Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

He has abandoned it a long time ago. He didn’t even have the guts to tell us lfap was going down—He just disappeared and became an art dealer. What a crook. I

So, lets all contact him...If he abandoned shell does in go into custodianship? SS is not bad here for a RM

https://www.facebook.com/bobby.blair1?mibextid=LQQJ4d

Also Bobby Blair tennis adventures, another business he will screw people out of money

This one is f ing funny Bobby Blair!!!

Former Wall Street index and ETF Founder

All on his Facebook page, Bobby Blair AKA Con Man! Ha

Does LFAP go to the courts for custodianship...Seems he abandoned the shell.

Please provide the pos Bobby Blairs contact info.

Contact Bobby Blair??? Haha

This guys is a lowlife scum bag, you think he gives a s hit about you, all he did the whole time he was the CEO was hang out on tennis courts, we supported his lifestyle, that is all, Bobby Blair is a sleaze bag.

End of story …

Exactly!

Class action should commence

$LFAP, committing fraud/scam with the help of big names.

COMPANY OFFICERS & CONTACTS

Robert A. Blair

CEO

Lawrence Patrick Roan

Executive Director

Jeff Sterling

COO

Eric Sherb

CFO

John Rochard

CSO

BOARD OF DIRECTORS

Robert A. Blair

Chairman, CEO

William Bean

Independent Director

Barney Frank

Independent Director

Martina Navratilova

Durwood Orlando Reece

Independent Director

Robert Tull

Bobby Blair and all those who ran this hustle need to be investigated. This was outright fraud.

Hope so … ridiculous it came to this…

NO...im not giving up...Some entity will take this shell IMO.

Am I the only a-hole here still holding shares? Looks like I can call Schwab to sell them? That call won’t be embarrassing at all…

Yep, expert market.

Is this officially toast? I’m not seeing a bid or ask….

So the shell can go into custodianship?

There is no update. Why do you think he deleted his Twitter lol.

The guy is a real piece of shit

He’s now defrauding investors through a real estate scam. His Facebook page is set where only “friends” can make comments.

Bobby might have some exposures for misguiding retailers

Wasn't he telling us how well the ETF was doing then all of a sudden it was shutting down.

He has no conscience

When you are a life-long crook, these kinds of things matters not a bit..

Thanks I just sold 5 million on your recommendation. What a douchbag how can he even sleep at night

.0002 is better than .0000 if you ask me. Bobby the crook has completely abandoned us. He deleted his Twitter account where he promised all kind of things to shareholders. He made sure everyone know on his FB that he is now “the former CEO of LFAP”. If he the former ceo, who is in charge now??? He has fiduciary duty to his shareholders and sounds like a complete abdication of his duties as a ceo. What a scammer.

I am getting very concerned. The ticker could go to the Expert market at any moment. I could clear my position or at least part of it at .0002 but is it worth it.

He has no conscience. He's a sociopath.

I know who id never buy art from. It's a crime that people are allowed to run these scams and then just walk away.. I lost a lot here. A lot. How much did Barney and Martina make? It was their names that caused me to buy in.

He sure did. He needs to be held accountable.

He deleted his Twitter account and announced on his FB page he’s a former CEO of LFAP—- now he is full time art broker

We were misled,

I don’t think he cares… he has already abandoned lfap and it’s retail shareholders… the only way to get him listening is through class action lawsuit.. he is a fraud.

Everyone should message Bobby on Facebook and let him know what a scumbag he is.

There is not much to it left… shell

They really going to let this go?

This stock and its promoters were all con artists. They should dll be in prison.

Yeah definitely. We just need a sign of life and a new direction and should be .001+ easily imo

UNDER 1 BILLION I MEANT...SORRY...FOR A TRIP, THIS IS A VERY SMALL FLOAT.

Float

413,254,678

07/16/2021

That’s in 2021

Held at DTC

920,186,618

04/10/2023

https://www.otcmarkets.com/stock/LFAP/security

Where the heck are you getting 1M float??????

ITS UNDER 1M FLOAT...LFAP SECURITY DETAILS

Share Structure

Market Cap Market Cap

353,967

04/19/2023

Authorized Shares

2,000,000,000

04/10/2023

Outstanding Shares

1,179,890,617

04/10/2023

Restricted

197,612,105

04/10/2023

Unrestricted

982,278,512

04/10/2023

Held at DTC

920,186,618

04/10/2023

1M float?????Lol

Have you read the last filing?

Over 1B in outstanding share count

Stop your nonsense with your 1M float

BS...no one knows...float under 1M here no need for RS IMO

Yup, probably got some at 0003 and wants to flip at 0004 or 0005. Lol

That would be fantastic… way overdue for something to happen here… SEC reporting shell with low SS sitting at bottom

Any merger will come with a huge reverse split. Imo. So careful acquiring these

Cheapies

Total user. Life has a way of settling up with such players

And he is only missing 1 filing..last q..they have kept up to date...next one I believe will be

new company merging in.

I believe the shell is being sold...Im expecting a merger and new entity moving in along with company and ceo. We all know what can happen then....pps increase dramatically if a good deal...SS is LOW here...I expect pps in increase dramaticall when announcements are made public to us. I have been accumulating at this bargain prices the crap ceo put the company...better times coming imo.

Yep. This is garbage. Bobby squandered a great opportunity here. What a POS he is

Does anyone have the level 2 data? What do the bids look like below .0003? ….. I guess I’ll likely find out today…. Should have dumped this garbage forever ago when literally everyone was saying no bid was coming….

Bobby updated his Facebook page:

FORMER CEO of LGBTQ Loyalty Holdings.

(January 2018-March 2023)

Hey Bobby, if you have resigned your post as the CEO, you have a duty to notify shareholders. You are not running a private company but rather a public company with many shareholders. You have a fiduciary duty to your shareholders and you are required to notify shareholders of any material events in the company, including your resignation as the CEO if it’s true. Bobby doesn’t even have the courage to let his shareholders know when he is quitting. He deleted his Twitter account and updated his Facebook account and is ready to scam some more people with his new gig as ceo of fan base art. What a crook you are Bobby.

Dude doesn’t have the fund to file. He is begging for money. This doomed

|

Followers

|

320

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

47935

|

|

Created

|

09/21/12

|

Type

|

Free

|

| Moderators | |||

Confirmation Regulation FD applies to social media April 2, 2013

https://www.sec.gov/news/press-release/2013-2013-51htm

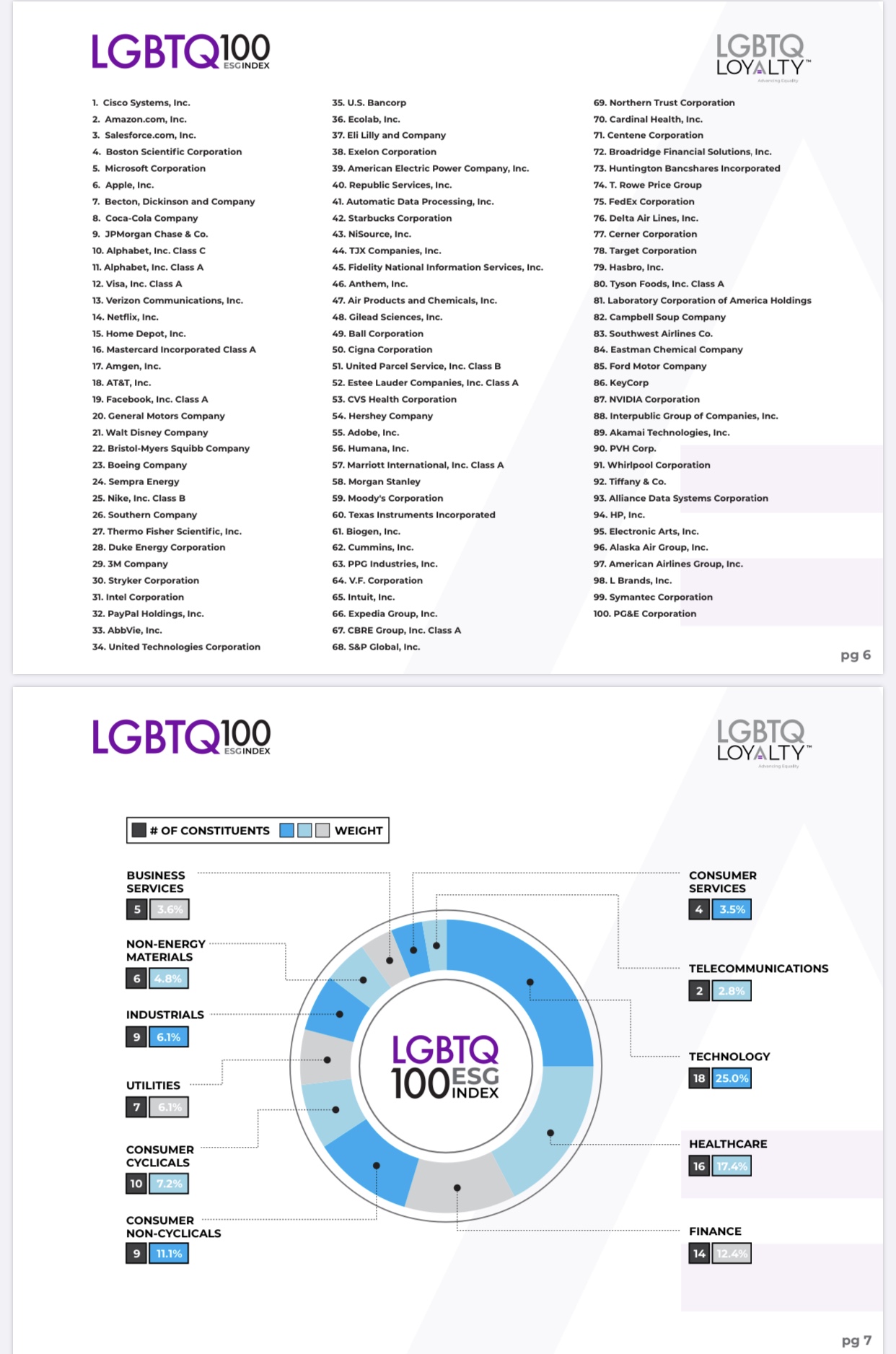

LFAP Acquires LGBT Loyalty to Create the First-Ever LGBT Loyalty ''Preference'' Index Traded Fund

ACCESSWIRE February 14, 2019 https://finance.yahoo.com/news/lfap-acquires-lgbt-loyalty-create-141500544.html?soc_src=strm&soc_trk=fb&fbclid=IwAR2qb6TXwHzF6OtARB9eg_DEg_pIHNuA0KxsKR137bR4HeVIHLBd71B3d3Q

WILTON MANORS, FL / ACCESSWIRE / February 14, 2019 / LifeApps Brands Inc., (OTC PINK: LFAP) ("LifeApps"), an emerging growth digital media company, has purchased LGBT Loyalty LLC, a New York limited liability company from Maxim Partners, LLC, a New York limited liability company. Through LGBT Loyalty, LifeApps intends to create, establish, develop, manage and capitalize a LGBT Loyalty (ETF) Index Traded Fund, supported through newly created dynamic business channels. ''Connecting the world's most supportive LGBT companies to the dynamic loyal and time-tested spending power of the LGBT community is a consequential step forward for the LGBT movement and investing community,'' said Bobby Blair, CEO of LifeApps. ''The acquisition of LGBT Loyalty from Maxim Partners provides us with a tremendous opportunity to make a major impact to the LGBT community we intend to serve.''

The LGBT Loyalty (ETF) Index Traded Fund is expected to be the first ''preference'' index fund to survey a representative group of LGBT consumers to determine the top public companies that best support and are supported by the LGBT community. We expect the S&P 500 to represent the universe of companies surveyed. Expert LGBT economists have repeatedly stressed the value of the LGBT brand loyalty to corporations. We believe the companies that best capture the spending trends and loyalty of the LGBT consumer will be better positioned for financial growth and success. In 2017, LGBT consumer buying power was over $917 billion in the US market alone. Our business strategy is targeted to part of the $3.7 trillion purchasing power of the LGBT consumer demographic worldwide.

More than 450 million people identify themselves as LGBT worldwide and the LGBT community is composed of some of the most loyalty driven consumers in the world. Same-sex households have a 23 percent higher median income compared to mainstream households. The LGBT consumer is 1.23 times more likely to buy brands that reflect their lifestyle and 1.56 times more likely to consider themselves a spender rather than a saver. Fortune 500 companies have mandated diversity and equality as part of their marketing profiles, and we intend to become a leading conduit between this incredibly powerful consumer group and respective LGBT social-impact driven companies around the world.

SEC final ruling on rule 6C-11 for open ended management ETF’s September 26, 2019

https://www.sec.gov/news/press-release/2019-190

Reference Page

https://lgbtqloyalty.com/reference-page/

Blueprint & Latest News

Initial Capital November 4, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf_exl.htm

Registration statement Form N-1A filed November 15, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013088/etf-t1_n1aa.htm

Registration statement Form N-1A filed December 10, 2019

https://www.sec.gov/Archives/edgar/data/1704174/000165495419013782/etf-t1_n1aa.htm

short-form registration statement, Form 8-A filed January 6, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000126/etf_8a12b.htm

Statement of Additional Information (“SAI”) ,Form-497 filed January 14, 2020

https://www.sec.gov/Archives/edgar/data/1704174/000165495420000395/etf_497.htm

LGBTQ100 ESG Index Reconstituted Ahead of LGBTQ + ESG100 ETF Launch May 14, 2021 12:03 ET

https://www.globenewswire.com/news-release/2021/05/14/2230111/0/en/LGBTQ100-ESG-Index-Reconstituted-Ahead-of-LGBTQ-ESG100-ETF-Launch.html

LGBTQ + ESG100 ETF Trading Symbol: LGBT Summary Prospectus May 14, 2021

https://www.sec.gov/Archives/edgar/data/1704174/000089418921003087/procureetftrusti497klgbt.htm

Video: LGBTQ Loyalty (OTC Pink: LFAP), (NASDAQ: LGBT) Emerging Growth Conference 5/26/21

https://www.youtube.com/watch?app=desktop&v=yk-zYu7rJak

LGBTQ Loyalty Announces $10M Financing Commitment From NYC-based Investment Group May 28, 2021 9:28AM

https://www.otcmarkets.com/filing/html?id=15000298&guid=p1RUkKQ9u5KFpth#EX99-1_HTM

CNN write-up: June is Pride Month, Wall Street has taken.notice, Tue June 1, 2021

https://www.cnn.com/2021/06/01/investing/pride-month-lgbtq-stocks/index.html

CNBC Video: What to know about the world’s first LGBTQ ETF for pride month, Wed June 2, 2021

https://www.cnbc.com/video/2021/06/02/what-to-know-about-the-worlds-first-lgbtq-etf-for-pride-month.html?&qsearchterm=etf

Market Watch Opinion: There’s a new LGBTQ-focused ETF — here’s how it differs from two others that failed June 4, 2021

https://www.marketwatch.com/story/theres-a-new-lgbtq-focused-etf-heres-how-it-differs-from-two-others-that-failed-11622821358

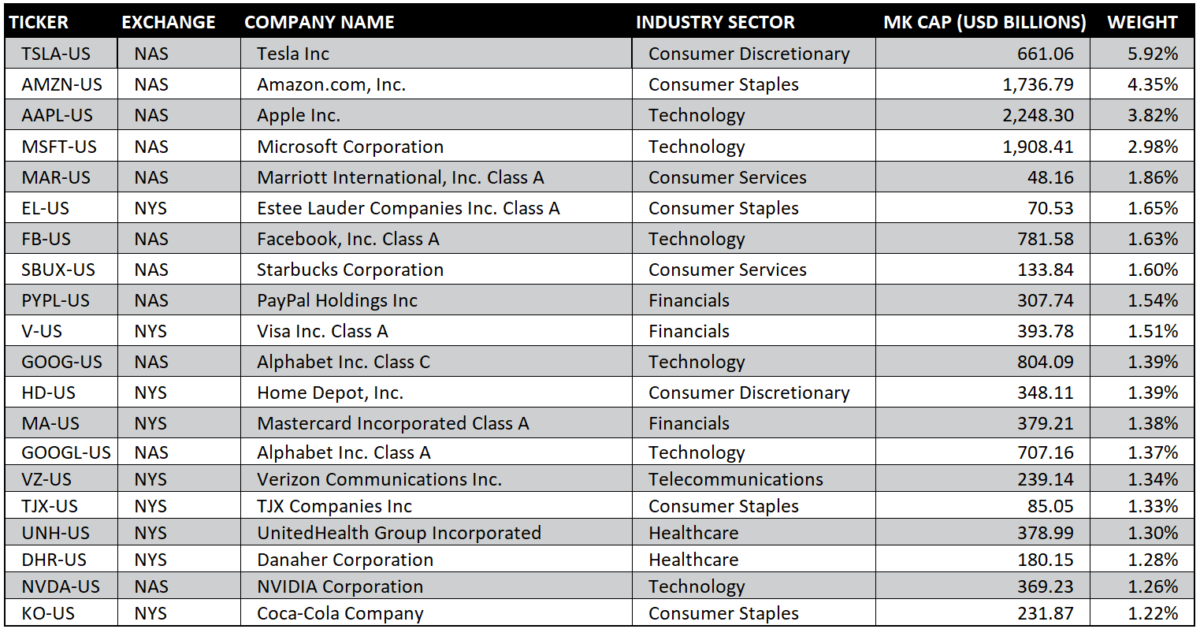

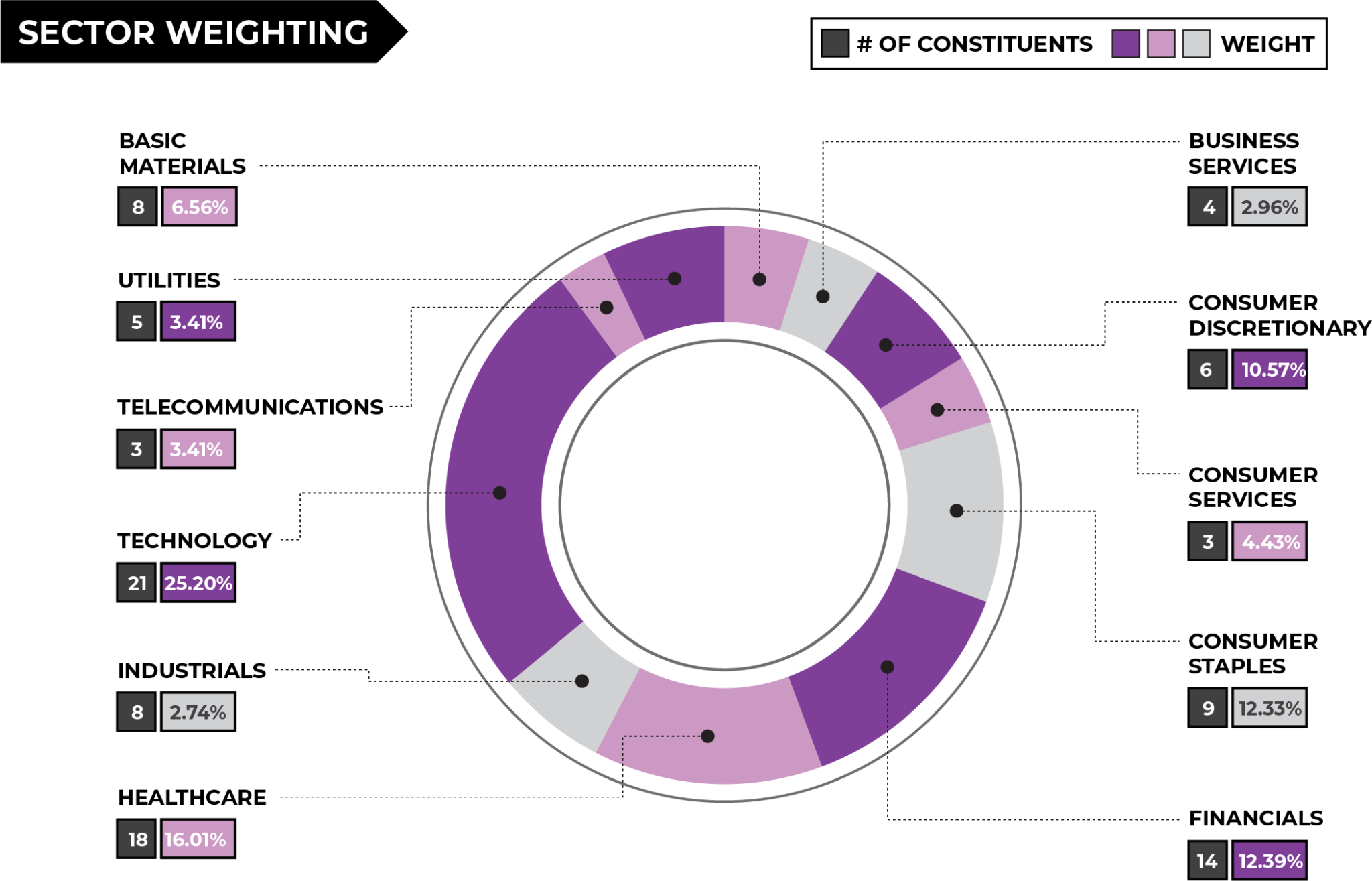

LGBTQ100 + ESG ETF

Shares will be listed on Nasdaq, Inc.

To start off LFAP is the creator of the LGBTQ Index 100

utilizing ProcureAM’s PAL (Procure Asset Launchpad) in which

ProcureAM helps bring ETF ideas to life. In this situation LFAP = Creator

of LGBTQ Index 100 and ProcureAM = ETF Fund Manager.

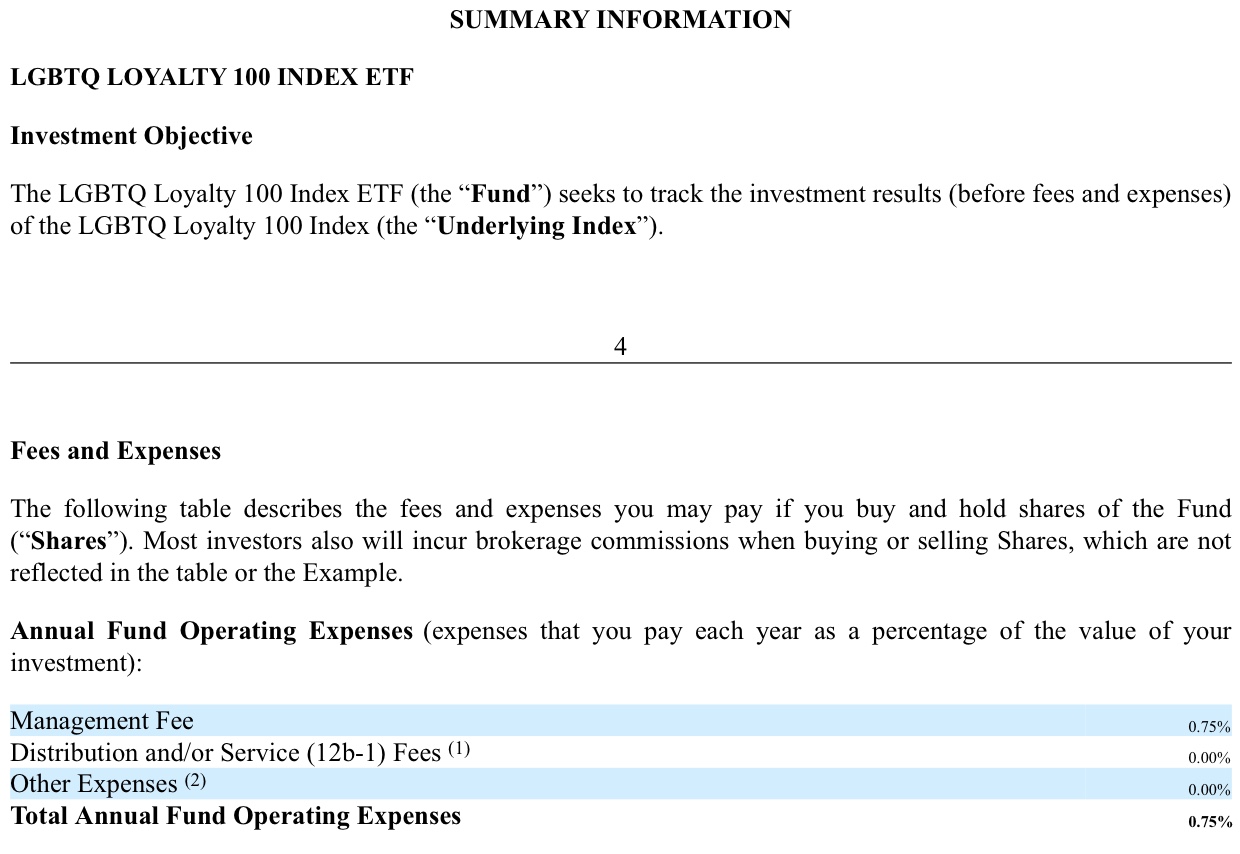

ProcureAM charges a manager fee of 25BP (or in layman terms .0025%)

for Assets Under Management.

The LGBTQ ETF Index 100 charges a management fee of 75BP

(.0075%) on all Assets Under Management. ProcureAM is paid 25BP

(.0025%) for duties as acting manager of the fund.

For Example: LGBTQ Index 100 has $1,500,000,000 AUM

LGBTQ Index 100 Management Fee:

$1,500,000,000 X .0075 = $11,250,000

LFAP keeps 50BP (.0050%) and ProcureAM is paid 25BP (.0025%) as

acting manager of fund.

LFAP revenue = $1,500,000,000 X .0050 = $7,500,000

ProcureAM revenue = $1,500,000,000 X .0025 = $3,750,000

What many here don’t realize, we are entering a whole new realm

of investing with this first ever “Preference Based Index”. This

will be the first index ever where a selected/targeted group will

select the companies that make up the ETF. Also, as technology

advances, our ETF’s performance will be for-seen by using Big

Data Analytics, AI, and Machine Learning. We are looking at a

new way to beat the market by using big data as raw material,

combined with machine learning, to build ETF portfolios that

could potentially outperform active management — even actively

managed ETFs.

You can read more about Big Data and ETF’s in this link

rovided. Also watch the video within the article of Rob Tull

explaining the technology:

https://www.google.com/amp/s/www.cnbc.com/amp/2019/08/24/artificial-intelligence-and-machine-learning-are-the-next-frontiers-for-etfs.html

This is where Fuzzy Logix is tied in with our LGBTQ Index 100.

Fuzzy Logix uses high powered Graphics Processing Units which

can sort through data at an alarming speed. The software from

Fuzzy Logix ultimately helps predetermine which companies will

outperform the market. More can be explained in this video

attached:

https://youtu.be/V8HBSfawGa8

This is how the our ETF (LGBTQ Index 100) was predicted to

outperform the S&P 500 (see slides 8 & 9 of attachment:

https://drive.google.com/file/d/13a-yxFXVBtt8GZXN7WmcCuu1U7i9r_5V/view

Revenue for LFAP will be accrued in 3 ways:

•Advertising

•Sales of Corporate Loyalty Program/ Loyalty Packages

•ETF Management Fee

The average ETF costs about $250,000 a year to maintain based on

complexity. Our Breakeven for our ETF is approx $40,000,000 AUM.

With this in mind, our ETF will have a yearly maintenance fee of

$200,000 given $40,000,000 X.0050 = $200,000.

More on expenses of ETF’s can be read here:

https://www.etf.com/sections/features-and-news/cost-run-etf?nopaging=1

This ETF is rumored to be the next big thing in the ETF world.

HACK accrued $1,500,000,000 AUM in approx 6 months of operation.

We could possibly match pr exceed HACK’s AUM.

LFAP has little to no overhead:

•Rent

•Salaries

•ETF Maintenance Fee’s

LFAP has 3 revenue streams: Advertising, Loyalty Packages, and ETF management fees.

Latest videos released 9/24 from BODs on YouTube

Robert Tull

https://youtube.com/watch?v=Mv-bTvK3acE

Billy Bean

https://youtube.com/watch?v=o0iXwXina7s

Barney Frank

https://youtube.com/watch?v=ckeEJMXObmk

Bobby Blair

https://youtube.com/watch?v=GPws-ia3Gcw

Company Contact:

LifeApps Brands Inc.

2435 Dixie Highway

Wilton Manors, FL 33305

info@lifeappsmedia.com

(954) 947-6133

https://lgbtqloyalty.com/

SOURCE: LifeApps Brands Inc

Share Structure

Chart Source: ~~~ https://www.marketscreener.com/LGBTQ-LOYALTY-HOLDINGS-IN-58457883/

Chart Source~~~ https://www.stockscores.com/charts/charts/?ticker=LFAP

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |