Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

EPGL is circling the porcelain bowl. It's going to require a trip to the municipal waste treatment plant to find the private I'mWithout shares.

2016 EPGL CONFERENCE • THE INSIDE SCOOP • TRANSCRIPT $EPGL $InWith

(Originally posted in early 2017)

In light of the phone call from Hayes—in which he affirmed current events as evolutionary of those referenced in the 2016 Vegas conference, I thought it beneficial to re-post the transcript and link to the video of said conference.

As you will note a number of predictions have come to fruition. Others, which were of an even further-future nature, remain yet to develop. For example, at time-stamp “51:00” there is indicated a two-year time-frame for the EPGL contact lens hitting the market; however the beginning and target delivery date is left to speculation (and now, coincidentally, this could equate to Hayes’ two-year privatization projection).

When someone tells you that a particular question has been addressed, there is a good chance you’ll find it here and straight from the horse’s mouth, so to speak. After finding something referenced in the transcript below, you can use the indicated time-stamp to source the info in the video (linked at the bottom) and thus see/hear the given info by EPGL/InWith representatives.

Save and bookmark this post for reference. You can also find this post (and its antecedent iterations) by searching for the term, “Inside Scoop.”

Disclaimer: Except for where quotation marks offset text indicative of actual dialogue, this is not a verbatim transcription or inclusive of everything said. Except for text appearing in quotations, this is a paraphrased account of select portions throughout the presentation. Numbers refer to the time-stamp of minutes and seconds whereat the dialogue is located in the video.

——BEGIN TRANSCRIPT——

5:00

“What is BioMEMS? BioMEMS is basically called Biomedical Micro-Electro-Mechanical System. So basically what we do, is produce mechanical and electrical machine(s) that can sense and actuate at the size of a human hair or nano-meters to (a) millimeter in size. So it is usually very small, okay? And then after that, when we built those system(s), we have to interface it (them) with a human so they can be used.”

7:30

Why an Electronic Contact Lens is discussed.

8:20 - 9:52

Elastic Circuit and Injection Molding discussed.

9:52 - 14:02

The Elastic Circuit Patent: What it does and why it was created.

14:03 - 14:48

Without the Elastic Circuit, Google’s electronic contact is substandard and why.

14:50 - 16:18

Ideas discarded in the creation of the Energy Harvester.

16:19 - 22:08

Production of the Energy Harvester Patent (harnessing the unlimited power of the eye, estimated power, power requirements, storage, ancillary use of Smart case, etc.).

22:09 - 26:50

The Smart Case Patent for additional power, data transfer and back-up of data via the first patented use of a saline fluid medium and testing confirming success of same. According to David Markus, EPGL is the first to file patents in fluid antenna space: A review of filings indicated J&J had only filed for charging the "electric toothbrush."

.

27:01 - 32:02

Predefined Space Patent—creation and utilization of the interior contact lens space as a reservoir for future solids and medication.

33:19 - 39:13

The 300 micron limitation of liquid crystal focusing as used by Google, Alcon, Johnson and Johnson and others, resulting in EPGL development of a limitless and magnetic mechanism for “haptic control” of contact material for focusing.

39:14 - 42:15

Ciliary Muscle Sensor. EPGL’s sensor that utilizes the eye’s ciliary muscle to activate electronic components.The concept is that the ciliary muscle moves, causing a vibration. A sensor in/on the contact (the Piezoelectric Sensor) detects the movement of the ciliary muscle (which controls the focusing of the eye) and that specific vibration causes the sensor to transmit a "Piezoelectric charge" that actives the electronics (such as auto-focusing). Since the movements in an eye (muscle movement, blinking, the iris, etc) each occur with a differing level of vibration (or "frequency" if you will), the theory is that the senor will be able to detect the vibration of movment specific to the ciliary muscle.

42:16 - 43:06

Q: "Has that been tested--how much, like, energy can it produce?"

A: "That one, uh, we're still working on it because we have to work closely with basically live animal(s).

Q: "Live animal(s)?"

A: "Live animal, live whatever--"

Q: "Or you. Would you like to volunteer?"

A: "Sure, let's do it. Let's do it right now. I trust you guys."

Dr. Markus tells us that this excited someone or some company of importance, but refrained from telling us who.

43:07 - 44:09

"Now I want to make sure you understand this is not an energy harvester, okay? This isn't producing energy. This is sensing the vibration of the muscle. The idea behind this is the Holy Grail application because if we can successfully integrate this within a lens that has that haptic, which can change the focus, now we've got a--basically replication of what's actually happening in your natural eye. But it's now in a prophylactic version ON your eye. So this is something that could renew vision for people who are in their--you know, 50 and above, back to giving them the ability to... You know if you're in a restaurant, and you can't see the damned menu and you want to see it, you know... Pick up your smart phone and dial the app or--that's the manual version--OR the automatic version is the ciliary muscle sensing your--your--the needs of what's going on and now it focuses automatically. It's a Holy Grail application

(NOTE: AN EPGL PATENT RELATED TO THIS WAS APPROVED IN JANUARY of 2017--Tolleson)

46:00 - 49:57

Optical Lens Patent—putting optics in a contact lens—also known as GRIN (Grabin Refractive Index Lens, (sp?)).

50:00 - 50:59

Dr. Markus describes when the diverse innovations will come together in one product.

51:00 - 51:40

The 2-year time frame for EPGL contact lens hitting the market. As the time period wasn’t identified, the beginning and target delivery date is open to speculation.

52:20 - 53:21

How EPGL got involved with the electronic contact lens when being contacted by CooperVision’s chief technical officer (following EPGL coming up with the Energy Harvester).

53:22 - 57:51

The “white hot” Future of augmented vision products are enumerated. “Autofocus, here, that we’re talking about is a huge business. 5 billion plus—annually—estimated. We intend—EPGL intends—to be one of the companies that develops the first working, viable, autofocus lens; with the exact technology that we’ve been talking to you about today.”

57:52 - 58:36

Various “groups” have put together acquisition proposals that aren’t even “close to being accepted.” Everything going forward is for the benefit of shareholders and a deal will not be made that, “screws you guys.”

59:17 - 59:23

USPTO feedback indicates other patents have good chance of approval.

1:00:15 - 1:00:36

Focus is building the technology for a large payoff and not day-to-day trading.

1:00:37 - 1:00:45

Between U.S. and international applications, there are 15 patent applications.

1:00:46 - 1:02:02

Expect “Downline Patents” based on current Patents and work related to same.

1:00:03 - 1:03:49

About J&J being faced with paying for EPGL tech or risk losing rights to the competition: Also about the team being built around David Markus.

1:04:03 - 1:08:29

About Augmented Vision and how Google “Glassholes” are contrasted by the discreet augmented vision of contact lenses produced with EPGL technology. This takes into consideration that EPGL patents utilize existing injection molding production while alternative methods of production would require a method of production layering. This includes a patent developed with CooperVision (of which EPGL now owns 100%) and which is of similar impact to that of the Elastic Circuit.

1:08:30 - 1:09:34

A listing of 8 patents pending or granted, which equals 16 pending or granted when counting international filings.

1:09:35 - 1:12:02

EPGL stock position compared to that of Apple in the early 80s and the overall wide market appeal of augmented vision.

1:12:03 - 1:13:26

EPGL learned that “we are further ahead than we thought” and are “doubling down” hardcore in going out in getting an autofocus prototype built. Also referenced is mobile phone app integration, which EPGL now considers a quicker path to market.

1:14:40 - 1:16:49

Expounding upon the GRIN lens and the cost effective nature of mass producing millions of lens using EPGL patented tech with current production methods over the alternative layering method.

1:18:01 - 1:20:12

Q: “Can you elaborate upon the whole agreement with J&J?; what that entails?; Is it certain technologies?; Is it all technologies?; Is it the company in general?“

A: An NDA prohibits extensive details but the agreement is for ALL EPGL technologies in terms of first right of negotiation. Speculation on large companies’ intent in regard to the track record and product of a smaller company. A “CooperVision situation of control” is also being avoided.

1:20:13 - 1:21:27

Q: “How is this whole team is going to work?; Do you guys have a plan in place where you are going to have that announced or... any information on that?”

A: When the team is in place, further details will be announced; however the team will likely be based in Irvine. A comparison to the company details followed on the heels of the CooperVision settlement is portrayed as something on which EPGL will “double down” in this instance of delivering on changes and developments going forward.

1:21:28 - 1:22:49

Q: “Can you discuss how large (the team) will be?”

A: The goal will be as many as 25 professionals in the biomems field that Markus picks (plus David Markus).

1:22:53 - 1:23:34

Q: “Is the J&J agreement an open-ended agreement? Are they just sitting back watching EPGL to see where they are headed? What they are coming up with? What the future looks like in the near term? Is there a deadline? A term? An expiration date?”

A: “There is a term that gives us plenty of time to get done what we want to get done. It is open ended in the sense that as we progress and as the relationship develops, there is possibility to grow, to continue. But, yeah, there is a term.”

1:23:35 - 1:24:05

Q: Inquiry regarding J&J’s interest being the technology or the company (audio was difficult to discern).

A: “It’s not an infinite situation nor would I want it to be. We fully plan on making them have to make that decision. Because we’re going to have some things that I think they’re going to—they as well as other companies—will be very interested in what we’re doing.”

1:24:06 - 1:25:46

Q: “How is the team going to be funded? The financials—is there income coming into the company? Are there sales? Or investments?”

A: “Let me just put it this way: We’re still in startup mode in the opthemalic area. We’re not turning a profit in this area yet. But the good news is that in some of these talks that we’ve been having with parties that are possibly interested in acquiring the company—which I want to emphasize, we have not made any decisions, okay? So no rumors get started. I’m just letting you know that its heated up recently. But we have some folks that are interested in capitalizing EPGL waaay beyond, waaay beyond... I mean, large-large capital that can launch us literally to be on par with a program that literally is the leader in the field. And that’s what my goal is—is to... When we do that... What’s the stupid clique? Katie bar the door? ... But anyway, the idea of us putting together a team that is backed by really big money is gonna—”

1:25:47 - 1:31:03

Q: “Is that financing—would that be as a loan, or would that be for stock—”

A: “It might involve Michel Hayes not having as much stock as he used to have. I don’t know, there’s a lot of different combinations. I’m not going to get too into the weeds on that right now. But the overall message here is that we’re kicking it into 7th gear, Okay? We’re in a sports car that’s been going along at maybe 5th—6th gear. There’s a Ferrari shop right out the door here. So if you imagine you’re driving your Ferrari—you’ve got those paddle shifters, right? It’s got 7 speeds. We’ve been going along in 4th and 5th, right? At 60, 70 miles per hour. We’re about to paddle up to 7th gear. We want to accelerate this program. And based upon what we’ve accomplished so far, we know we can. And we’ve got the right relationships falling into place. There will be more news on that front soon. We’re trying to execute on all levels. But I want to emphasize that the goal here with EPGL is to... We’re on the OTC, right? We’ve got designs and we’ve got ideas that don’t involve OTC any more, but they don’t necessarily involve going to OTCQB or QX. There’s ways of achieving our goals and these are some of the things I’m talking to some people on Wall Street about. And you guys and all current shareholders will be along for that ride—whatever it is. Okay? I’m not getting into details. I’m just saying I’m not happy with our stock setting on an OTC and having, you know, 500,000 average daily volume. I’m glad we have a lot of people that don’t want to sell, right? We’ve got a lot—we’ve got several hundred shareholders. And I’m glad we have a lot that don’t sell. But the fact that it can be moved so volatilely... Is that a word? Erratically, volatilely...on such small volume. I mean if someone wanted to come in, man—if someone had 50K or 100K they could blow us up through 10 cents in a heartbeat, right? But no one wants to do that because they realize there is always that possibility that they do that and then it immediately becomes a value of 30,000 in two or three days because so many people go ahead and sell, right? So it’s a tough market to be in to have somebody come in, a whale like that and really blast it. But that’s not what we should be about, anyway. We should be about slow, steady improvement. I mean look where we’re at right now. We’re sitting at 4 cents right now—we’re at two-hundred million market cap, based on the number of shares. The thing is that with another patent pending coming through soon—and with more on the way—why the hell would anybody want—why would anybody want... I mean, unless you’re a day trader just playing the swings... If you—unless you invested money that you can’t afford to invest, why would you want—at this point in time—to divest? We’re just at the beginning here. We got patents just barely coming. If anything—I mean I’m just talking for myself, looking at it objectively—I would, myself, I would...I... If I was looking at another company, and it was me in the exact same situation, I’d be wanting to buy—I’d be buying on the dips and I’d be trying to, you know, acquire. Because I think that we are—I do think we are undervalued, right now. I said it. I think we are going a lot further than we are right now. And if everybody can fast forward in that DeLorean, and see the future, you know? But there’s been a lot of people over time, and you can go down the list of companies, and there’s a wake of people in every successful company that sold way too soon or didn’t take advantage of their opportunity. And you know what? God bless everybody who makes a decision—whatever they do. But we’re, I think, you know, we’re in a point in time right now where we’ve got as good a chance as anybody to be really successful in this market. And we’ve got technology that is needed in a lot of ways and we’re planning on maximizing that opportunity. So...”

1:31:04 - 1:32:53

Q: “...People are asking (about) anything they can share about Intel or AT&T or any of those factors?”

A: “Intel is...a situation where we met with them for the purpose of discussing utilizing their chips in our prototypes—in our process. And, you know, that as well as Hitachi, is all still out there, okay? So we’re still open to using Intel chips. We, you know, we’re not partnering with Intl, okay? Because that’s not what the goal of the whole deal is. The goal with Intel was to discover what chips they had and what sizes they have that we could use. And that’s why we made the relationships with Intel at the time. And that’s all still open. What was the other—”

Q: “AT&T...”

A: “AT&T. When we went down to Plano and met with them. The—again I got to be careful because, you know, these things are under NDA and I don’t want to blow some of these things. But there were some technologies that they were specifically interested in incubating. So we went down, we spent a day with them. David came up with some solutions. We have rights to the technology. They have rights to the technology. I can’t go much more than that. And it is technology that is applicable in the market. Whether they do something with it, whether they maximize it, it’s up to them.”

1:32:54 - 1:33:22

Q: “Can you say—do you have other companies coming to you guys now, as research for other companies as well?”

A: “I get calls all the time. From people and companies that want to work with us, that heard of us. But we have to be judicious with our time and we’re really taxed right now. And so it’s got to be something that really is big time to get our attention because we’ve got our hands full right now.”

1:33:23 - 1:34:33

Q: “When you’re saying, ‘putting it into 7th gear,” is that—maybe involve maybe more people so you can handle more? And so you can really handle it more efficiently?”

A: “Well, theoretically, if we have a larger team, as we’re planning with David, we can handle more projects. But we—I mean how many potential things that are out there that are a 5 billion dollar annual market? There’s not many things like that out there. There’s not that many opportunities out there. The Augmented Reality is another thing that’s a multi-multi-billion potential market that we could have a slice of. So, you know, we’ve got enough gettin’ to go after right now. And we’ve laid down the ground work. So if we were to start, you know, really like diverting our attentions off into too many areas... On things that don’t have potential anywhere near this, we’d be doing everybody a disservice. So we’re focusing where we need to focus. Now if that becomes—if it becomes our ability to be involved in multiple other things, then yes, we would. But we kind of have a senior (word?) purpose right now...”

1:35:46 - 1:36:23

Q: Inquiry concerning which patents to expect approved following the Elastic Circuit.

A: There is no way to ascertain and an explanation as to why is offered.

1:36:32 - 1:38:05

Q: “Someone is asking, ‘Is there any chances that any of these companies will start acknowledging EPGL through announcements or anything like that any time soon?’“

A: There is no way to force these companies to mention EPGL and no way to know when that will happen. But J&J does acknowledge inquiries with regard to their working with EPGL, even going so far as confirming the first right of negotiation with the, “4 cent OTC.”

1:36:06 - 1:39:23

Q: An inquiry regarding the details of how J&J/EPGL will implement the actual negotiation upon which the agreement is based.

A: Any tech EPGL creates must be first offered to J&J. They may accept or decline. They also have the contractual right to meet or beat any deal offered to EPGL by other parties, and in said circumstances there is a specified period of time in which J&J must extend any offer.

1:39:24 - 1:40:02

Q: An inquiry as to whether J&J currently has any similar arrangement with any other company.

A: This cannot be known with certainty, but the belief is that there are no other companies similar to EPGL and EPGL’s circumstances.

1:41:08 - 1:44:53

Q: An inquiry as to recourse should J&J pass on any deals and other companies, like Apple, follow suit based upon J&J’s decision.

A: EPGL’s 100% ownership of tech reflects the freedom for EPGL to explore options and this—along with an operating prototype—is insulation against the possibility. The term limit of J&J’s agreement, however, is long enough for this to not be a concern.

1:44:57 - 1:49:05

Q: Inquiries regarding Topspin.

A: The tech is still owned and filed for patents, but EPGL is not focusing on Topspin which is currently shelved (as a “bank” of savings so to speak) in favor of the contact lens tech.

1:49:09 - 1:49:38

Q: Inquiry regarding the producing of a prototype not equating to an intention to do actual lens manufacturing.

A: EPGL is willing to commit to actual manufacturing in partnership with another company should such a possibility present itself.

1:49:39 - 1:50:16

Q: Inquiry as to if EPGL has the “in-house” ability to actually manufacture a prototype or lens.

A: The actual physical production of a lens is why EPGL requires a relationship with a manufacturer. However the apparatus and construction of the lens circuitry is done “in-house” by EPGL.

1:50:18 - End

Q: An inquiry as to if Price Waterhouse has a day-to-day influence or presence concerning EPGL.

A: Price Waterhouse does not exercise influence, control, input or presence in this regard. “They’re happy.” Price Waterhouse owns shares by virtue of having “converted about 8 million dollars of debt to equity of the company… That 8 million dollars is 90 million on paper right now—or thereabouts.”

——END TRANSCRIPT——

SOURCE VIDEO:

https://www.youtube.com/watch?v=Be6T8fkNJ4g

InWith Corporation @ InWithCorp

$InWith News: A new US Patent was filed yesterday for more breakthrough technologies to enable display of information to the eyes, from the contact lens medium. The new patent pending has a priority date established early in 2017 and will become public by USPTO in due course.

InWith has confirmed a previous tweet that the A/S will be lowered to 10 Million near conversion date. Currently the Secretary of State in Delaware filing shows 100 Million A/S in its initial filing on 1/4/2017 over 14 months ago. Since that time new developments have happened for the better as WSGR has taken an equity position in EPGL and apparently the leading firm in Silicon Valley believes 10 Million A/S is the number they want as they are now involved, should see a new filing in coming weeks with SOS to confirm this reduction of A/S. Cant wait for $EPGL to be converted to InWith Corp. Might take 2 years to IPO to NASDAQ, but a buyout can also happen at any time after conversion.

@InWithCorp $EPGL to end trading soon, in next 14-21 days. New $InWith shares to be distributed to all $EPGL holders beginning March 12th and completed by March 30th. New $InWith website and buy/sell matchmaker up March 15th.

info@inwithcorp.com is the email address for all $EPGL shareholders to use from today forward. @InWithCorp is the Twitter address for all news and updates from today forward.

Will anyone here be attending the Special Meeting being held today in CA?

and just as illusory...

$EPGL/InWith is a joke.

That's equivalent to .10 per share of the 5B A/S EPGL.

$InWith Corp. sets initial share price at $50.00 per share in private offering effective upon conversion of the $EPGL shareholders to $InWith Corp. The authorized shares of $InWith Corp. shall be set at 10 million.

https://twitter.com/InwithCorp

Great Tweet $EPGL ALERT: $InWith Corp. makes bid to takeover $EPGL in February 2018. $EPGL shareholders of record by January 10, 2018 can participate in the Proxy Vote for approval. The bid, if accepted, will see all $EPGL Shareholders receiving a large INCREASE in their equity percent and gifted shares of $InWith Corp. will be added to the takeover shares offered. $InWith now has established a full mgt. team and has top Silicon Valley law firm Wilson Sonsini (wsgr) as counsel. WSGR represents a "who's who" of tech giants including Google. $InWith Corp. Mgt will position the company for a future NASDAQ or NYSE IPO. Authorized private InWith Corp. shares will only be 10 million to start, but the $InWith per share price is anticipated to be many fold that of present $EPGL. $InWith Corp. Mgt. plans to position the new life sciences and technology company as a hot start-up in a very hot field using $EPGL developed IP and talent as well as added talent and IP. $InWith will team with major NYSE and NASDAQ corporations whom have already expressed interest in the new company. Many details of the equity increase for $EPGL Shareholders and the coming Proxy Vote will be released before January 10, 2018. Happy New Year!

I received a reply back from an email I sent this morning to EPGL IR below is my email and their reply....

Hello:

I see that on Dec 12, 2017 Google (Verily Scienses) was issued a Patent # 9,841,614 for a Flexible Conductor for use within a Contact Lens? I assume one of the differences is that this IP is layered? My question is... Is a Conductor the same as a Circuit? How does this IP compare to EPGL's Flexible Circuit?

In a Tweet on Dec 11th it was said that " $InWith Corp. is Now in Final Negotiation with Top Venture Capitals." and then nothing is said in the update about InWith. I think most of us were expexting to hear some details concerning the Capital Raise. Is Inwith having trouble raising the funds to do the BuyOut? Is InWith still going to make a buyout offer for EPGL? And is InWith's per share offer anywhere near the true value that Mr Hayes is expecting?

Have there been other offers made for EPGL other then that from InWith? IMO the tweets suggest there have been other offers. If not please stop teasing and misleading us shareholders on. Very frustrating.

As for EPGL's Tweet on Sep 21st saying that "EPGL shareholders may be cheerful going into Fall & New Year." So far IMO where EPGL's share price is concerned EPGL's shareholders have no reason to be Jolly.

Sincerely, Judy

.................................................

EPGL IR reply

No InWith has great interest. Just being careful who it decides to go with as interest has picked up quite a bit.

Regarding VERILY, if it isn't for mass manufacturing molded for stretchable circuitry, it isn't what EPGL has. Layering is not the holy grail.

And sometimes I wonder if it is not a trick of Epgl. Maybe it is JNJ, they went beyond the first rights agreements but they dont want to say it now.

Do the sentence of the PR is a clue with an inverted logic to disrupt our brains lol???

"This goes beyond a right of first negotiation to now having EPGL technology at the center of a commercial project that addresses a multi-billion-dollar market in the field."

https://finance.yahoo.com/news/epgl-contact-lens-technology-chosen-173130197.html?.tsrc=applewf

well just for the fun I would add Valeant company ( Nyse = VRX) to this list of 3. Everything is possible. Place the bets. lol.

ExxonMobil

Tesla

Netflix

Here are my 3 guesses as to which NYSE company is working with EPGL to build it's new electronic contact lens sensor prototype.

ABT

IBM

RTN

Anyone else care to speculate?

$EPGL Readies for Building a New Electronic Contact Lens Sensor Prototype with a Major NYSE, Multi-Billion Co. $InWith Corp. is Now in Final Negotiation with Top Venture Capitals. Another Update Here by Dec 20th. #Leading #IP" 11 December

it seems they are closer now, very close

judypudy, maybe because the phony InWith is old news never to be revisited like so many other previous announcements by EPGL.

Good luck.

How's come the FB page no longer lets me in? Franck said it was because I had no picture, but I had a picture on file. What gives?

3 more weeks until update of EPGL's capital raise. Where it's smart contact lens patents land?

EP Global Comm. Inc.? @EPGLMed 35 minutes ago

$EPGL $InWith meeting in San Francisco last week. Exciting time. Watch for developments coming. #LeadingGiants

https://twitter.com/EPGLMed?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Wilson Sonsini Goodrich & Rosati is going to great things for EPGL. Why? Because they know they are legit, with groundbreaking technology that will shape the future of the smart contact lens market.

WILSON SONSINI GOODRICH & ROSATI

Wilson Sonsini Goodrich & Rosati is the premier legal advisor to technology, life sciences, and other growth enterprises worldwide. We represent companies at every stage of development, from entrepreneurial start-ups to multibillion-dollar global corporations, as well as the venture firms, private equity firms, and investment banks that finance and advise them. The firm's broad range of services and practice areas are focused on addressing the principal challenges faced by the management, boards of directors, shareholders, and in-house counsel of our clients.

The firm is nationally recognized for providing high-quality services to address the legal solutions required by its enterprise and financial institution clients. Our services include corporate law and governance, public and private offerings of equity and debt securities, mergers and acquisitions, securities class action litigation, intellectual property litigation, antitrust counseling and litigation, joint ventures and strategic alliances, technology licensing and other intellectual property transactions, tax, and employee benefits and employment law, among other areas. Our distinguished international roster of clients span a wide variety of industries, including information technology, life sciences, energy and clean technology, media and entertainment, communications, retail, and financial services.

Client service is the cornerstone of our practice, and we strive to act as strategic partners to our clients by leveraging our expertise to provide innovative, responsive, and cost-effective legal services. We understand that the law is often a means to accomplish our clients' business objectives, and we pride ourselves on our intimate understanding of their industries and marketplaces. We also know that today's enterprises are facing unprecedented changes in the business, regulatory, and global landscapes, and we have the knowledge and experience to help them confidently adapt to such challenges with state-of-the-art solutions.

Wilson Sonsini Goodrich & Rosati has offices in Austin; Beijing; Boston; Brussels; Hong Kong; Los Angeles; New York; Palo Alto; San Diego; San Francisco; Seattle; Shanghai; Washington, D.C.; and Wilmington, DE.

Our Track Record

Advise more than 300 public enterprises and 3,000 private companies

Consistently named one of "America's Best Corporate Law Firms" by Corporate Board Member

Represent more companies that receive venture financing than any other U.S. law firm and consistently rank No. 1 by Dow Jones VentureSource for the number of venture capital deals handled each year

Completed more than 100 public equity and debt offerings over the past five years, helping clients raise more than approximately $50 billion

Have advised more U.S. companies in their initial public offerings than any other law firm since 1998

Provided representation in more than 500 M&A transactions valued at over $150 billion in the last five years

Annually rank among the top 10 M&A advisors in the U.S. and represent more technology enterprises in mergers and acquisitions than any other U.S. law firm

Consistently acknowledged as one of the nation's leading securities litigation firms

Litigated more than 200 patent lawsuits throughout the U.S. over the past five years and rank among the country's top law firms by number of patent cases defended

Ranked among the top 15 percent of all law firms for both IP litigation and securities and finance litigation based on feedback from corporate counsel at the world's largest companies

Recognized among the top firms in The American Lawyer's annual Diversity Scorecard, based on our high percentages of minority attorneys and partners

Provide more than 35,000 hours of pro bono legal work annually

Global Reach

With long-standing roots in Silicon Valley and 15 offices in technology, business, and regulatory hubs worldwide, Wilson Sonsini Goodrich & Rosati has a national presence with a global reach. Over the past five decades, we have developed a wide-ranging international practice, with particular strength in North America, Asia, and Europe.

Our global experience includes the representation of both U.S. and international clients in such matters as litigation, cross-border mergers and acquisitions, joint ventures, competition law, intellectual property counseling, and branch operations. Our clients span a broad array of industries, from energy to media and Internet, medical devices to food services, pharmaceuticals to many technology sectors. Among numerous other transactions and cases, our attorneys have represented a France-based energy conglomerate in its $1.3 billion acquisition of a solar-panel maker, a leading Taiwanese manufacturer of liquid crystal displays in a patent infringement suit, a major U.S. biotechnology company in its sale to a global pharmaceutical company based in Switzerland, an India-based software services company in a landmark Nasdaq IPO and its $1.6 billion secondary offering of American Depository Shares, and a China-based semiconductor company in its private-placement transactions and its $1.8 billion IPO of American Depository Shares. We also have represented a leading supplier of marine fuel products in its IPO on the Singapore exchange; Japanese companies in a variety of investments, acquisitions, joint ventures, licensing agreements, and formation of subsidiaries; a Taiwanese fabless semiconductor company in a high-profile litigation case before the International Trade Commission (ITC); a leading global medical device company in its nearly $500 million sale of business segments to a Danish life sciences company; and a Chinese medical and health products company in an ITC investigation.

I'd appreciate it if you could delete my last post.

I want the credit!

inWith Corps and H8ster..?? At 0:47 --- wow...: wag the dog !!

EPGL mentioned again as working with Apple...

https://labiotech.eu/contact-lens-glucose-diabetes/

Maybe we will learn more in a few more days...

http://www.otcmarkets.com/financialReportViewer?symbol=EPGL&id=166395

New International Patent Published for EPGL on February 1st, 2017

SYSTEM AND METHOD FOR CONTACT LENS WIRELESS COMMUNICATION

https://patentscope.wipo.int/search/en/detail.jsf?docId=EP191876873&recNum=1&maxRec=256&office=&prevFilter=&sortOption=Pub+Date+Desc&queryString=PA%3A%28markus+david%29+&tab=NationalBiblio

EPGL looking to be the leader in smart lens technology. No other companies appear close to having the technology to make it happen.

I wonder if this could be the patent that Mr Hayes Tweeted about on Friday...

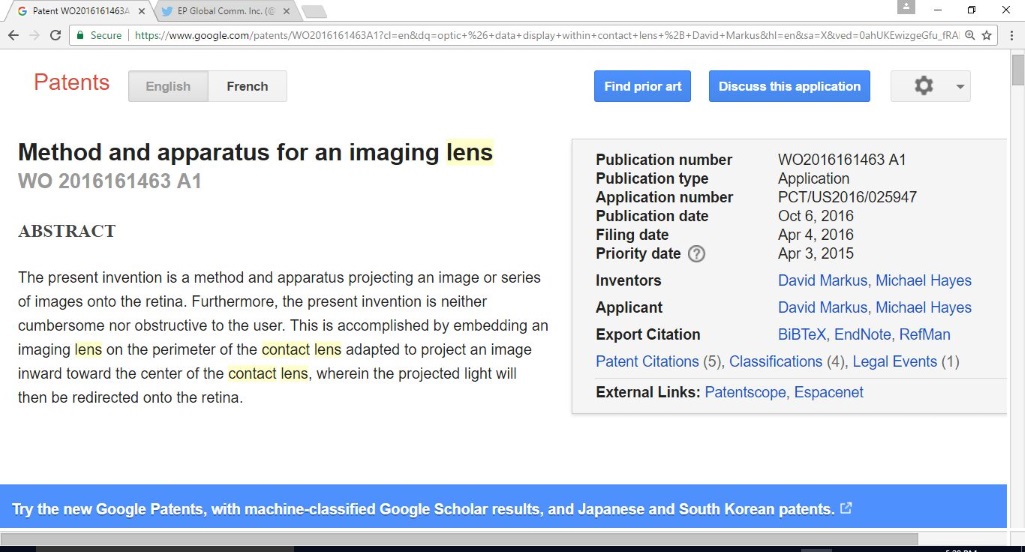

https://www.google.com/patents/WO2016161463A1?cl=en&dq=optic+%26+data+display+within+contact+lens+%2B+David+Markus&hl=en&sa=X&ved=0ahUKEwizgeGfu_fRAhXH2SYKHUioChoQ6AEIGjAA

Great opportunities with EPGL. They are the only company with IP to actually build smart contact lenses and will soon have them in production . Any other companies close? Google, Novartis have both failed.

I was able to Buy 11395 this morning @ .0265. I couldn't get my order filled until I lowered my Bid. Strange Doings

Yes vote for me :)

Let's vote and get this deal done! Time to make the donuts!

$$$$$$$$$$$$$$$$$$$$$ InWith $$$$$$$$$$$$$$$$$$$$$$$$$$$$$

"The offer is 9.8 cents / share OR 125% conversion equivalent. Gifted shares would be on top...."

"EPGL vote to approve + capital raise contingency is included."

Welcome! Lot of good stuff happening with BioMem technology and the current company being discussed. EPGL.

Good to see you all showing up! Let's get the discussion about what this one company, $EPGL, is doing in regards to putting smart technology into our eyes! Very interesting stuff. ;)

Ha, it took a few tries but I made it to ihub, Lol! Hola people!

That's great Viking, look forward seeing it

Hope to work on ibox tomorrow,(worst case this weekend) was going to do it tonight but got sidetracked

wazzz up cheeva

|

Followers

|

29

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

486

|

|

Created

|

02/01/17

|

Type

|

Free

|

| Moderator H8ster | |||

| Assistants vikingzskillz davidr2448 | |||

|

Posts Today

|

0

|

|

Posts (Total)

|

486

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |