Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The future looks promising - AuRico Gold Announces Inaugural Dividend Policy

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=85048747

Aurico Gold is practically debt-free, bought back a lot of shares and

announced a dividend.

Moreover, I expect some news through the company website.

The following news mentioning Aurico being in a strategic alliance

with a TSXV company was found on this company's website:

http://www.rogueiron.com/s/news.asp?ReportID=567232.

Aurico has not mentioned it yet.

The future looks promising - AuRico Gold Announces Inaugural Dividend Policy

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=85048747

Aurico Gold is practically debt-free, bought back a lot of shares and

announced a dividend.

Moreover, I expect some news through the company website.

The following news mentioning Aurico being in a strategic alliance

with a TSXV company was found on this company's website:

http://www.rogueiron.com/s/news.asp?ReportID=567232.

Aurico has not mentioned it yet.

AUQ chart is heading in north after the dip. BOL

I believe the Chinese will step in to the gold market and

support at these levels because they have a populace which

owns a lot of it, and they certainly have the wherewithal

to fight any 666 selling, especially if that selling is

short 666 selling.

So I’m very bullish.

I’m flat out 888 bullish on Gold.

http://countdowntozerotime.org/2013/02/22/china-will-have-worlds-largest-gold-reserves-in-2-to-3-years/

AuRico Gold plans to buy back USD$300mn in shares

Marc Howe | December 18, 2012

http://www.mining.com/aurico-gold-plans-to-buy-back-usd300-in-shares-91044/

http://www.biblebelievers.org.au/monie.htm

http://www.888c.com

God Bless

Ps.

the new symbol for NGX is AUQ AuRico Gold Inc. -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

the new symbol for NGX is AUQ AuRico Gold Inc. -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

the new symbol for NGX is AUQ AuRico Gold Inc. -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

the new symbol for NGX is AUQ AuRico Gold Inc. -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

the new symbol for NGX is AUQ AuRico Gold Inc. -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

mick the new symbol for NGX is AUQ AuRico Gold Inc. ![]() -

-

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

AUQ $GOLD TA Intact LT Trend Bull Breakout ![]()

GOLD Chart TA P&F LT Bullish Price Objective $1960.0/oz next Target ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72648018

inflation is coming our way. That's what I'm worried about.

I'd rather keep my money safe from inflation... ![]()

Project Remains on Schedule for Production by the End of Q1 2012

AuRico Gold Inc.

(TSX: AUQ) (NYSE: AUQ), ("AuRico", "AuRico Gold" or "the

Company) is pleased to provide the first monthly status update

on the exciting

Young-Davidson mine

located in the prolific Abitibi gold belt in Northern Ontario.

The Company remains on schedule to achieve the first gold pour

by the end of the first quarter of 2012.

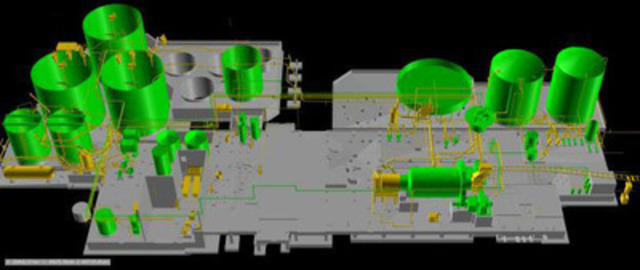

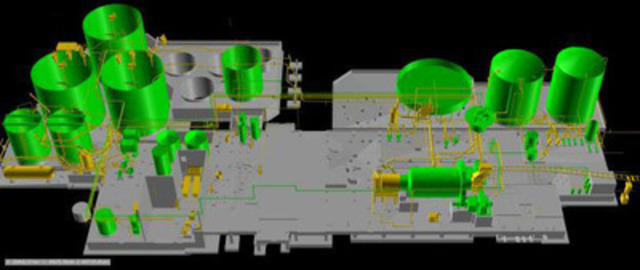

Young-Davidson Project Construction Update

The Young-Davidson Project remains on schedule nearing

completion of the 18-month pre-production construction phase.

Mill processing construction for commissioning is 92% complete

(see figure 1).

Over 900 contractors and employees are working towards

achieving the first gold pour by the end of March 2012.

"The entire operating team at Young-Davidson remains focused

on realizing production by the end of the first quarter and

remains confident that this milestone continues to be

achievable.

As well, the stockpile of open pit ore will ensure there is

sufficient mill feed as we ramp up to commercial production.

We will continue to provide monthly status reports that will

keep investors up to date with our progress as we move from

construction to commissioning and onward to commercial

production," stated Peter MacPhail, Chief Operating Officer,

Canada and Australia.

He continued, "I would like to congratulate all construction and

operating personnel for recently achieving 1,350,000 man-hours

without recording a lost time injury.

This is a tremendous achievement, particularly on a construction

project of this scale."

The following major project milestones have been achieved:

Mill systems required for initial production are 92% complete.

All required equipment is on site.

Mechanical and electrical / instrumentation construction teams

have started commissioning activities on process equipment

required for initial production, while personnel prepare for

operational readiness.

Open pit operations commenced in November 2011 and are ramping

up to targeted levels of 35,000 tonnes per day of ore and

waste.

Approximately 160,000 ore tonnes (approximately one-month mill

feed) have already been stockpiled for processing beginning in

mid-March.

Wet commissioning of the mill is on track for early March.

All senior operating personnel are in place.

Completion of the 115 kV power line and successful commissioning

of the site substation.

Underground development continues to focus on ramp and shaft

access to the 9,590 level (760 meters below surface) where the

mid-shaft ore and waste handling systems will be installed.

Raise boring of the second leg of the production shaft is

scheduled to begin mid-year.

About AuRico Gold

AuRico Gold is a leading intermediate Canadian gold and silver

producer with a diversified portfolio of properties in Canada,

Mexico and Australia.

The Company currently has five operating properties including

the Ocampo mine in Chihuahua State, the El Chanate mine in

Sonora State, the El Cubo mine in Guanajuato State, as well as

the Fosterville and Stawell gold mines in Victoria, Australia.

The first production from the exciting Young-Davidson gold mine

in northern Ontario is targeted by the end of Q1 2012 as the

mine ramps up to over 200,000 ounces of annual production by

2015.

AuRico's strong pipeline of development and exploration stage

projects includes advanced development properties in Mexico and

British Columbia and several highly prospective exploration

properties in Mexico.

AuRico's head office is located in Toronto, Ontario, Canada.

Image with caption: "Figure 1: Initial Production Model of mill facility. (Items in green have been installed. Installation of items in yellow are in progress.(CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 2: Mill exterior. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 3: Mill interior. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 4: Open pit operations. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 5: Open pit production drill. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 6: Headframe construction for Northgate shaft. (CNW Group/AuRico Gold Inc.)". Image available at:

For further information:

Please visit the AuRico Gold website at

http://www.auricogold.com

or contact:

René Marion

President & Chief Executive Officer

AuRico Gold Inc.

+1-647-260-8880

Anne Day

Director of Investor Relations

AuRico Gold Inc.

+1-647-260-8880

God Bless

AUQ $GOLD TA Intact LT Trend Bull Breakout ![]()

GOLD Chart TA P&F LT Bullish Price Objective $1960.0/oz next Target ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72648018

inflation is coming our way. That's what I'm worried about.

I'd rather keep my money safe from inflation... ![]()

Project Remains on Schedule for Production by the End of Q1 2012

AuRico Gold Inc.

(TSX: AUQ) (NYSE: AUQ), ("AuRico", "AuRico Gold" or "the

Company) is pleased to provide the first monthly status update

on the exciting

Young-Davidson mine

located in the prolific Abitibi gold belt in Northern Ontario.

The Company remains on schedule to achieve the first gold pour

by the end of the first quarter of 2012.

Young-Davidson Project Construction Update

The Young-Davidson Project remains on schedule nearing

completion of the 18-month pre-production construction phase.

Mill processing construction for commissioning is 92% complete

(see figure 1).

Over 900 contractors and employees are working towards

achieving the first gold pour by the end of March 2012.

"The entire operating team at Young-Davidson remains focused

on realizing production by the end of the first quarter and

remains confident that this milestone continues to be

achievable.

As well, the stockpile of open pit ore will ensure there is

sufficient mill feed as we ramp up to commercial production.

We will continue to provide monthly status reports that will

keep investors up to date with our progress as we move from

construction to commissioning and onward to commercial

production," stated Peter MacPhail, Chief Operating Officer,

Canada and Australia.

He continued, "I would like to congratulate all construction and

operating personnel for recently achieving 1,350,000 man-hours

without recording a lost time injury.

This is a tremendous achievement, particularly on a construction

project of this scale."

The following major project milestones have been achieved:

Mill systems required for initial production are 92% complete.

All required equipment is on site.

Mechanical and electrical / instrumentation construction teams

have started commissioning activities on process equipment

required for initial production, while personnel prepare for

operational readiness.

Open pit operations commenced in November 2011 and are ramping

up to targeted levels of 35,000 tonnes per day of ore and

waste.

Approximately 160,000 ore tonnes (approximately one-month mill

feed) have already been stockpiled for processing beginning in

mid-March.

Wet commissioning of the mill is on track for early March.

All senior operating personnel are in place.

Completion of the 115 kV power line and successful commissioning

of the site substation.

Underground development continues to focus on ramp and shaft

access to the 9,590 level (760 meters below surface) where the

mid-shaft ore and waste handling systems will be installed.

Raise boring of the second leg of the production shaft is

scheduled to begin mid-year.

About AuRico Gold

AuRico Gold is a leading intermediate Canadian gold and silver

producer with a diversified portfolio of properties in Canada,

Mexico and Australia.

The Company currently has five operating properties including

the Ocampo mine in Chihuahua State, the El Chanate mine in

Sonora State, the El Cubo mine in Guanajuato State, as well as

the Fosterville and Stawell gold mines in Victoria, Australia.

The first production from the exciting Young-Davidson gold mine

in northern Ontario is targeted by the end of Q1 2012 as the

mine ramps up to over 200,000 ounces of annual production by

2015.

AuRico's strong pipeline of development and exploration stage

projects includes advanced development properties in Mexico and

British Columbia and several highly prospective exploration

properties in Mexico.

AuRico's head office is located in Toronto, Ontario, Canada.

Image with caption: "Figure 1: Initial Production Model of mill facility. (Items in green have been installed. Installation of items in yellow are in progress.(CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 2: Mill exterior. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 3: Mill interior. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 4: Open pit operations. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 5: Open pit production drill. (CNW Group/AuRico Gold Inc.)". Image available at:

Image with caption: "Figure 6: Headframe construction for Northgate shaft. (CNW Group/AuRico Gold Inc.)". Image available at:

For further information:

Please visit the AuRico Gold website at

http://www.auricogold.com

or contact:

René Marion

President & Chief Executive Officer

AuRico Gold Inc.

+1-647-260-8880

Anne Day

Director of Investor Relations

AuRico Gold Inc.

+1-647-260-8880

God Bless

Northgate Minerals C (NGX)

3.71 ? 0.0 (0.00%)

Volume: 0 @- ET

Bid Ask Day's Range

- - - - -

TSE:NGX Detailed Quote Wiki

AuRico Gold NYSE AUQ formerly known as Gammon Gold -

bought and amalgamated with Northgate -

http://investorshub.advfn.com/boards/board.aspx?board_id=9242

Northgate Minerals C (NGX)

3.71 ? 0.0 (0.00%)

Volume: 0 @- ET

Bid Ask Day's Range

3.67 3.81 - - -

TSE:NGX Detailed Quote Wiki

mick, that's right, had wanted to see NGX above $10 first -

but we shareholders still have to approve it -

I hope the deal still be turned down but

we did gain about 25% and its positive ![]()

have to now compare it with the CALVF -

low cost gold producer leader penny bargain -

it will be interesting to follow -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66745131

God Bless

i first notice this...they didn't need this deal nxg

is huge in assets.

Northgate Minerals C (NGX) fiat$4.06 UP $0.96 +30.97% ![]()

Volume: 19,240,300 @ 1:35:33 PM ET Strong Demand ![]()

Bid Ask Day's Range

4.06 4.07 4.04 - 4.32

TSE:NGX Detailed Quote

AuRico Gold to Acquire Northgate Minerals and Create A Leading Intermediate Gold Company -

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/AuRico-Gold-to-Acquire-Northgate-Minerals-and-Create-A-Leading-Intermediate-Gold-Company1126418/default.aspx

Northgate Minerals L (NXG) fiat$3.38 UP $0.11 +3.36%

Volume: 5,148,659 @ 4:30:41 PM ET Strong Demand

Bid Ask Day's Range

3.34 3.4 3.21 - 3.39

NXG Detailed Quote

The volume has been great and IMO we are breaking out past 3.50

and a rela run can begin.

This is just for starters.

thanks for good info

NXG looking good

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=65231786

this sounds strong pr.

Northgate Minerals Provides Update on Construction and Exploration Activities at Young-Davidson

06.24.2011

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/Northgate-Minerals-Provides-Update-on-Construction-and-Exploration-Activities-at-Young-Davidson1125775/default.aspx

View Press Release (pdf)

Underground Mine Optimization to Proceed

VANCOUVER, June 24, 2011 /CNW/ - (All figures in US dollars except where noted) Northgate Minerals Corporation (TSX: NGX, NYSE-Amex: NXG) is pleased to provide an update on the progress of building its 100% owned Young-Davidson mine located near the town of Matachewan, in northern Ontario.

Highlights

Construction Activities

» The project remains on schedule and on budget:

- at the end of May 2011, 95% of the construction contracts have been awarded (approximately $245 million), 97% of the equipment purchase orders have been placed and 85% of the engineering has been completed.

» The project remains on budget:

- at the end of May 2011, Northgate has invested approximately $170 million towards construction of the Young-Davidson mine.

» After an intensive optimization study, a mid-shaft crushing and loading facility has been added to the original feasibility study mine design to facilitate access to higher grade underground ore one year earlier than planned, which will provide flexibility in the early years of mine operation and production.

Diamond Drill Program

» Hole YD11-234B in the YD West zone intersected 4.31 grams per tonne (g/t) gold over 79.6 metres (m) (estimated true thickness is 55.0 m), including 5.66 g/t over 49.9 m.

» The underground exploration program that will drill test targets to the east of the known reserves at Young Davidson is scheduled to begin in the final week of June.

"Our employees and contractors at Young-Davidson continue to put in hard work and dedication to all of the activities underway on site", said Ken Stowe, President and CEO. "Due to their great efforts, the project continues to advance on schedule and on budget. In addition, we are very pleased with the results from the YD West Zone and the new exploration program set to begin this month, potentially adding to our 2.8 million ounces of reserves and 650,000 ounces of resources."

Young-Davidson Construction Update

Production Shaft

The first leg (446 m) of the new Northgate production shaft is almost complete with breakthrough of the raise bore expected in mid-July. The second leg, to a depth of 700 m is expected to begin by November 2011.

Mid-Shaft Loading Facility

The Northgate Board of Directors have approved a mid-shaft loading facility, which is an optimization to the original mine design that will allow for early underground ore production from the 9590 level and above. This design will de-couple underground ore production from the ongoing development in the lower half of the mine and will provide for early underground ore feed to supplement open pit production. The facility is scheduled to be operational by Q1 2013, one year ahead of the feasibility schedule for underground ore production. Pre-production capital expenditures will not change as a result of this optimization, however, sustaining capital in the 2014-2015 period will increase by approximately $25 million.

115 kV Transmission Line

The 115 kV hydro transmission line from Kirkland Lake to the Matachewan Junction is proceeding ahead of schedule and is expected to be complete by September 2011.

Tailings Impoundment Area ("TIA")

Construction of the tailings dam facility is on schedule and the facility will be in a position to receive tailings from the mill's scheduled start up in March 2012. The tailings facility is an expansion of one of the historic tailings sites on the property.

Mill Building

The mill building erection is proceeding and will be enclosed by early July, at which time the installation of the process equipment will begin, much of which has already arrived at site.

More photos of the project development and a short video clip are available on our website at www.northgateminerals.com.

Exploration Update

Hole YD11-234B returned 4.31 g/t gold over 79.6 m and contained a higher grade section of 5.66 g/t over 49.9 m at the base (footwall) of the zone. This intersection which was reported in a news release on June 7, 2011 is located about 130 m above and 55 m east of Discovery Hole YD10-198. Both 234B and 198 are in a new gold zone west of the currently defined reserves and resources, confirming the fault offset model relating the YD West zone to the main Young-Davidson ore body.

Hole YD-11-240A, which was drilled perpendicular to the exploration holes in the YD West area in order to resolve the location and correlation of the north-south trending diabase dykes is now complete and the results are being analyzed.

Underground exploration in the area east of the current Young-Davidson Reserve is scheduled to get underway in the last week of June.

Figure 1 - YD West Zone-Longitudinal Section

Qualified Persons

John Andrew Cormier, PEng, Project Manager, Northgate Minerals Corporation, is the Qualified Person responsible for reviewing and approving the technical information of this press release.

Carl Edmunds, Exploration Manager, Northgate Minerals Corporation, is the Qualified Person responsible for reviewing and approving the exploration results of this press release.

Northgate Minerals Corporation is a gold and copper producer with mining operations, development projects and exploration properties in Canada and Australia. Our vision is to be the leading intermediate gold producer by identifying, acquiring, developing and operating profitable, long-life mining properties.

Cautionary Note Regarding Forward-Looking Statements and Information:

This Northgate press release contains "forward-looking information",----to update or revise such information, except as required by applicable law.

Cautionary Note to US Investors Regarding Mineral Reporting Standards:

Northgate Minerals Initiates Drill Program at the Awakening Gold Project, Nevada

06.23.2011

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/Northgate-Minerals-Initiates-Drill-Program-at-the-Awakening-Gold-Project-Nevada1125768/default.aspx

View Press Release (pdf)

VANCOUVER, June 23, 2011 /CNW/ - Northgate Minerals Corporation ("Northgate") (TSX: NGX, NYSE-Amex: NXG) is pleased to announce the mobilization of a diamond drill rig program to the Awakening Gold Project in Humboldt County, Nevada.

The Awakening Gold Project consists of 432 claims (approximately 35.9 square kilometres ("km2") or 13.9 square miles) and is located 50 km northwest of Winnemucca, Nevada, on the northwest flank of the Slumbering Hills. The property covers the northwest portion of the historic Awakening mining district and adjoins the north end of the former producing Sleeper Gold Mine, which has produced 1.7 million ounces of gold and 2.3 million ounces of silver.

Prior to commencing the current drill program, Northgate carried out an induced polarization ("IP") survey as well as additional soil and water geochemical sampling to further define drill targets.

The 2011 drill program will consist of 3,000 metres ("m") of diamond drilling on geophysical targets defined by an IP survey completed last year. The geologic target is a low sulphidation gold and silver deposit hosted by quartz-adularia veins in Tertiary volcanic rocks. The project area has been selected on the basis of anomalous ground water samples collected and analysed over previous years.

The drill program is anticipated to last four to six weeks, and drill results should be available for release in the fall.

The Awakening Gold Project is a joint venture agreement with Nevada Exploration Inc. ("Nevada") (TSX-V: NGE). The agreement has been in effect since June 7, 2010, when Northgate signed a formal exploration and option agreement on the project. Northgate recently entered into its second year of the agreement.

Further information on the Awakening Gold Project can be found under the Exploration section of Northgate's website at www.northgateminerals.com.

Figure 1 - 2011 Drill Targets

http://www.northgateminerals.com/Theme/Northgate/files/Releases/2011/targets_2011.gif

* * * * * * *

Northgate Minerals Corporation is a gold and copper producer with mining operations, development projects and exploration properties in Canada and Australia. Our vision is to be the leading intermediate gold producer by identifying, acquiring, developing and operating profitable, long-life mining properties.

hi Bob, how many grams make one oz. of gold?

Northgate Intersects 4.31 Grams per Tonne Gold Over 79.6 Metres at Young-Davidson

http://www.northgateminerals.com/OperationsProjects/default.aspx

06.07.2011

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/Northgate-Minerals-Intersects-431-Grams-per-Tonne-Gold-Over-796-Metres-at-Young-Davidson1125589/default.aspx

Hole YD11-234B Intersects One of the Best Intervals Ever Drilled on the Property

View pdf of the press release

TORONTO, June 7, 2011 /CNW/ -

Northgate Minerals Corporation

(TSX: NGX, NYSE Amex: NXG) is pleased to report that

Hole YD11-234B in the YD West zone intersected 4.31 grams per

tonne (g/t) gold over 79.6 metres (m) (estimated true thickness is 55.0 m), including 5.66 g/t over 49.9 m.

The YD West zone is a newly discovered zone, just west of

the currently known reserves at Young-Davidson in

northern Ontario.

Hole YD11-234B is one of the best intervals ever intersected

on the property and follows on the excellent results received

since Discovery

Hole YD10-198 intersected 3.46 g/t over 79.5 m last year.

Hole YD11-234B and YD West Zone Highlights

Hole YD11-234B returned 4.31 g/t gold over 79.6 m.

The hole contains a higher grade section of 5.66 g/t

over 49.9 m at the base (footwall) of the zone.

This new intersection is located about 130 m above and

55 m east of Discovery Hole YD10-198.

Both 234B and 198 are in a new gold zone west of the currently

defined reserves and resources, confirming the fault offset

model relating the YD West zone to the main

Young-Davidson orebody.

Hole YD11-234B and YD10-198 are amongst the highest

grade-thickness intervals intersected to date on the property.

The zone remains open up and down dip and to the west.

Two diamond drills continue to explore in the YD West zone area.

"Exploration at Young-Davidson continues to achieve outstanding

results as recent drilling has returned one of the best holes

ever intersected on the property" Ken Stowe, President and Chief

Executive Officer, remarked. "While last year's Hole 198

was very exciting resulting in the discovery of the YD West

zone, Hole 234B is equally exciting, confirming the fault offset

model along the western edge of the Young-Davidson deposit.

The results of this and other higher-grade follow-up holes

in 2011 underline the tremendous potential to expand the

currently known 2.8 million ounces of reserves1 on the property,

which will ultimately extend the initial 15-year mine-life

or increase the average annual gold output when production

commences in 2012."

Diamond Drill Program

The purpose of the 2011 diamond drill program on the west flank of the Young-Davidson deposit is to explore for new resources west of a major north-south trending diabase dyke that appeared to have truncated the zone. To date, seven holes have intersected the YD West zone and all but one has returned ore-grade intersections. This is a technically challenging area to drill due the depths of the holes and the presence of poor drilling conditions within ultramafic flows located well into the hanging wall. The target is blind due to its depth and thick younger post mineral Proterozoic sedimentary cover. Therefore, geology in the area is being interpreted as drill holes are completed. A number of drill holes have potential intercepts that have been either partially or completely "dyked out" by diabase at zone horizon (i.e. either occupies the entire width of the auriferous zone or a substantial part of the zone (see Figures 1 and 2, Holes 234, 234A and 239)). Currently, a hole is being drilled perpendicular to the exploration holes in the YD West area in order to resolve the location and correlation of the north-south trending diabase dykes. An improved understanding of the diabase dykes in the YD West zone will provide a more accurate resource model to be generated at year-end.

Hole YD11-234B instills confidence that the YD West zone is a highly prospective area evident from thick auriferous intersections in drill Holes 198 and 234B. Other drill holes (198A, 198B and 234) also had very significant gold intercepts (see Table 1 below for complete results). The gold mineralization here is hosted in mildly-hematitic coarse grained syenite with quartz vein stockwork and pyrite mineralization, which is similar to what is observed in the main Young-Davidson deposit.

This new YD West intersection is considered significant as this zone is open up and down dip and to the west. The YD West zone appears to have excellent potential to add significant gold resources to the project. Two diamond drills continue to focus on the YD West target until a sufficient number of intercepts have been obtained to estimate an initial resource by the end of the year. Subsequent drilling will focus on a broader scale to explore the limits of the zone towards the west.

Overview of Young-Davidson Exploration Area

Gold mineralization on the Young-Davidson property is present primarily in an intrusive syenite host rock dipping at approximately 70 degrees to the south. Figure 1 illustrates a longitudinal view of the YD West zone with current reserves illustrated in dark red to the east.

Figure 1 - YD West Zone-Longitudinal Section

www.northgateminerals.com/Theme/Northgate/files/Releases/2011/234B Fig1.JPG

Figure 2 - 9300m Level Plan

See Figure 2: www.northgateminerals.com/Theme/Northgate/files/Releases/2011/234B Fig2.JPG

Figure 2 presents a level plan (horizontal slice) of the property's geology immediately adjacent to the main Young-Davidson reserves. The currently defined reserves terminate against the brown diabase dyke that was the western limit of the reserve. Holes 234B, 234A, 234, 198 and 198A (holes are projected either 75 m up dip or 175 m down dip to the 9300 m level) clearly demonstrate that the younger diabase dyke occupies a fault with an apparent offset of 50 m to 100 m to the north on the western side of the dyke. The actual displacement on the fault could be to the north, downwards or a combination of the two.

Table 1: Assay Results from YD West Zone

Hole ID From (m) To (m) Interval (m) True Thickness (m) Gold Uncut (g/t) Gold Cut 20 g/t

YD11-234B 1064.8 1144.4 79.60 55.0 4.31 4.21

incl 1094.5 1144.4 49.90 34.4 5.66 5.51

incl 1128.0 1142.9 14.90 10.3 10.62 10.10

YD11-234A 1202.6 1221.8 19.20 13.4 1.22 1.22

YD10-234 1216.9 1234.7 17.80 9.5 4.37 4.37

incl 1217.8 1226.1 8.30 4.4 6.82 6.82

YD10-198 1258.0 1337.5 79.5 53.5 3.46 3.46

YD10-198A 1333.7 1355.0 20.20 14.2 6.31 5.42

YD10-198B 1353.5 1364.4 10.9 7.7 5.43 5.43

YD10-226A 1097.3 1134.0 36.7 25.3 0.74 0.74

1115.1 1125.5 10.4 7.2 1.19 1.19

YD11-239 Target zone occupied by diabase dyke ("dyked out")

* * * * * * *

Quality Control - Analyses and Sample Location

Details of quality assurance/quality control procedures for sample analysis and drill hole survey methodology are reported in detail in the Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") compliant Technical Report filed on SEDAR (www.sedar.com) on August 21, 2009.

Qualified Persons

The program design, implementation, quality assurance/quality control and interpretation of the results are under the control of Northgate's geological staff, which includes a number of individuals who are qualified persons as defined under NI 43-101. Carl Edmunds, PGeo, Northgate's Exploration Manager, is responsible for the overall supervision of the program.

* * * * * * *

Note to Investors:

The terms "Qualified Person", "Mineral Reserve", "Proven Mineral Reserve", "Probable Mineral Reserve", "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource", and "Inferred Mineral Resource" used in this news release are defined in accordance with NI 43-101.

* * * * * * *

Northgate Minerals Corporation is a gold and copper producer with mining operations, development projects and exploration properties in Canada and Australia. Our vision is to be the leading intermediate gold producer by identifying, acquiring, developing and operating profitable, long-life mining properties.

* * * * * * *

Cautionary Note Regarding Forward-Looking Statements and Information:

This Northgate press release contains "forward-looking information", as such term is defined in applicable Canadian securities legislation and "forward-looking statements" ----- in this press release is made as of the date of this press release, and Northgate disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Cautionary Note to US Investors Regarding Mineral Reporting Standards:

Northgate prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of US securities laws. Terms relating to mineral resources in this press release are defined in accordance with National Instrument 43-101-Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Standards on Mineral Resources and Mineral Reserves. The Securities and Exchange Commission (the "SEC") permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. The Corporation uses certain terms, such as, "measured mineral resources", "indicated mineral resources", "inferred mineral resources" and "probable mineral reserves", that the SEC does not recognize (these terms may be used in this press release and are included in the Corporation's public filings which have been filed with securities commissions or similar authorities in Canada).

1 See press release dated January 25, 2010.

http://www.northgateminerals.com/OperationsProjects/default.aspx

http://www.northgateminerals.com/Home/default.aspx

NXG $2,000 Gold Will Come From the East at Motley Fool Tue 11:13AM EDT

wow, that is huge; NXG AMEX 2.84 2.85 2.84 -0.03 -1.05% 18900X2400 2.91 2.82 1,265,391

Gold to Surge to $12,000/oz and Silver to $450/oz ![]()

Cazenove's Robin Griffiths ![]()

http://m.ibtimes.com/gold-silver-platinum-palladium-rhodium-precious-metals-145282.html

this is exciting Bob. new mgmt, hmmm.

re;

mick thanks, good NGX chart

Northgate Announces Retirement of President and CEO Ken Stowe

05.10.2011

Download this Press Release

View Press Release (pdf)

VANCOUVER, May 10 /CNW/ -

Northgate Minerals Corporation

("Northgate" or the "Company") (TSX: NGX) (NYSE Amex: NXG)

today announced that its President and Chief Executive Officer

(CEO), Ken Stowe, intends to retire on the appointment

of his successor.

Mr. Stowe joined Northgate in 1999 and has been CEO since 2001.

Mr. Stowe shared his retirement plans now to provide ample

time to complete the recruitment and hiring process.

A search will be conducted with the goal to select and

transition to a new President and CEO by the end of 2011.

The Board has designated the Corporate Governance and

Compensation Committee, chaired by Mark Daniel, to oversee

a comprehensive search process to identify Ken's successor,

taking both internal and external candidates into consideration.

Terry Lyons, Chairman, said:

"The Board is very appreciative of the contribution Ken has made

during his time at Northgate.

He has overseen the growth of the Company, the development

of Kemess into one of the most efficient and prolific gold

and copper mines in the world and, in Young-Davidson,

the establishment of another strong core asset for the Company.

He has also developed an excellent executive team that will

build on his accomplishments and continue to strengthen

Northgate.

I would like to take this opportunity to thank Ken for all that

he has done for the Company over the last twelve years."

"Ken remains in full control of the business until a successor

is appointed.

This will ensure continuity of strong management and will

support the achievement of our strategic objectives while

arrangements are made to find his successor."

Ken Stowe, Chief Executive Officer, added:

"It has been a privilege to lead Northgate and to work alongside

some of the most talented and capable people in the industry.

As I approach the tenth anniversary of my tenure as CEO,

I believe that the time is right to plan for my retirement.

The Company now has an exciting and excellent portfolio of

assets, and a strong platform from which we plan to grow

further and build towards the future."

During his distinguished career, Mr. Stowe has served as Vice

President, Technology of Diamond Fields Resources, where he

was responsible for the feasibility study of the Voisey's Bay

nickel-copper deposit and as Vice President, Operations

of Westmin Resources, where he oversaw the successful startup

of the Lomas Bayas copper mine in Chile.

He then moved on to Northgate to take on the significant

challenge of re-launching the Company as an operating entity

through the turnaround of the then recently-commissioned but

floundering Kemess South gold-copper mine.

Kemess South ultimately became one of the lowest cost gold

mines in the world.

In 2006, Mr. Stowe was the recipient of the prestigious

Canadian Mineral Processor of the Year Award.

Northgate Minerals Corporation is a gold and copper producer

with mining operations, development projects and exploration

properties in Canada and Australia.

Our vision is to be the leading intermediate gold producer

by identifying, acquiring, developing and operating

profitable, long-life mining properties.

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/Northgate-Announces-Retirement-of-President-and-CEO-Ken-Stowe1125228/default.aspx

mick thanks, good NGX chart ![]()

Northgate Announces Retirement of President and CEO Ken Stowe

05.10.2011

Download this Press Release

View Press Release (pdf)

VANCOUVER, May 10 /CNW/ -

Northgate Minerals Corporation

("Northgate" or the "Company") (TSX: NGX) (NYSE Amex: NXG)

today announced that its President and Chief Executive Officer

(CEO), Ken Stowe, intends to retire on the appointment

of his successor.

Mr. Stowe joined Northgate in 1999 and has been CEO since 2001.

Mr. Stowe shared his retirement plans now to provide ample

time to complete the recruitment and hiring process.

A search will be conducted with the goal to select and

transition to a new President and CEO by the end of 2011.

The Board has designated the Corporate Governance and

Compensation Committee, chaired by Mark Daniel, to oversee

a comprehensive search process to identify Ken's successor,

taking both internal and external candidates into consideration.

Terry Lyons, Chairman, said:

"The Board is very appreciative of the contribution Ken has made

during his time at Northgate.

He has overseen the growth of the Company, the development

of Kemess into one of the most efficient and prolific gold

and copper mines in the world and, in Young-Davidson,

the establishment of another strong core asset for the Company.

He has also developed an excellent executive team that will

build on his accomplishments and continue to strengthen

Northgate.

I would like to take this opportunity to thank Ken for all that

he has done for the Company over the last twelve years."

"Ken remains in full control of the business until a successor

is appointed.

This will ensure continuity of strong management and will

support the achievement of our strategic objectives while

arrangements are made to find his successor."

Ken Stowe, Chief Executive Officer, added:

"It has been a privilege to lead Northgate and to work alongside

some of the most talented and capable people in the industry.

As I approach the tenth anniversary of my tenure as CEO,

I believe that the time is right to plan for my retirement.

The Company now has an exciting and excellent portfolio of

assets, and a strong platform from which we plan to grow

further and build towards the future."

During his distinguished career, Mr. Stowe has served as Vice

President, Technology of Diamond Fields Resources, where he

was responsible for the feasibility study of the Voisey's Bay

nickel-copper deposit and as Vice President, Operations

of Westmin Resources, where he oversaw the successful startup

of the Lomas Bayas copper mine in Chile.

He then moved on to Northgate to take on the significant

challenge of re-launching the Company as an operating entity

through the turnaround of the then recently-commissioned but

floundering Kemess South gold-copper mine.

Kemess South ultimately became one of the lowest cost gold

mines in the world.

In 2006, Mr. Stowe was the recipient of the prestigious

Canadian Mineral Processor of the Year Award.

Northgate Minerals Corporation is a gold and copper producer

with mining operations, development projects and exploration

properties in Canada and Australia.

Our vision is to be the leading intermediate gold producer

by identifying, acquiring, developing and operating

profitable, long-life mining properties.

http://www.northgateminerals.com/news-and-media/press-releases/press-releases-details/2011/Northgate-Announces-Retirement-of-President-and-CEO-Ken-Stowe1125228/default.aspx

Northgate Minerals C (NGX) fiat$2.75 UP $0.07 +2.61% ![]()

Volume: 553,606 @ 4:00:00 PM ET good demand ![]()

Bid Ask Day's Range

2.74 2.75 2.67 - 2.75

TSE:NGX Detailed Quote

Northgate Minerals L (NXG) fiat$2.87 UP $0.11 +3.99% ![]()

Volume: 2,488,657 @ 4:00:09 PM ET good demand ![]()

Bid Ask Day's Range

2.86 2.87 2.76 - 2.87

NXG Detailed Quote

thanks good NGX chart ![]()

more on

NXG http://www.reuters.com/article/2011/04/13/northgateminerals-idUSL3E7FD1WR20110413?feedType=RSS&feedName=basicMaterialsSector&rpc=43

thanks for info ![]()

God Bless

Its a NGX Golden bargain day ![]()

Nice news on a crap day in the market, had it been a euphoric green day then it would have taken off.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60806844

Nice news on a crap day in the market, had it been a euphoric green day then it might have taken off a bit more north.

Northgate Minerals Reports Excellent Cash Flow from Operations of $56.5 Million in the Fourth Quarter of 2010

Mar. 8, 2011 (PR Newswire) --

Adjusted Net Earnings of $17.2 Million

Notice: Conference Call and Webcast Today at 10:00 am ET

Dial in: +647-427-7450 or 1-888-231-8191

VANCOUVER, March 8 /PRNewswire-FirstCall/ - (All figures in US dollars except where noted) -

Northgate Minerals Corporation

("Northgate" or the "Corporation") (TSX: NGX) (NYSE Amex: NXG) today announced its financial and operating results for the fourth quarter and year ended December 31, 2010.

The Company reported adjusted net earnings of $17.2 million or $0.06 per diluted share and cash flow from operations of $56.5 million or $0.19 per diluted share for the fourth quarter of 2010.

Fourth Quarter and Year End 2010 Highlights

- Adjusted net earnings(1) of $17.2 million or $0.06 per diluted share

for the fourth quarter and $19.2 million or $0.07 per diluted share

for the full year 2010.

- Excellent cash flow from operations of $56.5 million or $0.19 per

diluted share for the fourth quarter, a 36% increase compared to the

same period last year.

- Production of 66,077 ounces of gold and 10.6 million pounds of copper

in the fourth quarter, bringing full year production to 272,713

ounces and 40.7 million pounds, respectively, in 2010.

- Average net cash cost in the fourth quarter was $646 per ounce of

gold, bringing the average net cash cost for the full year to $660

per ounce.

- Fourth quarter metal sales were 70,145 ounces of gold at a realized

price of $1,393 per ounce and 12.4 million pounds of copper at a

realized price of $4.27 per pound.

- Northgate's cash balance at the end of the year was $334.8 million.

- At December 31, 2010, open pit reserves at Young-Davidson increased

by over 20% to 325,000 ounces of gold.

- Recently released an updated NI 43-101 compliant resource estimate

for the Kemess Underground project with an Indicated Resource of

136.5 million tonnes ("Mt") containing 2.6 million ounces of gold and

860.6 million pounds of copper.

- At the end of February, Northgate announced the sale of its entire

portfolio of auction rate securities ("ARS") for total consideration

of $40.9 million.

"We finished the 2010 year strong with solid operating and financial results, posting excellent cash flow from operations of $56.5 million in the fourth quarter" commented Ken Stowe, Northgate's President and Chief Executive Officer. "We also started 2011 on a positive note. In February, we released an updated resource estimate for the Kemess Underground project, which now contains an indicated resource of 2.6 million ounces of gold and 861 million pounds of copper. The project represents a significant organic growth opportunity for the company and would boost our growing production profile. We are also pleased to report that open pit reserves have increased by over 20% to 325,000 ounces at Young-Davidson. We look forward to the year ahead, where ongoing exploration at Young-Davidson is expected to further add to the current 15-year mine-life."

Financial Performance

Revenue in the fourth quarter of 2010 was a record $148.7 million, compared with revenue of $110.7 million in the same period last year. The record revenue in the most recent quarter was attributable to strong metal sales and higher realized metal prices. For the full year 2010, Northgate recorded consolidated revenue of $485.0 million.

Adjusted net earnings for the fourth quarter were $17.2 million or $0.06 per diluted share. For the full year 2010, Northgate reported adjusted net earnings of $19.2 million or $0.07 per diluted share. Adjusted net earnings do not include certain non-cash items from its calculation of net earnings prepared in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"). Northgate has provided this figure as it may be a useful indicator to investors.

The net loss for the fourth quarter was $72.0 million, compared with a net loss of $67.8 million in the corresponding period last year. The fourth quarter net loss includes a non-cash impairment charge of $76.9 million for the Fosterville Gold mine in Victoria, Australia, and a negative mark-to-market hedging adjustment of $12.0 million relating to Northgate's copper forward sales contracts, which were put into place in order to secure a significant portion of cash inflow over Kemess South's remaining mine-life.

During the fourth quarter of 2010, Northgate's cash flow from operations increased by 36% to $56.5 million or $0.19 per diluted share. For the full year 2010, Northgate generated cash flow from operations of $87.3 million or $0.30 per diluted share.

During the year, Northgate's cash and cash equivalents increased by $81.3 million. Our strong balance sheet now boasts cash and cash equivalents of $334.8 million at the end of 2010.

Corporate Development

Sale of Auction Rate Securities

At the end of February, Northgate announced the sale of its entire portfolio of ARS for total consideration of approximately $40.9 million. At December 31, 2010, Northgate had estimated the fair market value of its ARS at $36.0 million based on an independent third-party valuation. The proceeds from the sale were used to repay, in full, the outstanding balance of the loan of approximately $40.0 million. The loan was originally made by Lehman Brothers Inc. ("Lehman"), which was collateralized by the ARS held in the Corporation's investment account managed by Lehman. The loan and associated ARS account were subsequently acquired by Barclays plc in September 2008 as part of its court-approved purchase of the assets of then-bankrupt Lehman.

Organic Growth at Kemess Underground

In February, Northgate released a new resource estimate for its Kemess Underground Project, located five kilometres ("km") north of the Kemess South mine. The new resource estimate represents an 18% increase in tonnes, a 10% increase in contained gold and a 9% increase in contained copper when compared to the May 2010 resource. The total Indicated Resource now stands at 136.5 Mt containing 2.6 million ounces of gold and 860.6 million pounds of copper.

Northgate has engaged an independent mining consulting firm to complete technical studies, which will be incorporated into a Preliminary Assessment and will be used to determine the economics and development concept for the Kemess Underground Project that could be milled using the existing Kemess facilities. Production at Kemess Underground would further strengthen Northgate's growing production profile and significantly reduce the Corporation's average net cash cost of production.

Sale of Kemess South Equipment

As mining activities come to a close at the Kemess South mine, Northgate has appointed an international mining services firm to market for sale its open pit mining fleet and some limited milling infrastructure that will no longer be needed once production ceases. Northgate will continue to maintain a majority of its Kemess milling facilities for the development and operation currently being contemplated at Kemess Underground.

Results from Operations

The results from operations for the fourth quarter and year ended 2010 follows on the press release dated January 13, 2011, when Northgate released production figures for the same periods. The results from operations contained in this press release should be read in conjunction with Northgate's fourth quarter MD&A report, available on our website at www.northgateminerals.com.

Fosterville Gold Mine

Fosterville achieved quarterly production of 23,108 ounces of gold, which was better than forecast, due to higher than expected ore grades in the stopes that were mined. For the second straight year, production at Fosterville exceeded the 100,000-ounce mark, producing 100,441 ounces of gold in 2010. The average net cash cost of production for the fourth quarter and full year 2010 was $856 and $738 per ounce, respectively, in line with the most recent forecast. However, the net cash cost was impacted by the substantial appreciation of the Australian dollar during the year. The Australian dollar averaged slightly below parity with the US dollar for the last three months of 2010.

During the fourth quarter of 2010, a total of 163,404 tonnes of ore were mined for a total 729,080 tonnes mined in 2010. Also during the quarter, mill throughput was excellent, achieving a record 214,593 tonnes of ore. As a result, overall unit operating costs dropped to A$93 per tonne of ore milled compared to $101 per tonne in the same period last year. Mill throughput for all of 2010 was 817,535 tonnes of ore, which was better than the 781,879 tonnes milled last year.

For the full year 2010, the mill head grade was 4.57 grams per tonne (g/t). Gold recoveries averaged 82% for the year, slightly lower than forecast as a result of processing low-grade stockpile ore.

In 2011, production at Fosterville is forecast to be in the range of 97,000 - 102,000 ounces of gold.

Impairment Charges for Fosterville

At the end of each year, Northgate re-estimates reserves at all of its properties and revises its life-of-mine ("LOM") plans. LOM plans incorporate management assumptions and estimates of revenues and related costs, as well as the conversion of a portion of resources to reserves over the LOM. When this annual exercise was performed in early 2011, there were indicators of impairment at the Fosterville Gold mine. In accordance with Canadian GAAP, a recoverability test was performed for the long-lived assets, which identified them as potentially impaired as of December 31, 2010. The fair value of the Fosterville mine as at December 31, 2010 was established by using a LOM discounted cash flow model incorporating the following assumptions: gold prices of A$1,350/oz for 2011, A$1,300/oz for 2012 to 2013, A$1,250/oz for 2014 to 2015 and A$1,200/oz thereafter; a discount rate of 6.5%; and, a net asset value multiplier of 1.0x.

As a result of this analysis, an impairment charge of $76.9 million was recorded in earnings for the fourth quarter and year ended December 31, 2010.

Stawell Gold Mine

During the year, the Stawell Gold mine steadily improved operations since its low in the second quarter, producing 17,882 ounces of gold at a net cash cost of $1,129 per ounce. Production for the entire year totalled 71,482 ounces at an average net cash cost of $969 per ounce. The net cash cost for 2010 was negatively impacted primarily by lower than forecast production resulting from lower than expected ore grades and also by a stronger Australian dollar relative to the US dollar. Production in 2011 is expected to increase by at least 20% from 2010 to between 86,000 - 91,000 ounces of gold. In years 2012 and 2013, this improvement in production is expected to continue with production forecast to be in the range of 105,000 - 117,000 ounces as ore is increasingly sourced from the higher-grade GG6 zone. The net cash cost of production is also expected to decrease from 2010 by approximately 15% in 2011 and 20% in 2012 as ore is sourced from the higher-grade GG6 zone.

During the quarter, mine production improved to 209,644 tonnes of ore and mine development advanced 1,506 m. In addition, the mill performed extremely well, with approximately 211,405 tonnes of ore milled during the quarter, which was the highest quarterly throughput for the year. Mining costs were A$66 per tonne of ore mined and milling costs were A$23 per tonne of ore milled. For all of 2010, mill throughput of 826,454 tonnes of ore was achieved, which was 9% higher than mill throughput of 759,819 tonnes in 2009.

Kemess South

The Kemess South mine posted production of 25,087 ounces of gold and 10.6 million pounds of copper in the fourth quarter of 2010, bringing full year production to 100,790 ounces of gold and 40.7 million pounds of copper, which was in line with forecast. The net cash costs for the fourth quarter and full year 2010 were $109 and $363 per ounce, respectively, which were slightly higher than forecast due to lower copper production in the fourth quarter of the year.

The Kemess South mine is scheduled to close in March 2011. Total gold and copper production for 2011 is anticipated to be 12,000 ounces and 5.3 million pounds, respectively, at a net cash cost of $285 per ounce of gold. With the recent surge of copper prices in the first quarter of 2011, the net cash cost may be lower than previously forecast.

Summarized Consolidated Results

(Thousands of

US dollars,

except where

noted) Q4 2010 Q4 2009 2010 2009

-------------------------------------------------------------------------

Financial Data

Revenue $ 148,701 $ 110,698 $ 485,047 $ 484,976

Adjusted net

earnings(1) 17,198 27,862 19,184 73,191

Per share

(diluted) 0.06 0.10 0.07 0.28

Net loss (72,020) (67,755) (71,704) (49,506)

Per share

(diluted) (0.25) (0.23) (0.25) (0.19)

Cash flow from

operations 56,482 41,510 87,285 187,161

Cash and cash

equivalents 334,840 253,544 334,840 253,544

Total assets $ 905,484 $ 741,679 $ 905,484 $ 741,679

-------------------------------------------------------------------------

Operating Data

Gold production

(ounces)

Fosterville 23,108 26,615 100,441 103,360

Stawell 17,882 23,221 71,482 85,998

Kemess 25,087 30,917 100,790 173,040

--------------------------------------------------------

Total gold

production 66,077 80,753 272,713 362,398

--------------------------------------------------------

Gold sales (ounces)

Fosterville 22,427 25,166 100,544 103,518

Stawell 17,679 22,695 71,025 87,110

Kemess 30,039 30,154 97,730 180,040

--------------------------------------------------------

Total gold

sales 70,145 78,015 269,299 370,668

--------------------------------------------------------

Realized gold

price

($/ounce)(2) 1,393 1,181 1,256 994

--------------------------------------------------------

Net cash cost

($/ounce)(3)

Fosterville 856 720 738 576

Stawell 1,129 732 969 616

Kemess 109 234 363 348

--------------------------------------------------------

Average net cash

cost ($/ounce) 646 537 660 477

--------------------------------------------------------

Copper production

(thousands pounds) 10,625 11,750 40,666 52,496

Copper sales

(thousands pounds) 12,363 10,393 38,939 51,188

Realized copper

price ($/pound)(2) 4.27 3.54 3.61 2.87

-------------------------------------------------------------------------

(1) Adjusted net earnings is a non-GAAP measure. See section entitled

"Non-GAAP Measures" in the Corporation's interim MD&A Report.

(2) Commencing in the fourth quarter of 2010, metal pricing quotational

period is three months after the month of ship loading for copper and

one month after the month of ship loading for gold produced at

Kemess South. Previously, the metal pricing quotational period was

three months after the month of arrival ("MAMA") at the receiving

facility for copper and one MAMA for gold. Therefore, realized prices

reported will differ from the average quarterly reference prices,

since realized price calculations incorporate the actual settlement

price for prior period sales, as well as the forward price profiles

of both metals for unpriced sales at the end of the quarter.

(3) Net cash cost per ounce of production is a non-GAAP measure. See

section entitled "Non-GAAP Measures" in the Corporation's interim

MD&A Report.

Minerals Reserves and Resources

Northgate has provided its proven and probable mineral reserves and measured, indicated and inferred resources for the year ended December 31, 2010. A summary table for mineral reserves and resources are as follows:

Contained Gold (ounces) At December 31, 2010

-------------------------------------------------------------------------

Proven Reserves 714,000

Probable Reserves 2,840,000

-------------------------------------------------------------------------

Total Proven and Probable Reserves 3,555,000

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Measured Resources 195,000

Indicated Resources(2) 3,369,000

-------------------------------------------------------------------------

Total Measured and Indicated Resources 3,564,000

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Total Inferred Resources 1,449,000

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Contained Copper (000s pounds)

-------------------------------------------------------------------------

Total Proven Reserves(3) 9,247

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Total Indicated Resources(2) 861,000

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(1) Mineral reserves and resources are rounded to 1,000 ounces and 1,000

pounds. Minor discrepancies in summations may occur due to rounding.

(2) The new Kemess Underground Resource was announced on February 15,

2011. This resource is a subset of the Kemess North deposit that has

Measured and Indicated Resources of 719,190,000 tonnes at a grade of

0.30 g/t gold and 0.15% copper containing 6,939,000 ounces of gold

and 2,353,000,000 pounds of copper.

(3) Proven reserves for contained copper are for the Kemess South mine,

which is scheduled for mine closure in March 2011.

At December 31, 2010, Northgate reported Proven and Probable reserves of 3.6 million ounces.

At Young-Davidson, open pit reserves increased by over 20% to 325,000 ounces. Underground reserves at the end of 2010 remained unchanged at 26.2 million tonnes containing 2.5 million ounces of gold, as no revisions were made to price assumptions used for the mine plan.

During 2010, Northgate undertook a $3 million exploration program to better define the geometry and grade of the high-grade core of the Kemess North deposit for the purposes of evaluating the potential for mining a portion of the original 719 million tonne resource using bulk underground methods. As at December 31, 2010, a new indicated resource has been estimated for the Kemess Underground Project of 136.5 million tonnes containing 2.6 million ounces of gold at a grade of 0.56 g/t and 860.6 million pounds of copper at a grade of 0.29%. The total resource at Kemess Underground has increased by 18% in tonnes, 10% in contained gold and 9% in contained copper from the May 2010 resource estimate. Engineering studies are currently underway to determine the feasibility of converting a portion of this resource into a reserve.

At the Fosterville mine, reserves decreased slightly to 3.1 million tonnes containing 475,000 ounces. Fosterville was successful in resource to reserve conversion of approximately 100,000 ounces as a result of extending the Phoenix and Harrier orebodies (approximately 73,000 ounces) and from infill drilling within Phoenix (approximately 24,000 ounces). However, resource conversion was offset by mining depletion of 124,000 ounces during the course of 2010.

Indicated Resources at Fosterville increased by 65,000 ounces to 470,000 ounces as a result of successful drilling within the Phoenix and Harrier orebodies.

At Stawell, Proven and Probable Reserves at December 31, 2010 stood at 2.0 million tonnes containing 234,000 ounces. During the year, approximately 86,000 ounces were mined with a conversion of approximately 33,000 ounces to reserves to partially offset mine depletion.

The complete mineral reserves and resource estimates for Northgate as at December 31, 2010, including accompanying notes, can be found in Appendix I at the end of this press release.

Interim Consolidated Balance Sheets

December 31 December 31

Thousands of US dollars 2010 2009

-------------------------------------------------------------------------

(Unaudited)

Assets

Current Assets

Cash and cash equivalents $ 334,840 $ 253,544

Trade and other receivables 62,051 27,961

Income taxes receivable 2,236 -

Inventories 44,569 44,599

Prepaid expenses 2,367 2,566

Future income tax asset 5,619 5,541

-------------------------------------------------------------------------

451,682 334,211

Other assets 40,819 27,544

Future income tax asset 9,381 14,507

Mineral property, plant and equipment 367,083 327,416

Investments 36,519 38,001

-------------------------------------------------------------------------

$ 905,484 $ 741,679

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Liabilities and Shareholders' Equity

Current Liabilities

Accounts payable and accrued liabilities $ 109,385 $ 59,132

Income taxes payable - 29,395

Short-term loan 40,161 41,515

Equipment financing obligations 7,945 5,995

Provision for site closure and reclamation

obligations 22,460 23,501

Future income tax liability - 867

-------------------------------------------------------------------------

179,951 160,405

Equipment financing obligations 10,763 4,656

Convertible senior notes 131,235 -

Other long-term liabilities 2,803 8,995

Provision for site closure and reclamation

obligations 25,453 23,989

Future income tax liability 11,343 -

-------------------------------------------------------------------------

361,548 198,045

Shareholders' Equity

Common shares 407,036 402,879

Equity component of convertible senior notes 33,832 -

Contributed surplus 7,798 6,202

Accumulated other comprehensive income (loss) 28,716 (3,705)

Retained earnings 66,554 138,258

-------------------------------------------------------------------------

543,936 543,634

-------------------------------------------------------------------------

$ 905,484 $ 741,679

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Interim Consolidated Statements of Operations and Comprehensive Income

(Loss)

Thousands of US dollars,

except share and per Three Months Twelve Months

share amounts, Ended Dec 31 Ended Dec 31

unaudited 2010 2009 2010 2009

-------------------------------------------------------------------------

Revenue $ 148,701 $ 110,698 $ 485,047 $ 484,976

-------------------------------------------------------------------------

Cost of sales 95,386 72,789 322,558 300,800

Depreciation and

depletion 35,579 26,733 114,031 104,126

Administrative

and general 3,468 3,617 12,524 10,679

Net interest income (562) (558) (2,176) (1,580)

Exploration 4,199 2,765 22,129 14,637

Currency translation

(gain) loss (6,795) (3,495) (8,614) 1,143

Accretion of site

closure and

reclamation costs 433 952 1,677 3,253

Write-down of mineral

properties 80,411 84,849 80,411 84,849

Write-down of

investments - 31 374 10,979

Other income (400) (170) (1,895) (1,123)

-------------------------------------------------------------------------

211,719 187,513 541,019 527,763

-------------------------------------------------------------------------

Loss before income

taxes (63,018) (76,815) (55,972) (42,787)

Income tax recovery

(expense)

Current (1,062) 981 1,309 (29,472)

Future (7,940) 8,079 (17,041) 22,753

-------------------------------------------------------------------------

(9,002) 9,060 (15,732) (6,719)

-------------------------------------------------------------------------

Net loss for the

period $ (72,020) $ (67,755) $ (71,704) $ (49,506)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Other

comprehensive

income (loss)

Unrealized gain

(loss) on

available for

sale securities (616) 1,845 (1,465) (1,463)

Reclassification of

realized loss on

available for sale

securities to net

earnings - - 232 -

Reclassification of

other than temporary

loss on available for

sale securities to

net earnings - 31 374 10,979

Unrealized gain

on translation of

self-sustaining

operations 13,583 5,700 33,280 76,282

-------------------------------------------------------------------------

12,967 7,576 32,421 85,798

-------------------------------------------------------------------------

Comprehensive

income (loss) $ (59,053) $ (60,179) $ (39,283) $ 36,292

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Net loss per

share

Basic $ (0.25) $ (0.23) $ (0.25) $ (0.19)

Diluted $ (0.25) $ (0.23) $ (0.25) $ (0.19)

Weighted average

shares

outstanding

Basic 291,149,012 290,500,196 290,922,452 264,603,527

Diluted 291,149,012 290,500,196 290,922,452 264,603,527

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Interim Consolidated Statements of Cash Flows

Three Months Twelve Months

Thousands of US Ended Dec 31 Ended Dec 31

dollars, unaudited 2010 2009 2010 2009

-------------------------------------------------------------------------

Operating

activities:

Net loss for the

period (72,020) $ (67,755) $ (71,704) $ (49,506)

Non-cash items:

Depreciation and

depletion 35,579 26,733 114,031 104,126

Unrealized

currency

translation

losses 97 724 511 4,543

Accretion of

site closure and

reclamation costs 433 952 1,677 3,253

Net loss (gain)

on disposal of

assets 54 (766) (1,280) (490)

Amortization of

deferred charges - - - 196

Stock-based

compensation 513 361 2,952 1,467

Accrual of employee

severance costs 452 650 1,845 2,177

Future income tax

expense (recovery) 7,940 (8,079) 17,041 (22,753)

Change in fair value

of forward

contracts 12,002 15,055 13,768 37,674

Write-down of

investments - 31 374 10,979

Inventory

obsolescence

provision 584 363 584 363

Write-down of mineral

properties 80,411 84,849 80,411 84,849

Loss on sale of

investments - - 232 -

Changes in operating

working capital and

other (9,563) (11,608) (73,157) 10,283

-------------------------------------------------------------------------

56,482 41,510 87,285 187,161

-------------------------------------------------------------------------

Investing activities:

Increase in

restricted cash (301) (113) (10,191) (220)

Purchase of mineral

property, plant and

equipment (28,475) (3,695) (61,024) (30,528)

Mineral property

development (25,229) (18,801) (94,119) (51,468)

Proceeds from sale

of equipment 114 - 627 -

Proceeds from

insurable asset

disposition - - 1,619 -

Transaction costs

paid (300) - (378) -

Proceeds from sale

of investments - - 119 -

-------------------------------------------------------------------------

(54,191) (22,609) (163,347) (82,216)

-------------------------------------------------------------------------

Financing activities:

Repayment of

equipment financing

obligations (2,185) (1,225) (7,621) (5,029)

Repayment of

short-term loan (306) (312) (1,354) (1,581)

Repayment of other

long-term liabilities (264) (218) (910) (546)

Issuance of convertible

senior notes, net

transaction costs 164,239 - 163,419 -

Issuance of common

shares 2,143 846 2,801 89,647

-------------------------------------------------------------------------

163,627 (909) 156,335 82,491

Effect of exchange

rate changes on cash

and cash equivalents 748 (377) 1,023 3,689

-------------------------------------------------------------------------

Increase in cash and

cash equivalents 166,666 17,615 81,296 191,125

Cash and cash

equivalents,

beginning of

period 168,174 235,929 253,544 62,419

-------------------------------------------------------------------------

Cash and cash

equivalents,

end of period $ 334,840 $ 253,544 $ 334,840 $ 253,544

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Supplementary

information

Cash paid during

the period for:

Interest $ 575 $ (274) $ 2,160 $ 2,298

Income taxes - - 26,913 587

Purchase of mineral

property, plant

and equipment

through financing

arrangements 1,239 2,734 13,936 2,734

Mine construction

financed by accounts

payable and accrued

liabilities 8,935 - 18,836 -

Insurance premiums

financed by a loan

facility 650 - 650 856

Investment tax credit

recorded as a

reduction to

mineral property,

plant and equipment 1,878 - 5,366 -

Interest capitalized

to mineral property,

plant and equipment 1,435 - 1,435 -

Accretion on

convertible senior

notes capitalized to

mineral property,

plant and equipment 1,293 - 1,293 -

Deferred transaction

costs transferred to

liability or equity 820 - - 775

Future income tax

benefits recorded

in equity 354 (211) 354 1,565

-------------------------------------------------------------------------

-------------------------------------------------------------------------

This press release should be read in conjunction with the Corporation's fourth quarter MD&A report and accompanying unaudited interim consolidated financial statements, which can be found on Northgate's website at www.northgateminerals.com.

Financial figures for the fourth quarter and full year 2010 are unaudited estimates and are subject to revision. Northgate will file its complete 2010 audited annual financial statements, including the notes to the consolidated financial statements, with both the Canadian and US Securities regulatory authorities on SEDAR (www.sedar.com) and EDGAR (www.sec.gov) by March 31, 2011.

Appendix I - Mineral Reserves and Resources

Mineral Reserves - Proven & Probable

Grades Contained Metal

-----------------------------------

Copper

At December Quantity Gold Copper Gold (000s

31, 2010 Category (tonnes) (g/t) (%) (ounces) lbs)

-------------------------------------------------------------------------

Kemess South Proven 3,495,000 0.24 0.12 27,000 9,247

-------------------------------------------------------------------------

Fosterville Proven 446,000 7.19 n/a 103,000 n/a

Probable 2,659,000 4.35 n/a 372,000 n/a

--------------------------------------------------------

3,105,000 4.76 475,000

-------------------------------------------------------------------------

Stawell

(underground) Proven 254,000 3.69 n/a 30,000 n/a

(open pit) Probable 452,000 1.96 n/a 28,000 n/a

(underground) Probable 1,342,000 4.06 n/a 175,000 n/a

--------------------------------------------------------

2,048,000 3.55 234,000

-------------------------------------------------------------------------

Young-Davidson

(open pit) Proven 3,793,000 1.60 n/a 195,000 n/a

(open pit) Probable 2,388,000 1.69 n/a 130,000 n/a

(underground) Proven 3,469,000 3.22 n/a 359,000 n/a

(underground) Probable 22,740,000 2.92 n/a 2,135,000 n/a

--------------------------------------------------------

32,390,000 2.64 2,819,000

-------------------------------------------------------------------------

Total Proven & Probable

Reserves 41,038,000 3,555,000 9,247

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Mineral Resources - Measured & Indicated

Grades Contained Metal

-----------------------------------

Copper

At December Quantity Gold Copper Gold (000s

31, 2010 Category (tonnes) (g/t) (%) (ounces) lbs)

-------------------------------------------------------------------------

Kemess

Underground Indicated 136,500,000 0.56 0.29 2,610,000* 861,000

-------------------------------------------------------------------------

Young-Davidson

(underground) Indicated 132,000 3.08 n/a 13,100 n/a

-------------------------------------------------------------------------

Fosterville

(less than

100m from

surface) Measured 2,745,000 2.21 n/a 195,000 n/a

(less than

100m from

surface) Indicated 4,760,000 1.54 n/a 236,000 n/a

(greater

than

100m from

surface) Indicated 1,556,000 4.67 n/a 234,000 n/a

----------------------------------------------------------

9,061,000 2.28 665,000

-------------------------------------------------------------------------

Stawell

(less than

100m from

surface) Indicated 2,975,000 2.19 n/a 209,000 n/a

(greater

than 100m

from

surface) Indicated 448,000 4.62 n/a 67,000 n/a

3,423,000 2.51 276,000

-------------------------------------------------------------------------

Total Measured

& Indicated

Resources 149,116,000 3,564,000

-------------------------------------------------------------------------

-------------------------------------------------------------------------

* Includes silver contribution @ 55 ounces of silver to one ounce of

gold.

Mineral Resources - Inferred

Grades Contained Metal