Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I decided to cut my losses.

KGJI SEC Suspension "because of questions regarding the adequacy and accuracy of information in the marketplace about the Company and the market for its securities. KGJI has failed to restate its financial statements for the 2016, 2017, and 2018 fiscal years after its auditor resigned and withdrew its reports on those financial statements and has not filed any periodic reports since it filed a Form 10-Q for the quarter ended September 30, 2019. In mid-February 2021, in the absence of any publicly available information from the media or current information from the Company for about six months, the share price and trading volume of KGJI increased significantly."

https://www.sec.gov/litigation/suspensions/2021/34-91893.pdf

Order:

https://www.sec.gov/litigation/suspensions/2021/34-91893-o.pdf

Its closer alright! SEC suspended!

This is a true "under the radar" stock. A real sleeper. But, the potential is there, and it feels like it's getting closer.

anyne know whats going on with this uptick ? it s a very low floater i know they had a scan of fake gold bars used as deposits anyone has updates ?

KGJI has hit the bottom now. It is going to bound back strong and high. This is the right time to load it up. Don't miss this opportunity. It won't get any cheaper.

just another chinese scam allowed to steal money from taxpayers

KGJI delisted from the Nasdaq to the OTC:

https://otce.finra.org/otce/dailyList?viewType=Additions

Was just playing that song yesterday on my ipod

No gold-plated copper bars, just coppertone...

" rel="nofollow" target="_blank">https://www.youtube.com/watch?v=

Funny, I see golden earrings...

" rel="nofollow" target="_blank">https://www.youtube.com/watch?v=

None of these posts are about KGJI

and the 100% rise today. What am I missing here? I bought in lower today and was looking for more good data.

Company could have solid gold bars and not gold-plated copper bars. Just saying.

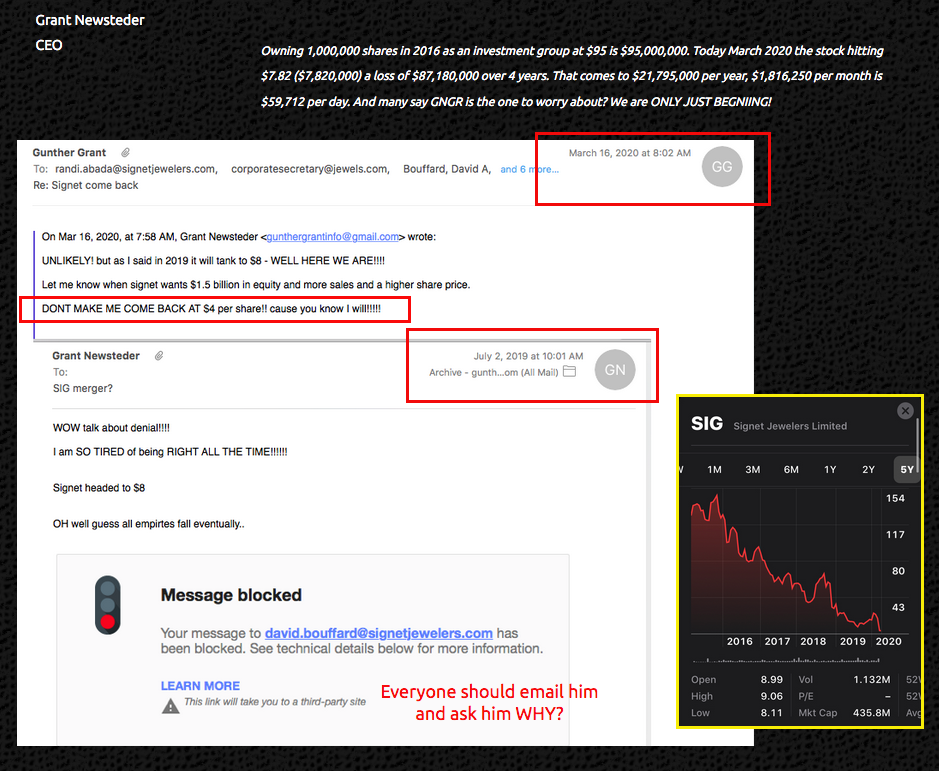

Long read but worth the time. GNGR predicted signets demise long ago, here is the communication with the CEO and Signet. Also Kingold data is to sensitive to post publicly but its similar to Signet. Kingold wanted GNGRs mold technology that is lightyears ahead of Chinas.

Post removed from the GUGR website.

Behind the scenes, we attempted many times to enter new markets and ideas and proposals to similar and even competing companies to work together and increase sales and shareholder value. I contacted SIGNET (ticker SIG) "YES I have emails to back up these statements" too possibly partner with GNGR. GNGR would supply SIGNET (owner of KAY and JARED and other jewelry stores) with new ideas in castings. Signet would receive a large amount of shares in GNGR and GNGR would be a supplier to Signet.

-

When they elected not to work with GNGR (yes they were NASTY) My closing e-mail to the directors of SIG was the following: "With MY help, SIG will rise to $200 per share and GNGR would rise well above $5 per share", I think they figured they can achieve that without my help, I replied back, "ILL MAKE CONTACT WITH YOU WHEN YOUR STOCK DROPS BELOW $25".

-

Well guess what? Signet tanked from $150 to $22.00 ( of course when it hit $24 I emailed the board saying TOLD YA!). Then I said ill be back again when its at $8... READ BELOW! By then the CEO blocked my emails out of denial. On March 16th 2020 the stock fell below $8 as I told the CEO in 2019 (see my email below to the directors)

-

Most of Signets board (still) read my emails (and probably really pissed) but the USA contact who blocked my emails as I get a message saying its been blocked "GUESS WHY" I then posted this on a member Facebook page and the shareholders were furious Signet did not look further into my proposal. Of course soon after my posts were blocked.

-

SO this is the way it is sometimes, We move ahead and also attempt to work with others. GNGR is growing, how is SIGNET DOING? You be the judge. I also spoke to one investor group. I said here is an offer.

Sell 100,000 of the shares they own in SIGNET at $95 ( the price at the time) and invest that $9,500,000 into GNGR and GNGR will build a new state of the art factory and expand sales to compete with the BIG jewelry companies. I would have given them 100,000,000 restricted shares in GNGR and 50,000,000 in FREE TRADING stock. With this deal GNGR would surly rise back to our 2012 high of $.23 per share or even higher. At that "ACHIEVABLE" level the investors would own 100,000,000 valued at $23,000,000 and the 50,000,000 free trading they could have sold with NO 144 waiting period for $11,500,000 ( easily topping the $9,500,000 investment)

-

As it happens, they declined and SIGNET tanked from $95 to $11 then on down to $7.82 per share.

I do believe that this deal would have caused GNGR to rise to $2-$5 per share making their 50,000,000 free trading worth $100,000,000 or more and the 100,000,000 worth between $100,000,000 and $500,000,000. Not to mention GNGR castings sales would be in the millions.

-

If they owned 1,000,000 shares at the time valued at $95 and did my deal, my offer would have netted them far more then the losses. If they owned 1,000,000 at $95 is $95,000,000 and at $7.82 comes to $7,820,000 a LOSS of over $87,000,000 POOF GONE! IF they sold it as I told them before it tanks below $25 they would have at least had the cash on hand not lower valued stock.

-

Can't imaging loseing that much dough in just a few years believing that just because they are a big company they can't fail. IF they took my offer they would have made up to 5 maybe even 20 times thier loss. Imagine that!

-

GNGR is small and when we approach BIG players they seem to think WHO IS GNGR and they dont need us. WELL looks like they made a HUGE mistake having lost $$$ BILLIONS $$$ in share value with shares dropping over 90%+ - OF course I told them ill be back when the stock hits $4 per share.

-

GNGR is expanding on our OWN with NO HELP. Sure we try to see if there are other Opportunities and this issue above is NOT isolated, I have many more similar but dont need to waste my time posting them all BUT you get the idea. IF you want to read another similar event (Click here)

-

Grant Newsteder

CEO

Sure! will keep them in watchlist, signet will come back strongly, while Kinggold is in serious trouble might crash..!!

The share structure is perfect, only 108,553,765 in the float. The CEO owns almost all the issued with some allies holding a few hundred million. Most of the A/S is restricted.

GNGR is more focused on sales and not the share price (yet)

GNGR will be moving up to OTC current once the financials are all caught up. GNGR is all made 100% in the USA and no portion of production in contracted or outsourced.

If you say that the share structure is the reason 2 out of 3 jewelry companies fail. Well then GNGR is the one that does not.

No worries just wanted to once again show that GNGR was right about Signet (1 of 3) and Kingold (2 of 3) GNGR will be the #3 that does not fail.

Sure bookmark GNGR and just watch what is happening very soon. NO pump, No debt dilution conversion just good old fashioned hard work.

Team10

984K MCap?

4.5B A/S

1.09 O/S

the share structure looks so bad if this is a competing candidate jeweler stock?, though the float is low, O/S above 1B most of the time reflect bad management or poor financials?.... other than the reason 2-3 jewelers going down, is there any reason why is this company or stock may be a good deal? or to be on watch list?

GNGR, are you talking about: Gunther Grant

www.gugr.com ??????

Major update.

Mr. Newsteder was 100% correct about SIGNET (ticker SIG) dropping from $140 to $5.40 and anticipated Kingold would not be able to even have that much gold on hand based on reserves known in the world.

And we just saw this post on his twitter page and got confirmation that in fact NASDAQ listed Kingold is in deep trouble.

Some have said in past posts that it is impossible for GNGR to compete with these major operations. It will now be hard for them to keep up with GNGR from jail.

Signet is almost done, Warren Buffets Benbridge is all but close to being done and kingold is done.

That's a lot of done when GNGR is only doing.

People better open their eyes and ears and leave the true aspects of this industry and how to make it succeed to the professionals like GNGR.

Team10

">

"> " />

" />

almost $ 3Billion fake gold bars?....that is perplexing, how do these criminals do things of that level of fraud and think they will get away?....time and again, time and again!, how fu..kd up are they?...

=================================

Nasdaq-listed firm caught up in 83-tonne fake gold bars scam

Bloomberg News | July 16, 2020 | 9:23 am Intelligence China Gold

https://www.mining.com/web/chinese-jeweler-probed-for-using-fake-gold-bars-for-loans/

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 14, 2020 (November 29, 2019)

KINGOLD JEWELRY, INC.

(Exact name of registrant as specified in its charter)

Delaware 001-15819 13-3883101

(State or other jurisdiction of incorporation) (Commission File Number) (IRS Employer Identification No.)

No. 8 Han Huang Road

Jiang’an District

Wuhan, Hubei Province, PRC

430023

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (011) 86 27 65694977

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered

Common Stock, $0.001 par value KGJI The NASDAQ Capital Market

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note

On July 6, 2020, Kingold Jewelry Inc. (the “Company”) filed a Form 8-K (the “Form 8-K”) to report certain events under Item 2.04. Due to inadvertent errors in the information gathered by the Company, three sentences in Item 2.04 were inaccurate, which stated that, at the time of the report, the Company was still in the process of locating the notices of default it may have received with respect to the unpaid balances of the relevant loans, when in fact it has not received a notice of default from the respective lenders with respect to two loans and one of loans was further extended. This Form 8 K/A is being filed to include the updated disclosure to correct the errors in the filed Form 8-K. The content of this Form 8 K/A is otherwise identical to the content of the original 8-K filed on July 6, 2020.

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

(a) Evergrowing Bank Loans. As previously disclosed, from February 24, 2016 to March 24, 2016, Wuhan Kingold signed ten loan agreements with the Yantai Huanshan Road Branch of Evergrowing Bank for loans of approximately $140.1 million (RMB 1 billion) in aggregate. The purpose of the loans was for purchasing gold. The original terms of loans were two years and bore fixed interest of 4.75% per year. Based on the loan repayment plan as specified in the loan agreements, approximately half of the principal loan amount (RMB 500 million) was repaid upon maturity. For the remaining balance of approximately $70.0 million (RMB 500 million), the Company entered into a loan extension agreement with the bank to extend the loan borrowing period for seven months until October 2018, with the new interest rate of 6.5% per year. The loans were secured by 2,735 kilograms of gold in aggregate with carrying value of approximately $89.1 million (RMB 635.9 million) and were personally guaranteed by the CEO and Chairman of the Company, Mr. Zhihong Jia. Upon the maturity of these loans, the Company entered into a series of supplemental agreements with Yantai Huanshan Road Branch of Evergrowing Bank to extend the term of the loan for an additional 12 months, with new maturity dates between October 9, 2019 and October 21, 2019. From April to September 2019, the Company repaid a total of $42.1 million (RMB 300.5 million) to the bank. As of September 30, 2019, the outstanding balance of the loans amounted to approximately $27.9 million (RMB 199.5 million). The loan subsequently matured in October 2019, and the Company signed a supplemental agreement with the bank to extend the loan’s due date to March 23, 2020. During the fourth quarter of 2019, the Company repaid a portion of the loan and the unpaid balance was approximately RMB 194.5 million as of December 31, 2019. As of the date of this report, Wuhan Kingold has not received from Evergrowing Bank a notice of default or a notice of repayment with respect to the outstanding balance of the loan due on March 23, 2020.

(b) Sichuan Trust Loans.

On September 7, 2016, the Company entered into two trust loan agreements with Sichuan Trust Ltd. (“Sichuan Trust”) to borrow a maximum of approximately $280.2 million (RMB 2 billion) as working capital loan. The required annual interest rate was 8.46%. The Company paid the first interest payment equal to 1.21% of the principal received as loan origination fee on an annual basis. The rest of the interest payments are calculated based on a fixed interest rate of 7.25%. The Company pledged 7,258 kilograms of gold with carrying value of approximately $236.4 million (RMB 1.7 billion) as collateral to secure this loan. The loan was personally guaranteed by the CEO and Chairman of the Company. The Company also made a restricted deposit of approximately $2.1 million (RMB 15 million) to secure these loans. The deposit would be refunded when the loan was repaid upon maturity. As of September 30, 2019, the Company received an aggregate of approximately $210.1 million (RMB 1.5 billion) from the loan. These loans originally had maturity dates between September 20, 2018 and November 30, 2018. During the year ended December 31, 2018, these loans were extended to have maturity dates between November 20, 2019 and January 30, 2020. As of September 30, 2019, 7,258 kilograms of gold with carrying value of approximately $236.4 million (approximately RMB 1.7 billion) were pledged as collateral to secure the loans. The Company stated the parties had agreed to further extend the loans and Wuhan Kingold had also signed the extension agreements. Sichuan Trust has not, however, returned its signed extension agreements to Wuhan Kingold. The loan records Wuhan Kingold obtained from the systems of the People’s Bank of China indicated that the loans were in fact extended with new maturity dates between December 2020 and January 2021. As of the date of this report, Wuhan Kingold has not received a notice of default or a notice of repayment due with respect to the outstanding balance of these loans.

In January 2019, Wuhan Kingold entered into a trust loan agreement in the amount of approximately $43.4 million (RMB 310 million) with Sichuan Trust. The purpose of the trust loan was to purchase raw material gold. The loan period was 12 months from receiving the principal amount. The loan bore interest at a fixed annual rate of 10.7615%. The loan was secured by 1,647 kilograms of gold in aggregate with carrying value of approximately $56.0 million (RMB 399.6 million). The loan was also personally guaranteed by the CEO and Chairman of the Company. On March 17, 2020, Wuhan Kingold received written notice from Sichuan Trust stating that, in light of the impact of COVID-19, Sichuan Trust agreed to extend the term of the loan for six months to July 27, 2020; and that in the event that the COVID-19 lockdown terminates before the extended due date, then Wuhan Kingold is required to repay the loan within one month after the ending of COVID-19 lockdown. The travel restrictions and lockdown were lifted on April 8, 2020. As of the date of this report, the outstanding principal balance of the loan is RMB 310 million. Wuhan Kingold has not received a notice of default or a notice of repayment with respect to this loan.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

KINGOLD JEWELRY, INC.

By: /s/ Yi Huang

Name: Yi Huang

Title: Acting Chief Financial Officer

Date: July 14, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 14, 2020 (July 8, 2020)

KINGOLD JEWELRY, INC.

(Exact name of registrant as specified in its charter)

Delaware 001-15819 13-3883101

(State or other jurisdiction of incorporation) (Commission File Number) (IRS Employer Identification No.)

No. 8 Han Huang Road

Jiang’an District

Wuhan, Hubei Province, PRC

430023

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (011) 86 27 65694977

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered

Common Stock, $0.001 par value KGJI The NASDAQ Capital Market

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On July 8, 2020, Wuhan Kingold Jewelry Co., Limited (“Wuhan Kingold”), a contractually controlled affiliate of Kingold Jewelry Inc. (the “Company”) received a Notice of Acceleration of Repayment Obligations (the “Notice”) from Bank of Zhangjiakou dated July 1, 2020 that an event of default has occurred with respect to a loan agreement entered into between Wuhan Kingold and Bank of Zhangjiakou.

On September 16, 2019, Wuhan Kingold entered into a Working Capital Loan Agreement with Zhangjiakou Bank for a loan of approximately $25.2 million (RMB 180 million). The purpose of this loan was to provide working capital for Wuhan Kingold to purchase gold as raw material. The term of the loan was one year with a maturity date of September 15, 2020. The loan bears fixed interest at 0.625% per month (7.5% per year), and the monthly interest is due on the 21st date of each month. An additional penalty interest will be applied to any unpaid monthly interest. The outstanding balance of loan principal and any remaining interest due must be paid at maturity. The agreement also provided that the bank has the right to accelerate repayment upon a default in interest payments. The loan is secured by 747 kilograms of gold in aggregate with the agreed carrying value of approximately $32.0 million (RMB 228.7 million) and is personally guaranteed by the CEO and Chairman of the Company.

The Notice states the outstanding balance of the unpaid interest due from February to June 2020 was RMB 5.7 million in aggregate. In the Notice, the bank declares that the entire loan shall be due and payable within three days of the delivery of the Notice, including RMB 180 million in principal and all unpaid interest.

Item 8.01 Other Events.

Business Operations of Wuhan Kingold. Wuhan Kingold’s operations have been significantly impacted by the disclosed loan defaults, related loan disputes, various legal proceedings and the resulting freezing of bank accounts. Further, as previously disclosed, its jewelry production had been halted in January through early April 2020 as a result of the COVID-19 outbreak. After Wuhan’s lockdown was lifted in April, Wuhan Kingold resumed its operations, albeit on a much smaller scale. The jewelry production has been limited to customized production, and the factory processes customized products for customers who supply gold to the Company, with virtually no branded production. Revenue generated from the customized product sale has historically counted only a small percentage of the total revenue, and such small revenue amount from recent sales has not been immediately paid by some customers and the unpaid portion is recorded as accounts receivable by the Company. Wuhan Kingold has granted to the delinquent customers a grace period from one to three months for making the payment given its long time relationships with those customers and Wuhan Kingold’s recent challenges. Factory production headcount has decreased from hundreds of employees to approximately 60 employees as of the date of this report. Employee salaries have mostly been funded by borrowings from an affiliated entity and paid through an employee’s personal bank account.

Legal Proceedings. In connection with various loan disputes with multiple lenders as disclosed in the current reports filed in July 2020, Wuhan Kingold and the Company’s CEO and Chairman of the Board, Mr. Zhihong Jia, have been involved in several legal proceedings.

Anxin Litigation Update. As previously disclosed, in February 2020, Anxin Trust Co., Ltd. (“Anxin Trust”) filed a lawsuit against Wuhan Kingold and the Company’s CEO in connection with the loan dispute arising from the loan agreement Wuhan Kingold entered into with Anxin Trust on January 29, 2016, and related extension and supplemental agreements. In April 2020, the plaintiff amended its complaint to add an additional defendant, Wuhan Kingold Industrial Group Co., Ltd, a related party to the Company, to the case and to change the outstanding balance of the due and payable amount under the loan from approximately RMB 0.39 billion in interest to a total of approximately RMB 2.3 billion including approximately RMB 2.0 billion of loan principal. This loan dispute suit is pending with the Shanghai Financial Court (the “Financial Court”). To preserve the defendants’ assets pending the outcome of the trial, in May 2020, the Financial Court issued a ruling and ordered to freeze the defendants’ assets of an aggregate value of approximately RMB 1.9 billion, including bank deposits, real property or personal property. At present, the parties’ suit regarding venue change is pending with the Shanghai High People’s Court and no hearing has been scheduled as of the date of this report.

Enforcement Orders by Court. Wuhan Intermediate People’s Court and Shandong Yantai Intermediate People’s Court have issued multiple orders to enforce Wuhan Kingold’s repayment obligations in accordance with the loan agreements and its performance of the remedy provisions as provided in the agreements upon the occurrence of default events. Such court orders were issued based on the official certification provided by several notary public offices in China certifying that the loan agreements between Wuhan Kingold and the lenders were valid and legally enforceable under Chinese law. In addition, the court orders also directed Wuhan Kingold to report the information regarding all of its assets to the courts.

Government Investigation. An investigation has been launched in Wuhan into the facts related to certain allegations regarding the adequacy and integrity of gold in the control of the lenders that was used as collateral to secure the loans Wuhan Kingold borrowed from those lenders under the relevant loan agreements.

Frozen Bank Accounts. All of Wuhan Kingold’s bank accounts have been frozen in connection with and as a result of various legal proceedings.

Special Committee Update. As previously disclosed, a special committee of the Board (the “Special Committee”) has been established to oversee an internal investigation into certain issues raised to the Board’s attention related to allegations in recent news articles that the gold pledged as collateral by Wuhan Kingold to secure certain loans was not pure gold (the “Internal Investigation”). However, the Special Committee is at present unable to retain independent advisors to conduct the Internal Investigation, because the Special Committee has been advised by the Company management that substantially all of the Company’s bank accounts have been frozen and as a result, the Special Committee is unable to access funds to retain advisors to conduct the investigation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

KINGOLD JEWELRY, INC.

By: /s/ Yi Huang

Name: Yi Huang

Title: Acting Chief Financial Officer

Date: July 14, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 6, 2020 (November 29, 2019)

KINGOLD JEWELRY, INC.

(Exact name of registrant as specified in its charter)

Delaware 001-15819 13-3883101

(State or other jurisdiction of incorporation) (Commission File Number) (IRS Employer Identification No.)

No. 8 Han Huang Road

Jiang’an District

Wuhan, Hubei Province, PRC

430023

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (011) 86 27 65694977

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered

Common Stock, $0.001 par value KGJI The NASDAQ Capital Market

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Between November 2019 and June 2020, Wuhan Kingold Jewelry Co., Limited (“Wuhan Kingold”), a contractually controlled affiliate of Kingold Jewelry Inc. (the “Company”) received various notices of default on a number of loans with seven lenders. The loans are all secured by gold assets in the control of the lenders, the adequacy and integrity of which are under dispute. The aggregate amount of loans for which Wuhan Kingold has received notices of default is approximately RMB 10 billion.

(a) Evergrowing Bank Loans. As previously disclosed, from February 24, 2016 to March 24, 2016, Wuhan Kingold signed ten loan agreements with the Yantai Huanshan Road Branch of Evergrowing Bank for loans of approximately $140.1 million (RMB 1 billion) in aggregate. The purpose of the loans was for purchasing gold. The original terms of loans were two years and bore fixed interest of 4.75% per year. Based on the loan repayment plan as specified in the loan agreements, approximately a half of the principal loan amount (RMB 500 million) was repaid upon maturity. For the remaining balance of approximately $70.0 million (RMB 500 million), the Company entered into a loan extension agreement with the bank to extend the loan borrowing period for additional seven months until October 2018, with the new interest rate of 6.5% per year. The loans were secured by 2,735 kilograms of gold in aggregate with carrying value of approximately $89.1 million (RMB 635.9 million) and were personally guaranteed by the CEO and Chairman of the Company, Mr. Zhihong Jia. Upon the maturity of these loans, the Company entered into a series of supplemental agreements with Yantai Huanshan Road Branch of Evergrowing Bank to extend the term of the loan for additional 12 months, with new maturity dates between October 9, 2019 and October 21, 2019. From April to September 2019, the Company repaid a total of $42.1 million (RMB 300.5 million) to the bank. As of September 30, 2019, the outstanding balance of the loans amounted to approximately $27.9 million (RMB 199.5 million). The loan was subsequently matured in October 2019, and the Company signed a supplemental agreement with the bank to extend the loan’s due date to March 23, 2020. During the fourth quarter of 2019, the Company repaid a portion of the loan and the unpaid balance was approximately RMB 194.5 million as of December 31, 2019. At the time of this report, the Company is still in the process of locating the notice of default with respect to the loan due on March 23, 2020.

(b) Sichuan Trust Loans.

On September 7, 2016, the Company entered into two trust loan agreements with Sichuan Trust Ltd. (“Sichuan Trust”) to borrow a maximum of approximately $280.2 million (RMB 2 billion) as working capital loan. The required annual interest rate was 8.46%. The Company paid the first interest payment equal to 1.21% of the principle received as loan origination fee on annual basis, then the rest of interest payments are calculated based on a fixed interest rate of 7.25%. The Company pledged 7,258 kilograms of gold with carrying value of approximately $236.4 million (RMB 1.7 billion) as collateral to secure this loan. The loan was personally guaranteed by the CEO and Chairman of the Company. The Company also made a restricted deposit of approximately $2.1 million (RMB 15 million) to secure these loans. The deposit would be refunded when the loan was repaid upon maturity. As of September 30, 2019, the Company received an aggregate of approximately $210.1 million (RMB 1.5 billion) from the loan. These loans originally had maturity dates between September 20, 2018 and November 30, 2018. During the year ended December 31, 2018, these loans were extended to have maturity dates between November 20, 2019 and January 30, 2020. As of September 30, 2019, 7,258 kilograms of gold with carrying value of approximately $236.4 million (approximately RMB 1.7 billion) was pledged as collateral to secure the loans. At the time of this report, the Company is still in the process of locating the notice of default it may have received with respect to the outstanding balance due under this loan.

In January 2019, Wuhan Kingold entered into a trust loan agreement in the amount of approximately $43.4 million (RMB 310 million) with Sichuan Trust. The purpose of the trust loan was to purchase raw material gold. The loan period was 12 months from receiving of principal amount. The loan bore interest at a fixed annual rate of 10.7615%. The loan was secured by 1,647 kilograms of gold in aggregate with carrying value of approximately $56.0 million (RMB 399.6 million). The loan was also personally guaranteed by the CEO and Chairman of the Company. On March 17, 2020, Wuhan Kingold received written notice from Sichuan Trust stating that, in light of the impact of COVID-19, Sichuan Trust agreed to extend the term of the loan for six months to July 27, 2020; and that in the event that the COVID-19 lockdown terminates before the extended due date, then Wuhan Kingold was required to repay the loan within one month after the ending of COVID-19 lockdown. The travel restrictions and lockdown were lifted on April 8, 2020. At the time of that notice, the outstanding principal balance of the loan at issue was approximately RMB 310 million. At the time of this report, the Company is still in the process of locating the notice of default it may have received with respect to the outstanding balance due under this loan.

(c) Aviation Capital Loans. On June 2, 2020, Wuhan Kingold received written notice from China Aviation Capital Investment Management (Shenzhen) (“Aviation Capital ”) that an event of default has occurred with respect to the trust loan agreement entered into between Wuhan Kingold and Aviation Capital on September 7, 2016. Pursuant to the agreement, Wuhan Kingold borrowed a maximum of approximately $84.1 million (RMB 600 million) as working capital loan. The first installment of the loan was approximately $40.6 million (RMB 290 million) to mature on September 6, 2018. The Company was required to make interest payments calculated based on a fixed annual interest rate of 7.5% and a one-time consulting fee of 3% based on the principal amount received as loan origination fee. The Company pledged 1,473 kilograms of gold with carrying value of approximately $48 million (RMB 342.5 million) as collateral to secure this loan. The loan was personally guaranteed by the CEO and Chairman of the Company. The loan was extended upon maturity for another 18 months with a new maturity date of March 5, 2020. According to the notice of default, the outstanding balance of the Aviation Capital loans was approximately RMB 304.7 million in aggregate, including loan principal of RMB 290 million.

(d) Minsheng Trust Loans.

On December 27, 2019, Wuhan Kingold received three written notices from China Minsheng Trust Co., Ltd. (“Minsheng Trust”) that an event of default has occurred with respect to two trust loan agreements entered into between Wuhan Kingold and Minsheng Trust. As previously disclosed on December 26, 2017, Wuhan Kingold entered into a trust loan agreement with China Minsheng Trust Co., Ltd. (“Minsheng Trust”) for the amount of no more than approximately $210.1 million (RMB 1.5 billion). The purpose of the trust loan was to supplement liquidity needs. The loans were issued in installments. Each installment of the loan had a 24-month term, and the period from issuance date of the first installment to the expiration date of the last installment was not to exceed 30 months. The loans had different maturity dates from January 3, 2020 to June 24, 2020. The loan bore interest at a fixed annual rate of 9.2%. The Company received a total of $210.1 million (RMB 1.5 billion) loans from Minsheng Trust under the agreements. The loan was secured by 7,887 kilograms of gold in aggregate with carrying value of approximately $260.3 million (RMB 1.9 billion). The loans were also personally guaranteed by Mr. Zhihong Jia, the CEO and Chairman of the Company. The Company also made a restricted cash deposit of approximately $2.1 million (RMB 15 million) to secure the loans. The agreements provided that the deposit would be refunded when the loan was repaid upon maturity.

On October 10, 2018, the Company entered into another trust loan agreement in the amount of no more than approximately $140.1 million (RMB 1.0 billion) with Minsheng Trust. The purpose of the trust loan was to supplement liquidity needs. The loan were issued in installments. Each installment had a 12-month term, and the period from issuance date of the first installment to the expiration date of the last installment shall not exceed 18 months. The loan bore an interest at a fixed annual rate of 10.5%. The loan was secured by 5,356 kilograms of gold in aggregate with carrying value of approximately $175.3 million (RMB 1.3 billion). The loan was also personally guaranteed by Mr. Jia.

On May 24, 2019, the Company entered into additional trust loan agreement with Minsheng Trust to borrow approximately $84.1 million (RMB 600 million) as working capital. Each installment of the loan had a 12-month term, and the period from issuance date of the first installment to the expiration date of the last installment shall not exceed 18 months. The loan bore an interest at a fixed annual rate of 11%. The loan was secured by 2,990 kilograms of gold in aggregate with carrying value of approximately $111.1 million (RMB 793.3 million). The loan was also personally guaranteed by Mr. Jia.

As of September 30, 2019, the aggregate outstanding loans payable to Mingsheng Trust amounted to approximately $574.4 million, among which approximately $78.8 million (RMB 526.6 million) has been subsequently repaid upon maturity in October 2019. According to the notice of default, the outstanding balance of the Minsheng Trust loans was approximately RMB 3.7 billion in aggregate, including RMB 3.1 billion in aggregate of loan principal.

(e) Dongguan Trust Loans. On November 29, 2019, Wuhan Kingold received written notice from Dongguan Trust Ltd. (“Dongguan Trust”) that an event of default has occurred with respect to a gold income rights transfer and repurchase agreement entered into in July 2018 between Wuhan Kingold and Dongguan Trust. The Agreement provided that Wuhan Kingold could borrow up to approximately $140.1 million (RMB 1 billion) in exchange for the income earning rights of Wuhan Kingold. Wuhan Kingold would be permitted to buy back the rights and repay the proceeds received, and shall pay a fixed interest of 11% over a term of 18 months. The Company determined that this Agreement was essentially a loan agreement due to the nature of this transaction. This loan was secured by 4,974 kilograms of gold in aggregate with carrying value of approximately $159.7 million (RMB 1,140 million). The loan was also personally guaranteed by Mr. Jia. The Company also made a restricted deposit of approximately $1.4 million (RMB 10 million) to secure the loan. The deposit would be refunded when the loan was repaid at maturity. According to the notice of default, the outstanding balance of the Dongguan Trust loans was approximately RMB 994.6 million in aggregate, including RMB 985 million of aggregate loan principal.

(f) Chang’An Trust Loans. On December 4, 2019, Wuhan Kingold received written notice from Chang’An Trust Ltd. (“Chang’An Trust”) that an event of default has occurred with respect to a trust loan contract Wuhan Kingold entered into with Chang’An Trust in September 2017. The agreement provided the Company with access to a total of approximately $140.1 million (RMB 1 billion) for the purpose of working capital needs. The loan bore an interest at an annual rate of 10% with a term of 24 months and was secured by 4,784 kilograms of gold with carrying value of approximately $157.5 million (RMB 1.1 billion). The loan was also personally guaranteed by Mr. Jia. The Company also made a restricted deposit of approximately $1.4 million (RMB 10 million) to secure these loans. The deposit would be refunded when the loan is repaid at maturity. On September 30, 2018, the Company made repayment of approximately $2.8 million (RMB 20 million). On October 31, 2018, the Company made additional repayment of approximately $25.9 million (RMB 178.2 million) to Chang’An Trust. As of September 30, 2019, the balance of loans from Chang’An Trust was approximately $112.3 (RMB 801.9 million), among which approximately $77.6 million (RMB 554.2 million) subsequently matured in October and early November 2019, and the Company entered into a supplemental agreement with Chang’An Trust to extend the loan repayment date to December 27, 2019. According to the notice of default, the outstanding balance of the Minsheng Trust loan principal was approximately RMB 604.2 million in aggregate and interest provided in the agreement.

(g) Anxin Trust Loans. In February 2020, Anxin Trust Co., Ltd. (“Anxin Trust”) filed a lawsuit against Wuhan Kingold claiming that an event of default has occurred with respect to a trust loan contract Wuhan Kingold entered into with Chang’An Trust in January 2016. On January 29, 2016, Wuhan Kingold signed a Collective Trust Loan Agreement with Anxin Trust Co., Ltd. (“Anxin Trust”). The agreement allowed the Company to access to approximately $420.3 million (RMB 3 billion) within 60 months. Each individual loan will bear a fixed annual interest of 14.8% or 11% with various maturity dates from February 19, 2019 to October 12, 2019. The purpose of this trust loan was to provide working capital for the Company to purchase gold. The loan was secured by 15,450 kilograms of gold in aggregate with carrying value of approximately $504.3 million (RMB 3.6 billion). The loan was also personally guaranteed by the CEO and Chairman of the Company. As of December 31, 2018, the Company received full amount from the loan. During the year ended December 31, 2018, the Company repaid approximately $78.5 million (RMB 0.56 billion), which resulted in an outstanding balance of approximately $341.8 million (RMB 2.44 billion). The Company also made a restricted deposit of approximately $3.4 million (RMB 24 million) to secure the rest of these loans. The deposit would be refunded when the loan is repaid upon maturity. In February and March 2019, the Company made repayments total of approximately $26.9 million (RMB 192 million) and extended the loans of approximately $17.8 million (RMB 127 million) which originally due on March 29, 2019 to April 10, 2019. In April and June 2019, the Company made repayments total of approximately $99.2 million (RMB 708 million) to Anxin Trust, and 5,580 kilograms of pledged gold with carrying value of approximately $55.4 million (RMB 395.3 million) has been released and returned upon the repayment. In August 2019, the Company made additional repayment of approximately $5.6 million (RMB 40 million) to Anxin Trust. 2,470 kilograms of pledged gold has been released and returned to inventory pool. As of September 30, 2019, the total outstanding loan payable to Anxin Trust amounted to approximately $210.1 million (RMB 1.5 billion), among which (1) $140.1 million (RMB 1 billion) matured in September 2019 but not repaid because the Company negotiated with Anxin Trust and extended the insurance coverage date to October 18, 2019, and subsequently further extended the insurance coverage date to December 18, 2019 and accordingly postponed the maturity date of $140.1 million loan to December 18, 2019, (2) The remaining $70.0 million (RMB 500 million) subsequently matured on October 11, 2019 and October 12, 2019, and the Company repaid RMB 100 million (approximately $14.0 million) to Anxin Trust upon loan maturity and then entered into a supplemental agreement with Anxin Trust to extend the loan term of RMB 400 million (approximately $56.0 million) for additional one year, with new maturity date in October 2020. As of September 30, 2019, 7,400 kilograms of gold with carrying value of approximately $241.0 million (approximately RMB 1.72 billion) was pledged as collateral to secure the loans. The plaintiff in the lawsuit sought repayment of the outstanding balance of approximately RMB 2.3 billion including unpaid principal of approximately RMB 2.0 billion.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On June 30, 2020, Kingold Jewelry Inc. (the “Company”) received a notification letter (the “First Notice”) from The Nasdaq Stock Market (“Nasdaq”) advising the Company that, because the Company has not filed its Form 10-Q for the period ended March 31, 2020 (the “Form 10-Q”), it no longer complies with Nasdaq’s Listing Rules for continued listing. Nasdaq Marketplace Rule 5250(c)(1) requires a company to timely file all required periodic financial reports with the U.S. Securities and Exchange Commission (the “Commission”) through the EDGAR system (the “Filing Requirement”). As disclosed by the Company on its Form 8-K filed with the Commission on May 14, 2020, the Company has delayed the filing of its Form 10-Q to allow additional time to complete the preparation of its financial statements required to be included in the Form 10-Q. The Company has not yet filed the Form 10-Q as of the date of this report and therefore does not meet the Filing Requirement. Although the May 14, 2020 Form 8-K anticipated that the Company would file the Form 10-Q by no later than June 29, 2020, due to the matters described in this Current Report on Form 8-K, the Company is currently unable to predict when it will file the Form 10-Q.

The First Notice states the Company has 60 calendar days until August 29, 2020 to regain compliance with the Filing Requirement or submit a plan to do so. The Notice also states that, if Nasdaq accepts the Company’s compliance plan, it may be eligible for additional time of up to 180 calendar days from the due date of the Form 10-Q, or until December 28, 2020 to regain compliance with the Filing Requirement.

On July 2, 2020, the Company received a second notification letter (the “Second Notice”) from Nasdaq advising the Company that, because the Company has not filed its Form 10-K for the period ended December 31, 2019 (the “Form 10-K”), it no longer complies with Nasdaq’s Listing Rules for continued listing. As disclosed by the Company on its Form 8-K filed with the Commission on March 30, 2020, the Company has delayed the filing of its Form 10-K to allow additional time to complete the preparation of its financial statements for the 2019 fiscal year required to be included in the Form 10-K. The Company has not yet filed the Form 10-K as of the date of this report. Although the March 30, 2020 Form 8-K anticipated that the Company would file the Form 10-K by no later than June 30, 2020, due to the matters described in this Current Report on Form 8-K, the Company is currently unable to predict when it will file the Form 10-K.

The Second Notice amends the First Notice and advises the Company that Nasdaq has determined to apply more stringent criteria to the submission timeframe and to shorten deadline for the Company to submit its plan pursuant to Nasdaq’s discretionary authority set forth in the Listing Rule 5101. The Company has now until July 16, 2020 to regain compliance with the Filing Requirement or submit a plan to do so. If Nasdaq accepts the Company’s compliance plan, the Company may be eligible for additional time of up to 180 calendar days from the due date of the Form 10-K, or until September 14, 2020 to regain compliance with the Filing Requirement.

If the Company does not regain compliance or submit a plan to obtain an extension from Nasdaq by July 16, 2020, Nasdaq will provide written notification to the Company that its common stock may be delisted. At that time, the Company may appeal Nasdaq’s decision to a Listing Qualifications Panel.

Item 8.01 Other Events.

Cancellation of Shanghai Gold Exchange Membership. On June 22, 2020, the Shanghai Gold Exchange (the “SGE”) issued a determination notification letter to the Company that, in light of the Company’s violations of certain rules and regulations of the SGE, the SGE has made the determination to cancel the Company’s membership with the SGE , with immediate effect.

Class Action Lawsuit. On June 30, 2020, a class action lawsuit styled RAJANI CHITTURI v. KINGOLD JEWELRY, INC., et al., Case No. 1:20-cv-02886, was filed in the United States District Court for the Eastern District of New York (the “Court”) against the Company and certain of its current and former officers (the “Defendants”). The complaint was filed on behalf of persons or entities who purchased or otherwise acquired publicly traded securities of the Company between March 15, 2018 and June 28, 2020. The complaint generally alleges that the Defendants engaged in acts and a course of business that operated as a fraud or deceit upon investors, and knowingly or recklessly disseminated or approved statements about the Company’s business operations, financial performance and prospects that were materially false and misleading. The complaint asserted claims for violations of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder, and Section 20(a) of the Securities Exchange Act of 1934. The claim sought damages and an award of reasonable costs and expenses, including counsel fees and expert fees.

Establishment of Special Committee. On June 29, 2020, Caixin Media published an article alleging, among other matters, that the gold pledged as collateral by Wuhan Kingold to secure certain loans was not pure gold. The Company’s Board of Directors (the “Board”) has formed a special committee (the “Special Committee”) to oversee an internal investigation into certain issues raised to the Board’s attention (the “Internal Investigation”). The Special Committee is currently comprised of two independent directors of the Board, Mr. Guang Chen and Alice Io Wai Wu, and one or two additional members are expected to be appointed to the Special Committee as soon as suitable candidates can be determined. The Special Committee will begin its search of independent advisors, including independent legal advisors and forensic accountants, in connection with the Internal Investigation. The Internal Investigation is at a preliminary stage.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

KINGOLD JEWELRY, INC.

By: /s/ Yi Huang

Name: Yi Huang

Title:

Acting Chief Financial Officer

Date: July 6, 2020

Kingold collapse coming.

I hope we do not buy based on garbage like Wallet Investor.

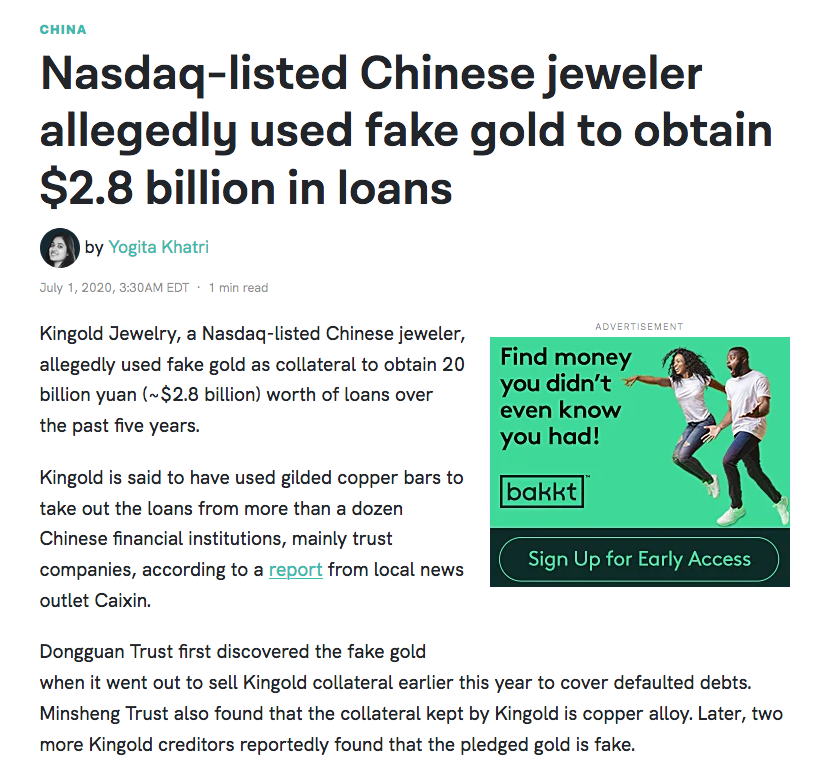

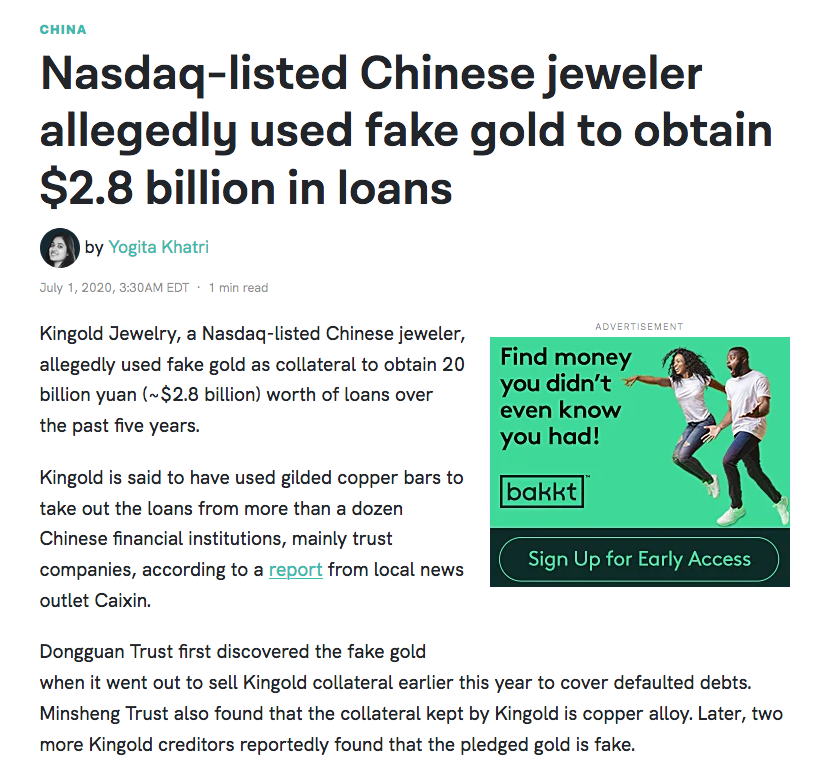

More than a dozen Chinese financial institutions, mainly trust companies, loaned 20 billion yuan ($2.8 billion) over the past five years to Wuhan Kingold Jewelry Inc. with pure gold as collateral and insurance policies to cover any losses.

Kingold is the largest privately owned gold processor in central China's Hubei province. Its shares are listed on the Nasdaq stock exchange in New York. The company is led by Chairman Jia Zhihong, an intimidating ex-military man who is the controlling shareholder.

What could go wrong?

Well, plenty, as at least some of 83 tons of gold bars used as collateral turned out to be nothing but gilded copper. That has left lenders holding the bag for the remaining 16 billion yuan of loans outstanding against the bogus bars. The loans were covered by 30 billion yuan of property insurance policies issued by state insurer PICC Property and Casualty Co. Ltd. (PICC P&C) and other smaller insurers.

fwiw.

"KGJI price target in 14 days: 1.142 USD* upside and 0.429 USD* downside. (Highest and lowest possible predicted price in a 14 day period)"

Say it ain't so, Joe...(the world series wasn't the only thing fixed)

is trading at historical low. low risk/high reward here. excellent funds protection against coming turbulent markets. $1 Billion dollar net gold assets.

On November 5, 2019, Nasdaq notified the Company that it has regained compliance with the Minimum Bid Price Rule $1

|

Followers

|

18

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

282

|

|

Created

|

01/14/10

|

Type

|

Free

|

| Moderators | |||

Third Quarter 2011 Highlights

Business Outlook

Based on the Company's performance during the first nine months of 2011 and management's current outlook for the remainder of the year, the Company has reassured its full year 2011 revenue guidance to a range of between $800 million and $850 million and net income guidance between $32 million and $34 million.

"Our performance in the first nine months of 2011 reinforces our optimism for another year of strong organic growth at Kingold," commented Mr. Jia. "Domestic demand for 24-karat gold products is still robust and we have been well positioned to take advantage of surging consumer demand in China."

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |