Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This company needs to do something.

LION ELECTRIC ANNOUNCES SECOND QUARTER 2024 RESULTS

July 31 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/94282760/lion-electric-announces-second-quarter-2024-result

MONTREAL, July 31, 2024 /CNW/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, today announced its financial and operating results for the second quarter of fiscal year 2024, which ended on June 30, 2024. Lion reports its results in US dollars and in accordance with International Financial Reporting Standards ("IFRS").

Q2 2024 FINANCIAL HIGHLIGHTS

- Revenue of $30.3 million, down $27.7 million, as compared to $58.0 million in Q2 2023.

- Delivery of 101 vehicles, a decrease of 98 vehicles, as compared to the 199 delivered in Q2 2023. Less vehicles were delivered due to the impact of the timing of EPA rounds and the continued delays and challenges associated with the granting of subsidies related to the ZETF program. Deliveries were also impacted by a slowdown in the Company's production cadence due to the integration of its Lion MD batteries onto its vehicles and the continued ramp-up of production of the Lion5 and LionD platforms.

- Gross loss of $15.2 million, reflecting higher manufacturing costs due to the introduction of new products and to the impact of lower sales volume, as compared to gross profit of $0.4 million in Q2 2023.

- Net loss of $19.3 million, as compared to net loss of $11.8 million in Q2 2023.

- Adjusted EBITDA1 of negative $20.6 million, as compared to negative $9.7 million in Q2 2023.

- Additions to property, plant and equipment of $1.3 million, down $17.8 million, as compared to $19.1 million in Q2 2023.

- Additions to intangible assets, which mainly consist of vehicle and battery development activities, amounted to $10.6 million, ($9.4 million net of government assistance received), down $7.3 million as compared to $17.9 million in Q2 2023.

________________________________

1 Adjusted EBITDA is a non-IFRS financial measure. See "Non-IFRS Measures and Other Performance Metrics" section of this press release.

BUSINESS UPDATES

- More than 2,100 vehicles on the road, with over 28 million miles driven (over 46 million kilometers).

- Vehicle order book2 of 1,994 all-electric medium- and heavy-duty urban vehicles as of July 30, 2024, consisting of 190 trucks and 1,804 buses, representing a combined total order value of approximately $475 million based on management's estimates.

- LionEnergy order book of 394 charging stations and related services as of July 30, 2024, representing a combined total order value of approximately $9 million.

- 12 experience centers in operation in the United States and Canada.

- Commercial launch of our Lion8 Tractor truck at the ACT conference in May

- Successfully completed the final certification for heavy duty Lion battery packs, which will be integrated into our Lion8 Tractor trucks

- On July 31, 2024, the Company announced an action plan (the "Action Plan") intended to streamline its operations, further align its cost structure with current demand and improve its liquidity position and ability to reach its profitability goals. The Action Plan includes the following actions and initiatives:

- a reduction of the Company's workforce by 30% (representing approximately 300 employees) across Canada and the United States and impacting all areas of the organization, which is expected to be implemented over the upcoming days and will result in mostly temporary lay offs (such initiative being expected to result in annualized costs savings for the Company of up to approximately $25 million, assuming that employees temporarily laid off are not re-hired);

- adjusting the Company's truck manufacturing operations in light of a lower market demand than initially anticipated for all-electric trucks, including by introducing a batch-size manufacturing approach for trucks directly aligned with the Company's order book;

- the creation of a new product line through which the Company will sell its battery packs to third parties;

- a process to optimize usage of the Company's facilities, including the potential sublease of a significant portion of its Joliet Facility and certain experience centers throughout Canada and the United States; and

- the implementation of an overall efficiency improvement plan to further reduce other operational expenses, such as third-party logistics costs, consultant costs, and other selling and administrative expenditures.

________________________________

2 See "Non-IFRS Measures and Other Performance Metrics" section of this press release. The Company's vehicle and charging stations order book is determined by management based on purchase orders that have been signed, orders that have been formally confirmed by clients or products in respect of which formal joint applications for governmental programs, subsidies or incentives have been made by the applicable clients and the Company. The order book is expressed as a number of units or a total dollar value, which dollar value is determined based on the pricing of each unit included in the order book. The vehicles included in the vehicle order book as of July 30, 2024 provided for a delivery period ranging from a few months to the end of the year ending December 31, 2028, with substantially all of such vehicles currently providing for deliveries before the end of the year ending December 31, 2025, which corresponds to the latest date by which claims are required to be made according to the current eligibility criteria of the ZETF, unless otherwise agreed by Infrastructure Canada. In addition, substantially all of the vehicle orders included in the order book are subject to the granting of governmental subsidies and incentives, including programs in respect of which applications relating to vehicles of Lion have not yet been fully processed to date. The processing times of governmental programs, subsidies and incentives are also subject to important variations. There has been in the past and the Company expects there will continue to be variances between the expected delivery periods of orders and the actual delivery times, and certain delays could be significant. Also, there has been in the past and the Company expects there will continue to be variances in the eligibility criteria of the various programs, subsidies and incentives introduced by governmental authorities, including in their interpretation and application. Such variances or delays could result in the loss of a subsidy or incentive and/or in the cancellation of certain orders, in whole or in part. The Company's presentation of the order book should not be construed as a representation by the Company that the vehicles and charging stations included in its order book will translate into actual sales.

On July 30, 2024, the Company and the lenders under the Revolving Credit Agreement agreed to certain accommodations relating to the temporary inclusion of additional assets in the borrowing base until August 16, 2024.

"Despite the important challenges the electric vehicle market is currently facing, Lion has been able to realize major headway in the recent rounds of the EPA program, which should bring significant positive momentum to our company, and also made important progress in the last quarter, such as the commercial launch of our Lion8 Tractor and the certification of our LionBattery HD pack" stated Marc Bedard, CEO-Founder of Lion. "Transition to electric is taking longer than initially expected, but transportation electrification is here to stay. It is with that mindset that we have put together an action plan to adjust our cost structure to enable us to continue to support the increasing electric school bus demand and maintain our leadership position, while allowing us to keep supporting the truck operators in their electric transition and focus on our profitability objectives," he added.

SELECT EXPLANATIONS ON RESULTS OF OPERATIONS FOR THE SECOND QUARTER OF FISCAL YEAR 2024

Revenue

For the three months ended June 30, 2024, revenue amounted to $30.3 million, a decrease of $27.7 million, compared to the corresponding period in the prior year. The decrease in revenue was due to a decrease in vehicle sales volume of 98 units, from 199 units (166 school buses and 33 trucks; 171 vehicles in Canada and 28 vehicles in the U.S.) for the three months ended June 30, 2023, to 101 units (95 school buses and 6 trucks; 84 vehicles in Canada and 17 vehicles in the U.S.) for the three months ended June 30, 2024. The decrease in vehicle sales volume was primarily attributable to the impact of the timing of EPA rounds and the continued delays and challenges associated with the granting of subsidies related to the ZETF program, as well as the impact on the Company's production cadence due to the integration of its Lion MD batteries onto its vehicles and the continued ramp-up of production of the Lion5 and LionD platforms.

For the six months ended June 30, 2024, revenue amounted to $85.8 million, a decrease of $27.0 million, compared to the six months ended June 30, 2023. The decrease in revenue was due to a decrease in vehicle sales volume of 122 units, from 419 units (373 school buses and 46 trucks; 386 vehicles in Canada and 33 vehicles in the U.S.) for the six months ended June 30, 2023, to 297 units (279 school buses and 18 trucks; 249 vehicles in Canada and 48 vehicles in the U.S.) for the six months ended June 30, 2024. The decrease in vehicle sales volume was primarily attributable to the impact of the timing of EPA rounds, the continued delays and challenges associated with the granting of subsidies related to the ZETF program, as well as the impact on the Company's production cadence of the integration of its Lion MD batteries onto its vehicles and the continued ramp-up of production of the Lion5 and LionD platforms.

Cost of Sales

For the three months ended June 30, 2024, cost of sales amounted to $45.5 million, representing a decrease of $12.1 million, compared to the corresponding period in the prior year. The decrease was primarily due to lower sales volumes, partially offset by increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs).

For the six months ended June 30, 2024, cost of sales amounted to $112.1 million, representing a decrease of $2.4 million, compared to the six months ended June 30, 2023. The decrease was primarily due to lower sales volumes, partially offset by increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs).

Gross Profit (Loss)

For the three months ended June 30, 2024, gross loss increased by $15.6 million to negative $15.2 million, compared to positive $0.4 million for the three months ended June 30, 2023. The gross loss was primarily due to increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs).

For the six months ended June 30, 2024, gross loss increased by $24.5 million to negative $26.4 million, compared to negative $1.8 million for the six months ended June 30, 2023. The increase in the gross loss was primarily due to increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs).

Administrative Expenses

For the three months ended June 30, 2024, administrative expenses decreased by $1.5 million, from $12.5 million for the corresponding period in the prior year, to $10.9 million. Administrative expenses for the three months ended June 30, 2024 included $0.4 million of non-cash share-based compensation, compared to $1.6 million for the three months ended June 30, 2023. Excluding the impact of non-cash share-based compensation, administrative expenses decreased from $10.9 million for the three months ended June 30, 2023, to $10.5 million for three months ended June 30, 2024. The decrease was mainly due to a decrease in expenses and a lower headcount, both resulting from the workforce reduction and cost reduction initiatives implemented in November 2023 and April 2024, partially offset by higher professional fees.

For the six months ended June 30, 2024, administrative expenses decreased by $3.4 million, from $25.5 million for the six months ended June 30, 2023, to $22.1 million. Administrative expenses for the six months ended June 30, 2024 included $0.7 million of non-cash share-based compensation, compared to $2.7 million for the six months ended June 30, 2023. Excluding the impact of non-cash share-based compensation, administrative expenses decreased from $22.8 million for the six months ended June 30, 2023, to $21.3 million for six months ended June 30, 2024. The decrease was mainly due to a decrease in expenses and a lower headcount, both resulting from the workforce reduction and cost reduction initiatives implemented in November 2023 and April 2024, partially offset by higher professional fees.

Selling Expenses

For the three months ended June 30, 2024, selling expenses decreased by $1.2 million, from $5.5 million for the three months ended June 30, 2023, to $4.3 million. Selling expenses for the three months ended June 30, 2024 included $0.1 million of non-cash share-based compensation, compared to $0.4 million for the three months ended June 30, 2023. Excluding the impact of non-cash share-based compensation, selling expenses decreased from $5.0 million for the three months ended June 30, 2023, to $4.2 million for three months ended June 30, 2024. The decrease was primarily due to streamlined selling related expenses, including lower headcount and marketing costs resulting from the workforce reduction and cost reduction initiatives implemented in November 2023 and April 2024.

For the six months ended June 30, 2024, selling expenses decreased by $3.3 million, from $11.3 million for the six months ended June 30, 2023, to $8.0 million. Selling expenses for the six months ended June 30, 2024 included $0.1 million of non-cash share-based compensation, compared to $0.8 million for the six months ended June 30, 2023. Excluding the impact of non-cash share-based compensation, selling expenses decreased from $10.5 million for the six months ended June 30, 2023, to $7.9 million for six months ended June 30, 2024. The decrease was primarily due to streamlined selling related expenses, including lower headcount and marketing costs resulting from the workforce reduction and cost reduction initiatives implemented in November 2023 and April 2024.

Restructuring Costs

Restructuring costs of $1.4 million for the three and six months ended June 30, 2024 are comprised mainly of severance costs related to the workforce reduction announced on April 18, 2024. No such restructuring costs were incurred for the three and six months ended June 30, 2023.

Finance Costs

For the three months ended June 30, 2024, finance costs increased by $10.3 million, from $2.0 million for the three months ended June 30, 2023, to $12.3 million for the three months ended June 30, 2024. Finance costs for the three months ended June 30, 2024 were net of $0.4 million of capitalized borrowing costs, compared to $1.4 million for the three months ended June 30, 2023. Excluding the impact of capitalized borrowing costs, finance costs increased by $9.3 million compared to the three months ended June 30, 2023. The increase was driven primarily by higher interest expense on long-term debt, due to higher average debt outstanding during the second quarter of fiscal 2024 relating to borrowings made under the Revolving Credit Agreement, the IQ Loan, the SIF Loan, the Finalta-CDPQ Loan Agreement, and the Supplier Credit Facility (as such terms are defined below), interest (including interest paid in kind with respect to the Convertible Debentures) and accretion expense as well as financing costs related to the Convertible Debentures and Non-Convertible Debentures issued in July 2023, and an increase in interest costs related to lease liabilities. Finance charges for the three months ended June 30, 2024 included non-cash charges of $5.5 million related to interest paid in kind with respect to the Convertible Debentures and accretion expense.

For the six months ended June 30, 2024, finance costs increased by $19.5 million, from $3.4 million for the six months ended June 30, 2023, to $22.9 million for the six months ended June 30, 2024. Finance costs for the six months ended June 30, 2024 were net of $0.7 million of capitalized borrowing costs, compared to $3.1 million for the six months ended June 30, 2023. Excluding the impact of capitalized borrowing costs, finance costs increased by $17.1 million compared to the six months ended June 30, 2023. The increase was driven primarily by higher interest expense on long-term debt, due to higher average debt outstanding during the first half of fiscal 2024 relating to borrowings made under the Revolving Credit Agreement, the IQ Loan, the SIF Loan, the Finalta-CDPQ Loan Agreement, and the Supplier Credit Facility (as such terms are defined below), interest (including interest paid in kind with respect to the Convertible Debentures) and accretion expense as well as financing costs related to the Convertible Debentures and Non-Convertible Debentures issued in July 2023, and an increase in interest costs related to lease liabilities, including for the Battery Plant. Finance charges for the six months ended June 30, 2024 included non-cash charges of $11.0 million related to interest paid in kind with respect to the Convertible Debentures and accretion expense.

Foreign Exchange Loss (Gain)

Foreign exchange loss (gain) relates primarily to the revaluation of net monetary assets denominated in foreign currencies to the functional currencies of the related Lion entities. For the three and six months ended June 30, 2024, foreign exchange loss was $1.0 million and $3.5 million respectively, compared to gains of $1.8 million and $3.0 million for the three and six months ended June 30, 2023, respectively, related primarily to the impact of changes in foreign currency rates (impact of changes in the Canadian dollar relative to the U.S. dollar).

Change in Fair Value of Conversion Options on Convertible Debt Instruments

For the three and six months ended June 30, 2024, change in fair value of conversion options on convertible debt instruments resulted in a gain of $12.5 million and $23.2 million, respectively, and was related to the revaluation of the conversion options on the Convertible Debentures issued in July 2023 resulting mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Change in Fair Value of Share Warrant Obligations

Change in fair value of share warrant obligations moved from a gain of $6.0 million for the three months ended June 30, 2023, to a gain of $13.3 million, for the three months ended June 30, 2024. The gain for the three months ended June 30, 2024 was related to the Specific Customer Warrants, the public and private Business Combination Warrants, the 2022 Warrants, and the July 2023 Warrants, and resulted mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Change in fair value of share warrant obligations moved from a gain of $11.7 million for the six months ended June 30, 2023, to a gain of $20.1 million, for the six months ended June 30, 2024. The gain for the six months ended June 30, 2024 was related to the Specific Customer Warrants, the public and private Business Combination Warrants, the 2022 Warrants, and the July 2023 Warrants, and resulted mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Net Loss

The net loss of $19.3 million for the three months ended June 30, 2024 as compared to the net loss of $11.8 million for the same period prior year was mainly due to the higher gross loss and higher finance costs, partially offset by the impact of the reduction in administrative and selling expenses as well as higher gains related to non-cash decrease in the fair value of share warrant obligations and the conversion options on convertible debt instrument.

The net loss of $41.0 million for the six months ended June 30, 2024 as compared to the net loss of $27.4 million for the same period prior year was mainly due to the higher gross loss and higher finance costs, partially offset by the impact of the reduction in administrative and selling expenses as well as higher gains related to non-cash decrease in the fair value of share warrant obligations and the conversion options on convertible debt instrument.

Continued Listing Standard Notice from the New York Stock Exchange

The Company also announced that on July 17, 2024, it received notice (the "Notice") from the New York Stock Exchange (the "NYSE") that, as of July 16, 2024, it was not in compliance with Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company's common stock was less than $1.00 per share over a consecutive 30 trading-day period.

In accordance with applicable NYSE rules, the Company notified the NYSE of its intent to regain compliance with Rule 802.01C and return to compliance with the applicable NYSE continued listing standards.

The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month.

The Company is considering all available options to regain compliance with the NYSE's continued listing standards, including, but not limited to, taking actions that are subject to shareholder approval no later than at the Company's next annual meeting of shareholders.

The Notice has no immediate impact on the listing of the Company's common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company's compliance with other NYSE continued listing standards. The Common Stock will continue to trade under the symbol "LEV," but will have an added designation of ".BC" to indicate that the Company currently is not in compliance with the NYSE's continued listing requirements. If the Company is unable to regain compliance during the cure period, the NYSE may initiate procedures to suspend and delist the Common Stock

Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission.

CONFERENCE CALL

A conference call and webcast will be held on July 31, 2024, at 8:30 a.m. (Eastern Time) to discuss the results. To participate in the conference call, please dial (404) 975-4839 or (833) 470-1428 (toll free) using the Access Code 940640. An investor presentation and a live webcast of the conference call will also be available at www.thelionelectric.com under the "Events and Presentations" page of the "Investors" section. An archive of the event will be available for a period of time shortly after the conference call.

Local school bus company gets $44M boost to electrify fleet

The new Langs buses will run on the busiest routes in the London area

CBC News · Posted: Jun 21, 2024

https://www.cbc.ca/news/canada/london/local-school-bus-company-gets-44m-boost-to-electrify-fleet-1.7242068

Key quote:

"Langs Bus Lines, which operates hundreds of buses in the region, will receive roughly $44 million for the purchase of 200 electric school buses by 2026."

LEV............................................https://stockcharts.com/h-sc/ui?s=LEV&p=W&b=5&g=0&id=p86431144783

LEV...............................https://stockcharts.com/h-sc/ui?s=LEV&p=W&b=5&g=0&id=p86431144783

Lion8 Tractor Launch | Press Conference ACT Expo 2024!

Lion Electric

Posted May 21, 2024

Watch the full-length press conference for the launch of the Lion8 Tractor, an all-electric semi-truck with a GCWR of up to 127,000 lbs, and the first vehicle in the Lion Electric lineup to be equipped with our proprietary heavy-duty battery packs combined for a 630 kWh battery capacity.

LION ELECTRIC UNVEILS THE GROUNDBREAKING LION8 TRACTOR, AN ALL-ELECTRIC CLASS 8 COMMERCIAL TRUCK

May 21 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/93900094/lion-electric-unveils-the-groundbreaking-lion8-tra

Oakland is now first in the US to have a 100% electric school bus fleet – and it’s V2G

Avatar for Michelle Lewis

Michelle Lewis | May 15 2024

https://electrek.co/2024/05/15/oakland-is-now-first-in-the-us-to-have-a-100-electric-school-bus-fleet-and-its-v2g/

SKLV, I'm holding a ton of warrants, no choice other than continue to hold and hope for a miraculous come back.

Thoughts if still holding the LEV 2026 $11.50 strike warrants.

LION ELECTRIC ANNOUNCES FIRST QUARTER 2024 RESULTS

08/05/2024

Link to Press release https://ir.thelionelectric.com/English/news/news-details/2024/LION-ELECTRIC-ANNOUNCES-FIRST-QUARTER-2024-RESULTS/default.aspx

Link to Presentation https://s27.q4cdn.com/902820926/files/doc_financials/2024/q1/070524-Q1-2024-Earnings-Presentation-v7-FINAL.pdf

Link to Webcast https://events.q4inc.com/attendee/256546900

Link to Previous (Q3/FY 2023) Results https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173942022

MONTREAL, May 8, 2024 /PRNewswire/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, today announced its financial and operating results for the first quarter of fiscal year 2024, which ended on March 31, 2024. Lion reports its results in US dollars and in accordance with International Financial Reporting Standards ("IFRS").

Q1 2024 FINANCIAL HIGHLIGHTS

- Revenue of $55.5 million, up $0.8 million, as compared to $54.7 million in Q1 2023.

- Delivery of 196 vehicles, a decrease of 24 vehicles, as compared to the 220 delivered in Q1 2023.

- Gross loss, reflecting higher manufacturing costs due to the introduction of new products, of $11.1 million as compared to a gross loss of $2.3 million in Q1 2023.

- Net loss of $21.7 million, as compared to net loss of $15.6 million in Q1 2023.

- Adjusted EBITDA1 of negative $17.3 million, as compared to negative $14.5 million in Q1 2023.

- Additions to property, plant and equipment of $0.4 million, down $22.7 million, as compared to $23.1 million in Q1 2023.

- Additions to intangible assets, which mainly consist of vehicle and battery development activities, amounted to $11.3 million, ($8.2 million net of government assistance received), down $5.2 million as compared to $16.5 million in Q1 2023.

___________________________________

1 Adjusted EBITDA is a non-IFRS financial measure. See "Non-IFRS Measures and Other Performance Metrics" section of this press release.

BUSINESS UPDATES

- More than 2,000 vehicles on the road, with over 25 million miles driven (over 40 million kilometers).

- Vehicle order book2 of 2,004 all-electric medium- and heavy-duty urban vehicles as of May 7, 2024, consisting of 211 trucks and 1,793 buses, representing a combined total order value of approximately $475 million based on management's estimates.

- LionEnergy order book of 350 charging stations and related services as of May 7, 2024, representing a combined total order value of approximately $8 million.

- 12 experience centers in operation in the United States and Canada.

- Initial deliveries to customers of Lion5 trucks (delivered with medium duty Lion battery packs) and of LionD buses during the first quarter of 2024.

On April 18, 2024, the Company announced a reduction of its workforce, combined with other cost-cutting measures, including in areas such as third-party inventory logistics, lease expenses, consulting, product development and professional fees. The workforce reduction affected approximately 120 employees in overhead and product development functions. These measures were aimed at further reducing the Company's operating expenses and aligning its cost structure to current market dynamics, notably delays experienced with the ZETF, which continue to adversely impact the Company's school bus deliveries.

"Despite a challenging first quarter marked by turbulence in the electric vehicle sector, our commitment to long-term growth remains unwavering. This drove us to make the tough decision to streamline our workforce and implement cost-saving measures. While difficult, this move was essential to fortify our liquidity in the face of market volatility, ensuring sustainability without compromising production capacity," commented Marc Bedard, CEO-Founder of Lion. "As we commence deliveries of the LionD and Lion5, our focus for the remainder of the year is on ramping up purchase orders and accelerating deliveries, essential steps in reaching profitability," he concluded.

_________________________________

2 See "Non-IFRS Measures and Other Performance Metrics" section of this press release. The Company's vehicle and charging stations order book is determined by management based on purchase orders that have been signed, orders that have been formally confirmed by clients or products in respect of which formal joint applications for governmental programs, subsidies or incentives have been made by the applicable clients and the Company. The order book is expressed as a number of units or a total dollar value, which dollar value is determined based on the pricing of each unit included in the order book. The vehicles included in the vehicle order book as of May 7, 2024 provided for a delivery period ranging from a few months to the end of the year ending December 31, 2028, with substantially all of such vehicles currently providing for deliveries before the end of the year ending December 31, 2025, which corresponds to the latest date by which claims are required to be made according to the current eligibility criteria of the ZETF, unless otherwise agreed by Infrastructure Canada. In addition, substantially all of the vehicle orders included in the order book are subject to the granting of governmental subsidies and incentives, including programs in respect of which applications relating to vehicles of Lion have not yet been fully processed to date. The processing times of governmental programs, subsidies and incentives are also subject to important variations. There has been in the past and the Company expects there will continue to be variances between the expected delivery periods of orders and the actual delivery times, and certain delays could be significant. Also, there has been in the past and the Company expects there will continue to be variances in the eligibility criteria of the various programs, subsidies and incentives introduced by governmental authorities, including in their interpretation and application. Such variances or delays could result in the loss of a subsidy or incentive and/or in the cancellation of certain orders, in whole or in part. The Company's presentation of the order book should not be construed as a representation by the Company that the vehicles and charging stations included in its order book will translate into actual sales.

SELECT EXPLANATIONS ON RESULTS OF OPERATIONS FOR THE FIRST QUARTER OF FISCAL YEAR 2024

Revenue

For the three months ended March 31, 2024, revenue amounted to $55.5 million, an increase of $0.8 million, compared to the three months ended March 31, 2023. The increase in revenue was primarily due to the impact of a higher proportion of U.S. vehicle sales (which results in a more favorable product mix), partially offset by the impact of a decrease in vehicle sales volume of 24 units, from 220 units (207 school buses and 13 trucks; 215 vehicles in Canada and 5 vehicles in the U.S.) for the three months ended March 31, 2023, to 196 units (184 school buses and 12 trucks; 165 vehicles in Canada and 31 vehicles in the U.S.) for the three months ended March 31, 2024.

Cost of Sales

For the three months ended March 31, 2024, cost of sales amounted to $66.6 million, representing an increase of $9.7 million, compared to the three months ended March 31, 2023. The increase was primarily due to increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs) partially offset by lower vehicle sales volumes.

Gross Loss

For the three months ended March 31, 2024, gross loss increased by $8.9 million to negative $11.1 million, compared to negative $2.3 million for the three months ended March 31, 2023. The decrease was primarily due to increased manufacturing costs related to the ramp-up of the new products (LionD, Lion5, and the Lion battery packs).

Administrative Expenses

For the three months ended March 31, 2024, administrative expenses decreased by $1.9 million, from $13.0 million for the three months ended March 31, 2023, to $11.1 million. Administrative expenses for the three months ended March 31, 2024 included $0.3 million of non-cash share-based compensation, compared to $1.0 million for the three months ended March 31, 2023. Excluding the impact of non-cash share-based compensation, administrative expenses decreased from $12.0 million for the three months ended March 31, 2023, to $10.8 million for three months ended March 31, 2024. The decrease was mainly due to a decrease in expenses and a lower headcount, both resulting from the workforce reduction and cost reduction initiatives implemented starting in November 2023. As a percentage of sales, administrative expenses were 20% of revenues for the three months ended March 31, 2024, compared to 24% for the three months ended March 31, 2023.

Selling Expenses

For the three months ended March 31, 2024, selling expenses decreased by $2.1 million, from $5.9 million for the three months ended March 31, 2023, to $3.8 million. Selling expenses for the three months ended March 31, 2024 included $0.1 million of non-cash share-based compensation, compared to $0.4 million for the three months ended March 31, 2023. Excluding the impact of non-cash share-based compensation, selling expenses decreased from $5.5 million for the three months ended March 31, 2023, to $3.7 million for three months ended March 31, 2024. The decrease was primarily due to streamlined selling related expenses, including lower headcount and marketing costs resulting from the workforce reduction and cost reduction initiatives implemented starting in November 2023.

Finance Costs

For the three months ended March 31, 2024, finance costs increased by $9.2 million, from $1.4 million for the three months ended March 31, 2023, to $10.6 million for the three months ended March 31, 2024. Finance costs for the three months ended March 31, 2024 were net of $0.3 million of capitalized borrowing costs, compared to $1.7 million for the three months ended March 31, 2023. Excluding the impact of capitalized borrowing costs, finance costs increased by $7.8 million compared to the three months ended March 31, 2023. The increase was driven primarily by higher interest expense on long-term debt, due to higher average debt outstanding during the first quarter of fiscal 2024 relating to borrowings made under the Revolving Credit Agreement, the IQ Loan, the SIF Loan, the Finalta-CDPQ Loan Agreement, and the Supplier Credit Facility (as such terms are defined below), interest (including interest paid in kind with respect to the Convertible Debentures) and accretion expense as well as financing costs related to the Convertible Debentures and Non-Convertible Debentures issued in July 2023, and an increase in interest costs related to lease liabilities, including for the Battery Plant. Finance charges for the three months ended March 31, 2024 included non-cash charges of $5.5 million related to interest paid in kind with respect to the Convertible Debentures and accretion expense.

Foreign Exchange Loss (Gain)

Foreign exchange loss (gain) relates primarily to the revaluation of net monetary assets denominated in foreign currencies to the functional currencies of the related Lion entities. For the three months ended March 31, 2024, foreign exchange loss was $2.6 million, compared to a gain of $1.2 million in the prior year, related primarily to the impact of changes in foreign currency rates (impact of changes in the Canadian dollar relative to the U.S. dollar).

Change in Fair Value of Conversion Options on Convertible Debt Instruments

For the three months ended March 31, 2024, change in fair value of conversion options on convertible debt instruments resulted in a gain of $10.7 million, and was related to the revaluation of the conversion options on the Convertible Debentures issued in July 2023 resulting mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Change in Fair Value of Share Warrant Obligations

Change in fair value of share warrant obligations moved from a gain of $5.7 million for the three months ended March 31, 2023, to a gain of $6.7 million, for the three months ended March 31, 2024. The gain for the three months ended March 31, 2024 was related to the Specific Customer Warrants, the public and private Business Combination Warrants, the 2022 Warrants, and the July 2023 Warrants, and resulted mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Net Loss

The net loss of $21.7 million for the three months ended March 31, 2024 as compared to the net loss of $15.6 million for the prior year was mainly due to the higher gross loss and higher finance costs, partially offset by the impact of the reduction in administrative and selling expenses as well as higher gains related to non-cash decrease in the fair value of share warrant obligations and the conversion options on convertible debt instrument.

CONFERENCE CALL

A conference call and webcast will be held on May 8, 2024, at 8:30 a.m. (Eastern Time) to discuss the results. To participate in the conference call, please dial (404) 975-4839 or (833) 470-1428 (toll free) using the Access Code 431009. An investor presentation and a live webcast of the conference call will also be available at www.thelionelectric.com under the "Events and Presentations" page of the "Investors" section. An archive of the event will be available for a period of time shortly after the conference call.

ANNUAL MEETING OF SHAREHOLDERS

This year, the Company will be holding its Annual Meeting of Shareholders as a completely virtual meeting, which will be conducted via live webcast on May 15, 2024, at 11:00 a.m. (Eastern Time). Shareholders of the Company, regardless of their geographic location, may attend the Meeting online at https://www.icastpro.ca/elion240515.

The Company's management information circular and notice of annual meeting of shareholders relating to the Annual Meeting of Shareholders are available on Lion's website at www.thelionelectric.com in the Investors section, under Events and Presentations, and have been filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

FINANCIAL REPORT

This release should be read together with the 2024 first quarter financial report, including the unaudited condensed interim consolidated financial statements of the Company and the related notes as at March 31, 2024 and for the three months ended March 31, 2024 and 2023, and the related management discussion and analysis ("MD&A"), which will be filed by the Company with applicable Canadian securities regulatory authorities and with the U.S. Securities and Exchange Commission, and which will be available on SEDAR+ as well as on our website at www.thelionelectric.com. Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the MD&A.

Argonne and Lion Electric Exploring Vehicle-to-Grid (V2G) Technology

Argonne National Laboratory

14.3K subscribers

Posted May 3, 2024

Argonne is a U.S. Department of Energy science and engineering research center that – along its partners in industry, academia and government – tackles global challenges in energy, security, and a range of other areas. Among those areas is electric vehicles and their integration into society.

Argonne and Lion Electric – the largest producer of medium and heavy-duty electric vehicles (EVs) in North America – are collaborating to explore vehicle-to-grid (V2G) technology.

The organizations aim to turn the company's electric trucks and buses into grid contributors for stability and renewable integration. V2G technology turns EVs into mini power plants, enabling their batteries to feed energy back into the grid. This helps balance demand on the grid and promotes renewable energy integration.

Argonne and Lion Electric recently conducted a successful V2G demonstration using the LionC all-electric school bus. The successful demonstration confirmed the LionC's seamless 48-kW, bi-directional charging capability. The demo also showcased LionC's potential to reduce reliance on fossil fuels by storing and feeding clean energy back into the grid.

LION ELECTRIC ANNOUNCES FIRST QUARTER 2024 RESULTS RELEASE DATE

April 23 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/93697906/lion-electric-announces-first-quarter-2024-results

MONTREAL, April 23, 2024 /CNW/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, today announced that it will release its first quarter 2024 results on May 8, 2024, before markets open. A conference call and webcast will be held on the same day, at 8:30 a.m. (Eastern Time) to discuss the results.

To participate in the conference call, please dial (404) 975-4839 or (833) 470-1428 (toll free) using the Access Code 431009. A live webcast of the conference call will also be available at www.thelionelectric.com under the "Events and Presentation" page of the "Investors" section. An archive of the event will be available shortly after the conference call.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The Company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric school buses. Lion is a North American leader in electric transportation and designs, builds and assembles many of its vehicles' components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

Cision View original content:https://www.prnewswire.com/news-releases/lion-electric-announces-first-quarter-2024-results-release-date-302123868.html

LION ELECTRIC ANNOUNCES WORKFORCE REDUCTION AND COST-CUTTING MEASURES

April 18 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/93678971/lion-electric-announces-workforce-reduction-and-co

MONTREAL, April 18, 2024 /CNW/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today a reduction of its workforce, combined with other cost-cutting measures, aimed at further reducing its operating expenses and aligning its cost structure to current market dynamics.

The workforce reduction affects approximately 120 employees, mostly Canada-based employees in overhead and product development functions. The measure should not negatively impact the Company's production capacity. Following this workforce reduction, Lion will have approximately 1,150 employees, including more than 600 manufacturing positions.

In addition to the workforce reduction, Lion continues to undertake internal measures to reduce its cost structure, including in areas such as third-party inventory logistics, lease expenses, consulting, product development and professional fees.

The workforce reduction and cost cutting measures announced today, combined with the measures announced in November 2023 and February 2024, are expected to result in annualized costs savings of approximately $40 million.

"Current market dynamics, notably delays experienced with the Canada's Zero-Emission Transit Fund, continue to adversely impact our school bus deliveries and forced us to further reduce our workforce," said Marc Bedard, CEO-Founder of Lion. "We sincerely regret the impact of this decision on our valued employees. It is however crucial to rightsize our workforce to the current environment. We remain confident in our long-term growth and that of our industry and, keeping our focus on our profitability objectives and our production requirements, we will continue to work tirelessly on the execution of our business plan", he added.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric school buses. Lion is a North American leader in electric transportation and designs, builds and assembles many of its vehicles' components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

LEV...............................https://stockcharts.com/h-sc/ui?s=LEV&p=W&b=5&g=0&id=p86431144783

Lion Electric Honored with mHUB Chicago's Manufacturer of the Year Award

March 14 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/93491233/lion-electric-honored-with-mhub-chicagos-manufactu

LionD Walkaround | Get a 360-degree view of this all-electric school bus!

Lion Electric

3.49K subscribers

Posted Feb 28, 2024

The LionD is now out in the wild and we want to make sure that everything awesome about this vehicle is also available for everyone's knowledge - zero-emission school transportation just got an bigger, and you've got to learn more about it!

LION ANNOUNCES UPCOMING PARTICIPATION AT INVESTOR CONFERENCE

March 08 2024

https://ih.advfn.com/stock-market/NYSE/lion-electric-LEV/stock-news/93453242/lion-announces-upcoming-participation-at-investor

MONTREAL, QC, March 8, 2024 /CNW/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today that the Company will be presenting at the following investor conference:

ROTH MKM - 36th Annual ROTH Conference

Date: March 17-19, 2024

Location: Dana Point, CA

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric school buses. Lion is a North American leader in electric transportation and designs, builds and assembles many of its vehicles' components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

Cision View original content:https://www.prnewswire.com/news-releases/lion-announces-upcoming-participation-at-investor-conference-302083545.html

SOURCE The Lion Electric Co.

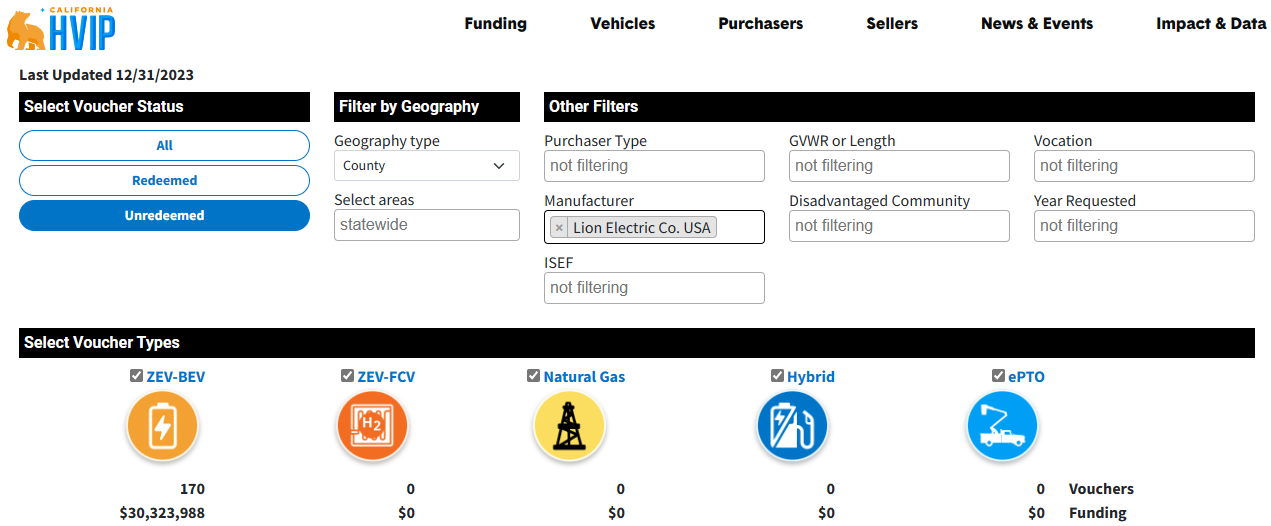

On the Road To Zero: Spotlight on Success | HVIP x Zum Transportation

CALSTART

6.53K subscribers

Posted Mar 5, 2024

See how Zum, with its fleet of Lion electric school buses, is improving the driver and student transportation experience for good—making the ride cleaner and quieter with reliable charging and power. Electric doesn’t mean compromising comfort or performance, and California’s Voucher Incentive Program (HVIP) can help make your fleet’s transition to a cleaner, safer environment easier.

Lion Electric Slams Slow Federal Grant Allocation

February 29, 2024

https://www.ledevoir.com/economie/808156/mises-pied-temporaires-lion-electrique-saint-jerome

Half of Lion Electric's backlog for school buses outside Quebec depends on federal grants. However, while Ottawa is ready to move forward with some of these funds, the majority has been delayed for more than two years. As a result, these orders are on ice and the manufacturer says it is suffering as a result. On Thursday, the company announced the layoff of 100 employees at its Saint-Jérôme plant, in addition to posting a net loss of more than $100 million for the past year.

"We have orders for about 1,200 vehicles that can't move forward," said Marc Bédard, founder and CEO of Lion Electric, in an interview with Le Devoir.

These come from outside Quebec and are conditional on receiving grants from the Zero Emission Public Transit Fund. This federal fund has a budget of $2.75 billion over five years and can cover up to 50% of the funding for eligible projects.

"In fact, to our knowledge, unfortunately there are no electric school buses that have been approved under this program so far," says Mr. Bédard, who laments the processing times.

In fact, a conditional order for 200 LionC buses, placed by Ontario-based Langs Bus Lines in December 2021, received an initial grant offer last September from Infrastructure Canada. In a letter from December, a copy of which was obtained by Le Devoir, Ottawa reiterated its offer.

Langs Bus Lines and Infrastructure Canada have not reached a final agreement to date. A source at the department argues that the delay in this file is not the fault of the federal government and believes that the carrier would be willing to move forward with the terms of the current contract.

However, another, much larger order has yet to qualify for the federal program: the conditional order for 1000 LionC buses placed in October 2021 by the organization Student Transportation of Canada. The file is still being analyzed.

"These backorders are just the tip of the iceberg," says Bédard. "There are a lot of operators who want to place orders in the rest of Canada today, but are waiting for approval from the Ministry of Infrastructure to place their orders."

Layoffs and losses

On Thursday, Lion Electric laid off 100 employees at its plant in Saint-Jérôme, in the Laurentians. The company made the announcement during the presentation of its financial results for the fourth quarter of 2023 and for the full year.

"We're eliminating the evening respite until the program's grants are approved," Bédard said in an interview. "It's very sad. But how can we pay employees when we are missing all this part of income? We can't put the company in difficulty," says the company's director. Until then, production continues, but the "rate is temporarily reduced under the circumstances."

These layoffs are in addition to the 150 layoffs announced last fall.

In the fourth quarter of 2023, Lion Electric's net loss was $56.5 million, compared to a loss of $4.6 million in the same period a year earlier. For the full year, its net loss was $103.8 million, compared to net income of $17.8 million in fiscal 2022. The company delivered 852 vehicles in the past year, 333 more than the 519 vehicles delivered last year.

Lion Electric's stock tumbled on the Toronto Stock Exchange following the announcements. At the close of trading on Thursday, it was worth $1.99, down 12.7% from the start of the day.

LION ELECTRIC ANNOUNCES FOURTH QUARTER AND FISCAL 2023 RESULTS

29/02/2024

Link to Press Release https://ir.thelionelectric.com/English/news/news-details/2024/LION-ELECTRIC-ANNOUNCES-FOURTH-QUARTER-AND-FISCAL-2023-RESULTS/default.aspx

Link to Webcast https://events.q4inc.com/attendee/506172225

Link to Investor Presentation https://s27.q4cdn.com/902820926/files/doc_financials/2023/q4/270224-Q4-and-F-2023-Earnings-Presentation-FINAL.pdf

Link to Prior (3Q 2023) Results https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173170525

MONTREAL, Feb. 29, 2024 /PRNewswire/ - The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, today announced its financial and operating results for the fourth quarter and fiscal year ended on December 31, 2023. Lion reports its results in US dollars and in accordance with International Financial Reporting Standards ("IFRS").

Q4 2023 FINANCIAL HIGHLIGHTS

- Revenue of $60.4 million, up $13.7 million, as compared to $46.8 million in Q4 2022.

- Delivery of 188 vehicles, an increase of 14 vehicles, as compared to the 174 delivered in Q4 2022.

- Gross loss of $9.1 million as compared to a gross loss of $4.8 million in Q4 2022.

- Adjusted gross profit1 of $0.8 million as compared to adjusted gross loss of $4.8 million in Q4 2022.

- Net loss of $56.5 million in Q4 2023, as compared to net loss of $4.6 million in Q4 2022.

- Adjusted EBITDA2 of negative $6.3 million, as compared to negative $13.9 million in Q4 2022.

- Additions to property, plant and equipment related to the Joliet Facility and the Lion Campus, amounted to $13.7 million, down $25.4 million, as compared to $39.1 million in Q4 2022. See section 8.0 of the Company's MD&A for the three and twelve months ended December 31, 2023 entitled "Operational Highlights" for more information related to the Joliet Facility and the Lion Campus.

- Additions to intangible assets, which mainly consist of vehicle and battery development activities, amounted to $17.8 million, down $3.5 million as compared to $21.3 million in Q4 2022.

- Impairment of intangible assets and property, plant and equipment of $36.0 million and write-down of inventory of $9.8 million related to the LionA and LionM minibuses for which the Company made the decision to indefinitely delay the start of commercial production, as announced on November 7, 2023.

________________________________

1 Adjusted gross profit (loss) is a non-IFRS financial measure. See "Non-IFRS Measures and Other Performance Metrics" section of this press release.

2 Adjusted EBITDA is a non-IFRS financial measure. See "Non-IFRS Measures and Other Performance Metrics" section of this press release.

FY 2023 FINANCIAL HIGHLIGHTS

- Delivery of 852 vehicles, an increase of 333 vehicles, as compared to the 519 delivered in fiscal 2022.

- Revenue of $253.5 million, up $113.6 million, as compared to $139.9 million in fiscal 2022.

- Gross loss of $5.5 million, as compared to gross loss of $12.9 million in fiscal 2022.

- Adjusted gross profit of $4.3 million as compared to adjusted gross loss of $12.9 million in fiscal 2022.

- Net loss of $103.8 million, as compared to net earnings of $17.8 million in fiscal 2022.

- Adjusted EBITDA of negative $34.3 million, as compared to negative $54.8 million in fiscal 2022.

- Additions to property, plant and equipment related to the Joliet Facility and the Lion Campus, amounted to $72.2 million, down $75.8 million, as compared to $148.0 million in fiscal 2022. See section 8.0 of the Company's MD&A for the three and twelve months ended December 31, 2023 entitled "Operational Highlights" for more information related to the Joliet Facility and the Lion Campus.

- Additions to intangible assets, which mainly consist of vehicle and battery development activities, amounted to $67.2 million, down $11.9 million, as compared to $79.1 million in fiscal 2022.

- Impairment of intangible assets and property, plant and equipment of $36.0 million and write-down of inventory of $9.8 million related to the LionA and LionM minibuses for which the Company made the decision to indefinitely delay of the start of commercial production, as announced on November 7, 2023.

BUSINESS UPDATES

- More than 1,850 vehicles on the road, with over 22 million miles driven (over 36 million kilometers).

- Vehicle order book3 of 2,076 all-electric medium- and heavy-duty urban vehicles as of February 28, 2024, consisting of 285 trucks and 1,791 buses, representing a combined total order value of approximately $500 million based on management's estimates.

- LionEnergy order book of 132 charging stations and related services as of February 28, 2024, representing a combined total order value of approximately $4 million.

- 12 experience centers in operation in the United States and Canada.

- Initiated commercial production of LionD units which led to the completion of first deliveries to customers in January 2024.

- Successfully completed the final certification for medium duty Lion battery packs, paving the way for initial deliveries of Lion5 trucks.

________________________________

3 See "Non-IFRS Measures and Other Performance Metrics" section of this press release. The Company's vehicle and charging stations order book is determined by management based on purchase orders that have been signed, orders that have been formally confirmed by clients or products in respect of which formal joint applications for governmental programs, subsidies or incentives have been made by the applicable clients and the Company. The order book is expressed as a number of units or a total dollar value, which dollar value is determined based on the pricing of each unit included in the order book. The vehicles included in the vehicle order book as of February 28, 2024 provided for a delivery period ranging from a few months to the end of the year ending December 31, 2026, with substantially all of such vehicles currently providing for deliveries before the end of the year ending December 31, 2025. In addition, substantially all of the vehicle orders included in the order book are subject to the granting of governmental subsidies and incentives, including programs in respect of which applications relating to vehicles of Lion have not yet been fully processed to date. The processing times of governmental programs, subsidies and incentives are also subject to important variations. There has been in the past and the Company expects there will continue to be variances between the expected delivery periods of orders and the actual delivery times, and certain delays could be significant. Also, there has been in the past and the Company expects there will continue to be variances in the eligibility criteria of the various programs, subsidies and incentives introduced by governmental authorities, including in their interpretation and application. Such variances or delays could result in the loss of a subsidy or incentive and/or in the cancellation of certain orders, in whole or in part. The Company's presentation of the order book should not be construed as a representation by the Company that the vehicles and charging stations included in its order book will translate into actual sales.

The Company decided to proceed with the temporarily lay off of approximately 100 employees, mostly impacting the nightshift production workforce at its Saint-Jerome manufacturing facility. The measure aims at further rationalizing the Company's cost structure in the context of prolonged challenges experienced by the Company, including delays and challenges associated with the processing and granting of various governmental subsidies and incentives, notably the ZETF program, which continue to negatively impact the Company's scheduled deliveries and sales efforts, and at further aligning its production workforce with current production requirements. The Company will reassess its production needs in the context of any future developments, including any developments relating to the foregoing challenges.

"2023 has been a year of significant progress, marked by record vehicle deliveries and revenue, which translated into positive adjusted gross margins, and also by several achievements, including the construction and operation of our two new factories and the start of commercial production of our Lion5 electric truck and our LionD electric school bus. However, this past year has not been without its challenges, particularly as it relates to a volatile incentive environment that slowed down the pace of orders and deliveries," commented Marc Bedard, CEO - Founder of Lion. "In 2024, with the growth capex investments now behind us, we will focus on driving growth in orders and deliveries, while diligently controlling costs and keeping a tight control of our liquidity, as we expect the volatile environment to persist for at least the next few months. Despite facing such uncertain environment, we remain committed to leveraging all investments made over the last 15 years, with the ultimate objective to reach profitability." concluded Marc Bedard.

SELECT EXPLANATIONS ON RESULTS OF OPERATIONS FOR THE FOURTH QUARTER AND FISCAL YEAR ENDED DECEMBER 31, 2023

Revenue

For the three months ended December 31, 2023, revenue amounted to $60.4 million, an increase of $13.7 million, compared to the corresponding period in the prior year. The increase in revenue was primarily due to an increase in vehicle sales volume of 14 units, from 174 units (139 school buses and 35 trucks; 160 vehicles in Canada and 14 vehicles in the U.S.) for the three months ended December 31, 2022, to 188 units (178 school buses and 10 trucks; 107 vehicles in Canada and 81 vehicles in the U.S.) for the three months ended December 31, 2023, including the impact of a higher proportion of U.S. vehicle sales than in the corresponding period in the prior year.

For the year ended December 31, 2023, revenue amounted to $253.5 million, an increase of $113.6 million, compared to the year ended December 31, 2022. The increase in revenue was primarily due to an increase in vehicle sales volume of 333 units, from 519 units (409 school buses and 110 trucks; 471 vehicles in Canada and 48 vehicles in the U.S.) for the year ended December 31, 2022, to 852 units (771 school buses and 81 trucks; 625 vehicles in Canada and 227 vehicles in the U.S.) for the year ended December 31, 2023. Revenues for the year ended December 31, 2023 were positively impacted by the impact of a higher proportion of U.S. vehicle sales as compared to fiscal 2022, however were negatively impacted by delays in the processing and granting of subsidies, which resulted in the postponement of deliveries of vehicles which were ready for delivery.

Cost of Sales

For the three months ended December 31, 2023, cost of sales amounted to $69.5 million, representing an increase of $17.9 million compared to $51.5 million in the corresponding period in the prior year. The increase was primarily due to the $9.8 million write-down of inventory to net realizable value as a result of the decision to indefinitely delay the start of commercial production of the LionA and LionM minibuses, increased sales volumes and higher production levels, increased fixed manufacturing and inventory management system costs related to the ramp-up of production capacity, higher raw material and commodity costs, and the impact of the inflationary environment.

For the year ended December 31, 2023, cost of sales amounted to $259.0 million, representing an increase of $106.2 million, compared to the year ended December 31, 2022. The increase was primarily due to increased sales volumes and higher production levels, increased fixed manufacturing and inventory management system costs related to the ramp-up of production capacity, higher raw material and commodity costs, and the impact of the inflationary environment. In addition, cost of sales were impacted by the $9.8 million write-down of inventory to net realizable value as a result of the decision to indefinitely delay the commercial production of the LionA and LionM minibuses.

Gross Loss

For the three months ended December 31, 2023, gross loss increased by $4.3 million, from a gross loss of $4.8 million for the corresponding period in the prior year, to a gross loss of $9.1 million for the three months ended December 31, 2023. The increase in gross loss was primarily due to the negative impact of the $9.8 million write-down of inventory to net realizable value as a result of the decision to indefinitely delay the start of commercial production of the LionA and LionM minibuses, increased fixed manufacturing costs and inventory management system costs related to the ramp-up of future production capacity, higher raw material and commodity costs, product mix, and the impact of continuing global supply chain challenges and inflationary environment, partially offset by the positive gross profit impact of increased sales volumes.

For the year ended December 31, 2023, gross loss improved by $7.4 million to negative $5.5 million, compared to negative $12.9 million for the year ended December 31, 2022. The improvement was primarily due to the positive impact of increased sales volumes, favorable product mix, and higher manufacturing throughput, partially offset by higher raw material and commodity costs, higher inventory management system costs related to the ramp-up of production capacity, and the impact of the inflationary environment. Gross loss for the year ending December 31, 2023 was also negatively impacted by the $9.8 million write-down of inventory to net realizable value as a result of the decision to indefinitely delay the commercial production of the LionA and LionM minibuses.

Administrative Expenses

For the three months ended December 31, 2023, administrative expenses increased by $3.0 million, from $10.0 million for the three months ended December 31, 2022, to $13.0 million for the three months ended December 31, 2023. Administrative expenses for the three months ended December 31, 2023 included $1.4 million of non-cash share-based compensation, compared to $2.1 million for the three months ended December 31, 2022. Excluding the impact of non-cash share-based compensation, administrative expenses increased from $7.9 million for the three months ended December 31, 2022, to $11.6 million for the three months ended December 31, 2023. The increase was mainly due to an increase in expenses, including higher headcount, resulting from the expansion of Lion's head office and general corporate capabilities.

For the year ended December 31, 2023, administrative expenses increased by $6.6 million, from $44.8 million for the year ended December 31, 2022, to $51.5 million. Administrative expenses for the year ended December 31, 2023 included $58.0 million of non-cash share-based compensation, compared to $59.0 million for the year ended December 31, 2022. Excluding the impact of non-cash share-based compensation, administrative expenses increased from $35.3 million for the year ended December 31, 2022 to $35.3 million for year ended December 31, 2023. The increase was mainly due to an increase in expenses and a higher headcount, both resulting from the expansion of Lion's head office and general corporate capabilities. As a percentage of sales, administrative expenses represented 20% of net sales for the year ended December 31, 2023, compared to 32% for the year ended December 31, 2022.

Selling Expenses

For the three months ended December 31, 2023, selling expenses decreased by $2.5 million, from $5.6 million for the three months ended December 31, 2022, to $3.1 million for the three months ended December 31, 2023. Selling expenses for the three months ended December 31, 2023 included a recovery of $1.0 million of non-cash share-based compensation, compared to a charge of $0.4 million for the three months ended December 31, 2022. Excluding the impact of non-cash share-based compensation, selling expenses decreased from $5.2 million for the three months ended December 31, 2022, to $4.1 million for the three months ended December 31, 2023. The decrease was primarily due to streamlined selling related expenses and lower marketing costs, partially offset by higher sales commissions related to higher revenue.

For the year ended December 31, 2023, selling expenses decreased by $3.3 million, from $23.0 million for the year ended December 31, 2022, to $19.7 million. Selling expenses for the year ended December 31, 2023 included $0.2 million of non-cash share-based compensation, compared to $2.9 million for the year ended December 31, 2022. Excluding the impact of non-cash share-based compensation, selling expenses decreased from $20.1 million for the year ended December 31, 2022, to $19.5 million for year ended December 31, 2023. The slight decrease was primarily due to streamlined selling related expenses, including lower headcount and marketing costs, partially offset by higher sales commissions related to higher revenue.

Restructuring Costs

Restructuring costs of $1.4 million for the three months ended December 31, 2023 and fiscal 2023 are comprised mainly of severance costs related to the workforce reduction announced on November 27, 2023.

Impairment of Intangible Assets and Property, Plant and Equipment

Impairment of intangible assets and property, plant and equipment of $36.0 million for the three months ended December 31, 2023 and fiscal 2023 relates to the write-down of previously capitalized vehicle development costs and property, plant and equipment which resulted from the Company's decision to indefinitely delay the start of commercial production of the LionA and LionM minibuses, as announced on November 7, 2023.

Finance Costs (Income)

For the three months ended December 31, 2023, finance costs increased by $7.6 million compared to the corresponding period in the prior year. Finance costs for the three months ended December 31, 2023 were net of $1.8 million of capitalized borrowing costs, compared to $5.1 million for the three months ended December 31, 2022. Excluding the impact of capitalized borrowing costs, finance costs increased by $4.3 million compared to the three months ended December 31, 2022. The increase was driven primarily by higher interest expense on long-term debt, due to higher average debt outstanding during the quarter relating to borrowings made under the Revolving Credit Agreement, the IQ Loan, the SIF Loan, the Finalta-CDPQ Loan Agreement, and the Supplier Credit Facility, interest and accretion expense as well as financing costs related to the Convertible Debentures and Non-Convertible Debentures issued in July 2023, and an increase in interest costs related to lease liabilities, including for the Battery Plant.

For the year ended December 31, 2023, finance costs increased by $16.9 million, from $1.0 million for the year ended December 31, 2022, to $17.9 million for the year ended December 31, 2023. Finance costs for the year ended December 31, 2023 were net of $6.5 million of capitalized borrowing costs, compared to $5.1 million for the year ended December 31, 2022. Excluding the impact of capitalized borrowing costs, finance costs increased by $18.3 million compared to the year ended December 31, 2022. The increase was driven primarily by higher interest expense on long-term debt, due to higher average debt outstanding during the year relating to borrowings made under the Revolving Credit Agreement, the IQ Loan, the SIF Loan, the Finalta-CDPQ Loan Agreement, and the Supplier Credit Facility (as such terms are defined below), interest and accretion expense as well as financing costs related to the Convertible Debentures and Non-Convertible Debentures issued in July 2023, and an increase in interest costs related to lease liabilities, including for the Battery Plant. In addition, finance costs for the year ended December 31, 2022 included a gain of $2.1 million on the derecognition of the financial liability occurred as a result of the termination of an agreement maturing on May 7, 2022 granting a private company with dealership rights in certain regions in the United States.

Foreign Exchange Loss (Gain)

Foreign exchange gains (loss) for both periods relate primarily to the revaluation of net monetary assets denominated in foreign currencies to the functional currencies of the related Lion entities. For the three months ended December 31, 2023, foreign exchange gain was $2.2 million, compared a loss of $0.6 million in the corresponding period in the prior year, related primarily to the impact of changes in the Canadian dollar relative to the U.S. dollar.

Foreign exchange loss (gain) relates primarily to the revaluation of net monetary assets denominated in foreign currencies to the functional currencies of the related Lion entities. For the year ended December 31, 2023, foreign exchange gain was $2.3 million, compared to a loss of $2.0 million in the prior year, related primarily to the impact of changes in foreign currency rates, related primarily to the impact of changes in the Canadian dollar relative to the U.S. dollar.

Change in Fair Value of Conversion Options on Convertible Debt Instruments

For the three months ended December 31, 2023, change in fair value of conversion options on convertible debt instruments was a gain of $1.6 million, and was related to the revaluation of the conversion options on the Convertible Debentures issued in July 2023.

For the year ended December 31, 2023, change in fair value of conversion options on convertible debt instruments was a gain of $5.0 million, and was related to the revaluation of the conversion options on the Convertible Debentures issued in July 2023.

Change in Fair Value of Share Warrant Obligations

Change in fair value of share warrant obligations moved from a gain of $15.4 million for the three months ended December 31, 2022, to a gain of $9.1 million, for the three months ended December 31, 2023. The gain for the three months ended December 31, 2023, was related to the Specific Customer Warrants, the public and private Business Combination Warrants, the 2022 Warrants, and the July 2023 Warrants, and resulted mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Change in fair value of share warrant obligations moved from a gain of $101.5 million for the year ended December 31, 2022, to a gain of $21.0 million, for the year ended December 31, 2023. The gain for the year ended December 31, 2023 was related to the Specific Customer Warrants, the public and private Business Combination Warrants, the 2022 Warrants, and the July 2023 Warrants, and resulted mainly from the decrease in the market price of Lion equity as compared to the previous valuations.

Net Earnings (Loss)

The net loss for the three months ended December 31, 2023 as compared to the net loss for the corresponding prior period is higher as it includes the impacts of the inventory write-down and the impairment charge related to the delay of start of commercial production of the LionA and LionM minibuses, and it reflects higher administrative and selling expenses and finance costs, and lower gains related to non-cash decrease in the fair value of share warrant obligations, as compared to the comparative period in the prior year.

The net loss of $103.8 million for the year ended December 31, 2023 as compared to the net loss of $17.8 million for the prior year was largely due to an improvement in gross loss, inclusive of the impact of the inventory write-down related to the delay of the start of commercial production of the LionA and LionM minibuses, more than offset by higher administrative and selling expenses, the impairment charge related to the delay of the start of commercial production of the LionA and LionM minibuses, higher finance costs, and lower gains related to non-cash decrease in the fair value of share warrant obligations.

CONFERENCE CALL

A conference call and webcast will be held on February 29, 2024, at 8:30 a.m. (Eastern Time) to discuss the results. To participate in the conference call, please dial (404) 975-4839 or (833) 470-1428 (toll free) using the Access Code 863541. An investor presentation and a live webcast of the conference call will also be available at www.thelionelectric.com under the "Events and Presentations" page of the "Investors" section. An archive of the event will be available for a period of time shortly after the conference call.

FINANCIAL REPORT

This release should be read together with the annual audited consolidated financial statements of the Company and the related notes for the years ended December 31, 2023 and 2022, and the related management discussion and analysis ("MD&A") for the three and twelve months ended December 31, 2023, which will be filed by the Company with applicable Canadian securities regulatory authorities and with the U.S. Securities and Exchange Commission, and which will be available on SEDAR+ as well as on our website at www.thelionelectric.com. Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the MD&A.

Transdev Canada Boosts Quebec's School Bus Fleet with $6M Electrification Investment

February 27, 2024

https://bnnbreaking.com/transportation/transdev-canada-boosts-quebecs-school-bus-fleet-with-6m-electrification-investment

Morokoy, agree.

So what would you like to see in Thursday's results ? I would like them to address this news item -