Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ohio law enforcement could soon perform rapid drug tests during OVI stops:

https://www.news5cleveland.com/news/local-news/ohio-law-enforcement-could-soon-perform-rapid-drug-tests-during-ovi-stops

"The bill would allow law enforcement officers to perform new fast-result drug tests in the field, among other things."

“They can do a swab of your mouth, test your saliva, and get an immediate result to know if you're under the influence of drugs or not,” Plummer said. “So, this is a game changer. It’s no longer having to take blood or urine and take it to the crime lab and wait months for the results. This is an immediate test.” Cuyahoga County Sheriff Harold Pretel said having saliva testing technology would be a game changer for the department.

The article fails to mention the name of the drug testing company or type of device they are using. But it does show the need for saliva based drug tests are increasing dramatically.

NIST Partners With the Gates Foundation to Develop Breathalyzers for Malaria and Tuberculosis:

https://www.einnews.com/pr_news/723094603/nist-partners-with-the-gates-foundation-to-develop-breathalyzers-for-malaria-and-tuberculosis

"Breath-based diagnostics may soon be used to identify or monitor the progression of a wide range of conditions and diseases, including liver disease, multiple sclerosis and cancer."

In recent years, scientists have begun identifying biomarkers in human breath — a so-called breathprint — that indicate when someone's been infected by malaria or TB. By developing sensors that can detect these biomarkers, researchers hope to build low-cost, easily deployable breathalyzers that can be used globally.

So much potential for a wide array of tests and conditions.

Lifeloc just made a post on Facebook, with a picture of the Spin Dx device, and thanked the shareholders for a wonderful Annual Meeting, and for their support...

I would like to see them expand the sales & marketing team and I'm sure that there is additional funding that is needed for molds, testing, disk finalization, etc. If more cash leads to faster/quicker acceleration to market, I am onboard that idea. I have always been a firm believer that they should be doing whatever it takes to get to market with this device. They are sitting on a potential billion dollar project and should be speeding across the finish line.

I want to see Wayne follow through with his statement that the time is ripe to get some help with social media awareness and to start letting people know this product is coming.

Completely agree! One question I thought of later is: if most of the R&D is done why do they need to raise money now? Shouldn't R&D expenses decline? They might have answered that by saying that the line of credit would allow them to borrow as they need, implying it won't be that much borrowing. I was happy to hear that they think they can get down to 5/ng detection when the device is made. Seems like 2025 could be quite exciting for Lifeloc.

10% growth in Lifeloc's alcohol business should put them at record revenues for the year and total revenue of over $10 million. It would be disappointing not to see them achieve this by the end of the year.

Wayne specifically mentioned "Performance enhancing drugs, food safety, human diagnostics are all additional sectors of the market that could be addressed" and stated that the market potential beyond drug testing is enormous. I have to look back into who Sandia has licensed the SpinDx technology in addition to Lifeloc and for what purposes.

Wayne seemed to have a firm grasp on competitors in the industry. He did mention that the current Draeger device is the closest competitive device on the market. I agree and think it would be great to see some type of collaboration with the big boys in this industry.

There was talk about an equity investment in the $5-$10 range and management seemed to at least be open to that idea. A current investor really wanted to get involved to help "speed things up" with an investment from a group he seemed to be well connected with. I have no idea if that ever leads to anything tangible but it certainly sounded like there are other interested parties looking to make a sizeable investment now that they know the SpinDx technology has proven itself. Obviously market acceptance is an unknown but Wayne assured everyone at the meeting that there is no longer any research that needs to be discovered but they still need molds and design finalization.

That's a win as far as I'm concerned!

Looks like their sales are now exceeding pre-pandemic levels, which is noteworthy in itself. Here's a copy of their PowerPoint presentation. https://lifeloc.com/pub/media/pdf/shareholderMeeting2024.pdf

Without getting too far ahead of ourselves, I'm curious as to what they have in mind when they state they plan on developing discs for testing beyond drugs of abuse? Is it medical testing for disease or viruses, such as Covid? Or could they be thinking rapid detection of biological agents - such as Anthrax, Ricin, Ebola, Botulism, Plague, Smallpox. Tularemia, etc...?

Looking far down the road, this could open a plethora of new revenue streams, including Homeland Security, Military, etc. I don't want to speculate too much on this now, just interesting that they included it in this year's Annual Report.

Another thing I don't want to speculate too much on, but interesting to note, that it sounds like they brought up Draeger more than once during the meeting. Draeger, a direct competitor of Lifeloc, has a Market Cap of nearly 1 Billion Dollars, is in 190 countries, and has over 16,000 employees. I have followed Lifeloc, and it's competitors, for many years, and can tell you that Draeger is keeping a close eye on the Marijuana/Drugs of Abuse Testing Sector, as well as the developments of Lifeloc's SpinDx device. I would not be surprised to hear more about discussions between these two companies in the future.

Great synopsis! Thanks for taking the time to do this. All very positive.

Line of credit is much better than dilutive financing ,but as I stated before, if Lifeloc could use extra cash to accelerate roll-out, marketing, etc., an extra 10 million + dollars in equity financing could be looked at very positively - as long as it was done with favorable terms. Quite honestly, if someone wanted to buy $10,000,000 worth of stock on the open market, it simply couldn't happen. So, Lifeloc management needs to keep shareholders in mind in regard to any equity financing. By this, I mean no death spiral financing, where every month, the company would issue shares of stock to the investor, at below market prices.

If I were management, I would consider this, but only do the deal at a price within 10% of it's current closing price, in one lump sum. This would also possibly achieve adding more liquidity in the trading of the stock, and possibly help meet criteria on eventually listing on a better exchange, such as the NASDAQ.

Everything else you summarized is very exciting, and we, as shareholders, should take a deep breath, and exhale. I'm sure there will be bumps in the road, but there is definitely beginning to be some light at the end of the tunnel.

Lifeloc Technologies 2024 Annual Conference call notes:

Profitable and cash flow positive to fund growth

Using full resources to pursue growth of the drug detection SpinDx device

Lifeloc still sees the company growing to $100 million and beyond

Spin DX technology utilized beyond drug testing. Over 2 million spent on research so far.

Recurring revenue from supplies and service should follow the increases in Alcohol device equipment sales

L series focus for core Alcohol product line

Rapid drug testing is best opportunity to grow revenue by multiples 2x, 5x, 10x is foreseeable

Legalization of marijuana just increases the demand for drug testing equipment

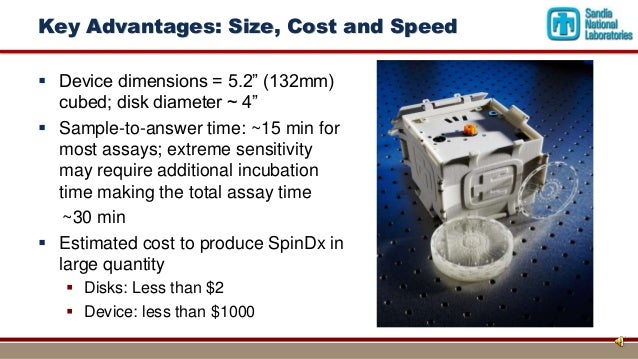

Sandia prototype with disk - real live functional prototype with firmware and inflection device

Current analysis time down to 15 minutes with 8-10 minutes expected in the near future

SpinDx demonstrated in lab to detect panel of drugs in saliva or blood

First US Utility and PCT patents filed for SpinDx technology

Testing beyond testing for drugs of abuse

Beta testing to begin Q4 this year

First product release will be a reader with collection kit

Questions:

1. 5 n/g spiked solutions. 10 n/g human saliva. Every reason to believe to get down to 5 n/g - that is the goal. We believe we will hit that target but still has yet be demonstrated. Some jurisdictions have taken 5 n/g 4 n/g or zero tolerance. Firmware will be able to call up different jurisdictions.

2. Beta testing – expected 4th quarter 2024

3. Not satisfied. No pre-market hype. Be careful to not hype so far in advance to lose credibility. Functional prototype was shown at the meeting. The time is ripe to start letting people know this product is coming.

4. On track to begin commercialization of saliva testing. No expected timeline for breath systems. Still a number of unknowns.

5. Cash is dropping and looking into ways to replenish. Close on a line of credit this month to plug a hole in cash.

6. Working on exact pricing strategy. Competitive to Draeger. Priced slightly under the Draeger device. $25 collection device. Price aggressively. Good margin. First quarter rollout small profit contribution is expected but grows rapidly.

7. US DOT issued rules for saliva testing but no methodology. Expect to satisfy the customers. Flexible and customizable software and firmware to do that.

8. Shareholder who attended the meeting and was in the room has been buying stock which is the reason for the large share prints recently.

9. Social media awareness - time is ripe to get some help for awareness.

10. Wayne agrees and is not satisfied with the current market cap. Company inherently more valuable now than in 2014. Tons of investment into SpinDX. Market value is unreasonably low. Confident that this is coming out next year.

Open floor to shareholder questions.

1 version of the SpinDx. Handheld device 2025. They have shown the SpinDx device only to a small group.

% of R and D expense - 65% towards SpinDx.

Design of disk and collection device are currently outsourced and are still being worked on by third parties.

Full panel of drugs - right around $25. Address every segment of the market depending on what's needed. Firmware will read the cutoff. 5 n/g vs. 25 n/g. Technology is readily available to be put into the firmware.

Other uses in addition to drug detection - Drugs of abuse current license. Performance enhancing drugs, food safety, human diagnostics are all additional sectors of the market that could be addressed, enormous market potential.

Expectation loaded with the reagents - will get there quickly with optimization and tuning.

How confident about testing and commercialization. Confidence is growing . We can identify everything that needs to happen. Reader is functional. Saleable today but they still need molds and design finalization. No longer any research that needs to be discovered - Just implemented.

Incremental to existing customer base - sales and marketing process - same customers base. Loyal customer base. Beta testing through current customers.

Sandia exclusive patent - modest annual fee to keep the license in addition to % of revenue from product. Lasts until last patent expires. 15 years left. The license of the device supports US manufacturing.

Competition currently on the market. Drager, Sotaxa saliva tester pass/fail - numbers for small panel of drugs. Hound labs - collect breath and send to lab. Not immediate. Days turnaround. Compete with Drager on price - flexibility to change drug panels and cutoffs.

Exceeding $100 million - 5 year achievable goal. Reasonable objective. Alcohol testing worldwide. Lifeloc currently has 4-5% share of alcohol market. Rapid drug testing $4 billion market. 2.5% chunk of that market seems reasonable and puts them at $100 million in additional revenue.

No sales effort to date. Just previews. Will be a dedicated position in marketing.

Sales in all 50 states. Workplace every state. Law enforcement - 25 states

Line of credit established - favorable terms - not expensive money. Minimize shareholder dilution.

No red flags in SpinDx rollout. On track with SpinDx. Reasonable reason to believe that it will succeed in the marketplace. Market acceptance is unknown. Better margin on consumables than the device. Subscription element - making sure firmware is up to date is critical for jurisdictions.

Accelerate to market faster with more cash - they are going as hard as they can go. Question comes from current investor – Would $5 - $20 million in capital help to speed up the Spin DX production and sales. Current investor has ties to a group that would be willing to invest upwards of $5-20 million in Lifeloc if it could be deplorable in a useful way to speed up production, sales, marketing, etc. Call ended with Lifeloc organizing a follow up meeting with this potential investor group.

I have to give credit where credit is due. Wayne did an excellent job on this call. Acted like a true CEO. Didn’t stumble through anything and very thorough answers for all the questions. It sounded like a few shareholders were present at the meeting and they did a great job with questions. Working on the summary now.

Awesome ! Just got back to my desk. Will be grateful to hear about it...

I’ll provide a summary of the call in a bit but if the market were open today, I’d probably buy additional shares after listening to the call and hearing the answers to our questions.

And so it starts... Who wants to share their story ?

https://www.nytimes.com/2024/06/13/us/marijuana-road-safety.html

Yes, feel free to ask anything you feel pertinent. I am having some remodeling done on my home in Florida, and will be traveling a lot this week, between there, and my home up North, so I may not be available to attend the meeting. Hopefully it will be recorded, and I can listen in at a later time.

Great set of questions and I did hear back from Dr. Wilkomm who stated the following:

Yes, you will be able to call in at 303-407-9190. Access number is 725#

And yes, shareholder questions will be welcomed.

Thank you,

Wayne Willkomm

Lifeloc Technologies, Inc.

Let me know if you would like to submit those questions on your behalf or if you would like me to add those to the set of questions that I will be asking.

Thanks!

Well the annual shareholders meeting is on Wednesday, and I put in my proxy vote, not that it matters... I wonder if we will get any material news next week, or just same old generic meeting? I'm going to try to listen in, but not sure of my schedule.

A few questions I would like to ask are:

1. The current accuracy of the device can detect THC down to 10ng/ml, have you made improvements, and what is the end point goal in terms of accuracy?

2. You previously stated you had begun human trials, and had a framework in place to begin Beta testing of the saliva based system. Where do you currently stand as far as this Beta testing, has it begun? Any insight here?

3. In regard to marketing, and brand awareness, Lifeloc seems to be very complacent with their achievements thus far, and the share price suffers due to this. Do you have a plan in place to increase marketing, social media awareness, and attract investors ?

4. Do you still feel that you are on track to begin commercialization of the saliva based, SpinDx device next year, and if so, do you have an expected timeline to integrate this system with the LX9 Breathalyzer.

5. Do you feel that you have sufficient means to continue funding the development of this device organically, without the need to raise cash through borrowing or Equity financing?

6. What do you value the Saliva based SpinDx device at in terms of yearly sales forecasts after commercialization? What price point do you expect to come in at for the device, and any associated hardware/software. What is an estimated price of the consumable disks, and will these be manufactured by Lifeloc, or a third party.

7. Do you expect that this device will meet the requirements of most modern registration standards set in place by the US, and abroad?

Investors have been patient for many years now, going all the way back to 2014, when Lifeloc was awarded a $250,000 grant by the state of Colorado, to develop a marijuana breathalyzer. An investment in Lifeloc common stock in 2014 would be worth half now, at best, and probably much less. Lifeloc's Market Cap is currently much lower than it's peers competing in the same market. It's time to bring this company, it's common stock, and it's investors to the forefront.

Yes, an improvement in the equipment's accuracy would be a huge step forward. I worked as a lab tech for Dupont, in their electronic imaging systems department, and know that not only does their technology have to be accurate, but it has to be accurate in all environmental conditions, due to the fact that they will be testing roadside - in climates all over the world. Things like temperature, humidity, etc. can definitely impact accuracy of equipment. I can say with some certainty, that this is one of the obstacles they are dealing with...

I think it would be reasonable to ask the Lifeloc team at the upcoming annual conference call if they have made any progress on SpinDx detection levels. The latest we have from them is the following:

"The LCMS data are validating the SpinDx test results on real-world human saliva tests at a limit of detection of approximately 10 ng/ml."

Germany is cracking down on marijuana impaired driving, as well as completely banning driving if you have used both alcohol and marijuana.

They have set a THC limit of 3.5 ng/ml. Setting this limit, paves the way for a quantitative test to measure THC levels in impaired drivers - just as the US Department of Transportation has set a cutoff limit for THC at 4 ng/ml.

https://www.marijuanamoment.net/german-lawmakers-approve-changes-to-marijuana-legalization-law-addressing-social-clubs-and-impaired-driving/?

My guess is that it was a balancing of shares for the MM's - hopefully in preparation for some good things to come. I noticed that after the 25,000 share trade, INTL was running the show for a day or two, whereas NITE had been the MM in charge up to that point.

As far as not getting your orders filled, you can always call your broker, and see if they can do anything for you. I had the same thing occur years ago, trading a stem cell stock. My trade never executed, even though thousands of shares traded well above, and below the limit price. I called my broker, they called the specialist, and my trade executed after hours at my original limit price, even though the closing price was well above my buy limit order.

As far as social media goes, I agree Lifeloc is missing the boat. I have owned several businesses, and I currently own a garden center and seafood business. Social media has been a huge, and very inexpensive way to advertise and build your brand. If we finally get some good news, it will be easy for the few of us on this board, to hit up Twitter and Facebook stock groups to spread the word. I've tried this in the past, and at least tried to get people to put it on their radar, but without any substantial news, traders just move on to "stocks in the news..."

We should really do our best to come up with some good questions for the upcoming annual stockholders call.

Do you think there is anything we can possibly ask that will actually help us create interest and momentum?

I would like to really try and get them to grasp the concept of increasing social media awareness. They just might be the worst public company in terms of utilizing social media. How does a company in the current day and age not use social media? It not only creates and brings awareness to the company's products but also increases the odds of finding investors and bringing awareness. Social media is a no brainer for every company that exists. How do they continue to not have a brand media manager who creates Lifeloc social media posts?

Lifeloc should be growing at minimum 10% year over year. No one can argue with that. The entire sector is exploding with growth domestic and overseas. I just feel like they could be doing more and I want to express this in a way that can get through to the team at Lifeloc. I want to see some changes.

They left us feeling excited after last year's call and I really want to leave this year's call with something tangible to grasp. Don't just keep pushing this thing back year after year after year. Create value, create substance, finish goals, follow through, bring this to life.

Can you help me to explain how my buy orders (bids) that were all the way from $3.75 to the low $3.00's were never filled on that 25,000 share print at $3.00? Was this an out of market print? Did the market maker have to take these shares? Was this a pre-arranged transaction? How can a stock print an order without having the shares in between the print get filled?

Do you make anything of that print or large sale of stock? It was basically 10% of the float that just changed hands.

Your correct. When it decides to go, it will go. I just wish there could be more excitement around this company and more than 4 people who gave it attention.

Chart still looks good. The technicals remain very positive for LCTC - without going into a long, in depth explanation, Barchart does a good job at explaining. I'm actually excited to see a $75,000 trade occur, and hope there's more to come...

https://www.barchart.com/stocks/quotes/LCTC/opinion

Chart doesn’t matter with this stock. When it goes it will go

This isn’t KO!

That was 3 months of progress just totally wiped out in 1 print. This thing is brutal. Chart was looking so good too up until today.

That is the largest share sale I have ever seen in this stock. But here's the thing, I have multiple bids in the $3.00's that were not filled so I'm not sure what exactly that print signifies and how that went through without trading anything in the $3 range. The chart pattern was just destroyed as we were looking at a nice bull flag and break out. That's basically 10% of the float in 1 print and we may set a record volume day. I would love to find out exactly what happened there.

where did all that volume come from?

It would take an absolute miracle - but it would be a really good time for Lifeloc to drop some game changing news while these low floaters are starting to move.

If Lifeloc were on NASDAQ it would have hit $50 already!

Let's hope low float mania can bring some interest into Lifeloc. LPA is bringing interest into some other low float names - ADRT, DHAC, MRNO, PUCK, HHGC.

Lifeloc has a job post for Research Laboratory Technician:

Lifeloc Technologies, a leader in commercial and professional breathalyzer testing technology, is looking to hire a Research Technician to support research, development, and commercialization of its latest product for detection of controlled substances. This position will support research to develop and validate tests for this exciting new technology in preparation for commercial launch.

Specifically, the Laboratory Technician will be expected to aid in the development and testing of antibody-based reagents and equipment, establish tests with the project manager for validation of the device, and then assist company personnel with scale-up processes for manufacturing and reagent packaging for final commercialization.

Low float name LPA was $10 a week ago and trading over $400 in the after hours. If the stock gods are listening, can we get a similar move in LCTC?

SOBR with it's highest volume day ever and up over 200% on no news that I can find. Obviously it's a direct competitor to Lifeloc but I'd love to find out what's moving this one today. I don't really think they move in tandem with eachother but I'm interested in finding out what's creating this volume and price surge.

It probably doesn't mean much but the Short Interest in Lifeloc is the highest it's been in a while. According to the OTC markets and shortsquueze.com the current short interest is 582 shares and it hasn't been that high in at least 6 months.

https://www.otcmarkets.com/stock/LCTC/quote#short-interest

Good find. And to highlight a line from the previous article you posted:

“The American Trucking Association quickly followed this news with a letter highlighting that rescheduling marijuana without an explicit allowance for a test for its use would create confusion and result in ‘serious safety impacts to safety-sensitive industries.’”

It seems like these organizations would be a bit more pro-marijuana if they had an instant and reliable safety test for measuring drug levels and impairment.

For the love of Lifeloc, it's time to get this device out there to those that need it.

Great synopsis! Just to add a little more fire to the flame, there are now more daily marijuana users in the US than daily alcohol users...

https://apnews.com/article/marijuana-cannabis-alcohol-use-disorder-daily-9cec33f3ac513123c8ffc8b8b3141877?utm_campaign=TrueAnthem&utm_medium=AP&utm_source=Twitter

I have been trying to submit a reddit post discussing the drug detection device companies and have been rejected on 3 different accounts. If anyone has a working reddit account and would like to post the following report to wallstreetbets, weedstocks, etc. here is what I had written. I was being as unbiased as possible and just providing the facts and comparisons:

Hound Labs

Current Valuation = $100-$500 Million (www.crunchbase.com/organization/hound-labs/company_financials)

Revenue = $34.8 Million (https://growjo.com/company/Hound_Labs#google_vignette)

Company is currently private

31 Patents Granted

Hound Labs is the developer of a breathalyzer technology designed to detect marijuana in a person's breath. The company's technology analyzes oral fluid, blood, and urine to measure recent marijuana use and alcohol in breath, enabling businesses to ensure workplace safety and productivity while allowing legal marijuana use after work hours. Hound Labs, Inc. is committed to developing ultra-sensitive, automated, and analytical breath technologies that will pave the way to practical and fair solutions for leading public health and safety issues. The Company’s first solution, the HOUND® CANNABIS BREATHALYZER, specifically targets THC molecules, limiting cannabis detection to the workday so employers can create testing policies that help balance workplace safety with employee fairness and privacy. Dr. Mike Lynn, emergency room physician, deputy sheriff (reserve), and former venture capitalist, co-founded Hound Labs, Inc. in 2014. Unlike traditional drug tests such as oral fluid, urine, and hair that have detection windows lasting days, weeks, or months after use, the HOUND® CANNABIS BREATHALYZER isolates detection to use within a narrow window of 2-3 hours.

Lifeloc Technologies (Ticker symbol LCTC)

Current Market Cap = $10.2 Million

Revenue = $9.3 Million

Stock Float = 256,000 shares

44 Patents Granted

Lifeloc Technologies Inc is a developer, manufacturer, and marketer of portable hand-held and fixed station breathalyzers and related accessories, supplies and education for law enforcement, workplace, corrections, original equipment manufacturing, and consumer markets worldwide.. It offers fuel-cell based breath alcohol testing equipment. In addition, it also offers a line of supplies, accessories, services, and training to support customers' alcohol and drug testing programs. Further, it provides breathalyzers; Sentinel zero tolerance alcohol screening station; R.A.D.A.R, a Real-time Alcohol Detection and Reporting; and calibration products, as well as breath testing devices. Additionally, it offers Easycal; Phoenix; Lifeloc; and SpinDx. The company was incorporated in 1983 and is headquartered in Wheat Ridge, Colorado.

Latest News:

SpinDx has been demonstrated in our laboratory to effectively detect for delta-9-THC, cocaine, fentanyl, amphetamine methamphetamine, morphine, MDMA, and benzodiazepines. Testing has validated the SpinDx measurement technology against the definitive standard liquid chromatography-mass spectroscopy (LCMS) measurement utilizing human samples. The LCMS data are validating the SpinDx test results on real-world human saliva tests at a limit of detection of approximately 10 ng/ml. With our research and development work, we continue to improve our technology's robustness, speed, and convenience of operation. The start of beta testing of our SpinDx saliva testing system utilizing the delta-9-THC disks is expected later in 2024 using prototype readers as shown in the photograph below. Commercial launch of our first SpinDx application is projected to occur in 2025. Following initial commercialization, we expect more offerings from this technology platform to include expanded drug panels and samples collected from blood and breath.

"Our top priority is pushing the SpinDx product platform across the finish line," Dr. Willkomm said. "We anticipate increasing our research and development expenses in this final push toward commercialization. With the rising interest in saliva drug testing, the initial release of SpinDx to the market becomes more urgent and valuable."

Cannabix Technologies (Ticker symbol BLO/BLOZF)

Current Market Cap = $64 Million

Revenue = 0

Stock Float = 104 million shares

5 Patents Granted

Cannabix Technologies Inc. is a developer of marijuana and alcohol breathalyzer technologies for law enforcement, workplaces and laboratories. It is developing breath testing technologies that can be used at the point of care to detect recent use of marijuana. It is also developing its technology to help employers, law enforcement, government and the public, when marijuana is becoming legal for recreational and medicinal use in many jurisdictions globally. The FAIMS device is designed to operate both independently or coupled in tandem directly to a mass spectrometer, used in forensic labs. The THC Breath Analyzer is a point of care breath testing tool for the rapid detection of recent cannabis use.

Latest News:

Cannabix Technologies Inc. reports that it has entered into a strategic partnership and development agreement dated May 15, 2024 with Omega Laboratories Inc of Ohio, USA. The Agreement provides a pathway for commercialization of Cannabix’s marijuana breathalyzer technology. Pursuant to the Agreement, Cannabix and Omega Laboratories have agreed to, among other things, complete research and development, refine and expand the use of Cannabix’s technology to meet existing and emerging needs of Omega’s clients, contemplate manufacturing and distribution and introduce the delta9 THC breath testing technology to customers in North America. The agreement contemplates critical steps to further Cannabix’s technology from the research and development stage to commercialization.

And in full disclosure, I do own some shares of LCTC and BLOZF and I am waiting to hear back from Hound Labs to find out if they will be doing an IPO anytime in the near future. If we do get a Hound Labs IPO, it should bring interest to the drug detection sector and the other companies also working on marijuana breathalyzers. If either Lifeloc or Cannabix can produce a working and reliable drug detection device, then I have to imagine they would also have a valuation similar to that of Hound Labs ($100-$500 Million). That leaves plenty of room for upside potential in both names.

Be prepared to start hearing this more and more....

https://www.marijuanamoment.net/ted-cruz-suggests-marijuana-rescheduling-might-lead-to-more-people-dying-in-car-crashes-from-impaired-driving/?

Now that the annual report and quarterly earnings are out of the way, and the expo has wrapped up, there are not many catalysts left in the near term.

We have the annual shareholders conference call about a month from now on June 19 (9:00 AM - (303) 407-9190 725#). That's our last chance to get some answers and I think we should brainstorm any and all relevant questions to ask the Lifeloc team. We need to get them on board and show some interest in increasing shareholder value.

Of course it's painful to watch not only Cannabix stock rise dramatically but all small cap and low priced stocks seemed to have gotten a bid recently.

The chart on Lifeloc does look good for a breakout - similar to Cannabix when it broke out above $0.20 but it's vitally important to keep up the volume. There is a buyer who seems to be willing to soak up shares in the mid $3.00's. That's our most important level to hold above. I'm not sure we have anything near term that will move us higher but as long as it can hold these levels, it looks good for a breakout at some point.

We are at the point where any investment over the last 10 years would have produced better returns than Lifeloc. Something needs to change soon so we can get excited again. It simply can't be another year of them telling us commercialization by end of next year. Get your shit together and make this happen.

It's painful to watch Cannabix (BLOZF) triple in price in just a few short weeks... They hired three marketing firms to pump their company, and just teamed up with Omega Labs to help commercialize their product.

The thing is, Cannabix is in a much disadvantaged position compared to Lifeloc. Their product is no further along than Lifeloc's, and they are further diluting investors by teaming with Omega, and allocating 1,000,000 shares of BLOZF, and 11,000,000 Warrants to Omega for their partnership agreement.

Cannabix also just came out with a fix mount alcohol breathalyzer, much like Lifeloc's Sentinel - which has been in use for years... I just don't get it...

In Lifeloc's defense, you can't simply create news releases, if there is no substantial news to release. The same goes for quarterly reports - you can only report factual results. Hopefully, the day will come when Lifeloc gets it's full recognition - hopefully sooner than later (as we watch all of these companies in the sector skyrocket in price per share).

On a positive note, there is only a little over 6 months remaining in the year. If Lifeloc can actually produce what they say they will in 2024, we may eventually see the kind of moves that are currently occurring in these other companies, such as BLOZF and CGC...

The NDASA’s Conference and Trade Show officially opens at 8:00 AM today and includes the following sessions:

Emerging Technology and the Future of Drug Testing

(Cocoa Suites 4-5)

The world of drug testing is changing as cannabis legalization increases, the economy continues to sputter, and employers look for economical ways to keep their workplaces safe and drug-free. This panel of experts will discuss emerging technologies such as lab-based oral fluid, rapid oral fluid using current and emerging methods specific for parent THC, proctored virtual collections and tests, and non- drug testing impairment evaluations using proven drug recognition eye response technology. Facilitated by Bill Current of Current Consulting Group

What is Trending for Drugs of Abuse?

(Cocoa Suite 1)

New drugs are evolving, including many variations of THC. See an overview of research into the new variants, recognize the psychoactive metabolites present in urine & oral fluid and learn what is presenting in workplace drug test samples. Additional drugs will be discussed based on their importance and impact to the population as we examine developing trends. Dr. David Kuntz, Executive Director for Analytical Toxicology of Clinical Reference Laboratory (CRL)

This is the first time they have stated:

"SpinDx has been demonstrated in our laboratory to effectively detect for delta-9-THC, cocaine, fentanyl, amphetamine, methamphetamine, morphine, MDMA, and benzodiazepines."

At least they are making progress on something. Being able to effectively detect fentanyl is a nice win!

They did provide us with a new image of the updated SpinDx device. Maybe someone out there will be excited with it's new look:

https://media.zenfs.com/en/accesswire.ca/e95953454c0ec46d1b18f5ae8beb492e">https://media.zenfs.com/en/accesswire.ca/e95953454c0ec46d1b18f5ae8beb492e" />

Highlights from first quarter earnings report:

Smart phone pairing of the LX9 units is expected to be introduced in the second quarter of 2024. "We are excited to be able to offer smart phone pairing with our LX9 units soon to achieve better systems integration, which some customers have been seeking,"

Research and Development investment rose by 40%, primarily for SpinDx development, contributing significantly to the current period loss.

SpinDx has been demonstrated in our laboratory to effectively detect for delta-9-THC, cocaine, fentanyl, amphetamine methamphetamine, morphine, MDMA, and benzodiazepines. Testing has validated the SpinDx measurement technology against the definitive standard liquid chromatography-mass spectroscopy (LCMS) measurement utilizing human samples. The LCMS data are validating the SpinDx test results on real-world human saliva tests at a limit of detection of approximately 10 ng/ml. With our research and development work, we continue to improve our technology's robustness, speed, and convenience of operation. The start of beta testing of our SpinDx saliva testing system utilizing the delta-9-THC disks is expected later in 2024 using prototype readers as shown in the photograph below. Commercial launch of our first SpinDx application is projected to occur in 2025.

"Our top priority is pushing the SpinDx product platform across the finish line," Dr. Willkomm said. "We anticipate increasing our research and development expenses in this final push toward commercialization. With the rising interest in saliva drug testing, the initial release of SpinDx to the market becomes more urgent and valuable."

Well, the quarterly report is out, and I did not see anything really good, or really bad about the report. It was a standard report, much like all of Lifeloc's financial reports. Sounds like inflation and R&D costs are biting into profits, which we new going into the "final push" of development of the SpinDx device, that management is prioritizing development of the marijuana breathalyzer over short term profits.

May 13th is the absolute latest Lifeloc has ever reported its first quarter earnings report. I have to imagine the report comes out any day now.

Keep in mind the NDASA’s Conference and Trade Show starts tomorrow.

Can someone tell this guy Andrew Tate to do the same with Lifeloc:

JUST IN: Andrew Tate becomes the latest celebrity to say he is buying Gamestop stock, $GME, and never selling, according to a post on X.

— The Kobeissi Letter (@KobeissiLetter) May 13, 2024

He says Gamestop is a "battle against the system."

Trading halts are being viewed as an attempt to stop the meme stock rally.

Short sellers… pic.twitter.com/KvuxKKZVu8

The National Drug & Alcohol Screening Association's Annual Conference and Trade Show occurs this week. NDASA’s Conference and Trade Show is the largest, most exciting and relevant event of the year for the drug and alcohol testing industry.

Big names attending include Intoximeters, Abbott, Hound Labs, Quest Diagnostics, and Lifeloc Technologies.

These sessions that occur during the week are very relevant to Lifeloc:

Emerging Technology and the Future of Drug Testing

(Cocoa Suites 4-5)

The world of drug testing is changing as cannabis legalization increases, the economy continues to sputter, and employers look for economical ways to keep their workplaces safe and drug-free. This panel of experts will discuss emerging technologies such as lab-based oral fluid, rapid oral fluid using current and emerging methods specific for parent THC, proctored virtual collections and tests, and non- drug testing impairment evaluations using proven drug recognition eye response technology. Facilitated by Bill Current of Current Consulting Group

What is Trending for Drugs of Abuse?

(Cocoa Suite 1)

New drugs are evolving, including many variations of THC. See an overview of research into the new variants, recognize the psychoactive metabolites present in urine & oral fluid and learn what is presenting in workplace drug test samples. Additional drugs will be discussed based on their importance and impact to the population as we examine developing trends. Dr. David Kuntz, Executive Director for Analytical Toxicology of Clinical Reference Laboratory (CRL)

Quick market cap comparison has Lifeloc at $10.5 million and BLOZF at $42.6 million.

The market still values Cannabix at over 4 times that of Lifeloc. I still don't see it.

|

Followers

|

21

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1901

|

|

Created

|

02/23/14

|

Type

|

Free

|

| Moderators | |||

Lifeloc (OTC:LCTC) is a public company established in 1983. We introduced our first breathalyzer to the US Department of Transportation in 1988. We are an American manufacturer of professional-grade, platinum fuel cell based instruments for alcohol detection, measurement and enforcement.

Since our founding, our corporate mission has been to build the most precise, reliable and easiest to use breath alcohol testing devices in the industry. We take pride in offering everything an organization requires to establish an effective alcohol monitoring program including equipment, mouthpieces, factory authorized training and certifications, and a complete line of alcohol testing supplies and calibration equipment.

-Today, our highly accurate and reliable fuel cell devices are the preferred choice by professionals in countries around the world. We back everything we sell with exemplary customer service and technical support.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |