Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yaccov still in this midas? Hello there old friend dont see his name in PR did he retire?

Their margins are very good. Their revenues are pathetic after being around for what, 20 years?

Put some money into sales and marketing.

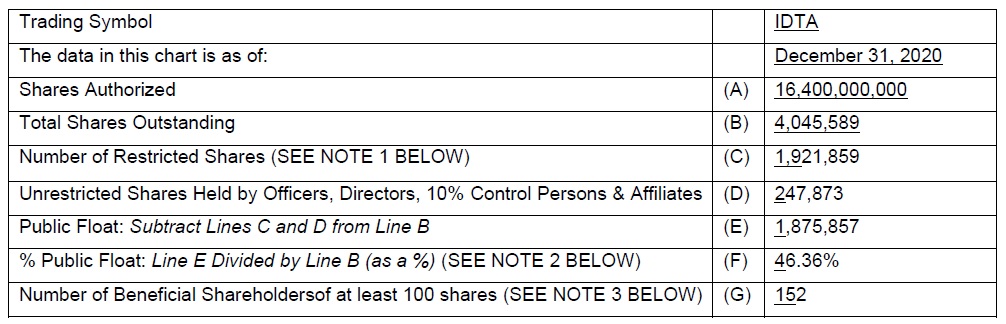

Dilution is non-existent, but the liquidity of the stock is a joke. Just take it private. The majority of the stock is already owned by insiders.

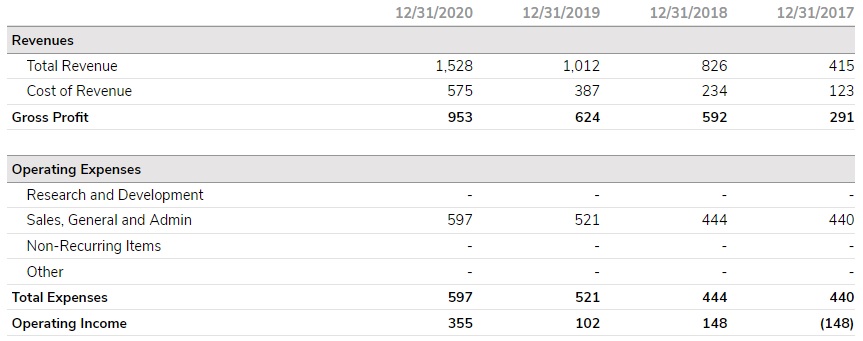

IDenta Corp Reports 2020 First Quarter Financial Results Showing an Increase in Sales During COVID-19

Published: May 14, 2020 at 12:11 p.m. ET

JERUSALEM, May 14, 2020 /PRNewswire via COMTEX/ -- JERUSALEM, May 14, 2020 /PRNewswire/ -- IDenta Corp. (OTCQB: IDTA) is a worldwide leader in the development of Detection Kits to identify Drugs and Explosives and Unique Forensic Products in the Homeland Security Market and Consumer Market. Today IDenta Corp reported its 2020 first quarter financial statement. The revenue was $227,571 for the first quarter of 2020 compared to $197,384 for the same period of 2019. This is a 15% increase in sales.

Mr. Amichai Glattstein, Chief Executive Officer, commented: "The Company today presented amazing results in its financial report, especially in light of the global economic situation. Sales increased during the pandemic. IDenta streamlined and improved both production and management, resulting in increased profitability and efficiency. The company's products are required even during the Corona virus pandemic and are not luxury items. The war on drugs and crime does not stop and even grows. Explosive detection still remains paramount. We are excited to be part of a number of limited companies that have maintained stability and even increased sales during this challenging time."

Highlights of the First Quarter of 2020 compared to the First Quarter of 2019:

Revenues for the First quarter of 2020 were $227,571 compared to revenues of $197,384 in the first quarter of 2019. This is a 15% increase in sales;

Gross profit increase to $195,882 in the first quarter of 2020 compared to gross profit of $131,381 in the first quarter of 2019. This is a 49% increase.

Operating profit increased exponentially to $72,247 for the first quarter of 2020 compared to operating profit of $6,021 in the first quarter of 2019. This is a 1,200% increase and represents both the increase in revenues as well as significant streamlining in operations;

Net profit increased dramatically to $72,471 in the first quarter of 2020 compared to $(3,039) in the first quarter of 2019. This was a result of optimizing manpower, improving production line and improving the profitability of the company in selling its products.

Cash and cash equivalents decrease to $140,453 for the first quarter of 2020 compared to $224,623 for the first quarter of 2019 as a result of giving extra credit to distributors.

IDenta Corp Reports 2019 Annual Financial Results Showing Highest Sales Ever

PR Newswire PR Newswire•March 31, 2020

JERUSALEM, March 31, 2020 /PRNewswire/ -- IDenta Corp. (OTCQB: IDTA) is a worldwide leader in the development of Detection Kits to identify Drugs and Explosives and Unique Forensic Products in the Homeland Security Market and Consumer Market. Today IDenta Corp reports its 2019 Annual financial statement which shows revenues of $1,012,822 for 2019 year compared to $826,975 in 2018.

Mr. Amichai Glattstein, Chief Executive Officer, commented: "We are pleased with the strongest annual results ever which show a steady trend of increasing sales. The changes the company has undergone prove in terms of sales growth, entry into new markets and new customer orders. The company has advanced on another level of product development according to specific customer requirements, which allows us to penetrate markets and organizations that are looking for creative and unique solutions that we know how to provide and deliver. We are ready and looking forward to 2020."

Highlights of the Annual Report of 2019 compared to Annual Report of 2018:

Revenues for 2019 were $1,012,822 compared to revenues of $826,975 in 2018;

Gross profit increased in 2019 to $624,876 compared to $592,565 in 2018;

Operating profit for 2019 decrease to $102,881 compared to operating profit of $148,166 in 2018 as a result of an increase in the number of employees, sales commission payments and participation in exhibitions;

Net profit decrease in 2019 to $65,519 compared to $142,862 in 2018 as a result of a significant increase of 41% in inventory and a sharp decline in currency rates;

Cash and cash equivalents in 2019 increased to $224,623 compared to $195,648 in 2018;

About IDenta Corp.

Since 2002, IDenta Corporation and its subsidiary IDenta Ltd has been recognized as a worldwide leader in the development of proprietary on-site Drug, Drug Precursor and Explosive detection kits. IDenta develops, manufactures and distributes revolutionary products for both the professional and civil markets which consistently pass the highest qualifications and testing procedures of law enforcement and security agencies around the world.

https://finance.yahoo.com/news/identa-corp-reports-2019-annual-141500072.html

That's Million with a capital M. How many other companies have yearly revenue of a MILLION dollars? I would love to see their sprawling corporate campus. I'll bet they have a gym and gourmet cafeteria.

A different penny stock I got into back then, then it dumped to the sub penny ranges so I forgot about it....is now climbing back up. Only wish I had bought as much shares as I had with this one!

So it DID do a rs? Good to know. Yea, I wanted the money to buy something else. This thing teased me for so long, over a decade, news about border patrol using the kit(s), etc. I even saw it on the shelves at CVS going for around $12-$19. But nothing on the PPS!

You did good selling out. Nowadays after a massive rs you wouldn't be able to get rid of the small amount you had left over as volume is pitifully low

Just out of curiosity, did this stock do a reverse split of some kind years ago? I held over a million shares back in the day when it was in the .008 ranges, because I believed that one day their product would skyrocket and overtake all law enforcement agencies world wide. But I got sick of holding after over a decade of following it, so I sold to buy something else. Who'd a thunk 5+ years later I would see the price in the .40+ ranges?? So this is why I ask, did it do a RS, or did I completely blow it by selling out?

Indeed those were the days. I was one of idta keenest fans until i felt it was not right.

Luckily i sold out at a minor loss.

I still keep them on my watch list, for old times sake.

I have to follow all the old "big" penny plays from back in the day. Just kind of a sick fascination I have. DEFINITELY not a shareholder. I can't think of anything that would convince me to buy shares of IDTA. I don't think booming sales/income, audited financials, and uplist would even do it. Just so much in the past that still seems to be going on. It's hard to look away from a trainwreck. I just can't believe this thing has been around this long. So many of the "original" ones are long gone.

And you still follow the company?

Hopefully for you, you are not a shareholder?

Good to see they really haven't changed. They once again have some US marketing partner. How did the last several of those work out?

On top of that, they say they have this new line or products in this PR, but they say nothing about them. The IDTA website makes no mention of new products and the ProGard website doesn't say anything about IDTA products.

Maybe they'll dilute by several billion shares next and open several manufacturing plants around the world.

i used to own a large number of shares that i dumped a few years back at a small loss because the company was going no where......just stopped in and checked them out after a long while and it seems like they are making progress

What do you mean with "figured it out"?

Shoham looks to have finally figured it out

Looks like they are still making progress. Still not much over $1 million/yr run rate. I have no idea why they stay public at this point. Based on the company's statements, most of the shares are owned by insiders or close associates. It would take very little money to buy up the actual public float. The stock has no traction and is not liquid. I believe the company's history is directly responsible for this. If their product is as amazing as they say, their sales and marketing are completely ineffectual, bordering on incompetent.

Financials are out.

Revenue increase looks good as a percentage gain, but it's still too low. They need to put money into marketing and sales.

https://backend.otcmarkets.com/otcapi/company/financial-report/220117/content

OTC quarterly report out today. Quarterly financials have been released on the same day in the past, so I would expect those to be published soon.

A little cleaning up of the OTC quarterly report.

https://backend.otcmarkets.com/otcapi/company/financial-report/220119/content

They don't list the holdings of the different families, but do state that the float is 2,334,459 shares.

“Public Float” shall mean the total number of unrestricted shares not held directly or indirectly by an officer, director, any person who is the beneficial owner of more than 10 percent of the total shares outstanding (a “control person”), or any affiliates thereof, or any immediate family members of officers, directors and control persons.

Name_______________Holdings

Glattstein Family_______20.22%

Shoham Family________20.22%

Public________________13.67%

Private Investors________37.99%

Weismann Family________4.18%

Alliance Family__________3.72%

Totally_______________100.00%

According to the company disclosure, the public float is around 553,000 shares. Everything else, in theory, is tied up.

Name_______________Holdings

Glattstein Family_______20.22%

Shoham Family________20.22%

Public________________13.67%

Private Investors________37.99%

Weismann Family________4.18%

Alliance Family__________3.72%

Totally_______________100.00%

AS 4,100,000

OS 4,045,589

Price could really jump on little volume, but it'd be hard to make any money due to lack of interest. Kind of like the company just started from scratch after the RS and still has a few more years to make any substantial headway.

Profitable for 2018. Definitely never thought that would ever happen. Unbelievable that their revenue is still so pathetic after this long, but 100% yoy is nothing to sneeze at.

It'd be interesting to see what kind of repeat business they get from customers.

Sure looks like it is going to be a while before anybody buys the stock.

AS/OS has remained stable at just over 4 million (million with an "m") for 1.5 years. Never thought that would happen either.

They need to put some money into marketing and sales. Their website is stale as hell. Earnings conference call is probably out of the question because of language barriers, but that would be cheap and easy. Not sure who would listen, however.

I think OTC has it wrong. Not that IDTA is a bastion of integrity and maybe you're referring to something else, but one of their recent filings states AS as 4,100,000 and OS as 4,045.589.

Earnings in the next week or two. Their website hasn't been updated in a long time and touch-know.com isn't accessible from several ISPs (appears to be a problem with their host, but I don't care enough to verify that).

This company continues to find new ways to be bizarre.

I'm wondering if their biggest revenue comes from putting different people on their board. The turnover has been remarkable.

I'm surprised nobody new has been sucked into IDTA.

From OTC:

Authorized Shares

16,400,000,000

02/15/2019

Outstanding Shares

4,045,589

02/15/2019

Restricted

2,159,922

02/15/2019

Unrestricted

1,885,667

02/15/2019

Held at DTC

745,842

02/15/2019

Too bad the share structure is shot... .16-.29 in any given trading day would create buzz and interest.... But oh I forgot Yaccov killed that years ago.

But look at this major progress!

No numbers, no evidence, but a PR is sure meaningful. "dramatic increase in sales". Going from pitifully low to less pitifully low isn't all that impressive.

I wonder if they are trying to drum up some interest and push the pps up a little bit to sell some shares.

IDenta Corp. (IDTA) is a worldwide leader in the development of field drug and explosive detection kits and unique forensic products. Over the past two years, the company's new management has revolutionized the company, which includes a dramatic increase in sales, winning tenders, expanding the product portfolio, increasing company profits, entering new markets and signing of new distribution agreements with significant companies.

Amichai Glattstein, CEO of IDenta Corp, stated: "There have been countless changes in the company in the last two years in order for the company to be a very significant player in the various markets it operates while creating a great added value compared to other products that exist in the market. In 2019, the Company will continue to advance on all levels and occupy additional targets in the territories it operates and in new territories that it has not operated to date."

I remember selling this stock after it's post RS and briefly it went up... I think it was $1.55 Yaccov ran this into the ground. I'm surprised it's not back into trips...

Might get a few eyeballs with $168 million being in the headline. Still amounts to one kit sold for probably $20 for IDTA.

$168 Million Worth of Cocaine was Discovered in Busan Port, Korea by IDenta Corp's Kit

JERUSALEM, ISRAEL / ACCESSWIRE / December 20, 2018 / IDenta Corp (OTC PINK: IDTA), is a worldwide leader in the development of Drug, Drug Precursor and Explosive Detection kits. IDenta kits were used successfully in discovering $168 million worth of cocaine in Korea - https://m.news.naver.com/read.nhn?mode=LSD&mid=sec&sid1=102&oid=052&aid=0001230142. This significant seizure of Cocaine clearly demonstrates again the added value of using IDenta's technology. The IDenta kits are highly reliable, top quality, extremely safety and easy to use!

Amichai Glattstein, CEO of IDenta, said "The company continues its global operations everywhere. Some of the successes are advertised and we are happy to share the importance of our products anywhere in the world and at any time. The company continues to grow and expand in the various markets while meeting very significant milestones that have led to achieving very important goals and will continue in the near future."

It's somewhat like term limits for congress people (in the US). Their terms can be limited by voters.

Companies would stop dilution if people would stop buying the shares. Typically, there is some sort of horrible financing involved by some company (at least in the pennies), but that company can usually turn around and dump those shares at a profit because the shares get bought by individuals.

People continually vote for their incumbent because it's the OTHER states' congress people that are the problem.

Agree, there is no doubt about their repeat rip off behaviors, they can rip off the small percentage of shareholders as you narrated quite well, what a great reputation...!.. hats off to these criminals squandering shareholders with R/S...….I wish some day this so called R/S is banned for good!!

Zero. No.

According to their latest filing, only 13.67% of shares are in the hands of the public. The very few other owners of 86.23% would be smart to buy the 13.67% and make the organization private. They will see a greater and earlier return on their money that way if the company is profitable. They used gullible buyers for 10+ years to fund the company, then reverse split most of those shares away, now they can grab the rest for very little. Unfortunate, but I think the company would be fine with that given their history.

Really, what percentage of companies O/S you own?.. are you the board?..

I'm not a fan of the company/management, but if they are profitable, there is no need for dilution. I don't think the pps is getting any traction because of the past. It definitely won't cost them much to take IDTA private. If they are actually making money and growing and I was one of the larger shareholders, I would demand it.

It is a "PS" been holding since April 2017, nothing but downward spiral, imagine a cost basis of shares 2.70 and the stock is trading now at 0.12???...there is no way this garbage can survive, more dilution and may be sub pennies!!

Positive news about that French government contract. If they continue as they are, that will basically guarantee profitability through the length of that contract. Again, sounds great, but at less than $1 million/yr, shareholders aren't going to be reaping any great rewards. If they can actually grow the business and revenue, at some point they will have to spend money to increase production and possibly fund additional R&D if/when competition increases.

Wow. Back to back profitable quarters and no dilution.

Not sure why revenue is still so low. Comparing the first 6 months of 2017 to 2018, revenue is up 84% which sounds great, but they aren't going to break $1 million in 2018 at this rate.

I'm guessing they are waiting to see if they will need to sell shares for money over then next year or two before they wipe out any remaining independent shareholders.

Multiple new directors, so that won't be cheap.

Is the "corporate action" over? Looks like there were a couple trades this week. Even if they were to have some substantial earnings, I don't see the stock going anywhere. Their RS cut the float to the point there is no liquidity. Maybe they'll forward split now. 1:100,000 sounds about right.

Whatever Identa can do to cause problems for shareholders is what they want to do. They are probably going to do another reverse split to eliminate more of the very few retail holders that still have some shares, then they'll go private. Now that they are making money, they don't want to have to share any of that money with the ones who financed the company for over a decade to get them to this spot.

Of course, their miniscule revenues last quarter were not impressive--especially after they had been touting all of the progress and sales that were coming. What else is new? They have been spewing the same garbage for years.

It'll be interesting to see if they are profitable again next month. Although, if they are private, they won't have to bother to tell anybody.

hehe oh it made me a bit curious, it's on my low volume watch list.

They put out news and they can't be traded online....???

Oh the horror!

I'm pretty sure nobody cares. Including the company.

Company going through a corporate action and cannot be traded online.

Profitable quarter on a really disappointing increase in sales. Their revenues are just too low. This is startup money for a company that has been trying to do this for what, 15 years now? Maybe their 2Q forecast will come true, but based on trading, obviously anybody who knows this company is going to continue to keep their distance. Justifiably so.

Still seems to me like they should go private. Not sure what staying public really gets them.

Jaackoff no longer a director? That seems a little strange.

He's still on the website as co-founder, but they also have the COB from a couple years ago, so who knows.

First quarter financials are due.

Shareholders don't need to know about every trade show IDTA is going to be attending. Shareholders, the public, and potential customers WOULD like to know about "new products" which they have said nothing about, so the only logical conclusion is there are no new products. Just like the multiple manufacturing sites that were talked up several years back.

Their websites are severely lacking in worthwhile or current information.

I expect to see more dilution in the near future.

Annual report out. Sales up VERY slightly from 2016. Looks like their margins are improving. Not sure about the share structure, now. Their financials appear to have been audited, but I'm not sure the auditors know what they are doing based on the share structure being inconsistent.

Appears that dilution is already taking place, but with the price holding over $1 it doesn't look quite as bad.

I'm interested to see Q1 revenues and see if all of their recent PRs pan out to anything. These were all potential Q1 revenue sources:

French contract - $2million over 4 years.

Order from Japanese firm

Spanish Civil Guard

German Armed Forces - 3 year contract. First order of $10,000.

"New Asian Customer" order for $85,000. That is roughly 1/5th of their revenue for the entire year of 2017

Brazil pilot program. According to the PR, Brazil paid $10,000.

New US distributor for US Armed Forces

All of this should show a significant revenue increase in Q1 and that report is due mid-May. The US distributor is one of several over the years. None has produced much of anything.

Their website is still idiotic. None of the recent PRs shows up anywhere on there. www.touch-know.com is no better.

What are these alleged "new products"? Wouldn't THAT information be beneficial to shareholders or customers?

This PR is mostly fluff, but at least it is understandable.

JERUSALEM, ISRAEL / ACCESSWIRE / March 29, 2018 / IDenta Corp. (OTC PINK: IDTA) is a worldwide leader in the development of field drug and explosive detection kits and unique forensic products. Today IDenta Corp published its annual financial statement for 2017. The report shows a modest increase in sales and revenues, which along with a decrease in expenses, resulted in a significant increase in gross profit. 2017 was a year of major changes and challenges in the company including new officers, new products, and IDenta's entry into new markets. In addition, IDenta has entered into several new and exciting partnerships.

Amichai Glattstein, CEO of IDenta Corp, stated, "2018 has already been a very productive year. Revenues to date, along with contracted committed purchases to take place over the next few months, will soon exceed total revenues from 2017. IDenta has become the exclusive provider of field test units for the Armed Forces of Germany and for all French Government Security Forces. IDenta has entered the challenging and complex Brazilian and Japanese markets. Inroads have also been made into the Australian market as well as a number of markets in Africa. The company will put forth major efforts in 2018 to better penetrate the US, Indian and Chinese markets. IDenta is making all necessary adjustments in order to improve sales in these countries which have tremendous potential for the company. IDenta's major and achievable goals for 2018 include a doubling of sales compared to 2017, continued activity in the capital markets and taking all possible actions for the benefit of our shareholders."

The company has been run so poorly for so long, it's not surprising. Who knows if any of this is real? Remember them PRing about the multiple manufacturing plants they were starting in different companies?

Simply based on their website, people can see that not a whole lot has changed with IDTA. Without more concrete facts--not PRs by the company--people need to be very skeptical. I still wouldn't put $10 of my money into IDTA at this point.

Hi chain, it seems nobody believes IDTA any more...that new was awesome...but no volume at all again.

Also, this new was really good...sad nobody cares.

IDenta Corp. Receives Formal Approval from US Patent Office for SNIFFER Technology Press Release | 03/06/2018

JERUSALEM, ISRAEL / ACCESSWIRE / March 6, 2018 / IDenta Corp. (OTC PINK: IDTA), a worldwide leader in the development of Drug, Drug Precursor and Explosive Detection field kits, has developed a unique SNIFFER product called AeroChamber. This device can detect tiny airborne particles of drugs or explosives. After several years of extensive negotiations by IDenta Corp., the US Patent Office has recognized the company's technological innovation and has approved its patentability. The product has countless possibilities for use by the security forces on land, on the sea, and in the air.

"IDenta Corp. holds a number of US patents. This will add another important patent to the respectable list that already exists on the company's platform. IDenta is constantly innovating new technologies in the field of forensic detection and identification. We are very proud of the fact that our technology has been officially recognized by competent authorities around the world," said Amichai Glattstein, the COO of IDenta.

I'm still skeptical until I see financials and I still have major problems with the lack of attention to detail, but if this actually comes to fruition, based on the one quarter they were profitable, this should put IDTA in the black for the next two years. Coupled with a few other recent events, it's almost like they have turned a corner.

Hard to value at this point, but I won't be buying, regardless.

I wonder if they'll get any volume out of this PR.

JERUSALEM, ISRAEL / ACCESSWIRE / March 8, 2018 / IDenta Corp (OTC PINK: IDTA), a worldwide leader in the development of Drug, Drug Precursor and Explosive Detection and Identification field kits, today announced a contract with the French Ministry of the Interior valued at 2 million dollars. The contract is for four years, during which time IDenta will supply products for government agencies throughout the country. The contract was signed in France by IDenta's representative. France is a worldwide leader in science and technology and IDenta is proud to be an integral part of this leadership now, and into the future.

Amichai Glattstein, COO of IDenta, said, "This is a tremendous achievement for IDenta. It is the largest contract since the company's inception. IDenta has undergone significant changes in recent times, including restructuring, product development, expansion of activities and entry into new markets. The Company will continue to act as a leader in its field for the benefit of both its customers and its shareholders".

The company is a joke. Not sure how they screwed up the Walgreens deal. Actually, I know that their incompetence screwed it up, but I don't know why it just kind of fizzled out. That should have been enough to keep them going and bring some decent money into the stock, but they completely fumbled that one. They haven't had anything in Walgreens for a few years now.

Based on recent PRs, they appear to be making some good progress, but the fact that they supposedly have new products and haven't informed shareholders or the public in general by putting them on their website means nothing has changed with them. Their new website is outdated already and several links simply don't work because of laziness.

There are very few shareholders left after that reverse split. I don't know why they bother to be a publicly traded company if they are in fact making progress. They should just go private.

I have thought about buying shares on several occasions over the past few years, but I have thought better of it every time. It's a bad gamble.

It is indeed an amazing company in the sense that their public statements are supported by Facts. I have been with IDTA for quite some time and all these years of experience certify that

Mr. Yacov is

(1). Immune to criticism and

(2). has no respect towards shareholders

(3). To fool shareholders and to make the company survive on "Life Supporting False Statements".

(4). Share holders get a kick describing Yacov in bad lanquage and that is what he earned from me.

(5). One good thing is the company is SURVIVING FOR NAMESAKE !!!

(6). Also, I went to the Walgreen store yesterday and to my surprise, I did not find any IDTA product there. It looks like they pulled it from the shelves. It is unfortunate but that's what Yacov deserves for his mismanagement of the Company.

(7). Probably we the shareholders deserve that too because a lot of us are not screaming and yelling at Yacov and SEC.

(8). Let us be patient with IDTA for another 3 years and hope that IDTA gets out of Life Support.

Chairman of the board gone. A lot of public companies would comment on that. But since they didn't bother about their last CEO leaving, I guess the COB is small potatoes.

I'm being patient and still looking for cans. When IDTA hits .0001 again, I'll be a buyer! What a great company!

If a PR falls in the internet and nobody is there to care, does it make any difference?

Why don't the larger shareholders just take IDTA private? Only reason would be that selling shares is the only way they can keep going.

I'm sure shareholders are really happy to see all of the detailed information on the new products they supposedly came out with months ago.

Website is still painfully lacking.

What does IDTA management do all day? It's not communication. It's not generating revenue.

I guess now with almost no shareholders they don't hear as many complaints.

|

Followers

|

114

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

21203

|

|

Created

|

07/12/05

|

Type

|

Free

|

| Moderators | |||

Florida Profit Corporation

IDENTA CORP.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |