Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

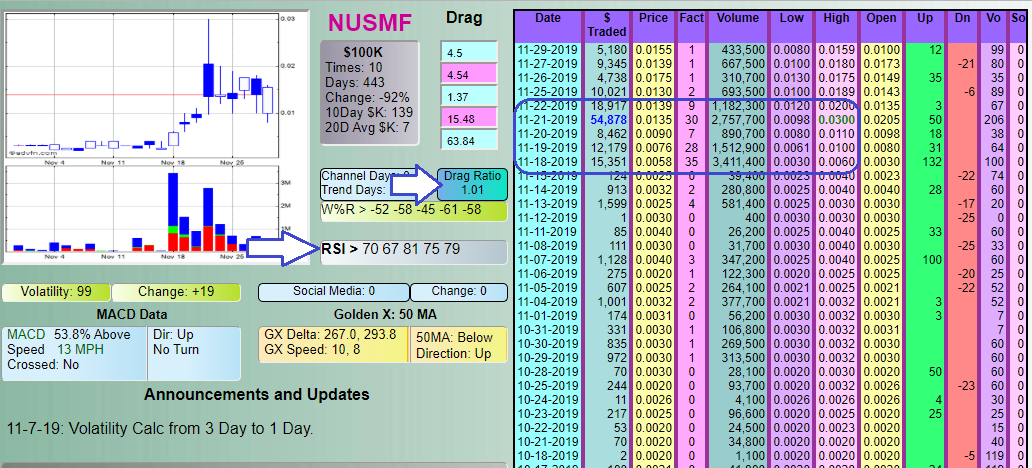

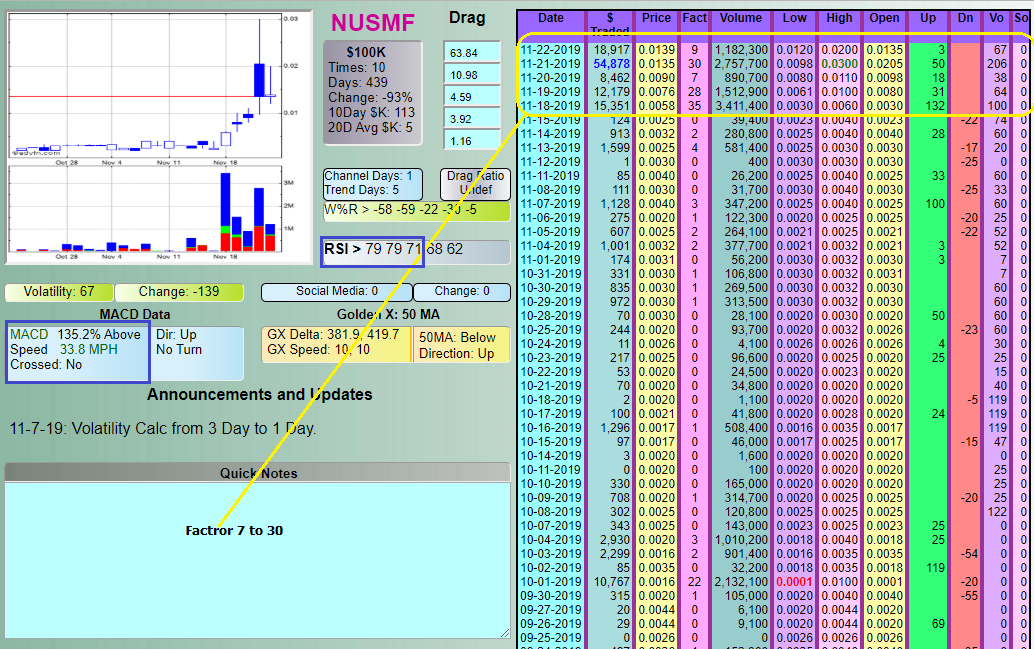

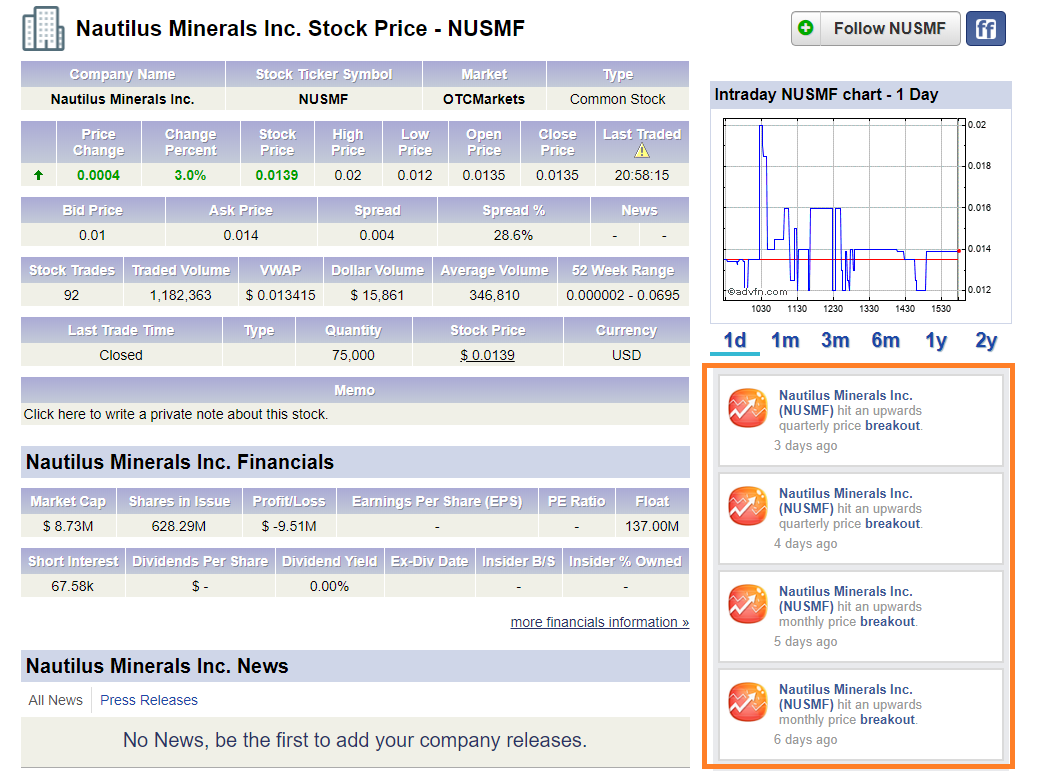

Still trading in a very tight range with no give or take between buyers and sellers. Already almost 250,000 shares traded in first 20 minutes today so still plenty of posturing going on.

Still hoping that as we get nearer the completion dates at least one of the better known gold companies will take a position which would be huge. I'm sure Nautilus have many patents in place that would be of interest to other Companies wanting to get into the space.

The Wild West of Deep-Sea Mining

The International Seabed Authority is racing to draft regulations for the nascent deep-sea mining industry.

by Harrison Tasoff, Published May 19, 2017

In the coming years, a new gold rush will begin. Deep beneath the ocean’s waves, from scalding hydrothermal vents to the frigid stretches of the abyssal plain, ocean processes have deposited vast quantities of valuable minerals on the seafloor. Now, the convergence of technological development and political will has placed this ore within reach. But like the gold rushes of old, the deep-sea-mining industry is emerging on the frontiers of society, far from legislatures and law enforcement.

Officially, the nascent deep-sea-mining industry is governed by the International Seabed Authority (ISA), a nongovernmental organization established in 1996 by the United Nations Convention on the Law of the Sea (UNCLOS). The authority’s critical task is to coordinate its 168 member nations in establishing and enforcing regulations for the developing deep-sea-mining industry.

But the ISA lacks teeth, says Duncan Currie, a legal adviser to the Deep Sea Conservation Coalition, an advocacy organization. “They won’t and they can’t” force compliance, he says.

Back in 1982, when UNCLOS was still under development, US president Ronald Reagan and British prime minister Margaret Thatcher introduced an agreement guiding how the treaty would operate—a provision that also applies to the ISA. According to that agreement, once the ISA receives an application for a mining permit, it has two years to develop regulations. If the ISA does not finalize its rules after two years, it has to give the country provisional approval with whatever rules it has in place.

So far, the ISA has yet to finalize its regulations for deep-sea-mineral extraction. It has, however, already granted 26 permits for deep-sea-mineral exploration in international waters, though none yet for mineral extraction.

Though there appears to be little likelihood of a country bypassing the ISA’s permitting process, “there’s very little to stop them,” Currie says. At the moment, deep-sea mining in international waters is sufficiently far in the future that the regulatory situation has not yet made any country itchy enough to jump the gun, he says.

As it stands, deep-sea mining is a game for two. If a company wants to mine in international waters, it needs to partner up with an ISA member state. The country, in turn, must have regulations to govern the company’s activities. The ISA checks this as part of the application review process, but can’t compel a country to adopt any rules.

“It’s simply a question of peer pressure,” says Michael Lodge, the ISA’s secretary general. “That’s how the international system works.”

If there’s a difference between the country’s laws and those of the ISA, the company must meet the higher standard, says Mike Johnston, CEO of Toronto-based Nautilus Minerals Inc. Nautilus found its partner in the Tongan government, and has since been granted 75,000 square kilometers of prospective territory in the eastern Pacific Ocean.

The international regulations under development will also impact mining in national waters, since UNCLOS member states are required to pass laws that fall in line with international standards. But here again, the ISA does not have the power to compel nations to adopt provisions.

That the ISA has not yet landed on a set of rules puts countries such as Papua New Guinea—where Nautilus plans to open the first commercial deep-sea-mining operation—in an uncertain state. There’s no international template for Papua New Guinea to follow, says Conn Nugent, director of the Pew Charitable Trusts’ efforts to study and guide the development of seabed mining. Papua New Guinea’s Mining Act governs both onshore and offshore activities.

The ISA has also yet to determine how it will enforce regulations and respond to allegations of noncompliance. There are provisions within its mandate to create an inspection arm, says Lodge, but it has not been established because mining has yet to begin. Currently, the ISA has no revenue to fund an enforcement division before mining begins, says Nugent, adding that the two will probably be parallel processes.

The International Tribunal for the Law of the Sea presents one option for member nations to settle disputes, says Nugent. The tribunal was established by UNCLOS to deal with any major disputes that would arise from the treaty.

Still, Nugent has confidence that the ISA will eventually develop and enforce strong policies. Unlike high-seas fishing, which is regulated by more than a dozen regional agencies, the entirety of the international seafloor falls under the ISA’s purview. This centralization will help it create stronger, more coherent regulations for mining, says Nugent.

Besides, says Lodge, deep-sea mining is not a fly-by-night enterprise—a deep-sea-mining operation requires an investment of hundreds of millions of dollars. This means that companies will have to get money from banks, and banks want certainty. “The consequences of license denial are extremely high,” says Lodge. A company that opts to go rogue after failing to get ISA approval will quickly find itself without the financial backing it needs to operate.

Many scientists, however, argue that we do not yet know enough about the potential effects of mining in deep-sea ecosystems to create sound regulations, let alone begin mining. Nugent agrees, but he also notes “the time to write environmental protections is before an activity becomes profitable.

“There are no regulations yet. This is a wonderful, I would even say historic, opportunity to help write the rulebook to [govern] an extractive activity before the activity begins.”

https://www.hakaimagazine.com/article-short/wild-west-deep-sea-mining

Off-market insider buying at Nautilus Minerals (T:NUS)

Updated Monday May 15, 2017 03:37 AM EDT

Joint Stock Company Holding Company METALLOINVEST, a 10% Holder, acquired 5,598,744 Common Shares on a control or direction basis for registered holder Metalloinvest Holding (Cyprus) Limited at a price of $0.239 through a prospectus or prospectus exempt offering on May 11th, 2017. This represents a $1,338,100 investment into the company's shares and an account share holdings change of 5.0%.

Nautilus Minerals is in the Integrated Mining Sub Industry Group under the Basic Materials Sector.

https://m.canadianinsider.com/private-eye/2017-05-15/market-insider-buying-nautilus-minerals-nus

Company confident PNG seabed mining project on track

Michael Johnston:

The company is confident the project will be on track to start extracting ore in the first quarter of 2019, he said.

"So that's the budgeted first ore date and we're tracking to that schedule at the moment so I don't see any reason why it won't achieve it."

http://www.radionz.co.nz/international/p...t-on-track

It's exciting. I'd like to see this date stay firm.

The financial results announced today....The most positive comment is in the very last sentence. The project completion is still set for Q1 2019.

•Received US$4 million through the US$20 million bridge financing facility provided by the Company's two largest shareholders.

•Announced the arrival of the Seafloor Production Tools (SPTs) in PNG.

•Announced the arrival of the LARS and ancillary equipment to the Mawei shipyard in China.

•US$19.5 million in cash and cash equivalents as at March 31, 2017.

Mike Johnston, Nautilus' CEO, commented, "It was very pleasing to see the SPTs arrive in PNG where they will undergo submerged trials in the coming months. We now remain focused on the build of the Production Support Vessel and the integration of the rest of the equipment on it. Subject to further financing, we remain on schedule to develop the world's first commercial high grade seafloor copper-gold mine at the Solwara 1 project site in Q1 2019*."

Agreed. When I have bought it changes the price :)

Seems to be deep entrenchment in the 24 - 25.5 cent bracket with very little give or take on the bid/ask which has caused the big drop off in trading volume. The more NUSMF can update the completion schedule the more chance of some movement in the share price.

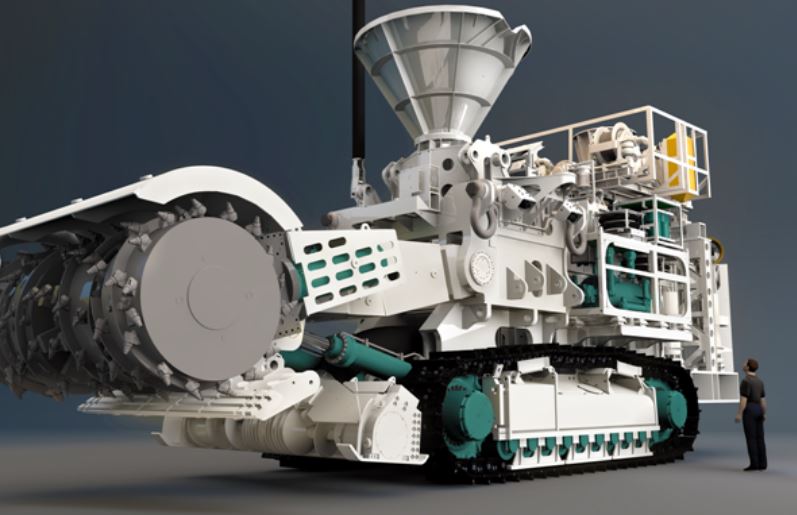

Nautilus Minerals to Test Seafloor Mining Tools

Posted by Eric Haun April 18, 2017

Canada based Nautilus Minerals Inc. said its Seafloor Production Tools have arrived in Papua New Guinea (PNG), and will shortly commence submerged trials.

Nautilus’ CEO Mike Johnston said, “We are delighted to be undertaking submerged trials in PNG. The trials will result in money and investment going into the PNG economy, and the employment of Papua New Guineans in state-of-the-art technology which are some of the key benefits of seafloor production. The trials also allow us to work closely with our partner Petromin, government officers from the various government agencies, as well as representatives from Provincial Governments of New Ireland and East New Britain.”

The submerged trials will take place in an existing facility on Motukea Island, near Port Moresby in PNG.

Nautilus was granted the first mining lease and environmental permit for polymetallic seafloor massive sulphide deposits at the prospect known as Solwara 1, in the territorial waters of PNG, where in the coming years it is aiming to produce copper, gold and silver.

http://www.marinetechnologynews.com/news/nautilus-minerals-seafloor-mining-547422

Last week's other top-gaining mining stocks on the TSX were Nautilus Minerals, Arizona Mining, Largo Resources and Coro Mining.

Nautilus Minerals

Nautilus Minerals bills itself as the first company to commercially explore the seafloor for massive sulfide systems, a potential source of high-grade copper, gold, zinc and silver. The company is developing a production system to commercially extract these metals using existing technologies adapted from the offshore oil and gas industry, and from the dredging and mining industries.

On April 10, Nautilus closed a $2-million private placement; more recently, on April 20, it delivered a $2-million financing notice for May. Last week, the company’s share price rose 8.7 percent to close at $0.25.

http://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/weekly-tsx-stocks/?as=1&nameplate_category=Daily

I'm 5 years holding and bought in at $3 first time around. Been alot of dilution and delays since those days. Did get a whole bunch more on last years 15 cent offering which brought down my average cost per share significantly.

Now that we are starting to see completed components arriving and other majors parts of the jigsaw puzzle well into production I'm starting to get that good feeling back again.

The share price movement has also been interesting, a month ago the share price shot up from 15 cents to 26.5 cents in about 3 days but then dropped back to 20 cents pretty quickly. Since then however the has been a steady climb back up and consolidation at the various levels, also the volume has been very healthy. That is a really encouraging trend and hopefully we continue to see steady growth up until the launch in the first quarter of 2019.

Obviously the one big stumbling block for Nautilus will be as we get closer, I expect the treehuggers and protesters to step up there opposition to the idea of mining the seabed. In the meantime I'll continue to enjoy the ride.

Nautilus Minerals pressing ahead with controversial deep sea mining project in PNG

The planned undersea mining project, Solwara 1, in Papua New Guinea is entering the first underwater testing stage.

Despite being beset by financial problems, Nautilus Minerals is pressing ahead with plans to mine the sea bed off New Ireland and East New Britain starting in 2018.

Nautilus Minerals chief executive Mike Johnston says equipment manufactured in the UK has arrived and submerged trials are about to take place on Motukea Island, near Port Moresby.

He says the equipment has been modified to do less long term damage to the sea floor.

Nautilus Minerals pressing ahead with controversial deep sea mining project in PNG http://www.abc.net.au/news/programs/pacific-beat/2017-04-18/nautilus-minerals-pressing-ahead-with/8448984

Thanks for posting this. I'm long on this one. In for 3 years and holding. Luckily for me I had some other traditional investment success to cover a moderate investment. This could be a great fairytale ending for sure. Its like holding a multi year lottery ticket. You could always win some day! :)

Interesting concept, could be some big players coming in if this works.

Nautilus Minerals' Seafloor Production Tools Arrive in Papua New Guinea

Monday, April 03, 2017

Nautilus Minerals' Seafloor Production Tools Arrive in Papua New Guinea

News today

07:30 EDT Monday, April 03, 2017

TORONTO, ONTARIO--(Marketwired - April 3, 2017) - Nautilus Minerals Inc. (TSX:NUS)(OTCQX:NUSMF)(OTC:NUSMF Nasdaq Intl Designation) (the "Company" or "Nautilus") announces that the Company's Seafloor Production Tools have arrived in Papua New Guinea ("PNG"), and will shortly commence submerged trials.

Mike Johnston, Nautilus' CEO, commented, "We are delighted to be undertaking submerged trials in PNG. The trials will result in money and investment going into the PNG economy, and the employment of Papua New Guineans in 'state of the art' technology which are some of the key benefits of seafloor production. The trials also allow us to work closely with our partner Petromin, government officers from the various government agencies, as well as representatives from Provincial Governments of New Ireland and East New Britain."

The submerged trials will happen in an existing facility on Motukea Island, near Port Moresby in PNG.

Thanks for that... Always good to get perspective from someone who knows... Sounds like you guys are ridiculously long... And if you get into this you better be prepared to be in for long-haul... But the concept is intriguing...

GLTY

And thanks again...

Don't hold your breath for to long that things will develop quickly. I have been in Nautilus for over 5 years and paid over $3 each for my first bunch of shares. Fortunately I took advantage of last years 15 cent offering which brought my average cost down substantially.

The problem has been, on every update, the expected launch date goes out by at least another quarter, now it is the 1st quarter 2019. I wish we could be certain that Nautilus will hold that date but the track record says it wont.

Our saving grace is that the 2 major shareholders have stood firm and have also given more money when asked for, however the shares have become much more diluted in the process.

If Nautilus can still prove to investors that they can achieve the 1st quarter 2019, by this time next year, then I really do believe the following 12 months, through to launch, could see some major action on the share price but there could also be some further dilution of shares in the interim due to more loans required to complete the ongoing work.

Late to this party but will put it on a watch list for sure...should trade in a choppy sideways pattern for a bit till more news comes out...solid floor around .16 looks like a trading range from .16 to .178 or so...so swings of 12.5% should be expected and taken advantage of...but one day soon another serious pop could come with the right news...already captures the imagination...more DD required on my part...

Two days after I wrote my previous post .... this thing has come unglued

I definitely won't buy here

I don't know what is behind this move up and with more dilution in the future ...

I see on the other MAIN board this is discussed on ... no one else has a clue really as to why this is moving up

Oh well .... as I said previously I sort of really want to own some of this but things are so mysterious with them and I just can't afford to be tying money up for months at a time ...

That being said ... Shoulda ,woulda ,coulda ..... still looking for that crystal ball

Congratulations to those who bought and had the patience to hold... you definitely deserve it

Waiting to see if it holds ... if we get a body slam back to lower levels again ... that could be my entry

... this might just be a pre-cursor to things to come but

Still indecided

If I had to guess I would think something is afoot because if it were manipulation of the price it could have been done any time in the last several years... Why now?

Guess I can always buy higher if something concrete comes along ,but might be hard to squeeze through the door at a decent price

Patience is not my virtue

Good luck

"I might throw down a gamble on it at some point ... but I couldn't call it anything else without having a magic genie or a crystal ball."

Still not back in the stock,waiting for something and not sure what it is ... Timelines keep getting stretched forward ... so much money spend and still have to lease the vessel? How queer that is to my mind ,however,I guess that's the way it is in this market.

Need more financing or it will never get to the starting gate

R/Split? Death nail for holders

Mike is a fool sometimes and we could go on about the idiocy of some of the moves made over the years

Environmentalists are still squawking and I would imagine they will continue all the way up to and even through the beginnings of mining under the sea.

I really want this company to succeed ... more importantly I want to own some of the stock when it finally ,maybe ,possibly ... starts making money

However,Mike has been so stupid about dilution I.E. (Should have diluted much less when the stock was at higher prices)

They blew off 10 million that someone stole and in fact who knows.... could have been an inside job

Too many things about this just tell me to wait and see... wait and see ....

Unfortunately when news finally breaks that sets things in motion I'll miss the best moves off these low prices OR they file bankruptcy because they can't get any more financing at all and people give up on the dream.

Who knows but just like many ... I am still watching

Keep thinking ... I should buy some, but I just feel like currently I might as well flush it down the troilet vs. buy into the company now

Maybe later this year...or next year....or never

Good luck to all those holding shares ... I feel for you and I envy all at the same time

I just need some throw away money and I'm in!!!

Although I do throw away money all the time ...it wasn't dead money I threw away ... it was live money ![]()

Where did I put that crystal ball?

This has been brewing of late and an upward trend seems to be forming. Up around 25% from the recent money raising share offer price of 15 cents (Canadian).

Agree in general ... however.... anything can happen right now ... no one knows what may happen here .... I might throw down a gamble on it at some point ... but I couldn't call it anything else without having a magic genie or a crystal ball.

Recent news is more “Possible Dilution” rather than “Possible Chap 11”.

At the risk of wasting more of my time responding to silly questions and now silly statements

Just what the Fk is your point?

Bwahahahahaa

Standard Risk warning see on every penny stock 10Q. Including this one, year after year.

"The Company has no producing mines and has no source of operating cash flow other than through debt and/or equity financing. Furthermore, there is no precedent for the Projects, so debt financing may not be available on commercially reasonable terms, or at all. There is, therefore, no assurance that additional

funding will be available to allow the Company to proceed with development of the Projects. Failure to obtain additional financing on a timely basis could cause the Company to reduce or terminate its proposed operations. "

There can be no assurances that the Company will be able to obtain the necessary bridge financing or project financing on acceptable terms or at all. Failure to secure bridge financing and/or project financing may result in the Company taking various steps aimed at maximizing shareholder value, including suspending or terminating the development of the seafloor production system and the Solwara 1 Project, and engaging in various transactions including, without limitation, asset sales, joint ventures and capital restructurings. The Company's independent directors will be looking to engage a financial advisor to assist them in this process.

Where is this exact phrase?

"engaging financial advisors and restructurings"

No offense Willbone ,but if you read through my posts on the board you will find that I am well aware of their past deals.Not sure if you were directing it to me or the board in general because you replied to my post.

Could be entertaining to watch this play out now ... to me if I were to take a position it would have to be stamped GAMBLE

They recently raised $30 million.

Nautilus Minerals Provides Update

I was afraid of something like this.... some of the wording is pretty scary and I am not trying to scare anyone or get the stock cheaper etc. It's just that when a company starts talking about "engaging financial advisors and restructurings" it could turn into a Bankruptcy .... hence the drop in price this morning;Doesn't instill confidence for investors;In addition to fault of management here they have screwed the shareholders over more than once with dilution,some might say mismanaged because they could have secured a LOT more $ to get to the end result of first ore here when the stock was at 3.00 ,2.00 a share .... they have been azz raping shareholders since BEFORE the last round of financing.It's not completely hopeless but it is not looking good and happy with my own decision to stay out of the stock until they did secure financing,I was very fearful ... now this? Really?

Another thought due to the nature of this being the "FIRST" deep sea mining operation , the environmentalists , and other "entities" is this an intentional delay for some other unknown reason??? Now beginning to wonder if they aren't going to clean house of debt and all shareholders ... sell everything to some big mining company on the cheap and flush everyone here down the toilet.

Not much chatter on the shareholdersunite forum .... Frankly I don't use that site I prefer here over that one and have always wondered why more people don't post here but that is another subject!!

Good luck peeps!!! They are doing it again!! It really ticks me off to and I currently don't even own it so I feel for those that are in ... I've wanted to buy and hold and was worried about not getting in ... in time to catch what might have been a nice wave forward but alas my cautionary gut instincts seem to have paid off for me in not losing on this but still their is a glimmer of hope for the future but it is getting worse and worse as time goes by.

Stock was over .10 still when I started writing now under .09 ... won't be surprised if it trades at a nickel or less now ... a true penny stock this has become!!!

TORONTO, ONTARIO, Jun 29, 2016 (Marketwired via COMTEX) -- TORONTO, ONTARIO--(Marketwired - Jun 29, 2016) - Nautilus Minerals Inc. (NUS)(otcqx:NUSMF) (the "Company" or "Nautilus") announces that, further to the Company's news release dated April 8, 2016, the Company continues to seek and consider various alternative sources of financing in order to maintain the development of the Solwara 1 Project and the Company's operations.

As previously disclosed, the Company requires significant additional funding in order to complete the build and deployment of the seafloor production system to be utilized at the Solwara 1 Project by the Company and its joint venture partner (as to 15%), the Independent State of Papua New Guinea's nominee.

In view of the Company's funding requirements, the Company and its operating subsidiaries are currently exploring alternatives for delaying project spending and securing immediate bridge financing to facilitate the time required to secure the significant additional project funding that is needed and/or to explore alternative transactions aimed at maximizing shareholder value. Any such bridge financing may include a loan facility provided by a major shareholder of the Company on commercial terms for such a facility with security over certain of the Company's assets.

There can be no assurances that the Company will be able to obtain the necessary bridge financing or project financing on acceptable terms or at all. Failure to secure bridge financing and/or project financing may result in the Company taking various steps aimed at maximizing shareholder value, including suspending or terminating the development of the seafloor production system and the Solwara 1 Project, and engaging in various transactions including, without limitation, asset sales, joint ventures and capital restructurings. The Company's independent directors will be looking to engage a financial advisor to assist them in this process.

There can be no assurances that any transaction will result from these matters and the Company will provide updates as circumstances warrant. Any transaction(s) will be subject to all necessary stock exchange and, if applicable, shareholder approvals as well as compliance with all other regulatory requirements.

The Company previously disclosed that the construction and development of the entire seafloor production system for initial deployment and testing operations at the Solwara 1 Project, was scheduled to occur during the first quarter of 2018 based on the Company's project timetable and subject to securing additional project funding. However, since, as indicated above, the necessary additional project funding has not been secured, the Company now believes that, in the event that the required funding is secured and the Company is able to continue development of the Solwara 1 Project, the schedule would be delayed but the Company is unable to determine the extent of the delay at this time. The Company will provide updates as circumstances warrant.

For more information please refer to www.nautilusminerals.com.

http://www.marketwatch.com/story/nautilus-minerals-provides-update-2016-06-29?d=nbst

I started a position at 0.11 @ 1000 shares last week. I will buy again if it dips. and will hold long for some encouraging news. I decided to not invest to much more this very risky business.

How long will it be until the transport ship is completed? anyone out there?

Is there anyone with brains can tell me what is happening with this company lately is it time to start buying? don't want to hurt anyones feelings.

And you know this how? Or are you simply masterbidding again?

Investors on this one have deep pockets...and tons of shares. Likely in their best interest to support it.

How long can that last I wonder ...

At least it's entertaining for now

Could also be the fact that GOLD is blowing up at 1255 an ounce right now

Getting pushed on Canadian side... Their majority shareholders likely propping up

I wouldn't pay anymore than .11 for it and probably wait for a dip even lower .... Can't figure who is buying at these prices unless they didn't read the news LOL!

They are selling 686 Million shares at .11 US dollars .15 Canadian .....Anyone buying at .14 / .13 even .12 in my opinion is NOT right in the head lmao

It does suck... I really was concerned they might do this ... I thought the first time they diluted it was pretty ballsy and had no respect for shareohlders ...this is a real beech slap to long term holders. JUST SPIT IN YOUR FACE ...UNBELIEVABLE GALL this company has!!!

I think they should have started smaller ... less expensive ...smaller tools /smaller ship ....once you get going and prove your theory ... use cash you are bringing in to expand.In other words I think they bit off more than they could chew and are screwing shareholders to get the job done.

Well... after all it is a penny stock ![]()

Nautilus Minerals Files Preliminary Prospectus for C$103M Rights Offering

NO position currently but dang ... I could have had one ... just hadn't hit the trigger yet .... part of me was thinking this might happen

Really can't believe they did this to shareholders again

Is a reverse split coming next?

Plus it says it still won't be enough money to get the job done ... incredible

And for those thinking the stock will go to .15 ... think again ... that's Canadian money

In US DOLLARS you should be seeing around .11 cents

TORONTO, ONTARIO, Feb 10, 2016 (Marketwired via COMTEX) -- Nautilus Minerals Inc. (NUS)(otcqx:NUSMF) (the "Company" or "Nautilus") announces that it has today filed a preliminary short form prospectus within each province of Canada, other than Quebec, in respect of a rights offering to raise gross proceeds of up to C$103M through the issuance of rights to subscribe for an aggregate of 686,666,666 common shares at a subscription price of C$0.15 per common share.

The record date and the expiry date for the rights offering will be determined at the time of filing a final short form prospectus. The rights offering will include an additional subscription privilege under which holders of rights who fully exercise their rights will be entitled to subscribe for additional common shares of the Company, if available, that were not otherwise subscribed for under the rights offering.

The Company is also registering the offer and sale of the shares issuable on exercise of the rights within the United States with the United States Securities and Exchange Commission on a Form F-7 registration statement under the U.S. Securities Act of 1933, as amended.

The Company has not received any standby commitments in respect of the offering. However, the Company's two largest shareholders, MB Holding Company LLC and Metalloinvest Holding (Cyprus) Limited, which, together with their affiliates, collectively hold approximately 48% of the outstanding common shares of the Company, have each indicated to the board of directors of the Company their present intention to participate in the offering by exercising all or a portion of their basic subscription privilege. Pursuant to applicable regulatory requirements, completion of the rights offering is not subject to raising a minimum amount of proceeds.

The net proceeds from the offering will be used by the Company to advance the construction and development of the Company's Seafloor Production System and for general working capital requirements. As detailed in the "Use of Proceeds" section of the preliminary prospectus, as at January 31, 2016, the outstanding contract values for certain equipment forming part of the Seafloor Production System (namely, the Seafloor Production Tools, Riser and ancillary equipment, and Subsea Slurry Lift Pump) total approximately US$52.5 million, and the net proceeds from the offering, together with the Company's existing cash and cash equivalents which were approximately US$52.2 million as at January 31, 2016, are expected to be applied towards such outstanding contract values following the closing of the offering. In order to complete the entire Seafloor Production System for initial deployment and testing operations, including integration of the Company's equipment into, and completion of, the production support vessel, Nautilus will need to obtain additional funding in excess of the maximum proceeds that can be raised under the rights offering.

The offering is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory approvals, including the acceptance of the Toronto Stock Exchange.

http://www.marketwatch.com/story/nautilus-minerals-files-preliminary-prospectus-for-c103m-rights-offering-2016-02-10-1717360?d=nbst

.20 gotta be a steal. Might get lucky with production starting in a year. Future of mining and we are on the cuff of some very exciting days to come. Gotta love it...

They have released quite a few updates so far this year. But I cant get them posted here to keep this board alive.

This board never has been very active ,,,not even when the share price was above 2.00 as I recall....besides.....I think what you really mean is "Let's get this stock going again" LOL!

I currently don't have a position but hope to eventually before it does start moving ........they are so slow at what they are doing .....I suppose I could miss the move eventually when it comes ......I just hate to have dead money sitting on a stock doing nothing.The company isn't very shareholder friendly....first they diluted the hell out of everyone and since then they really do nothing and frankly there is nothing they can do until the ship is built.

I should start adding in a position and might make that a priority soon!!

Let's get this board going again

I use to be MOD here and in fact did what I think is a super job on the IBOX ...looks like my work there is still there...however,I'm sure it probably needs updating.I gave up on this board but still check in often just to see what,,, if anything is posted.

If you want to be MOD for the board just request it off the webpage and you can work on updating the IBOX if that is what you are referring to.

I found no interest in being MOD here because there is nothing to moderate ...no one posts here much and I am currently out of the stock ...........all of the head cheese posters are posting over here >>>>

You might want to grab this link quickly because I may be at fault for posting a competing website on IHUB?

Just search NUSMF on here and you'll find the posters >>>>>

http://shareholdersunite.com/mybb/search.php?action=results&sid=6bf9b8b4fbc92ccd27e5912eff5c0d7f&sortby=lastpost&order=desc

I love NUS but cant seem to find a community online with a good MB to share. Is there a moderator on here yet? News should really be updated.

Curious why the news isnt being updated here?

https://finance.yahoo.com/news/nautilus-minerals-recommences-exploration-programs-114040060.html

https://finance.yahoo.com/news/nautilus-minerals-announces-release-annual-103032607.html

https://finance.yahoo.com/news/nautilus-subsea-slurry-lift-pump-103454791.html

https://finance.yahoo.com/news/umbilical-winches-nautilus-spts-successfully-114614995.html

https://finance.yahoo.com/news/nautilus-minerals-inc-vessel-cargo-131716323.html

https://finance.yahoo.com/news/nautilus-minerals-commences-commissioning-auxiliary-121737152.html

https://finance.yahoo.com/news/nautilus-minerals-inc-vessel-engines-125113363.html

This is all positive news? Wouldnt it be useful to have it posted?

Were any of you able to take advantage of the drop in price to the $0.35/$0.36 area this past week? I bought back in at that level. I'm holding now for a rise in price to perhaps the $0.49/$0.50 area.

Nautilus CEO misleading the world on experimental seabed mining process and impacts

Nautilus Minerals CEO Mike Johnston finds it very hard to tell the truth when speaking about his company’s experimental seabed mining plans. In his latest interview (below) there are at least three glaring mistruths:

1. The Solwara 1 project … ‘doesn’t have waste”. Not only is this not true, it is a ludicrous statement. Of course there will be waste. Waste is commonly defined as “unused or unwanted material” – so for starters there will be all the millions of tonnes of seawater that will be pumped to the surface as part of the slurry and then piped back down to the seafloor! Then what about the waste that is going to be created by a 227m long, 40 wide mining support vessel and the 180 people who live on board? Or the 350 tonne robotic machines that will carve up the seabed? Or all the huge plumes of sand, ash and silt that will be created by the open cut strip mining operations on the seafloor. That is a hell of a lot of waste!

More at >>>>>

https://ramumine.wordpress.com/2015/03/17/nautilus-ceo-misleading-the-world-on-experimental-seabed-mining-process-and-impacts/

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

966

|

|

Created

|

07/02/10

|

Type

|

Free

|

| Moderators | |||

United States sitting out race to mine ocean floor for metals essential to electronicsChina and other countries are racing to be the first to mine trillions of dollars worth of metals used in cell phones, supercomputers and more, while the U.S. is on the sidelines. 60 Minutes reports, Sunday at 7:30 p.m. ET and 7 p.m. PT on CBS https://www.cbsnews.com/news/united-states-sitting-out-race-to-mine-ocean-floor-for-rare-earth-elements-metals-electronics-60-minutes-2019-11-13/..

Contact InformationOperations (Brisbane, Australia) | |

| |

|

Nautilus Minerals Inc (referred to on this website as "Nautilus", "Nautilus Minerals" or the "Company") is the first company to commercially explore the seafloor for massive sulphide systems, a potential source of high grade copper, gold, zinc and silver. Nautilus is developing a production system using existing technologies adapted from the offshore oil and gas industry, dredging and mining industries to enable the extraction of these high grade Seafloor Massive Sulphide ("SMS") systems on a commercial scale.

Nautilus’ copper-gold project, Solwara 1, is under development in the territorial waters of Papua New Guinea. The Company has been granted the Environment Permit and Mining Lease required for resource development at this site.

The Company plans to grow its tenement holdings in the exclusive economic zones and territorial waters of Papua New Guinea, Fiji, Tonga, the Solomon Islands, Vanuatu and New Zealand as well as other areas outside the Western Pacific.

Nautilus has among its significant shareholders, two of the world’s largest resource companies and the nature of its alliances and technical partners place it firmly in pole position as the world leader in deepwater exploration and the development of mineral systems.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |