Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

New Market CHANGES Will PUMP Silver Price TO ALL-TIME HIGHS -Jeff Christian | Silver Forecast 2022

Kootenay Silver looks to be very busy this year on Columba Silver Project

Kootenay Silver Set to Commence 15,000 Meters of Drilling at Columba High-Grade Silver Project, Mexico

May 6, 2022

Kootenay Silver Inc. (TSXV: KTN; OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce drill crews are on site at the Columba high-grade silver project (the “Property”), located in Chihuahua State, Mexico in preparation to begin the 2022 drill program. Two diamond core drills are scheduled to arrive within the next few days.

Drilling for this 15,000-meter program will focus on several areas on the property, including:

* The F Vein; host to historic high-grade silver underground workings (4 shafts and 6 levels of drifts) measuring over 1,000 meters in length;

* D, and B Veins located 800 metres south and along strike from the F Vein;

* JZ Zone located 700 meters east of the F Vein; and

* East Block located 200 meters east form the JZ Zone.

Initial focus of this program will be on deeper drill testing on the F Vein and expanding on the D and B Vein intercepts. This plan follows up promising results from previous drill programs highlighted by these examples of many:

F Vein

CDH-19-41: 787 gpt silver over 5.95 meters within 650 gpt silver over 7.45 meters and 159 gpt silver

D Vein

CDH-21-110: 932 gpt silver over 6.07 meters within 650 gpt silver over 17.8 meters and 453 gpt silver over 29.9 meters

B Vein

CDH-21-82: 1186 gpt silver over 4.6 meters within 9 meters of 691 gpt silver

JZ Trap Zone:

CDH-21-103; 2035 gpt silver over 6 meters within 805 gpt silver over 17 meters and 333 gpt silver over 44 meters

East Block:

CDH-21-101: 1190 gpt silver over 0.5 meters within 459 gpt silver over 1.6 meters

Sampling and QA/QC at Columba

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals ("ALS") in Chihuahua. The Company inserts blanks, standards and duplicates at regular intervals as follows. On average a blank is inserted every 100 samples beginning at the start of sampling and again when leaving the mineral zone. Standards are inserted when entering the potential mineralized zone and in the middle of them, on average one in every 25 samples is a standard. Duplicates are taken in the mineralized zone, on average 1 to 2 duplicates for each hole.

The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish. All drilling reported is HQ core and has been contracted to Globexplore Drilling from Hermosillo, Sonora, Mexico.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-set-to-commence-15000-meters-of-drilling-at-columba-high-grade-silver-project-mexico

Kootenay Silver (TSX:KTN; OTC:KOOYF) Reports Aztec – Kootenay JV Drilling Intercepts 0.42 gpt Gold over 68.4 Meters Including 2.25 gpt Gold over 10.6 Meters in the California Zone, Cervantes Project, Sonora, Mexico

May 5, 2022

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-reports-aztec-kootenay-jv-drilling-intercepts-042-gpt-gold-over-684-meters-including-225-gpt-gold-over-106-meters-in-the-california-zone-cervantes-project-sonora-mexico

Posted on Silicon Investor 4/22/22...

Kootenay Silver (KTN; KOOYF) made a major announcement the other day ( https://bit.ly/3xQgJx9 ), but very few heard about it because it was on behalf of their spun-out subsidiary named Kootenay Resources that is not listed, and for some reason it was decided that neither 'Kootenay Silver' or 'KTN' would appear in the PR. This is just one of the problems with this kind of spinout, another of which was recently foisted on Silver Bull shareholders.

Kootenay Resources was set up to hold the company's properties in BC, of which there are dozens. Kootenay Silver (and presumably Kootenay Resources ) is a project generator that may do some preliminary exploration on their prospects but looks to farm them out so another company that funds the exploration in exchange for a partial interest. In this case, it is Copley, a gold prospect on the Nechako Plateau. Centerra Gold is earning 70% in exchange for $400k cash and $4M in exploration expenditures.

KTN has been making noises about listing Kootenay Resources; let's hope the $40k goes to pay for that so shareholders can get some benefit.

https://www.siliconinvestor.com/readmsg.aspx?msgid=33812194

Live Webinar with Kootenay Silver Inc.

Tuesday, April 26, 2022

4:05 PM - 5:05 PM EDT

Sierra Madre Trend

Drill Program for 2022

CLICK HERE TO REGISTER

Kootenay Silver Inc. (TSX-V: KTN, OTC: KOOYF) is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. The Company is focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Chihuahua, State and Sonora, State, Mexico, respectively.

Company Website, Webinar Registration Link, Amvest Webinar Schedule & Replay Library

Silver

* Approximately 36 Million ounces Ag equivalent M+I and 35 Million ounces Ag equivalent Inferred1

High-Grade Drill Discoveries

1. Columba Silver Property – 3rd Drilling Program Completed

2. Copalito Silver-Gold Property – 2nd Drilling Program Completed

Properties with Resource Base

1. Promontorio - Resource WorkAdvancing at La Negra silver discovery

2. La Cigarra - Geological Modeling Underway

Generative Portfolio

* Exploration ongoing on earlier stage properties with JV on Cervantes

https://mailchi.mp/amvestcapital.com/join-uskootenay-silver-inc-webinar-tues-april-26-405-pm-edt-silver-in-mexico-2022-drill-program?e=8622d71292

KOOTENAY SILVER REPORTS AZTEC – KOOTENAY JV INTERSECTS 0.87 GPT GOLD OVER 152.4 M INCLUDING 2.05 GPT GOLD OVER 33.5 M FROM CALIFORNIA ZONE AT CERVANTES PROJECT IN SONORA, MEXICO

Initial gold results from 8 additional drill holes are pending

Kootenay Silver Inc. (TSXV: KTN, OTC: KOOYF) (the "Company" or "Kootenay") is pleased to announce additional positive drill results from the Aztec-Kootenay JV on the Cervantes Project located in Sonora, Mexico.

Results continue to intersect wide intervals of good grade gold mineralization with every hole in the California Zone to date hitting wide intervals of anomalous gold in mineralized quartz feldspar porphyry and hydrothermal breccias.

California Zone Drill Highlights

* CAL22-011

0.43 gpt Au over 132.2 meters, including 1.29 gpt Au over 12.2 meters along the north central edge of the mineralized zone.

* CAL22-012

0.87 gpt Au over 152.4 meters, including 2.05 gpt Au over 33.5 meters along the north central edge of the mineralized zone.

* CAL22-014

0.48 gpt Au over 54.9 meters located at the northern edge of the eastern portion of the mineralized zone

To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides. There are 8 more holes pending from the California zone including one pending from each of the Jasper and California North targets.

View drill sections here:

CAL22-011 to CAL22-014: https://bit.ly/3jC4v3c

California 2022 RC Drill Program Plan Map: https://bit.ly/37IAoEo

Gold mineralization at the California zone now measures approximately 900 metres long by 250 to 500 metres wide, with demonstrated, continuous mineralization up to 265 metres depth vertically. The porphyry gold-copper mineralization is still open in all directions.

Eight holes are awaiting assay results and will be reported accordingly. The program of Reverse circulation (RC) drilling totaled 26 holes and 4,649 metres. Four main target areas were tested with objectives to better define the open pit, heap leach gold potential of the porphyry oxide cap at California, evaluate the potential for deeper copper-gold porphyry sulfide mineralization underlying the oxide cap, test for north and west extensions of the California mineralization at California North and Jasper, and assess the breccia potential of Purisima East.

All widths are drilled widths, not true widths. Gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within the quartz-feldspar porphyry and related hydrothermal breccias.

Drill samples cuttings are collected every 5 feet (1.52m) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Cervantes Property Overview

Cervantes is a highly prospective porphyry gold-copper property located in southeastern Sonora state, Mexico and is held under a joint venture with Aztec Minerals (65%) and Kootenay Silver (35%) respectively. The project lies 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along an east-west trending gold belt 60 km west of the Mulatos epithermal gold mine (Alamos Gold), 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos). View: Cervantes Project Location Map

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Chihuahua, State and Sonora, State , Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-reports-aztec-kootenay-jv-intersects-087-gpt-gold-over-1524-m-including-205-gpt-gold-over-335-m-from-california-zone-at-cervantes-project-in-sonora-mexico

Kootenay Silver's Catalysts for 2022 - Jim McDonald talks with Wallstreet Silver

Gold - Silver Stocks THE GREATEST BULL RUN IN HISTORY IS COMING

Great news basserdan - and the silver price is close to a breakout.

Keep it coming - and SHARE ![]() I think we can be right at the right place at the right time.

I think we can be right at the right place at the right time.

GLTA, do your own research always.

This Is Happening With Silver Market !! - Michael Oliver

KOOTENAY SILVER (TSXV: KTN; OTC: KOOYF) ANNOUNCES, AZTEC – KOOTENAY JV REPORTS STRONG DRILL RESULTS INTERSECTING 0.53 GPT AU OVER 138.3M AND 0.88 GPT AU OVER 54.7M FROM AT CERVANTES PROJECT IN SONORA, MEXICO

March 22, 2022

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-announces-aztec-kootenay-jv-reports-strong-drill-results-intersecting-053-gpt-au-over-1383m-and-088-gpt-au-over-547m-from-at-cervantes-project-in-sonora-mexico

Boy, that share count must be climbing out of control. Going to be hard to find a buyer.

Kootenay Silver latest drill result; 12,000 grams-meter silver at Columba

Jim McDonald speaks with WallStreet Silver about the latest round of financing -- 14.02.2022

Once u see this... u know why he put about a million-dollar bet 1 week ago!

KOOTENAY SILVER CEO Major Insider Share Purchase Today

https://www.kootenaysilver.com/news/2022

TSXV: KTN; OTC:KOOYF On suggestion I ad the tickers and stock exchanges.

A follow mark added - helping out each other benefits the board ![]()

GLTA and have a good weekend!

Analyst Coverage - Kootenay Silver

https://www.kootenaysilver.com/

Please note that any price targets, opinions, estimates, or forecasts regarding the Company's operational or equity performance made by these analysts are theirs alone and do not represent opinions, forecasts, or predictions of the Company or its management. Kootenay Silver Inc. does not by its reference below or distribution imply its endorsement of or concurrence with such information, conclusions, or recommendations.

Financial Institution Analyst

Mackie Research Capital Corporation Stuart McDougall 416.860.8636

Fundamental Research Corp. Siddharth Rajeev 604.682.7050

(Hi basserdan, thx for your message)

Kootenay Silver 5-Day Change+ 0.045 (+24.32%) Buy Rating

https://r.search.yahoo.com/_ylt=AwrJETdXaypio...6A8ntrwqs

(if the link not working, go to; www.marketbeat.com and u find it)

Kootenay SILVER In Position For Coming Rush!

https://www.kootenaysilver.com/

Kootenay Silver - Red Cloud 2022 Pre-PDAC Mining Showcase

KOOTENAY SILVER REPORTS AZTEC – KOOTENAY JV DRILLS BEST HOLE YET INTERSECTS 3.42 GPT AU OVER 51.7 M WITHIN 1.49 GPT AU OVER 136.8 M FROM CALIFORNIA ZONE AT CERVANTES PROJECT IN SONORA, MEXICO

March 2, 2022

*CAL22-05 represents the best gold mineralized intersection drilled to date at the Cervantes project

*Initial gold results from 15 additional drill holes are expected over the coming weeks

Kootenay Silver Inc. (TSXV: KTN, OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce project partner and operator Aztec Minerals has reported on 3 more holes from the Cervantes project in Sonora, Mexico.

California Zone Drill Highlights

* CAL22-005

-1.486 gpt Au over 136.8 m, including 51.7 metres of 3.424 gpt Au at the southern edge of the central part of the mineralized zone some 50 meters from hole CAL22-004 that previously reported 1.0 gpt Au over 167 meters with 24.4 meters of 4.25 gpt Au.

*CAL22-006

-0.75 gpt Au over 100.3 m including 3.087 gpt Au. Over 9.1 meters at the northern edge of the central portion of the mineralized zone

*CAL22-007

-0.422 gpt Au over 63.8 m located at the northern edge of the central portion of the mineralized zone

To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides. There are 13 more holes pending from the California zone with one pending from each of the Jasper and California North targets.

View drill section here:

Link to section view holes CAL22-004 and CAL22-005 https://bit.ly/3IFS4xU

Link to section view hole CAL22-005 https://bit.ly/3HwShlO

Link to section view hole CAL22-006 https://bit.ly/3vxGpgW

Link to section view hole CAL22-007 https://bit.ly/3MutH95

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks and related hydrothermal breccias.

California 2022 RC Drill Program Plan Map https://bit.ly/3K9auHV

Holes CAL22-005, 006 and 007 intersected extensive gold mineralization, see table below, extending the known mineralized zone at depth and to the north and to the south and covers an area now measuring approximately 900 metres long by 250 to 500 metres wide, with demonstrated, continuous mineralization up to 265 metres depth vertically. The porphyry gold-copper mineralization is still open in all directions.

Click on link below to view mining table

Drill samples cuttings are collected every 5 feet (1.52m) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Cervantes Property Overview

Cervantes is a highly prospective porphyry gold-copper property located in southeastern Sonora state, Mexico. The project lies 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along an east-west trending gold belt 60 km west of the Mulatos epithermal gold mine (Alamos Gold), 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos). View: Cervantes Project Location Map

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Chihuahua, State and Sonora, State , Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-reports-aztec-kootenay-jv-drills-best-hole-yet-intersects-342-gpt-au-over-517-m-within-149-gpt-au-over-1368-m-from-california-zone-at-cervantes-project-in-sonora-mexico

KOOTENAY SILVER REPORTS AZTEC – KOOTENAY JV DRILLS 4.2 GPT GOLD OVER 24.4 METERS WITHIN 167 METERS OF 1.0 GPT GOLD AT THE CERVANTES PROJECT, SONORA, MEXICO

February 23, 2022

Kootenay Silver Inc. (TSXV: KTN, OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce that its joint venture (“JV”) partner and JV operator, Aztec Minerals Corp. (“Aztec”) continues to intersect broad, high-grade, gold mineralization during the 2022 RC drill program at the California target on the Cervantes property located in Sonora, Mexico.

The best of three drill holes reported in this news release is CAL22-004 which intercepted:

*167.2 meters grading 1.002 gpt gold including 24.4 meters grading 4.247 gpt gold.

Two fences of drilling have now been completed on each side of the previously drilled fence of holes on the California shallow oxide gold target with the objective of expanding the size of the zone identified in 2017-2018 drilling. This has been successful so far with a foot print now measuring 250 to 500 meters wide and 900 meters long with mineralization continuous vertically to at least 245 meters.

California Zone Drill Highlights

* 1.002 gpt gold over 167.2 meters in mineralized quartz feldspar porphyry, including 24.4 meters of 4.247 gpt gold in CAL22-004, located in the central part of the mineralized zone

* 0.374 gpt gold over 99.1 meters in mineralized porphyries and hydrothermal breccias in CAL22-002 located at the west end of the mineralized zone

* 0.451 gpt gold over 45.7 meters in mineralized porphyries in CAL22-003, including 13.7 meters of 0.868 gpt gold located at the south end of the mineralized zone

View drill section here:

Link to section view hole CAL22-002: https://bit.ly/3seIHzA

Link to section view hole CAL22-003: https://bit.ly/3ImRPIg

Link to section view hole CAL22-004: https://bit.ly/3sdnHJx

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks and related hydrothermal breccias.

California 2022 RC Drill Program Plan Map: https://bit.ly/3vckYSo

Holes CAL22-002 and 003 intersected extensive gold mineralization, see table below, extending the known mineralized zone at depth and to the north, west, and CAL22-004 to the south. The porphyry gold-copper mineralization is still open in all directions.

Detailed Drill Results – CAL-22-001 to CAL-22-004

Click on link below to view Drill Results table

The Aztec-Kootenay JV has now completed its Phase 2 Reverse circulation (RC) program of 26 holes, totaling 4,649 meters at the Cervantes Property. Four holes drilled into the Purisma target have been previously reported. The single drill holes at Jasper and California North found mineralized quartz feldspar porphyry with results pending.

The Aztec-Kootenay JV will now carry out channel sampling and geologic mapping of the new drill roads at California, California Norte and Jasper, as well as to expand surface sampling and mapping on the property in general to continue the 2021 phase 1 surface program.

Drill samples cuttings are collected every 5 feet (1.52 meters) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Cervantes Property Highlights

View: Cervantes Project Location Map: https://bit.ly/353s9ld

*Large well-located property (3,649 hectares) with good infrastructure, road access, local town, all private land, water wells on property, grid power nearby

*Seven prospective mineralized zones related to high level porphyries and breccias along an 7.0km east-northeast corridor with multiple intersecting northwest structures

*Distinct geophysical anomalies California target marked by high magnetic and low resistivity anomalies, high radiometric and chargeability anomalies responding to pervasive alteration

*Extensive gold mineralization at California zone 118 soil samples average 0.44 gpt gold over 900 m by 600 m area, trench rock-channel samples up to 0.47 gpt gold over 222m

*Already drilled the first discovery hole at the California zone, intersected gold oxide cap to a classic gold-copper porphyry deposit, drill results up to 0.77 gpt gold over 160 m

*Excellent gold recoveries from preliminary metallurgical tests on drill core from California zone; oxide gold recoveries in bottle roll tests range from 75% to 87%

*California geophysical anomaly wide open laterally and at depth, IP chargeability strengthens and broadens to >500m depth over an area 1100 m by 1200 m

*Three-Dimensional IP Survey conducted in 2019 extends strong chargeability anomalies to the southwest covering Estrella, Purisima East, and Purisima West, coinciding well with alteration and Au-Cu-Mo soil geochemical anomalies, all undrilled.

Cervantes Property Overview

Cervantes is a highly prospective porphyry gold-copper property located in southeastern Sonora State, Mexico located 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along a northeast-southwest transverse trending gold belt that includes the Mulatos epithermal gold mine (Alamos Gold) 60 km to the east, 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos). The property was acquired by Kootenay Silver by prospecting and staking and later optioned to Aztec Minerals who earned a 65% interest under the agreement. The property is now a 65/35 JV operated by Aztec with Kootenay holding a 35% interest and both parties contributing their pro rata interests to the project.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-reports-aztec-kootenay-jv-drills-42-gpt-gold-over-244-meters-within-167-meters-of-10-gpt-gold-at-the-cervantes-project-sonora-mexico

Kootenay Silver announces Aztec – Kootenay JV Intersects 2.8 gpt Au over 24.4 meters within 1.1 gpt Au over 88.4 meters at the Cervantes property in Sonora, Mexico.

February 16, 2022

Kootenay Silver (KTNV: KTN; OTC: KOOYF) is pleased to announce JV operator Aztec Minerals Corp. has reported a broad, high grade, gold intercept in the first RC drill hole on the California target on the Cervantes property located in Sonora, Mexico.

California Zone Drill Highlights

* 1.1 gpt Au over 88.41 m in mineralized quartz feldspar porphyry

- Including 1.56 gpt Au over 54.9 m with 2.8 gpt Au over 24.4 meters

View drill section here: Link to section view hole CAL22-001 https://bit.ly/3rYcxIk

This is the first hole in the California target in the current program and represents a significant step out from a previous fence of holes that established a broad area of shallow oxide gold mineralization. The best hole from which graded a drill length of 160 meters of 0.77 gpt Au, 0.13% copper and 3.4 gpt silver.

The Phase 2 RC drill program at Cervantes is focussed on expanding previously drilled California zone by completing two drill hole fences parallel to and on either side of the 2017-18 Phase 1 drill hole fence. To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides.

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within a quartz-feldspar porphyry stock and related hydrothermal breccias.

James McDonald President and CEO of Kootenay Silver says “The current drill program on the Cervantes project is off to a great start with the best hole drilled to date. We are looking forward to the remainder of the drill holes results.”

The Cervantes project is a 65/35 joint venture with Kootenay holding a 35% participating interest.

California 2022 RC Drill Program Plan Map https://bit.ly/34JoXLI

Hole CAL22-001 intersected extensive gold mineralization extending the known mineralized zone at depth and to the north. The area currently being drilled measures approximately 800 metres long by 300 metres wide, with demonstrated, continuous mineralization of up to 170 metres depth. The porphyry gold-copper mineralization is still open in all directions.

The Aztec-Kootenay JV has completed 22 holes of a 25 hole, 5000 meter RC program. The first four RC holes tested the previously undrilled Purisima East target, where high grade gold mineralization was sampled in a glory hole. Preliminary gold assays in these four holes exhibit anomalous but sub-economic gold grades.

The main objective of the 2021 – 2022 exploration program is to further test the open pit, heap leach gold potential of the porphyry oxide cap at California and evaluate the potential for deeper copper-gold porphyry sulfide mineralization underlying the oxide cap.

Drill samples cuttings are collected every 5 feet (1.52m) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-announces-aztec-kootenay-jv-intersects-28-gpt-au-over-244-meters-within-11-gpt-au-over-884-metres-at-the-cervantes-property-in-sonora-mexico

This company is lean, and ready, to get bought out by a junior or mid tier miner for implementation & full scale development.

KOOTENAY SILVER INTERCEPTS 1,050 GPT SILVER OVER 2.0 METERS WITHIN 667 GPT SILVER OVER 7.05 METERS WITH FINAL 2021 DRILL HOLES ON COLUMBA HIGH-GRADE SILVER PROJECT (TSXV: KTN; OTC: KOOYF)

December 16, 2021

James McDonald Kootenay's President and CEO states, "The B Vein is continuing to yield impressive grades and widths. These results are amongst the best on the Property and as such we view the B Vein as having excellent potential for the discovery of large, mineralized zones within the vein."

Gustavo Gallego, Kootenay's Chief Geologic Engineer commented, "The B vein system is very promising, like all the targets drilled to date in Columba, drilling has returned excellent values with very interesting widths. We have tested a little more than 200 meters in length of this system and up to 200 meters in depth with drilling. On the surface we did not find high values of silver, however important grades begin approximately 100 meters deep, which gives us confidence that almost the entire epithermal system is preserved from erosion. With the 1:500 scale mapping program we have managed to extend this area by up to 600 meters on strike with vein widths of up to 1 meter on the surface. We look forward to the phase 4 program to begin drilling to expand this entire zone."

Continued at:

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-intercepts-1050-gpt-silver-over-20-meters-within-667-gpt-silver-over-705-meters-with-final-2021-drill-holes-on-columba-high-grade-silver-project

Not to mention the fact that Mr. Sprott loves this little company.... That's because he knows that $KOOYF is (and has been) carved up perfectly for a buyout.

KOOTENAY SILVER ANNOUNCES DRILL RESULTS FROM COPALITO SILVER-GOLD PROJECT. HIGHLIGHTS INCLUDE 276 GPT SILVER EQ. OVER 23 METERS AND 642 GPT SILVER EQ. OVER 5 METERS (TSXV: KTN; OTC: KOOYF)

December 2, 2021

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-announces-drill-results-from-copalito-silver-gold-project-highlights-include-276-gpt-silver-eq-over-23-meters-and-642-gpt-silver-eq-over-5-meters

Jim McDonald, CEO of Kootenay Silver (TSXV:KTN; OTC:KOOYF) at The 2021 StockPulse Silver Symposium

Daybreak in the Land of Precious Metals

Michael J. Ballanger

Friday, November 12, 2021

There have been many times in my sexagenarian journey through four and a half decades of inflationary, disinflationary, and deflationary cycles when the spinning plates above my head suspended upon poles of flawed data and errant central bank policy appear on the verge of a massive chaotic accident. There are, however, other times when all is right with the world in which the precious metals investor resides and this past week was just one of those.

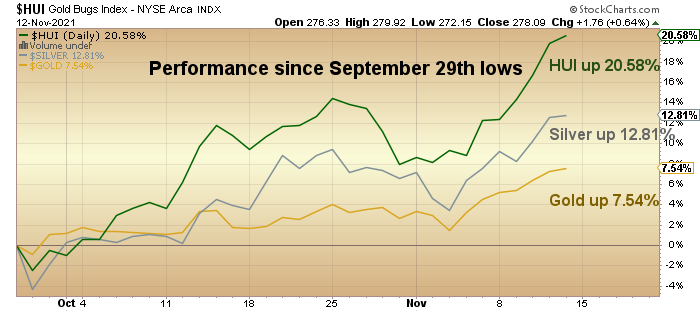

From a technical perspective, I could not ask for a more enviable confluence of conditions and events. Firstly, the precious metals bucked the trend of yielding to U.S. dollar strength so to the degree that this decoupling marks a new paradigm of gold and silver drivers, it was a watershed week. Secondly, as you all have been reading for as long as I have been allowed to perch upon the soapbox of blogosphere scrutiny, that repetitive drone resembling the bespectacled high school English teacher blathering on about conjugations with fifteen minutes left in an early summer school day, it was that silver outperformed gold and that the HUI outperformed both metals while the mightily-gilded TSX Venture Exchange surpassed 1,000, symbolizing the return of “animal spirits” to the world of precious metals.

To coin the Longfellowian phrase, it was as if the world of the hard asset disciple rolled into light; it was daybreak everywhere; and it was long overdue.

I have been arguing the bullish case for gold and silver since the middle of August, having stepped away from the senior and junior miner ETF’s back in August of 2020, when suddenly every blogger on the planet were reciting quotes from the “Gold Bug’s Almanac” while quoting Von Mises and Keynes and Peter Schiff chapter and verse in their rebirth into gold and silver idolatry. Flash forward to late September 2021 when I seized upon silver’s phony false breakdown below $22/ounce (so obviously orchestrated by the bullion bank silver shorts) and designed to spook speculative longs into a final cathartic capitulation. I contend that the late September reversal was the precise moment that the precious metals gods finally held up both hands and pronounced “Enough!” putting an end to the ever-ignored shenanigans that have plagued the paper markets for what seems like an eternity.

The star performer was gold for much the early move but now it appears that the freckle-faced, red-haired hellion – silver – has put a clamp on the leadership torch wrenching it away from gold and about to pass it over happily to the mining shares, where the GDX and GDXJ have been absolute beasts since the late September reversal.

Outside of the RSI levels for the HUI, GDX, and GDXJ all closing out the week solidly above 70 (overbought), history has proven that they can stay overbought for weeks and especially when gold has moved away from “correction” mode and into “resumed uptrend” mode in which I believe we are now immersed and in a highly-convincing manner.

This chart marks the performance of the three precious metal classes and it is textbook. Shares are outperforming metal and silver is outperforming gold; this is a classic trademark of a confirmed bull market and while it will most certainly not be a straight line to all-time highs, my only conundrum is whether gold gets there by New Year’s Day.

We all read the same commentators and listen to all the same podcasts but to whom I pay particular attention are those highly-successful investors that have rarely, if ever, owned precious metals that are now on the record as owning gold and looking for significantly higher prices. A few weeks ago, I listened to an interview with Sam Zell, one of the greatest horse-traders in the history of modern finance, in which he basically called out the policymakers for trashing the American balance sheet while citing gold as an appropriate place to park one’s wealth. It is those massive pools of capital that are now sloshing around the bond and equity arenas that are going to be eventually forced to assets that have no counterparty risk and when that occurs, it will be elephantine demand meeting rodent-ine supply resulting in an unfathomable price reaction in everything vaguely even associated with gold or silver.

I have told this story before but it bears repeating. In the late 1970’s while working as a clueless trainee for a large Canadian brokerage firm, one of the senior salesmen (not “wealth advisor”) told me about a junior gold explorer called “Mattachewan Consolidated Mines” at about CAD $.08 per shares so, having never bought a stock before in my life, I took my life savings at the time and bought 20,000 shares worth CAD $1,600 and then promptly forgot about it. A few months later, I was handing out the bond quote sheets (there were no quote terminals for bonds back then) when I ran into the senior salesman who asked while sporting a broad smile how I liked the move in Mattachewan. I asked him what it was doing, sluffing off my ignorance due to being “too busy” counting Canada Savings Bonds and licking stamps. “Why,” he said “it just traded at $1.80 and it’s going to $3!” Having earlier learned my “times tables”, I quickly did the math and realized (while hyperventilating madly) that I had just won a lottery with my $1,600 now worth $36k and possibly on its way to $60k! “Well,” I said puffing out my chest and trying to look scholarly, “I need to do some research on this. Can you tell me where they have their gold and how much of it they own?” The senior salesman began laughing hysterically after which he responded while wiping tears from his ruddy cheeks, “son, this is a gold bull market and there is no bull market like a gold bull market. The only gold Mattachewan has is the letters G-O-L-D in their name.” He then embarked on another howling round of laughter and I skulked off to the cloakroom.”

The point I make is that the vast majority of Millennials and Genexers have never seen a) a bear market or b) a bull market in precious metals miners. They know crypto and they know technology but their eyes glaze over when you describe the move in Consolidated Stikine in 1989 or Diamondfields in 1996. Just as fortunes have been made in this cycle in worthless EV companies or counterfeiting schemes like certain crypto deal, fortunes are about to made in the junior developers and explorers. The TSX Venture Exchange is the Canadian version of the junior NASDAQ so like its U.S. counterpart, it is a great barometer for speculative sentiment. While the tech-laden COMPQ hit record highs last week, it is important to remember that the high for the TSXV was in May 2007 when it traded over 3,350; it has been that long since the junior mining markets have received anything resembling “love” on a par with technology or crypto. The bottom line is that like silver, which has yet to see record highs, the junior resource sector has a great deal of upside if we are to believe that the Great Currency Debasement exercise around the world is going to reprice all assets to new highs. We have seen it everywhere in the industrial and soft commodities and should expect to see it in uranium, silver, and the TSXV before the cycle gets terminated by either policy errors or global war, both of which are possible but impossible to either time or predict.

I went long December Silver in late September the day the bullion bank monkeys tried to smash it below $22 but just as the Twitterverse had concluded that it was $18 bound, the mysterious forces of short-covering evil stepped into the panic and before you could say “JP Morgan”, silver went on an eleven-day recovery to $23 and has not looked back. I see some resistance around $27-28 after which 2021 highs are likely above the $30 “#silversqueeze” spike level that created the underperformance that has persisted since February. This week it appears to have broken the shackles of its lead-filled sneakers once and for all, so since we own the SLV:US from $22.10 (now $23.42) and the January $20 calls from $2.10 (now $3.56), I see no reason to rush to ring the register unless RSI spikes into the high 70’s (or until I see all of the usual silver bugs taking victory laps around the Twitter Track).

Gold and silver investors have had to endure a very long and very cold night since the sun went down in August 2020. As I pointed out last week, the gold and silver mining shares represented by the GDM are absurdly undervalued despite a superb advance this past week but what are even more undervalued are those junior developers with large and rapidly-growing resources (like Getchell Gold Corp. GTCH:CSE / GGLDF:US OTC QB) whose share prices are wallowing in sentiment purgatory despite impressive 2021 results. As I constantly harp on every time an unattended pair of ears or eyes can be found, it is the junior developers that will have the biggest lift in 2022 along with selected exploration issues (available to all subscribers).

Enjoy the warmth of the daylight sun and remember the lesson behind Mattachewan Consolidated Mines because that is where we are headed…

MJB

https://lemetropolecafe.com/toulouse-lautrec_table.cfm?pid=17269

(Sub required ~ painless 2 week trial available)

hmmmm...3-4-X daily volume on both Canada and here.....when we are apparently on a grey market status...(in the US)... Something smells foul if you ask me.

Eric Sprott Announces Holdings in Kootenay Resources Inc.

Toronto, Ontario--(Newsfile Corp. - November 4, 2021) - Eric Sprott announces that he acquired common shares of Kootenay Resources Inc. (KR Shares) pursuant to the closing of the plan of arrangement (Arrangement) between Kootenay Resources and Kootenay Silver Inc., on October 29, 2021, as announced by them on November 2, 2021.

Pursuant to the Arrangement, among other things, the holders of common shares of Kootenay Silver received one new common share of the Kootenay Silver (each, a New KS Share) and 0.04 KR Shares, and each common share purchase warrant of Kootenay Silver (each a KS Warrant) was amended to entitle the holder to receive upon due exercise for the original exercise price, one New KS Share and 0.04 KR Shares.

As a result of the Arrangement, Mr. Sprott through, 2176423 Ontario Ltd., received 1,206,000 KR Shares (as well as New KS Shares) and upon exercise of 16,835,000 KS Warrants currently held, will be entitled to acquire 675,000 KR Shares (as well as New KS Shares) representing approximately 7.5% of the outstanding KR Shares on a non-diluted basis and approximately 11.3% of the outstanding KR Shares on a partially diluted basis assuming exercise of the KS Warrants. Prior to the Arrangement, Mr. Sprott did not beneficially own or control any securities of Kootenay Resources.

The securities noted above are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities including on the open market or through private acquisitions or sell the securities including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Kootenay Resources Inc., is located at Suite 1125 -595 Howe Street, Vancouver BC V6C 2T5. A copy of the early warning report with respect to the foregoing will appear on the company's profile on the System for Electronic Document Analysis and Retrieval at www.sedar.com and may also be obtained by calling Mr. Sprott's office at (416) 945-3294 (2176423 Ontario Ltd., 200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

https://www.newsfilecorp.com/release/102117

<<<looks like we could go live here...we are at least listed...and I do have shares for Koootenay Resources....but not active...>>>

Hi gandalf...

KTNV is trading higher in Canada with better volume compared to yezzer...

https://finance.yahoo.com/quote/KTN.V/

Being that my Kootenay Resources shares are still not showing up at Ameritrade, may I ask who your broker is?

looks like we could go live here...we are at least listed...and I do have shares for Koootenay Resources....but not active...

left msg for Raj Kang... EM

KOOTENAY SILVER REPORTS SECOND PLUS 12,000 GRAM-METER SILVER INTERCEPT AT COLUMBA HIGH GRADE SILVER PROJECT, MEXICO

Highlights Include: 453 gpt Silver over 29.9 Meters including 650 gpt Silver over 17.8 Meters and 932 gpt Silver over 6 Meters

November 3, 2021

Kootenay Silver Inc. (TSXV: KTN) (the “Company” or “Kootenay”) is pleased to announce multiple high-grade drill results from three holes intercepting the D Vein located on the Columba High-Grade Silver Project in Chihuahua State, Mexico.

The D Vein is situated approximately 600 meters southwest from the F Vein where most of the historic production has taken place on the property. Results from the recent drill holes intercepting the D Vein include a high-grade silver intercept grading 13,545 gram-meters in hole CDH-21-110. Gram-meters are defined as grams per tonne multiplied by meters drilled (459 gpt silver times 29.9 meters). This is the second highest intercept to date. CDH-21-103 returned the high of 14,652 gram-meters (333 gpt silver times 44 meters).

Drill Highlights from holes CDH-21-108 to CDH-21-110 are as follows:

BDH 21-110:

* 453 gpt silver over 29.9 meters; including

* 650 gpt silver over 17.8 meters; including

* 932 gpt silver over 6 meters

* Intercept includes a high of 1,915 gpt silver over 0.85 meters

BDH 21-109:

* 193 gpt silver over 14.56 meters; including

* 294 gpt silver over 7.11 meters; including

* 476 gpt silver over 2.31 meters

* Intercept includes a high of 592 gpt silver over 0.75 meters

BDH 21-108:

* 98 gpt silver over 77 meters; including

* 328 gpt silver over 11 meters; including

* 504 gpt silver over 5.9 meters

* Intercept includes a high of 1,100 gpt silver over 1.0 meter

* All hosted in wide mineralized zone averaging 57 gpt silver over 166 meters

Click to view plan map ( https://bit.ly/3k4uwsp ) and cross sections ( https://bit.ly/3wcjDJM ).

These three holes were completed to follow-up on previous drill results which demonstrated high-grade silver potential within the D Vein. Earlier holes drilled along the D Vein included hole CDH-20-079 returning 525 gpt silver over 1.58 meters within 5.35 meters of 290 gpt silver and hole CDH-19-022 returning 373 gpt silver over 1.5 meters within 6.25 meters of 244 gpt silver. Drill hole CDH-21-110 happens to be the second richest intercept at Columba to date on a gram per meters basis. It is also the deepest drill test on the D Vein to date hitting the vein at about a 1650-meter elevation. Higher silver grades have been typically intercepted at and below this elevation across many of the veins at Columba and these recent results continue to confirm the Company’s general exploration model.

The Columba veins are exposed at the very top of epithermal level and as such management believes what is exposed at surface is only a very small part of whatever was deposited. The D Vein is a good example as values at surface averaged about 100 gpt silver over narrow intervals yet 150 meters vertically below is an intercept of 453 gpt silver over 29.9 meters.

Surface mapping has traced the D Vein at surface for at least 500 meters and aerial images indicate it continues beyond that. Drilling has scarcely tested only 180 meters of strike length.

Kootenay President and CEO, James McDonald states, “These results demonstrate excellent potential for the definition and development of high-grade resources at Columba. The D Vein now represents another area with multiple high-grade intercepts which increases the probability that Columba hosts a viable high grade silver resource.”

Gustavo Gallego, Kootenay’s Chief Geologic Engineer adds, “These results at the D vein encourage us to propose more drilling to define a high-grade silver resource in the near future. We are confident that we will continue to find high-grade silver and thus confirm the interpretations we have developed from our surface mapping program."

Detailed Drill Results – CDH-21-108 to CDH-21-110

(Click on link below to view Drill Results)

Notes: Notes: All widths are drilled widths. At this time the true widths are estimated to be between 45 and 60% of drilled widths for these holes. Additional drilling could change this interpretation. All silver composites rounded to the nearest whole number.

Further results from the 2021 - Phase 3 Drill Program will be released as they are received and analysed by the Kootenay team.

Sampling and QA/QC at Columba

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals ("ALS") in Chihuahua. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish. All drilling reported is HQ core and has been contracted to Globexplore Drilling from Hermosillo, Sonora, Mexico.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-reports-second-plus-12000-gram-meter-silver-intercept-at-columba-high-grade-silver-project-mexico

I called the 888 # a couple times...and both times...busy

In my experience, emailing rarely gets 'it' done.

If you want answers, giving them a call during market hours is the way to go as it's harder to be ignored when they answer the phone.

I have an idea what may be happening...but it's purely speculation. It would have everything to do with previous short sales...and making everyone whole before this goes online here in the States. KOOYF was not on the restricted Stock List as was purported by the rep at TDA...and was regularly trading up until this spin-off event. AND, that KOOYF is currently only on the gray market and the only action we can take per TDA is to liquidate would indicate that it WAS on the restricted list. OR, and this would be my guess, some entities are looking for shares PRONTO! But why would the Company allow this to happen? They can't be in the dark about this...I'm sure they're getting plenty of inquiries. I've emailed twice in as many days...no response. They KNOW this is happening. Pretty negligent to allow it to continue...IMO.

<<<Have you heard anything?>>>

No I haven't gandalf, and there isn't much chatter on the I'net msg boards either.

I did find this post over at Silicon Investor: https://www.siliconinvestor.com/readmsg.aspx?msgid=33555788

Fwiw, I'm not particularly antsy because I have no plans to buy or sell at these levels...

Have you tried calling them?

James McDonald, at 403-880-6016

Raj Kang, at 604-601-5653 or 1-888-601-5650

The volume in Canada is only 5800/sh so far and is trading @ C$0.2600 +0.0150(+6.1224%)

As of 2:38PM EDT. Market open.

https://finance.yahoo.com/quote/KTN.V/

Dan...I fail to see where it is indicated we would be trading only on the gray market...and for liquidating positions only...? Have you heard anything?

Kootenay Silver and Kootenay Resources Announce Completion of Spin-Out Transaction

VANCOUVER, BC, Nov. 2, 2021 /CNW/ - Kootenay Silver Inc. ("Kootenay Silver") (TSXV: KTN) and Kootenay Resources Inc. ("Kootenay Resources") are pleased to announce that the spin-out transaction whereby Kootenay Silver spun-out 80% of the common shares of Kootenay Resources (each, a "Kootenay Resources Share") to its shareholders by way of a share capital reorganization effected through a statutory plan of arrangement (the "Arrangement") was completed effective at 12:01 a.m. (Vancouver time) on October 29, 2021. Pursuant to the Arrangement, the holders of common shares of Kootenay Silver (each, an "Old Kootenay Silver Share") on October 28, 2021, received one new common share of Kootenay Silver (each, a "New Kootenay Silver Share") and 0.04 Kootenay Resources Shares for each Old Kootenay Silver Share previously held. The Old Kootenay Silver Shares were delisted from the TSX Venture Exchange (the "TSXV") at the close of business on October 28, 2021. The New Kootenay Silver Shares commenced trading on the TSXV at the market open on October 29, 2021. The CUSIP numbers of the New Kootenay Silver Shares and the Kootenay Resources Shares are 500583703 and 50058V107, respectively.

For further details of the Arrangement, please refer to Kootenay Silver's management information circular dated August 12, 2021, which is filed on SEDAR under Kootenay Silver's profile. Those shareholders who are physically holding shares should complete their letter of transmittal.

Early Warning Disclosure

Kootenay Resources became a reporting issuer as a result of the Arrangement, and accordingly, Kootenay Silver is providing the following disclosure pursuant to National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues with respect to its ownership of more than 10% of the issued and outstanding Kootenay Resources Shares. Immediately prior to the Arrangement, Kootenay Silver owned a total of 16,026,370 Kootenay Resources Shares, representing all of the issued and outstanding Kootenay Resources Shares. Following the disposition of 12,821,096 Kootenay Resources Shares pursuant to the Arrangement, Kootenay Silver owns a total of 3,205,274 Kootenay Resources Shares. Kootenay Silver's ownership of Kootenay Resources Shares decreased from 100% to 20% of the issued and outstanding Kootenay Resources Shares on an undiluted basis.

The Kootenay Resources Shares held by Kootenay Silver are for investment purposes only. Kootenay Silver currently has no plans or intentions that relate to, or would result in, any of the actions requiring disclosure under applicable early warning reporting provisions. In accordance with applicable securities laws and the policies of the TSXV, Kootenay Silver may, from time-to-time, acquire additional Kootenay Resources Shares in the open market or otherwise, and reserves the right to dispose of any or all of such securities from time-to-time, and to engage in similar transactions with respect to such securities, the whole depending on market conditions, the business and prospects of Kootenay Resources and other relevant factors.

An early warning report (the "Early Warning Report") will be filed with the British Columbia, Alberta, Ontario Securities Commissions and will be available for viewing on SEDAR under the profile of Kootenay Resources. For further information, or to obtain a copy of the Early Warning Report, please contact Kootenay Silver using the contact information provided below. The head office of Kootenay Silver and Kootenay Resources is Suite 1125 595 Howe Street, Vancouver, British Columbia V6C 2T5.

About Kootenay Silver Inc.

Kootenay Silver is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay Silver continues to provide its shareholders with significant leverage to silver prices. Kootenay Silver remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

On behalf of the board of directors of Kootenay Silver:

James McDonald,

CEO and President

On behalf of the board of directors of Kootenay Resources:

Raj Kang,

CFO and Corporate Secretary

For additional information, please contact:

James McDonald, at 403-880-6016

Raj Kang, at 604-601-5653; 1-888-601-5650

or visit: www.kootenaysilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-and-kootenay-resources-announce-completion-of-spin-out-transaction

|

Followers

|

17

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

371

|

|

Created

|

11/21/10

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |