Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I agree... If Lifeloc's Market Cap was equal to Cannabix, it would put LCTC's share price over $16.

When I google search "Lifeloc technologies public stock float" the results show:

"As of September 4, 2024, Lifeloc Technologies Inc.'s (LCTC) public stock float was 139,260 shares.

A stock's float is the number of shares that are available for the public to buy and sell. It doesn't include restricted stock held by insiders, but if insiders sell their stock, it becomes part of the float."

Marketwatch.com also confirms that number:

https://www.marketwatch.com/investing/stock/lctc

There just cannot possibly be that many publicly traded shares left that are not being held by long term investors.

Using those float numbers, the entire public market available for non-insiders is valued at just $584,892.

I know I'm not selling anytime soon and I have to imagine those on this board are locked up also so my point is if we get some really market moving news and we don't hold it down with shares to sell, it could move up very quickly just like Energy Manager said. Ideally I would like to see us get up there to at least in-line with the Cannabix valuation before we start seeing the news releases from Lifeloc.

#LCTCNoSharesToSell

#LCTCLockedUp

A quick review of the Cannabix (BLOZF) latest quarterly earnings report continues to show no sales, no revenue, no product, a quarterly loss of $1.25 million, more dilution to current shareholders, and an accumulated deficit of over $38 million. They are spending $14,000 each day to fund activities with no source of revenue and investors continue to value this company 4 times that of Lifeloc. It's time for Lifeloc to finally play some catch up.

I'd love to see some news releases/PR's from Lifeloc regarding the SpinDx progress before the end of this year. Something that will sustain momentum to the upside and bring in some buyers of the stock. Something that catches the attention of investors during the "perfect storm" of upcoming events.

Busy month for Lifeloc:

Upcoming Lifeloc Technologies exhibitor conferences:

SAPAA (Substance Abuse Program Association) Oct. 6th-9th

The ANESTHESIOLOGY 2024 annual meeting October 18th - 22nd

IACP (International Association of Chiefs of Police) Oct. 20th-22nd in Boston, MA

It's probably pretty fair to say that we probably won't hear much about their new product until the next earnings release, which is still over a month away. This should coincide closely with the November election, which I can only see as being a positive for anything marijuana related, due to both candidates stance on legalization.

As I have stated before, it is very important to understand that legalization of cannabis, does not mean that it will be legal to drive an automobile while impaired by marijuana, alcohol, or any other drug of abuse, including OTC drugs. The timing of Lifeloc's new device, that will provide a quantitative measurement of THC in a subject, could not be more appropriate for the "New America" in which we now live, where more adults now use marijuana daily, than alcohol. I would say that Lifeloc has all of the bases covered, and this is setting up to be the "perfect storm..."

I can also say, with some confidence, that all of the recent insiders purchasing their company's stock, did not buy the stock because they feel the price will be going down in the near term. That simply would not make sense. It's my opinion, that a $40 per share price is not unreasonable, and could be obtained very quickly, due to the very tight share structure of Lifeloc's common stock.

Patience...

"Lifeloc will be at SAPAA, exhibiting our core alcohol testing products. The SpinDx is not yet ready for open public display. Yes, we will be in training sessions, staying current on the latest training is important to us as it is a significant part of our revenue."

I believe some of the marijuana/cannabis stocks are moving higher today on this comment:

Kamala Harris Says 'We Need To Legalize' Marijuana For First Time As Democratic Presidential Nominee

Lots of gems in this years Letter to Shareholders:

https://lifeloc.com/pub/media/pdf/shareholderLetter2023.pdf

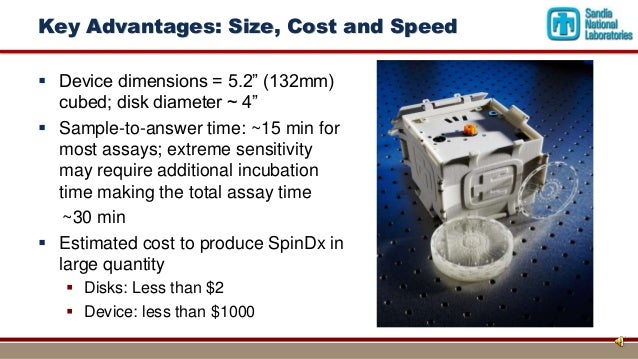

Our SpinDx™ technology platform or "Lab on a Disk", which we anticipate bringing to market in 2025, consists of a series of devices and tests that can be used at the roadside, in emergency rooms and in workplace testing to obtain a rapid and quantitative measure for a panel of drugs of abuse. The SpinDx reader is the base product, which we anticipate will ship with the ability to read disks for delta-9-THC detection from an oral fluid sample collected from a test subject. With firmware updates, we expect the SpinDx to be able to read future disk offerings for a broader array of drug panels. Firmware updates will be available to customers through a subscription model, with disks and sample collection kits as consumables, together producing a potentially significant recurring revenue stream.

We anticipate that both quantitative and pass/fail disks will be made available, which would make this offering the only rapid, quantitative saliva test for delta-9 THC available on the market. Following this we expect to release a system based on our LX9 breathalyzer to collect a sample for analysis from breath, which, coupled with the SpinDx reader, we expect to complete our marijuana breathalyzer system.

We have improved the detection sensitivity for delta-9-THC as well as the robustness of the device. Our first utility patent application was filed in early 2024 covering some of the improvements that we have made on the SpinDx technology. We are continuing to work on developing this system into an easily portable device that can be used for roadside testing, as well as other venues requiring fast response. We have committed additional personnel and new equipment resources to this effort, with the goal of placing beta test units in 2024 with validation partners who have already been identified. We anticipate full commercialization and revenue contribution to begin in 2025. Human trials have begun validating SpinDx detection of delta-9-THC at the detection limits of 10 ng/ml in real-world human samples. We intend to prioritize the acceleration of SpinDx even at the expense of short-term profitability, with research and development investments, including validation testing, expected to remain high in 2024.

I am trying to find out if Lifeloc will be presenting or attending any of these oral fluid testing training modules. I also asked if there is any chance that the SpinDx prototype will be available for display to attendees.

This should be an interesting conference next weekend, as pdicamillo stated. Very heavy on oral fluid testing...

https://www.sapaa.com/mpage/2024conference

Take a look at what a low float stock can do with the right news:

TNON was a $4 stock yesterday and hit a of $125 in the pre-market today. TNON has a float similar to that of Lifeloc at 455,560. Both working on types of drug devices.

Someone got 500 shares for 3.40 right at the open today

Do you think the topic of cannabis/marijuana will be brought up at tonight’s debate?

Fantastic close right at the highs. We haven't seen the mid $5.00's in close to 3 years. Very thin in both directions. Could you imagine if someone wants to build a sizeable position and just has to continue to buy the offer.

Chart looks great. Let's pray this volume continues to the upside.

Breakout to new 52 week highs - on no news. These are the strongest kind of breakouts.

It really does seem like it's the perfect storm of events for drug detection devices.

Yesterday we saw about 1% of the float trade into stronger hands up near 2 year highs. That's a good sign.

What I'd love to see is a grant or funding come from Sandia or the state of Colorado to help Lifeloc get a push through the finish line. I don't think either of those are completely out of the question.

Yes, could be some interest brewing from the shows, or the fact that both Presidential candidates are now pushing for legalization of marijuana in the US. President Trump is now all-in on the rescheduling, and legalization of marijuana, and will be voting to legalize marijuana in his home state of Florida. Statistics show that more people use marijuana daily than alcohol, and this number will only continue to grow as more and more states legalize it. The important thing to remember is that as marijuana becomes legal in more states across America, and in other countries - it will never be legal to drive while impaired by alcohol, or any drug, legal, illegal, or even over the counter drugs. This includes cannabis.

The timing of the Beta testing for Lifeloc's device could not be better positioned, as the marijuana sector builds momentum going into the November election. Hopefully this will coincide simultaneously, and we will see a growing interest in Lifeloc's common stock, as state or local police forces start testing the device in real life situations. Lifeloc has stated that they have Beta testing in place, and are looking to add more agencies to the list for additional testing - which is expected to begin this year.

Maybe someone saw something at the GHSA safety conference over the weekend that they thought was worthy of an investment in Lifeloc. Volume has been dead up until today.

First things first - let’s get this thing through $5 and upwards and onwards to $25!

These Expos and conferences seem like they would be the perfect opportunity for Lifeloc to show the SpinDx prototype and hand out information on the device. Start building interest and taking preliminary purchase orders so when it's ready to go, sales and revenues can happen from day 1.

I don't see why this isn't the plan. Why not build some interest at these shows where everyone attending is a potential customer?

What’s it going to take to crack above $25

Lifeloc is an exhibitor at this weekend's GHSA (Governors Highway Safety Association) in Indianapolis Sept. 7th-11th.

Sadly there is no mention of the SpinDx drug detection device being introduced or presented.

From Lifeloc's LinkedIn:

Visit Lifeloc at Booth #216

Stop by for a demo of the LT7 portable breath alcohol tester and the EASYCALG2 Automatic Calibration Station.

Lifeloc’s breath alcohol testers cover the full spectrum of police use from economical alcohol screeners to portable roadside evidential devices provisioned with printers. All devices come standard with both passive and direct testing and depending on the unit include a variety of features. These features incl extensive test memory, wireless keyboard and printing, remote web-based diagnostics, and software tailored to the specific needs of your agency.

When used with the Lifeloc EASYCALG2® station, the FC and L Series instruments offer fully automatic calibration, calibration verification and record keeping functionality whether in the field or the lab.

Lifeloc's portable breath analyzers are US manufactured, CE marked and NHTSA approved as evidential instruments. International certifications are available

Better PR by Cannabix. If people knew Lifeloc's advantages the valuation spread would narrow.

Cannabix earnings shows a loss of over $3.1 million in their latest fiscal year and is running a total deficit of $37.4 million.

Can someone explain to me how the collective market participants are valuing Cannabix 4 times that of Lifeloc fully knowing that Cannabix only has a device that is able to detect marijuana and Lifeloc has a device that is capable of not only detecting multiple drugs of abuse but also gives a quantifiable test result for each of those drugs. Still baffles me to this day.

"The additional disc Parameters can open the device to a much broader scope of testing capability in the future":

Can we please add MPOX diagnostic tests to the list:

https://www.who.int/news/item/29-08-2024-who-urges-rapid-access-to-mpox-diagnostic-tests--invites-manufacturers-to-emergency-review

"Expanding access to diagnostic services is urgently needed as tests are essential to critical measures such as strengthened laboratory capacity, improved case investigation, contact tracing, surveillance data collection, and timely reporting. As a package, these help countries identify chains of transmission, detect cases early, prevent further spread, and monitor the virus in real-time. The establishment of Emergency Use Listing procedures for mpox diagnostic tests will help advance towards this goal."

It looks like Lifeloc is not presenting or showing the SpinDx drug detection device but at least they are "discussing" the device with interested parties and claim they are generating significant interest from attendees.

I'd consider that a win.

From the recent IACP (Impaired Driving & Traffic Safety Conference) that Lifeloc attended on Aug. 16th-18th:

Innovating Roadside Alcohol & Drug Testing

Lifeloc Technologies recently attended the IACP IDTS Conference in Washington DC where we had the opportunity to showcase our latest products and innovations. Our team had the pleasure of demonstrating our full line of breath alcohol testers, which are widely used by law enforcement agencies nationwide. In addition, we discussed our upcoming saliva drug testing device which generated significant interest from attendees. We are excited to announce that we will begin initial beta testing later this year, specifically testing for delta-9-THC, the primary psychoactive substance in cannabis. Our team appreciated the positive feedback and interest from attendees; we welcome any agencies interested in being added to our beta testing list to contact us.

At Lifeloc Technologies, our commitment to advancing and enhancing testing solutions reflects our dedication to public safety and effective enforcement. We look forward to continuing to innovate and support the vital work of law enforcement agencies across the country. Lifeloc’s SpinDX technology for detecting delta-9-THC in saliva could be a significant step forward in drug testing and enforcement.

Stay tuned for updates on our progress and the release of Lifeloc’s drug testing device.

Update on the Lifeloc SpinDx Patent Info:

The US patent office routinely publishes applications 18 months after the application priority date, which in this case was the filing of the provisional patent in February 2023. The publication of the application has no bearing on the grant of the patent, and this patent has not yet been granted. I do not believe the publication of the application really is noteworthy and so there is no press release on it. The publication of the application does give us a little more freedom to talk without the worry of releasing too much confidential information, as the whole application is now available publicly.

We have not yet received any communication from the patent office regarding the acceptance of this application, and with their typical timelines, probably will not hear anything before next year.

Receiving a grant of this patent certainly will be a news worthy event.

After looking into it further, it looks like NIST is working with the University, not in conjunction with any company, but to support the industry as a whole. NIST is an agency within the US Dept. of Commerce, that, in part, works to advance measurement science, standards, and technology, to promote industrial competitiveness, and improve quality of life.

They see the need to standardize the measurement of THC in Breath Samples, and are working to provide the science and measurement standards for a reliable way to validate testing in breath samples. Simply put, they have Lifeloc's back. It's a government agency, working to prove the validity of testing for THC in the breath, which they say, may take a couple of years...

In the meantime, Lifeloc was on the correct path, by focusing on saliva based testing, which is now becoming widely adapted, and the testing method of choice for our current time. As NIST works in the background, Lifeloc can continue to adapt their technology to utilize breath samples vs saliva, after they have commercialized the SpinDx, saliva based test.

Is it safe to assume that it's this line your referring to:

"We continue with validation testing utilizing actual human samples obtained through the Colorado School of Public Health at the University of Colorado Anschutz, with results to date confirming SpinDx performance."

Have you seen any other information that links Lifeloc with the University of Colorado?

Once again, excellent find!

The need for a device to detect recent THC use is evident, and lawmakers, and our government want to bring it to fruition as soon as possible. More news, this time, much closer to home - working with the University of Colorado. Lifeloc is currently working with the University of Colorado, in testing of human subjects with their SpinDx device, so something tells me that there may be some sort of collaboration here ?

https://www.marijuanamoment.net/federal-researchers-explore-paradigm-changing-approach-to-detect-recent-marijuana-use-through-breath-tests/?

This article is a good read for further clarification on the Sandia and Lifeloc SpinDx technology agreement:

https://labpartnering.org/success-stories/77c61f75-d247-4bf9-9164-4285a9159ae8

Quick question - Do you know if Lifeloc has ever talked about or mentioned the accuracy or reliability of the SpinDX drug testing device?

The other drug testing devices on the market are not very accurate. The Drager 5000, Sotoxa unit and Hound Labs device have never been praised for their accuracy.

Do you think the technology used by the SpinDx device would be the most accurate one on the market?

Thanks!

They have been traditionally slow to release pertinent information, if at all, until their quarterly reports. I have a feeling this may soon change, as their device nears completion. I only found the patent info by chance, a few minutes before the market close. Maybe we will here something early net week, which would be better than a Friday afternoon anyway.

It is a valuable piece of information, and should be treated as material news, and a press release should be issued in my opinion.

Good question. I'm sure that if it was not covered under the current licensing agreement, that Sandia would be open to discussing further applications. I think it's important to not get too excited about future diagnostics, and focus on the goal at hand, which is the development for drugs of abuse, firstly, THC.

I do find the inclusions that were listed, are very intriguing, and could be very valuable in the future. Lifeloc has it in their "back pocket," for now, and everything is starting to fall into place, and we, as early investors, should find this very exciting...!

Can you see any reason as to why Lifeloc would not publicly announce the updated SpinDx patent information?

It continues to baffle me how the market can value Cannabix 4 times that of Lifeloc. A company that continues to lose over $2 million each quarter and will most likely never have a device that can quantitatively measure any type of drug.

In my opinion, Lifeloc should at least be double the value of Cannabix. The market does not see it this way. Hopefully it’s time to play some catch up.

Not sure about cancer and diabetes, although there has been studies done on early detection from breath samples. I think the value of the device, is that it will be able to give immediate, non-invasive results for the items listed in the patent app.. This can prove to be invaluable to first responders, in sporting events, bodybuilding competitions, mass outbreaks of GI or Respiratory Dx, pandemics as we witnessed with COVID, etc...

From the original licensing agreement between Lifeloc and Sandia, it allows Lifeloc to develop and market the SpinDx technology to detect drug abuse.

How does this fit into the other applications of food and water safety, medical diagnostics, illness, performance enhancing drugs, bio-agent detection, etc.

This makes it sound like the SpinDx device becomes infinitely more valuable. They are talking about detecting illness, disease, infections, performance enhancing drugs, food borne issues, etc.

Any chance that the device could detect the early onset of cancer, diabetes, etc. from the results on the disk?

You would have to think multiple companies would have an interest in this type of detection device.

The additional disc Parameters can open the device to a much broader scope of testing capability in the future - such as immediate, on site testing for anabolic steroid use - Stanozolol and Oxandrolone, respiratory diseases and viruses - including COVID, gastrointestinal infections from E Coli, Listeria, and Salmonella, etc...

Although this is not the immediate scope of intention for the device, which is currently focused on detection of THC, and secondly, detection of other drugs of abuse, including Fentanyl, Meth, and Cocaine, it gives them the ability, and protection from a provisional patent, to expand their product line vastly in the future...

Patents almost always add value to a company in many ways. A patent application basically is a precursor to the actual patent. It gives the company a quick way to protect the invention for a year, while they put the finishing touches - testing, etc on the device. Basically a "Patent Pending" status. This about locks it up for Lifeloc, and it's intellectual property - giving Lifeloc a proprietary advantage over all of it's competitors.

I find the items I have copied from the Patent Application very, very valuable in my opinion...

9. The centrifugal micro-fluidic disk of claim 1, wherein one of the array of chemical detection sectors is a delta-9-THC detection sector.

10. The centrifugal micro-fluidic disk of claim 1, wherein the array of chemical detection sectors includes one or more of cocaine, methamphetamine, and fentanyl detection sectors.

11. The centrifugal micro-fluidic disk of claim 1, wherein the array of chemical detection sectors includes one or more of oxandrolone, stanozolol, and erythropoietin detection sectors.

12. The centrifugal micro-fluidic disk of claim 1, wherein the array of chemical detection sectors includes one or more of E. coli O157:H7, Listeria spp., and Salmonella spp. detection sectors.

13. The centrifugal micro-fluidic disk of claim 1, wherein the array of chemical detection sectors includes one or more of Streptococcus pneumoniae, Respiratory Syncytial Virus, and COVID-19 detection sectors.

14. The centrifugal micro-fluidic disk of claim 1, wherein the array of chemical detection sectors includes human or veterinary health diagnostic detection sectors.

Good find! I was able to access the link yesterday night but for some reason today I have been getting an "unauthorized" message.

Is this an actual patent grant for Lifeloc technologies for the SpinDx device?

This patent seems like it would be enough of a "material event" for Lifeloc to post a PR about it. Would it kill them to let the public know they were just granted a SpinDx technology patent?

You know if this were Cannabix, they would release this news everywhere and the stock price would benefit by at least 30%.

This seems like a big deal. Do you have any further opinion on it?

Also in the news:

https://www.marijuanamoment.net/polls-show-support-for-marijuana-legalization-rescheduling-and-industry-banking-access-in-three-key-battleground-states/

"As the November election approaches, a new series of polls shows widespread majority support for marijuana legalization, cannabis federal rescheduling and cannabis industry banking access among likely voters in three key presidential battleground states: Michigan, Pennsylvania and Wisconsin."

In the News...

“There are now more options for officers to test for cannabis, and as a result, this has led to an increase in the detection of drug-impaired drivers.” Mathew Austin, Saskatchewan Highway Patrol

The majority (65%) of carriers and drivers surveyed have indicated they would prefer an industry-wide shift toward a test that indicates recent marijuana use (for example, the day before) instead of the current test that can identify earlier marijuana use.

There are different testing methods, and currently, in Canada, urine and oral fluid tests play roles in identifying recent versus past drug use. Davids explained that urine tests, for instance, detect substances over a longer period.

Meanwhile, oral fluid tests – which have been gaining increased popularity – are more effective in identifying recent use, particularly for THC, within the last 12 to 24 hours. Meanwhile, hair testing is not widespread since it detects cannabis use within one to three months, and blood tests are considered too invasive.

Driver Check, for example, uses oral fluid and urine tests to determine drug use.

https://www.trucknews.com/health-safety/canada-sees-steady-trends-in-marijuana-positive-tests-among-truck-drivers-since-legalization/1003187827/

Lifeloc is also a Bronze sponsor at the 2025 annual IACT meeting on April 6 - 11, 2025 | Sahara, Las Vegas:

The International Association for Chemical Testing is an organization composed primarily of employees of governmental agencies involved in chemical testing related to traffic safety.

Drager and Intoximeters will also be exhibitors. This would be a great conference for Lifeloc to showcase the SpinDx device.

It does seem like they are exhibiting at as many of these shows as they can. We know one of the next steps is to start building some interest in this device and gaining attention.

Nothing too impressive with the earnings report. Increased spending on R&D which is what they need to do. Remember Hound Labs raised/spent over $100 million on their device.

We did get an updated photo of the actual SpinDx device:

It would be great if Lifeloc could get another grant from the state of Colorado to help get this thing across the finish line. Or even some funding from Sandia would be beneficial.

|

Followers

|

21

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1880

|

|

Created

|

02/23/14

|

Type

|

Free

|

| Moderators | |||

Lifeloc (OTC:LCTC) is a public company established in 1983. We introduced our first breathalyzer to the US Department of Transportation in 1988. We are an American manufacturer of professional-grade, platinum fuel cell based instruments for alcohol detection, measurement and enforcement.

Since our founding, our corporate mission has been to build the most precise, reliable and easiest to use breath alcohol testing devices in the industry. We take pride in offering everything an organization requires to establish an effective alcohol monitoring program including equipment, mouthpieces, factory authorized training and certifications, and a complete line of alcohol testing supplies and calibration equipment.

-Today, our highly accurate and reliable fuel cell devices are the preferred choice by professionals in countries around the world. We back everything we sell with exemplary customer service and technical support.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |