Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Nio Inc. to Officially Enter Germany in October

By: Michael Elkins | August 19, 2022

An exclusive report by electric-vehicles.com shows that Chinese electric vehicle maker Nio Inc. (NYSE:NIO) will officially arrive in Germany on October 7. The report cites an internal memo and states that the company will hold an event to meet the User Advisory Board members in Munich on September 9, four weeks before the official market launch.

In the memo, NIO says it would like to get to know users personally, exchange ideas with them and also “give a first look into the world of NIO”. The company added that will “be in touch shortly” with an official invitation for the event in September.

Continuing with the user-centered approval that helped NIO enter Norway in 2021, the company has been inviting enthusiasts from Germany, Denmark, The Netherlands, and Sweden to join the User Advisory Board. The board gives members the opportunity to experience NIO’s products, technology, and services.

On the official invitation for each of those markets, NIO said it believes that “the most valuable feedback on our brand, our products and our services comes from users” and that they are looking for users that want to think along with them.

According to people familiar with the matter, NIO also plans to enter the U.S. market in 2025 and deploy the first Battery Swap Station in the country as soon as November 2022. The first battery swap station may end up behind the company’s current headquarters in San Jose. However, the station would be built for testing purposes.

NIO is down 1.1% in pre-market trading.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO ES7: Bringing You an Immersive Experience

In June, we launched the newest member, NIO ES7, to the family. Similar to the NIO ET7, the NIO ES7 also comes standard with PanoCinema, the AR/VR compatible custom digital cockpit system with a 7.1.4 surround sound system enabled with Dolby Atmos®, which will bring you an immersive visual and audio experience at the same time.

Dolby Atmos® was created for the cinema, introducing object-based three-dimensional sound design. Creatives can place sounds anywhere in space with unprecedented and precise control over the placement and movement of sound for the most immersive user experience.

Dolby Atmos® technology has just started to be used in the automobile industry, and NIO has become one of the early pioneers to bring this beyond audio experience to our users. DolbyStereo

NIO ES7 (or NIO ET7), with 23 speakers and a total output of 1000w, uses the Dolby Atmos® software solution combined with cabin tuning and speaker mapping to decode and recreate the exact placement of every sound inside the car cabin.

Paired with the Dolby Atmos-supported audio channels, which include NIO users’ own NIO Radio, the users can hear music as the artist heard it in the studio when it was recorded, even while on the go in the car.

NIO Really like how this one is shaping up

By: StockChartArt | August 16, 2022

• $NIO Really like how this one is shaping up. Large inverse head and shoulders pattern with a large volume shelf. Look at the RS on right side of base while market was in deep decline. Price is coming up the right side approaching the 200 day SMA. Don't sleep on this one!

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO weak economic data from China spooked the marketplace https://www.kitco.com/news/2022-08-15/Price-declines-in-gold-silver-after-downbeat-China-data.html

Nio Inc. Partners with UN on Clean Parks Initiative

By: Michael Elkins | August 15, 2022

Electric vehicle maker, Nio Inc. (NYSE:NIO) announced on Monday that it has joined with the United Nations Development Program (UNDP) to promote its Clean Parks platform. NIO launched its Clean Parks program late last year to help protect environmentally sensitive areas and has since secured some high-profile partners such as the World Wildlife Foundation.

According to a post by Nio on its mobile app, the EV company and the UNDP will work together to promote in-depth cooperation in environmental protection in nature reserves, youth empowerment, and the development of eco-investment standards.

William Li, founder, chairman and CEO of Nio, and Qin Lihong, co-founder and president of Nio, along with executives from UNDP and officials from China's Ministry of Ecology and Environment (MEE), attended the signing ceremony.

Nio and the UNDP expect the partnership to help the private sector to step up their efforts in biodiversity conservation and tackling climate change through the Clean Parks initiative.

"It's a great honor to have the United Nations Development Program on board to support the Clean Parks Initiative with Nio, to build a clean and low-carbon energy circulation system in nature reserves," said Nio founder William Li.

"Ecological protection and biodiversity conservation are high on the global and national agenda and I look forward to this partnership contributing to these priorities," said Beate Trankmann, UNDP resident representative in China.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO: Mounting Headwinds Batter Investor Confidence

By: GuruFocus | August 11, 2022

• NIO Inc. (NYSE:NIO) struggled in the first half of 2022 as economic turmoil and supply issues slowed production and sales growth. The Chinese electric vehicle maker has guided for a substantial uptick in the second half of the year. Investors do not seem wholly convinced, however.

The company will have an opportunity to address these concerns when it reports second-quarter earnings later this month.

Mid-year performance review

NIO sold 25,059 vehicles during the second quarter, up 14% year over year. June was especially important to this growth, with 12,961 units delivered during the final month of the quarter, up 60% year over year. The June boom was not enough to deliver sequential growth, however. The company's second-quarter delivery print fell 2.8% short of the 25,768 units sold during the first quarter.

During the first quarter, NIO brought in $1.48 billion in revenue, which translated to a GAAP loss of 17 cents per share. Revenue is set to decline in the second quarter due to lower unit sales and other economic headwinds. Analysts currently estimate that NIO will bring in $1.43 billion in revenue in the second quarter. Analysts predict a widening loss of 20 cents per share.

Despite recent downward revisions by several analysts, the consensus may still be a bit too generous. Headwinds from supply chain issues and rising costs likely did not help NIOs bottom line in the second quarter. A shortage of casting parts had a particularly negative impact on sales growth, especially for the ET7, the company's sole sedan model currently on the market.

What comes next

NIOs longtime promise of monumental growth is looking shakier. In July, the company delivered just over 10,000 vehicles, which increased 27% year over year but was down considerably from June and was just the fifth best month for the company overall. Notably, this was in spite of NIO having an additional model available in July 2022 that was not on the market the year prior.

The company does not have much time to get its growth engine back into high gear. In May 2021, NIO signed an extension to its manufacturing contract with state-owned JAC Manufacturing, doubling its unit production commitments to 240,000 vehicles per year. According to management guidance released in July, NIO aims to reach monthly production of 30,000 vehicles either in late 2022 or early 2023. However, the persistent headwinds that have slowed growth in recent months show little sign of dissipating anytime soon.

Still, NIO has a few positive things going for it, including two new vehicle models set to go to market in the third quarter. The first of these, the ET5 sedan, is scheduled for release in September. If NIO can ramp up production of these new models quickly, it may be able to get closer to its target. That is easier said than done, especially if the ET5 production line faces the same casting parts shortage that has thus far stymied production of its other sedan.

My take

Problems with sourcing parts and supplies, especially for the ET7, has already cost NIO some growth momentum. Those issues look likely to persist into the third quarter, at least. The stock was down 5% for the day on Aug. 9 and down 57.6% over the last 12 months. With a market capitalization still standing at more than $30 billion, the stock remains richly valued despite its recent battering by the market, in my opinion.

Investors interested in this name will be watching closely when NIO reports earnings for the second quarter, especially after the company opted to push its earning date out to Aug. 25.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO with an early channel breakout as price accelerates off the volume POC

By: TrendSpider | August 11, 2022

• $NIO with an early channel breakout as price accelerates off the volume POC.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Held in well this last week, broke out of the down channel, but no power yet

By: Options Mike | August 7, 2022

• $NIO Held in well this last week, broke out of the down channel, but no power yet.

21 area still problematic.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Falling wedge breakout this week with MACD looking primed for a bull cross!

By: TrendSpider | August 6, 2022

• $NIO Falling wedge breakout this week with MACD looking primed for a bull cross!

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Incorporates Mobile Tech Subsidiary

By: Michael Elkins | August 5, 2022

William Li, Nio’s co-founder and CEO, told Nio (NYSE:NIO) users on July 28 that the company would develop and launch a new smartphone for its vehicle owners every year. According to data provider Qichacha, Nio incorporated its mobile subsidiary on Thursday.

The new company named Nio Mobile Technology, was incorporated with a registered capital of $100 million naming Qin Lihong, co-founder of NIO, as its legal representative.

The company is wholly owned by NIO NEXTEV LIMITED and is allowed to operate in information integration, mechanical equipment R&D, mobile device sales, AI application R&D, and wearable device sales.

Read Full Story »»»

DiscoverGold

DiscoverGold

Did anyone else that the notification of the proxy vote.

Hi, everyone,

The Nio app is now available in some European app stores.

Download in the app store and use the invitation code when registering

*HTXCD4*

so you and I get *200 bonus* Nio points credited

*enjoy this beautiful app*

Nio Inc. (NIO) Stock Facing Major Challenges Right Now

By: Stock News | August 1, 2022

The electric vehicle (EV) market has faced several headwinds, including high inflation, semiconductor chip shortage, and persisting supply chain disruptions. These factors have affected the production of companies in this space, making it difficult for them to meet the pent-up demand.

Although vehicle orders have surged to unexpected heights, the shortage of automotive semiconductors and other parts forces auto manufacturers to cut production levels.

Moreover, consumers’ concern about the upfront cost of EVs, lack of enough charging infrastructure, and long charging hours on a road trip have been weighing down the industry’s growth prospects.

Due to these challenges, we think it could be wise to avoid fundamentally weak EV stocks NIO Inc. (NIO) and Lucid Group, Inc. (LCID).

NIO Inc. (NIO)

Headquartered in Shanghai, China, NIO is a pioneer and leading high-end smart electric vehicles manufacturer. It provides power solutions, battery swapping services, rapid charging, vehicle internet assistance, and extended lifetime warranties. Dubbed the “Tesla of China,” NIO is a leading EV manufacturer globally.

For the fiscal quarter ended March 31, 2022, NIO’s gross profit decreased 6.9% year-over-year to RMB1.45 billion ($214.97 million). Its adjusted loss from operations widened 760.4% year-over-year to RMB1.71 billion ($253.51 million), while its non-GAAP net loss came in at RMB1.31 billion ($194.21 million), up 269.3% from the prior-year quarter. In addition, its non-GAAP loss per share widened 243.5% year-over-year to RMB0.79.

Analysts expect NIO’s earnings per share to remain negative in fiscal 2022. Shares of NIO have declined 49.9% over the past nine months and 53.7% over the past year to close the last trading session at $19.73.

NIO’s POWR Ratings reflect this bleak outlook. The stock has an overall F rating, equating to a Strong Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

It has an F grade for Growth and a D for Value, Stability, and Quality. It is ranked #51 of 65 stocks in the D-rated Auto & Vehicle Manufacturers industry. Click here to see additional ratings (Momentum and Sentiment) for NIO.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc (NIO) Stock Rises on Europe Expansion

By: Schaeffer's Investment Research | August 1, 2022

• Nio stock is opening a power product plant in Europe

• NIO is on track for its fourth-straight session of gains

Electric vehicle concern Nio Inc (NYSE:NIO) is up 4.9% at $20.70 at last check, after the China-based company announced the opening of its first overseas plant. The power product plant, which will be in Pest, Hungary, will develop and manufacture products such as battery-swapping stations for European users.

On the charts, the $24 level has given NIO trouble for most of 2022. Recently, however, the 60-day moving average has swooped in as support, guiding the stock to now be on track for its fourth-straight daily win. Year-to-date, the security is down roughly 34%.

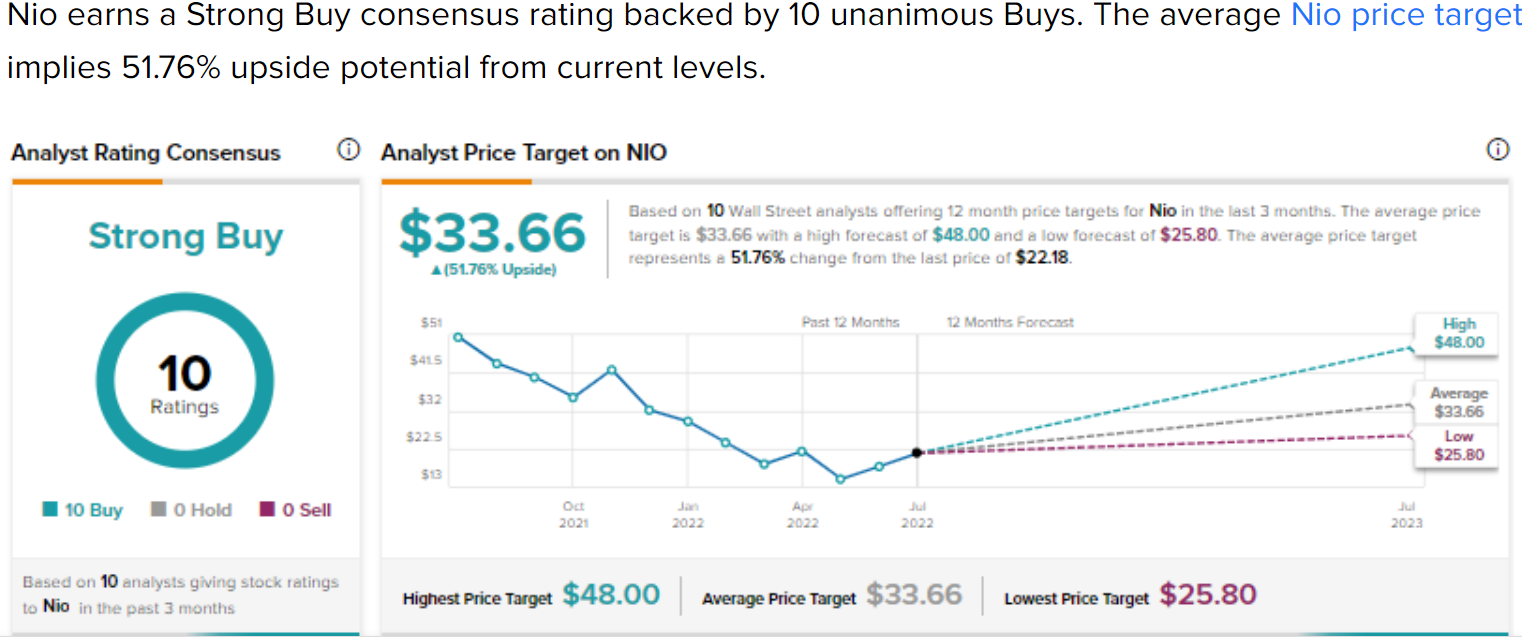

Most of the brokerage bunch is bullish toward Nio stock, with eight of the nine in coverage carrying a "strong buy" rating, and one a "hold." Meanwhile, the 12-month consensus price target of $36.35 is a 77% premium to current levels.

NIO is a consistently popular stock amongst options traders, and particularly options bears as of late. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 50-day put/call volume ratio of 0.76 ranks higher than 94% of annual readings. So while calls are stilling winning out on an absolute basis, puts have been picked up at a much quicker-than-usual clip of late.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Down channel here to keep a eye on for a break either way

By: Options Mike | July 31, 2022

• $NIO Down channel here to keep a eye on for a break either way.

Read Full Story »»»

DiscoverGold

DiscoverGold

STOCK IS GOING TO MAKE YOU A MILLIONAIRE IN 2025! Check the video!

NIO This handle is beginning to get awfully tight!

By: TrendSpider | July 28, 2022

• $NIO This handle is beginning to get awfully tight!

Read Full Story »»»

DiscoverGold

DiscoverGold

Have 1000 shares of f. Nice that they finally started dividends again. Have amc but not enough.

Nio Is Down 70% From All-Time Highs

By: Motley Fool | July 27, 2022

• Nio Is Down 70% From All-Time Highs. Here Are 2 Reasons Why It's Worth a Second Chance.

Two service models give Nio an edge versus the competition.

The electric vehicle industry is one of the newest, most volatile investment opportunities on the market today. With Tesla (TSLA 1.58%) as the only established industry leader, there is still a great opportunity for start-up electric vehicle (EV) makers to ultimately dominate the market. As of now, Nio (NIO -0.89%) and Rivian (RIVN -0.79%) are ahead of the competition, but all EV companies have faced supply chain challenges as a result of COVID-19. The bear market has also been less than kind to the EV industry; at Tuesday's prices, Nio's stock has dropped almost 70% from its all-time high in January 2021, and other companies are struggling similarly.

Among these top three manufacturers, only Nio is based in China. That's significant, because China was responsible for almost 60% of global exports of electric vehicles in 2021. The Chinese government is also taking several steps in 2022 to boost EV demand, such as introducing subsidies for new-energy vehicles and reducing charging fees. These circumstances balance China's recent lockdowns, which forced manufacturing plants to halt production for weeks at a time. In two years, Nio managed to increase its quarterly production of EVs from less than 4,000 to more than 25,000. Once supply chain issues are no longer as prevalent, the company should be able to produce more than 500,000 EVs yearly.

Nio's innovation is the primary reason it's taking the EV market by storm. Its battery-as-a-service (BaaS) and autonomous-driving-as-a-service (ADaaS) investments set the company apart from the competition. The company's stock is up roughly 200% since it began trading almost four years ago and gained 24.9% in June alone (the S&P was down more than 6% during that same period), showing that Nio is growing and adapting with plenty of room to grow.

Nio's battery-as-a-service advantage

Not even Tesla has managed to replicate the popularity of Nio's convenient battery-as-a-service technology (although that hasn't kept Tesla from trying). The service allows Nio customers to quickly swap their batteries up to six times per month without leaving their cars. It's faster than EV charging, clocking in at under three minutes per swap. Compare that to the average time it takes to recharge using a Tesla Supercharger station: The fastest car to charge on average, Tesla's Model S, charges about 200 miles in 15 minutes -- about five times as long as the average Nio battery swap.

Nio purchasers who subscribe to the optional BaaS service snag a discount of Yuan 70,000 ($10,380) off the sticker price. Subscribers pay a monthly fee of Yuan 980 (about $145) that includes a 70 kilowatt-hour (KWh) battery. For reference, the average cost to charge a Tesla is around $14. And it costs around $4 to $5 per 100 miles using at-home charges, which can cost between $800 and $2,000 in installation fees.

China has supported the rollout of these BaaS stations, even going so far as to give Nio special tax exemptions for luxury vehicles. In July, Chinese state television reported that the government is considering extending existing tax breaks for EVs.

Not one to limit itself to China -- the largest national consumer of EVs in the world -- Nio has expanded its BaaS network to Norway and discussed opening some of its European BaaS stations to other carmakers, giving it potential leverage similar to Tesla's Supercharger network. If this pans out, Nio's growing network of BaaS stations could be a major growth lever as competition in the EV space heats up.

Currently, Nio has the largest battery-swap network by far. This could be because BaaS stations are expensive to install. However, Nio claims that its newest battery-swap stations are half the cost of prior stations, which had cost $500,000 per installation. In addition, battery-swap stations require Nio to create a surplus of batteries to be swapped, a high up-front cost that grows with scale. Investors could argue that despite the cost, Nio's scale creates a wider competitive advantage down the line, especially versus companies attempting to imitate Nio's battery-swap service. Drivers will turn to Nio to reduce range anxiety. As the EV industry continues to grow, this competitive advantage could easily outweigh the costs in the long run.

BaaS is a sticky service and potentially a competitive moat. Customers probably won't want to ditch the convenience of BaaS for slower, more cumbersome EV-charging stations offered by companies like Tesla (though Nio is also rolling out its own charging network). Things only get more interesting for this large-cap growth company when you factor in Nio's second service advantage.

Nio is steering customers to a hands-free future

Nio offers self-driving capabilities to drivers through its autonomous-driving-as-a-service platform. According to the president of Mobileye, a world leader in computer vision for ADaaS, the company will collaborate with Nio to enable Level 4 electric autonomous vehicles for both consumers and robotaxi fleets. At Level 4, cars are expected to be perfectly capable of operating without a human behind the wheel.

The potential runway for autonomous driving is huge. Estimates pegged the 2021 Chinese EV market at about $124 billion. Cathie Wood's ARK Invest estimates that the Chinese autonomous driving market will expand to $2.5 trillion by 2030. A more conservative estimate by McKinsey research pins it at $2 trillion by 2040, which is still massive. Both analysts believe China has the opportunity to become the largest market for autonomous driving products and services.

Recently, Nio has announced an upgrade to existing self-driving models with an advanced system called Alder. As the car's cockpit and sensors become smarter, so will the self-driving capabilities of the car. According to a 2021 study conducted by 42Mark, while Tesla's Model 3 beats Nio's E6 in basic ADaaS performance (lane changing, congestion, etc.), Nio's E6 outperforms the Model 3 in navigation-assisted ADaaS and automatic parking. Drivers familiar with Tesla should have plenty of confidence in Nio's ADaaS capabilities.

Nio deserves a second look

American investors are understandably wary of Chinese investments right now. The stock market is down, a recession looms, and heavy-handed Chinese regulation has blown the valuation clean off former pandemic darlings like Alibaba (BABA -1.46%) and Tencent (TCEHY -1.58%), which are down 15% and 29% year to date, respectively. However, the Chinese government's newly demonstrated support of the EV industry only serves to enhance Nio's growth prospects.

Nio's innovation has the potential to help the company overcome the bear market and emerge as a major player in the ever populated EV market. This company seems to have a bright future due to its numerous advantages over competing EV manufacturers. Its battery-as-a-service and autonomous-driving-as-a-service technologies allow Nio to rise above its competitors, making Nio a growing company that is certainly attractive to risk-tolerant investors. Warren Buffett's mindset applies here: The market is fearful, which means it's time to get greedy. Nio is worth a small portfolio allocation.

Read Full Story »»»

DiscoverGold

DiscoverGold

Countries with the most EVs — check out China!

By: Markets & Mayhem | July 27, 2022

• Countries with the most EVs — check out China!

Read Full Story »»»

DiscoverGold

DiscoverGold

any new updates regarding the delisting issue ?

please share links to some helpful reliable sources

useless video. On the one hand it says will go crazy in 24 hrs which it has not. On the other hand it says investors may want to wait for a better entry point. Which is it?? Clickbait

Where Will Nio Be in 5 Years?

By: Motley Fool | July 23, 2022

• The Chinese electric vehicle maker looks poised to grow.

In a year, Nio's (NIO -6.96%) stock price has fallen more than 50%. Investors are concerned about Nio's slower growth due mainly to supply chain challenges, as well as the resurgence of COVID-19 cases in China. More importantly, competition in the Chinese EV market is heating up, with big players as well as newer entrants having their eyes on the massive opportunity. Then there is the short seller's report accusing Nio of overstating its revenue.

Can Nio thrive in such a scenario?

The EV stock has fallen steeply

If you just look at the fall in Nio's stock price, you get a feeling that something might be terribly wrong with the company. However, if you look at Nio's revenue growth, figuring out why the stock has fallen so dramatically could be a head-scratcher.

NIO DATA BY YCHARTS

As the chart shows, Nio's revenue has been growing, albeit at a far slower pace, in recent quarters. The stock, which was trading at a high valuation due to its rapid growth, saw a steeper correction than its slower growth warranted.

Let's take a closer look at Nio's growth over the years. In 2019, Nio produced 20,565 electric vehicles. It more than doubled its production to 43,728 units in 2020. Likewise, the company again more than doubled its production to 91,429 units in 2021. Nio's pace of growth, however, slowed in 2022.

In the first half of 2022, Nio delivered 50,827 units. Now, the company expects the second half to be better, with June already better than April or May. So, for the year, it is expected to grow deliveries, though they may not double from 2021.

Attractive product lineup

Nio began deliveries of its new luxury sedan, ET7, in March. In June, it launched ES7, a five-seat electric SUV. Nio expects its deliveries to begin in August. The new products should drive Nio's sales growth.

However, the company's key challenge is supply chain constraints, and it is making every effort to secure a smooth supply. It expects to ramp up deliveries significantly in the second half of the year.

Does the stock's fall make sense?

Slower growth in deliveries has hurt Nio stock. The key question is, are concerns relating to Nio overblown, and is the stock better valued now?

NIO PS RATIO (FORWARD) DATA BY YCHARTS

Even after the fall, Nio stock is trading at a forward price-to-sales (P/S) ratio of 3.7, which clearly doesn't looks cheap. However, if we compare Nio's ratio with its peers, the stock looks attractive. As the chart shows, Nio stock's forward P/S ratio is the lowest among its peers. Nio's ratio is also much lower than its own historical average.

EV stocks have been commanding premium valuations based on their expected growth and long runway for growth. If Nio continues to double its deliveries every year, as it did in the past, it won't take long for its P/S ratio to fall to far more reasonable levels.

Nio looks well-placed to grow

Nio has set up an independent committee to investigate the recent short seller's allegations. If the allegations are found false, Nio stock's fall may reverse. The company is launching new models, working on resolving supply chain challenges, and its efforts seem to be working, as evidenced by the strong delivery numbers in June.

Nio is also expanding in the European market and looks well-placed to capture a growing piece of the EV pie. The Chinese government plans to extend subsidies for electric vehicles, which should continue to support EV growth in the country.

Overall, Nio could be a far more established, and profitable, company five years from now. The stock's fall this year presents a buying opportunity.

Read Full Story »»»

DiscoverGold

DiscoverGold

TECH BILLIONAIRE JUST DROPPED A BOMBSHELL! NIO STOCK WILL GO CRAZY IN 24 HOURS! NIO NEWS! Click here to watch the video.

he is a fraud with no credibility.

NIO Inc. (NIO) back on the 50D, can't hold 17 next spot to watch.. hast clear the 8 and 21D to the upside

By: Options Mike | July 24, 2022

• $NIO back on the 50D, can't hold 17 next spot to watch.. hast clear the 8 and 21D to the upside.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO or meme stock $SNDL ? Thinking about buying stock in Ford, Sundial Growers, AMC Entertainment, Nio, or Robinhood Markets?

https://www.prnewswire.com/news-releases/thinking-about-buying-stock-in-ford-sundial-growers-amc-entertainment-nio-or-robinhood-markets-301591719.html

Bought mine at 1.98. Everyone said they were going under. But Chinese govt gave them money.

Yes I was. It is the reason I bought and have stuck.

NIO’s current US headquarters is an 85,000 sq. ft. building located at 3200 N. First St., a two-minute drive away on the same block as its new location.

NIO expands US headquarters as North American launch begins to feel more and more likely

Jim Cramer said it’s impossible to recommend Chinese stocks https://cnbc.com/2022/01/05/cramer-says-its-impossible-to-recommend-chinese-stocks-in-a-hostile-communist-regime.html $NIO

Jim Cramer said it’s impossible to recommend Chinese stocks https://cnbc.com/2022/01/05/cramer-says-its-impossible-to-recommend-chinese-stocks-in-a-hostile-communist-regime.html $NIO

$NIO Needs to hold 20 or 50D back in play, 8D needs to be cleared above

By: Options Mike | July 17, 2022

• $NIO Needs to hold 20 or 50D back in play, 8D needs to be cleared above.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc - (NIO) Given Consensus Recommendation of "Moderate Buy" by Analysts

By: MarketBeat | July 15, 2022

• Nio Inc - (NYSE:NIO - Get Rating) has earned an average recommendation of "Moderate Buy" from the fifteen research firms that are presently covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a hold recommendation and thirteen have assigned a buy recommendation to the company. The average 1 year target price among analysts that have issued ratings on the stock in the last year is $38.71...

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Wedging just below April's highs as price attempts to hold the 50 day EMA

By: TrendSpider | July 16, 2022

• $NIO Wedging just below April's highs as price attempts to hold the 50 day EMA.

Read Full Story »»»

DiscoverGold

DiscoverGold

I grabbed some at 46 and been averaging down ever since, now averaging at 25. Recently price dropped to $12 you could have significantly bring your average down

wouldn t put much stock in what kramer says, he is a proven fraud. although he WAS funny on seinfeld

NIO 1.20 Million Share at $21.05 #darkpool print

By: Money Flow Mel | July 14, 2022

• $NIO 1.20 million share #darkpool print at $21.05.

Read Full Story »»»

DiscoverGold

DiscoverGold

World Bank's warning: 'recession will be hard to avoid' 1970s stagflation is 'likely'

https://kitco.com/news/2022-06-07/World-Bank-s-warning-recession-will-be-hard-to-avoid-1970s-stagflation-is-likely.html $NIO

Jim Cramer said it’s impossible to recommend Chinese stocks https://cnbc.com/2022/01/05/cramer-says-its-impossible-to-recommend-chinese-stocks-in-a-hostile-communist-regime.html $NIO

A wake-up call for the company to be honest to the shareholders. I'm not selling.

Nio: A Mixed Grade On The Short Report

By: Vince Martin | July 13, 2022

• An activist short report on Nio seems to miss the mark

• Perhaps the most aggressive accusation appears to have been disproven

• But Nio is responding as if there is some truth to the story; investors should keep that in mind

Late last month, activist short seller Grizzly Research took aim at Chinese electric vehicle manufacturer Nio (NYSE:NIO). Some investors no doubt shrugged off the report without even reading it.

NIO Weekly Chart.

Source: Investing.com

Some of those investors might simply dislike short sellers. The rise of meme stocks, like AMC Entertainment (NYSE:AMC) and GameStop (NYSE:GME), has engendered deep disdain for those traders making bearish bets. Some might see a conflict of interest for Grizzly, which disclosed a short position in NIO stock ahead of the release of its report.

Neither is a reason to dismiss the report out of hand, however. Short selling, and activist short selling in particular, provide important checks on market exuberance. Those checks offer value to the rest of the market — but can't be incentivized without creating some value for the short seller.

Indeed, no one should know this better than investors in a Chinese electric vehicle stock. Well-known firm Muddy Waters Research made its name correctly identifying fraud in that country. That same firm in early 2020 passed along an anonymous report that correctly spotted financial regularities at Luckin Coffee (OTC:LKNCY).

Activist sellers have targeted the EV space as well. Perhaps the most impactful of those campaigns was the report from Hindenburg Research on Nikola (NASDAQ:NKLA). Hindenburg's research led not only to a plunging NKLA stock price but federal charges against its founder.

To be clear, that history doesn't mean Grizzly's own report is correct. Indeed, the firm appears to have made at least one significant mistake. But Nio itself seems to be taking the allegations seriously. Investors should as well.

The Grizzly Research Allegations

Grizzly's report on NIO can be described as having three core pillars.

The first is an argument that Nio is using a third party to inflate its revenue. Nio has developed a so-called “BaaS” (battery-as-a-service) program that allows vehicle purchasers to subscribe to a battery swap program in lieu of purchasing a battery upfront. The BaaS program, however, is run by a separate company, Wuhan Weineng Battery Asset Co., of which Nio owns 19.8%.

That setup allows Nio to book the revenues from the battery subscriptions it sells upfront, instead of over a period of years. To be clear, this is not illegal, as even Grizzly notes. In fact, this revenue treatment is required under accounting rules. But the effect is to inflate Nio's current revenue — and, more importantly, its profits.

Grizzly alleges that Nio has gone even further, however. It highlights a document from Wuhan Weineng, noting that as of Sept. 30, 2021, the company was servicing 19,000 subscribers. Yet, Wuhan Weineng at the same point had purchased more than 40,000 batteries from Nio.

Grizzly sees no need for these extra sales — and no signs of those batteries actually being stored anywhere. And so the firm concludes that Nio is allegedly overshipping batteries that it simply keeps at its service centers, further boosting revenue and earnings.

Finally, Grizzly raises some concerns about governance. It points to the installation of Nio executives at the head of Wuhan Weineng as disproving Nio's claims that it doesn't control that company. Grizzly notes the ties of Nio chairman Bin Li to individuals and entities involved in the Luckin fraud. And the firm claims that Li pledged shares ostensibly owned by Nio users to back loans, and that Li may well have routed 50 million RMB (roughly $7.4 million) to his personal account through Nio.

Is Grizzly Right?

Nio's initial response was to claim that “the report was without merit.” For the most part, the market seems to have agreed. NIO stock did drop about 3% on the day the report was released — but the entire market was down, with the less-volatile S&P 500 index declining 2%.

And, indeed, there appears to be a key error on perhaps the most inflammatory claim. The 19,000 subscriber figure was derived by a prospectus from Wuhan Weineng for an asset-backed financing. But as a number of users on Twitter pointed out, that prospectus doesn't cover all of the BaaS users — only a subset. Grizzly's claim here appears to fall completely flat.

As far as the argument that revenue and earnings are being inflated, there is some truth to it. But it's worth noting that accounting treatments typically depress the reported profits of SaaS companies. Costs are booked upfront; revenue is recognized over time. For this reason, in SaaS (software-as-a-service) businesses, investors often focus more on cash flow (where upfront payments are booked 100%) and/or pay close attention to deferred revenue balances.

The existence of Wuhan Weineng does perhaps suggests that Nio's results are better than they would be otherwise — but it does not imply that those results are distorted. Indeed, in the hypothetical scenario where Wuhan Weineng didn't exist, investors to some extent would treat Nio's BaaS revenue the same way they do SaaS, and make their own adjustments in valuing the business.

Reason For Concern?

Overall, the case made by Grizzly doesn't quite land. But that doesn't mean investors can or should simply dismiss the report out of hand.

There are governance concerns here. The pledging of Nio shares, if true, at best would be a significant violation of trust.

Grizzly notes that Chinese government entities — who rescued Nio when the company was at legitimate risk of bankruptcy in late 2019 — continue to redeem shares at a rapid clip. Nio still has obligations on that front that could total as much as $6.7 billion — and only $8.2 billion in cash on hand ahead of a planned global expansion. The firm is correct in noting that further redemptions could cause Nio to need to raise additional capital — which likely would require equity issuance and thus shareholder dilution.

The risks aren't as explosive as Grizzly's broader tone would suggest. But this still is a company with a market capitalization just shy of $35 billion — and no profitability in immediate sight. (Wall Street consensus projects a modest loss in 2023.) It's also a company that this week said it would form an independent committee of directors to probe the allegations made by Grizzly.

Perhaps that response is intended to mollify the market, and remove any semblance of doubt raised by the short report. But it's worth noting that Nio said its committee would be advised by “a well-regarded forensic accounting firm.”

That kind of firm isn't necessarily one required to respond to an error-riddled report with no basis in fact. It suggests that Nio's board at least wonders if there might be something to at least some of the allegations made here. Given the history of the space, and the still-stretched valuation, that's a risk investors, at the least, need to be aware of.

Read Full Story »»»

DiscoverGold

DiscoverGold

Officially CONFIRMED by CATHIE WOOD that NIO will hit $50 within 90 days! Check this video

Nio (NIO) Another retest of the trendline breakout today

By: TrendSpider | July 12, 2022

• $NIO Another retest of the trendline breakout today which is confluent with this ascending channel off the lows?

Read Full Story »»»

DiscoverGold

DiscoverGold

very one sided view, the authors have missed the point about how to manage inventory of batteries when you don't know where your subscribers will need them.

if they had sold one battery for one subscriber there would be none available to swap out or upgrade. They don't show evidence of any thrd party battery either.

If you are growing the number of stations at over 25% a year you also need inventory to stock them....

But there is an odd synchronization with NIO fiscal quarters and not sure about the pricing either.

Some smoke for sure but no fire IMHO

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |