Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Also a holder. Finally got funds posted to my account overnight. $2.01 is a tad light compared to the numbers reported in the last few days. Sort of PO'd that as stockholders, we were denied the ability to stay on board and ride the growth of the company, or be given a better piece of the pie for stealing our shares. Feel like taking my break even investment and try to re-invest in the new company and hopefully continue to ride the profit ride into the future. Any ideas on the name/ticker of the new company, or is it going totally private???

Just checked account and money is there. Looks like we got 2.007 dollars for each share. GLTA

Yea, mine says it takes a little longer to process when its a international exchange. Hope it gets there by tomorrow. Looks like it will be about 2.00 dollars a share USD. Had high hopes this would have sold at 3 dollars or more.

Broker says money should be in account(s) today, with shares removed.

Please let me know what you learn. I will do so for you as well.

Same here, my account lost 50k today and I don't see the money from the buyout. Has to be from delisting the stock, going to call my broker tomorrow to make sure everything is ok.

SEC should have something to say as well.

I need to call my broker tomorrow. My LIXXF is showing 80 -90 percent loss as of yesterday. Where is our buy-out money?

LIXXF FINRA Deleted Symbol:

Acquisition/Merger

http://otce.finra.org/DLDeletions

"The Company’s security holders received cash consideration of $2.61 per Share for each Share held."

I hope someone responds to your question, as I am in the same boat.

Does anyone know if stockholders are required to do anything when a buyout like this happens. Never been a part of something like this. I don't know if the money just shows up in your account or if you have to file some paper work.

Lithium X Responds to Share Price Drop Caused by Its Buyer, NextView's Default on Its Payment Obligations to Bacanora Minerals

LINK: https://www.juniorminingnetwork.com/junior-miner-news/press-releases/1832-tsx-venture/lix/43106-lithium-x-energy-update-on-completion-of-plan-of-arrangement-with-nextview.html

Bloomberg: Giustra-Backed Lithium X Plunges on Doubts About Chinese Buyer

LINK: https://www.bloomberg.com/news/articles/2018-02-28/giustra-backed-lithium-x-plunges-on-doubts-about-chinese-buyer

Lithium X's Buyer, NextView Capital, "Fails" To Send Proceeds Of Bacanora Minerals Placing

LINK: http://www.iii.co.uk/alliance-news/1519825442573704500-3/nextview-capital-fails-to-send-proceeds-of-bacanora-minerals-placing-alliss-

odd...may have to wait for the first week in March to know...

But with a price drop like this you'd think some news would come from the company...and their phones should be ringing constantly...? what happened.

From previous post.. "the Company expects the remaining funds will be wired to the depositary during the first full week of March, 2018. The Company expects that the Effective Time for completion of the Arrangement will occur the day following the Depositary’s receipt of the required funds.

I agree, very strange for people to sell now at this price. Someone must know something we don't.

LIXXF...Something strange going on here...some kind of breakdown in the buyout that was approved Feb. 6...?...$funding?...Court not agreeing?...

...or some algoBoT trying to fake everyone out...

PRICE almost went back to $1.70 Buyout news Dec. 18...

C$2.61 buyout is USD $2.08/2.06...which is where price has been sitting until recently...=google search 2.61 Canadian dollar = U.S. dollar

http://www.lithium-x.com/news-release/effective-date-for-completion-of-plan-of-arrangement-with-nextview-new-energy-lion-hong-kong-limited/

The reverse break-fee of C$20 million, an amount that is significantly higher than the market standard for break-fees, is being held by the depositary in Canada and the Company expects the remaining funds will be wired to the depositary during the first full week of March, 2018. The Company expects that the Effective Time for completion of the Arrangement will occur the day following the Depositary’s receipt of the required funds.

http://www.lithium-x.com/news-release/lithium-x-energy-corp-announces-securityholder-approval-of-plan-of-arrangement-with-nextview-new-energy-lion-hong-kong-limited/

Completion of the Arrangement remains subject to, among other things, final approval of the Supreme Court of British Columbia, with the hearing for the final order to approve the Arrangement being scheduled for February 7, 2018. The Arrangement is expected to become effective on or about February 14, 2018. ????... last 2 days price has taken a big % drop...

Daily Chart...

Any warrant holders here? I was wondering there was anything scheduled for warrant holders to have a call before the feb 6th call with the company?

It does look that way. They should be announcing something soon

I’m assuming that the buyout is going to happen? I haven’t heard anything about the vote.

Considering I am in at 0.65 I am in good shape but I had hoped We would see $2 or higher by now.

I like the way you think. With the future of lithium looking so bright, I just cant imagine bringing an offer like this to the stock holders. I had high hopes for this one, management failed big time.

Agree.I like $5 instead minimun with other comparables. it is sweet deal for insiders but not for me as south america are risk free to me and nevada investment has and plant approved and production in plans. They are not paying for any of the risk exploration in the past or present. Greed is good so $5 . i just send my ballot with a denied for the merger

I hope everyone thinks hard about this buyout, with the market for lithium

going up this offer is very low. I would think somewhere in the 3.50 usd range would be more accurate.

read the buying companies proposal I suppose

How do I get $2.61 for my shares?

I think I read the buy out offer was in Canadian money also. That seems like a ridiculous offer to me.

Shareholders not buying the buyout.

Holding strong at $1.90 after the .30 cent PPS spike after the buyout PR.

I take that as good.

This buy out offer is laughable.

BOUGHT PRICE IS IN CANADIAN MONEY?

Oct 2, 2017 Article - Asphalt helps lithium batteries charge faster

A touch of asphalt may be the secret to high-capacity lithium metal batteries that charge 10 to 20 times faster than commercial lithium-ion batteries, according to Rice University scientists.

https://phys.org/news/2017-10-asphalt-lithium-batteries-faster.html

How does this work since Nextview is not a publicly traded company? If I buy thousands of shares at the closing price of today at tomorrow's opening will they convert to $2.61 a share. How does this work?

I just love my picks. LOL!

$LIXXF

NextView to acquire Lithium X Energy Corp.https://finance.yahoo.com/news/nextview-acquire-lithium-x-energy-180200739.html

Yep, money to be made...takeover bid at $2.61. Anyone here ever heard about the "super fuel" they supposedly found on their Argentina land?? If it was reported correctly, I was looking for a price that was MUCH HIGHER than currently offered.

Always money to be made here. $LIXXF

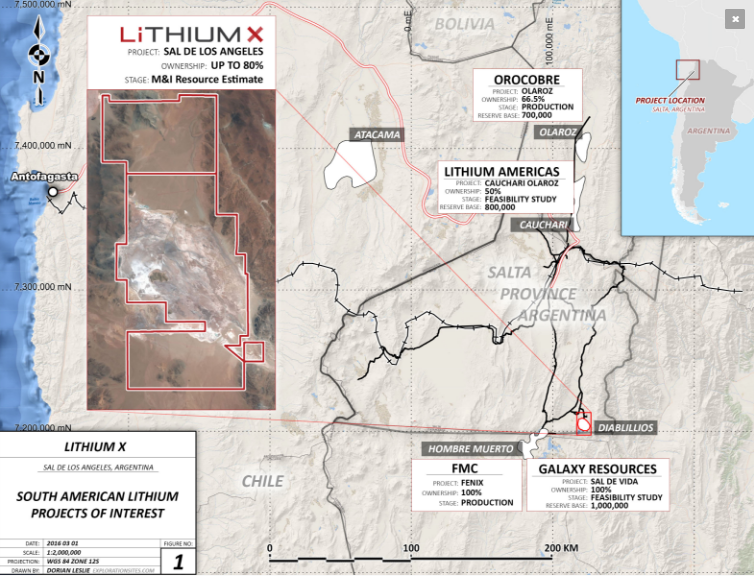

Lithium X closes the Orocobre Agreement acquiring 100% control over the Diablillos Basin Brine

https://finance.yahoo.com/news/lithium-x-closes-orocobre-agreement-130000330.htmlhttps://finance.yahoo.com/news/lithium-x-closes-orocobre-agreement-130000330.html

Lithium has investors in a ‘frenzy’ — and soon you’ll be able to trade it too

Ryan Browne

CNBC October 4, 2017

The future of electric vehicles has led several investors to view lithium as the hot new commodity. Governments and car manufacturers alike have taken steps to electrify fleets and further phase out the combustion engine. In turn, many traders now believe lithium to be a high-return investment as demand soars.

This is no surprise; lithium is a vital component to lithium-ion batteries. These rechargeable batteries are used in devices as common as smartphones and laptops. They have increasingly become popular with electric car manufacturers due to being able to produce more electricity per unit than conventional batteries. "Any consumer behavior is going toward electric vehicles so the market is forced to come with them," Brian Paes-Braga, CEO of Lithium X, told CNBC via phone call last month. "I'm absolutely a believer in electric vehicles. "But trading lithium is no easy task. "There's very few ways to play the space. You've got to provide investors with the opportunity to play this revolution that's happening in the transportation business and energy business," Paes-Braga said. Traders can buy the physical metal but there is not yet a single lithium commodities exchange in existence.

One alternative is to bet on a fund that tracks a basket of lithium producers and battery tech manufacturers. The Global X Lithium & Battery Tech ETF (LIT) has climbed at least 50 percent in the last 12 months.

"It's not exactly a lithium ETF (exchange traded fund). It's an ETF of companies that have exposure to lithium, and it includes both producers and consumers of lithium," Jeffrey Christian, managing director at CPM Group, told CNBC via phone call last month. But now analysts believe there could be an alternative to investing in lithium, one that would allow traders to make hedge investments to reduce risk, or bet on possible movements in the price of the commodity.

Exchanges discussing lithium futures A lack of avenues into buying and selling lithium is an issue that has led some investors to believe a lithium futures contract might one day be possible. There has been increasing discussion about the possibility of lithium futures contracts, according to a Bank of America Merrill Lynch study published last month.

Analysts have echoed this sentiment. "It's possible that there will be a lithium futures contract, I know some of the exchanges are talking about it," CPM Group's Christian said. "A well-run exchange is going to take a lot of time to consider a lot of implications, including the diversification and the number of companies on the supply side as well as the demand side, the potential for investor participation in it, storage issues, whether there are sufficient inventories to support a futures exchange. "Futures contracts allow commodities traders to agree to buy or sell a particular commodity at a predetermined price later. This enables price movement speculation and the avoidance of volatility in the market. As well as this, it would allow lithium producers to lock in prices and thereby secure an immutable return, so long as they produce the agreed amount of an asset."

As lithium becomes an increasingly important metal to the tech and transportation industries, we anticipate there will be efforts to create futures contracts for the metal," Jay Jacobs, director of research at Global X, told CNBC via email last week. "A lithium futures contract would allow producers and users of the commodity to help mitigate risks associated with price fluctuations. "He noted that investors were better off buying lithium mining stocks for the meantime. "We see the upstream lithium miners as the biggest beneficiaries in this market because they have the most exposure to lithium prices. Miners are compensated on the price of lithium and the amount of output."

Jacobs said indications that China could set a deadline for sales of fossil fuel-run cars to come to an end had driven up the demand expectation for lithium-ion batteries.

He added: "With that being said, battery producers have benefited from this trend as well as they play a key role in supplying the staggering amount of batteries that will be necessary for a growing electric car fleet around the globe. "'Speculative frenzy.” This trend will however be faced with difficulties, analysts noted.

Billionaire Elon Musk's Tesla is one of the most notable firms included in Global X's lithium-related fund (NYSE Arca: LIT) - but skeptics claim that profitability is a concern for the electric car maker.

If the business model of automakers falters on a reining in of petroleum and diesel, this could take its toll on both the supply of lithium and demand. "There are a lot of uncertainties about how it will all shake out, and any transformation away from petrol-powered vehicles to electric vehicles is going to take a long time to evolve," CPM Group's Christian said. "In the meantime, you clearly have a speculative frenzy related to lithium and the idea of electric vehicles. So there are any number of people who are investing in lithium and companies related to lithium as if there's going to be this massive transformation. It's probably going to take decades to occur, and something else might come along and change it all. "A number of automotive players have made significant moves towards electric vehicles.

Last month, Carlos Ghosn, chairman and chief executive of the Renault-Nissan-Mitsubishi Alliance, said the group of carmakers would introduce 12 zero-emission electric vehicles by 2022.

In an interview with CNBC, he addressed concerns of "bottlenecks" in production that could arise from refining capacity shortfalls for lithium miners. He said: "This is a risk. I think it's very remote. We have evaluated the capacity of production of lithium and the capacity that can be made available very quickly. We don't think this is going to be a bottleneck at least for the next five-to-six years. "Tesla added to concerns of production "bottlenecks" Monday, after the firm admitted it had delivered just 220 of its new Model 3 vehicles in the third quarter — well below analyst expectations.

But Global X's Jacob said investors should be "patient" with the pace of electric car and battery storage developments. "We believe this is a multi-decade theme as battery costs fall and electric vehicles eventually replace combustion engine vehicles," he said. "Therefore, we believe investors should be patient to allow this theme to fully develop as well as seek broad exposure to the full lithium cycle, including lithium miners and processors, as well as battery producers.

"And Lithium X's Paes-Braga said that, although lithium remains a "small market," he could see a futures contract on the way. "I don't think (it will happen) yet – but I do believe that at some point there will be a futures market for sure. It (lithium) is not unlike other markets," he said.

Sorry for my type o.

This is a long term hold. As the electric car developed, this commodity should follow.

With it being close to the Tesla battery plant it just may have some advantage over the other suppliers.

This is a hot commodity along with cobalt. I think we have some good prospects here.

October 13, 2017

LIXXF Just Got Full Control Over the OBL Motherlode

By Dr. Kent Moors

Keep an Eye On:

Wed.: EIA Petroleum Status Report

Thu.: EIA Natural Gas Report

Fri.: Baker-Hughes Rig Count

Follow Kent

The OBL Revolution is imminent.

Demand for OBL (or lithium) is spiking, as lithium-based batteries become more and more common in cars and power grids all over the world.

Sooner than some might think, lithium-based batteries will become standard issue.

Here in Energy Advantage, we know, and we've been tracking this trend closely. That's why we're already positioned to profit...

The main pick in this area is Lithium X Energy Corp. (LIXXF), which we've been following since April 10, 2017.

This tiny mining company was working on developing and eventually mining lithium deposits in the U.S. and Latin America.

Well, Lithium X just announced that it now controls 100% of the mineral rights in the South American Diablillos basin.

Shares jumped 7.89% on the news, putting the position up 16.15% since we added it to the Energy Advantage Portfolio.

With complete control over the Diablillos basin, Lithium X is in an amazing position to begin lithium production.

And with news from China suggesting the government there might require new cars to be partly or fully electrically powered in not too long, Lithium X's production can't come soon enough.

Sincerely,

due a little diligence and find out, the common denominator is Elon Musk, ever hear of him?

how does that help lixxf? sounds like bs to me!

Tesla Semi Truck debut is officially set for November 16

https://www.slashgear.com/tesla-semi-truck-debut-is-officially-set-for-november-16-06503097/

Musk is delaying the semi's debut` to divert resources in helping Puerto Rico

|

Followers

|

26

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

540

|

|

Created

|

03/28/16

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |