Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$4.00/share is a very key level for next week. Not much resistance above that. If we can get some volume, I think we have a shot at some new yearly highs. If we can couple that with some news, that would be perfect. It feels like it’s small cap season out there and I’d love for Lifeloc to participate.

You might be correct on that but it’s also going to depend on current demand and shares available for sale. Let’s just say Lifeloc was announced another grant by the state of Colorado to get them across the finish line, if supply (stock for sale) is limited I think we could get an explosive move upward and it wouldn’t take a lot. One high net worth individual could have this thing trading above $10 in a couple minutes.

I think Lifeloc would have to get on the NASDAQ for that kind of move, OTC stocks just don't move like that anymore since brokerages started restricting and/or charging for OTC trades.

HOLO is an example of a low float name that was less than $2.00 about a week ago. Today, it almost hit $100/share. According to Yahoo Finance, It's float is around 950,000 shares, is 70% owned by insiders and went from a market cap of about a $12 million to almost a $600,000,000 market cap in about a week. It's certainly possible.

On a daily basis, we see $1 and $2 stocks exploding and trading hundreds of percent higher. It feels like the time is right for low float small cap stocks with a catalyst or good news story to see a ton of upside potential. A $2.00 can go to $10 overnight. It's happening on a daily basis. It's go time Lifeloc. Let's see some magic.

I totally agree that timing is perfect and could not be any better. What I don't want to hear from them is another year of "commercialization by year's end" and no updates throughout the year. I still think they could have done a better job with this device. A working prototype was given to them 8 years ago! That's 2,920 days. Hounds Labs got a working device done in less time and are currently being rewarding for it with millions in revenue and a valuation close to half a billion dollars.

As far as an equity raise, I'm all for it. However, it would make more sense to me if they announced it when stock prices are higher. Big difference between issuing stock at a price of $2 vs. at a price of let's say $6. It would be worth their efforts to increase the stock price first whether through a series of PR's or just buying stock on the open market. They could move this stock higher with a couple thousand bucks and get rewarded with a couple extra million in financing when the time comes.

Love to see this thing bust its way through $4.00 resistance level and see what we can do.

With the current trend in testing, I think the timing is perfect for Lifeloc... They probably could have pushed a little faster by hiring more people, and working around the clock, that would require more money, and probable stock dilution by issuing more shares, or going into debt by borrowing money to finance the fast track. It's amazing that they have achieved getting this far by financing the rollout merely by day to day operations.

I would not be against Lifeloc issuing more shares as a form of equity funding, coupled with commercialization of their SpinDx platform, and funding it's rollout. Although it's commonly looked at as dilutive, and negative for stock price, I feel that this could be positive for the stock price, if done correctly. They could possibly gain some institutional ownership, add liquidity to the trading of the stock, and bring the freely tradeable shares into compliance of the required minimum public float of 1,000,000 shares for listing on the NASDAQ Exchange. I think that this is just a matter of time until something like this occurs.

The push towards oral drug testing is all well and good but where is the sense of urgency from Lifeloc?

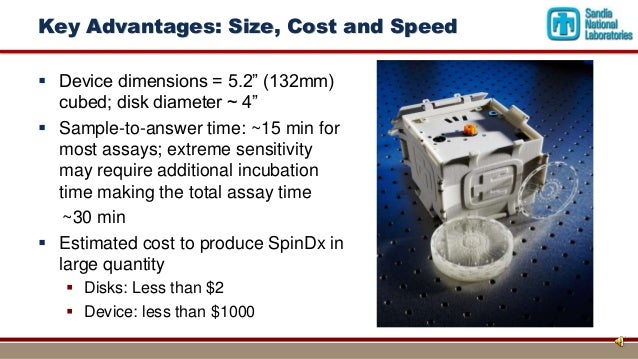

They were given a prototype from Sandia National Laboratories almost 8 years ago:

https://www.sandia.gov/partnerships_reach/#!/stories?category=1&id=130&page=1

They didn't have to start this process from scratch. They were given a prototype that probably took years to develop. I feel like you and I could have developed this thing quicker than Lifeloc. I have to go back to the fact that when you are sitting on a potential multi-billion dollar opportunity like this, you do whatever it takes to make it happen. Work on weekends, spend the money on R & D, find the best minds in the workforce to get it done. I just don't see any of that with Lifeloc. Hopefully we see things change soon!

2023 was a historical year in drug testing... With the trend moving toward Oral fluid testing and breath testing...

https://ndasa.com/2024/01/21/staying-current-looking-back-at-an-historic-year-for-drug-testing/

Anyone have any idea where the volume came from today? I can account for 100 shares but that’s it.

It’s nice to see it break out of the $2 range it’s been in for over a year but can we sustain this or do we go right back down tomorrow? $4 is a huge resistance level to get through but hey - it has to start somewhere.

Let’s be thankful for this upward momentum.

Well, Lifeloc did actually give us an update in November, in their last quarterly financial report. They stated this in their last 8-K "The release of our SpinDx saliva testing system for beta testing utilizing the delta-9-THC disks is expected

in early 2024 and is projected to result in commercialization in later 2024. We expect to accelerate development by

combining our LX9 breathalyzer with the THC SpinDx detection unit, to produce our roadside marijuana breathalyzer

system."

They have cried wolf before, making similar statements in the past, so, unfortunately, it's a wait and see. I would take the phrase "in early 2024" as initiating Beta testing in the first quarter of 2024 - which is now. They will be reporting 4th Quarter results in about 4 weeks, which historically, is about the only time investors receive updates. Reporting results of last quarter will most likely not include any specific data in any Beta testing which was recently initiated, at best, I would hope for a statement indicating that they have begun beta testing of the SpinDx platform. I guess we will know in the next month...

And yes, I agree that Lifeloc should start to make more public press releases, rather than relying on reporting results in quarterly reports, which no one reads -except the few people that are already following the stock. The problem with press releases, is that if they are not meaningful releases, they simply attract short sellers in to profit off of the recent interest, due to a "Fluffy" press release, with no material things to report. Because of this, I still put my trust in Lifeloc's management, and believe that if they do start to initiate any press releases, that they believe they have what it takes for positive momentum, and follow through with the stock price. This is just my opinion.

Best of luck to everyone !

Maybe one day we will see Lifeloc have a similar chart to HOLO. We deserve that for being so patient.

Essentially, Hound Labs is replicating the same thing that Lifeloc is trying to do and that company is valued anywhere from 50 to 200 times that of Lifeloc.

I just want to see some changes being made. Hit us with some updates and fire up social media outlets. Something needs to change here. The overall market continues to hit new highs and Lifeloc continues to trade near all time lows. This is absurd.

Wouldn't it be nice to also find a video where the police force is using Lifeloc's SpinDx device to test for drugs of abuse. We are working on 8 months now with no updates or any indication of progress being made. No volume in the stock tells me no one is interested anymore. People have lost hope.

Amazing to me that garbage Chinese stocks like HOLO, HKIT, CCTG can go up 100's of percent in a day, but a real company like LCTC with hardly any shares in the float can't participate.

Over the weekend I was watching “on patrol live “ and officer puller over driver and had to administer breathalyzer and the device was Lifeloc’s !!!!

Don’t you just feel like they could be doing more with the resources they have? The lack of urgency is concerning.

Market sits at all time highs across the board and Lifeloc once again trades near/at all time lows. Market cap is again less than $5 million.

We need something to change here. We have heard nothing since the annual conference call 7 months ago. For 3 years we have gotten excited and once again nothing. How is everyone not just tired of this.

We need to get someone in there who can make moves in a positive direction and not just talk a good game.

In reply to Hound Labs "cannabis testing trends." Here's an often overlooked segment of Lifeloc Technologies....

10 years ago, Lifeloc purchased the leading company in the field of drug and alcohol testing regulations, and training. STS is the Leader in Employee and Supervisor Online Drug and Alcohol Training for all DOT and Drug-Free Workplace Requirements.

If you click through their different headings >Home,>About Us, and > Resources, I think you will find it quite impressive...

https://www.stsfirst.com/STSStaff.asp

Drager and Abbott are multi-Billion Dollar Market Cap Companies, and have invested Millions in the R&D of Oral Fluid Testing devices. It's time for Lifeloc, the little 7 Million dollar market cap company, to come forward with their device, and put it up to the test with the "Big Boys..."

I think they will shine like a diamond...

https://www.mprnews.org/story/2024/01/05/coming-soon-to-minnesota-roadways-oral-tests-for-marijuana-other-drug-use-by-drivers

Is Lifeloc building a better mousetrap...? The current move in roadside testing for drugs of abuse is "Oral Fluid Testing."

The NDASA - National Drug & Alcohol Screening Association has begun a set of nationwide, Department of Transportation Oral Fluid Collection Training classes, to prepare for the movement toward oral fluid testing for drugs.

There are currently several options available for oral fluid testing by two of Lifeloc's competitors - Intoximeter, and Drager. Intoximeter teamed up with Abbott Labs, and is currently the distributer for the Sotoxa Mobile Test System. Drager is currently marketing their Drager Drug Test 5000 to Law Enforcement officials. The problem with both of these systems, is that they are a +/- result only, which does not put a number to the level of impairment. Samples must further be sent to a lab for further analysis after a positive sample is identified.

Lifeloc claims that their unit will give a quantitative result of the oral fluid test, meaning that the result will be shown as a value in xx ng/ml, at roadside. This is a huge advantage of Lifeloc's SpinDx technology.

The following was recently released by the National Conference of State Legislatures, by their senior editor, Mark Wolf...

Drugs Appear to Be a Factor in Rising Impaired Driving Crashes

States are boosting oral fluid testing and toughening laws on ignition interlocks and impaired drivers who cause fatalities.

By Mark Wolf | December 11, 2023

police traffic stop nighttime

Analyzing an oral fluid test sample generally takes a few minutes. Twenty-seven states have laws authorizing some form of oral fluid screening.

Drunken driving is one thing that makes driving increasingly dangerous. Combined with drug use, it can be quite another.

The latest available statistics reported that of the nearly 43,000 people killed in motor vehicle crashes in 2021, 31% of those fatalities involved alcohol-impaired drivers—a 14% increase from 2020—and 18% involved a driver who tested positive for two or more impairing drugs

“That’s pretty sobering and a real crisis on our roadways,” Kelly Poulsen, senior vice president of government relations for Responsibility.org, told a session of NCSL’s Base Camp on impaired driving.

Annie Kitch, a senior policy specialist at NCSL, says driving under the influence of drugs appears to be a factor in the increasing number of impaired driving crashes.

“One thing that’s critical to point out is that it is difficult to track drug-impaired driving because we don’t have enough data regarding drug prevalence in impaired drivers,” she says. That’s because impaired drivers are often tested only for alcohol, not drugs.

Interventions to Combat Impaired Driving

“More states are exploring roadside oral fluid testing as an alternative to identifying drug presence in drivers,” Kitch says. “Most of us are familiar with roadside breath testing for alcohol with a breathalyzer. But similarly, roadside oral fluid testing involves a law enforcement officer who observes signs of impairment.”

Fluid testing involves using a cotton swab or other absorbent collector to take a mouth fluid sample. Analyzing the sample generally takes a few minutes. A positive result can help establish probable cause in a court case. However, the test only measures the presence of a drug, not the amount.

Even though 27 states have laws authorizing some form of oral fluid screening, only Alabama and Indiana currently have active programs, Kitch says. Other states are studying whether oral fluid tests can be a sustainable method to police cannabis in DUIs.

Other interventions to combat drunken driving include ignition interlocks, which are devices installed in a vehicle to prevent it from starting if a certain amount of alcohol is detected on a driver’s breath.

“Studies are currently showing that these devices can reduce DUI recidivism by about 70%,” Kitch says.

The devices have stopped more than 20 million attempts to drive drunk after alcohol consumption over the last decade, according to the Coalition of Ignition Interlock Manufacturers.

“However, despite their noted benefits, and the fact that every state has an ignition interlock law in some form, the industry is seeing that there are still relatively low installation rates,” Kitch says. “States are really working to revise these laws to ensure that the individuals who may qualify to install these devices in their vehicles are installing them in order to help keep the roads safer and use the devices properly.”

More states are passing laws that require all offenders, including first-time offenders, to install an ignition interlock, she says, adding that some states are enacting or considering legislation requiring impaired drivers convicted of vehicular homicide to pay child support for their victims’ surviving children.

“This is legislation that we saw take off like wildfire in 2023,” with at least 19 states considering bills requiring impaired drivers to pay child support if a parent is killed in a wreck, Kitch says. Tennessee was the first to enact such legislation in 2022, followed by Kentucky, Maine and Texas in 2023.

“We are eager to see if it continues in 2024 throughout the bulk of the legislative sessions,” she says.

Mark Wolf is a senior editor at NCSL.

As a stock, LCTC has been trading in a $2 range for well over a year now with a low of $1.50 and a high of $3.35. That’s a long consolidation time period and should make a fairly significant moves once it breaks out. I don’t expect it to break to the downside but as we all know anything is possible.

There’s a chance that Lifeloc has its highest revenue year ever in 2023 and of course we have been patiently waiting for any updates on the SpinDx technology/marijuana breathalyzer.

If we want to see this stock go anywhere this year $3.35 is a very important price level to break above with some volume and then we have some resistance at $4.00 and $5.00. After $5.00 it’s possible we see a quick move up to $10.00.

2024 Cannabis testing trends to watch article put out by Hound Labs:

https://houndlabs.com/2024/01/11/cannabis-testing-trends-to-watch-in-2024/?utm_source=pardot&utm_medium=email&utm_campaign=blog

If I had F-U money and wanted to have some fun here's what I would do:

I would place 100,000 share bid starting at $2.50 and increase that bid a penny every new trading day until I started to get filled. I would eventually take down the entire rest of the available public float and just wait until news knowing that the only sales that could possibly occur would be from Lifeloc insiders and in the entire history of Lifeloc there has not been any insider sales. I know we talked about this before but it would essentially be owning the float and praying that Lifeloc makes good with its promises about its SpinDx technology.

I would also guess that the previous insiders are out of the stock, but that still leaves only 320k shares which is unheard of. With that tiny a float any good news should send this skyward. From the end of 2014 into early 2015 this went from $3 to $34. No reason that's not possible this time.

Here's some interesting findings on Lifeloc's share structure and Insider ownership:

Current information has the following insider ownership:

Vern: 1,889,445 shares

Donald: 1,000 shares

Robert: 185,979 shares

Wayne: 51,200 shares

Michelle 5,000 shares

Michael 1,000 shares

Total insider ownership = 2,133,624 shares

Total shares outstanding = 2,454,116

Total available public float = 320,492 shares

Previous insider ownership from individuals who are no longer associated with Lifeloc:

Barry Knott: 64,125 shares

Mark A Lary: 50,000 shares

Alan Castrodale: 50,000 shares

Robert Summers: 11,500 shares

Gurumurthi Ravishankar: 10,000 shares

Kristie LaRose: 7,500 shares

Total shares owned by previous insiders = 193,125 shares

Current float of 320,492 minus the shares owned by previous insiders 193,125 = 127,367 shares

That means there is only 127,000 shares available to the public that are not owned by current or previous management. I do believe that previous CEO Barry Knott and some of the previous management may have sold some of their shares which would add to this number but it's still a very small number of shares currently available.

We gotta get this thing moving!

Hound Labs has revenue of $34.8 Million according to Growjo (https://growjo.com/company/Hound_Labs). That's just from October of last year when they first started selling their device. If they have the same results this year it would equate to about $140 million in revenue.

We also know that back in 2017, Hound Labs had an approx valuation of $31.5 Million (https://www.cbinsights.com/company/hound-labs/financials) and crunchbase as of Sept. 2021 has a post-money valuation in the range of $100-500 Million (https://www.crunchbase.com/organization/hound-labs/company_financials). I think it's fair to say that 2 years later it would be safe to value Hound Labs at $300 million.

If Lifeloc's SpinDx device can sell just a tenth of what Hound Labs device has done, I would expect at least $14 million to be added to Lifeloc's revenue and a valuation of $30 million. That's about 5 x from where we are today.

We have been more than patient with this company and it's time for us as long term investors to be rewarded. 2024 is your year Lifeloc. Let's see some magic happen!

I also noticed that Lifeloc is registered as an exhibitor and a sponsor at the 2024 IACT Annual Conference during April in San Diego (https://iactonline.org/Annual-Meeting) and will also be at the 2024 IACP during October in Boston (https://iacp2024.mapyourshow.com/8_0/exhview/?orsearchtype0=exhibitor&orsearchvalue0=1797173&orsearchdisplay0=Exhibitor&orsearchvaluedisplay0=Lifeloc%20Technologies&selectedBooth=2370)

The sector does seem to be in play again and BLOZF had a nice move recently.

Wayne even posted on Linkedin recently (https://www.linkedin.com/in/wayne-willkomm-980b4b5/) but there social media presence is just absolutely terrible.

Still wondering if Hound Labs decides to go public this year now that revenue is coming in. That's another possible catalyst for the group.

May 2024 be the year of great things at Lifeloc!

I would be surprised to see a high volume drop in price like we saw last year, but you never know. Last year, I made 7 purchases during this period, and I'll be ready again this year, should it occur again. It currently appears that there is some interest gaining in the sector, with volume and price increases in stocks like TLRY, LCTC, CGC, BLOZF, etc...

There is a lot of stimulus in the months ahead, including possible re-scheduling, the Presidential election, Lifeloc claims they will be releasing their SpinDx device for Beta testing very soon, with full scale commercialization by the end of this year. I know they have said this before, and hopefully they aren't crying wolf this time. Lifeloc is also presenting at National Drug & Alcohol Screening Association's Annual Conference and Trade Show this May, in Hershey Pennsylvania, which is the largest annual event in the drug and alcohol testing industry - all the big players will be there. Hopefully Lifeloc has something meaningful to display at the show, they do have a nice, corner location of their booth #49, near an entrance/exit.

Hopefully, the CEO will continue to buy more shares on the open market - which I must admit, is a very positive sign...

Today was the most volume we have seen in Lifeloc in over 4 months. January 4th last year saw volume of over 20,000 shares and an all time low of $1.35.

We really need to see some volume and a break of the $3.35 price level to get things moving.

Let's see if there's any repeat of last year

The selloff in January was most likely a selloff triggered by technicals. Some investors may have had stop-losses in place near 52 week lows, which were triggered, causing a greater sell-off. Notice the price bounced back slightly, equalized, and doubled in price by August.

Hopefully Wayne can help hold a bottom around 2.25 - if he continues to buy in his previous buy price range of 2.22 - 2.25, and it currently looks like there is some buying interest at these levels. Some news before the next earnings release would be nice, but I wouldn't count on it. Most likely see some sideways movement through January/February, going into earnings in March.

Happy New Year !

Last day for 2023 tax loss selling but does anyone know why in first 3 days of this year, LCTC traded 32,000 shares mostly on the sell side?

That's probably more shares traded in 3 days than we have done all year.

Does anyone remember news coming out or an article being published that would have caused this?

Here's to 2024 being a much better year for Lifeloc!

Dear Wayne, why not just take down the whole Lifeloc float in one shot and call it a day?

https://ih.advfn.com/stock-market/USOTC/lifeloc-technologies-pk-LCTC/stock-news/92851842/form-4-statement-of-changes-in-beneficial-owners

I was wondering if anyone from Lifeloc was going to buy any stock down here. This is the third year now we thought we were going to have some results from the SpinDx and marijuana breathalyzer and nothing.

Let's see if he is still in the market to buy while the stock in the low $2 range.

I still don't think anyone really cares about this stock or it's future and management has made it this way.

BLOZF market cap sits at $20 million. SOBR market cap is $8 million and Lifeloc is at $5.5 million.

I'm asking Santa this Christmas for a new management team at Lifeloc. Someone needs to come in a make this thing happen.

Small purchases by Wayne the ceo. Good to see.

Last year around the middle of December, Lifeloc had a severe sell off (tax loss selling/harvesting) that cut it's value in half.

I'm wondering if we see anything similar towards the end of this year. I don't think there's too many shares in either direction right now so someone who wanted to either sell or buy a couple thousand shares is definitely going to move this stock.

Obviously it would be great to have some positive news towards year end but I'm not holding my breath. This is the third year as investors we were looking forward to seeing some news by the end of the year and nothing. I continue to think a new team running this ship would make all the difference.

According to Forbes, Hound Labs has an estimated $400 million valuation:

https://www.forbes.com/profile/mike-lynn/?sh=7ba7ea02396e

That puts Hounds Labs at about a 53x valuation to that of Lifeloc. I'd love to see what the team from Hound Labs would do if they were running Lifeloc.

The accumulated deficits that originated from the company losing money can offset taxable income in future years.

Can’t they write the accumulated deficit off future profits down the road ?

Accumulated deficit doesn't have to be paid back, it just reduces shareholder's equity. So basically it reduces a company's book value.

Accumulated deficit is the amount of losses accumulated over the years, it is not debt. It reduces shareholders equity.

Since Lifeloc's earnings report, it has traded a total of less than 100 shares - No one cares!

Lifeloc's Management has made it so that no one cares. And it would take a miracle to hear something from them before the end of the year. Feels like the same pattern just repeating itself.

I wish we could just get a team in there that is focused on getting things done and believes in communication with shareholders. The business has so much potential if it just could be executed properly.

Accumulated deficit is just the amount of debt that has been accumulated through the years.

I have looked at their financials, but you can see that current debt number (what is owed) under liabilities.

Thanks for the insight. So help me to understand - does accumulated deficit ever have to get paid back? Who does is get paid back to? If the company does start to become profitable, do they start to pay it back? Can they be a profitable business if the accumulated deficit is still negative?

Thanks!

It is frustrating, but this is one of those situations where it can go from $3 to $20 in a week. I just hope it happens sooner rather than later.

This lack of volume-interest-communication is just getting old. Insiders could be buying shares every week or starting to announce developments. Then you get random 15 share trades out of the blue that make zero sense. I like the idea but my patience is starting to run out. Almost 10 years since my first purchase. Sadly I need the stock over $9 just to match the performance of S&P 500.

Accumulated deficit isn’t currently owned debt… just so you know

I find this amazing:

SOBR has an accumulated deficit of $85,224,294 and quarterly revenues of $36,274. That would take 586 years just to break even. They lose over $2 million each quarter and have diluted shareholders by over 5 million shares in the past year.

BLOZF has an accumulated deficit of over $32 million and has never had revenue or produced a sale of anything.

In what universe do either of these 2 companies have a market cap that's over twice that of Lifeloc who has never diluted shareholders, has the potential to have a $10 million year and has no accumulated deficit?

Astonishing to say the least.

Lifeloc's management team really deserves credit for increasing net revenue for the past 9 months, compared to a loss for the same period last year - despite the 65% increase in the cost of research and development... While other OTC companies are issuing shares of stock, and doing dilutive financing through convertible debt deals, and death spiral financing to finance their operations, Lifeloc has continued to grow organically - without digging themselves (and us) into a hole... Keep up the good work !

If they can maintain quarterly revenues at this pace, Lifeloc could have a $10 million year which I believe would be a first for them as a company.

My concern is that we have another 5 months before we hear from them again. That cannot happen. We really need to get some updates from them in the form of PR’s and news releases before this year is over.

Does seem like things are moving as fast as they can, seems positive.

The September quarter was helped by a tax benefit, but sales were up nicely.

|

Followers

|

21

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1901

|

|

Created

|

02/23/14

|

Type

|

Free

|

| Moderators | |||

Lifeloc (OTC:LCTC) is a public company established in 1983. We introduced our first breathalyzer to the US Department of Transportation in 1988. We are an American manufacturer of professional-grade, platinum fuel cell based instruments for alcohol detection, measurement and enforcement.

Since our founding, our corporate mission has been to build the most precise, reliable and easiest to use breath alcohol testing devices in the industry. We take pride in offering everything an organization requires to establish an effective alcohol monitoring program including equipment, mouthpieces, factory authorized training and certifications, and a complete line of alcohol testing supplies and calibration equipment.

-Today, our highly accurate and reliable fuel cell devices are the preferred choice by professionals in countries around the world. We back everything we sell with exemplary customer service and technical support.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |