Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

As I said a long time ago, they were not building a shrimp production facility in that old wooden barn, they were building the mother of all barn fires

And burn it did, exactly as I said it would. There were hundreds if not thousands of code violations of various systems that indicated what was to happen

NaturalShareSellingScams

Noted and Correct

It becomes a Scam when they find out the Cost of Production is too high to make a profit and they don't tell anyone. They start a fire instead. And then another fire.

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed! wow

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 wow

OMG PEPE FREED !!!

Be careful, you know who is keeping very close tabs just waiting for some bullshit excuse to return either of us to captivity. And they wonder why the website is dying and in a fraction of what it once was

SHMP is a total scam as I have said for years. Eqinvestor won’t even drop in to apologize for suggesting this wasn’t a scam from day one.

Remember that Gerald Easterling podcast where Gerald says “we thought we could pocket that $20 million”

Such scam. Maybe ADVFN can merge with SHMP. it would be a perfect marriage, in my opinion. We just need Sterling to pump it and give us a valuation

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 huzzah

Don’t tell eqinvestor that because he thinks it was just a failed business plan

Note he doesn’t come around anymore

NaturalShareSellingScams

Noted and correct

Don’t tell eqinvestor that because he thinks it was just a failed business plan

SHMP was not a scam. A business plan that doesn't work out or one you don't agree with does not make it a scam. I don't care about your faith.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175985346

The only people who made money were the Con men running this Scam! They could care less about the Investors Cough Cough Suckers who put money into this LIE.

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed! wow!

Utah fizzle, do you think Bilky DelCrappo unloaded his shares in this share selling scam before it went bust ?

I wonder how many new BAGHOLDERS he created ?

NaturalShareSellingScams

Noted and Correct

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 huzzah

Xperts agree SHMP share selling SCAM

NaturalShareSellingScams

Noted and Correct

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed

Yes, power 11 was buying again today for his $5.00 target price.

We are ready for liftoff.

Noted and corrected

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 wow

Hey Franny, how’s SHMP thing working out for you and your fellow shrimpers ?

Yeah, this has got to hurt and hurt bad

You should have considered my very accurate opinions.

NaturalShareSellingScams

Noted and Correct

What happened to equinvestor ? Looks like he finally realized SHMP was the share selling scam we always said it to be

He might be in counseling

NaturalShareSellingScams

Noted and damn CORRECT

Markets Primed for what ? SHMP is mere inches from bankruptcy, has no assets left but their corporate charter and their SHMP ticker which Bilky DelCrappo will probably go whore out to the next buyer just like he did with MultiPlayer Dragon. As for Easterlied, I guess his girl will just have to continue with him squatting at her home.

Utterlydumb will have to turn in his Tesla

NaturalShareSellingScams

I told you all so years ago

Noted and Correct

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed

NaturalBillyUtahDeceptionShareSellingScams

NaturalCoinVendingSalesmsnShareSellingScams

NaturalSquatterInGirlfriend’sHouseShareSellingScams

NaturalBilkyShareSellingScams

NaturalTom’sMotherStillDressesHimShareSellingScams

Noted and Correct

NATURALSCAMS

Noted and Corret

Markets Primed💹Xperts Are ✅JUMBO SHORT✅$SHMP💹 $10 wow

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed! wow

NaturalShareSellingScams

Noted and Correct

Yeah. Looks like a scam that has $19M in assets. Too bad you can't look deep enough to see the root cause of the problem. I'm hearing there is still a lot of life....

Did the job get filled?

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 wow

Lmao Absolutely no one is Foolish enough to believe that horse shit.

No One

Who has $19M in assets? Not SHMP that's for damn sure.

Nope. What we have here is another Delgado shell to get pumped out. Which is how SHMP ended up here in the first place.

Yeah. Looks like a scam that has $19M in assets. Too bad you can't look deep enough to see the root cause of the problem. I'm hearing there is still a lot of life....

No, the assets of NaturalShrimpScam are lost to Fife, but the corporation belongs to the shareholders. It would be nice to see one last filing though

I told you so, just for the record

And told you so several hundred times

I see in my absence that equivestor has disappeared. Probably doesn’t want to defend his record defending this share selling scam, and yes, this was a scam.

NaturalShareSellingScams

Noted and Correct

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed!

Has “Fool Production” started?

Markets Primed💹Xperts Are ✅JUMBO SHORT✅ $SHMP💹 $10 wow!!

🏆️ Absolutely No One got left holding the bag more than power11.

No one

Please don’t feel bad for me. Feel bad for the guy still doing the limbo waiting on 5 bucks a share!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175904365

“ KEEP DREAMING JIMBO, NOW 5 BUCKS ....SURE BUDDY !!”

JIMBO, I REALLY FEEL BAD FOR YOU, YOU STAYED WITH THIS GARBAGE

FOR WAY TO LONG.

Xperts Are💹 JUMBO SHORT✅ $10 💹Markets Primed! wow

You still doing the limbo? Lmfao

KEEP DREAMING JIMBO, NOW 5 BUCKS ....SURE BUDDY !!

“North” thinkin it’s the wrong “North”

“ONE DAY SMART INVESTORS WILL WAKE UP AND REALIZE HOW VALUABLE OUR TECHNOLOGY HAS BECOME.

5 DOLLARS IS WHERE WE'RE GOING !!”

$5.00 or .00000000005?

Check out ASII and AFFU

|

Followers

|

583

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

115203

|

|

Created

|

12/26/10

|

Type

|

Free

|

| Moderators JoshTaeger | |||

https://upticknewswire.com/interview-ceo-bill-williams-of-naturalshrimp-incorporated-otcqb-shmp-2/

April 4, 2019: NaturalShrimp takes possession of New Water Treatment Systems Toward Full Production:

https://www.globenewswire.com/news-release/2019/04/04/1796949/0/en/NaturalShrimp-Takes-Delivery-of-New-Water-Treatment-Systems-Toward-Full-Production.html

March Event (1): NaturalShrimp will be at "Seafood Expo North America" March 17-19, 2019, the Largest Seafood Expo in North America for Suppliers, Industry Professionals

SHMP management is hitting all of the top industry gatherings in the U.S. to engage the broadest range of those in attendance. https://www.seafoodexpo.com/north-america/

March Event (2): NaturalShrimp will meet industry/business clients at "Aquaculture 2019" March 7-11,2019: https://www.was.org/meeting/code/AQ2019

Also: To see other upcoming Aquaculture or Seafood Events coming in 2019-2020 that NaturalShrimp and/or F&T may be headed, go to: https://thefishsite.com/events

Douwe Iedema, Executive Corporate Chef, NaturalShrimp, Inc. - 2019

TOP CHEFS ARE DROOLING OVER NATURALSHRIMP" - Clientele at Ritz Carlton, Four Seasons Hotels & Resorts!

Tripveel is a trending online Travel and Haute Cuisine e-magazine, a collaborative product partnered with Open Table, Priceline.com and Booking.com.

Tripveel: https://www.tripveel.com/tripveel/natural-shrimp Instagram: https://www.instagram.com/p/BujKAERnby6/ Facebook: https://www.facebook.com/tripveel/

Also served at these Dallas venues: Hyatt Regency, Cowboys Stadium, Celebrity Chef Tour, Green Grocer Dallas: http://naturalshrimp.com/our-shrimp/

NaturalShrimp, Inc. (OTCQB: SHMP) announced today that it completed testing its patented technology to grow shrimp indoors with onsite Shrimp Lot 180.

“The method worked extremely well and maintained the water control parameters within acceptable limits through the grow-out period,” said Bill G. Williams,

Chairman and CEO. With the results and the hard data now recorded, the acquisition of additional new systems will allow NaturalShrimp to facilitate roll-out

and expansion by adding additional harvests to present capability. This new equipment will enable NaturalShrimp to increase operations, while at the same

time providing additional R&D development for continuous innovation. The Company said it anticipates issuing additional news about its partial harvest soon.

The Company said it was cleared to harvest shrimp on February 21, 2019 by the Texas Parks and Wildlife Department (TPWD). The TPWD is a Texas State

Agency. The TPWD also conducted an onsite inspection of the shrimp and the Company’s production facility on February 22, 2019. (Article is linked above)

>>> Paul Knopick email at E&E Communications: pknopick@eandecommunications.com

>>> Office Telephone Number for Paul Knopick at E&E Communications: (940) 262-3584

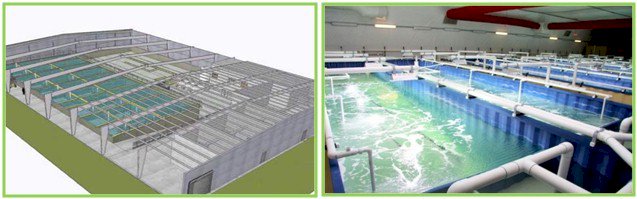

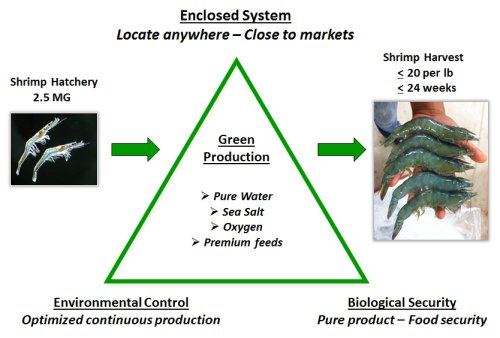

| NaturalShrimp is a global shrimp farming company that has developed a technology to produce fresh, gourmet-grade shrimp reliably and economically in an indoor, re-circulating, saltwater facility. Our eco-friendly, bio-secure design does not rely on ocean water. It recreates the natural ocean environment allowing for high-density production which can be replicated anywhere in the world. |

| Volume: | 120,032 |

| Day Range: | 0.0001 - 0.0003 |

| Last Trade Time: | 3:43:45 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |