Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

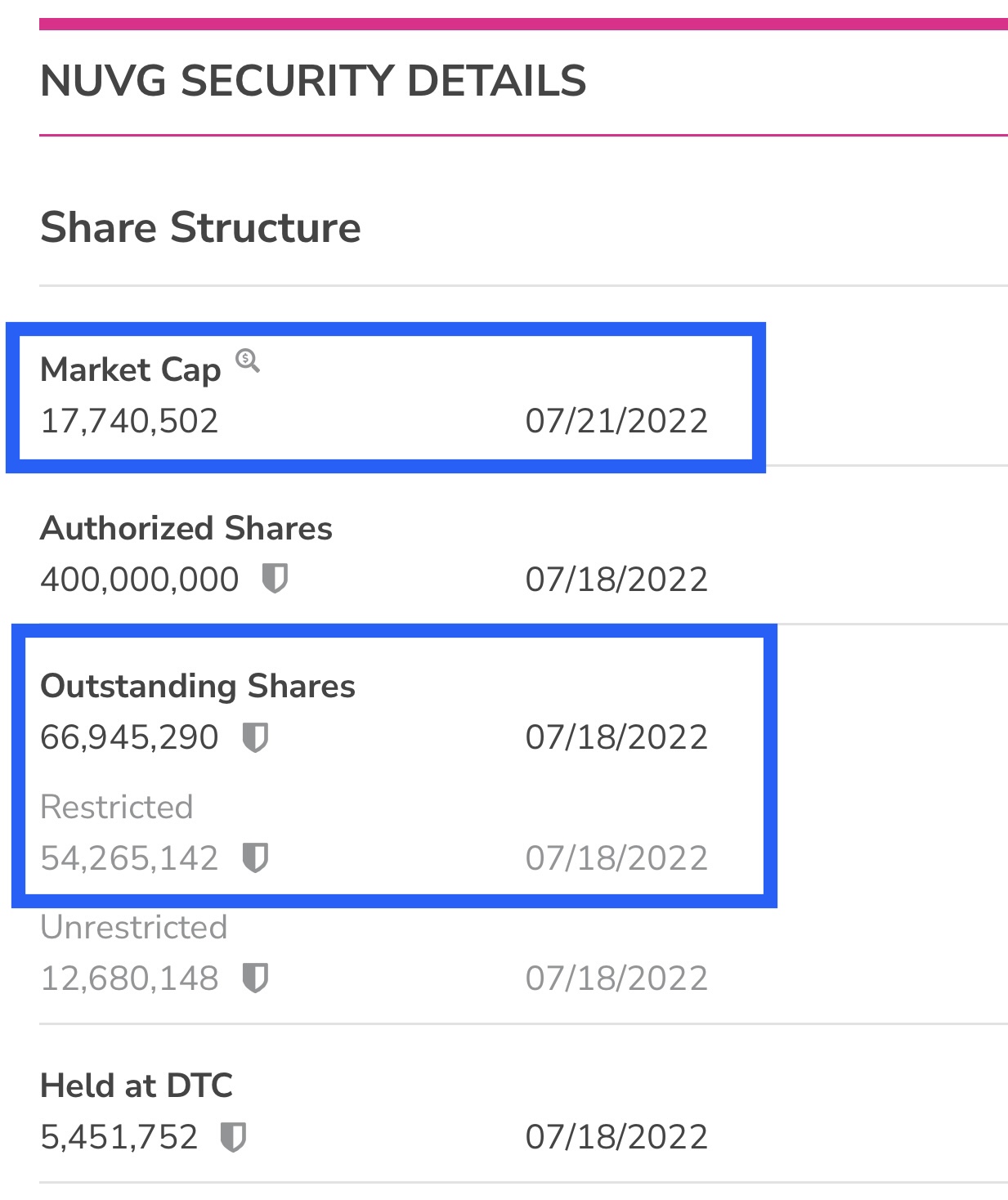

Massive short squeeze coming. 5.4M float

BWAHAHA

https://media.giphy.com/media/LmCYGjPpr1SDS6FqZX/giphy.gif

Talking about the owners of PMR. Allegedly, worth $400+M, and they'll have to be given stock for its value since NUVG has no money.

The owners of $NUVG have already been compensated. They got .0118 on 37,900,000 shares and the millions of shares that still hold, probably 10-15 million shares, went from .01 to .30 already and will go much higher.

It’s a dream come true for them. They almost went out of business and now they will make 10’s of millions of dollars.

I think they did pretty well.

![]() .

.

Looking great here!!

I give up… how many?

$NUVG

If PMR is worth $100's of millions, how many shares of stock will that be to the former owners?

Yep. A deal will be made and paperwork will be filed. What is your point?

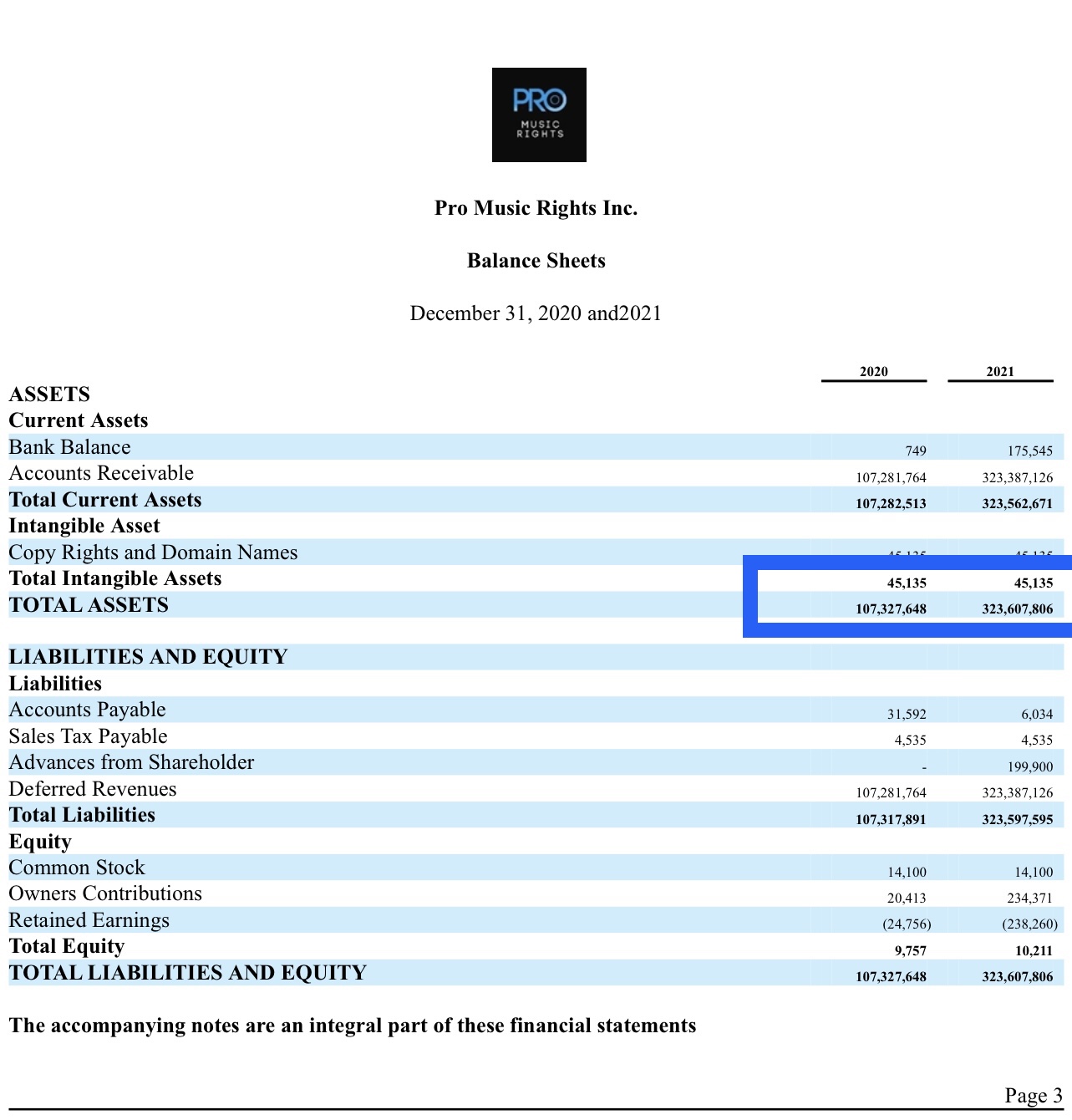

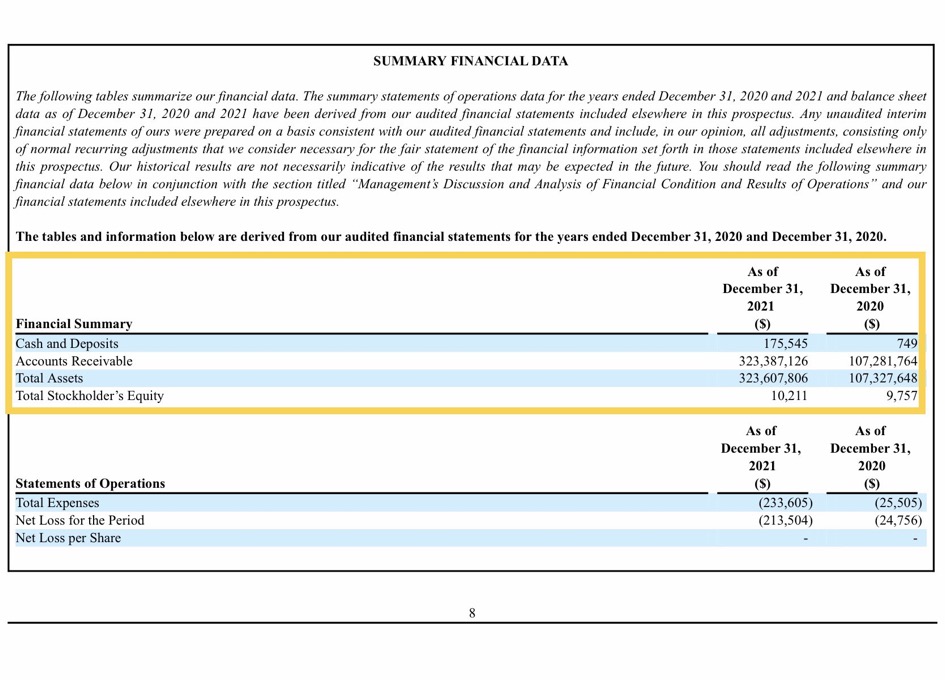

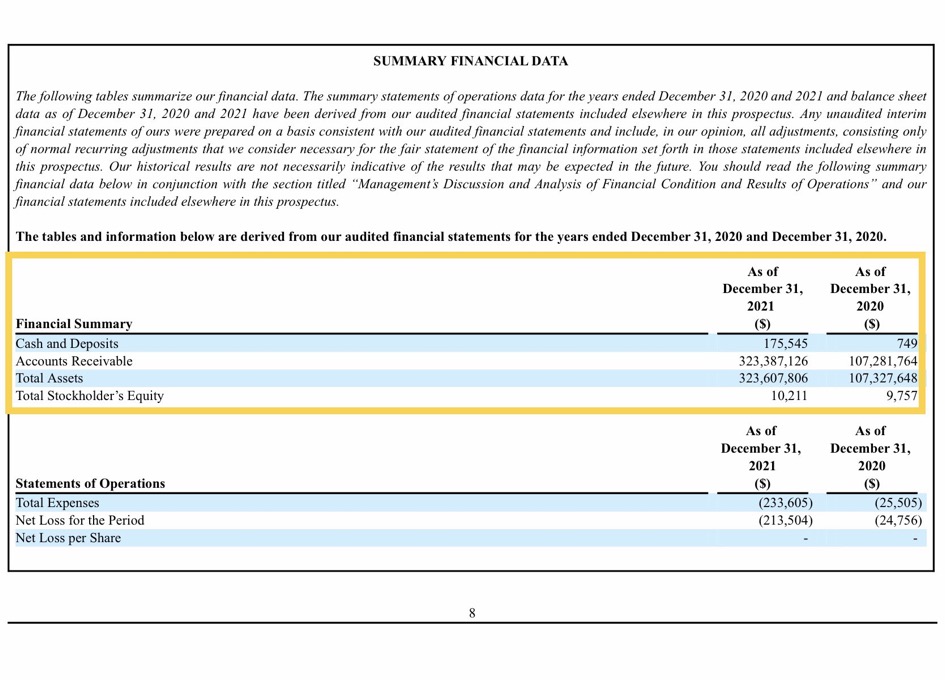

The auditor CONFIRMED A/R of $323M was collectible when he took out the 'GOING CONCERN' paragraph from his 3/23/22 Audit Report for Y/E December 31, 2020 and 2021.

AUDIT REPORT dated 3/23/22 - No Going Concern Paragraph

https://www.sec.gov/Archives/edgar/data/1831925/000121390022019488/ea158372ex5-2_promusic.htm#a_001

Auditors must comply with Generally Accepted Accounting Principles (GAAP). Since the auditor did not book any 'Allowance for Doubtful Accounts' in either audit year. It is a logical conclusion that in the auditors professional judgement all of the $323M in Accounts Receivable was collectible in the future.

In addition, as part of the auditors audit testing of Accounts Receivable, he would have mailed A/R Confirmations to the company's who owed the $323M to Pro Music Rights. If any of these customers disputed their A/R balance, then the auditor would be required by GAAP Rules to reduce the $323M in Accounts receivable to a more conservative number (the GAAP Principle of Conservatism). This was NOT done the auditor. Therefore, it is a logical conclusion that all of $323M in Accounts Receivables is collectible.

Note: Auditors can be sued for malpractice and they DO NOT just casually drop the 'Going Concern' paragraph unless they have verified the accuracy and collectability of the $323M in Accounts Receivable.

But in Pro Music Rights audits, that's exactly what the auditor did. POOF! The Going Concern paragraph was taken out... end of story!

JMO

The CEO has acquired the shell, NUVG. NUVG has not yet acquired PMR. In order to do that as a material event, the complete details of the agreement of acquisition will now have to be published, as well as 2 full years of financials (ie - not the excerpts that were shown in the S-1/A). The owners of PMR will also have to be compensated for its fair value, and since NUVG has no money, it’ll all be stock with value. Considering what folks are saying PMR is worth, that’s going to be a boat load of stock. If it isn’t a boat load of stock, it will indicate what the value truly is to PMR’s owners. Pretty sure that has to be done within 4 days of the acquisition.

This is on Edgar to the SEC…

The company wants to go public.

They found a good share structure.

They have a metric sh$t ton of assets.

Those are the facts.

$NUVG

Can this be too good to be true for a penny stick?

Yeah, instead of collecting up on the 100's of M's of "accounts receivable," they sold stock... that was the point...

That snippet in your post was from 4/13/22. And on 6/28/22, they solved their cash flow issue. In case you missed it. They did a Rule 506(b) private placement to accredited investors and raised $5.5M. That stock is "restricted" (as per 506(b) rules, and cannot be registered for sale for at least 6 months up to 1 year (Google it!)

Couldn't care less about the "going concern" paragraph, nor do I believe that auditor dug into those accounts receivable and deemed them "collectable" from a legal standpoint. $100+M from 2020, not collected... wonder why that is?

I reiterate, $NUVG is self-reporting in their tweet $414M in Net Assets and no liabilities, which is in-line with Accounts Receivable balances of $323M five months before on 12/31/21.

Based on 67M OS, The book value is $6.20 without a multiple. Apply a 2x multiple and you get $12 BUCKS. Now, I hope everyone is beginning to understand just how undervalued $NUVG is, and why in ZARDIW post, it showed a FACTOR OF 8,735, when the RM was announced three days ago.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169459248

JMO

The auditor determined the $323M in Accounts Receivable as of 12/31/21 was collectible. Afterwards, the auditor felt it was appropriate under Generally Accepted Accounting Principle rules to dropped their 'Going Concern' paragraph from their Audit Opinion.

FYI.. Auditors DO NOT just casually drop the 'Going Concern' paragraph unless they have verified the accuracy and collectability of the Accounts Receivable balance of $323M as of 12/31/21. But in Pro Music Rights audit for 2020 & 2021 that's exactly what the auditor did. POOF! Going Concern paragraph was taken out.

And this little snippet from the S-1/A seems pertinent, too. With all that "audited" accounts receivable, seems they're having a little cashflow problem, hardly any real revenue. How can that possibly be? (It's on page 42, btw)

Plan of Operation

While we have generated revenue from operations, such revenue does not appear to be recurring and various downstream customers have failed to continue payments under their respective agreements. As reflected in our audited balance sheet for the period ended December 31, 2021 and 2020, our accounts receivable are $323,387,126 and $107,281,764, respectively, and deferred revenues of $323,387,126 and $107,281,764. Our plan of operation for the 12 months following the offering the subject of this prospectus is to continue growing our business in the United States by seeking (i) partnerships to grow our repertory, (ii) songwriters, composers and publishers to contribute musical works to our repertory, and (iii) downstream customers to enter into per location or per service licensing agreements with us. We further intend to seek collection on the outstanding accounts receivable. While the Company intends to minimize its operational expenses, the Company does not believe it can satisfy its cash requirements through the fiscal year end of December 31, 2022 or thereafter without collecting on its outstanding accounts receivable. If the Company is unable to collect a significant percentage of its outstanding accounts receivable by December 31, 2022, the Company will likely have insufficient funds to continue its operations, expend resources on marketing or advertising, and otherwise maintain its information systems. Lastly, in such event, our songwriters, composers and publishers may seek to rescind their grants of public performance licenses or otherwise terminate their agreements with us, substantially impacting the Company’s ability to operate as a going conern.

I'll say it again since it's so important to understand. For the years ended 2018, 2019, 2020 and 2021 audits, the auditor DID NOT record any 'Allowance for Doubtful Accounts' on the Balance Sheet. That means a minimum of 323M in Accounts Receivables will be collected and recorded as revenue in the future. End of story.

You can "CLAIM" whatever you want about the $323M in Accounts Receivables as of 12/31/21, but you have not performed the audit yourself... a Certified Public Account has! They have included their Audit Opinion with the financial statements and can be sued by unintended third parties (that includes banks, you and me).

LASTLY, and this is HUGE.

The auditor DID NOT include a 'Going Concern' explanatory paragraph with their Audit Opinion F/Y/E 2020 and 2021 (but it was included in the 2018 & 2019 audit opinions).

WHAT DOES IT MEAN WHEN THE 'GOING CONCERN' PARAGRAPH IS TAKEN OUT BY THE AUDITOR?

The short answer is: To use a metaphor.. it's like winning the entire Mega Millions Lottery of $790M next week.

But seriously here's the longer answer: The Going Concern paragraph is viewed by layman as a 'Black Eye'. Nevertheless, it's inclusion is common place because we live in a litigious society and lawyers sue everyone involved if their client loses money in an investment.

For example, if anyone loses money in $NUVG because the Accounts Receivable balance is not collectible, then we can file a class action lawsuit against the auditor for negligence and malpractice. Why? Because we relied on the financial statements and disclosures to make an investment decision. So, auditors DO NOT just casually drop the 'Going Concern' paragraph unless they have verified the accuracy and collectability of the Accounts Receivable balance of $323M as of 12/31/21. But in Pro Music Rights audit for 2020 & 2021 that's exactly what the auditor did. POOF! Going Concern paragraph was taken out.

JMO

That was an S-1/A, now withdrawn, where PMR was doing an IPO to list themselves on the OTC while selling stock. The offering was 500M shares at a penny, and the holdings of the officers/directors with those additional shares matches up.

LMAO.. the $0.01 is an arbitrary number to calculate the registration fee. It even says that right in the S-1 Offering.

We have arbitrarily determined the offering price of $0.01 per share in relation to this offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria.

https://www.sec.gov/Archives/edgar/data/0001831925/000121390020045304/ea132224-s1_promusic.htm

$NUVG

— Pro Music Rights (@ProMusicRights) July 24, 2022

Straying from the subject. I asked why this company wanted to "go public" and raise money with an alleged accounts receivable of over $400M, especially "going public" by handing over equity to people who never gave them a plug nickel. The current owners of PRM (mostly the CEO) own all of it, the owners of this stinky pink own none of it. Why on earth would anybody do that? If that $400M was true, verifiable, and collectable, it would be a cakewalk to get a loan against it.

Really? So, the "audited" Accounts Receivable number of $323,000,000 should be ignored in valuing $NUVG. I don't think so for the reasons I stated in this post.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169481462

And that "intends to refile" was 9-10 months ago...

You left out the part where it says Jake Noch "intends to refile". Why? did that not suite your purpose.

Do your DD. The $5.5M came from accredited investors, not from an "institution or venture capitalist. It was a Rule 506(b) private placement. The shares are restricted for at least 6 months and up to a year.

— Pro Music Rights (@ProMusicRights) July 24, 2022

Here you go

Go to SEC.gov

https://www.sec.gov/edgar/searchedgar/companysearch.html

Search - "Pro Music Rights"

https://www.sec.gov/edgar/browse/?CIK=1831925

Click on the S-1/A - dated 4/13/22

https://www.sec.gov/Archives/edgar/data/0001831925/000121390022019488/ea158372-s1a3_promusic.htm

Go to the bottom of P. 7 of previous link

Note: The S-1 was withdrawn on 5/25/22

https://www.sec.gov/Archives/edgar/data/0001831925/000121390022029530/ea160630-rw_promusic.htm

Looking great here!!

Your use of the word "claiming" is misleading.

Claiming over $300M of "accounts receivable" from "licensing" music rights.

In our opinion, the financial statements

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2029/b],

Accounts receivable are stated at Net Realizable Value (NRV). No allowance for doubtful accounts was booked as of December 31, 2021, and 2020, respectfully.

Can you please provide the LINK to the document you reference that shows “MUSIC“ as the requested “New Ticker Symbol”?

That is really cool!!!

What exactly is this document? I look forward to seeing the LINK that will lead me to the entire document!!

Thanks so much!!

![]()

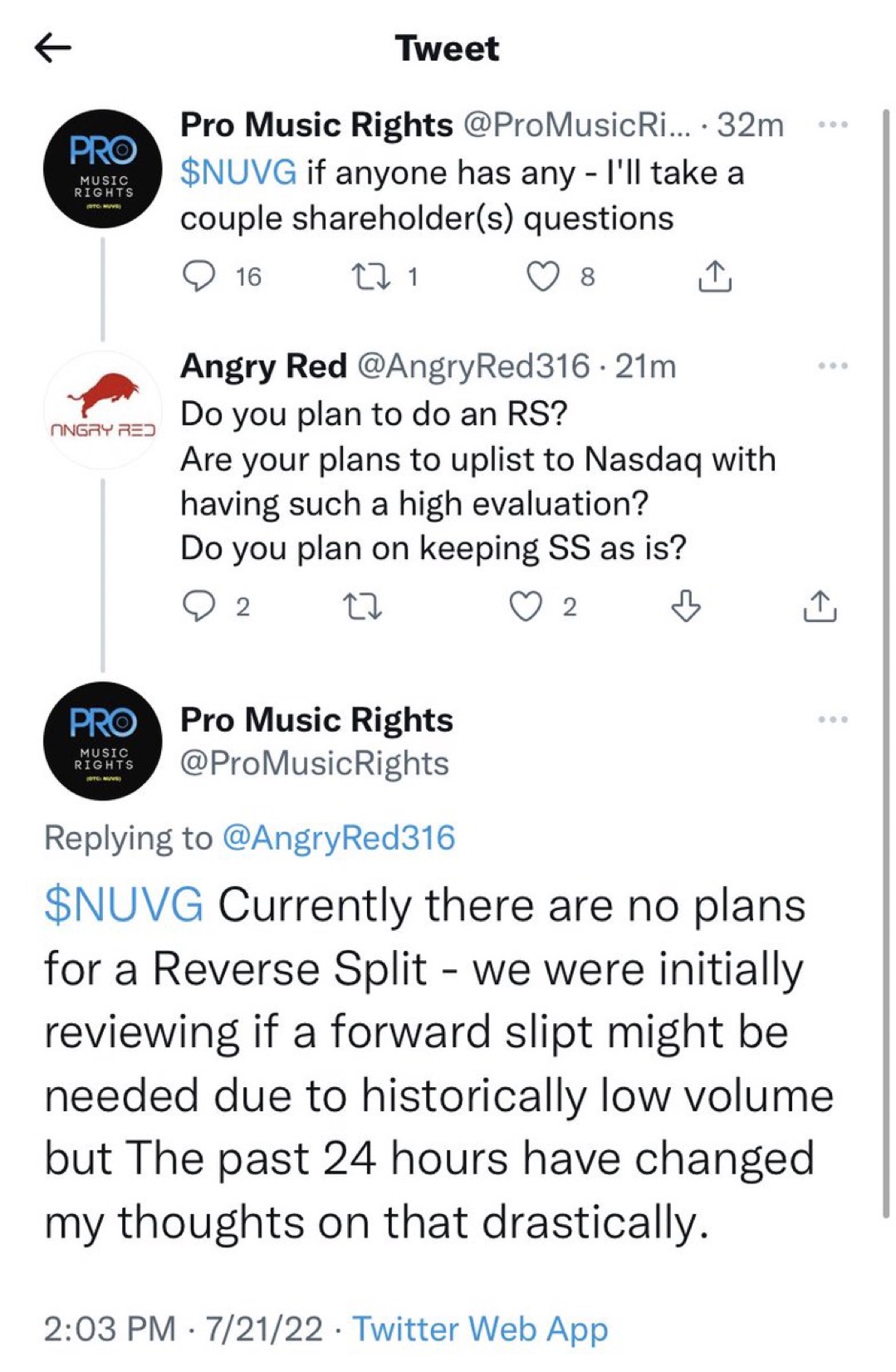

A Reverse Split with this beautiful existing share structure? If anything, a forward split of 3:1 may be in order once all the paperwork is finished and the name/ticker change.

Oh okay, so converting from an Florida LLC to a Delaware Corporation gets rid of those complaints and investors have nothing to worry about? And April, 2022 is hardly 2 years old.

No. But I saw that they tweeted that there were no plans to uplist anytime soon.

$NUVG

Nice! and thank you. Did you see their proposed NASDAQ symbol on page 7.

RESERVED SYMBOL ON NASDAQ: “MUSIC”

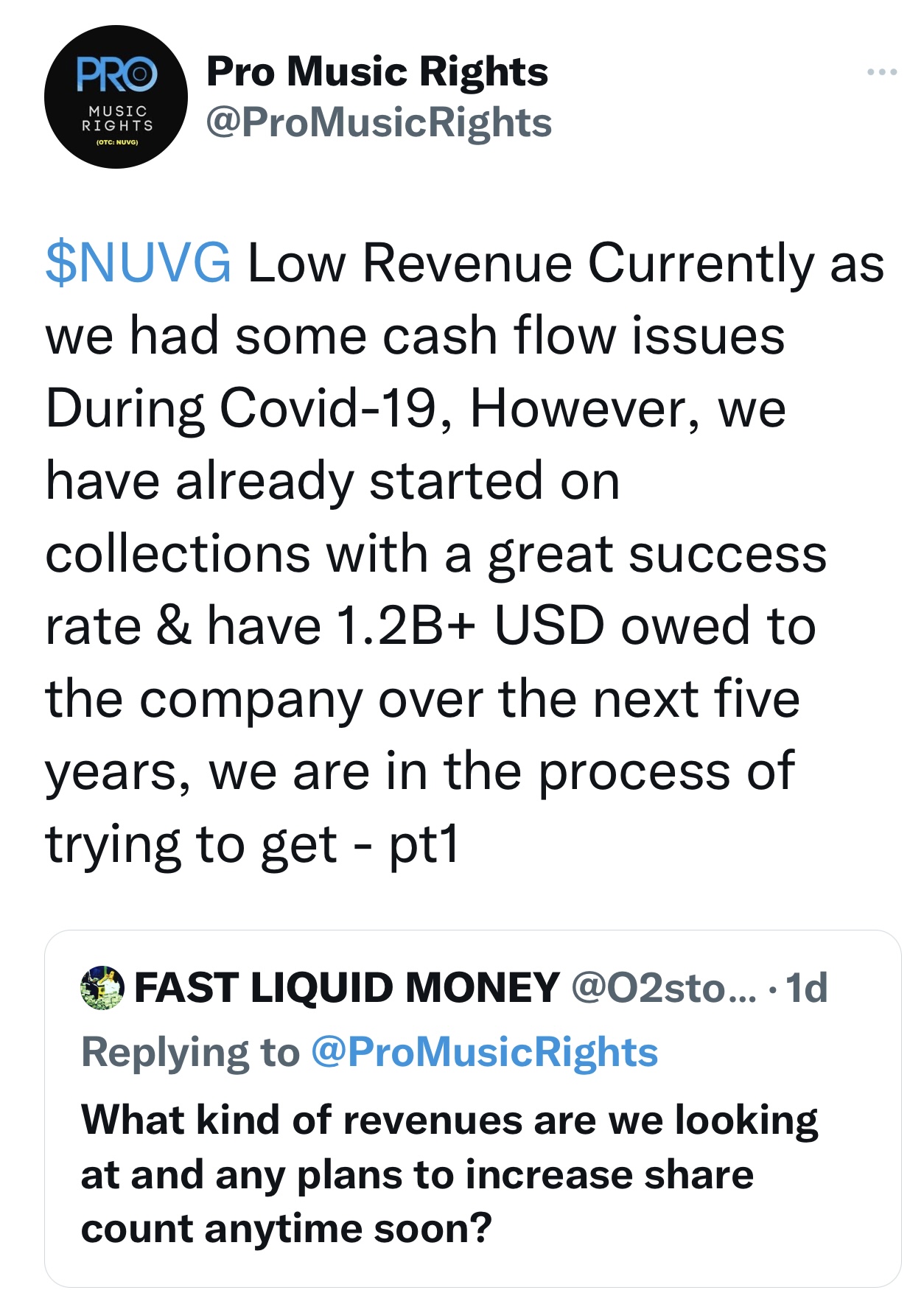

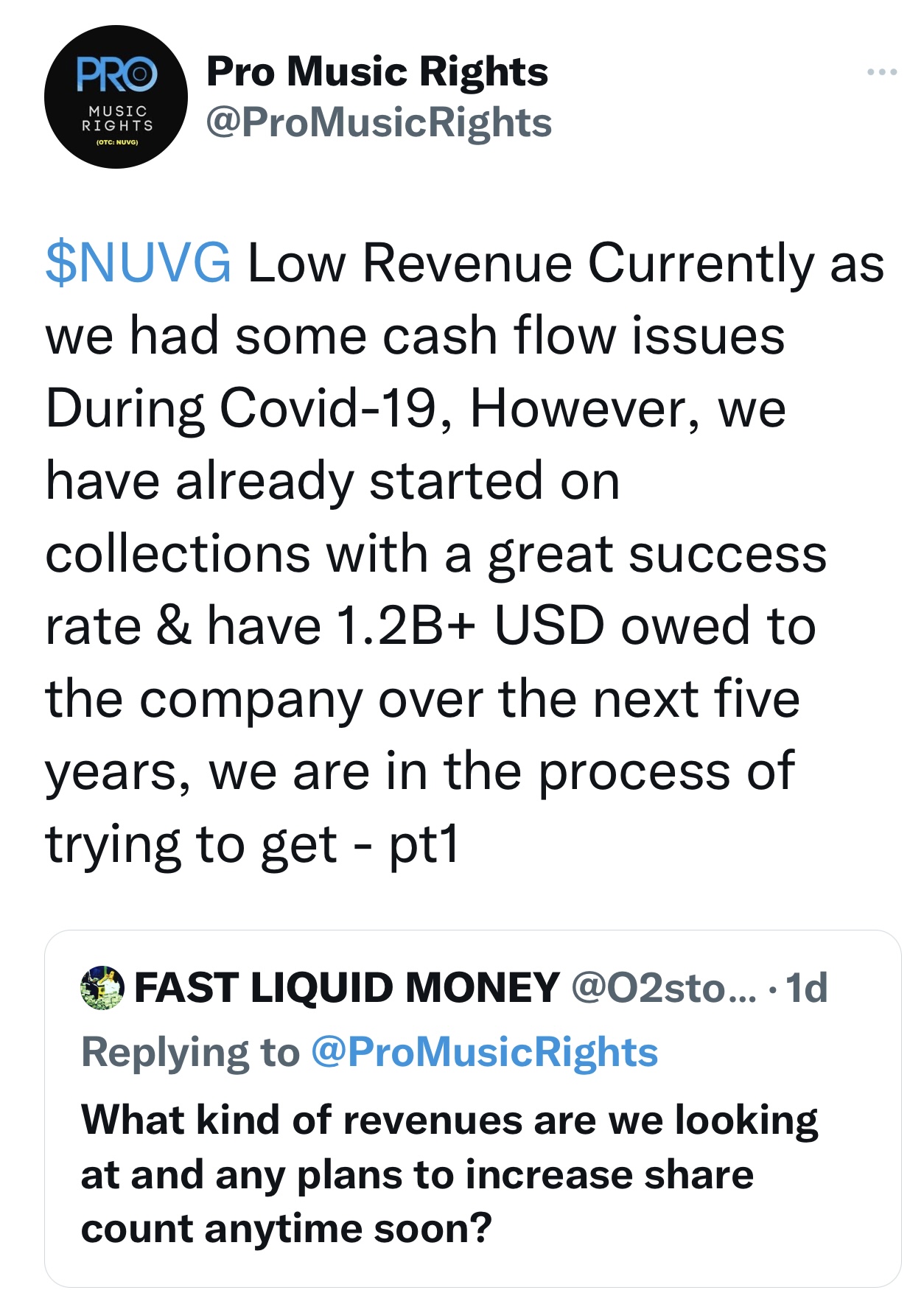

UPDATED: Pro Music Right reverse merger into $NUVG $NUVG Low Revenue Currently as we had some cash flow issues During Covid-19, However, we have already started on collections with a great success rate & have 1.2B+ USD owed to the company over the next five years, we are in the process of trying to get - pt1 https://t.co/HoHS3nnaoH Here’s an excerpt from Pro Music Rights now withdrawn S-1/A before they bought the control block in $NUVG $NUVG Currently there are no plans for a Reverse Split - we were initially reviewing if a forward slipt might be needed due to historically low volume but The past 24 hours have changed my thoughts on that drastically.

Here are the basics.

Their twitter page is very active. I suggest you go through it to get a feel for their style. @ProMusicRights

This is their OTCM page, but it’s being updated. Most of the info on it is from the previous company. That has already started changing though. You can already find Jake Noch as CEO.

NUVG - Nuvus Gro Corp | Company Profile | OTC Markets

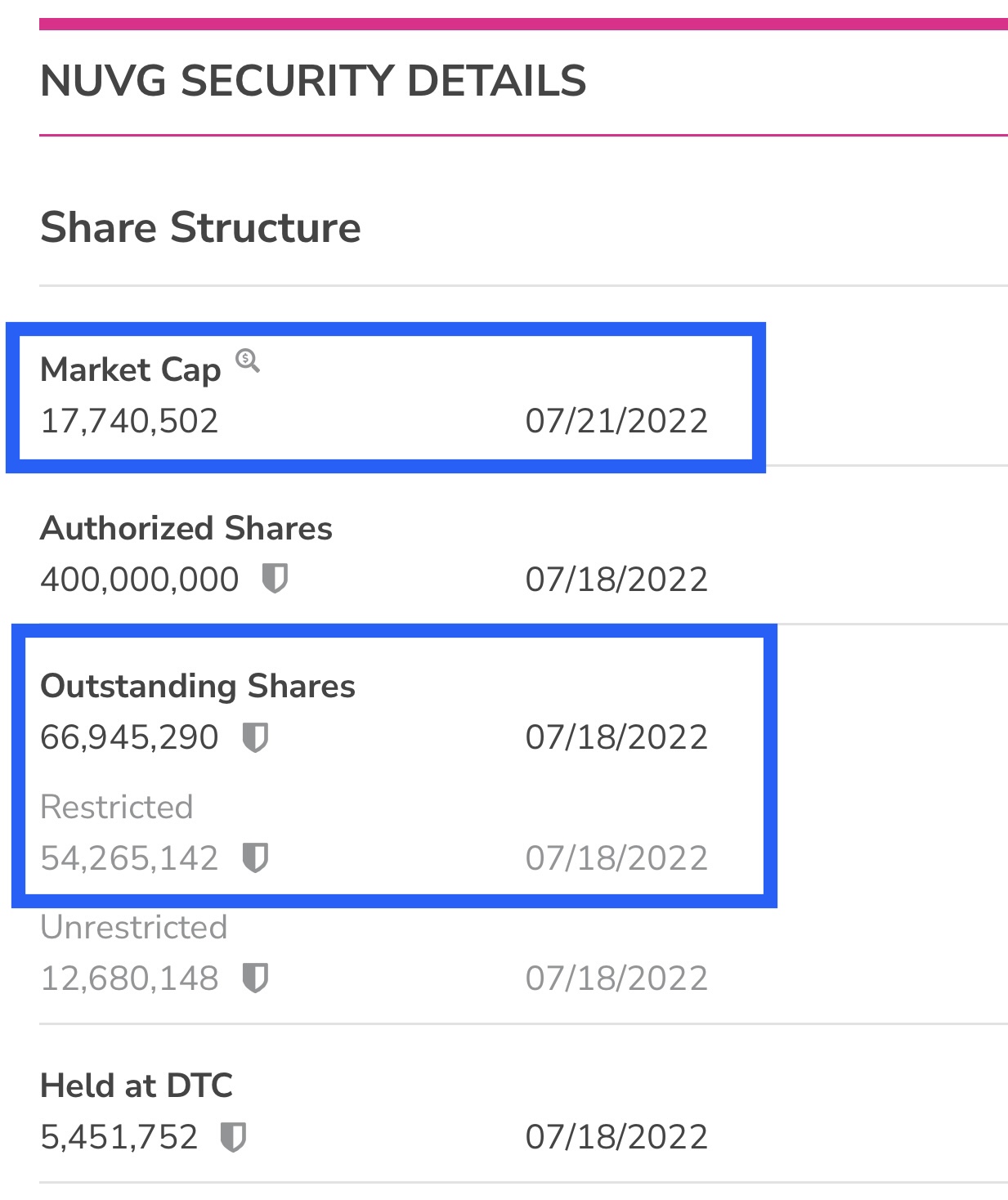

Their share structure is amazing. Only 67 million outstanding shares, and most of that is restricted

Announcement of the reverse merger https://finance.yahoo.com/news/pro-music-rights-inc-one-123000803.html

Announces Jake Noch as new CEO of NUVG

https://www.prnewswire.com/news-releases/pro-music-rights-inc-announces-jake-p-noch-as-new-ceo-of-nuvus-gro-corp-otc-pink-nuvg-301590705.html

Qualifications of Jake Noch

https://files.brokercheck.finra.org/individual/individual_7323097.pdf

This is an important tweet about their value and share structure going forward

This from BEFORE Pro Music rights bought the controlling block in $NUVG.

As you can see, assets were rising year over year, and this fits with the most recent valuation in May 2022 of 414 million dollars

It can be found here

https://www.sec.gov/Archives/edgar/data/0001831925/000121390022019488/ea158372-s1a3_promusic.htm

Thank you @CorbellSherri

This can be found here: https://t.co/rO2NzWY4SV pic.twitter.com/MCkpzT0P9N

Here’s a reply to a person on twitter stating that he is not diluting

Also, there are no plans for a reverse split

They are moving quick. They stated they’d get this form filed and they did https://www.otcmarkets.com/filing/html?id=15961418&guid=WKU-knejEd9kdth

You’ve seen the numbers.

414 million dollars in assets.

1.2 billion dollars in collections in the next five years.

All squeezing into 67 million outstanding shares with no plans for dilution or changing the SS.

This reverse merger isn’t an “IF”. It’s a done deal and the paperwork is being filed.

I will not even get into the multiples on the stock price. I’ll let others discuss that. But this is worth TEN’s of dollars per share.

Alright. Just for you, I will.

I’m also going to add this gem I just discovered

This from BEFORE Pro Music rights bought the controlling block in $NUVG.

As you can see, assets were rising year over year, and this fits with the most recent valuation in May 2022 of 414 million dollars

It can be found here

https://www.sec.gov/Archives/edgar/data/0001831925/000121390022019488/ea158372-s1a3_promusic.htm

Thank you @CorbellSherri

Here’s an excerpt from Pro Music Rights now withdrawn S-1/A before they bought the control block in $NUVG

— Sherri Corbell (@CorbellSherri) July 23, 2022

This can be found here: https://t.co/rO2NzWY4SV pic.twitter.com/MCkpzT0P9N

Yes. I thought about putting it in, but with the share structure so small to begin with, I didn’t think it would have been on the table anyway.

$NUVG

There are currently no plans for a RS as per Pro Music Rights/$NUVG

https://twitter.com/ProMusicRights/status/1550179832985681920/photo/1

Thank you.

$NUVG

Fantastic post! Glad you became a mod and stickied it! Looking forward to the weeks ahead. $NUVG$

$NUVG and the Pro Music Rights reverse merger. Here is the basic DD. $NUVG Low Revenue Currently as we had some cash flow issues During Covid-19, However, we have already started on collections with a great success rate & have 1.2B+ USD owed to the company over the next five years, we are in the process of trying to get - pt1 https://t.co/HoHS3nnaoH

Their twitter page is very active. I suggest you go through it to get a feel for their style. @ProMusicRights

This is their OTCM page, but it’s being updated. Most of the info on it is from the previous company. That has already started changing though. You can already find Jake Noch as CEO.

NUVG - Nuvus Gro Corp | Company Profile | OTC Markets

Their share structure is amazing. Only 67 million outstanding shares, and most of that is restricted

Announcement of the reverse merger https://finance.yahoo.com/news/pro-music-rights-inc-one-123000803.html

Announces Jake Noch as new CEO of NUVG

https://www.prnewswire.com/news-releases/pro-music-rights-inc-announces-jake-p-noch-as-new-ceo-of-nuvus-gro-corp-otc-pink-nuvg-301590705.html

Qualifications of Jake Noch

https://files.brokercheck.finra.org/individual/individual_7323097.pdf

This is an important tweet about their value and share structure going forward

Here’s a reply to a person on twitter stating that he is not diluting

They are moving quick. They stated they’d get this form filed and they did https://www.otcmarkets.com/filing/html?id=15961418&guid=WKU-knejEd9kdth

You’ve seen the numbers.

414 million dollars in assets.

1.2 billion dollars in collections in the next five years.

All squeezing into 67 million outstanding shares with no plans for dilution.

This reverse merger isn’t an “IF”. It’s a done deal and the paperwork is being filed.

I will not even get into the multiples on the stock price. I’ll let others discuss that. But this is worth TEN’s of dollars per share.

Yeah. This is ridiculously ginormous. I honestly just understand why this isn’t already in dollars. I guess in due time. There is going to be a crazy correction when the big boys get here.

$NUVG

It’s just some traders that picked up shares earlier today at .25-.26, cashing out for pennies while we hold for multi-dollar, maybe even double-digit dollars!!!

![]()

A Change of Control Form 1-U was filed this afternoon

$NUVG it's been sent out https://t.co/SOKS419LTF

— Pro Music Rights (@ProMusicRights) July 22, 2022

Except this company claims a value in the 100’s of millions, so giving away any equity to shareholders of a dead company will never be cheaper. Plus, this company had already prepared its S-1 and a couple revisions, sunk costs.

And it still doesn’t answer the avoided question of why this company wants to go public in the first place. If the value was true and verifiable, it would be a cakewalk to get favorable terms on financing of a mere $5M from an institution or venture capitalist.

When you RM a company saves on IPO fees to Wall Street firms and keeps much more equity than if they had IPO’d. That’s a fact.

Have you ever heard of the CK*X / SPE*A reverse merger? You should look it up. That was later referred to as the Elvis Presley company, and subsequently bought American Idol. SPE*A stockholders made a fortune.

ONE O’CLOCK that is huge!!

$NUVG had recurring monthly REVS of $83 mil In 2021. That’s a billion $$ in trailing annualized REVS.

Apply a 2x - 3x REV multiple and Pro Music Rights/$NUVG is looking at a $2B - $3B market, or $30 - $45 stock price.

(No wonder ZARDIW algorithm showed a factor of 8,735.)

|

Followers

|

167

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

10727

|

|

Created

|

02/04/11

|

Type

|

Free

|

| Moderators tdbowieknife Dragon Lady | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |