Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Have not seen or heard anything new about this. Would be great if it happened.

NYBob, thanks for all of the good information. Would you happen to know if this is from earlier this year or a new update to the news from before?

Looks great but will we be left in the dust due to SEC?

Mayfair Mining & Minerals -

Mayfair Mining & Minerals, Inc. is a publicly held, momentarily

unlisted mining and exploration company, operated from the U.K.

Its experienced management team, headed

by Mr. Clive de Larrabeiti,

has designed a business plan to build the company into a

successful exploration company with the focus on establishing

actual gold production in the foreseeable future.

To this effect, Mayfair recently acquired assets in Zimbabwe,

formerly held by

Conquest Resources (TSXV:CQR),

consisting of three former gold producing mines,

the Babs Gold Mine,

the Beehive Gold Mine,

the Piper Moss Mine and

the Eva exploration property.

The consideration for the acquisition was $2.0 million,

payable by 20 million fully paid common shares,

thus giving Conquest an approximate interest of

36.4% in the capital of Mayfair.

The Project

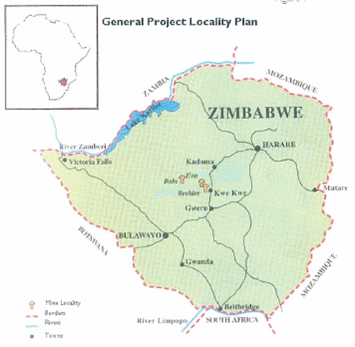

The three acquired mines are situated north and northeast of

Kwe Kwe within the Midlands Greenstone Belt on the highly

prospective Taba Mali Deformation Zone.

This major structural feature exceeds 100 km in length and

20 km in width and hosts some of the significant

gold producing operations in Zimbabwe.

The Beehive and Babs mines were developed between 1997 and 1998

at a cost of approximately $4.5 million and operated for 9 months

before being placed on care and maintenance in early 1999,

due to falling gold prices and increasing costs in Zimbabwean

currency.

In 1998, a 300 tpd processing plant was installed at

the Beehive mine site, equipped with a crushing circuit,

two parallel ball mills, C.I.P. tanks for leaching and

subsequent carbon recovery.

Unfortunately, the machinery attracted the attention of thieves

and was stolen in the idle and bad years.

The Beehive mine is reported to have produced 15,000 ounces

whilst the Babs produced 20,000 ounces.

The average grade of the ores from which this production

was derived were 6.8g/t and 9.6g/t.

The Eva prospect, located 4 km north of the Beehive,

has produced minor amounts of gold in the past.

The inferred mineral resources for the Beehive Mine are in

excess of 145,000 tonnes at an average grade of 6.8g/t gold,

whilst the Babs Mine may initially host 214,650 tonnes at

5g/t gold.

The Eva prospect may host 360,000 tonnes grading 2-3g/t.

The Piper Moss Mine

has an extensive history going back to the original claim staking

in 1912.

Old production records show that 163,190 ounces of gold

were produced from 518,376 tons of ore.

The mine is situated 3km north of the Globe and

Phoenix Mine which has produced over 3.2 million ounces of

gold from 3.6 million tons, which made it one of

the richest gold mines in the then British Commonwealth.

Prospects

The most recent availabe documentation on the acquired properties

are summary geological reports that date from respectively

October 2000 on the Beehive, Babs and Eva properties and October

1996 on the Piper Moss property.

According to these reports, the following observations can be

made:

all properties are situated in regions where various finds

of mineralization are known to be present,

all properties are fully documented and should be read and

studied with the general mining and exploration knowledge of

today;

none of the properties have been subjected to modern exploration

techniques;

the known reserves seem small but a great potential for further

resources has been recognized;

the Eva prospect has the potential to become a significant

low grade open pit mining operation;

all mining localities can be brought into production

relatively quickly;

it is believed that

the Beehive, Eva and Babs mines have the potential to become

significant medium-sized gold producing operations whereas

the Piper Moss mine has the additional feature of the Moss vein

that offers great potential, provided comprehensive and

meaningful exploration and development programs are carried out;

on all four properties, there are substantial quantities of

tailings readily available which should be sampled and

investigated for possibilities of early and economically

feasible recovery of the gold by vat and/or heap leaching;

all properties are easily accessible via main paved roads and

short distances on gravel roads and close to railroads and large

hydroelectric power lines;

within the territories of the company’s licensed areas, there are

several indications of mineral occurrences that should be

investigated.

First financing

Mayfair Mining & Minerals

is seeking an initial financing by Private Placement of Units

to a total amount of C$500,000.

The price of each Unit offered is C$0.10 and each Unit shall

consist of one share of the Company’s restricted Common Stock,

par value US$0.001 per share and one warrant to purchase an

additional common share for a period of two years from the date

of the issue at a subscription price of C$0.15 per Unit.

The proceeds of the issue will be used to enable the company

to design the first working program to inspect, organize and

evaluate theproperties, including a program for pre-exploration,

initial sampling and testing, and starting up the refurbishing of

the processing plant;

preparing and initiating a listing of the company’s shares

on a generally recognized stock exchange or automated

quotation system in Canada.

Management has already commenced having discussions with some

of the suitable choices for listing;

preparing and initiating negotiations to conduct a first major

financing in a range of US$5.0 million plus to enable the company

to start its first mature exploration and refurbishing program on

the acquired properties in Zimbabwe.

The challenge: An opportunity

Management of Mayfair Mining & Minerals

is determined to build a future in Zimbabwe, where it has

recognized good opportunities to participate in its emerging gold

industry.

The completed acquisition of the four above described mineral

properties should be a sound and prospective base for

accomplishing that.

The company is also in further advanced discussions on additional

mining project acquisitions or joint ventures in other highly

prospective gold regions of Zimbabwe.

Zimbabwe may not be the easiest operating environment in

the world but considering its history and the process of

change that is underway, Zimbabwe is widely and increasingly

becoming regarded as one of the more promising mining

destinations of Africa.

The rich greenstone belts that were the host of hundreds

of smaller gold mines were not left because they were depleted,

the mines stopped working due to adverse political and

economic circumstances.

Over the last few months, it has become apparent that several good

parties are coming to join the new interest in Zimbabwe gold

mining.

It is too early to speak of a gold rush but I am sure that we

will see a lot more of the same happening in the forthcoming

future.

On a longer term, it is likely to change the nature of the mining

industry as we know it from the past.

It will be a time that larger entities will come in and will

be created.

Consolidation should be the name of the new game, as may

be applying a new way of approaching exploration and mining.

The richness of Zimbabwe may not only to be found in deep

underground mining, there may be enough gold to be found

closer to surface.

New techniques should be used, unconventional thinking should

be given room.

The resources are there, in ample quantities and qualities.

Mayfair Mining & Minerals

has entered the Zimbabwe gold search at an early stage,

reflecting management’s vision of what is likely to develop

in the Zimbabwean gold mining scene over the next few years.

To make it happen and get the activities off to a good start,

the company is seeking a small group of sophisticated and

smart investors that are willing to share and support

that vision.

As I described it on the first page of this report,

I feel that Mayfair represents

”A NEW VENTURE ON HISTORICALLY KNOWN RESOURCES”,

offering a ”GROUND-FLOOR OPPORTUNITY”

that you don’t see coming by every day.

Henk J. Krasenberg

European Gold Centre

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990's led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000's and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Argonaut Gold – Initiating coverage new supporting company

Gold has started next move

Branding natural resources a primary asset

Africa: Strongest growth in gold mining

Gold ready for new uptrend

inShare

TAGS: EUROPEAN GOLD CENTRE, GOLD, HENK J KRASENBERG, MAYFAIR MINING & MINERALS, ZIMBABWE

« Platina har nått våra utpekade mål – vad händer nu?

Dokumentär om oljans historia »

http://ravarumarknaden.se/bringing-old-glory-to-a-new-shine/

I have not heard anything. This appears to be from January of this year.

Have you heard anything new?

Mayfair Mining & Minerals, Inc.,

is a publicly-held exploration stage mining company with an

experienced Board of Directors and management team that intend,

through the strategic acquisition of economically feasible past

producing mining projects, and exploration areas close to and

contiguous with those, to create and exploit a portfolio of

valuable gold mining assets in Zimbabwe, Southern Africa.

http://www.mayfair-mining.com/d_management.php

Objective Capital Investment Conferences - Home

Clive de Larrabeiti. CEO. Mayfair Mining.

Nigel Ferguson. Pres, CEO & Dir.

African Metals. Hugh Mackay.

Chairman.

Avannaa Resources.

Eric Kohn. Chairman ...

http://www.objectivecapitalconferences.com/

Africa Resources Investment Congress

Our Global Mining series of investment conferences and summits concentrate on the metals, minerals and energy sectors.

http://www.objectivecapitalconferences.com/ocic/africa.html

Any News after the info below:

In the mailing of the link to my January GOLDVIEW I

mentioned a new addition to The Centre's group of

SUPPORTING COMPANIES. I have the pleasure to

introduce to you a company that just recently has joined

the revival of the gold mining industry in Zimbabwe.

Mayfair Mining & Minerals Inc., a US company with its management in the U.K., recently

signed a contract with Conquest Resources (TSXV:CQR), whereby it acquired 4 mineral

projects in Zimbabwe's most prospective greenstone belt, consisting of three former gold

producing mines, the Babs Gold Mine, the Beehive Gold Mine, the Piper Moss Mine and

the Eva exploration property. The consideration for the acquisition was $2.0 million,

payable by 20 million fully paid common shares, thus giving

Conquest an approximate interest of 36.4% in Mayfair.

The ultimate objective of management is to get all 4 projects to

the production stage in the shortest possible time. To that effect,

Mayfair is now designing a first working program to inspect,

organize and evaluate the properties, including a pre-exploration

program, initial sampling and testing, investigating the possibility to process the extensive

quantities of tailings, bringing the present reserves up to NI43-101 standards and starting up

the refurbishing of the existing mines.

Another priority is, to prepare and initiate a listing of the company shares on a recognized

stock exchange or automated quotation system in Canada. In the past the shares were trading

at the OTCBB, but management has reasons not to repeat that. Discussions with some other

choices have begun.

E U R O P E A N G O L D C E N T R E

______________________________________________________________________________________________________________________________

? Although Mayfair is a public company by definition, the shares are mainly in private

hands. As said above, that will change somewhere in the next few months when the shares

will be listed. So at this time, you can not buy the shares unless........you are interested in

participating in the Private Placement that the company is currently undertaking.

Mayfair Mining & Minerals is seeking an initial financing by

issuing Units to a total amount of $500,000. The price of each Unit

shall be $0.10 and each Unit shall consist of one share of the company's restricted Common

Stock and one warrant to purchase an additional common share during a period of two years

from the date of the issue at a subscription price of $0.15 per Unit. The proceeds of the issue

will be used to enable the company to start up its first exploration and refurbishing program

and to get the shares listed. Should you be interested in this first financing, you are most

welcome to contact us and we will be pleased to provide more information or refer you to

the company.

Over the next few months, Mayfair's management will analyze re-evaluate all the available

geological documentation on the 4 projects and prepare a detailed plan of the next steps that

should be proposed. A mature financing, possibly coinciding with another listing on a major

exchange, will be needed then to commence the necessary work that should bring the

properties closer to the production stage.

I am excited about the possibilities that exist in the Zimbabwe gold mining sector, despite the

presence of some of the known pitfalls. The opportunities outweigh those. The entry of more

good companies and the influx of international capital into the industry are encouraging and

telling me something. Having examined the assets that Mayfair acquired and having known

the Mayfair management for many years, I am pleased to have the company as a supporter of

my ongoing efforts to inform you and at the same time, be a supporter of theirs. In my view,

Mayfair represents "a new venture on historically known resources" and a "groundfloor opportunity" for investors to become involved. ???

Henk J. Krasenberg

120210

??MAKE SURE TO GET YOUR FUTURE ISSUES TOO, SIGN UP AT THE WEBSITE, FREE AND NO STRINGS ATTACHED??

MINING IN AFRICA

i s a p u b l i c a t i o n o f

E U R O P E A N G O L D C E

http://www.europeangoldcentre.com/files/MIA-1202.pdf ?

______________________________________________________________________________________________________________________________

.

OBSERVATION

SPECIAL ATTENTION

for a new

SUPPORTING COMPANY5

E U R O P E A N G

Have not. Just happened to see that online.

just wondering if you ever spoke to the company in regards to if we'd get 'new' shares or even be included?

Very interesting. Thanks for sharing. Hopefully we get an interest in their new listing and not left as dust

Company trying to get listing in Canada. Here is an article with some information. (page 4 and 5)

http://www.europeangoldcentre.com/files/MIA-1202.pdf

Also look at the news on the companies website from January 26.

http://www.mayfair-mining.com/

This just may come back after all.

i was accumulating too once i saw them updating filings... still have no clue why the sec chose them

oh well.... win some lose some

It shows at OTCMarkets under this link.

http://www.otcmarkets.com/marketActivity/suspended-symbols

are u sure? it's still in my account at tda... geez.. if so, not good at all.. sux b/c they were actually filing (working on filings) when the sec hit them

MFMM got revoked this morning, Renee.

The Ceo of MMFM is a con artist and he is just making a profit on the back of his investors. If you look since inception until now, Zambia operation revealed that they do not hold the licences, then Madagascar was written off...a lot of directors & good guys out of the company for a good reason....now another saga with they are suing the seller in Zimbabwe.....honestly this is a wet paper bag & chairman/ceo....whatever he call himself is a master of bull*****.....I just wish the SEC will interest themselves into this fraudulent activity! The only thing he is good at is to write "nice" press releases....Come on people wake up!!!!!

If they file the audited 2011 report will they automaticly come off of the grey sheets?

Thanks.

will do Renee.. have a good one

I am keenly interested in how the SEC responds, db7, so please let me know the outcome.

The Company has been aggressively and diligently finalizing its audited financial statements and in the past year has filed the following Form 10Ks with the SEC –

07 -16-2010 for the period 03-31-07

01-05-2011 for the period 03-31-08

06-30-2011 for the period 03-31-09

07-08-2011 for the period 03-31-09 ( 10K/A )

07-15-2011 for the period 03-31-10

In conjunction with the Company's auditors, Malone Bailey LLP of Houston, Texas, the Company continues to focus on the issue of compliance and attaining current status in regard to its financial filings. The Form 10K for the period 03-31-2011 is currently undergoing final preparation and will then be submitted for review by the auditors.

The Company has responded to the SEC on this issue and awaits their comments.

New from the company filings just released. Does this mean they can get off of the Grey sheets in August?

Were the 10K's audited? If not then the company will need to audit their fins and comply with Exchange Act Rule 15c2-11.

MFMM definitely will open on the Grey Sheets.

Excerpt:

The Commission cautions brokers, dealers, shareholders and prospective purchasers that they should carefully consider the foregoing information along with all other currently available information and any information subsequently issued by these companies.

Brokers and dealers should be alert to the fact that, pursuant to Exchange Act Rule 15c2-11, at the termination of the trading suspensions, no quotation may be entered relating to the securities of the subject companies unless and until the broker or dealer has strictly complied with all of the provisions of the rule. If any broker or dealer is uncertain as to what is required by the rule, it should refrain from entering quotations relating to the securities of these companies that have been subject to trading suspensions until such time as it has familiarized itself with the rule and is certain that all of its provisions have been met. Any broker or dealer with questions regarding the rule should contact the staff of the Securities and Exchange Commission in Washington, DC at (202) 551-5720. If any broker or dealer enters any quotation which is in violation of the rule, the Commission will consider the need for prompt enforcement action.

they just filed 10k for period ending march 2010 AND a 10k/a for 2011 10k

questionable imo that they should have been suspended BUT at least it's just a temp suspension ... if they get their filing in it will be no big deal

BUT... it may trade on the greys until an mm sponsors it which will be frustrating

Odd....the SEC suspended because they hadn't filed any Fins since 2009. Too little too late?

they just filed a 10k too.. working on it but not fully there yet

MFMM: SEC Suspension and Admin Proceeding:

http://sec.gov/litigation/suspensions/2011/34-64921.pdf

http://sec.gov/litigation/admin/2011/34-64920.pdf

Looks like 10K filed for 2010. Looks like they are almost caught up.

Mayfair -- Corporate Update, Recent Events

Mayfair Mng&mnrls (PL) (USOTC:MFMM)

Intraday Stock Chart

Today : Tuesday 5 July 2011

Mayfair Mining & Minerals, Inc., (the Company) (Pink Sheets:MFMM) (Frankfurt:M1M) is pleased to announce that it continues to build structure and increase its presence in Zimbabwe. It has been agreed that Mayfair will now establish its own subsidiary, based in the capital, Harare, to deal with the many business opportunities currently available to the Company. This will be accomplished with the appointment of Simba Chopera, a native and resident of Zimbabwe, as Executive Director to the Board of the subsidiary, to be named Mayfair Capital. Clive de Larrabeiti will hold the position of Chairman of the subsidiary.

Simba Chopera has fifteen years senior managerial experience in Auditing, Corporate Finance and Banking operations within Zimbabwe and the region, having trained with Deloitte. He holds a Bachelor of Accounting Science Honours Degree from UNISA and is a member of the Chartered Institute of Management Accountants - CIMA (UK). He has also been on the University of Pretoria - Gordon Institute of Business Science – Banking Board Leadership program and served an internship at the world-renowned Amembal and Associates Academy, for asset backed finance modelling. Previously, he has worked for Delta Corporation as an Internal Auditor, Innscor Africa as Group Treasury Manager and Trust Banking Corporation as a Divisional Executive responsible for Trust Finance. He joined Loita Capital Bank in Management Services and served as Chief Operating Officer in their leasing business in Zambia, where he completed a number of corporate finance projects. Simba was the convener of the 2007 Afro Leasing School and Winning with Leasing programs conducted in Lusaka, Zambia. After joining MBCA Capital, a Nedbank Group company as Finance Executive, Simba was promoted to the office of Chief Executive Officer, a position he held until May 2011. He was instrumental in the management sponsored buyout of the business by Platinum Groupe in May 2010. He was voted the Best Fund Manager at the 2009-2010 Top Quoted Companies Awards – an annual review of Zimbabwe Stock Exchange listed companies run by the Zimbabwe Independent newspaper and BancABC.

Clive de Larrabeiti, President of Mayfair commented – "We are extremely pleased to have secured Simba to head up our growing operations in Zimbabwe and to be able to attract someone of his calibre and experience. The compelling nature of Zimbabwe as an investment destination is becoming more evident as time passes, with dollarization and a growing economy contributing to that conclusion. We are excited to be at the forefront of these developments."

The previously announced transaction with SouthernCentral Private Equity will not now proceed.

The Company is currently in the process of reviewing a number of potential acquisitions and joint ventures on past producing mines and exploration areas in highly prospective gold bearing regions of Zimbabwe.

On behalf of the Board of Directors,

Clive de Larrabeiti

President

The Mayfair Mining & Minerals, Inc. logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=5317

SAFE HARBOR STATEMENT

This Corporate Overview may include forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Act of 1934, as amended, with respect to achieving corporate objectives, developing additional project interests, the Company's analysis of opportunities in the acquisition and development of various mining project interests and certain other matters. These statements are made under the "Safe Harbor" provisions of the United States Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties which could cause actual results to differ materially from those in the forward looking statements contained herein. Forward-looking statements involve risks and uncertainties. Words such as "will," "anticipates," "believes," "plans," "goal," "expects," "future," "intends" and similar expressions are used to identify these forward-looking statements. Actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks described in this business plan. Such risks include, but are not limited to terrorist activities that may affect our business or the economy in general; lack of success in mining activities; the prices of metals and gemstones; lack of funds to conduct mining activities; increase in costs of production, and similar risks. For further information about the Company, please refer to its materials filed with the Securities and Exchange Commission and available on the SEC website at www.sec.gov

CONTACT: Mayfair Mining & Minerals, Inc.

info@mayfair-mining.com

A lot of reading to do with all these filings...

"State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date. As of June 30, 2011 – 55,036,000 shares of common stock."

10k, "SPAIN – ACQUISITION OF RECURSOS METALICOS

During June 2009, the Company entered into an agreement with Cambridge Mineral Resources plc. a UK incorporated company, to acquire its wholly-owned Spanish subsidiary Recursos Metalicos SA. As of the date of this report this transaction has not closed.

ZIMBABWE – ACQUISITION OF SOUTHERN CENTRAL PRIVATE EQUITY (PRIVATE) LIMITED

In March 2011, the Company entered into an agreement with Southern Central Private Equity (Private) Limited, a Zimbabwean private company, to acquire 100% of its equity. As of the date of this report this transaction has not closed."

My hope it for an update this week. Annual report for 2010 is way overdue.

Should not take this long to update the web site. I am starting to have doubts at there slow pace. What do you think?

Thanks.

I am going to say the website will be updated next week. Filings will be the middle of the month. Lets see what happens.

Still making this my weekly pick. When it runs I want to win the contest.

I could be wrong but I don't think this will go sub .03 again. Once they are current on their filings and such it will move. Very tight float as you can see with the lack of volume.

i'd love to add sub .03.. not sure if i'll get a chance to or not... all it will take is one nice deal and this should fly imo

If I had the money it would be :) Still a hidden gem here. You know this will not last long.

no.. was wondering if that was u seeing that nobody else cares lol (yet)

Did you buy more today? Hit .045

I think the website will be udpated very soon. Just wish I had the cash to get more now. With the way these stocks have moved its just a matter of time before this moves also.

Yeah I got a reponse back in the beginnig of the year but nothing recently. Maybe its getting close and they do not want to give any of the pending info out.

still watching, but had to cut back on my workload.

too busy.

and I don't particularly like when emails aren't returned.

~A.

GL

How come your not the mod anymore?

Very tight float so when news comes of any new gold mining in Africa MFMM could be in for a maga move. Until then 0 or low volume. Still a hidden gem for now but not much longer. I am still hoping to get some more shares here.

added a bunch today .03-.035 .. still think this is a hidden gem

Thought that it would be this week but it should be next week for sure.

hard to say ~ they haven't exactly been consistent with their filings....lol

I haven't received any answer to my emails either...

they are active ~ but time will tell...

Do you think the 10K will come this week? When it does come does that mean this will be changed from limited information to fully reporting on the pink sheets?

Thanks.

My guess now is next week 10K will be filed. What do you think?

Thanks.

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

135

|

|

Created

|

10/18/08

|

Type

|

Free

|

| Moderators | |||

Pinnacle Digest: Mayfair Mining & Minerals Sparks Interest Of Pinnacle Digest

Aug 08, 2008 (M2 PRESSWIRE via COMTEX) -- www.PinnacleDigest.com is a performance-driven online financial magazine and social network with a proven track record. After yesterday's news from Mayfair Mining & Minerals, Inc. (OTCPK:MFMM) announcing that at a Board meeting held on July 29th Alexander Holtermann was elected to stand and agreed to serve as a Director of the Company, our team has launched their exclusive investor controlled forum. Our staff and members have requested that all Mayfair Mining & Minerals shareholders join our community and share their thoughts on the company, its development and future outlook. One of the most important aspects when we research for new investments is to understand the sentiment of the current shareholders; that is why we have released this announcement - we want to know your opinion.

Once a member of PinnacleDigest.com you will have access to all our Mayfair Mining & Minerals research. It is our goal to find viable opportunities for each one of our members.

Join PinnacleDigest.com to

Find out if Mayfair Mining & Minerals makes it as a Pinnacle Featured Company

Chat with other shareholders invested in Mayfair Mining & Minerals

Explain to our investor community what differentiates this company

Connect with investors and professionals in the equity markets

Meet the thousands of investors who have already become members of the Pinnacle community.

PinnacleDigest.com is an investment club comprised of over 15,000 members. We use all of our member's insight when selecting our next investment opportunity. Your membership is free - join today.

PinnacleDigest.com has no vested interest in the company mentioned herein. This source of information is from an unbiased perspective. If you wish to become a member of www.pinnacledigest.com you will be gaining access to articles similar to this one and many other useful services we know you will find valuable. Keeping you educated and up-to-date with the market is one of our main purposes. Our approach in achieving this goal and our ability to consistently deliver high quality investment material is what defines our business model.

This news release shall not constitute an offer to sell or the solicitation of any offer to buy securities in any jurisdiction.

All material herein was prepared by Pinnacledigest.com (Pinnacle Digest) based upon information believed to be reliable. The information contained herein is not guaranteed by Pinnacledigest.com to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Pinnacledigest.com is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. Pinnacledigest.com may receive compensation in cash or shares from independent third parties or from the companies mentioned.

Pinnacledigest.com will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and Pinnacledigest.com undertakes no obligation to update such statements.

CONTACT: Pinnacledigest.com WWW: http://www.pinnacledigest.com

M2 Communications Ltd disclaims all liability for information provided within M2 PressWIRE. Data supplied by named party/parties. Further information on M2 PressWIRE can be obtained at http://www.presswire.net on the world wide web. Inquiries to info@m2.com.

(C)1994-2008 M2 COMMUNICATIONS LTD

-0-

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |