Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ron Bienvenu ugly POS scammer should be in prison .

Wow silence for the past 7 months anyone know anything?

Hopefully they do something with this in 23!

LOLOL.....Broke $0 Asset Stinky-Pinky "buying" Rite-Aid...HAHAHA.....

I could announce I am buying Tesla....Sounds impressive!

wow is this real , buying Rite aid? https://www.otcmarkets.com/otcapi/company/dns/news/document/58643/content

Amendment and name change to Silverback United, Inc.

Break even point.. whoo hoo

$5pps incoming on this share structure.

1)

2)

3)

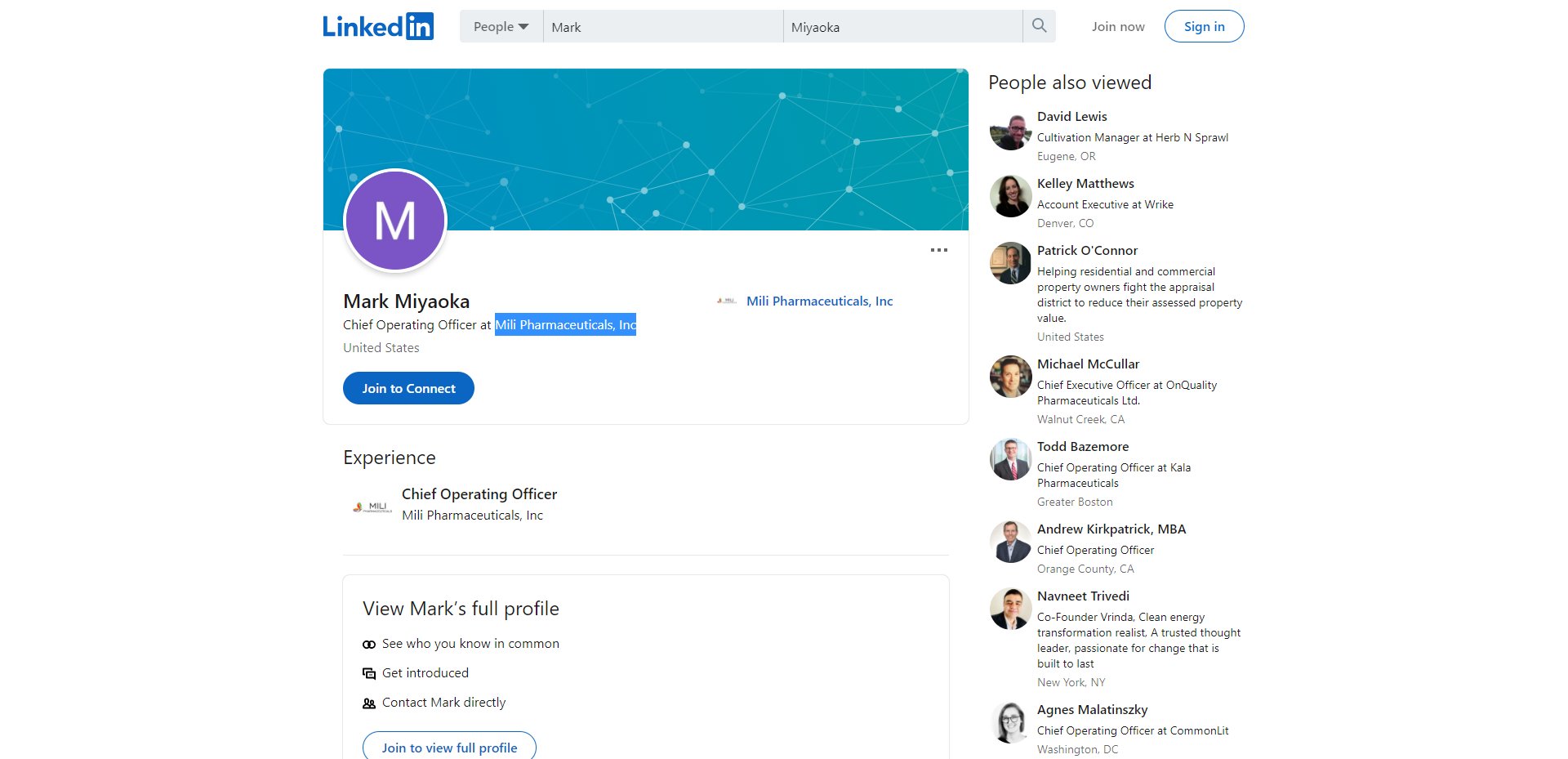

Miii Pharmaceuticals https://milipharma.com

Mark Miyaoka

Chief Operating Officer at Mili Pharmaceuticals, Inc

We have activity. This one will move fast back up to $1+

Per CEO $MLCG and $TONR should have an update before June 30 deadline on OTC. Fingers crossed.

Anyone know what's up here? Held on for years in hopes it would recover. Exciting to see these jumps in price. Why now and all of a sudden?

I would love to know what people's thoughts are here. See if we can get a heartbeat from this board again. Lol

ML Capital Group Inc (MLCG)

0.061 ? -0.00379 (-5.85%)

Volume: 1,097 @04/23/21 11:37:32 AM EDT

Bid Ask Day's Range

0.0601 0.1 0.061 - 0.061

MLCG Detailed Quote

Wow 110k on the ask, wouldn’t be shocked to see someone snatch it up

wow big exchange of shares today. Volume came out of nowhere!!

1 mil OS, 30k market cap, recent officer changes. This one will hit big eventually, and we’ve had a definite increase in bids and volume of late

Any news as to why it went up? Seems it was verified last Thursday

yep, looking good

MBOT

cant beat that

Outstanding Shares

1,280,896

02/03/2020

https://www.otcmarkets.com/stock/MLCG/security

MBOT

Nice, give it some time to file, might be management change R/M ect,

nice to get in these early and watch them grow imo

MBOT

I took some. Market Cap under $100k

Nevada is unlikely to ever be resolved. MLCG unlikeliest of lottery plays to ever play a lottery. Bobryk gone

MLCG now in default

Calculate Annual List of Officer Fees for

ML CAPITAL GROUP, INC.

Item Fee

Annual List (due 9/30/2018) File This List Online Now! File Offline

$ 8,375.00

Annual List Late Fee $ 75.00

Business License (due 9/30/2018)

$ 500.00

Business License Late Fee $ 100.00

TOTAL*

$ 9,050.00

IF CHANGING REGISTERED AGENT NAME OR ADDRESS THERE IS AN ADDITIONAL $60 FEE.

* These fees are current as of today's date of 06/17/2019 07:28 AM but can change based on events occurring on future dates. Calculated fees for entities in Default or Revoked status do not include fees and penalties due to resignation or other registered agent deficiency or being on administrative hold. For these types of inquiries please contact our office. The above fees assume that a State Business License Exemption does notapply. Exemptions from the State Business License may not be filed online.

ML CAPITAL GROUP, INC.

Business Entity Information

Status: Default File Date: 9/22/2009

Type: Domestic Corporation Entity Number: E0507482009-1

Qualifying State: NV List of Officers Due: 9/30/2018

Managed By: Expiration Date:

NV Business ID: NV20091388049 Business License Exp: 9/30/2018

Dark/Defunct Company, per OTC Markets

Also, Nevada, their state of incorporation, lists them as in Default and business license is expired.

Business Entity Information

Status: Default File Date: 9/22/2009

Type: Domestic Corporation Entity Number: E0507482009-1

Qualifying State: NV List of Officers Due: 9/30/2018

Managed By: Expiration Date:

NV Business ID: NV20091388049 Business License Exp: 9/30/2018

Here are the list fees MLCG owes to Nevada, if they ever want to conduct business, enter into contracts, file a lawsuit, or defend themselves against lawsuits in the USA again:

Calculate Annual List of Officer Fees for

ML CAPITAL GROUP, INC.

Item Fee

Annual List (due 9/30/2018) File This List Online Now! File Offline

$ 8,375.00

Annual List Late Fee $ 75.00

Business License (due 9/30/2018)

$ 500.00

Business License Late Fee $ 100.00

TOTAL*

$ 9,050.00

IF CHANGING REGISTERED AGENT NAME OR ADDRESS THERE IS AN ADDITIONAL $60 FEE.

* These fees are current as of today's date of 06/05/2019 11:40 AM but can change based on events occurring on future dates. Calculated fees for entities in Default or Revoked status do not include fees and penalties due to resignation or other registered agent deficiency or being on administrative hold. For these types of inquiries please contact our office. The above fees assume that a State Business License Exemption does not apply. Exemptions from the State Business License may not be filed online.

Beware - wash sale trades?

Looks like a prearrange buy at a higher price, then almost the same (a little larger) share dump a lot lower.

Only takes a few bucks to manipulate the share price like that. Beware.

I expect to see .000's before year end..

I haven't even looked lately. They do Reverse Splits at the drop of a hat... Whatever the bid is; I would just watch and wait...

Wondering why such a disparity between the bid and the ask... ! Is there a future here..?

And the pastries.. Wow.. Had some good Chillian Food to. I'll be back down there in a few weeks. I won't forget my homework assignment on the next trip... Cheers

Sound tasting... ! :)

I had some Coffee con leche near 8th and 36th ave. But I forgot to drive by there... Lol.... My bad..

Did you find anything interesting there? BTW, there is a good restaurant a block away from there where you can eat fine Portuguese delicatessens

Oh yea. Similar name. About $9,000 to nail the wheels back on in Nevada.

Not permanently revoked, but is in default. The one you mentioned is not this company.

Apparently MLCG has decided to not file unaudited financials.

Just did a huge reverse split, and the PPS kept falling. Now it is diluting as fast as it can, but not many buyers at these high prices.

Shares Out

1,280,896

01/01/2019

(equal to over 7 billion pre-split shares = dilution nightmare)

Company has some trouble with the truth, since it got caught saying it had record bookings, then later showed it really has $0 revenue/sales. SEC/FINRA didn't catch on to that lie by the CEO.

ML CAPITAL GROUP, INC.

Business Entity Information

Status: Default File Date: 9/22/2009

Type: Domestic Corporation Entity Number:

A unique alpha-numeric identifier assigned to a business entity by the Secretary of State's commercial recordings office.

E0507482009-1

Qualifying State: NV List of Officers Due: 9/30/2018

Managed By: Expiration Date:

NV Business ID: NV20091388049 Business License Exp: 9/30/2018

Additional Information

Central Index Key: 0001527698

Lol Wow !! Well 1801 Coral Way STE 312, Miami, FL, USA, 33145 was or is still an address on the otc... I'm not far away from there. Will drive by there today. Doubt I'll find anything interesting... But I'll look.

Dunno. It was a Nevada Corp but it’s permanently revoked in NV

So What's the latest with mlcg ? Or they still in corporated in fl or az ?

|

Followers

|

274

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

31518

|

|

Created

|

07/29/13

|

Type

|

Free

|

| Moderators | |||

“This partnership between MLCG, PURA and Spanish Peaks is a sound strategy for every participant, and an opportunity for the shareholders of every participant to take part in the history making and money making transition from an illegal marijuana market to a legal one.”

Global travel is growing by leaps and bounds, and at the same time splintering into a seemingly endless number of extraordinary diverse market segments. In 2000, international travelers number about 600,000,000. In 2015, the number of global travelers reached 1.2 billion. Travel industry sales topped $2.1 TRILLION in 2015 and travel sales are expected to reach $2.5 TRILLION by 2020.

The massive, overall travel sector is segmenting into super specific sectors characterized by travel trends that include, for example, not just travel for women, but travel for women in India; not just mindfulness travel to include yoga and meditation sessions, but African safari, mindfulness travel. Millennials in the travel industry are likely to be called “Roamies” – co-living nomads traveling around the world while co-living within a consistent community that all travel together. One of the faster growing travel segments includes history hikes across the Middle East. Theme park vacations are continuing to become more and more popular in Asia. And the segmentation diversity goes on. Cannabis tourism is hardly a stretch.

A consistent, yet underserved theme that crosses every travel segment is that sub-segment of travelers looking for luxury treatment and accommodations whether on safari in Africa or on trek across the Middle East. ML Capital Group has zeroed in on the luxury sub-segment and already operates a luxury tour service in Hawaii. ML Capital Group has also recognized the expanding role of mobile technology within the travel industry and launched a dedicated initiative to build a mobile brand.

As a young, entrepreneurial company dependent on access to investment capital, it is simply practical to identify popular investment trends, and if possible, integrate popular trends, where appropriate, into the overall business strategy. The cannabis sector is certainly hot and not by accident, or misplaced enthusiasm. Face it, cannabis has been a multi-billion dollar business in the United States for decades. It just hasn’t been a legal business. By comparison, alcoholic beverage sales in the US before the end of Prohibition in 1933 were large and colorful enough to inspire Hollywood scripts that have yet to stop coming, and the growth of the legal alcoholic beverage sector continues to grow today over eighty years since legalization. There are, no doubt, fortunes to be made in becoming part of the transition from illegal marijuana commerce to legal.

Taking a page from the super-segmentation of the 2.1 trillion travel industry, let’s not underestimate the segmentation potential of the marijuana industry. It’s not all about smoking weed. In fact, smoking weed will probably be only a fraction of the overall cannabis sector. Cannabis infused cosmetics are already on shelves. “Edibles” as a category can’t begin to represent the vast diversity of cannabis infused products for human consumption that are already hitting the market. Let’s not overlook all those weed t-shirts or the high-end clothes actually made from cannabis fiber. Again, with the far-reaching subcategorization potential of both the travel industry and the cannabis industry, luxury cannabis tourism is hardly a stretch.

While you might agree that luxury cannabis tourism is a viable business opportunity, you might still be asking how does acquiring a cannabis infused beverage company contribute to MLCG entering the luxury cannabis tour business?

Consider the vineyard tours in Napa Valley or Tuscany; Picture the distillery tours in Scotland or the brewery tours in Bavaria. This should give an idea of the magnitude of the opportunity MLCG plans to build into Colorado’s $19 billion travel market with the help of Spanish Peaks ScrumpDelicacies and Puration.

As an industry, however, cannabis cultivation and production has a long way to go in regard to becoming a universally attractive tourist destination. Having evolved from clandestine grow room operations, today’s legal cannabis cultivation and production operations may be interesting, but probably not exotic or anywhere near a typical “luxury” destination.

Now is the perfect time for MLCG to get involved with Spanish Peaks and PURA. Earlier this year, PURA and Spanish Peaks entered into a $1 million collaboration agreement to produce a line of cannabis Infused beverages. In conjunction with the agreement, Spanish Peaks conducted a cannabis beverage naming contest and announced the contest winners on October 21, 2016:

Since the contest, Spanish Peaks has worked to establish brand name trademarks and to develop beverage formulations. With MLCG getting involved at this early stage, the Spanish Peaks and PURA production facilities can be designed with luxury tourism in mind. Consider the Napa Valley comparison one more time. Nearly 25% of Napa Valley wines - almost $1 billion in wine sales - are sold to customers directly at the vineyards. That’s selling wine to tourists.

This partnership between MLCG, PURA and Spanish Peaks is a sound strategy for every participant, and an opportunity for the shareholders of every participant to take part in the history making and money making transition from an illegal marijuana market to a legal one.

While the Luxury Cannabis Tours offering will start in Colorado, additional Cannabis Tour locations, to include destinations outside the United States, are already in the works. Stay tuned.

Market Value | $2,554,224 | a/o June 10, 2016 |

|---|---|---|

Authorized Shares | 5,010,000,000 | a/o June 10, 2016 |

Outstanding Shares | 1,216,297,221 | a/o June 10, 2016 |

Float | 1,096,716,070 | a/o June 10, 2016 |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |