Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The previous "filings" Klug did post to EDGAR were also incomplete. misleading, and fraudulent.

Klug is not what he may appear to be... Klug is a lying con man...

..

.

He hid the books by going delinquent, then private.

...I don’t see where he personally took huge sums from the company, though I never reviewed books to see actual checks or transfers....

IF SOMEONE MET OR THEY KNOW MR KLUG THEY HAVE NO PROBLEM CALLING HIM IMO

IMO MR KLUG IS WAITING ON YOUR PHONE CALL. HE DOESNT EVEN KNOW YOU DARE YOU TO CALL MR KLUG

Well, I guess someone either cannot read or has not read of when someone met Mr. Klug face-to-face, and shook his hand, and we talked. He’s a very nice person.

I would have a hard time believing that what happened to Redhawk was done on purpose by GDK. That’s not to say that the lawsuits are not very damming., In this man’s opinion anyway

When did you this "very nice old fella?" Recently?

I have already met the man, in person. Shook his hand and we talked for awhile. He is a very nice old fella

I already posted truth backed up with court docs... I'm not going to call Klug, a lying con man, or tell anyone else to. Pointless...

Read the Docs and compare them to what was filed to EDGAR. There are many glaring discrepancies.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175108290

..

.

KNIFE HAVE YOUR OTHER BUDDY CALL MR KLUG SINCE HE SAID HE KNOWS HIM I DARE YOU NONE YOU WILL CALL HIM ALSO KNIFE HAVE A GOOD WEEKEND AND DRINK A COLD ONE

How is Mr Klugg going to move forward with all those legal judgements piling up ?

I feel sorry for the elderly fella

Redhawk = we’ve been had

No need to call... This explains everything.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175092851

..

.

I DARE YOU TO MAKE THE CALL TO MR KLUG HE IS WAITING FOR YOUR CALL TODAY

Why don't you reply to whom you are posting too?

No wonder you got scammed.

..

.

REDHAWK !!!

Took all of your money

About a stock you don't own. Why pick this board when there are literally thousands to choose from???

This is my lane. It's a message board about stocks.

Dummy

..

.

Obviously, you have 0 shares of SNDD, right? So Stay in your lane, I am not asking you for shares you don't have.

Call your broker and ask how that works... There is time, expenses, and pain in the ass, on both ends... to make that work. You need to BUY them. Not just have him work to give them to you. To a person that has been a jerk.

..

.

Let me try this one last time: if SNDD shares are worthless, can I have yours?

IMO HE IS STILL WAITING FOR YOU TO CALL HIM BUT I KNOW THE ANSWER NO! I DARE YOU TO CALL HIM . HE IS WAITING ON THE CALL IMO

Why would anyone call Mr. Klugg and ask him any serious questions about Redhawk ? He cannot openly and honestly give any real honest answers about the financial condition of Redhawk without placing himself in serious legal jeopardy

That’s a fact folks, especially given the discovery of the unreported lawsuits (and the financial perils of what’s in those lawsuits) that were filed against the company and were not reported in any filings.

For the benefit of the very elderly Klugg, the best path for him is to say nothing and allow Redhawk to die a natural death, which it appears he is doing.

In defense of Mr. Klugg, I don’t see where he personally took huge sums from the company, though I never reviewed books to see actual checks or transfers.

Redhawk under the direct control of Mr Klugg has also taken your money too

The stock is REVOKED

Shares are worthless and unable to be traded

Then Redhawk under the direct control of Mr. Klugg has separated and removed you from your “real money”

I have real money in this dark horse

Loving the interest you show here daily of a stock you own no shares in.

I HAVE BEEN HERE FOR A VERY VERY LONG TIME WITH LOTS OF SHARES!

I have real money in this dark horse . I will ride this beautiful pony all the way to the beach. You all can be part of this wild ride. Some don’t have a horse in the race yet you look on from the side lines with tears in your eyes, disgruntled and yelling insults at the riders. Your envy is evident. The race started long ago and you were left behind. I can see how you would be upset. But you’re gonna drive yourself mad yelling at us from the sidelines. I feel bad for you. But I’m enjoying the ride with my fellow racers. The finish line is just over the hill. I can smell the ocean. Our time it’s coming.

They don't want the truth, they want to continue with their made up agenda.

Write on!

Right on!!

RedHawk!!!

$$$$$$$trong!!!!

How about Klug put it in writing and for all to see??? Heck, He could post it here.

..

.

Lol.... Sure...

..

.

PRIVATE COMPANY ARE EVERYWHERE AND THEY ARE IN BUSINESS AND GIVE OUT STOCKS ALL THE TIME. I AM ON 4 PRIVATE COMPANY BOARD OF DIRECTORS AND AM GETTING STOCKS ALL THE TIME SOME NOT WORTH ANYTHING NOW BUT MAYBE ONEDAY. JUST LIKE REDHAWK PRIVATE COMPANY BUT WHO KNOWS EVEN PUBLIX IS PRIVATE COMPANY

I COULD CARE LESS HOW MANY TIMES ITS SAID REDHAWK IS NOT TRADING! WE ALL KNOW THIS NOTHING NEW BEING SAID LIKE I SAID THIS WAS PLAY MONEY FOR ME! FUN MONEY POKER MONEY BEANS REEL MONEY ON BIG STOCKS YOU GET IT

IMO REPORT BACK ON HERE AFTER YOU CALL AND TALK YO HIM . THIS WILL BE THE LAST TIME I EVER RESPOND TO YOU STOP EMAILING ME I WILL NOT RESPOND . I WILL RESPOND TO THE OLD REDHAWK FOLKS ONLY FOR NOW ON

IMO I KNOW THE ANSWER YOU WILL NOT CALL HIM ! MR KLUG IS WAITING FOR TOU TO CALL HIM

IMO I DARE YOU TO CALL MR KLUG! LETS SEE YOU DO IT IMO

MR KLUG WOULD LIKE FOR ALL ON HERE TO CALL AND TALK TO HIM! IMO ONES IN HERE SAY THEY KNOW HIM AND THEY DONT! THEY ARE WHAT YOU CALL A NOBODY THAT KNOWS VERY LITTLE IMO! REDHAWK!

Redhawk, in whatever form it may remain or not remain, is a REVOKED and now very private company under the control of a very elderly man. It is very doubtful if the man will ever share any information about HIS now very private company

The only shareholders are Mr. Klugg himself

All public shareholders were wiped out when the stock was REVOKED.

Any other story is pure fantasy

Redhawk no longer exists

IMO THE JUDGE WILL DECIDE THE CASE!!! REDHAWK!!!

Thanks for sharing!!!

If Klug ever gets any money from anybody, what in the world makes you think this lying fraudster will give SNDD shareholders any benefit of it??? The same shareholders Klug purposely screwed by not filing and allowing the SEC to revoke the stock making it untradeable and worthless. All done to protect himself and NOT you or any other shareholders...

Geeeezz...

...

.

|

Followers

|

354

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

82352

|

|

Created

|

05/01/12

|

Type

|

Free

|

| Moderators Diamond_Dog tdbowieknife Homebrew MNKD_RISE trippininLaCoste | |||

About RedHawk Holdings Corp.

RedHawk Holdings Corp., formerly Independence Energy Corp., is a diversified holding company which, through its subsidiaries, is engaged in the sales and distribution of medical devices, sales of branded generic pharmaceutical drugs, commercial real estate investment and leasing, sales of point of entry full-body security systems, and specialized financial services. Through its medical products business unit, the Company sells the Sharps and Needle Destruction Device (SANDD™), WoundClot Surgical - Advanced Bleeding Control, and the Carotid Artery Digital Non-Contact Thermometer. Through our United Kingdom based subsidiary, we manufacture and market branded generic pharmaceuticals. RedHawk Energy holds the exclusive U.S. manufacturing and distribution rights for the Centri Controlled Entry System, a unique, closed cabinet, nominal dose transmission full-body x-ray scanner. For more information, please visit: http://www.redhawkholdingscorp.com

May 11, 2022

Redhawks Year to Year Growth, 2020 to 2022

For the fiscal year ending June 30, 2022 and the fiscal years ended June 30, 2021 and 2020, a summary of our net revenues under contract on a disaggregated basis:

2020 = $1,134,192 2021 = $1,992,952 2022 = $951,519,231

https://www.sec.gov/Archives/edgar/data/1353406/000175392622000688/g083009_ex99-1.htm

May 16, 2022

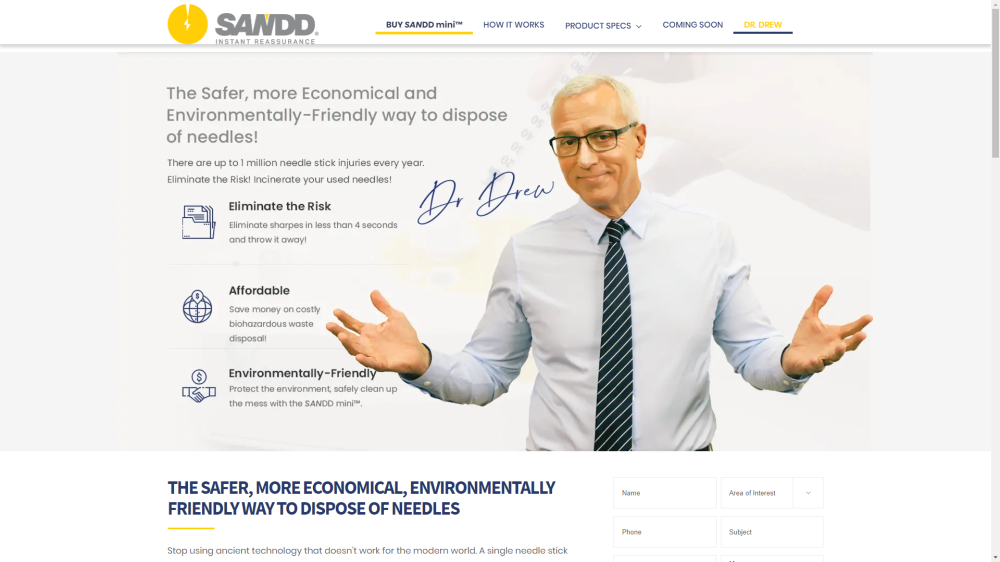

Redhawk is working with a leading US healthcare provider/pharmacy to have our SANND Pro Needle Destruction Devices in all of their locations nationwide.

They are also working on an agreement to sell our SANDD mini units as well.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1353406/000175392622000715/g083015_8k.htm

Redhawk Medical is a branch of Redhawk Holdings:

ABOUT REDHAWK MEDICAL

https://redhawkmedicalproducts.com/pages/about-redhawk-medical

Who We Are

Redhawk Medical Products and Services is a wholly owned subsidiary of RedHawk Holdings Corp. a diversified company which, through its partially and wholly owned subsidiaries, is engaged in medical device sales, pharmaceuticals, and medical equipment lease & sales.

Capabilities

In addition to the distribution of an industry changing line of medical devices, RedHawk Medical Products and Services is capable of distributing products to aid in a return to work and safe reopening of our nation’s schools, restaurants, hospitality brands, law enforcement and first responder agencies and healthcare providers.

We’re committed to manufacturing and distributing quality products that will make a positive contribution in our communities.

Sharps and Needle Destruction Device SANDD, FDA approved, proprietary line of devices that provide a safer, more economical and environmentally friendly method of disposing of used needles.

UV C light sanitization products developed to maintain safe and clean environments, air space and surfaces.

High quality Personal Protective Equipment sourced from reputable manufacturing partners

Personal Protective masks, gloves and face shields that meet NIOSH specifications and/or FDA guidelines.

Customized PPE packages for Law Enforcement and First Responders

Safe Sanitized Classroom bundles for School Systems

Safe Sanitized Patron packages and Guest Room packages for Restaurants and Hospitality applications

Safe Resident package for Assisted Living and Nursing Home residents

Our Core Principles: RedHawk Medical Products and Services develops, introduces and distributes equipment that serves a greater purpose by offering safe, more economical and environmentally friendly products to our customer base. RHMP&S unconditionally guarantees its products.

Owners: RedHawk Medical Products and Services is a wholly owned subsidiary of RedHawk Holdings Corp. (OTC: SNDD)

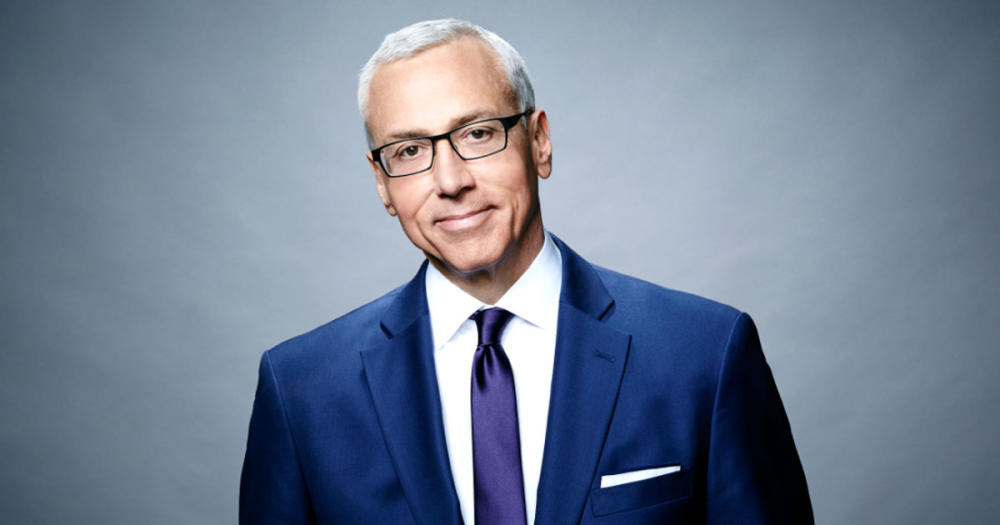

National Spokesperson: Dr. Drew Pinsky

Redhawk Medical carries Numerous medical products which are wholesaled and retailed:

https://redhawkmedicalproducts.com/

Redhawk Medical also holds the Intellectual Property Rights to the SANDD line of Needle Destruction devices. Through its medical products business unit, the Company sells the Sharps and Needle Destruction Device (SANDD™)

https://nomoresharps.com/

The SANDD Mini:

The SANDD Pro:

More information on the SANDD line of products can be found here:

https://nomoresharps.com/

https://twitter.com/destroyneedles

https://www.facebook.com/destroyneedles/

https://www.linkedin.com/company/destroyneedles/

https://www.instagram.com/destroyneedles/

The SANDD line featuring Dr. Drew has had commercials on the following networks:

CMT, Ovation, CNN, Fox News, INSP, Discovery Life Channel:

https://ispot.tv/a/nfyA

https://www.youtube.com/watch?v=z1e1GnI06n4

Actor Derek Theler Joins SNDD as a spokesman

Some Police Departments are currently using the SANDD First Responder.

There are many aspects to Redhawk Holdings which also include:

-EcoGen Europe

https://ecogen-europe.co.uk/

-RedHawk energies

https://www.redhawkholdingscorp.com/redhawk-energy-corp/

http://www.redhawkenergycorp.com/

-RedHawk Land and Hospitality

https://www.redhawkholdingscorp.com/redhawk-land-hospitality/

The team that has been created here has vast medical experience. They have been strategically selected and have years of experience in the medical supply chain with hospital and law enforcement connections.

Who We are:

Darcy Klug - CEO:

https://www.expertconnectionpr.com/darcy-klug/

Philanthropy:

https://www.lsufoundation.org/s/1585/17/interior.aspx?sid=1585&gid=1&pgid=880

Interview with Darcy Klug:

https://healthprofessionalradio.com.au/sandd-mini-sharps-and-needle-destruction-device/

Board of directors member Joseph Mohr:

https://finance.yahoo.com/news/redhawk-announces-appointment-supply-chain-170000139.html

https://www.accesswire.com/559414/RedHawk-Announces-Appointment-of-Supply-Chain-Veteran-to-the-Board-of-Directors

Here is his Linkedin showing all his experience:

https://www.linkedin.com/in/joe-mohr-1bbb7015

Board of directors member Charles D'Agostino:

https://ih.advfn.com/stock-market/USOTC/redhawk-holdings-corp-SNDD/stock-news/81319066/charles-f-dagostino-joins-redhawk-board

https://www.accesswire.com/569664/Charles-F-Dagostino-Joins-RedHawk-Board

https://www.linkedin.com/in/charles-d-agostino-349a613

Board of directors member Gerald C. Guzzino

https://ih.advfn.com/stock-market/USOTC/redhawk-pk-SNDD/stock-news/80726865/redhawk-announces-appointment-of-senior-medical-de

https://www.accesswire.com/559537/RedHawk-Announces-Appointment-of-Senior-Medical-Device-Sales-Executive-to-Board

https://www.linkedin.com/in/gerald-guzzino-32601a80/

Redhawk hired Sheriff Bud Torres to lead the first responder marketing unit:

https://www.prnewswire.com/news-releases/sheriff-bud-torres-iii-to-lead-redhawks-first-responder-marketing-unit-301037487.html

https://ih.advfn.com/stock-market/USOTC/redhawk-pk-SNDD/stock-news/82195158/sheriff-bud-torres-iii-to-lead-redhawks-first-resp

https://www.linkedin.com/in/bud-torres-0a6116a0/

For information about the current share structure please follow this link:

https://www.otcmarkets.com/stock/SNDD/security

===================================================================================================================

OVER YEAR+ DELINQUENT FINANCIALS !!

SHAREHOLDERS IN THE DARK ABOUT SNDD's FINANCIAL SITUATION.

LAST FILING AS OF Period End 3-31-2021

|

Posts Today

|

1

|

|

Posts (Total)

|

82352

|

|

Posters

|

|

|

Moderators

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |