Update: 08-01-2024

http://www.scjak.com/list-154-1.html unankang's plan to build a market value of 100 billion

Create a large health industry group company focusing on domestic health towns, rural health tourism complexes, medical care,

elderly care, health management, health tourism, cultural tourism, agricultural tourism, and cultural creation http://www.scjak.com/list-140-1.html http://www.scjak.com/list-137-1.html Medical Care and Elderly Care

BRAND

CORE VALUE

New Restricted shares vs Old --- looks like float is the same

The company shows heavy restricted shares 08-18-2023 <> Restricted 1,615,067,114

08/17/2023

https://www.otcmarkets.com/stock/IHGP/security IHGP SECURITY DETAILS

Share Structure

Market Cap Market Cap 27,383,361

08/17/2023

Authorized Shares 7,500,000,000

08/17/2023

Outstanding Shares 1,629,961,987

08/17/2023

Restricted 1,615,067,114 vs Restricted........................735,067,114 <> UPDATED SHARE STRUCTURE AS OF 04-28-2021

08/17/2023

Unrestricted 14,894,873

08/17/2023

Held at DTC 14,886,369

08/17/2023

Float 14,894,873 <> Float......................................14,894,873 no change AS OF 04-28-2021

12/31/2022

Par Value 0.00001

=================================================

Interact Holdings Group, Inc.

UPDATED SHARE STRUCTURE AS OF 04-28-2021

$IHGP SECURITY DETAILS S/S MKT CAP 379 04/27/2021 O/S 14,961,987

Market Cap Market Cap.....27,748,594

02-07-2022

Authorized Shares......7,500,000,000

Outstanding Shares....--749,961,987

Restricted........................735,067,114

Unrestricted........................14,894,873

Held at DTC.........................14,886,369

Float......................................14,894,873

Par Value..................................0.0001

BULLISH

THE MEDICAL INDUSTRY

medical industry

Chengdu Red Star Geriatric Hospital Zigong Hongxin Hospital CRRC Auto Repair (Group) Chengdu 7436 Factory Staff Hospital Weiyuan Tongxin Hospital Weiyuan Baolikang Hospital Zhejiang Xiangshan Star City Hospital 04-20-2023

$IHGP / Jun An Kang Group Inc. f.k.a. Interact Holdings Group, Inc. (the "Company") was [JAKG for the issuance of 10,000,000 shares of the Company’s common stock. JAKG through its China based subsidiaries,] previously as shell company, until December 24, 2022, as the Company was dormant and had no or little operations. The Company’s status as a shell company has changed. As of December 24, 2022, the Company was no longer a shell company. https://www.otcmarkets.com/stock/IHGP/disclosure https://www.otcmarkets.com/otcapi/company/financial-report/358931/content The reason the Company believes it is no longer a Shell Company under the SEC's definition is as follows: On December 14, 2022, the Company entered into a Definitive Share Exchange Agreement with Jun Ankang Group Holding Ltd, a British Virgin Islands corporation (“JAKG”), whereunder the Company acquired 100% ownership interest in JAKG for the issuance of 10,000,000 shares of the Company’s common stock. JAKG through its China based subsidiaries, Sichuan Junankang Aishang Health Technology Co., Ltd., is a health industry company mainly focusing on medical care, pension, combination of medical care, health care, community care, home care, community medical care, and home care, and has launched online and offline health care services. The transaction closed effective December 24, 2022 and has been treated as a business combination under common control, resulting in JAKG becoming a wholly-owned subsidiary of the Company. As such, the Company recognized the assets and liabilities of JAKG acquired in the reorganization, at their historical carrying amounts. The Company is an operating company with more than nominal non-cash assets and more than nominal operations. This can be confirmed in the financial statements included in the Annual Report for the year ended December 31, 2022, which has been published on the OTC Markets.Jun An Kang Group Inc. f.k.a. Interact Holdings Group, Inc /s/ Hongbin Xu Hongbin Xu, President & CEO NEW NAME CHANGE HERE MY FRIEND 10-24-2022

@ yahoo.com Jun An Kang Group Inc. (IHGP)

https://finance.yahoo.com/quote/IHGP?p=IHGP&.tsrc=fin-srch https://finance.yahoo.com/quote/IHGP/community?p=IHGP Other OTC - Other OTC Delayed Price. Currency in USD

0.01900.0000 (0.00%)

At close: November 15 01:14PM EST

https://seekingalpha.com/symbol/IHGP IHGP Jun An Kang Group Inc.

Jun An Kang Group Inc. provides infrastructure management and technology services. The company intends to restructure its business through the acquisition of additional business opportunities.

The company was formerly known as Interact Holdings Group, Inc. Jun An Kang Group Inc. was founded in 1998 and is based in San Diego, California.

- 8880 Rio San Diego Drive

8th Floor

San Diego, CA, 92108

United States

BNB Fear & Greed Index

@BNBFear

BNB Fear and Greed Index is 65 - Greed

8:53 AM · Aug 4, 2022

[-chart]pbs.twimg.com/media/FZVAuvHWIAMB1iS?format=png&name=small[/chart]

UPDATE; 07-28-2022

$ihgp /\ $IHGP They talk about $100billion market value that converts to $742 million US.

8:16 AM · Jul 28, 2022

New website, and company looks huge. 2000 employees.

http://scjak.com COMPANY OFFICERS & CONTACTS

[-chart]pbs.twimg.com/media/FYw1CQwXwAApikd?format=png&name=small[/chart]

courtesy of $IHGP UPDATE; 7-7-2022

[-chart]pbs.twimg.com/media/FR1XjtsX0AAZIR9?format=jpg&name=large[/chart]

$IHGP it’s coming! patience is key with this low floater

UPDATED: 4-6-22

https://www.otcmarkets.com/otcapi/company/financial-report/324797/content March 22, 2022 VIA EMAIL OTC Markets Group, Inc. 304 Hudson Street, 3rd Floor New York, NY 10013 Re: Jun An Kang Group Inc.,

formerly known as Interact Holdings Group, Inc., Adequate Current Information Ladies and Gentlemen:

This firm has been retained by Jun An Kang Group Inc., formerly known as Interact Holdings Group, Inc., a Florida corporation (the "Issuer"),

for the purpose of providing this letter with respect to the information publicly disclosed by the Issuer published through the OTC Disclosure and News Services

(the “OTC Disclosure”). We have acted as legal counsel to the Issuer for approximately eight months.

OTC Markets Group, Inc. is entitled to rely on this letter in determining whether the Issuer has made adequate current information publicly available within the meaning

of Rule 144I(2) under the Securities Act of 1933. OTC Markets Group, Inc. shall have full and complete permission

and rights to publish this letter through the OTC Disclosure for viewing by the public and regulators.

500 Fifth Ave, Suite# 938, New York, NY 10110 Office: 646.861.7891

http://www.cronelawgroup.com NOW CURRENT;

==========================================================

UPDATE; 08-26-2021

https://www.otcmarkets.com/stock/IHGP/disclosure https://emerginggrowth.com/ Interact Holdings Group, Inc ALL SHAREHOLDERS SHOULD BE PROUD OF

Harry Haining Zhang appointed the sole director/officer on February 1, 2021. 07-07-2021

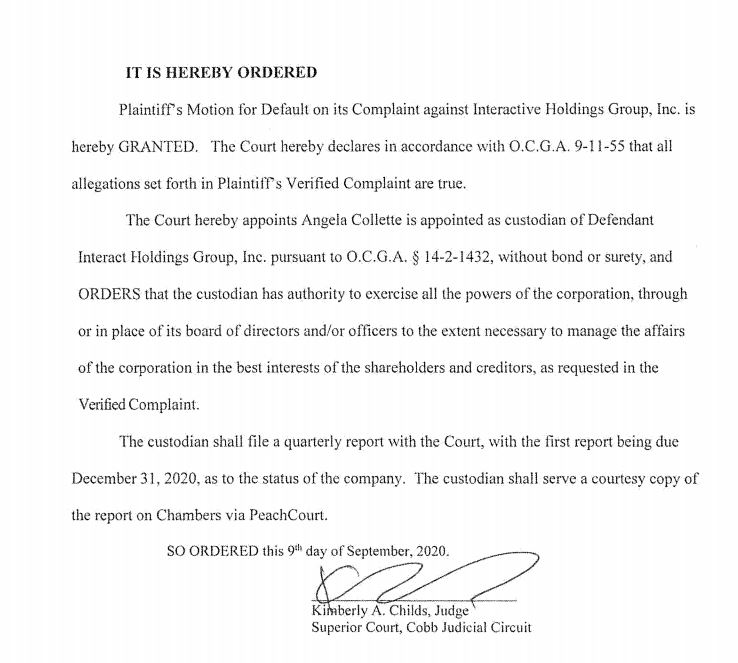

CUSTODIAN

Supplemental Disclosure for Court Appointed Custodian Events Interact Holdings Group, Inc. 701 Ann Street, #564, Stroudsburg, Pa 18360 6463830883 hzmails@yahoo.com

The goal of this disclosure is to provide information with respect to a company’s Court Appointed Custodian.3 Please address each of the below items to the best of the company’s

ability and to the extent they are applicable to the company’s custodianship proceedings. Disclosure of Court Appointed Custodian and Other Material Events:

1. Date of court order, name of court, case number, and name of custodian (if a corporate entity, include name of controlling individual). Angela Collette was appointed as

Receiver by Honorable Judge Kimberly A. Childs in Superior Court of Cobb County, Georgia in case number 19-0105682-CV (ID# 2019-0140152-CV; 19105682) on September 9, 2020.

2. Number of securities held by custodian, voting power of the securities, and description as to how the securities were acquired (e.g., open market purchases, compensation,

loan settlement). 15 Million Shares of Common (compensation)

3. A description of officer/director appointments, resignations or terminations made in connection with the custodianship proceedings, including names and relevant titles.

Former officer/director have not been located since the appointment of receiver. Harry Haining Zhang was appointed the sole director/officer on February 1, 2021.

4. A description of any opposition by former management or shareholders (if there was no opposition, this should be stated). No opposition

5. A description of any other material transactions since grant of custody identified in item 1 above. N/A Certification:

July 7, 2021 [Date] /s/Harry Haining Zhang [Officer/Custodian Signature] (Digital Signatures should appear as “/s/ [NAME]”) 3 “Court Appointed Custodian” means a custodian,

receiver, agent or other person appointed for the Company or its parent in a proceeding under federal or state law in which the court or government authority has assumed

control over substantially all of the assets or business of the company or its parent.

@ PINKS 07-23-2021 FILINGS AND DISCLOSURE OTC Disclosure & News

On Twitter said, IF NOT CURRENT BY SEPT. DATE , 2021 THEN STOCK GOES TO EXPERT MARKET MAKER.

NOT GREY SHEETER !!!!!

$IHGP Additional information/Share Structure Updated[14M+;$IHGP LOW COUNT TOO $IHGP SEPT.,2020 Custodianship granted. Reinstatement VERIFIED 12-07-2020

https://www.otcmarkets.com/stock/IHGP/profile

http://www.interactholdings.com/

[-chart]www.interactholdings.com/images/bzudzCapture.jpg[/chart] - Interact Holdings Group

Brands

Investors

Our Mission

Contact Us

Terms of Service and Privacy Policy

Interact Holdings Group, Inc. is bringing together traditional technologies in a non-traditional delivery service to save consumers time

and money while delivering exceptional service that exceeds expectations.

Interact Holdings Group, Inc. believes sometimes a shift in the business paradigm is needed, and a good thing.

It is time for a paradigm shift in the residential technology market, and Interact Holdings Group, Inc. wants to lead the way.

What We Do

We acquire and establish companies or business units that serve

the

utility,

municipal,

and energy industry marketplace with products and services used to manage the world’s industrial infrastructure.

Some of the services our companies offer are:

front-end systems engineering design,

machine-to-machine (M2M) telemetry services,

network operations management,

security assessments and operational audits.

[-chart]www.interactholdings.com/images/bestonlinecasinogames.png[/chart]

[-chart]www.interactholdings.com/images/1page_img2.jpg[/chart]

Bringing Environmentally Friendly Technologies to the Home

Providing one product or service is a great place to start,

but Interact Holdings Group's goal is to provide complete solutions which save consumers money while doing their part for the Earth.

[-chart]www.interactholdings.com/images/1page_img1.jpg[/chart]

Bringing "Green" to the Home

Money doesn't grow on trees, but we are trying to help consumers save their dollars by brining products such as Cable Television,

High-Speed Internet, Telephone, and Home Security to consumers in a new business-model.

Our Team

William Yates

CEO & President

Mr. Yates has over 21 years of experience in the Information Technology Industry, with the last 10 years being in…

William Yates

President

Hello all, it has been a very busy start to the New Year for Interact Holdings Group. We are in…

COURTESY OF ILIKEBBSTOCKS 06-08-2021

control block added! Restricted now. 735,067,114 05/27/2021 was 14,961,987, Harry Haining Zhang President,

14M float, merger coming! Ran to .14 on TA confirmation bout a month ago

COURTESY OF ILIKEBBSTOCKS

Wow I think the description updated recently "DESCRIPTION

The Company is engaged in the acquisition of long-term recurring revenue contracts.

The Company is also involved in the sales and distribution of "Green" products to residential builders and developers.

Interact Holdings Group Inc. is currently the exclusive distributor of LUUMS LED products in the USA."

this now matches the website interactholdings.com

looks like its going to be a green company, which sells LED

products LightSpread® Technology,

Light Space solutions with Elumen Lighting Network (DLC approved)

LED products, provide 40% more coverage vertically and horizontally,

creating a uniform 3D space lighting effect with minimum shadow.

William Yates CEO, would think we'd see change of control/name change

on FL SOS shortly, they are known to be slow.

http://www.lightspaceus.com/tech-1

Authorized Shares

7,500,000,000

05/12/2021

Outstanding Shares

14,961,987

05/12/2021

What We Do:

We acquire and establish companies or business units that serve

the utility,

municipal, and

energy industry marketplace with products and services used to

manage the world’s industrial infrastructure.

Some of the services our companies offer are: front-end systems engineering design,

machine-to-machine (M2M) telemetry services,

network operations management,

security assessments and operational audits.

[-chart]www.stockscores.com/chart.asp?TickerSymbol=IHGP&TimeRange=180&Interval=d&Volume=1&ChartType=CandleStick&Stockscores=1&ChartWidth=830&ChartHeight=500&LogScale=None&Band=BB&avgType1=SMA&movAvg1=50&avgType2=SMA&movAvg2=100&Indicator1=MACD&Indicator2=AccDist&Indicator3=FStoch&Indicator4=RSI&endDate=&CompareWith=&entryPrice=&stopLossPrice=&candles=redgreen[/chart]

SO MKT CAP IS ONLY $800-K 'Interact Holdings Group, Inc. (IHGP)'now 1.265 mil.

https://www.otcmarkets.com/stock/IHGP/security

UPDATE LITTLE OVER $MIL.

Market Cap Market Cap

1,264,288

05/12/2021

Authorized Shares

7,500,000,000

05/12/2021

Outstanding Shares

14,961,987

05/12/2021

Restricted

67,114

05/12/2021

Unrestricted

14,894,873

05/12/2021

Held at DTC

14,886,369

05/12/2021

Interact Holdings Group, Inc.

UPDATED SHARE STRUCTURE AS OF 04-28-2021

$IHGP SECURITY DETAILS S/S MKT CAP 379 04/27/2021 O/S 14,961,987 Market Cap Market Cap.....27,748,594

02-07-2022

Authorized Shares......7,500,000,000

Outstanding Shares....--749,961,987 Restricted........................735,067,114 Unrestricted........................14,894,873 Held at DTC.........................14,886,369 Float......................................14,894,873

Par Value..................................0.0001

==============================================================

$IHGP SECURITY DETAILS

Share Structure

Market Cap Market Cap

379

04/27/2021

Authorized Shares

7,500,000,000

04/28/2021

Outstanding Shares

14,961,987

04/28/2021

Restricted

67,114

04/28/2021

Unrestricted

14,894,873

04/28/2021

Held at DTC

14,886,369

04/28/2021

Float

Not Available

Par Value

0.0001

Market Value calculated only for respective security

Transfer Agent

Transfer Online, Inc.

Shareholders

Not Available

Corporate Actions

Symbol Changes

ACTION TYPE EFFECTIVE DATE SYMBOL DESCRIPTION

Symbol Change 10/11/2010 IHGP Symbol change from IHGPD to IHGP

Symbol Change 09/14/2010 IHGP Symbol change from IHGP to IHGPD

Symbol Change 12/19/2008 IHGP Symbol change from IHGR to IHGP

Displaying 3 of 3 Actions

Dividends & Splits

DividendsSplits

No dividends

Short Selling Data

Short Interest

1,347

(100%)

03/15/2021

Significant Failures to Deliver

No

SECURITY NOTES

Capital Change=shs decreased by 1 for 1000 split. Pay date=11-22-04

Capital Change=shs decreased by 1 for 2000 split. Pay date=2-1-05

Capital Change=shs decreased by 1 for 2000 split. Pay date=5-9-05

Capital Change=shs increased by 4 for 1 split. Ex-date=5-27-05. Payable upon surrender.

Capital Change=shs decreased by 1 for 500 split Pay date=02/13/2007.

Capital Change=shs decreased by 1 for 200 split Pay date=12/19/2008.

Capital Change=shs decreased by 1 for 500 split. Pay date=09/14/2010.

01-27-2021 i am going to place some possibilities in IBOX

http://www.lightspaceus.com/

http://www.lightspaceus.com/about-us

http://www.lightspaceus.com/products-1-1

http://www.lightspaceus.com/tech-1

http://www.lightspaceus.com/new-page

http://www.lightspaceus.com/energy-saving

http://www.lightspaceus.com/solar-solution-1 LIGHT SPACE SOLAR TEAM PROVIDE PV EPC/O&M/INVESTOR TOTAL SOLUTION

HIGH QUALITY PV PARTS

HIGH EFFICIENT PV MODULE

STRONG AND ANTI–CORROSION MOUNTING SYSTEM

WELL KNOWN INTERNATIONAL INVERTER

DOUBLE GUARANTEE—20 YEARS WARRANTY AND POWER GENERATING EFFICIENT PROMISE

http://www.lightspaceus.com/artificial-intelligence

ARTIFICIAL INTELLIGENCE

http://www.lightspaceus.com/energy-storage

http://www.lightspaceus.com/high-bay

http://www.lightspaceus.com/low-bay

http://www.lightspaceus.com/outdoor-2

http://www.lightspaceus.com/led-tube

http://www.lightspaceus.com/smart-lights

http://www.lightspaceus.com/ultrasonic-parking-guidance-system

Headquarters

200 Spectrum Center Dr Suite 300, Irvine, CA 92618

Taipei HQ :

8F. -801, No.54, Sec. 4, Minsheng E. Rd., Songshan Dist.,

Taipei City 105, Taiwan

Vietnam Office :

Phong 102 toa nha Phuong Hoang, TDP Tan Phong,

thi xa Ky Anh, Tinh Ha Tinh

The China POC (EB) :

Rm 304 Building No. B, Bao Tian 1st road,

Xixiang Town, Baoan District (Ding Jun Shan Cultural Science

and Technology Creatvie Park) Shenzhen City, Guangdong, P.R. China

Zipcode : 518102

The Netherlands POC (LUUMS) :

Marsstraat 1, 4105 JK Culemborg, Netherlands

http://www.lightspaceus.com/about-us

01-06-2021

CUP WIT FRYING PAN HANDLE

UPDATE 11-22-2020

IHGP Short Information, Interact Hldgs Group Inc

https://marketwirenews.com/stock/ihgp/short/

09-24-2020 ANNOUNCED REINSTATEMENT

Sun biz site

https://dos.myflorida.com/sunbiz/]

OWNER ; UPDATE -11-23-2020

Here’s more DD about Harry Zhang and Quanleap Capital. I translated the webpage to English from Chinese:

http://www.vcgcc.com/en-us/Home/info/a43d35f1-1cf9-432b-8bb0-4046eb7c77e9

2020

(1)917-723-0338

U.S. OTC backdoor listing through train This is the U.S. backdoor listing through train!

There have been many misrepresentations/misunderstandings/rumors about U.S. backdoor listing/OTC in the Chinese space for many years.

Now is the time to remove these misleading/straightforward words.

United States The small capital market (Pinksheets, OTC and NASDAQ) is still a high-growth market.

We Quanleap LLC holds a large number of OTC/Pinksheets shell companies, which can be used for listing through reverse mergers.

If necessary, please call the United States; WeChat: harryzhang21; Email:

hzmails@yahoo.com.

The down payment is $150,000 and will be completed in about two weeks.

Shell company transaction code: IHGP, for details, please check https://www.otcmarkets.com/stock/ihgp/profile The current stock price

is two cents The buyer needs to send the remittance to the relevant account, and attach the business plan/mail address//email address/copy of the ID card, etc.

Fifty-eight companies uplisted to a national exchange in 2018.

Of the companies, 36 moved to NASDAQ Capital Markets,

10 went to NASDAQ Global Select and 12 listed on NYSE American.

The companies moved up from various marketplaces, including 30 from the OTCQB, 12 from the OTCQX and 16 from the OTC Pink Current.

In order to list on a national exchange, companies must meet the listing requirements of the exchange.

Remove all redundant intermediaries, including so-called lawyers!

If necessary, please call Haining Zhang, USA (Harry Zhang); WeChat: harryzhang21; Email: hzmails@yahoo.com; Address: Harry Zhang, Quanleap LLC, 2544 Route 534, Albrightsville, PA 18210, USA

CUSTODAINSHIP 09-23-2020 [09-O9-2020]

$IHGP wow wowzer BB i like dis [wow custodianship granted]

https://ctsearch.cobbsuperiorcourtclerk.com/CaseNumber

Case number: 19105682, Haining Zhang

[-chart]investorshub.advfn.com/uimage/uploads/2020/9/23/nhgoiIHGP-cust.JPG[/chart]

-

per

'i_like_bb_stock' [CUSTODAINSHIP 09-23-2020 [09-O9-2020]

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=158485594

thank you.

04-22-2020 , oversold;

$IHGP, oversold; Note that the stock is in oversold territory based on its Slow Stochastic indicator (14, 3,

https://otcbb.swingtradebot.com/equities/IHGP:OTCIHGP

$IHGP

TEN YR; $IHGP

### Haining Zhang patent invention listings [MR. ZHANG IS AN INVENTOR]

The bibliographic references displayed about Haining Zhang's patents are for a recent sample of Haining Zhang's publicly published patent applications.

The inventor/author may have additional bibliographic citations listed at the USPTO.gov. FreshPatents.com is not associated or affiliated in any way with

the author/inventor or the United States Patent/Trademark Office but is providing this non-comprehensive sample listing for educational and research purposes

using public bibliographic data published and disseminated from the United States Patent/Trademark Office public datafeed.

This information is also available for free on the USPTO.gov website.

If Haining Zhang filed recent patent applications under another name,

spelling or location then those applications could be listed on an alternate page.

If no bibliographic references are listed here,

it is possible there are no recent filings or there is a technical issue with the listing--in that case, we recommend doing a search on the USPTO.gov website. 10/05/17 - 20170286323 - Methods and apparatus for providing access to a shared memory resource.

In one embodiment, a first processor generates a first window register associated with the shared memory resource;

and transmits the first window register from the first processor to a second processor,

the first window register defining a first extent

09/28/17 - 20170279510 - The disclosed embodiments provide a system that uses a first antenna and a second antenna in a portable electronic device.

During operation, the system receives a request to switch from the first antenna to the second antenna to transmit a signal to a cellular receiver. Next, the system loads a

08/31/17 - 20170249164 - Methods and apparatus for enabling a peripheral processor to retrieve and load firmware for execution within the constraints of its memory.

The peripheral processor is allocated a portion of the host processor's memory, to function as a logical secondary and tertiary memory for memory cache operation.

The described embodiments enable Inventors: Vladislav Petkov, Haining Zhang, Karan Sanghi, Saurabh Garg

12/09/10 - 20100309898 - A method and system of reachability indication between a wireless device and at least one push server,

the method comprising the steps of: sending device status information from the wireless device to the at least one push server;

and receiving the status information at the at least one push server;

01/22/15 - 20150026093 - A wireless communication device declares one of a plurality of extended instant messaging states and transmits the declared states to a presence information server.

Declared extended instant messaging states for destination devices are received, and an enhanced instant message based on declared extended instant messaging states is generated.

12/15/16 - 20160364350 - Methods and apparatus for a synchronized multi-directional transfer on an inter-processor communication (IPC) link.

In one embodiment, the synchronized multi-directional transfer utilizes one or more buffers which are configured to accumulate data during a first state.

The one or more buffers are further configured to transfer the accumulated data during 07/27/17 - 20170215145 - Methods and apparatus for limiting wake requests from one device to one or more other devices.

In one embodiment, the requests are from a peripheral processor to a host processor within an electronic device such as a mobile smartphone

or tablet which has power consumption requirements or considerations associated therewith. 08/31/17 - 20170249098 - Methods and apparatus for locking at least a portion of a shared memory resource.

In one embodiment, an electronic device configured to lock at least a portion of a shared memory is disclosed.

The electronic device includes a host processor, at least one peripheral processor and a physical bus interface closed down 42.5 percent on Thursday, April 16, 2020, on 10 percent of normal volume.

Note that the stock is in oversold territory based on its Slow Stochastic indicator (14, 3, 3)

-- sideways movement or a bounce should not be unexpected.

$IHGP; 1-Year Forecast *?2.635 USD

https://walletinvestor.com/stock-forecast/ihgp-stock-prediction

LAST 2010 $IHGP IHGP SECURITY DETAILS

https://www.otcmarkets.com/stock/IHGP/security

Share Structure

Market Cap Market Cap

100

09/21/2020

Authorized Shares

Not Available

Outstanding Shares

19,937

09/14/2010

Restricted

Not Available

Unrestricted

Not Available

Held at DTC

Not Available

Float

Not Available

Par Value

0.0001

INTERACT HLDGS GROUP INC (IHGP)

$ 0.0022-0.0022 | -50.00%

At Walletinvestor.com we predict future values with technical analysis for wide selection of stocks like Interact Holdings Group, Inc (IHGP).

If you are looking for stocks with good return, Interact Holdings Group, Inc can be a profitable investment option. Interact Holdings Group, Inc

quote is equal to 0.00440 USD at 2020-04-14. Based on our forecasts, a long-term increase is expected,

the "IHGP" stock price prognosis for 2025-04-08 is 0.0157 USD. With a 5-year investment, the revenue is expected to be around +256.1%.

Your current $100 investment may be up to $356.1 in 2025.

April 14, 2020 1:33 PMEDTVolume: 300,000 USDOTC PINKDELAYED PRICE

https://potstocknews.com/stock-quote/IHGP/

https://potstocknews.com/stock-quote/IHGP/chart/

*DISCLAIMER *The Board Monitor and The Board Assistants herewith, are not licensed brokers and assume NO responsibility for the actions, investment decisions, and or messages posted on this forum.

• We do NOT recommend that anyone buy or sell any securities posted herewith. Any trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.