation 352 417 1,106 1,730

Accrual of employee

severance costs 197 662 1,527 969

Future income

tax recovery (4,193) (1,892) (14,674) (3,121)

Change in fair

value of forward

contracts 8,262 (22,984) 22,619 15,537

Writedown of

auction rate

securities 10,440 16,912 10,948 16,912

Changes in operating

working capital

and other (note 12) 11,341 15,956 21,891 (3,903)

-------------------------------------------------------------------------

50,452 638 145,651 56,948

-------------------------------------------------------------------------

Investing activities:

Release of

restricted cash - 14,340 - 67,496

Increase in

restricted cash (302) (811) (438) (24,723)

Purchase of plant

and equipment (7,945) (3,445) (26,833) (20,524)

Mineral property

development (15,047) (10,664) (32,667) (23,959)

Transaction costs

paid - (679) - (2,912)

Acquisition of

Perseverance,

net of cash

acquired - - - (196,590)

Repayment of

Perseverance hedge

portfolio - - - (45,550)

Proceeds from sale

of equipment 21 13 331 3,234

-------------------------------------------------------------------------

(23,273) (1,246) (59,607) (243,528)

-------------------------------------------------------------------------

Financing activities:

Repayment of

capital lease

obligations (1,145) (1,508) (3,804) (4,916)

Financing from

credit facility 139 389 398 8,745

Repayment of credit

facility (468) (797) (1,667) (9,961)

Repayment of other

long-term

liabilities (4) - (328) (746)

Issuance of common

shares 88,525 173 88,801 1,700

-------------------------------------------------------------------------

87,047 (1,743) 83,400 (5,178)

-------------------------------------------------------------------------

Effect of exchange

rate changes on

cash and cash

equivalents 944 (2,825) 4,066 (2,587)

-------------------------------------------------------------------------

Increase (decrease)

in cash and cash

equivalents 115,170 (5,176) 173,510 (194,345)

Cash and cash

equivalents,

beginning of

period 120,759 76,876 62,419 266,045

-------------------------------------------------------------------------

Cash and cash

equivalents,

end of period $ 235,929 $ 71,700 $ 235,929 $ 71,700

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Supplementary cash flow information (note 12)

Interim Consolidated Statement of Shareholders' Equity

Number of Common

Thousands of US dollars, Common Shares Contributed

except common shares, unaudited Shares Amount Surplus

-------------------------------------------------------------------------

Balance at December 31, 2007 254,452,862 $ 309,455 $ 3,940

Transitional adjustment on

adoption of inventory standard - - -

Shares issued under employee

share purchase plan 382,909 406 -

Shares issued on exercise of

options 881,300 1,846 (492)

Stock-based compensation - 201 1,821

Net earnings - - -

Other comprehensive income - - -

-------------------------------------------------------------------------

Balance at December 31, 2008 255,717,071 311,908 5,269

Shares issued under new equity

offering (note 6) 34,300,000 89,234 -

Shares issued under

employee share purchase plan 243,864 301 -

Shares issued on exercise of

options 144,000 398 (132)

Stock-based compensation - 152 954

Net earnings - - -

Other comprehensive income - - -

-------------------------------------------------------------------------

Balance at September 30, 2009 290,404,935 $ 401,993 $ 6,091

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Accumulated

Other

Thousands of US dollars, Comprehensive Retained

except common shares, unaudited Income (loss) Earnings Total

-------------------------------------------------------------------------

Balance at December 31, 2007 $ (3,282) $ 176,663 $ 486,776

Transitional adjustment on

adoption of inventory standard - 381 381

Shares issued under employee

share purchase plan - - 406

Shares issued on exercise of

options - - 1,354

Stock-based compensation - - 2,022

Net earnings - 10,720 10,720

Other comprehensive income (86,221) - (86,221)

-------------------------------------------------------------------------

Balance at December 31, 2008 (89,503) 187,764 415,438

Shares issued under new equity

offering (note 6) - - 89,234

Shares issued under

employee share purchase plan - - 301

Shares issued on exercise of

options - - 266

Stock-based compensation - - 1,106

Net earnings - 18,249 18,249

Other comprehensive income 78,222 - 78,222

-------------------------------------------------------------------------

Balance at September 30, 2009 $ (11,281) $ 206,013 $ 602,816

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The accompanying notes form an integral part of these interim consolidated

financial statements.

---------------------

This press release should be read in conjunction with the Corporation's

third quarter MD&A report and accompanying unaudited interim consolidated

financial statements, which can be found on Northgate's website at

www.northgateminerals.com, in the "Investor Info" section, under "Financial

Reports - Quarterly Reports".

---------------------

>>

Q3 2009 Financial Results - Conference Call and Webcast

You are invited to participate in today's live conference call and webcast discussing our third quarter financial results. The conference call and webcast will be held at 10:00 amToronto time.

You may participate in the Northgate Conference Call by calling 416-644-3425 or toll free in North America at 1-800-594-3790. To ensure your participation, please call five minutes prior to the scheduled start of the call.

A live audio webcast and presentation package will be available on Northgate's homepage at www.northgateminerals.com.

Conference Replay

A replay of the conference call will be available beginning on November 3, 2009 at 12:00 p.m. ET until November 17, 2009 at 11:59 p.m. ET.

<<

Replay Access No. 416-640-1917 Passcode: 4167 983 followed by the

number sign

Replay Access No. 877-289-8525 Passcode: 4167 983 followed by the

number sign

--------------------

>>

Northgate Minerals Corporation is a gold and copper producer with mining operations, development projects and exploration properties in Canada and Australia. The company is forecasting record gold production of 365,000 ounces in 2009 and is targeting growth through further acquisition opportunities in stable mining jurisdictions around the world.

<<

--------------------

>>

Cautionary Note Regarding Forward-Looking Statements and Information:

This Northgate press release contains "forward-looking information", as such term is defined in applicable Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995, concerning Northgate's future financial or operating performance and other statements that express management's expectations or estimates of future developments, circumstances or results. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects", "believes", "anticipates", "budget", "scheduled", "estimates", "forecasts", "intends", "plans" and variations of such words and phrases, or by statements that certain actions, events or results "may", "will", "could", "would" or "might" "be taken", "occur" or "be achieved". Forward-looking information is based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Northgate operates, are inherently subject to significant operational, economic and competitive uncertainties and contingencies. Northgate cautions that forward-looking information involves known and unknown risks, uncertainties and other factors that may cause Northgate's actual results, performance or achievements to be materially different from those expressed or implied by such information, including, but not limited to gold and copper price volatility; fluctuations in foreign exchange rates and interest rates; the impact of any hedging activities; discrepancies between actual and estimated production, between actual and estimated reserves and resources or between actual and estimated metallurgical recoveries; costs of production; capital expenditure requirements; the costs and timing of construction and development of new deposits; and the success of exploration and permitting activities. In addition, the factors described or referred to in the section entitled "Risk Factors" in Northgate's Annual Information Form for the year ended December 31, 2008 or under the heading "Risks and Uncertainties" in Northgate's 2008 Annual Report, both of which are available on the SEDAR website at www.sedar.com, should be reviewed in conjunction with the information found in this press release. Although Northgate has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in forward-looking information, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate or that management's expectations or estimates of future developments, circumstances or results will materialize. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information in this press release is made as of the date of this press release, and Northgate disclaims any intention or obligation to update or revise such information, except as required by applicable law.

%CIK: 0000072931

Flip~Ant, well NXG shorts get Short % Decrease -22.19 %

Short Squeeze Ranking ![]()

A great day and hopefully we can blast through 3.00 tomorrow. ![]()

the rest of the shorts may get their margin calls soon ![]()

NXG TA consolidated and built strenghts to next bull wave ![]()

NXG Gold Spot (FOREX:XAUUSDO) $ 1101.80 per ounce ![]()

Last trade 1100.71 Change -1.09 (-0.10%)

Open 1101.80 Previous Close 1101.8

High 1102.30 Low 1100.60

Bid 1100.71 Ask 1101.35

2009-11-10 00:14:59, 0 min delay

imo. tia.

God Bless

Northgate Minerals C (TSE:NGX)fiat(CAD)$ 3.0 UP $0.06 (+2.04% ![]()

Bid 2.99

Ask 3.00

Volume 1,466,426

Day's Range 2.92 - 3.01

Last Trade 2:51:13 PM EST

Click for Detailed Quote Page

Northgate Minerals C (TSE:NGX)

Last Price (CAD)

$ 2.97

Change 0.04 (1.37% ![]()

Bid 2.97

Ask 2.98

Volume 377,856

Day's Range 2.97 - 3.01

Last Trade 10:45:03 AM EDT

Click for Detailed Quote Page

|

Followers

|

9

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

540

|

|

Created

|

03/30/06

|

Type

|

Free

|

| Moderators | |||

http://www.northgateminerals.com/

http://www.northgateminerals.com/OperationsProjects/KemessSouth/default.aspx

http://www.northgateminerals.com/OperationsProjects/Young-Davidson/default.aspx

http://www.northgateminerals.com/OperationsProjects/KemessNorth/default.aspx

http://www.northgateminerals.com/OperationsProjects/Exploration/default.aspx

Northgate Minerals Corporation is a gold and copper mining

company focused on operations and opportunities in the Americas.

The Corporation's principal assets are the Kemess South mine in

north-central British Columbia and the Young-Davidson property

in northern Ontario. Northgate is listed on the Toronto Stock

Exchange under the symbol NGX and on the American Stock Exchange

under the symbol NXG.

Northgate Minerals presentation -

http://216.128.10.207/Theme/Northgate/files/pdf/presentation/Northgate_Minerals_Scotia_Conference_November_28.pdf

Northgate prides itself in its strong operating abilities and

has gained a reputation as one of the finest operators

in the business.

This reputation is based on the Corporation's outstanding track

record of delivering on its promises. Over the past seven years,

a dedicated and knowledgeable workforce has transformed

Kemess into one of the most efficient open pit mines

in the world.

In 2006, exceptional operating performance at

Kemess, combined with a strong metal price environment,

produced record earnings of $107 million and record cash flow

of almost $147 million.

As the Corporation moves forward into 2007 and beyond,

the culture of operational excellence that exists

within Northgate will provide a solid foundation for growth

in pursuit of the Corporation's vision of becoming a

larger, multi-mine gold producer.

Our 2006 Achievements:

* Produced record metal production: 310,296 ounces of gold; 81.2 million pounds of copper

* Recorded lowest gold cash cost of negative $56 per ounce, one of the lowest cash costs in the industry

* Generated record cash flow and earnings

* Increased Young-Davidson total resource base to 2.1 million ounces

* Share price appreciation of 92% (52-week high of Cdn$5.15)

Our 2007 Objectives:

* Deliver forecast metal production at Kemess

* Advance Young-Davidson on schedule and on budget

* Extend mine-life within Kemess camp

* Continue to generate strong free cash flow position

* Grow through acquisition, development and exploration

* Build Northgate into a leading multi-mine gold company

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |