Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Seriously?? An animated video of a nonexistent winery??

“We shall see in a few days as today they tweeted that they would be current in a few days.”

Current with who? It sure won’t be the SEC and that is the ONLY one that matters.

Lol. Ha...good to see you ten and as usual we don’t agree GLTY. Imo this is a rare one We shall see in a few days as today they tweeted that they would be current in a few days. Every now and then an optimist (me) hits one out of the park. They have plenty that’s verifiable

Nonsense; court's do not approve illegal kickback schemes; the court approved the terms of the settlement LOL; they just retired 1.6 billion shares which will certainly counter act any fall out from the settlement, if not improve upon the float. The payout is contingent on stock value as I read it and the value has skyrocketed which I think will dramatically reduce the number to be paid out. But I am not ingenious enough to figure the number before events occur which are calculated into the formula. Apparenly I need your Ouija board LOL

Yup, ignore the noise.

MSPC Charts cooled off. Bounce coming up as we head for higher highs.

There ya go!

Info most likely started flowing to the SEC now!

Watch your back! No kidding!

Finally an admission.

Wow that’s huge you need to share this special broker with he rest of us !! Don’t hog all the short shares for yourself ! Lmao

LOLOL!! Oh yes!! I've shorted trillions and trillions, and my Very Special Broker is happy to take ALL my risk for me, and so doesn't even charge margin and maintenance!!

just like damned near every other otc play; who cares; it all goes into the decision making process; they r catching up; this argument is always way the hell overblown; most huge plays start with a stop sign cause people make the mistake of not looking at value

LOL.. Good Luck with that.

From the MSPC filings.

MSPC filed a 10Q on October 30, 2017 for the period ending March 31, 2016

https://backend.otcmarkets.com/otcapi/company/sec-filings/12345327/content/html

In that filing we are told As of October 20, 2017, there were 3,892,178,868 shares of the Registrant’s Common Stock outstanding.

1,850,000,000 were restricted (owned by the executives) the rest (2,042,178,868 shares) were free trading.

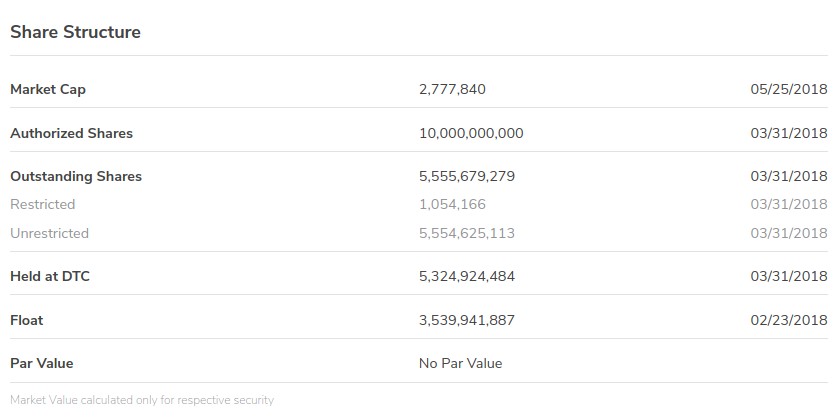

Now visit the OTC markets website and you see the share structure as of February 23, 2018

https://www.otcmarkets.com/stock/MSPC/security

5,389,941,887 outstanding

1,850,000,000 restricted

3,539,941,887 free trading

That's an increase of 1,497,763,019 shares to the float between October 20, 2017 and February 23, 2018

The 3(a)10 transaction was settled on November 1, 2017.

On November 14, 2017 CF3 Enterprises LLC got its first monthly tranche of shares - 460,000,000 shares

https://backend.otcmarkets.com/otcapi/company/sec-filings/12433063/content/html

The only place the other 1,037,763,109 new free trading shares could have come from was the 3(a)10 transaction - probably the monthly tranches for December and January.

MSPC is a delinquent SEC filer. Why should one not "cast aspersions" on that? It's irresponsible on the part of the company.

A suspension and a revocation would not be at all good for shareholders.

I missed this one Cann Corp

https://twitter.com/metrospaces/status/971777957495803904

You guys can beleive or not

The 10Gbps Eletix cable is real with growing revs.

NYC Metrospaces realestate. Localy street confirmed.

Ikal Premium Vinyard Chile harvest and wine

Cann corp.

Dude, we up tomorrow.. I can tell & don't be surprised if we close .003+

I would agree with you :)

this makes absolutely no senses whatsoever; they just hired a law firm that is all

where do you get those numbers?

that gap already filled

Looking for the same to add to my collection

The lodge/ winery

I’m with you adding on any major dip. I’ve seen this too many times before. We should definitely get to at least 0.01. Almost every other trip with this dollar volume has done so and I don’t expect anything different here.

This though... I think this guy just stated many facts to take into consideration. Not bashing, but if this post is true I'm out tomorrow. Any thoughts?

That is even worse. That means that 1,497,763,019 shares were added to the float and not a penny of debt was paid off. So MSPC is still carrying $1,037,238.88 in debt.

Either way it is going to lead to future dilution for MSPC.

And that proves that the 3(a)10 transaction was structured as an illegal kickback scheme with the shares being issued first before the debt was paid for.

MSPC participating in a kickback scheme is just another reason that MSPC is a suspension risk (besides being a delinquent filer and doing business with a banned securities violator named Robert Gandy).

That press release raises major red flags.

#1) the 3(a)10 transaction was from September (then settled on November 1st) - not from December.

#2) there is no question that shares were issued and sold already from the 3(a)10 transaction. MSPC disclosed this in an 8K from November and the MSPC float grew by 1,497,763,019 shares since the 3(a)10 settlement

The fact that Oscar Brito is giving false information in the press release is disturbing.

TOO FUNNY - NOBODY CAN GUARANTEED ANYTHING - LMFAO

All gaps gotta fill.

Bidding .0009

I'm in since .0002 and kept adding till over .0024 and won't sell a single share under .01

I did not sell any shares today. The sun will come out tomorrow. We went up two at the buzzer which is a good sign. People should see the incredible opportunity out of the gate. Sometimes tweets ahead of news backfires because it raises expectations to absurdity.

Nothin but blue sky ahead here imo

then again I am just a crazy old man

Hey Janice! How are you? Haven't been in a play with you posting in a while. Glad you're here! The sweeter it will be when we squeeze all the shorts. I have millions of dollars in powder ready. Let's see who wins this one! ;)

I agree. The pre market dumping scared a lot of folks. We were doomed either way. If the letter didn't have ground breaking update, folks would sell. Like what happened. And if no letter came out, folks also would of sold. So here we are. RSI reset and its oversold. Good things to come. Hang in there all.

Give me the addresses for the properties in Brooklyn. I’ll take pics while I’m out there next week

Never even said the stock was going down, run by bafoons

I think this could have been much uglier. The last eight days looks like it is still climbing even though it dumped pretty hard today. Tomorrow, if it stabilizes we may very well see a recovery as individuals begin to understand the potential and what happened this morning. At least we are not staring at a chart like VTNL. That was sad.

What I think happened this morning was the hype pressure did not equal the pressure the newsletter brought and people bailed. From there it was the fear factor and stop losses that caused selling, probably by people who got in on the advise of others and or speculation of what the news would bring, without understanding the potential of the company. That is my opinion. The dumping of stocks pre-market certainly did not help.

There is still the possibility of recovery and personally I think it may. We will see.

Im guaranteeing we will reach new highs next week! If we don't you can sue me! I'll be buying hundreds of millions of shares myself to squeeze those shorts. Sell at your own risk

Have you shorted 1 trillion or 2 trillion so far? Can you please share the broker which lets you short and borrow these shares to short ? Lol

I can guarantee you this stock will be over .01 soon

MSPC gap at .0010 on the one minute chart

When are they expected to have put out the numbers for February?

This is false information. The company is making 20 million a year just from Etelix. That more than covers any debt they have

Ready bounce 50% retrace big guns coming to lift this!!

NOT GOING TO HAPPEN - LMFAO

Shorty going to get really SMOKED!! Whales in house going to send this!! Big $$$$ coming!! Haha

They did the audit on the company’s last 10K, but there is no evidence they audited or reviewed an audit of the Reg S-X 8K financials for the Etelix acquisition.

Thank you for not being blind. Most have absolutely disregarded their potential for revenue...

|

Followers

|

652

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

66045

|

|

Created

|

08/31/07

|

Type

|

Free

|

| Moderators | |||

NEW YORK, NY / ACCESSWIRE / January 9, 2019 / Stock Market Press (SMP) looks back at 2018 and the massive shift towards increased cannabis growing facilities and highlights Metrospaces, Inc. (OTC PINK: MSPC) which is rapidly moving forward with its revenue producing cannabis cultivation acquisition. Demand for cannabis is set to increase exponentially as both medicinal and recreational cannabis use spreads across the USA, Canada and other countries. Cultivation will be the key driving force over the next year as companies like GW Pharmaceuticals receiving FDA approval for a cannabis based drug, Cronos' (NASDAQ: CRON) production deal with Ginkgo, and Tilray's (NASDAQ: TLRY) innovation license approval.

About Metrospaces acquisition target: ''The facility is located in the city of Adelanto, California and consists of a 12,000 ft2 canopy facility licensed for cultivation, manufacture and distribution of approximately 300 lbs of monthly cannabis production. This production currently generates approximately $7.2 million in annual revenue with an operating profit of approximately $4.5 million per year. Additionally, the site is set on a 6.5 acres site which allows us to build another (already licensed) 8,000 ft2 canopy. The acquisition also includes a non-operating retail operation.''

Land and facility acquisitions continue in the cannabis space. Just this week Tilray's wholly owned subsidiary High Park received processing license to allow for further innovation, increased capacity and additional finished products. High Park's focus on new products such as edibles like beverages and confectioneries, concentrates, and topicals will require increased production. Metrospaces understands the real estate market and more specifically the increase in demand for viable cannabis production facilities.

The cannabis industry is just beginning to 'stretch its legs' as legalization on a global scale is emerging. The opportunities for a company as agile as Metrospaces to acquire key real estate properties ahead of this global shift are virtually unlimited. Mr Brito's move to acquire an existing grower facility at this juncture is putting Metrospaces at the forefront of this shift.

As previously noted, Canadian growers were caught off guard by the massive demand when recreational use was legalized last year. This has prompted a rapid increase in license requests to switch farms to cannabis growing and increased demand for production facility construction, both good for the local economies. Adelanto, California, where Metrospaces acquisition is located, has seen a near exponential increase in license requests, both retail/dispensary and grower, prompting the area to be labeled the 'Silicon Valley' of cannabis. The acquisition facility is already in production as seen in the revenue numbers above and includes a non-operating retail facility, a 'perfect storm' setup.

Cronos' partnership with Ginko is just 1 of many production heavy deals in the works. Taken from their presentation (https://thecronosgroup.com/wp-content/uploads/2018/09/Ginkgo_Deal_Announcement_Presentation.pdf): ''Gingko Bioworks' platform could enable Cronos Group to produce the cannabinoids (ingredients) that are essential for product development at a fraction of the cost, at commercial scale and at higher purity than what is currently available.'' Further confirmation that supply needs are where the money is, something that Mr Brito is well aware of, stating 'Our background in real estate, combined with the knowledge of our JV Partner, is allowing us to better locate prime properties and facilities that will meet this increase in demand. The Adelanto acquisition is just the first of many acquisitions we have planned.''

Now that the FDA has approved the 1st cannabis based drug, pressure on the cannabis growers is only going to increase. GW Pharmaceuticals is looking at additional cannabis based drugs, as are many other biotech and pharmaceutical companies. Securing grower facilities, as Metrospaces is doing, will net rapid ROI and solid returns to investors.

SMP continues to highlight the massive pent up demand in the cannabis marketplace which Metrospaces is exploiting with their plans to increase production for the existing Adelanto facility along with additional acquisitions.

Stock Market Press is a financial news company that delivers up to date stock news, introduces private and public companies to a wide audience of investors, consumers, journalists and the general public via social media and a rapidly expanding network.

NEW YORK, NY, Jan. 09, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Metrospaces, Inc. (OTC: MSPC) announces it has begun phase II of financial and legal due diligence to acquire California-based Profitable Cannabis Site.

Mr. Oscar Brito, Company Executive President, said: “We are now in the process of receiving detailed financial and legal information regarding the site, as to begin the more detailed portion of the due diligence period for the acquisition of the Adelanto site. Since this is a profitable site, we are looking in detail at every aspect of production, distribution, and marketing. We’ll be doing this phase with our JV partner and financial partners. Once this phase has been completed, we will look to advance conversations with senior lenders. Even though we currently have a firm commitment from one senior lender, we will be sourcing offers from at least 1 or 2 more recognizable senior lenders. We fully expect to be able to leverage our current balance sheet to provide the equity portion, and additionally, we have received a lot of interest from one of our long-term investors to be part of the investment group.”

About the Cannabis Facility:

The facility is located in the city of Adelanto, California and consists of a 12,000 ft2 canopy facility licensed for cultivation, manufacture, and distribution of approximately 300 lbs of monthly cannabis production. This production currently generates approximately $7.2 million in annual revenue with an operating profit of approximately $4.5 million per year. Additionally, the site is set on a 6.5 acres site which allows us to build another (already licensed) 8,000 ft2 canopy. The acquisition also includes a non-operating retail operation.

Metrospaces was originally founded by company President Oscar Brito.

NEW YORK, NY / ACCESSWIRE / December 26, 2018 / Stock Market Press (SMP) sees a major shift towards acquisitions in the cannabis space and highlights Metrospaces, Inc. (OTC PINK: MSPC) which today announced the acquisition of a profitable ($4.5m annually), licensed California cannabis facility. In addition, the market has seen Altria and Cronos, Tilray and Anheuser-Busch execute on acquisitions in the cannabis space. SMP is watching additional companies in the cannabis space, including Aurora, for potential partnerships and/or acquisitions.

Mr. Oscar Brito, Metrospaces Company Executive President, is taking full advantage of the emerging real estate-cannabis market place with an acquisition of an existing, revenue producing facility. Generating over $7m annually, the 6.5 acre site houses a 12,000 sq ft canopy and is licensed for an additional 8,000 sq ft canopy facility. The acquisition fits squarely within Mr Brito's business plans to acquire key real estate properties ahead of the next big cannabis wave.

As seen over the past few weeks, companies like Altria, are making major moves in the industry. The acquisition of a 45% stake in Cronos (NASDAQ: CRON) highlights why Mr Brito's business plan is focused on real estate-cannabis acquisitions. Conversions of farmland and other properties into cannabis growing facilities is set to explode in 2019. This is literally the ground floor of a massive new market in which real estate will play a key role; Metrospaces is at the forefront with today's announcement.

Tilray (NASDAQ: TLRY) is solely focused on the Canadian market in the Anheuser-Busch deal. In an article on MarketWatch (https://www.marketwatch.com/story/tilray-and-budweiser-maker-will-partner-to-research-weed-drinks-2018-12-19 ) "For us, it's early days in this industry and research feels like the right place to start," Tilray Chief Executive Brendan Kennedy said in a telephone interview. While a company like Tilray is focused on research, Metrospaces on the other hand is lining up real estate acquisitions including revenue producing facilities, jumping ahead of competitors.

The marketplace rarely sees such an opportunity as the real estate-cannabis combo is providing. Because of advances in hydroponics and canopy growing, cannabis can be grown virtually year round in most any climate. Legalization continues to spread across the United States, providing a company like Metrospaces the opportunity, with its real estate expertise, to gain significant ground, beating out larger players like Aurora, a company who has yet to make an acquisition in this sector, due to the fact that it is leaner and faster to make acquisition decisions.

Canadian suppliers were unprepared for the demand of Cannabis when it was legalized nationwide in October. "MarketWatch talked to officials and retailers in eight of Canada's 10 provinces, and all said they are receiving only small portions of the product they have ordered. One of the provinces, British Columbia, said supply issues aren't expected to be resolved for six to 18 months, based on discussions with licensed pot producers." wrote Max Cherney of MarketWatch. This clearly highlights the massive opportunity Metrospaces has right now, ahead of any easing of US cannabis regulations, to procure real estate for cannabis growth, sales, etc.

The US Federal government is on the cusp of a cannabis regulations change as states continue to ease their own laws. The passage of the Farm Bill with provisions for Hemp is only a teaser for whats to come when cannabis regulations are relaxed. The time is now to secure land and facilities, something Metrospaces is focused on.

Discussing the recently announced acquisition, Mr Brito stated, "This acquisition would introduce us in the cannabis industry through the front door. It's a very neatly run operation, with substantial upside potential. We think it's the perfect operation for us to focus after our very positive experience in IQSTel" [now public, trading on the OTC] Metrospaces is set to grow rapidly, like it did with IQSTel, leading one to expect a spin-out or other potential lucrative transaction in the near future.

Stock Market Press is a financial news company that delivers up to date stock news, introduces private and public companies to a wide audience of investors, consumers, journalists and the general public via social media and a rapidly expanding network.

Contact:

NEW YORK, NY, Dec. 26, 2018 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE – Metrospaces, Inc. (OTC: MSPC) announces the execution with DLBCC Group to acquire profitable cannabis facility and operate under JV Agreement.

Mr. Oscar Brito, Company Executive President, said: “Approximately in May of 2018, the Company took a management decision to focus its resources and business plan towards the legalized cannabis industry. Our business plan is to leverage our extensive experience in real estate financing and development to establish JV partnerships to acquire and operate facility or real estate-based cannabis operations. We don’t have the industry expertise to operate a cannabis facility, but we do have extensive experience in construction, acquisition development, financing and repositioning of real estate assets. We are very excited to establish this JV LOI agreement with LBCC Group to acquire, operate and grow this facility. LBCC Group has executed a Property Purchase Agreement with the seller and is set to close in approximately 90 days. A final JV agreement and Purchase Agreement is contingent on transfer of license and senior acquisition funding. Metrospaces would provide the equity portion of the acquisition, agreed at $20 million. Metrospaces would retain 75% of the business initially, but LBCC Group can gain an additional 10% equity stake based on achievement of certain financial goals.

“The facility is located in the city of Adelanto, California and consists of a 12,000 ft2 canopy facility licensed for cultivation, manufacture, and distribution of approximately 300 lbs. of monthly cannabis production. This production currently generates approximately $7.2 million in annual revenue with an operating profit of approximately $4.5 million per year. Additionally, the site is set on a 6.5 acres site which allows to build another (already licensed) 8,000 ft2 canopy. The acquisition also includes a non-operating retail operation.

“This acquisition would introduce us in the cannabis industry through the front door. It’s a very neatly run operation, with substantial upside potential. We think it’s the perfect operation for us to focus after our very positive experience in IQSTel (OTC: IQST).”

NEW YORK, NY, July 12, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that it will issue a one-time dividend in the form PureSnax (OTC:PSNXD) shares.

Mr. Brito stated: “The public listing of Etelix by way of merger with PureSnax International has so far released more than $19 million in additional shareholder value to MSPC’s balance sheet and shareholders as per yesterday’s closing price. Although we are committed to the long-term success of Etelix and are highly confident that this is just the beginning of the additional share value this merger will create, we believe it is fair that we reward our common shareholders by giving them direct ownership in PureSnax by way of this dividend. After the dividend, Metrospaces will continue to retain the majority of the PureSnax’s common stock directly. The dividend will be issued to all MSPC shareholders of record. By having done the spin-off, Etelix now has the financial tools to pursue acquisitions and world-class financing independent of MSPC’s balance sheet This means that both MSPC and Etelix will now be independent to pursue their own destiny, new acquisitions and financial structure. This is a high vote of confidence in Etelix’s current management team and its business plan. Metrospaces also announces that it will do a 150-to-1 reverse stock split, to pursue new acquisition opportunities.*** We are confident that this proposed financial structure will allow us to continue to pursue such acquisitions and growth opportunities as Etelix and provide the opportunity for dramatic increase in shareholder value and price per share. Metrospaces has also instructed its transfer agent, West Coast Transfer, to inform its shareholders of its number of shares outstanding at any given moment. As of July 11, 2018 total shares outstanding stands at 5,709,012,612.”

NEW YORK, NY, June 29, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that Etelix has been spun off as its own public company via reverse takeover of PureSnax (OTC:PSNXD)

Mr. Silva stated: “This is a huge day for Etelix and a great win for Metrospaces shareholders. Metrospaces will now own 44% of the combined company, down from 51%. However, now Etelix will have its own public market to continue with acquisitions and set its own path. PureSnax now owns 100% of Etelix, and MSPC will now own 44% of total PSNXD public capital. Not only is this a huge win for Metrospaces and our shareholders, it represents a huge arbitrage opportunity for new investors to buy into Etelix. After the reverse takeover, PSNXD will only have a total of 15 million total shares, however, there will only be 75,000 in the float, so there will be very little opportunity to buy PSNXD except through MSPC. Etelix is on its way to having another record revenue and operating profit year and we will continue to be long-term shareholders and partners of Etelix to continue to reap the rewards of this investment. With June revenue of $1.2 million and profitable, Etelix is on its way to smashing last year’s revenue and profit. MSPC will continue to have an active role in Etelix’s growth through Board Representation, continued investment and helping them with new acquisition targets. We look forward to a very long-term, successful partnership and investment.”

NEW YORK, NY, June 26, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that Etelix continues monthly revenue growth at above forecast.

Mr. Silva stated: “January to May revenue budgeted forecast was $3,800,293. However, May revenue of $1,201,102 now brings total January to May 2018 revenue to $4,493,570. This is an increase of 18% over forecast and sets the company revenue at a $14 million annual run rate, as opposed to $7.6 million in revenue for 2017. It’s been an amazing year, and the wonderful thing is that most of our recently executed interconnection agreements are not yet at full capacity. Having achieved this amazing revenue growth, while still being cash flow positive on an EBITDA basis is even more notable. This continued above-forecast growth is setting the company up for some very exciting new prospects such as the continued hiring of world-class talent as well as new potential acquisitions the company is now considering. Being able to handle this sort of revenue and operating profit growth is giving the company confidence to approach more and more companies for potential acquisitions. Although Etelix is still held as a private company, our internal valuation methods have this already be an acquisition that has surpassed all our expectations.”

NEW YORK, NY, June 19, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that Etelix had best monthly revenue ever in April 2018 with $1,112,303.

Mr. Silva stated: “Management team at Etelix continues to under promise and over deliver. Our revenue forecast set up in December of 2017 had the company reaching the $1 million monthly revenue marks sometime in July-August of 2018. We achieved that mark a full 3 months ahead of schedule and have been growing revenue in 2018 at over 10% month-over-month, surpassing even our own best-case scenarios. Our meetings at the ITW conference and the interconnection agreements executed Q1 of 2018 are now starting to come into full effect. Additionally, we see this growth gathering steam as just last week we executed 9 new agreements for a total of 16 agreements that have been achieved from the ITW conference in May of 2018, while still have at least another 6-9 agreements in different stages of negotiations.”

NEW YORK, NY, June 01, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC PINK: MSPC) today issued a letter to shareholders addressing concerns regarding financial statements and disclosures.

LETTER TO OUR SHAREHOLDERS

To Metrospaces Inc. Shareholders:

Management is well aware of the acute concern shareholders have had regarding our delay in finalizing our Pink Current guidelines and reaching “Pink Current Status” on the OTC Marketplace. We realize that this concern has been an ongoing situation for few months, raising doubts on management’s ability to properly run a publicly traded company and keeping its shareholders and market informed in a timely manner on the company’s financial and legal status.

On this matter, we would like to assure our patient shareholders that management is working at full capacity to finalize the guidelines and is just as concerned as our shareholders regarding this delay. The break-need growth rate Etelix has experienced since our acquisition has surpassed all our expectations, and has taken us by surprised, and frankly “flat-footed”. We simply did not have the capital and human resources in place to handle this sort of real-business growth and still be able to handle our previous day-to-day operation. We basically went from a near “stand-still” in our growth and business execution to a rocket-like spur that has left us all scrambling just to catch up.

Etelix’s growth has basically monopolized our capital and human resources to a point of completely starving the rest of the company’s responsibilities and operations. Frankly, we are still catching up. However, we can assure our shareholders that management is working overtime to finally finish the requirements in the guideline. We are hesitant to give shareholders any time frame due to us failing to meet past guidance on time lines and dates. But, we will again stress that this is currently our absolute top priority and that management is breaking at the seams to get it finalized as soon as possible.

On a more positive note, we would like to continue to reaffirm our shareholders that our fundamental business is getting stronger every day, and that we could not be more satisfied about our current financial performance. Although, we still have a lot of work to do, we are already hitting revenue marks that we set for late summer of 2018.

On a final note, we would like to thank our shareholders for the special patience they have shown us. We are confident that they see the long-term potential we are all so hard working for will be realized. We are confident that we will continue to hit our mark in the fundamental business and that these growing pains will soon be a thing of the past, and in hind-sight will be looked at as a tremendous investment opportunity in our company. We look forward to continuing to work for our shareholder’s and management’s mid- and long-term vision and again, THANK YOU FOR YOUR SUPPORT.

NEW YORK, NY, May 03, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) incorporates 26-year Telco Sr. Management Vet Italo Segnini to lead Etelix to next level.

Mr. Silva stated: “Italo is a high-caliber 26-year telco veteran having held senior management positions at Movistar, Televisa Telecom, and Millicom. Italo’s unique experience in leading revenue growth at such world-class companies will lead our revenue growth to the next stage, as well as allow us to set the stage for growth via acquisitions. We expect Italo to help Etelix in its continuing transformation into a world-class international telco company. Italo will be key in continuing to sign on Tier-1 telco companies, as well as the sourcing of potential acquisition targets. In a very short time, Italo’s industry experience and relationships are starting to come into effect, already bringing in several potential clients that in advanced conversations, as well as having made 2 introductions to potential acquisition targets. We are very proud to have Italo on our Board and certainly expect big things from him.”

Italo Segnini LinkedIn Profile: https://www.linkedin.com/in/italo-segnini-75068310

Metrospaces Announces Etelix March 2018 Revenue of $837,195 for Record Company Month

April 25, 2018

NEW YORK, NY, April 25, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces another record revenue month in March 2018 for Etelix.

Mr. Silva stated: “Our fundamentals continue to be very strong, our growth continues strong and Etelix management continues to hit record revenue numbers. Management’s budget revenue for April 2018 was $778,906; however, the company did 7% higher revenue than our forecast, representing a year-over-year growth of 14%. The recently executed deals with Vodafone India and other such agreements are now starting to hit their stride and are really making a difference in our growth forecast. With this March revenue number, we are currently approximately 2% above our first quarter revenue forecast for 2018 and growth rate is picking up. Total first-quarter revenue for 2018 was $2,204,827 in comparison to $1,959,113 in 2017. Additionally, we take this opportunity to notify our shareholders that last Friday, April 20th, 2018 we received a formal email from OTC Markets regarding missing items and a need to reformat some of our financial statements. Actual financial statements were not brought to question, only some of our formatting. We expect to revert to OTC Markets their request in the next 2-3 days and are looking forward to receiving “Current Information” status shortly thereafter.”

NEW YORK, NY, March 29, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that the Company has filed all necessary financial statement and disclosures filings with the OTC Markets.

Mr. Brito, Metrospaces CFO, stated: “We have now filed all our due financial statements and disclosures with the OTC Markets for 2016 and 2017. This would bring our financial disclosures to current status. We still need to file a legal opinion letter which will be provided by Waller Law in the next day or so. With this letter of opinion, we complete all requirements by OTC Markets to gain “Current Information” status and thus have the “Stop” sign removed from our ticker symbol on the OTC Markets. With this new status on the OTC Markets, the Company will gain a bigger audience and target for future potential shareholders that were previously unable to invest in our common stock through certain broker-dealers due to our ‘No Information’ status. Additionally, we announce that we have converted all aged notes that were up for conversion into common stock, and that the rest of the aged and other notes will be redeemed in cash. The last conversions happened Monday, March 27, 2018.”

NEW YORK, NY, March 23, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces delays in their financial statement filings with the OTC Markets.

Mr. Brito, Metrospaces CFO, stated: “It bears us great disappointment to not have met the established deadline of March 22nd, 2018 to file our financial statement on the OTC Markets. To be perfectly frank with our shareholders, there was a lot of work and detail needed from different sources that was not made available to us in time to meet the deadline. Switching of transfer agent and the termination of our corporate counsel and hiring of new counsel was a big cause in the delay. The firing of our long-time corporate legal counsel made a big difference in the flow of timely information. As a side note, Mr. Barry Miller, Esq. was terminated on March 13, 2018 due to his advice and role in the structuring of the 3(a)10 with CF3. I forward our shareholders, however, that all financials and disclosure will come in line with expectation and all the press releases and 8K’s filed regarding our business, terminated 3(a) 10 transaction and acquisition of Etelix, including audited financial statements presented in the February 20th, 2018 8K.”

Etelix Announces Execution of Vodafone India Deal and 2018 Record February Revenue of $726,365

March 16, 2018

NEW YORK, NY, March 16, 2018 (GLOBE NEWSWIRE) -- Metrospaces, Inc. (OTC: MSPC) announces that Etelix increased February revenue by 13% over January.Mr. Leandro Iglesias, Etelix CEO, stated: “Our business plan continues in frank execution with continued and notable revenue growth not just year-over-year but also month-over-month. Continued reinvestment from operation has been key in growing revenue and this is a trend that must continue in order to meet our mid-year estimates or $1 million in monthly revenue. February 2018 revenue closed at $726,365 in comparison to $644,147 in 2017. This represents an increase of approximately 13% year-over-year and an increase of also 13% month-over-month. Additionally, we signed Vodafone India into our carrier VoIP exchange business, setting the first step of a potentially multi-service relationship. Vodafone India has over 211 million retail subscribers interconnected to Etelix’s international VoIP exchange and value-added services. I will congratulate the rest of our management team for a great job as the company continues to meet its short, mid and long-term revenue and profit growth. The company foresees continue reinvestment of operating profits to continue to grow the business, as the company will continue to generate more revenue opportunities that it is able to finance with cash flow.”

Etelix.com USA (http://www.etelix.com/) is a Miami-based, FCC-licensed voice, SMS and data/hosting operator. The company’s main products and services are international voice wholesale, data and hosting services as well as residential and commercial triple-play provider. The company was founded in 2007 and has been profitable since inception.

Metrospaces www.metrospaces.net is a publicly traded real estate investment and Development Company which acquires land, designs builds, and develops then resells condominiums and Luxury High-End Hotels, principally in urban areas of Latin America. The company’s current projects are located in Buenos Aires, Argentina, and Miami, USA. It is operated by an elite group of real estate and investment professionals and entrepreneurs located in New York City, Miami, and Buenos Aires. Company shareholders have extensive careers in real estate and business financing worldwide and have funded projects both in the America’s and across Europe valued in excess of US $550Million.

Metrospaces’ majority shareholders have partnered with Investors on Elite properties including The London BLVGARI 5 Star Hotel and is currently involved in negotiations for the development of several Elite luxury properties in South America.

Among Metrospace partners are Architects, Real Estate Developers, Agents and Attorneys of the highest standing, with extensive experience in the global property market.

Metrospaces was originally founded by company President Oscar Brito.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |