Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

.025 Getting Hit NUSMF

HUGE !!!!!

BIG RUN IN THE WORKS !!! NUSMF

This article is dated today NOVMEBER 13th

Electric car future may depend on deep sea mining

By David Shukman

Science editor, Malaga, Spain

Nautilus just keeps flipping shareholders the bird what a POS the company turned out to be .... in the end I didn't own it because I saw BS coming ,thought I'd wait for it to be over,but didn't expect really the way it turned out.

The quote in this article that really slapped me up side the head and I'm sure will piss off a few ex-NUSMF shareholders is

"A Nautilus Minerals representative has told me that the company is being restructured and that they remain hopeful of starting to mine."

Really?

https://www.bbc.com/news/science-environment-49759626

If anyone does find a PUBLIC company that is moving forward with deep sea mining

Post it here ... I'll do the same

I'd be interested .....uhhhhmmm I think LOL!

In the news today on CNBC they are talking about RARE EARTHS and how China is in the lead etc.,it's really a shame they gave this company away because had someone been smart enough from the USA to help Nautilus out of their pickle .... they could have been first to the seafloor to get those rare earth minerals that are so abundant;Nautilus will probably end up in Chinas greedy hands.

"KUMUL MINERALS FILES CLAIM FOR SOLWARA PROJECT"

https://postcourier.com.pg/kumul-minerals-files-claim-solwara-project/

I am not a shareholder but still follow the story and get alerts in my email from time to time

This was from an email alert and the shareholdersunite forum doesn't show it posted there so I thought I'd put it here for anyone concerned ,I'm not a member of that other forum.

While Nautilus is bogged down with financial woes after a decade of devlopment,testing,planning,researching and modifying challenges and being so close to actually mining the seabed floor,others are ramping up behind them;It really is a shame Nautilus hasn't done better and is now facing insurmountable financial issues;Stopping in it's tracks what could have been.

This was published today 03/29/2019 and I found it very intriguing;Fyi this is not a public company but private;I'm sure others,(if they see this), will find it as intriguing as I did.

For what it's worth I hope current shareholders will be given of piece of whatever NUSMF becomes and somehow through all this they do make a well- deserved profit;As it looks now though .... not too promising,but as I am not a holder of the stock currently I still wish everyone well and I hope to find an opportunity somewhere in the new emerging technology of deep sea mining and be able to capitalize on that myself.

I will continue to follow this story and if they right the ship and stock becomes available with a new balance sheet,new management and a vision for the future,even if the price of stock is much higher than when it last traded,I would probably start investing in this again;Time will tell.

A Bus-Sized Robot Will Soon Be Mining the Ocean Floor

https://singularityhub.com/2019/03/29/a-bus-sized-robot-will-soon-be-mining-the-ocean-floor/#sm.0001519rtbkpseq4qu41qhogkzhlp

They are getting delisted from the TSX;I'm just guessing they will continue to trade on the OTC ?

Maybe the Fat lady is still warming up her vocal cords and she isn't singing yet !!!

La la la la la la la la laaaaa

![]()

Nautilus Provides Corporate Update

VANCOUVER, British Columbia, March 28, 2019 (GLOBE NEWSWIRE) -- Nautilus Minerals Inc. (TSX:NUS, OTC:NUSMF Nasdaq Intl Designation) (the "Company" or "Nautilus") announces that Toronto Stock Exchange ("TSX") has advised the Company that the common shares of Nautilus will be delisted from TSX effective at the close of market on April 3, 2019. Nautilus appealed the initial decision by TSX to delist the Company's common shares; however, the Company's appeal was unsuccessful.

The Company's common shares will continue to be suspended from trading on TSX until the Company is delisted on April 3, 2019. The Company's common shares remain halted from trading on the OTC Markets.

As previously disclosed, Nautilus filed for, and was granted, creditor protection under the Companies' Creditors Arrangement Act ("CCAA") by the Supreme Court of British Columbia (the "Court"). The Court approved a sale and investment solicitation plan ("SISP"). The SISP had been prepared with input from PricewaterhouseCoopers Inc. ("PwC" or the "Monitor"), the Court appointed Monitor of the Company. PwC will oversee the implementation of the SISP.

The Court order, the SISP, the Monitor's reports, other Court documents and general updates on the CCAA proceedings can be viewed at www.pwc.com/ca/nautilus-minerals.

Through the CCAA proceedings, a company controlled by affiliates of Nautilus' two major shareholders is prepared to advance up to US $4 million to Nautilus under a credit facility in order to fund the ongoing expenses and restructuring activities of Nautilus, including the implementation of the SISP. To date US $1.1 million has been advanced. The Company expects to draw further advances on an as needed basis.

https://www.nasdaq.com/press-release/nautilus-provides-corporate-update-20190328-01165

I guess this means the fat lady is singing

Call for PNG deep sea mining licenses to be cancelled

TRANSCRIPT

For more than a decade, New Ireland civil and community groups have opposed the project in the Bismarck Sea over its potential to damage the environment.

Gold and copper deposits on the sea floor enticed Nautilus to form a PNG subsidiary of which the government acquired a 15 percent share.

But with Nautilus now selling its assets to pay debts, the groups want its licenses cancelled so other miners can't continue the project.

With support from the Centre for Environmental Law and Community Rights, the groups went to court to seek the disclosure of the licenses and other documents they say the government is constitutionally bound to produce.

But since the court case finished in September, the centre's executive director Peter Bosip says the judge has not issued a decision.

"The reasons for withholding the decision is not known. It's kind of holding people at ransom. So, we need to know whether we lost or we were successful in this instance. We don't know and we are still waiting."

The former chief justice Sir Arnold Amet also wants the licenses cancelled.

Sir Arnold says if released, the documents would show the government is liable for the company's debts and if the government can reacquire or cancel the licenses.

"All of those are going to be packaged and put on the market for any potential bidders. So, our abilities to actually extricate ourselves from those binding licenses and agreements, and to free ourselves from ongoing liabilities may be limited considerably by the current legal entitlements of Nautilus in the region."

The mining minister Johnson Tuke could not be reached for comment.

Mr Bosip says given the company's financial strife and local opposition to deep sea mining, it would be futile for the government to continue to back Nautilus or any other company.

"The government has to think about cancelling this license because apart from economy loss, they also have to realize that the fight to reject deep sea mining in PNG is not over. The communities have mobilized."

Sir Arnold says PNG is not equipped to regulate foreign mining companies, especially those experimenting with deep sea mining.

"Regulations, governance, accountability mechanisms, in a developing country like Papa New Guinea, and if I might say so in the Pacific region, are considerably wanting. We don't have the capacity of professional institutions to hold to account sufficiently, all the mining giants, multinationals of the world that are continuing to exploit our natural resources."

Sir Arnold says other Pacific countries have given rights to Nautilus that could be sold to mining giants ready to exploit the sea floor and islanders who depend on the ocean.

https://www.radionz.co.nz/international/programmes/datelinepacific/audio/2018686541/call-for-png-deep-sea-mining-licenses-to-be-cancelled

PwC's first report to the court

https://www.pwc.com/ca/en/car/nautilus-minerals/assets/nautilus-minerals-022_030719.pdf

Seabed mining project in PNG moves to sell assets

"But the company is also being advertised for sale, including its Solwara 1 project in PNG. PwC are acting as solicitors."

https://www.radionz.co.nz/international/pacific-news/383392/seabed-mining-project-in-png-moves-to-sell-assets

If this is the end of the line and the Fat lady is singing on NUSMF

I'm now wondering if the two largest shareholders who seem to be able to pick up the the puzzle pieces (assets) will re-start the project with a new ticker symbol,new MGMT. and of course a new trading symbol and this will continue into the future to see it to fruition.

If that happens all "old" shareholders get crapped on and it will become a new game.

I would still be interested in "investing" in the new company if one is formed because no matter how difficult this journey has been or still will be in the future ... Someone will mine the seabed and with the equipment they have already created (seafloor robots etc.) They still have a better chance than anyone else I think.

For me Nautilus lost my trust way back when they were so stupid that they transfered 10 million dollars to the wrong entity and basically had it stolen from them;Stupidest thing I ever saw them do and I still smell a Big Fat RAT involved ,,,,, might have went to Johnstons bank account....there was no real follow through on that screw up.

It's an interesting story and one that cost current shareholders millions ..... so sad Johnston ... You obviously should never have been CEO of the company.

As well on this board apparently no one is reading my posts or commenting if you are...... so this has become my own personal ledger or Blog LOL!

![]() Happy Trading !!!

Happy Trading !!!

P.S.

To me it looks like Bankruptcy but I guess I would have to throw it to an expert and ask the question >>>

What makes this different from Bankruptcy?

It certainly reads similar to Bankruptcy !

Nautilus Minerals : files for relief under the Companies Creditors Arrangement Act and receives additional loan under secured loan facility

Personally I continue not holding a position,but could change ,right now I see this as an absolute gamble to enter into a position;If I had some gambling money I would take a position just to see how it turns out,but I don't so I won't ![]()

Unfortunately if there is clarification and the game for mining the seabed is turned back on here at Nautilus it will probably be too late to get a substantial position at current price before a big move up;I just see everything as a mess right now and IF it is resolved to the benefit of common shareholders I would be surprised.

I think many battles lie ahead and maybe just maybe those that have spent so much time and money over the years will score and in that regard I have followed this for many years and been in and out but to those suffering losses or are about to in the future I feel for you and wish you all well and good fortune;It's unfortunate as well there is not more discussion here vs. the "other" website where most/all shareholders unite;I like Ihub at times for many reasons but times I don't so I get it;A combination of the two would be much better in my opinion.

GLTA

Press release from Nautilus >>>

02/23/2019 | 05:31am EST

(GlobeNewswire) - Nautilus Minerals Inc. (TSX:NUS, OTC:NUSMF Nasdaq Intl Designation) (the "Company" or "Nautilus") announces that it has obtained an order (the Initial Order) of the Supreme Court of British Columbia providing the Company protection from its creditors pursuant to the Companies Creditors Arrangement Act (Canada) (the CCAA) so as to enable Nautilus to restructure its business and financial affairs.

Shortly prior to the Companys application for protection under the CCAA, the Company received a loan from Deep Sea Mining Finance Ltd. (the "Lender") in the principal amount of US$750,000 (the "Loan") under the previously announced loan agreement, as amended (the "Existing Loan Agreement"), between the Company, two of its subsidiaries and the Lender which provides for a secured structured credit facility of up to US$34 million.

The Initial Order also authorized the Company and two of its subsidiaries to enter into a new Interim Loan Agreement with the Lender, pursuant to which the Lender has agreed to advance to the Company up to $4 million to fund the Companys ongoing operations and restructuring.

CCAA

The Company is evaluating a range of alternatives to recapitalize Nautilus so that the reality of its seafloor mining projects can be achieved. The options could include the sale of Nautilus polymetallic nodule business unit and its seafloor massive sulfide business unit.

Nautilus is not bankrupt and remains in possession and control of its business, while continuing to receive support in the form of loans from the Lender.

For any updates on the CCAA proceedings, please refer to the website of the Companys monitor appointed under the Initial Order, PricewaterhouseCoopers Inc.: www.pwc.com/ca/nautilus-minerals

Secured loan facility

In connection with the most recent US$750,000 portion of the Existing Loan Agreement, the Lender waived the requirement for the Company to issue share purchase warrants to the Lender as contemplated by the Existing Loan Agreement.

To date, the Company has received loans from the Lender totaling US$18,250,000. The loans bear interest at 8% per annum, payable bi-annually in arrears. All loans have a maturity date of March 8, 2019.

As previously disclosed, the Lender is a private company owned 50% by each of: (i) USM Finance Ltd., a wholly owned subsidiary of USM Holdings Ltd, an affiliate of Metalloinvest Holding (Cyprus) Limited; and (ii) Mawarid Offshore Mining Ltd., a wholly-owned subsidiary of MB Holding Company LLC. As the Lender is indirectly controlled by affiliates of the Company`s two largest shareholders, the Lender is a "related party" of the Company and the Loan transaction constitutes a "related party transaction" of the Company under MI 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101.

The Company did not file a material change report more than 21 days before the expected closing of this transaction, as the details of the transaction were not finalized until immediately prior to the closing and the Company wished to close the transaction as soon as practicable for sound business reasons.

The Company continues to seek short and long term funding solutions while assessing its options, including various restructuring options. Negotiations with various third parties continue. There can be no assurances that the Company will be able to successfully negotiate and complete any funding or other transactions. Any transactions will be subject to all necessary stock exchange, third party and government approvals, as well as compliance with all other regulatory requirements. The Company will provide further updates as circumstances warrant.

https://www.marketscreener.com/NAUTILUS-MINERALS-INC-1411070/news/Nautilus-Minerals-files-for-relief-under-the-Companies-Creditors-Arrangement-Act-and-receives-addi-28058228/

.............

If you want to know more about the canadian "ACT" that is allowing them to make this move >>>>

Companies’ Creditors Arrangement Act (R.S.C., 1985, c. C-36)

https://laws-lois.justice.gc.ca/eng/acts/C-36/

Not sure but...the fat lady is warming up behind the curtain

Could be show time soon....

or not

LOL!

The time has come! Load the f’n boat!!

The time is not yet

The PEA models first production starting Q3 2019, and also shows that the Project has a high fixed cost component (~52%), largely vessel related, and is highly leveraged to metal grade, metal prices, equipment utilization and production rates.Possible start up at Q3 of 2019 plus a ramp up time of---15 month ramp up to steady state production (~3,200 t/mth) MEANS full production is at best Q4 2020. 2 and a half years away. TOO LONG to hold. Will come back later , closer to where ramp up will be able to start to pay for the project. With so many shares out, close to a billion and much more money needed to finish I think it is highly possible for a reverse split diluting the stock within the next 2 and a half years. Time to leave and wait for a better entry point. From latest financial statements(this tells us what the stock should be worth.)---The weighted average fair value of the options granted was C$0.09 in 2016. No options were granted in 2017.

Robots emerging as the perfect tool for dangerous underwater mining missions

The majority of the Earth’s waters are pretty much virgin territory, probably in even more ways than you can imagine. More than simply being home to many yet-to-be identified animal species, it also holds tons of valuable resources that are just sitting there and waiting to be harvested.

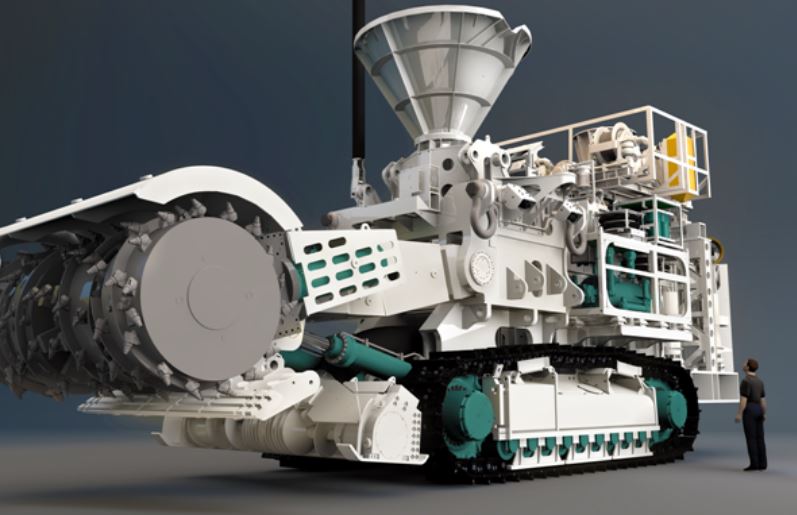

The problem is that the deep ocean is quite inhospitable, making it impossible for humans to go out there and perform simple mining operations easily. Enter giant mining robots. Big, bulky machinery just might be the golden ticket to getting the most out of the ocean. That’s the idea that Nautilus Minerals has in mind as it tries to kickstart a whole new industry by using giant underwater mining robots sitting atop a 700-foot-long ship.

Nautilus Materials is a Canadian company that has taken years to prepare for its latest project, which involves the use of three separate robots on a platform that it calls the Production Support Vessel (PSV). Its current base of operations is somewhere off the coast of Papua New Guinea, where it will be used on the Solwara 1 seabed to retrieve copper and silver deposits that are said to be about 10 times more in concentration compared to what one might find on land.

The task at Solwara 1 is rather simple, but because Solwara 1 is rather big, it becomes such a monumental task – so much so, that Nautilus Minerals needs to use three giant machines to work on it. And that’s not even counting all of the smaller robots and machinery that will be used by the company to assist in the major parts of their mission.

Part of what makes the mission so difficult is the fact that the seawater in Solwara 1 is super-heated to almost 400 degrees Celsius due to volcanic activity and jets from the seabed. When the hot water mixes with cold seawater in the area, it results in tall rock chimneys that are filled with highly valuable resources, which are referred to as seafloor massive sulfides (SMS). Nautilus Minerals’ mission is simply to retrieve them.

But again, they need to use complex machinery because of how difficult it is to pull off. According to Mark Collins, the managing director of remotely operated underwater vehicle (ROV) systems at Soil Machine Dynamics, that’s just the way things are on the ocean. “Everything you do on land is 10 times more difficult underwater,” he said in a statement given to Popular Mechanics. And that is exactly why, on top of all three giant robots already mentioned, Nautilus Minerals will also rely on a few other smaller robots.

All three of Nautilus Minerals’ biggest robots are going to be tethered to the surface with long umbilical cables and powered by electricity. The first two are meant to cut up the raw materials found on the floor of the seabed, while it’s the third one’s job to agitate the stuff left by the first two and to stir it all up with seawater so that it can be sucked up in a slurry. The resulting slurry will be channeled through three 440-horsepower dredge pumps to the Subsea Slurry Lift Pump before being sent up to the surface.

While the use of all this machinery will certainly cut back on the potential danger for human life, Nautilus Minerals’ mission is not without concern. However, the company maintains that these operations are completely safe, saying that multiple environmental impact analyses with universities and environmental institutions have shown that they will cause little disturbance compared with land-based mines. In fact, they said that their project on Solwara would only cause around one-tenth the disruption of an equivalent terrestrial mine.

In any case, the success of the company with this particular operation remains to be seen. If they can somehow pull it off without any problems, it could become the start of a new era in underwater mining with giant robots.

https://science.news/2018-03-08-robots-perfect-tool-for-dangerous-underwater-mining-missions.html

Find out other innovative uses of robots in Robotics.news.

Sources include:

PopularMechanics.com

NautilusMinerals.com

Undersea mining

Race to the bottom

Mining the ocean floor is about to go mainstream

PATANIA ONE sits in a large shed on the outskirts of Antwerp. Green and cuboid, with an interior steel frame, rubberised treads and pressure-resistant electronic innards, it is about the size of a minivan. In May 2017 it became the first robot in 40 years to be lowered to the sea floor in the Clarion Clipperton Zone (CCZ), about 5,000 metres beneath the Pacific ocean near where the Jasper did her pioneering sonar work. There it gathered data about the seabed and how larger robots might move carefully across it, sucking up valuable minerals en route.

The CCZ is a 6m square-kilometre (2.3m square-mile) tract between two of the long, straight “fracture zones” which the stresses of plate tectonics have created in the crust beneath the Pacific. Scattered across it are trillions of fist-sized mineral nodules, each the result of tens of millions of years of slow agglomeration around a core of bone, shell or rock. Such nodules are quite common in the Pacific, but the CCZ is the only part of the basin where the International Seabed Authority (ISA), which regulates such matters beyond the Exclusive Economic Zones (EEZs) of individual countries, currently permits exploration. Companies from Japan, Russia, China and a couple of dozen other countries have been granted concessions to explore for minerals in the CCZ. The ISA is expected to approve the first actual mining in 2019 or 2020.

Shock and ore

This could be big business. James Hein of the United States Geological Survey and colleagues estimated in a paper in 2012 that the CCZ holds more nickel, cobalt and manganese than all known terrestrial deposits of those metals put together. The World Bank expects the battery industry’s demand for these, and other, minerals to increase if the transition to clean energy speeds up enough to keep global temperatures below the limits set in the Paris agreement on climate.

One of the firms attracted by this vast potential market is DEME, a Belgian dredging company which has already proved resourceful in seeking out new businesses: installing offshore wind farms now provides it with revenues of nearly €1bn ($1.2bn) a year. Korea, Japan and China all have state-run research projects looking to dredge nodules from the deep sea with robots: “It really is a race,” says Kris Van Nijen, who runs DEME’s deep-sea mining efforts. At the moment his firm is setting the pace. It has learned a lot from the exploits of Patania One (pictured), such as how hard you can push bearings rated to 500 atmospheres of pressure and how deep treads sink into the deep-sea ooze for a given load.

The idea of mining the CCZ is not new. The Pacific’s mineral nodules were discovered by HMS Challenger, a British research vessel that first dredged the abyssal depths in the 1870s. Lockheed Martin, an American defence contractor, tried prospecting the CCZ in the 1960s. Its caterpillar tracks were not reliable enough to operate at such depth, so the company imagined two Archimedes screws to drag its vehicle through the mud. (Lockheed’s deep-sea mining expertise was later used in a CIA operation to recover a Soviet submarine which sank in the CCZ in 1968.) At the time there was hyped speculation that deep-sea mining would develop rapidly by the 1980s. A lack of demand (and thus investment), technological capacity and appropriate regulation kept that from happening. The UN Convention on the Law of the Sea (UNCLOS), which set up the ISA, was not signed until 1982. (America has still not ratified it, and thus cannot apply to the ISA for sea-floor-mining permits.)

Mr Van Nijen and his competitors think that now, at last, the time is right. DEME is currently building Patania Two, or P2, in an Antwerp shipyard. It will be deployed to the Pacific in 2019. Where P1 was basically a deep-sea tractor, P2 is a full-blown prototype. A sweeping nozzle mounted on its front (which gives it the look of a combine harvester) will suck up tonnes of nodules every minute; the power it needs to do so will flow down a thick umbilical from a mother ship above. In commercial production, a similar cord will pump a slurry of nodules and dirt back up to the ship—an impressive bit of engineering. For the time being P2 will just keep some of the nodules in a container on its back for later inspection.

In order to satisfy the ISA, this new machine does not just have to show it can harvest nodules; it also has to show that it can do so in an environmentally sensitive way. Its harvesting will throw up plumes of silt which, in settling, could swamp the sea floor’s delicate ecosystem. A survey of CCZ life in 2016 found a surprising diversity of life. Of the 12 animal species collected, seven were new to science. To help protect them, the mining field will be ringed with buoys, monitoring any plumes of silt that are bigger than DEME had predicted. The operations will also be monitored by a German research ship, funded by the EU.

If P2 succeeds, it will be time for P3, which will be the size of a small house. It will have two drone escorts, one to move ahead of it and one behind. They will monitor how much silt it disturbs, and will shut down the operation if necessary. Thus, P3 will be able to steer along the seabed autonomously. DEME will then build a customised surface vessel, ending up in about 2025 with a new kind of mining operation, at a total cost of $600 million.

The CCZ is not the only sea floor that has found itself in miners’ sights. Nautilus, a Canadian firm, says it will soon start mining the seabed in Papua New Guinea’s EEZ for gold and copper, though at the time of writing the ship it had commissioned for the purpose sits unfinished in a Chinese yard. A Saudi Arabian firm called Manafai wants to mine the bed of the Red Sea, which is rich in metals from zinc to gold. There are projects to mine iron sands off the coast of New Zealand and manganese crusts off the coast of Japan. De Beers already mines a significant proportion of its diamonds from the sea floor off the coast of Namibia, although in just 150 metres of water this is far less of a technical challenge.

If the various precautions work out, the benefits of deep-sea mining might be felt above the water as well. Mining minerals on land can require clearing away forests and other ecosystems in order to gain access, and moving hundreds of millions of tonnes of rock to get down to the ores. Local and indigenous people have often come out poorly from the deals made between miners and governments. Deep-sea mining will probably produce lower grade ores, but it will do so without affecting human populations.

It will also deliver those ores straight on to ships which can move them directly to processing plants on any coast in the world, including those using solar or wind power, thus reducing the footprint of mineral extraction even more. Having seen the destruction wrought by mining on land, undersea miners are working doubly hard to plough a different furrow.

https://www.economist.com/news/technology-quarterly/21738059-mining-ocean-floor-about-go-mainstream-race-bottom

The uncertainty of deep sea mining

Normal Anti-Nautilus sentiment from locals which has gone on for years now ... I'd call it bloviating Bullchit as the right hand takes money from Nautilus in the form of schools,bridges etc.,and the left hand draws a picture against Nautilus;You can't have it both ways ....

Wondering...are there cannibals still in the jungle?

Probably...

By Ursula Dallman

• March 7, 2018

Deep sea mining (DSM) is a relatively new mineral retrieval process that takes place on the ocean floor. Ocean mining sites are usually situated around large areas of polymetallic nodules or active and extinct hydrothermal vents up to 3,700 metres below the ocean’s surface. The vents create sulfide deposits, containing valuable metals such as silver, gold, copper, manganese, cobalt, and zinc.

The deposits are mined using either hydraulic pumps or bucket systems that take ore to the surface to be processed. But what do we know about DSM’s environmental impacts?

Due to DSM being a relatively new field, the answer is very little. Research shows that polymetallic nodule fields are hotspots of abundance and diversity for a highly vulnerable abyssal fauna. The ecosystems surrounding hydrothermal vents have been found to host over 500 unidentified species.

Scientists believe that DSM will result in disturbances to the benthic layer, increased toxicity of the water column and sediment plumes from tailings. This increases the turbidity of the water, clogging filter-feeding apparatuses used by benthic organisms. It also impacts zooplankton and light penetration, affecting photosynthesis and the food web of the area. Secondary impacts include leakages, spills and corrosion that could alter the mining area’s chemistry.

So, should DSM go ahead? Nautilus Minerals, the world’s first DSM company, certainly thinks so. The Solwara 1 project is viewed as prosperous because of the rising demand for metals due to the development of electric vehicles and storage batteries. Despite this prosperity however, the possible ramifications may not be worth it.

The company failed to raise US$41 million for the project by the end of 2017, as well as US$270 million to build and deploy the seafloor production system for the project.

Furthermore, in January, Arnold Amet, former PNG attorney-general and justice minister, asked the government to end its partnership with Nautilus, saying that the mining project was financially risky and posed an environmental threat. The international community’s legal position largely ignores environmental safeguards when it comes to Deep Sea Mining.

“Villagers have already reported high incidents of dead fish washing up on shore including strange deep sea creatures that are not familiar to anyone and are actually hot to the touch,” said Julian Aguon, a Guam based lawyer.

A new international agreement is needed to prevent the exploitation of the deep ocean because of the rising threats of DSM and bottom trawling for fish.

“Deep-sea trawling for fish has already had terrible long-lasting impacts on the deep sea”, says Kristina Gjerde, a high seas policy advisor for the International Union for Conservation of Nature. The deep-sea fish populations are quickly depleted because of the fish aggregate, making them easy to catch. One-fifth of the world’s continental margins, an area the size of the United States and Canada combined, have already been trawled.

Significant deep-sea resources are often found within the deep seas of the developing world. “Yet these countries often don’t have the necessary expertise or technology to explore the deep seabed. They rely on countries that do have the technology and expertise,” said Gjerde. “It is important to set and maintain common standards so that a few unscrupulous operators can’t take advantage of countries with weak legal systems, causing irreparable harm in return for very short-term gain. These countries must be able to manage their own deep ocean resources.”

Given the environmental risks, Nautilus Minerals should place more emphasis on protecting the diverse marine biodiversity and seas within the Pacific and focus on the money and benefits that tourism can bring rather than just on the economic gains to be made by exploiting the minerals beneath.

http://www.studentnewspaper.org/the-uncertainty-of-deep-sea-mining/

Sea mining could destroy underwater Lost City

Video released March 6th,2018 ... not directly about NUSMF ,but just shows the conversations about Deep Sea Mining are getting more and more frequent;One of the most important statements in this video is the amount of cobalt that is going to be required for a "green" future and 90% is on the bottom of the seas.

Where is nusmf going in pps in one year from now? anyone have any predictions. I estimate 2.50 3.00 US

Deep Impact

SPRING ISSUE of the "Earth Island Journal"

Mentions Nautilus a couple of times,nothing earth shattering or lengthy about Nautilus, but interesting article for anyone who's waiting for that "Share price to go through the roof"

http://www.earthisland.org/journal/index.php/eij/article/deep_impact

At least ,for the moment it seems to be starting to finally trade like a "normal" stock ... nice move to .27

I need more so back da frick down......

Actually was expecting it to start moving this year like this..... but wasn't expecting quite this soon...was just starting to get into the accumulation mode for next years "First Ore possibilities".....knowing of course that it was and still seems to be a pure gamble because of the needed $ 300 million

No fault but my own I suppose,but don't think it's too late to get more at lower prices,as always ....could be wrong about that.....should be more dips though ,especially until they clear that $300 million dollar hurdle

Been watching the media blitz ,sort of,.....contemplating all of this .... Question is ?? Since they still need 300 million are they pushing the price higher with their media PR as of late for a stock sale? Is this a sheep to the slaughter scenario?

You know how it works ....get the share price as high as you can get it ...then do a stock sale ... Boom ...ouch

Just wondering...kind of thinking out loud ......been a rough last year for me so only picked up a few shares around .18 and still not able to buy more until possibly next week..... but at least I have a small ticket to ride ....

Until they lift the 300 million problem off their backs I really can't see it going much higher and in fact hoping for a drop back below .20 in the near future as that was my buy target ...I.E. below .20

The question I asked above is not mean't to bash the stock to get it lower for me,although I want it lower,it is a legite question ... I mean ,why the media blitz right now? What are they up to? LOL

Guess the real question is the stock going up because they have actually gotten some kind of financing or the scenario I painted?

Interesting story....all these years ....can't say I've watched any other stock as long as this one

Good luck all you lurkers!!! ![]()

I often find myself looking back here too. Almost bought here as well. Just seems stuck.

I almost bought into this a few years ago, but the system as designed seemed just a little too Rube-Goldberg.

It's been a hard few years putting money in this thing. Waiting for it to come to fruition. Date changes, company changes, staff changes - still we march on. This thing has two huge not gonna let it fail investors. Some of us tagging along for the ride. Whats the current status? Equipment being built and tested, ship being built, new finance company to work with. We will have additional news at the end of the month I think, at least to explain changes in schedule or cash situation. I am choosing to go positive on this one. The sleeper will awaken.

14 Months to go.....

I definitely feel like an orphan at this point :)

The Curve shows exactly where we are.

http://palisade-research.com/wp-content/uploads/2017/06/1-2.png

Sounds like the two major share holders of nautilus have access to a substantial amount of cash.

That's what I'm thinking. Plenty time to pick up some cheap shares.

I sincerely feel they will. Too close to quit now!

Thank you. Interesting read. I hope nautilus finds the cash. Share price has been dropping since the announcement last week.

Japan mines seabed for zinc

www.nextbigfuture.com/2017/10/japan-mines-seabed-gets-zinc-equal-to-japan-annual-consumption.html

Can you post the link pls

The Japan Oil, Gas and Metals National Corp. just announced the recovery, in the space of a month-and-a-half (if I read the article right), enough zinc off the seabed equal to Japan's regular annual production.

The system they used is surprisingly straightforward. Makes Nautilus' setup look like a Rube Goldberg contraption, which it sort of is.

Thank you plenty time to build up a nice position. I would like 50k-75k. If they can pull it off, money should be made.

Planning purposes even looking at end of March 2019. But they have said Productions to start first quarter 2019

I took a large position in ffmgf over the last 3 years. I have been watching this stock and waiting. I have a small position and will start building this one now. I too feel it will be a nice earner. Best of luck to ya. When is the schedule for starting up production? I can't find the new date.

I do. I have a good base so far, but we are definitely in a consolidation, wait and see mode. As soon as this starts moving up I'd like to buy in on the way up. This is a good shot for a 10x-20x, heck some think it could be a $200 peak, though I think thats a bit much.

You think it's time to start loading up?

Crickets. Yes I'm here!

Isn't today the deadline to secure the rest of the funds for the project?

Is deep sea mining vital for a greener future – even if it destroys ecosystems?

Pretty cool article from the Guardian.

https://www.theguardian.com/environment/2017/jun/04/is-deep-sea-mining-vital-for-greener-future-even-if-it-means-destroying-precious-ecosystems

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

966

|

|

Created

|

07/02/10

|

Type

|

Free

|

| Moderators | |||

United States sitting out race to mine ocean floor for metals essential to electronicsChina and other countries are racing to be the first to mine trillions of dollars worth of metals used in cell phones, supercomputers and more, while the U.S. is on the sidelines. 60 Minutes reports, Sunday at 7:30 p.m. ET and 7 p.m. PT on CBS https://www.cbsnews.com/news/united-states-sitting-out-race-to-mine-ocean-floor-for-rare-earth-elements-metals-electronics-60-minutes-2019-11-13/..

Contact InformationOperations (Brisbane, Australia) | |

| |

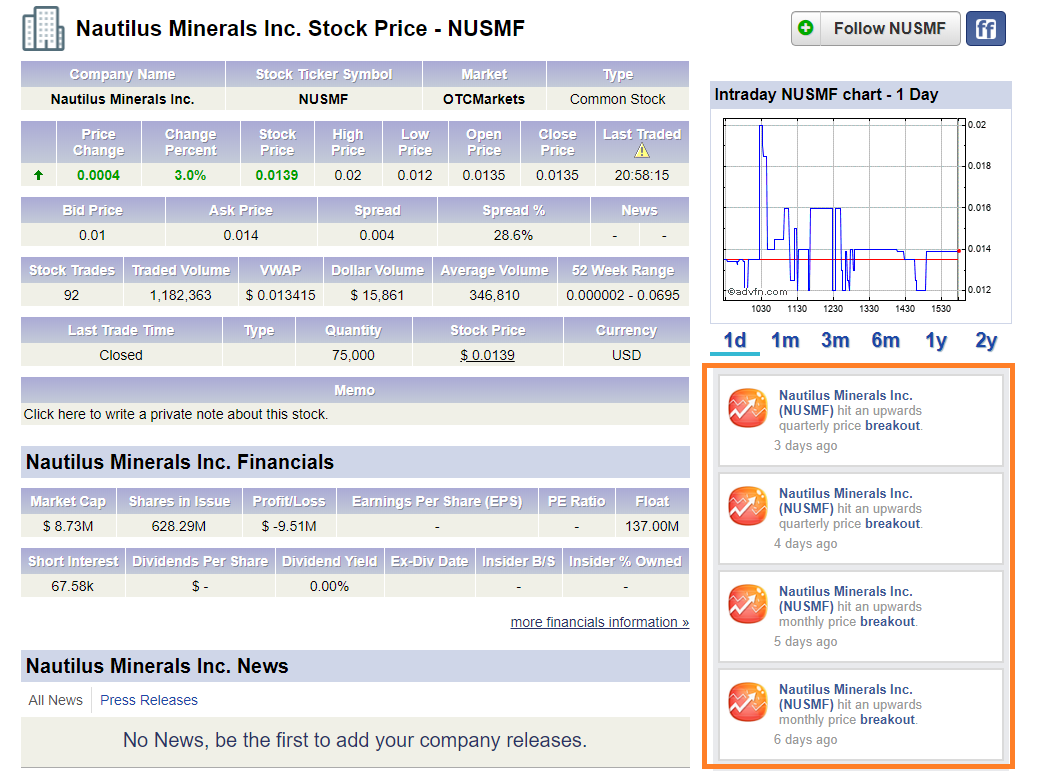

|

Nautilus Minerals Inc (referred to on this website as "Nautilus", "Nautilus Minerals" or the "Company") is the first company to commercially explore the seafloor for massive sulphide systems, a potential source of high grade copper, gold, zinc and silver. Nautilus is developing a production system using existing technologies adapted from the offshore oil and gas industry, dredging and mining industries to enable the extraction of these high grade Seafloor Massive Sulphide ("SMS") systems on a commercial scale.

Nautilus’ copper-gold project, Solwara 1, is under development in the territorial waters of Papua New Guinea. The Company has been granted the Environment Permit and Mining Lease required for resource development at this site.

The Company plans to grow its tenement holdings in the exclusive economic zones and territorial waters of Papua New Guinea, Fiji, Tonga, the Solomon Islands, Vanuatu and New Zealand as well as other areas outside the Western Pacific.

Nautilus has among its significant shareholders, two of the world’s largest resource companies and the nature of its alliances and technical partners place it firmly in pole position as the world leader in deepwater exploration and the development of mineral systems.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |