Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Im wondering now that Roger Knox is on the SEC hot seat whether any of the other companies listed in the SEC complaint will come under scrutiny besides NEWG. The SEC says as many as 50 companies may be involved in the scam.

So, anyone know what's going on with this company now?

What a relief for the company, no more pesky 10Ks, 10Qs or 8Ks.

Form 15 filed today, with only 6 holders of record:

https://www.sec.gov/Archives/edgar/data/1537274/000164033417000762/newg_1512g.htm

Not until the 17th, if then:

.... this is now known as 'Greenwind Holdings Inc

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11979282

I suppose this certainly seems plausible but you'd have to directly connect the Sammon's to Gary O'Flynn somehow, beyond both being from Cork, Ireland...... which I agree is kind of suspect, especially given the timing of the shells setups.

Your probably on to something but I don't have the energy to continue to look into it, I've already wasted too much time here as it is.

Personally, I don't think the SEC and/or FINRA should even allow a shell company to change their name, to match the merging entity, until AFTER the merger is actually finalized.

How many investors bought this during the stock promotion thinking this was actually NewGen(New Jersey), I doubt the promo would have been nearly as successful if it was still named Greenwind NRG Inc.

3) Deficiency Determination

In circumstances where an SEA Rule 10b-17 Action or Other Company-Related Action is deemed deficient, the Department may determine that it is necessary for the protection of investors, the public interest and to maintain fair and orderly markets, that documentation related to such SEA Rule 10b-17 Action or Other Company-Related Action will not be processed. In instances where the Department makes such a deficiency determination, the request to process documentation related to the SEA Rule 10b-17 Action or Other Company-Related Action, as applicable, will be closed, subject to paragraphs (d)(4) and (e) of this Rule. The Department shall make such deficiency determinations solely on the basis of one or more of the following factors: (1) FINRA staff reasonably believes the forms and all supporting documentation, in whole or in part, may not be complete, accurate or with proper authority; (2) the issuer is not current in its reporting requirements, if applicable, to the SEC or other regulatory authority; (3) FINRA has actual knowledge that the issuer, associated persons, officers, directors, transfer agent, legal adviser, promoters or other persons connected to the issuer or the SEA Rule 10b-17 Action or Other Company-Related Action are the subject of a pending, adjudicated or settled regulatory action or investigation by a federal, state or foreign regulatory agency, or a self-regulatory organization; or a civil or criminal action related to fraud or securities laws violations; (4) a state, federal or foreign authority or self-regulatory organization has provided information to FINRA, or FINRA otherwise has actual knowledge indicating that the issuer, associated persons, officers, directors, transfer agent, legal adviser, promoters or other persons connected with the issuer or the SEA Rule 10b-17 Action or Other Company-Related Action may be potentially involved in fraudulent activities related to the securities markets and/or pose a threat to public investors; and/or (5) there is significant uncertainty in the settlement and clearance process for the security.” (emphasis added)

https://www.linkedin.com/pulse/sec-supports-finras-rule-6490-authority-over-actions-anthony-esq-

finra might not be keen on approving corporate change requests for a company under sec investigation.

On March 31, 2017, NewGen BioPharma Corp., a Nevada corporation (the “Company”), filed an application to change its name to Greenwind Holdings Inc. The name change is being made pursuant to Nevada Revised Statutes 92A.180 and 92A.200 by merging a wholly-owned subsidiary of the Company with and into the Company. The Company is the surviving corporation in the merger, and in connection with the merger, the Company’s Articles of Incorporation will be amended to change the Company’s corporate name to Greenwind Holdings Inc. On April 3, 2017, the Company filed an Issuer Company Related Action Notification with FINRA to effect the name change, and the Company’s application is currently under review by FINRA. The name change will be effective on or about April 17, 2017 upon review and approval by FINRA.

Mod to avoid any possible confusion, could you delete all the info in the iBox, as this is just an empty shell that no longer associated with NewGen BioPharma (New Jersey).

They were required to change the shell company name after the merger was terminated so this is now known as 'Greenwind Holdings Inc'.

http://nvsos.gov/SOSEntitySearch/CorpDetails.aspx?lx8nvq=Khquk4Zw0j%252b7L421uY5zzA%253d%253d&nt7=0

Well, if this was indeed a shell scheme then it certainly wasn't an obvious one, as they would have pulled the wool over the eyes of Dr. Singhvi, Dr. Patel, Dr. Jaikaria and Dr. Alam, four highly intelligent individuals with extensive corporate and Wall Street experience on every level.

I personally believe that all involved, Greenwind and NewGen, wanted this merger to happen.

In my old pre-promo research on NEWG from November 2016, I suspected that the O'Flynn family from Ireland was involved in the set-up of this shell and the creation of all of the free trading stock registered in the sham S-1 filing when it went public.

Same O'Flynn family that was involved in paid promo tickers GOFF, DPSM, and SPWZ.

More about the GOFF scam at this link:

https://www.sec.gov/litigation/complaints/2015/comp23195.pdf

It will be interesting to see if the SEC eventually files charges here to explain what they meant in the Suspension Order when they said:

The Commission temporarily suspended trading in the securities of NewGen BioPharma because of questions regarding the accuracy and adequacy of publicly available information about the company, specifically (i) the identity of its former sole executive officer, director, and majority shareholder; and (ii) possible undisclosed former and current controlling persons.

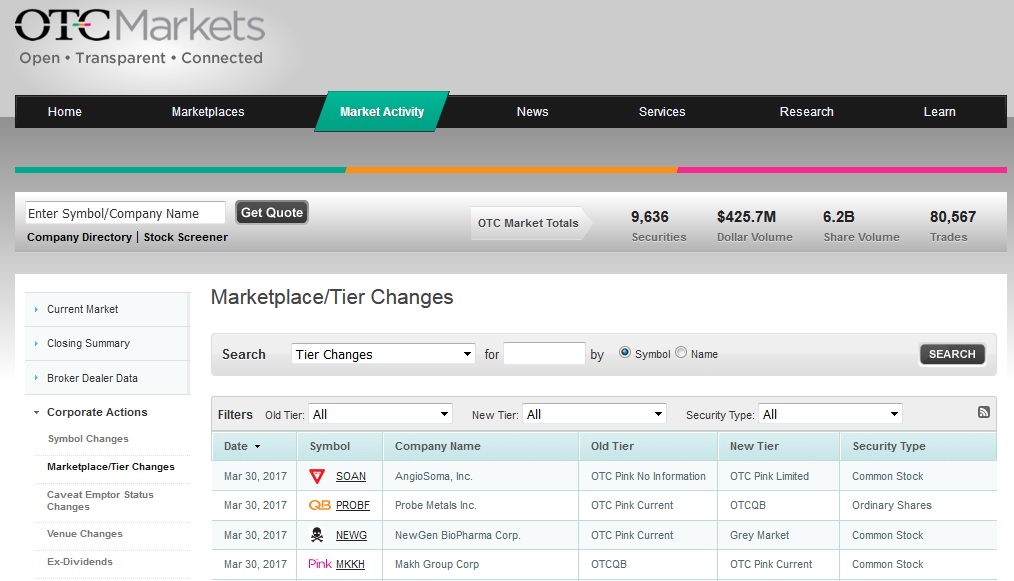

NEWG became a Grey Sheet stock today

After not trading for a couple of days because of the SEC suspension, NEWG was down-tiered by OTCMarkets to the Gray Market, so when trading resumes on April 11, it will be without the visibility of LII quotes:

More about Grey Market:

http://www.extraordinaryinvestor.com/grey-sheets.html

Scumbags LOL

**Merger Terminated**

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11961487

The SEC doesn't suspend to protect existing investors in the stock. They have already made their bet. They also know the suspension will hurt them which is why they do it relatively infrequently given the number of scams in the otc. But when they decide to do it...it's pretty much a slam dunk case...or low hanging fruit as they say.

At that point protecting potential investors becomes more important.

If that's the case then so be it, I once read somewhere that we never completely lose in penny stocks, we either make money or we learn a lesson. Well I have learned a valuable lesson, whenever a stock gets halted by the BCSC it's time to sell an move on, regardless of how good it looks.

Virtually every stock that has ever gotten a BCSC Halt Trade Order has turned out bad for investors, there are a couple exceptions, but not many at all.

they may still try and get this one reinstated,

they may try but they will not be likely to succeed. mm's are reluctant to sign of on a form 211 when the company has been suspended by the sec for fraud.

The vast majority of these companies probably deserved to be suspended as they were more then likely share selling scams, p&d's, zombie tickers, etc....and there are dozens and dozens more currently trading on the OTC.

I personally don't believe NEWG should have been suspended, yes someone clearly dropped the ball somewhere but they never set out to defraud anyone IMO. In fact if NewGen(private) terminated this merger and moved on to go public through another shell company, I'd gladly line up to be one of the first buyers.

Whatever the case, I guess we'll have to wait and see what happens, they may still try and get this one reinstated, there are a lot of investors with big time $$$'s in this.

some do get reinstated and get off the GREY Market but very, very few..

unfortunately for shareholders, you are correct. rene keeps track. the history of suspended stocks is dismal. it can be seen here;

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127559570

I think the stock promotion that got them halted in Canada also got them on the SEC's radar and thus ultimately suspended.

Personally I always thought Jerwin Alfiler seemed like a ghost to me, I couldn't find much on him, the company he supposedly worked for, Butas Financial, or the address they used in the Philippines. I didn't think much about it though since I figured Dr Jaikaria had probably done extensive due diligence.

it seems pump and dump may not have been the issue. according to the sec.....

The Commission temporarily suspended trading in the securities of NewGen BioPharma because

of questions regarding the accuracy and adequacy of publicly available information about the

company, specifically (i) the identity of its former sole executive officer, director, and majority shareholder; and (ii) possible undisclosed former and current controlling persons

The saddest thing about this was that by suspending it the SEC actually hurt far more investors then they supposedly protected.

Even if there was indeed an ill-timed stock promotion, it wasn't a true pump and dump type scenario, it was never a case in which the company was dumping it down into oblivion, like most promos, the pps was holding up very well.

No one was really losing any money here so they didn't need to be 'protected'....and..... had the merger gone through everyone would have made money.

Not actually Gray Sheets today, but effectively

A stock has to not trade for 2-3 trading sessions before it's moved to the Gray Sheets, so NEWG didn't go to the Grays today.

OTC Markets will move it to the Grays by this Thursday or Friday, and when it comes off suspension at Midnight on April 10, that's where it will trade.

I'd say he is right, some do get reinstated and get off the GREY Market but very, very few....it's usually the kiss of death.

If I were Dr. Jaikaria I'd terminate the merger immediately and begin looking for another shell, perhaps one with ethical and professional ownership this time.

Suspended, well I suppose that was always a serious risk here after they ran a stock promotion pre-merger and got halted in Canada. That was stupid on so many levels it's almost inconceivable, Dr. Jaikaria should have terminated the merger immediately after that happened.

and delisted to the grey sheets today.

NEWG SEC Suspension:

https://www.sec.gov/litigation/suspensions/2017/34-80318.pdf

Order:

https://www.sec.gov/litigation/suspensions/2017/34-80318-o.pdf

The Commission temporarily suspended trading in the securities of NewGen BioPharma because of questions regarding the accuracy and adequacy of publicly available information about the company, specifically (i) the identity of its former sole executive officer, director, and majority

shareholder; and (ii) possible undisclosed former and current controlling persons.

From the ORDER:

It appears to the Securities and Exchange Commission that there is a lack of current and accurate information concerning the securities of NewGen BioPharma Corp. (CIK No.0001537274) because of questions regarding the accuracy and adequacy of publicly available information, in periodic and other reports, about the company since at least January 9, 2014, specifically (i) the identity of its former sole executive officer, director, and majority shareholder; and (ii) possible undisclosed former and current controlling persons. NewGen BioPharma Corp. is a Nevada corporation whose current principal place of business is in Seattle,

Washington. Its stock is quoted on OTC Link LLC, operated by OTC Markets Group, Inc., under the ticker symbol NEWG.

Good grief, $100K on the ASK @ $1.60 62K shares WTF.

When I first started looking into this I thought all they had to do was:

A) Get the merger done on time

B) Limit dilution

C) Don't do anything stupid (ie promo, trading halt, etc), keep everything extremely professional and legit

And this could be the best play on the OTC in years.

They basically butchered all these things, thankfully the pps is still holding up for now but what a mess they have made of this, no amount of DD could have predicted this.

Uplisted from the Pink sheets to the OTCQB today.

$50K+ dollar bidder today @ $1.50, though most of that got whacked a few seconds ago. Even after all the shenanigans there are still big time buyers interested in this, just need to get the merger done and this will start moving north again quickly IMO.

Canadian trading halt should be lifted tomorrow, be interesting to see if it brings sellers.....buyers....or has no effect, I'm guessing it's not going to have much effect.

This merger has been a mess thus far, way over the Jan 31 completion deadline, stock promotion, trading halt, etc. Plus there was too much dilution pre-merger, there is currently at least $85K sitting on the ask @ $1.60 and $1.65 alone.

There is still potential here but it's definitely not the slam dunk I thought it would be when I originally started conducting due diligence.

Yet another 8K out.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11887556

This one sounds meaningless to me and is the basically the equivalency of a fluff PR.

It essentially just says they are giving Dr.Jaikaria 11M restricted shares, as an advance on the 40M per the merger agreement.....BUT....if the merger doesn't go through those shares will be forfeited in their entirety.

As far as stock promotions go it was actually quite good, the pps isn't that far off from the high of $2, so it wasn't a true p&d type scenario, the share price has actually held up very well.

It's just the timing that was incredibly stupid, pre-merger should be a quiet period, not a promoting period, thats why I didn't believe that was what was happening.....even though the trading activity, with the extreme volatility and incessant flipping was what you'd typically see in a promotion.

Who executed the promo is the bigger question, Alfiler and/or the Irish had the most to gain BUT they could have lost the merger as well, so there was a lot to lose. Maybe a 3rd party executed it, without the companies knowledge, seems more likely.

The Canadian trading halt on NEWG should be lifted by March 10th, it will be interesting to see if it has any effect on the volume or pps. Will it bring in new buyers...or...more sellers who were stuck after buying in a promo.

If you look at the past companies that were halted by the BCSC, only one went on to do anything long term and that was AVXL, the rest are under .03 cents pps currently.

MDCN-- .0002

CHUM-- .03

AVXL--$5.21

BOPT--.001

TAGG--.0001

QWTR--.01

FMNL--revoked

KNKT--.002

CPOW--.0002

http://www.bcsc.bc.ca/Enforcement/Halt_Trade_Orders/

IMO the company needs to file an 8K and explain why trading was halted in Canada. If it was halted due to 'promotional' activities, it probably wasn't very bright running a promo pre-merger, this could have easily been halted by the SEC as well or at the very least been slapped with caveat emptor status on OTC Markets.

BCSC Halt Trade Order??

Anyone familiar with this...? Looks like the first stock halted by the BCSC since 2015, I guess this would explain the volume drop off.

Seems like we should have seen an 8K or PR on this issue. It looks like many of the other companies on the list were involved in paid promotional campaigns.

Even if there was some sort of promo on NEWG, why would they be singled out by the BCSC, there are promos everyday on the OTC. For that matter why would NEWG have even done a promo to begin with, they didn't need it, it would have eventually run on it's own.

It's all very bizarre.

http://www.bcsc.bc.ca/Enforcement/Halt_Trade_Orders/

http://www.otcmarkets.com/stock/NEWG/news/BCSC---Halt-Trade-Order?id=151512&b=y

http://www.bcsc.bc.ca/Enforcement/Halt_Trade_Orders/PDF/2017_BCSECCOM_46/

This merger has been a disappointment thus far and somewhat poorly executed. It started off great but clearly some sort of issue has caused a delay....perhaps the audit..??

They brought a new accounting firm on board last week, so hopefully this will resolve the issue.

Nevada SOS updated showing Long as President, Secretary, Treasurer and Director.

http://nvsos.gov/SOSEntitySearch/CorpDetails.aspx?lx8nvq=Khquk4Zw0j%252b7L421uY5zzA%253d%253d&nt7=0

There has been less volume since Long took over but less price volatility as well.

There have been some massive blocks on the ask though, yesterday there was around a quarter million dollars worth on the ask @ $1.65, not sure if this is a manipulation tactic or someone just has a lot of shares to sell.

Huge blocks on the ask today, someone wants out but the volume is gone. Wish we knew what happened or is happening with this merger, things seemed to be progressing nicely then it all went to shite.

I have no idea what the latest 8K was about, why was Brad Long, an IR guy made president of NEWG..? I see no obvious connection between Long and the folks at NewGen(private). Did they go a different direction? Is Long going to be IR for NewGen post merger...if so...why would he be president..?

It's all very bizarre.

As far as Brad Long is concerned, I like GLLA but it's highly illiquid, they just entered cannabis(e-liquid) industry back in November and they still get very little interest from investors....and it's only a .12 cent stock. Personally I'm not impressed at all with the job that has been done by IR there.

It's kind of interesting that Jerwin Alfiler was out yesterday and there was also a major drop off in volume yesterday as well, I guess it was Alfiler who got this started trading and brought in all that initial volume...??

Now that Alfiler has left NewGen I'll be watching to see if he pops up on another public company in the future, I'll be buying that for sure if he does. You rarely see that kind of buying action on an obscure shell company.

Another crazy 8K filing out today, I'm not sure what to make of this one either. Alfiler is out and Brad Long has been appointed President of NewGen. I recognize Long from another stock I have been following for several years GLLA, he is their investor relations guy.

What this means for the NewGen and the merger I have no idea, it's bizarre to say the least.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=11837843

Much less volatile today, yesterday was a roller coaster ride, flippers must have had a field day.... Got dumped down to $1.08 then rebounded back to $1.60.

Agreed, I just don't like what I'm seeing, extremely volatile, trades too much like a p&d with nothing but flippers and very few longs.......not really what I was expecting here when I first started looking into this months ago.

something doesnt smell right. i hope we get some clarity this week.

Big selloff today, somethings not right here IMO, merger dead or delayed..???

Websites back online but don't really see any changes.

I think folks are starting to lose faith in this merger, the last few filings, IMO, have essentially been 'fluff' to prop up the pps but how long is that going to last. Need to see some real progress, this has gone as high as it can go without the merger.

NewGen website appears to be down or taken offline.

https://newgenbiopharma.com

Was not quite what I was expecting when I saw the change of control, as it doesn't give us anything definitive on the actual merger, however, it does at least it show us the wheels are still turning I suppose. The Irish wouldn't have given their shares away for peanuts for nothing.

Must be some reason they did this, maybe they are still waiting on the NewGen(private) audit and wanted to release a filing that looked like progress until that is complete....I have no clue.

Why wouldn't you just issue Dr. Jaikaria 40M shares, make him sole director of the company and be done with it..?? Why this additional step?

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

209

|

|

Created

|

11/14/16

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |