Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

SK Hynix aims to lead HBM Market for AI Chips, invests $75 Billion by 2028 https://www.digitimes.com/news/a20240701VL205/sk-hynix-hbm-demand-ai-chips-2028.html

Stokd $NLST When BOC trial concluded, Samsung wanted discovery from ED, to support their new manufactured theory about Netlist hiding discovery. Of course after losing they have to find something to raise/object.

It stems from Netlist using an exhibit inappropriately during trial, which blindsided Samsung and exposed their lies and contradicted their position.

The judge struck it from the record and instructed the jury to disregard. SInce that doesn't overturn the verdict nor warrant a new trial, Samsung cries, lies, and spins...filing in BOC for a hearing.

Netlist's response completely contradicted Samsung's position, and laid out in detail with specifics, how/why. Samsung filed to lift protective order in ED on June 25—unsealed/redacted version filed today—and Netlist responded in support though contingent.

Netlist's motion is sealed—SEALED MOTION for Contingent Relief from Protective Order by Netlist—but this doc is not and indicates Netlist has the goods and nothing to hide. Game over!

https://sih-st-charts.stocktwits-cdn.com/production/original_578403550.png

The bottom part of the doc pictured below⬇️. The app to make docs I pay/pull on Pacer publicly accessible on Courtlistener, is not working again...hit & miss.

https://sih-st-charts.stocktwits-cdn.com/production/original_578404196.png

https://stocktwits.com/Stokd/message/578403550

NLST here's that new patent mentioned https://patents.justia.com/assignee/netlist-inc

robcobb

5m

$NLST I guess a lot could happen in 11 minutes and that’s all the hearing took yesterday. I have listened to all of Samsungs arguments through the last two years plus.It is hard for me to imagine they got their way with a motion hearing that took only 11 minutes ! I guess we will know pretty soon. I think we are about to find out when I will be witnessing Samsung in the courtroom again. I am starting to get excited again about traveling to Marshall and witnessing justice in the making!Cannot wait till Stokd posts the decision in the motion hearing yesterday ,whatever it is because we know it is still moving forward!

microby patent news!!!

it´s a hot paper, this morning puplished

US 12,026,397

Hybrid memory module having a volatile memory subsystem and a module controller configurable to provide data to accompany externally sourced data strobes to the volatile memory subsystem

If you believe that Netlist will be successful with its own product, then you can buy a share for 1.35 dollars.

The battle for recognition and confirmation of the innovative developments on the DIMM DDR4/DDR5 standard in recent years is still ongoing.

But in the background, the team around CEO Hong is not waiting in the wings! They are testing, soldering, programming, modifying and adjusting. It will be finished! I believe in that!

https://sih-st-charts.stocktwits-cdn.com/production/original_578383326.png

https://stocktwits.com/microby/message/578383326

nlst, maybe gail doesnt want shoes no more ???

thx man, i'll be home taking it easy, i dont play amature night anymore !!! nlst baby

Thank you Robcobb, and as always Striper too !

A lot of work put in ! May you have an extended holiday weekend.. with easy and awesome reporting… Hopefully a safe holiday for all.

Thank you, as well for those whom gave it some and especially for those whom gave it for this country..

Godspeed

much agreed!!! NLST Text only entry in the Samsung 293 case, with no doc --- "Minute Entry for proceedings held before District Judge Rodney Gilstrap: TELEPHONIC Motion Hearing held on 7/1/2024 re 712 OPPOSED SEALED MOTION for Continuance filed by SAMSUNG ELECTRONICS AMERICA, INC., Samsung Electronics Co, LTD, Samsung Semiconductor Inc from 04:33 to 04:44 PM. Court opened and counsel were identified. Court took up Dkt. No. 712. Discussion held re: continuance of pretrial conference and jury trial setting. Court made rulings as set forth in the record. An Order will be forthcoming."

https://sih-st-charts.stocktwits-cdn.com/production/original_578332438.png

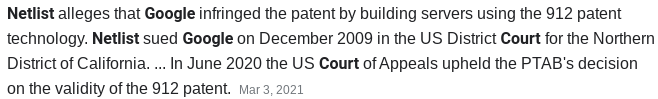

the 912 patent which the PTAB all of sudden decided was obvious (after 10+++ years of litigation) is going to make us rich. when we beat google we are going to be ...... .... . the judicial branch is going to make sure we get paid. its sad that this has taken this long but I believe finally the highest court in the land is seeing how it is has errored and this latest ruling is an attempt at fixing the problems.

In a major ruling, the Supreme Court on Friday cut back sharply on the power of federal agencies to interpret the laws they administer and ruled that courts should rely on their own interpretation of ambiguous laws. The decision will likely have far-reaching effects across the country, from environmental regulation to healthcare costs.

Jul 2, 2024

Minute Entry for proceedings held before District Judge Rodney Gilstrap: TELEPHONIC Motion Hearing held on 7/1/2024 re 712 OPPOSED SEALED MOTION for Continuance filed by SAMSUNG ELECTRONICS AMERICA, INC., Samsung Electronics Co, LTD, Samsung Semiconductor Inc from 04:33 to 04:44 PM. Court opened and counsel were identified. Court took up Dkt. No. 712. Discussion held re: continuance of pretrial conference and jury trial setting. Court made rulings as set forth in the record. An Order will be forthcoming. (No exhibits)(Court Reporter Shawn McRoberts.) (aeb)

We should be seeing Gilstrap's order regarding the case #00293 continuance request within minutes/hours! I'm betting no continuance!

robcobb

7:09 AM

$NLST I am wondering if I will be attending the Samsung Nlst 293 trial( sooner or later or unchanged),since the hearing for continuance was held yesterday? I called Judge Gilstraps clerk yesterday and he said the telephonic hearing was closed to the public.We would already know that answer if I could have listened in! I have to think Stokd will be posting the result from the motion hearing yesterday soon ! Whatever the decision is,I am on GO for the pre-trial and

trial as usual! It’s almost time for some more people of Marshall Tx. and Gilstrap justice!

NLST Samsung Dram and Nand prices will increase by 15/20% in the third quarter of 2024. Netlist revenues will therefore increase in the next quarterly quarters at similar rates to 2021. I hope that Netlist can increase the revenues of the company's products and make margins.

Samsung Reportedly to Raise Memory Price by 15-20% in Q3, Boosting Second Half Performance

DRAM SPACE

According to a report from South Korean media Maeil Business Newspaper, Samsung Electronics plans to raise prices for server DRAM and enterprise NAND flash by 15% to 20% in the third quarter due to surging demand for artificial intelligence (AI). This move is expected to improve the company’s performance in the second half of the year, while boosting momentum for some Taiwanese companies like Nanya Technology, ADATA, TeamGroup and Transcend in the coming quarters.

Industry sources cited by a report from Economic Daily News believe that with manufacturers defending prices, there is strong support for the market. Additionally, as the three major manufacturers focus on developing high-bandwidth memory (HBM), which limits the output of DDR4 and DDR3, it helps maintain a healthy state for the DRAM industry.

Per Maeil Business Newspaper, sources have revealed on June 26th that Samsung Electronics has recently notified major customers about the planned price increase. The Device Solutions (DS) division, responsible for Samsung’s semiconductor business, held a global strategy meeting at its Hwaseong plant in Gyeonggi-do on the same day, where this matter was discussed.

The report further stated that Samsung Electronics had already increased the prices of NAND flash supplied to enterprises by at least 20% in the second quarter, anticipating that the AI boom will drive higher server demand in the second half of the year.

According to data from DRAMeXchange, the global sales of enterprise NAND flash reached $3.758 billion in the first quarter of this year, marking a 62.9% increase from the previous quarter. With the rising demand, some products are experiencing shortages.

TrendForce also notes that with a slight improvement in server demand, Samsung has indicated it will adopt a more aggressive pricing strategy for server DRAM and enterprise SSDs for 3Q24 deals. TrendForce’s price projections posit that server DRAM prices are expected to increase by more than 10% QoQ, with enterprise SSDs enjoying a similar price range. However, due to sluggish smartphone demand, price increases in mobile categories are expected to be more modest.

https://www.reddit.com/r/Netlist_/comments/1dtk8jp/samsung_reportedly_to_raise_memory_price_by_1520/?share_id=JmgCWznWz_4iIIqRHwJNy&utm_content=2&utm_medium=ios_app&utm_name=ioscss&utm_source=share&utm_term=1

that should read 7-2024. not 04.07

States Join Together to Defend Against NPEs

https://www.patentprogress.org/2024/06/states-join-together-to-defend-against-npes/

In 2013, Vermont became the first state to pass an “anti-patent troll” law. Since then, more than 30 states have passed similar laws to rein in patent trolls. These efforts, which range from allowing companies and states to sue patent trolls for bad-faith assertions, to providing civil penalties and to giving companies that are targeted the opportunity to seek damages, have helped discourage trolls from targeting small businesses and inventors.

Unsurprisingly, over the last several years, a handful of states have been challenged in court by patent trolls who argue that these laws are unconstitutional and infringe on federal patent law. An Idaho law, the most recent target of such challenges, imposes a bond requirement on NPEs. This measure requires NPEs to prove that, if they are found to be likely to have violated the bad-faith assertion law, they will be able to pay any penalty imposed by the law. This helps deter NPEs from making bad-faith assertions. In other words, it forces NPEs to think twice before they target a small business for patent infringement.

The Idaho case stemmed from a patent infringement claim that was filed by Longhorn IP LLC and Katana Silicon Technologies LLC against chip maker Micron Technology Inc. in 2022. Under the Idaho law, a federal judge ordered Katana to post an $8 million bond based on accusations that the patents were asserted “deceptively.” In response, Longhorn called the law “the most extreme” statute in the country, arguing that it, “and particularly its bond provision are unconstitutional and preempted” by federal law.

The pushback was swift. We at CCIA submitted a brief alongside the High Tech Inventors Alliance in support of the Idaho law, explaining that it is not only essential for preventing abuse in the patent system, but is in full compliance with federal patent law. “This Court,” we wrote “should uphold the judgment below, finding that the Idaho bad faith assertion statute is not preempted as the court below found, in line with the decisions of other district courts around the country examining similar state bad faith patent assertion laws.” The 34 state legislatures that have passed similar laws, we argue, have the right to protect local businesses from abuse and “the Federal Circuit should not lightly second-guess these states and their elected legislatures.”

We were not alone. Twenty-seven states, led by North Carolina Attorney General Joshua H. Stein, submitted a separate brief, outlining a similar argument and urging the appeals court to side with Micron and the state of Idaho.

While the NPEs argue that this is a case of federal vs. state law, it’s not really about that at all. Not only are these state laws legal and in compliance with federal court precedents, but they are common-sense measures that help deter abuse in our court system and protect American businesses and inventors from costly and unfair litigation – something we should all be able to support.

youngstarter $NLST Dear longs,

News from Germany:

The hearing for EP660 on 04.07. in Munich has been postponed and no new date has been set yet. No reason known!

Netlist, Inc. v. Samsung Electronics Co, LTD (2:22-cv-00293)

District Court, E.D. Texas

https://storage.courtlistener.com/recap/gov.uscourts.txed.216364/gov.uscourts.txed.216364.720.0.pdf

Stokd $NLST Well, at least it's nice to get affirmation that there is indeed a trial still scheduled-😂-given the doc below which was filed after today's hearing on continuance.

It is also odd—though I don't want to read too much into it—that we haven't even had the pretrial conference yet, and Samsung is already filing a request for daily transcripts & real-time reporting of trial.

Maybe Gilstrap did move the trial up....kept the pretrial date same of July 23, with trial earlier in Aug.

Would Samsung file this today if their continuance was granted???

https://sih-st-charts.stocktwits-cdn.com/production/original_578289453.png

NLST a doc drop for 293. For a request for the transcripts and reporting

https://sih-st-charts.stocktwits-cdn.com/production/original_578284023.jpg

microby

Yesterday 3:29 PM

a motto of mine - swarm intelligence -

so what do we find out together,

Lynk labs v. samsung appeal no 23-2346!?!

cafc issued a ruling?? your part of the swarm - 🙏😉

stands in relation to ptab claim 16 obvious bullshit

Netlist has kindly pointed out several times

- not a printed publication under 35 U.S.C. paragraph 311 b -

meaning the elsberry paper which was published 1 year later, as a patent application!!! not as a granted patent

this matter is currently before the cafc,

Lynk labs v. samsung appeal no 23-2346

https://sih-st-charts.stocktwits-cdn.com/production/original_578255404.png

thread............ https://stocktwits.com/microby/message/578255404

I don't think the striking down of Chevron by the Supreme Court will affect the PTAB at all. It's going to take Congress to reform or abolish "The America Invents Act" which established the PTAB in order for any meaningful changes to be made. The constitutionality of and particular functions of the PTAB has been litigated before the Supreme Court in three separate cases. Each time patent owners came out lacking any real reform.

https://blog.petrieflom.law.harvard.edu/2021/06/23/ptab-arthrex-scotus-decision/

Massive shock to the legal system? Yes and maybe in a good way! Bought 1k sh @ 1.37

Thats awesome thx you, I thought I missed news on NLST because you were buying lol

Keep the Federal Gobment out of peoples bussiness...

Sorry you have a link ? I have no idea what news your talking about tia

Nice! Looking to do the same!

robcobb

26m

$NLST I am hoping Judge Gilstrap denies Samsungs continuance motion today and instead moves the Samsung pre-trial and trial up. (That’s how I would help the Samsung lawyers with their problem if I were Judge Gilstrap).I guess we will know after the telephonic hearing 4pm central today ! I’m starting to get bored it’s been too long since I was in the courtroom!

i'm getting the impression that these articles i'm posting coupled with other like minded opinions are seeing it the same way. this milking of the system has to come to a stop. the judicial system whether here and there corrupt has to have already acknowledged its presence. so, lets see what becomes of it........

$NLST 912 that has undergone over a decade long battle and affirmed by CFAC is surely a locked win now.

What we now know for sure is MU, a company we were not even thinking about, owes $400 million on the 912.

How much will Samsung be?

Shit, how much will GOOGLE BE? Remember Judge said profits included***

If you are a betting type, this is a sure bet!

https://www.linkedin.com/posts/schelljeffrey_recent-statistics-show-ptab-invalidation-activity-7212606200641675265-GF0b

We need a justice system that only allows a company that steals technology to beable to sell for one yr after litigation has been level against them. these cases wouldn't beable to drag out for 10 yrs if that was the case.

South Korea's SK Hynix, the world no.2 memory chip maker, will invest 103 trillion won ($74.6 billion) through 2028 to strengthen its chips business, focusing ...

any one else think nlst will benefit in here some where ???

https://finance.yahoo.com/news/south-koreas-sk-hynix-invest-030038452.html

FrankFromYahoo

20m

$NLST The impact of the SCOTUS judgement this week, may be that big that nothing may change for while until new/amended procedures are in place. USPTO and PTAB will continue to work as they did, at least for a while. However, where you have situations where a court has made already a judgement and in parallel also administrative judges/agencies on the same issue, I could imagine that the later could be declared moot by the CACF. Still the CAFC would deal with the appeals of Samsung and Micron against the ED Texas‘ judgements (success rate probably a low single digit % against Gilstraps judgements). We have to see and wait about the consequences.

We can only speculate at this moment. Curious to read more educated articles in coming days and weeks, especially related to the PTAB/USPTO.

microby

24m

you know my opinion, I think at least with regard to the way the 912 works modules

I can absolutely understand what the genius Bhakta and his team created back then 2005-2012

the copied rank multiplication concepts of mtaRAM and their former partner hynix were torn apart by a court decision and metaRAM died after this judgement!

For years without financial success for the inventor, google and INPHI have recognised the valuable method!!! Have used the destructive system!!!

912 in DDR4 RDIMM has pushed all high power computing systems

now 2024, at the end of the '912 lifetime, will success/money/ gradually materialise

the battle for acceptance of further technology has started in parallel!!!

pmic from the '054 on DDR5, not just in one module type, no! The whole collection of DDR5 gen SO/U/R/MRdimm has this function!!

Bhakta was also involved here! The claim construction is so clear, the judgement in 463 so clear.

This battle for recognition will run faster than in '912.

https://sih-st-charts.stocktwits-cdn.com/production/original_578146465.png

Stokd

1:14 AM

$NLST Politics aside—regardless of leaning—the reason Netlist is still litigating while infringement continues, is the administrative state—USPTO/PTAB & ITC.

Google CA case was stayed for 10+ years while the USPTO allowed and conducted numerous reviews and reexaminations of the 912 patent. Stayed again now pending PTAB 912 IPR appeal.

SK Hynix case was wrapped up at the ITC—seeking international injunction—but the extent of nonsense and influence was enough for Netlist to not go there again.

PTAB instituted IPRs for infringers and invalidated Netlist patents using administrative patent judges with the help of USPTO Dir Vidal, who used her discretion to allow institution despite time bar and RPI/Privity between Google/Samsung.

District Court cases are stayed to await PTAB decisions, trials are cancelled. Some are kept stayed till CAFC appeals conclude. Transfer of our WD case was denied pending PTAB appeal.

Investors are hurt by the administrative branch at every step of the process.

https://sih-st-charts.stocktwits-cdn.com/production/original_578140869.png

https://stocktwits.com/Stokd/message/578140869

tokd

Yesterday 11:08 PM

$NLST From the deference case—overturning Chevron—"The Court recognized from the outset, though, that exercising independent judgment often included according due respect to Executive Branch interpretations of federal statutes. Such respect was thought especially warranted when an Executive Branch interpretation was issued roughly contemporaneously with enactment of the statute and remained consistent over time. The Court also gave “the most respectful consideration” to Executive Branch interpretations simply because “[t]he officers concerned [were] usually able men, and masters of the subject,” who may well have drafted the laws at issue. United States v. Moore. “Respect,” though, was just that. The views of the Executive Branch could inform the judgment of the Judiciary, but did not supersede it. “[I]n cases where [a court’s] own judgment . . .differ[ed] from that of other high functionaries,” the court was “not at liberty to surrender, or to waive it.” United States v. Dickson."

https://sih-st-charts.stocktwits-cdn.com/production/original_578139179.png

Stokd

Yesterday 10:55 PM

$NLST To be clear, there were 2 SCOTUS decisions against the administrative branch. Great/worthy reads below—syllabus versns.

SEC v Jarkesy

"The forum the SEC selects dictates certain aspects of the litigation. In federal court, a jury finds the facts, an Article III judge presides, and the Federal Rules of Evidence and the ordinary rules of discovery govern the litigation. But when the SEC adjudicates the matter in-house, there are no juries. The Commission presides while its Division of Enforcement prosecutes the case. The Commission or its delegee—typically an Administrative Law Judge—also finds facts and decides discovery disputes, and the SEC’s Rules of Practice govern"

Case/ruling

https://www.supremecourt.gov/opinions/23pdf/22-859new_kjfm.pdf

Loper Bright Enterprises v Raimondo

"Under the Chevron doctrine, courts have sometimes been required to defer to “permissible” agency interpretations of the statutes those agencies administer—even when a reviewing court reads the statute differently."

Case/ruling

https://www.supremecourt.gov/opinions/23pdf/22-451_7m58.pdf

https://sih-st-charts.stocktwits-cdn.com/production/original_578138898.png

$NLST What does Judge Gilstrap know about Netlist? https://stocktwits.com/SilviaJ/message/578134958

CHEVRON GOES DOWN!

— eve (@eveforamerica) June 29, 2024

This is a great clip on the Chevron Doctrine. pic.twitter.com/4nkhbeA6GK

Zacks

Netlist (NLST) Wins $445 Million in Patent Violation Case

Zacks Equity Research

Tue, May 28, 20243 min read

2

In This Article:

MU

-0.53%

NLST

0.00%

ANET

+0.73%

Netlist, Inc. NLST recently announced a legal victory in a patent infringement trial against Micron Technology and its subsidiaries (Micron Semiconductor Products, Inc. and Micron Technology Texas LLC).

The U.S. District Court for the Eastern District of Texas awarded Netlist a substantial $445 million damages award following a jury trial, which centered on two key Netlist patents - U.S. Patent Nos. 7,619,912 and 11,093,417. The products that were infringing the patent were all of Micron’s DDR4 RDIMMs and DDR4 LRDIMMs.

The tribunal’s unanimous verdict not only confirmed the infringement but also ruled that Micron had “wilfully infringed” these patents. The compensation granted covers the period from April 2021 to May 2024 for the '912 patent and from August 2021 to May 2024 for the '417 patent.

NLST highlighted that this legal win marks the second successful case in a relatively short period where a global semiconductor giant has been found to wilfully infringe Netlist's patents.

In 2023, Samsung was found guilty of wilfully infringing NLST’s patent technologies, such as HBM and DDR5 that form the bedrock for generative AI computing. In terms of compensation, NLST received more than $303 million as a reasonable royalty for Samsung's violation of its patents for a short past damages period and pre and post-judgment interest in addition to costs.

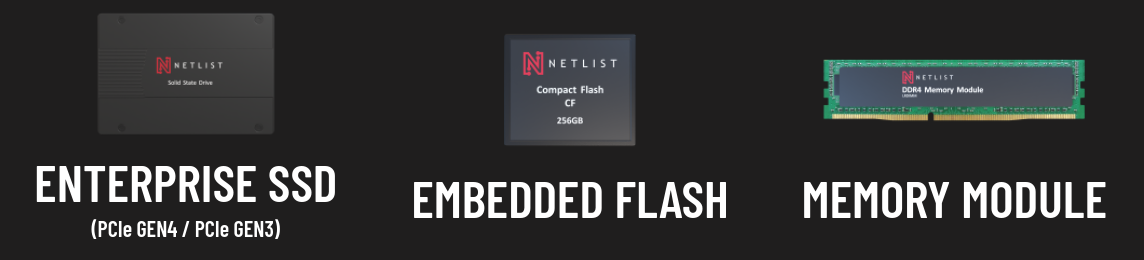

Based in Irvine, CA, NLST is a leading designer and manufacturer of high-performance memory subsystems for OEMs across the globe. Its rich portfolio of patented technologies provides cost-effective solutions backed by top performance and high density. The patents are from the fields of, storage class memory, hybrid memory, rank multiplication and load reduction and others.

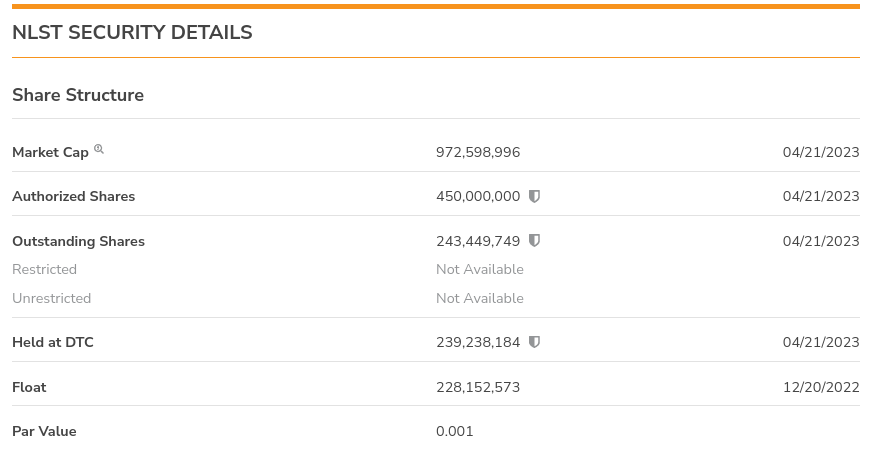

In the last reported quarter, NLST’s net sales soared 297% year over year to $35.8 million, driven by solid momentum in the memory market. The top line beat the Zacks Consensus Estimate by 2.31%.

However, it reported a loss of 7 cents per share for the March quarter, the same as the prior-year figure. The loss was wider than the Zacks Consensus Estimate of a loss of 5 cents.

Nice summary of NLST vs MU I nabbed from Micron's own recent 10Q

On April 28, 2021, Netlist, Inc. (“Netlist”) filed two patent infringement actions against Micron, Micron Semiconductor Products, Inc. (“MSP”), and Micron Technology Texas, LLC (“MTEC”) in the U.S. District Court for the Western District of Texas. The first complaint alleges that one U.S. patent is infringed by certain of our non-volatile dual in-line memory modules. The second complaint alleges that three U.S. patents are infringed by certain of our load-reduced dual in-line memory modules (“LRDIMMs”). Each complaint seeks injunctive relief, damages, attorneys’ fees, and costs. On March 31, 2022, Netlist filed a patent infringement complaint against Micron and Micron Semiconductor Germany, GmbH in Dusseldorf Regional Court alleging that two German patents are infringed by certain of our LRDIMMs. The complaint seeks damages, costs, and injunctive relief.

On June 10, 2022, Netlist filed a patent infringement complaint against Micron, MSP, and MTEC in the U.S. District Court for the Eastern District of Texas (“E.D. Tex.”) alleging that six U.S. patents are infringed by certain of our memory modules and HBM products. On August 1, 2022, Netlist filed a second patent infringement complaint against the same defendants in E.D. Tex. alleging that one U.S. patent is infringed by certain of our LRDIMMs. On August 15, 2022, Netlist amended the second complaint to assert that two additional U.S. patents are infringed by certain of our LRDIMMs. The complaints in E.D. Tex. seek injunctive relief, damages, and attorneys’ fees. On May 23, 2024, following a four-day trial regarding the second complaint filed by Netlist in the E.D. Tex., a jury rendered a verdict that Micron’s memory modules infringe two asserted patents — U.S. Patent No. 7,619,912 (“the ‘912 patent”) and U.S. Patent No. 11,093,417 (“the ‘417 patent”) — and found that Micron should pay $425 million for infringement of the ‘912 patent and $20 million for infringement of the ‘417 patent. Micron expects to appeal the verdict. On April 17, 2024, the Patent Trial and Appeal Board (“PTAB”) of the United States Patent and Trademark Office (“USPTO”) issued a final written decision (“FWD”) finding unpatentable the sole asserted claim of the ‘912 patent. Netlist has sought review of that ruling by the Director of the USPTO. If the Director upholds the FWD, and the United States Court of Appeals for the Federal Circuit subsequently affirms the FWD, then the affirmed FWD will preclude any pending actions asserting infringement of the ‘912 patent (including any infringement verdict that is subject to an ongoing appeal). The PTAB’s final written decision regarding whether all claims of the ‘417 patent are also unpatentable is expected to be issued on or before August 2, 2024.

Stokd $NLST A telephonic hearing was just scheduled in the Samsung 293 case/912 ptnt for July 1st on Samsung's Continuance motion.

Though we haven't seen Netlist's opposition response—because the unsealed version has not been filed yet—but I assume there is something to it and Netlist has a strong/reasonable opposition for Gilstrap to hold a hearing instead of just granting it and rescheduling a trial date.

Perhaps Gilstrap suspects BS/games from Samsung, and by providing due process and any/all chances to argue their point, he can deny it without incurring issues raised by Samsung later. I am certainly hopeful, and worst case scenario is only about a month—as requested by Samsung.

"NOTICE of TELEPHONIC Hearing on Motion 712 OPPOSED SEALED MOTION for Continuance : TELEPHONIC Motion Hearing set for 7/1/2024 at 04:00 PM before District Judge Rodney Gilstrap."

https://sih-st-charts.stocktwits-cdn.com/production/original_578099357.png

DEF 14A Proxy Statement (definitive) Jun 28, 2024 https://investors.netlist.com/websites/netlist/English/3210/us-sec-filing.html?format=convpdf&shortDesc=Proxy%20Statement%20%28definitive%29&secFilingId=3945254a-360e-485b-81e1-64eb34a0278c

|

Followers

|

301

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

24535

|

|

Created

|

05/14/07

|

Type

|

Free

|

| Moderators gdog 100lbStriper Daylas Jetmek_03052 eyeownu Redoocs | |||

IN HONG WE TRUST....

Created by Sub-Teacher:

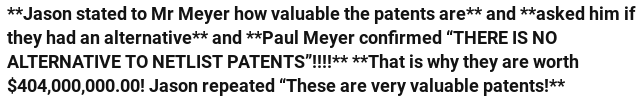

Samsung's Expert WItness Quote:

https://netlist.com/

brings over two decades of high-tech management experience to Netlist. He most recently served as President of Infinilink, a DSL equipment manufacturer, and as executive vice president of Viking Components, Inc. Prior to that, he spent 15 years with LG where he held various senior management positions in the U.S and Korea. Mr. Hong holds an MS in technology management from Pepperdine University and a BS in economics from Virginia Commonwealth University.

brings over two decades of high-tech management experience to Netlist. He most recently served as President of Infinilink, a DSL equipment manufacturer, and as executive vice president of Viking Components, Inc. Prior to that, he spent 15 years with LG where he held various senior management positions in the U.S and Korea. Mr. Hong holds an MS in technology management from Pepperdine University and a BS in economics from Virginia Commonwealth University.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |